Abstract

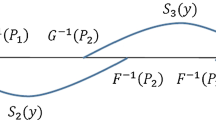

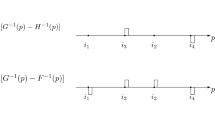

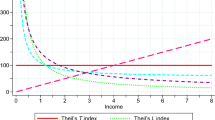

This paper clarifies the conceptual distinction of downside inequality aversion (or transfer sensitivity) as a normative criterion for judging income distributions from the Pigou-Dalton principle of transfers. We show that when the Lorenz curves of two income distributions intersect, how the change from one distribution to the other is judged by an inequality index exhibiting downside inequality aversion often depends on the relative strengths of its downside inequality aversion and inequality aversion. For additive inequality indices or their monotonic transformations, a measure characterizing the strength of an index’s downside inequality aversion against its inequality aversion is shown to determine the ranking by the index of two distributions whose Lorenz curves cross once. The precise condition under which the same result generalizes to the case of multiple-crossing Lorenz curves is also identified. The results are particularly useful in understanding the distributional impact of tax reforms.

Similar content being viewed by others

References

Atkinson AB (1970) On the measurement of inequality. J Econ Theory 2:244–263

Atkinson AB (1973) More on the measurement of inequality. mimeo

Bossert W, Pfingsten A (1990) Intermediate inequality: concepts, indices, and welfare implications. Math Soc Sci 19:117–34

Budd EC (1970) Postwar changes in the size of distribution of income in the U.S. Amer Econ Rev 60:247–260

Chiu WH (2005) Skewness preference, risk aversion, and the precedence relations on stochastic changes. Manag Sci 51:1812–1828

Dardanoni V, Lambert P (1988) Welfare rankings of income distributions: a role for the variance and some insights for tax reform. Soc Choice Welfare 5:1–17

Davies JB, Hoy M (1985) Comparing income distributions under aversion to downside inequality. mimeo

Davies JB, Hoy M (1994) The normative significance of using third-degree stochastic dominance in compariing income distributions. J Econ Theory 64:520–530

Davies JB, Hoy M (1995) Making inequality comparisons when lorenz curves intersect. Amer Econ Rev 85:980–986

Davies JB, Hoy M (2002) Flat rate taxes and inequality measurement. J Pub Econ 84:33–46

Kimball MS (1990) Precautionary saving in the small and the the large. Econometrica 58:53–73

Kolm S (1976) Unequal inequalities: I. J Econ Theory 12:416–442

Kuznets S (1963) Quantitative aspects of economic growth of nations. Econ Dev Cult Change 11:1–80

Lambert PJ (2001) The distribution and redistribution of income. Manchester University Press, Manchester

Lambert PJ, Lanza G (2003) The effect on inequality of changing one or two incomes. Economics Discussion Paper, No. 15, University of Oregon

Mehran F (1976) Linear measures of income inequality. Econometrica 44:805–809

Menezes C, Geiss C, Tressler J (1980) Increasing downside risk. Amer Econ Rev 70:921–932

Sawyer M (1976) Income distribution in OECD countries. OECD economic outlook, occasional studies, paris

Sen A (1973) On economic inequality. Oxford University Press, Oxford

Shorrocks AF, Foster JE (1987) Transfer sensitive inequality measures. Rev Econ Stud 54:485–497

Yarri M (1998) A controversial proposal concerning inequality measurement. J Econ Theory 44:381–397

Zheng B (1997) Aggregate poverty measures. J Econ Survey 11:123–162

Author information

Authors and Affiliations

Corresponding author

Additional information

I received exceptionally helpful comments from Mike Hoy, Peter Lambert, the Editor, Buhong Zheng, and an anonymous referee. The remaining errors and shortcomings are my own – W.H. Chiu

Rights and permissions

About this article

Cite this article

Chiu, W.H. Intersecting Lorenz Curves, the Degree of Downside Inequality Aversion, and Tax Reforms. Soc Choice Welfare 28, 375–399 (2007). https://doi.org/10.1007/s00355-006-0170-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-006-0170-7