Abstract

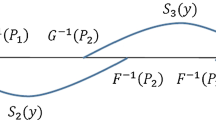

When generalized Lorenz curves cross, it is not possible to rank the underlying income distributions by the unanimous preference of all additively separable symmetric inequality-averse social welfare functions. But in many cases, unanimous preference results in terms of inequality-aversion are nevertheless available. When generalized Lorenz curves cross once, variance is decisive in determining a robust welfare ranking, and can provide a rationale for choosing equity over efficiency where these two desiderata conflict. Welfare recommendations for certain types of income tax reform are implied, including cases of yield-increasing redistribution.

Similar content being viewed by others

References

Atkinson AB (1970) On the measurement of inequality. J Econ Theory 2: 244–263

Brumelle SL, Vickson RG (1975) A unified approach to stochastic dominance. In: Ziemba WT, Vickson RG (eds.) Stochastic optimization models in finance. Academic Press, New York

Formby JP, Smith WJ (1986) Income inequality across nations and over time: comment. South Econ J 53: 562–563

Foster J, Greer J, Thorbecke E (1984) A class of decomposable poverty measures. Econometrica 52: 761–766

Foster J, Shorrocks A (1985) Poverty orderings and welfare dominance. Purdue University, Economics Discussion Paper

Hanoch G, Levy H (1969) The efficiency analysis of choices involving risk. Rev Econ Stud 38: 335–346

Hemming R, Keen MJ (1983) Single crossing conditions in comparisons of tax progressivity. J Publ Econ 20: 373–380

Hutton JP, Lambert PJ (1983) Inequality and revenue elasticity in tax reform. Scott J Polit Econ 30: 221–234

Jakobsson U (1976) On the measurement of the degree of progression. J Publ Econ 5: 161–168

Kakwani NC (1984) Welfare ranking of income distributions. Ad Econometr 3: 191–213

Kolm S-C (1976) Unequal inequalities II. J Econ Theory 13: 82–111

Lambert PJ, Hey JD (1979) Attitudes to risk. Econ Lett 2: 215–218

Lambert PJ, Pfähler W (1987) Intersecting tax concentration curves and the measurement of tax progressivity: a rejoinder. Natl Tax J (forthcoming)

Meyer J (1975) Increasing risk. J Econ Theory 11: 119–132

Meyer J (1987) Two-moment decision models and expected utility maximization. Am Econ Rev 77: 421–430

Minarik JJ (1982) The future of the individual income tax. Natl Tax J 35: 231–241

Shorrocks A (1983) Ranking income distributions. Economica 50: 1–17

Shorrocks A, Foster J (1987) Transfer sensitive inequality measures. Rev Econ Stud 54: 485–497

Whitmore GA (1970) Third degree stochastic dominance. Am Econ Rev 24: 617–628

Author information

Authors and Affiliations

Additional information

This paper has benefitted considerably from the perceptive comments of an anonymous referee. Valentino Dardanoni gratefully acknowledges financial assistance from the Banco di Sicilia and the Ente Luigi Einaudi of Rome.

Rights and permissions

About this article

Cite this article

Dardanoni, V., Lambert, P. Welfare rankings of income distributions: A rôle for the variance and some insights for tax reform. Soc Choice Welfare 5, 1–17 (1988). https://doi.org/10.1007/BF00435494

Received:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/BF00435494