Summary

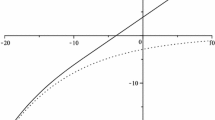

We consider optimal dividend payment under the constraint that the controlled risk process has a ruin probability which does not exceed a given bound. The underlying simple model has independent identically distributed total claims per year and a constant yearly premium, all integers. The solution to this constraint optimization problem is given in a modified Hamilton-Jacobi-Bellman (HJB) equation. It is shown that this equation has a solution, and a verification argument is given showing that the solution of the HJB equation is the value function of the optimization problem. The optimal dividend payment strategy is given in the usual feedback form.

Zusammenfassung

Optimale Dividendenzahlung wird berechnet unter der Nebenbedingung, dass der so kontrollierte Reserveprozess eine vorgegebene Ruinwahrscheinlichkeit nicht überschreitet. Das zugrundeliegende einfache Modell hat unabhängige identisch verteilte ganzzahlige Gesamtschäden pro Jahr und eine ebenfalls ganzzahlige konstante Jahresprämie. Die Lösung wird in der Form einer modifizierten Hamilton-Jacobi-Bellman Gleichung angegeben, für die die Existenz einer Lösung und das Verifikationslemma nachgewiesen wird.

Similar content being viewed by others

References

E. Altmann (1999): Constrained Markov Decision Processes. Chapmann & Hall, New York.

H. Bühlmann (1996): Mathematical Methods of Risk Theory. Springer, Berlin.

H. U. Gerber (1979): An Introduction to Mathematical Risk Theory. S. S. Huebner Foundation Monographs, University of Pennsylvania.

H. U. Gerber (1981): On the Probability of Ruin in the Presence of a Linear Dividend Barrier. Scand. Act. J. 2, 105–115.

C. Hipp andH. Schmidli (2003): Dividend Optimization under a Ruin Constraint the Lundberg Model. In preparation.

J. Paulsen (2003): Optimal Dividend Payouts for Diffusions with Solvency Constraints. Preprint, University of Bergen.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Hipp, C. Optimal dividend payment under a ruin constraint: Discrete time and state space. Blätter DGVFM 26, 255–264 (2003). https://doi.org/10.1007/BF02808376

Issue Date:

DOI: https://doi.org/10.1007/BF02808376