Abstract

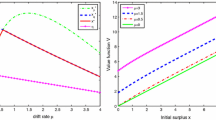

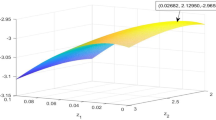

In the dual risk model, we consider the optimal dividend and capital injection problem, which involves a random time horizon and a ruin penalty. Both fixed and proportional costs from the transactions of capital injection are considered. The objective is to maximize the total value of the expected discounted dividends, and the penalized discounted both capital injections and ruin penalty during the horizon, which is described by the minimum of the time of ruin and an exponential random variable. The explicit solutions for optimal strategy and value function are obtained, when the income jumps follow a hyper-exponential distribution. Besides, some numerical examples are presented to illustrate our results.

Similar content being viewed by others

References

H Albrecher, S Thonhauser. On optimal dividend strategies in insurance with a random time horizon, In: Advances in Statistics, Probability and Actuarial Science, 2012, 1: 157–180.

B Avanzi, H U Gerber. Optimal dividends in the dual model with diffusion, Astin Bull, 2008, 38(2): 653–667.

B Avanzi, H U Gerber, E S WShiu. Optimal dividends in the dual model, Insurance Math Econom, 2007, 41(1): 111–123.

B Avanzi, J Shen, B Wong. Optimal dividends and capital injections in the dual model with diffusion, Astin Bull, 2011, 41(2): 611–644.

E Bayraktar, A Kyprianou, K Yamazaki. On optimal dividends in the dual model, Astin Bull, 2013, 43(3): 359–372.

E Bayraktar, A Kyprianou, K Yamazaki. Optimal dividends in the dual model under transaction costs, Insurance Math Econom, 2014, 54: 133–143.

K Borch. The Mathematical Theory of Insurance, Lexington Books, Lexington (Mas- sachusetts), 1974.

W H Fleming, H M Soner. Controlled Markov Processes and Viscosity Solutions, Stoch Model Appl Probab, Vol 25, Springer, New York, 2006.

Z Liang, V Young. Dividends and reinsurance under a penalty for ruin, Insurance Math Econom, 2012, 50(3): 437–445.

X Peng, M Chen, J Guo. Optimal dividend and equity issuance problem with proportional and fixed transaction costs, Insurance Math Econom, 2012, 51(3): 576–585.

S Thonhauser, H Albrecher. Dividend maximization under consideration of the time value of ruin, Insurance Math Econom, 2007, 41(1): 163–184.

D Yao, H Yang, R Wang. Optimal financing and dividend strategies in a dual model with proportional costs, J Ind Manag Optim, 2010, 6(4): 761–777.

D Yao, H Yang, R Wang. Optimal dividend and capital injection problem in the dual model with proportional and fixed transaction costs, European J Oper Res, 2011, 211(3): 568–576.

C Yin, Y Wen, Y Zhao. On the optimal dividend problem for a spectrally positive Lévy process, Astin Bull, 2014, 635–651.

Y Zhao, R Wang, D Yao, P Chen. Optimal dividends and capital injections in the dual model with a random time horizon, J Optim Theory Appl, 2014, DOI: 10.1007/s10957-014-0653-0.

Author information

Authors and Affiliations

Corresponding author

Additional information

Supported by the National Natural Science Foundation of China (11231005), Promotive research fund for excellent young and middle-aged scientists of Shandong Province (BS2014SF006), the Natural Science Foundation of the Jiangsu Higher Education Institutions of China (15KJB110009).

Rights and permissions

About this article

Cite this article

Zhao, Yx., Yao, Dj. Optimal dividend and capital injection problem with a random time horizon and a ruin penalty in the dual model. Appl. Math. J. Chin. Univ. 30, 325–339 (2015). https://doi.org/10.1007/s11766-015-3252-4

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11766-015-3252-4