Abstract

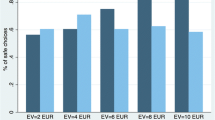

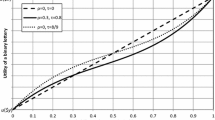

This paper examines the risk propensities of experienced executives in the oil and gas industry faced with a hypothetical risky business decision that involves significant gains and losses. The executives were asked to provide the minimum price their firm should accept before selling their share of a joint exploration venture whose future prospects were systematically varied to include gains only, losses only, and mixed gains and losses. In addition, they were asked to provide a single probability equivalence for a mixed gain/loss situation in lieu of breaking even for sure. The executives were more risk taking than risk averse over pure losses, consistent with the prediction of prospect theory. Over pure gains, however, there was as much risk taking as risk aversion, with more risk taking occurring when the chance of breaking even was higher. The relationship between risk propensity over pure gains and over pure losses was insignificant, indicating very different attitudes in these two domains. Although the reflection effect did occur in some cases, it was not pervasive. There was a tendency for certainty equivalences to show greater risk taking than probability equivalences in mixed gain/loss situations, which was consistent with a reframing effect. Risk propensity over mixed gains and losses was closer to that expressed in the losses only domain than to risk propensity over pure gains. More than half of the executives gave responses that were fully consistent with expected utility, and an additional quarter of executives were consistent within a 10% margin of error in their responses. However, one out of five executives did not satisfy the stochastic dominance relationships among the certainty equivalences. Systematic inconsistencies occurred most frequently in the mixed situations where the certainty equivalences for some subjects were biased toward the outcome that had the predominant chance of occurring.

Similar content being viewed by others

References

J.D. Barnes and J.E. Reinmuth, Comparing imputed and actual utility functions in a competitive bidding setting, Decision Sciences 7(1976)801.

M. Cohen, J. Jaffray and T. Said, Experimental comparison of individual behavior under risk and under uncertainty for gains and for losses, Organizational Behavior and Human Decision Processes 39(1987)1.

P.C. Fishburn and G. Kochenberger, Concepts, theory and techniques: Two-piece von Neumann-Morgenstern utility functions, Decision Sciences 10(1979)503.

L.R. Freifelder and K.A. Smith, Risk preferences of professional risk bearers: An expected utility analysis, Working Paper, University of Connecticut (1986) 42 p.

C.J. Grayson,Decisions under Uncertainty: Drilling Decisions by Oil and Gas Operators (Harvard University Press, Boston, 1960).

P.E. Green, Risk attitudes and chemical investment decisions, Chemical Engineering Progress 59(1963)35.

A.N. Halter and G.W. Dean,Decisions under Uncertainty (Southwestern Publ. Co., Cincinnati, 1971).

J.C. Hershey, H.C. Kunreuther and P.J.H. Schoemaker, Sources of bias in assessment procedures for utility functions, Management Science 28(1982)936.

J.C. Hershey and P.J.H. Schoemaker, Risk taking and problem context in the domain of losses: An expected utility analysis, Journal of Risk and Insurance 47(1980)111.

J.C. Hershey and P.J.H. Schoemaker, Prospect theory's reflection hypothesis: A critical examination, Organizational Behavior and Human Performance 25(1980)395.

J.C. Hershey and P.J.H. Schoemaker, Probability versus certainty equivalence methods in utility measurement: Are they equivalent?, Management Science 31(1985)1213.

R.M. Hogarth and M.W. Reder, eds.,The Behavioral Foundations of Economic Theory, Journal of Business 59(1986) pp. 181–505.

E.J. Johnson and D.A. Schkade, Anchoring, adjustment, and bias in utility assessments, Working Paper, Carnegie-Mellon University (1986) 43 p.

D. Kahneman and A. Tversky, Prospect theory: An analysis of decision under risk, Econometrica 47(1979)263.

G.M. Kaufman,Statistical Decision and Related Techniques in Oil and Gas Exploration (Prentice-Hall, Englewood Cliffs, 1963).

H. Kunreuther, J. Linnerooth and J.W. Vaupel, A decision-process perspective on risk and policy analysis, Management Science 30(1984)475.

D.J. Laughhunn, J.W. Payne and R.L. Crum, Managerial risk preferences for below target returns, Management Science 26(1980)1238.

R. Libby and P.C. Fishburn, Behavioral models of risk taking in business decisions: A survey and evaluation, Journal of Accounting Research 15(1977)272.

K.R. MacCrimmon and D.A. Wehrung,Taking Risks: The Management of Uncertainty (The Free Press, New York, 1986).

K.R. MacCrimmon and D.A. Wehrung, The risk in-basket. Journal of Business 57(1984)367.

J.G. March and Z. Shapira, Managerial perspectives on risk and risk taking, Management Science 33(1987)1404.

H. Markowitz, The utility of wealth, Journal of Political Economy 60(1952)151.

J.W. Payne, D.J. Laughhunn and R.L. Crum, Translation of gambles and aspiration level effects in risky choice behavior, Management Science 26(1980)1039.

J.W. Payne, D.J. Laughhunn and R.L. Crum, Further tests of aspiration level effects in risky choice behavior, Management Science 27(1981)953.

P.J.H. Schoemaker and H. Kunreuther, An experimental study of insurance decisions, Journal of Risk and Insurance 46(1979)603.

P.J.H. Schoemaker, The expected utility model: Its variants, purposes, evidence and limitations, Journal of Economic Literature 20(1982)529.

P. Slovic, B. Fischhoff, S. Lichtenstein, B. Corrigan and B. Combs, Preference for insuring against probable small losses: Insurance implications, Journal of Risk and Insurance 44(1977)237.

P. Slovic and S. Lichtenstein, Relative importance of probabilities and payoffs in risk taking, Journal of Experimental Psychology Monograph 78(1968)1.

R.O. Swalm, Utility theory: Insights into risk taking, Harvard Business Review 44(1966)123.

C.S. Spetzler, The development of a corporate risk policy for capital investment decisions, IEEE Trans. on Systems Science and Cybernetics SCC-4(1968)279.

T.S. Wallsten and D.V. Budescu, Additivity and non-additivity in judging MMPI profiles, Journal of Experimental Psychology: Human Perception and Performance 7(1981)1096.

D.A. Wehrung, K.R. MacCrimmon and K.M. Brothers, Utility assessment: Domains, stability, and equivalence procedures, Infors 22(1984)98.

M.C. Weinstein, Risky choices in medical decision making: A survey, Geneva Papers on Risk and Insurance 11(1986)197.

C.A. Williams, Attitudes toward speculative risks as an indicator of attitudes toward pure risks, Journal of Risk and Insurance 33(1966)577.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Wehrung, D.A. Risk taking over gains and losses: A study of oil executives. Ann Oper Res 19, 115–139 (1989). https://doi.org/10.1007/BF02283517

Issue Date:

DOI: https://doi.org/10.1007/BF02283517