Abstract

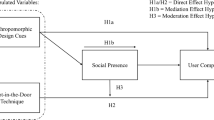

By 2030, the global chatbot market in the fintech industry is expected to reach 6.83 billion USD (Vailshery 2022), and while using chatbots, consumers might be unable to tell whether they are interacting with a human. As chatbots are increasingly being used to provide a more human-like service experience, understanding the factors affecting trust, adoption, and how chatbots drive consumer experience in insurtech is important. This study investigates key factors that encourage (practicity, enjoyment and personalization) and inhibit (privacy concerns, creepiness) trust in and intention to adopt a chatbot and the moderating role of technology anxiety. To do so, 430 respondents applied a simulated auto insurance quote involving a textual-based chatbot and responded to a questionnaire. The results highlight practicity and enjoyment as the key drivers of trust and adoption intention, while the positive impact of personalization is marginal. Creepiness decreases trust in chatbots and their adoption intention, whereas privacy concerns have little effect. Almost half of these relationships are moderated by technological anxiety; for instance, trust does not translate into stronger adoption intention for technology-anxious users, but positively impacts less anxious users. Managerial implications are provided for the successful implementation of chatbots.

Similar content being viewed by others

Notes

Sixty-nine percent of respondents used a computer to complete the study, and 31% reported using a mobile device. Vehicle ownership was reported by 84%, and the remaining 16% leased. Overall, the sample matches the population of vehicle owners/leasers with respect to the demographic variables (Vividata 2020).

References

Abbas, N., A. Følstad, and C.A. Bjørkli. 2023. Chatbots as part of digital government service provision–A user perspective. In chatbot research and design: 6th international workshop, conversations 2022, Amsterdam, The Netherlands, November 22–23, 2022, revised selected papers, 66–82. Cham: Springer International Publishing.

Abdulquadri, A., E. Mogaji, T. Kieu, and N. Nguyen. 2021. Digital transformation in financial services provision: A Nigerian perspective to the adoption of chatbot. Journal of Enterprising Communities: People and Places in the Global Economy 5: 258–281.

Ada, T. 2022. Conversational AI: What it is and how it works. https://www.ada.cx/conversational-ai. Accessed 20 Sept 2022.

Adam, M., M. Wessel, and A. Benlian. 2021. Ai-based chatbots in customer service and their effects on user compliance. Electronic Markets 31 (2): 427–445.

Ajzen, I., and M. Fishbein. 1975. A Bayesian analysis of attribution processes. Psychological Bulletin 82 (2): 261–277.

Alt, M.A., I. Vizeli, and Z. Săplăcan. 2021. Banking with a chatbot – A study on technology acceptance. Studia Universitatis Babes-Bolyai Oeconomica 66 (1): 13–35.

Amelia, A., C. Mathies, and P.G. Patterson. 2021. Customer acceptance of frontline service robots in retail banking: A qualitative approach. Journal of Service Management 33: 321–341.

Apple Store. 2021. Lemonade insurance. https://apps.apple.com/us/app/lemonade-insurance/id1055653645. Accessed 8 Nov 2021.

Arcand, M., S. PromTep, I. Brun, and L. Rajaobelina. 2017. Mobile banking service quality and customer relationships. International Journal of Bank Marketing 35 (7): 1068–1089.

Arcand, M., J. Nantel, M. Arles-Dufour, and A. Vincent. 2007. The impact of reading a web site’s privacy statement on perceived control over privacy and perceived trust. Online Information Review 31 (5): 661–681.

Aslam, W., D.A. Siddiqui, I. Arif, and K. Farhat. 2022. Chatbots in the frontline: Drivers of acceptance. Kybernetes

Atwal, G., and D. Bryson. 2021. Antecedents of intention to adopt artificial intelligence services by consumers in personal financial investing. Strategic Change 30 (3): 293–298.

Ba, S., and P.A. Pavlou. 2002. Evidence of the effect of trust building technology in electronic markets: Price premiums and buyer behavior. MIS Quarterly: Management Information Systems 26 (3): 243.

Bailey, A.A., I. Pentina, A.S. Mishra, and M.S. Ben Mimoun. 2017. Mobile payments adoption by US consumers: An extended Tam. International Journal of Retail & Distribution Management 45 (6): 626–640.

Barnard, L. 2014. The cost of creepiness: How online behavioral advertising affects consumer purchase intention. Doctoral dissertation. Chapel Hill: University of North Carolina.

Bart, Y., S. Venkatesh, S. Fareena, and G.L. Urban. 2005. Are the drivers and role of online trust the same for all web sites and consumers? A large-scale exploratory empirical study. Journal of Marketing 69 (4): 133–152.

Baruh, L., E. Secinti, and Z. Cemalcilar. 2017. Online privacy concerns and privacy management: A meta-analytical review. Journal of Communication 67 (1): 26–53.

Bay, S. 2018. Chatbots like Citibank could usher in a new era of mobile banking. https://venturebeat.com/2018/06/26/chatbots-like-citibanks-could-usher-in-a-new-era-of-mobile-banking/. Accessed 31 May 2020.

Belanche, D., L.V. Casaló, and C. Flavián. 2019. Artificial intelligence in fintech: understanding robo-advisors adoption among customers. Industrial Management & Data Systems.

Beldad, A.D., S. Hegner, and J. Hoppen. 2016. The effect of virtual sales agent (VSA) gender – product gender congruence on product advice credibility, trust in VSA and online vendor, and purchase intention. Computers in Human Behavior 60: 62–72.

Benessaieh, K. 2022. Une nouvelle employee chez Desjardins, https://www.lapresse.ca/affaires/finances-personnelles/2022-06-12/une-nouvelle-employee-virtuelle-chez-desjardins.php.

Bentler, P.M. 1989. EQS structural equations, program manual, program version 3.0, vol. 6. Los Angeles: BMDP Statistical Software, Inc.

Bentler, P.M. 2004. EQS 6 structural equations program manual. Los Angeles: University of California.

Bhatt, K. 2021. Adoption of online streaming services: Moderating role of personality traits. International Journal of Retail & Distribution Management 50 (4): 437–457.

Bhattacherjee, A. 2002. Individual trust in online firms: Scale development and initial test. Journal of Management Information Systems 19 (1): 211–241.

Bickmore, T., and J. Cassell. 2001. Relational agents: A model and implementation of building user trust. In Proceedings of the SIGCHI conference on human factors in computing systems, 396–403. SIGCHI, New York

Bock, D.E., J.S. Wolter, and O.C. Ferrell. 2020. Artificial intelligence: Disrupting what we know about services. Journal of Services Marketing 34 (3): 317–334.

Bouhia, M., L. Rajaobelina, S. PromTep, M. Arcand, and L. Ricard. 2022. Drivers of privacy concerns when interacting with a chatbot in a customer service encounter. International Journal of Bank Marketing, (ahead-of-print).

Brandtzaeg, P.B., and A. Følstad. 2017. Why people use chatbots. In International conference on internet science, 377–392. Springer.

Brangier, E., M. Desmarais, N. Alexandra, and S. Prom Tep. 2015. Évolution de l’inspection heuristique: Vers une intégration des critères d’accessibilité, de praticité, d’émotion et de persuasion dans l’évaluation ergonomique. Journal D’interaction Personne-Système (JIPS) 4 (1): 69–84.

Bressolles, G., and J. Nantel. 2008. The measurement of electronic service quality: Improvements and application. International Journal of E Business Research 4 (3): 1–19.

Brun, I., L. Rajaobelina, L. Ricard, and B. Berthiaume. 2017. Impact of customer experience on loyalty: A multichannel examination. Service Industries Journal 37 (5–6): 317–340.

Bruner, G.C., and A. Kumar. 2005. Explaining consumer acceptance of handheld internet devices. Journal of Business Research 58 (5): 553–558.

Brusilovsky, P., A. Kobsa, and W. Nejdl. 2007. The adaptive web: methods and strategies of web personalization (Ser. Lecture notes in computer science; state-of-the-art survey, 4321). Springer.

Camilleri, M.A., and C. Troise. 2023. Chatbot recommender systems in tourism: A systematic review and a benefit-cost analysis. In (2023). In Chatbot recommender systems in tourism: A systematic review and a benefit-cost analysis, ed. Camilleri, MA and Troise, C, Stockholm, Sweden: 8th International Conference on Machine Learning Technologies (ICMLT 2023).

Cebeci, U., O. Ince, and H. Turkcan. 2019. Understanding the intention to use Netflix: An extended technology acceptance model approach. International Review of Management and Marketing 9 (6): 152–157.

CGS. 2018. CGS’s 2018 global consumer customer service survey. https://www.cgsinc.com/sites/default/files/media/resources/pdf/CGS_Consumer%2BCustServ%2Binfographic%2B2018.pdf. Accessed 6 Nov 2020.

Chang, Y.K. 2022. Understanding of insurance technology from a consumers’ perspective: The antecedents of Malaysian millennials' acceptance on insurtech. Doctoral dissertation. University Tunku Abdul Rahman (UTAR).

Chaves, A.P., and M.A. Gerosa. 2020. How should my chatbot interact? A survey on social characteristics in human-chatbot interaction design. International Journal of Human-Computer Interaction 37: 729–758.

Chevalier, S. 2022. Challenges of using chatbots according to US internet users, % of respondents. May 2018. https://www.statista.com/statistics/918007/challenges-using-chatbots-according-internet-users/#:~:text=According%20to%20the%20results%2C%2050.7%20percent%20of%20respondents,stated%20that%20chatbots%20provided%20too%20many%20unhelpful%20responses. Accessed 20 Aug 2022.

Chiang, A.H., S. Trimi, and Y.J. Lo. 2022. Emotion and service quality of anthropomorphic robots. Technological Forecasting and Social Change 177: 121550.

Chin, A.G, M.A. Harris, and R. Brookshire. 2020. An empirical investigation of intent to adopt mobile payment systems using a trust-based extended valence framework. Information Systems Frontiers.

Chung, M., E. Ko, H. Joung, and S.J. Kim. 2020. Chatbot E-service and customer satisfaction regarding luxury brands. Journal of Business Research 117: 587–595.

Chung, T.S., M. Wedel, and R.T. Rust. 2016. Adaptive personalization using social networks. Journal of the Academy of Marketing Science 44 (1): 66–87.

Corritore, C.L., B. Kracher, and S. Wiedenbeck. 2003. On-line trust: Concepts, evolving themes, a model. International Journal of Human - Computer Studies 58 (6): 737–758.

Davis, F.D. 1989. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly 13 (3): 319–340.

Davis, F.D., R.P. Bagozzi, and P.R. Warshaw. 1989. User acceptance of computer technology: A comparison of two theoretical models. Management Science 35 (8): 982–1003.

Demoulin, N.T.M., and S. Djelassi. 2016. An integrated model of self-service technology (SST) usage in a retail context. International Journal of Retail and Distribution Management 44 (5): 540–559.

Dickinger, A., M. Arami, and D. Meyer. 2008. The role of perceived enjoyment and social norm in the adoption of technology with network externalities. European Journal of Information Systems 17 (1): 4–11.

Digalaki, E. 2022. The US P&C insurance ecosystem business insider intelligence. https://www.insiderintelligence.com/content/us-p-c-insurance-ecosystem. Accessed 3 Sept 2022.

Doney, P.M., and J.P. Cannon. 1997. An examination of the nature of trust in buyer-seller relationships. Journal of Marketing 61 (2): 35–51.

Elia, G., V. Stefanelli, and G.B. Ferilli. 2022. Investigating the role of fintech in the banking industry: what do we know? European Journal of Innovation Management, (20220331).

Elmorshidy, A., M.M. Mohamed, E.-M. Issam, and A.-M. Husain. 2015. Factors influencing live customer support chat services: An empirical investigation in Kuwait. Journal of Theoretical and Applied Electronic Commerce Research 10 (3): 63–76.

eMarketer. 2022. AI in customer experience. How AI is improving the ways companies reach consumers, https://content-na1.emarketer.com/ai-customer-experience. Accessed 4 Sept 2022.

Eren, B.A. 2021. Determinants of customer satisfaction in chatbot use: Evidence from a banking application in Turkey. International Journal of Bank Marketing 39 (2): 294–311.

Euronews. 2023. ChatGPT in the spotlight as the EU steps up calls for tougher regulation. Is its new AI Act enough? https://www.euronews.com/next/2023/02/06/chatgpt-in-the-spotlight-as-the-eu-steps-up-calls-for-tougher-regulation-is-its-new-ai-act. Accessed 8 Feb 2023.

Fan, H., and M.S. Poole. 2006. What is personalization? Perspectives on the design and implementation of personalization in information systems. Journal of Organizational Computing and Electronic Commerce 16 (3 & 4): 179–202.

Flavián, C., A. Pérez-Rueda, D. Belanche, and L.V. Casaló. 2021. Intention to use analytical Artificial Intelligence (AI) in services–The effect of technology readiness and awareness. Journal of Service Management 33 (2): 293–320.

Følstad, A., and P.B. Brandtzaeg. 2020. Users’ experiences with chatbots: Findings from a questionnaire study. Quality and User Experience 5: 1–14.

Følstad, A., C.B. Nordheim, and C.A. Bjørkli. 2018. What makes users trust a chatbot for customer service? An exploratory interview study. In International conference on internet science, 194–208. Cham: Springer.

Fornell, C., and D.F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18 (1): 39–50.

Gatzioufa, P., and V. Saprikis. 2022. A literature review on users' behavioral intention toward chatbots' adoption. Applied Computing and Informatics, (ahead-of-print).

Gefen, D., E. Karahanna, and D.W. Straub. 2003. Trust and aam in online shopping: An integrated model. MIS Quarterly 27 (1): 51–90.

Georganteas, N. 2022. Digital transformation in the Insurance industry: Towards a superior customer experience. Master dissertation. Hellenic Open University.

Grudin, J., and R. Jacques. 2019. Chatbots, humbots, and the quest for artificial general intelligence. In Proceedings of the 2019 CHI conference on human factors in computing systems, 1–11.

Ha, S., and L. Stoel. 2009. Consumer e-shopping acceptance: Antecedents in a technology acceptance model. Journal of Business Research 62 (5): 565–571.

Hancock, P.A., D.R. Billings, K.E. Schaefer, J.Y.C. Chen, V.E.J. De, and R. Parasuraman. 2011. A meta-analysis of factors affecting trust in human-robot interaction. Human Factors 53 (5): 517–527.

Hari, H., R. Iyer, and B. Sampat. 2022. Customer brand engagement through chatbots on bank websites, examining the antecedents and consequences. International Journal of Human-Computer Interaction 38 (13): 1212–1227.

Hayes, A.F. 2017. Introduction to mediation, moderation, and conditional process analysis: A regression-based approach, 2nd ed. Guildford publications.

Henseler, J., C.M. Ringle, and M. Sarstedt. 2015. A new criterion for assessing discriminant validity in variance based structural equation modeling. Journal of the Academy of Marketing Science 43 (1): 115–135.

Henseler, J. 2023. Bridging design and behavioral research with composite-based structural equation modeling, https://www.henseler.com/htmt.html. Accessed 20 Jan 2023.

Hentzen, J.K., A. Hoffmann, R. Dolan, and E. Pala. 2022. Artificial intelligence in customer-facing financial services: A systematic literature review and agenda for future research. International Journal of Bank Marketing 40 (6): 1299–1336.

Hildebrand, C., and A. Bergner. 2019. Detrimental trust in automation: How conversational robo advisors leverage tust and mis-calibrated risk taking. In NA - Advances in consumer research volume 47, ed. Rajesh Bagchi, Lauren Block, and Leonard Lee, 123–128. Duluth: Association for Consumer Research.

Hildebrand, C., and A. Bergner. 2021. Conversational robo advisors as surrogates of trust: Onboarding experience, firm perception, and consumer financial decision making. Journal of the Academy of Marketing Science 49 (4): 659–676.

Ho, A., J. Hancock, and A.S. Miner. 2018. Psychological, relational, and emotional effects of self-disclosure after conversations with a chatbot. Journal of Communication 68 (4): 712–733.

Hoehle, H., and V. Venkatesh. 2015. Mobile application usability: Conceptualization and instrument development. MIS Quarterly 39 (2): 435–472.

Holbrook, M.B., and E.C. Hirschman. 1982. The experiential aspects of consumption: Consumer fantasies, feelings, and fun. Journal of Consumer Research 9 (2): 132–140.

Hooper, D., J. Coughlan, and M.R. Mullen. 2008. Structural equation modelling: Guidelines for determining model Fit. The Electronic Journal of Business Research. 6 (1): 53–60.

Hsu, C.-L., and J.C.-C. Lin. 2018. Exploring factors affecting the adoption of internet of things services. The Journal of Computer Information Systems 58 (1): 49–57.

Hu, L.-T., and P.M. Bentler. 1999. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling 6 (1): 1–55.

Hu, Z., S. Ding, S. Li, L. Chen, and S. Yang. 2019. Adoption intention of fintech services for bank users: An empirical examination with an extended technology acceptance model. Symmetry 11 (3): 340.

Hwang, Y., and D.J. Kim. 2007. Customer self-service systems: The effects of perceived web quality with service contents on enjoyment, anxiety, and e-trust. Decision Support Systems 43 (3): 746–760.

IBM. 2022. IBM Watson is AI for smarter business, https://www.ibm.com/watson. Accessed 17 Jun 2022.

Inman, J.J., and H. Nikolova. 2017. Shopper-facing retail technology: A retailer adoption decision framework incorporating shopper attitudes and privacy concerns. Journal of Retailing 93 (1): 7–28.

Janssen, A. 2022. Contributions to chatbots and digital analytics in industry. Doctoral dissertation, University of Gottfried Wilhelm Leibniz.

Joreskog, K.G. 1969. General approach to confirmatory maximum likelihood factor analysis. Psychometrika 34 (2): 183–202.

Jünger, M., and M. Mietzner. 2020. Banking goes digital: The adoption of fintech services by German households. Finance Research Letters 34: 101260.

Kasilingam, D.L. 2020. Understanding the attitude and intention to use smartphone chatbots for shopping. Technology in Society 62: 101280–101280.

Kayak. 2017. Mobile travel report: Chatbots in the UK. Kayak report. https://www.kayak.co.uk/news/mobile-travel-report-2017/. Accessed 22 Oct 2021.

Khalid, H.M., L.W. Shiung, V.B. Sheng, and M.G. Helander. 2018. Trust of virtual agent in multi actor interactions. Journal of Robotics, Networking and Artificial Life 4 (4): 295–295.

Khalilzadeh, J., A.B. Ozturk, and A. Bilgihan. 2017. Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Computers in Human Behavior 70: 460–474.

Kim, J., and I. Im. 2023. Anthropomorphic response: Understanding interactions between humans and artificial intelligence agents. Computers in Human Behavior 139: 107512.

Kim, J.W., H.I. Jo, and B.G. Lee. 2019a. The study on the factors influencing on the behavioral intention of chatbot service for the financial sector: Focusing on the UTAUT model. Journal of Digital Contents Society 20 (1): 41–50.

Kim, S., B. Schmitt, and N. Thalmann. 2019b. Eliza in the uncanny valley: Anthropomorphizing consumer robots increases their perceived warmth but decreases liking. Marketing Letters 30 (1): 1–12.

Kim, D.J., D.L. Ferrin, and H.R. Rao. 2008. A Trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decision Support Systems 44 (2): 544–564.

Kim, J., and S. Forsythe. 2008. Adoption of virtual try-on technology for online apparel shopping. Journal of Interactive Marketing 22 (2): 45–59.

Kinney, J. and J. Brown. 2021. Best renters Insurance companies of 2021. https://www.usnews.com/insurance/renters-insurance. Accessed 1 Oct 2021.

Klein, K., and L.F. Martinez. 2022. The impact of anthropomorphism on customer satisfaction in chatbot commerce: an experimental study in the food sector. Electronic Commerce Research 1–37.

Kronemann, B., H. Kizgin, N. Rana, and Y. K. Dwivedi. 2023. How AI encourages consumers to share their secrets? The role of anthropomorphism, personalization, and privacy concerns and avenues for future research. Spanish Journal of Marketing-ESIC.

Komiak, S.Y.X., and I. Benbasat. 2006. The effects of personalization and familiarity on trust and adoption of recommendation agents. MIS Quarterly 30 (4): 941–960.

Langer, M., and C.J. König. 2018. Introducing and testing the creepiness of situation scale (cross). Frontiers in Psychology 9: 2220–2220.

Law, T. and M. Scheutz. 2021. Chapter 2 - trust: Recent concepts and evaluations in human-robot interaction. In Trust in human-robot interaction, ed. Chang S. Nam, Joseph B. Lyons, 27–57. Academic Press (2021), ISBN 9780128194720.

Lee, M., L. Frank, and W. IJsselsteijn. 2021. Brokerbot: A cryptocurrency chatbot in the social-technical gap of trust. Computer Supported Cooperative Work (CSCW) 30 (1): 79–117.

Leong, M.K. 2003. Conversational design as a paradigm for user interaction on mobile devices. In Workshop on mobile and ubiquitous information access, 11–27. Berlin, Heidelberg: Springer.

Li, L., K.Y. Lee, E. Emokpae, and S.B. Yang. 2021. What makes you continuously use chatbot services? Evidence from Chinese online travel agencies. Electronic Markets 1–25.

Liébana-Cabanillas, F., J. Sánchez-Fernández, and F. Muñoz-Leiva. 2014. Antecedents of the adoption of the new mobile payment systems: The moderating effect of age. Computers in Human Behavior 35: 464–478.

Lin, J.-S.C., and P.-L. Hsieh. 2011. Assessing the self-service technology encounters: Development and validation of SSTqual scale. Journal of Retailing 87 (2): 194–206.

Ling, E.C., I. Tussyadiah, A. Tuomi, J. Stienmetz, and A. Ioannou. 2021. Factors influencing users’ adoption and use of conversational agents: A systematic review. Psychology & Marketing 38 (7): 1031–1051.

Lionello, R.L., L.A. Slongo, and C.A. Matos. 2020. Electronic service quality: A meta-analysis. Marketing Intelligence and Planning 38 (5): 619–635.

Lu, L., R. Cai, and D. Gursoy. 2019. Developing and validating a service robot integration willingness scale. International Journal of Hospitality Management 80: 36–51.

Luo, X., S. Tong, Z. Fang, and Z. Qu. 2019. Frontiers: Machines vs. humans: The impact of artificial intelligence chatbot disclosure on customer purchases. Marketing Science. https://doi.org/10.1287/mksc.2019.1192.

Lutz, C., and G. Newlands. 2021. Privacy and smart speakers: A multi-dimensional approach. The Information Society 37 (3): 147–162.

Maduku, D.K., M. Mpinganjira, N.P. Rana, P. Thusi, A. Ledikwe, and N.H.B. Mkhize. 2023. Assessing customer passion, commitment, and word-of-mouth intentions in digital assistant usage: The moderating role of technology anxiety. Journal of Retailing and Consumer Services 71: 103208.

Malaquias, R.F., and Y. Hwang. 2019. Mobile banking use: A comparative study with Brazilian and U.S. participants. International Journal of Information Management 44: 132–140.

Malhotra, N.K., S.S. Kim, and J. Agarwal. 2004. Internet users’ Information privacy concerns: The construct, the scale, and a causal model. Information Systems Research 15 (4): 336–355.

Malle, B. F. and D. Ullman. 2021. Chapter 1 - A multidimensional conception and measure of human-robot trust. In Trust in human-robot interaction, ed. Chang S. Nam, Joseph B. Lyons, 3–25. Academic Press (2021), ISBN 9780128194720.

Manrai, R., and K.P. Gupta. 2022. Investor’s perceptions on artificial intelligence (AI) technology adoption in investment services in India. Journal of Financial Services Marketing 1–14.

Marshall, J.A. 2021. The robot revolution is here: How it’s changing jobs and businesses in Canada. In The conversation. Online: https://theconversation.com/therobot-revolution-is-here-how-its-changing-jobs-and-businesses-in-canada-155267.

Marketing Science Institute, research priorities (2020–2022). https://www.msi.org/wp-content/uploads/2020/06/MSI_RP20-22.pdf. Accessed 29 Jun 2020.

Marketing Science Institute, research priorities (2022–2024). https://ua.thearf.org/wp-content/uploads/2022/10/MSI-2022-24-Research-Priorities-Final.pdf. Accessed 23 Jan 2023.

Matemba, E.D., G. Li, and B.J. Maiseli. 2018. Consumers’ stickiness to mobile payment applications: An empirical study of WeChat wallet. Journal of Database Management (JDM) 29 (3): 43–46.

McKnight, D.H., V. Choudhury, and C. Kacmar. 2002. The impact of initial consumer trust on intentions to transact with a web site: A trust building model. Journal of Strategic Information Systems 11 (3): 297–323.

McLain, D.L., and K. Hackman. 1999. Trust, risk, and decision-making in organizational change. Public Administration Quarterly 23: 152–176.

Medhi Thies, I., N. Menon, S. Magapu, M. Subramony, and J. O'neill. 2017. How do you want your chatbot? An exploratory wizard-of-Oz study with young, urban Indians. Human-computer interaction–interact (Vol. 10513, pp. 441–459).

Melián-González, S., D. Gutiérrez-Taño, and J. Bulchand-Gidumal. 2021. Predicting the intentions to use chatbots for travel and tourism. Current Issues in Tourism 24 (2): 192–210.

Meuter, M.L., M.J. Bitner, A.L. Ostrom, and S.W. Brown. 2005. Choosing among alternative service delivery modes: An investigation of customer trial of self-Service technologies. Journal of Marketing 69 (2): 61–83.

Mogaji, E., J. Balakrishnan, A.C. Nwoba, and N.P. Nguyen. 2021. Emerging-market consumers' interactions with banking chatbots. Telematics and Informatics 65.

Molina-Collado, A., J. Salgado-Sequeiros, M. Gómez-Rico, E.A. García, and P. De Maeyer. 2021. Key themes in consumer financial services research from 2000 to 2020: A bibliometric and science mapping analysis. International Journal of Bank Marketing 39 (7): 1446–1478.

Montreal Declaration for a Responsible Development of Artificial Intelligence (2018). https://www.montrealdeclarationresponsibleai.com/_files/ugd/ebc3a3_506ea08298cd4f8196635545a16b071d.pdf. Accessed 8 Feb 2023.

Mori, M. 1970. Bukimi no tani [the uncanny valley]. Energy 7: 33–35.

Mostafa, R.B. 2020. Mobile banking service quality: A new avenue for customer value co-creation. International Journal of Bank Marketing 38 (5): 1107–1132.

Mostafa, R.B., and T. Kasamani. 2021. Antecedents and consequences of chatbot initial trust. European Journal of Marketing 56 (6): 1748–1771.

Mozafari, N., W.H. Weiger, and M. Hammerschmidt. 2021. That’s so embarrassing! When not to design for social presence in human–chatbot interactions. In 42nd international conference on information systems, Austin.

Mozafari, N., W.H. Weiger, and M. Hammerschmidt. 2022. Trust me, I’m a bot – repercussions of chatbot disclosure in different service frontline settings. Journal of Service Management 33 (2): 221–245.

Nasirian, F., M. Ahmadian, and O.K.D. Lee. 2017. AI-based voice assistant systems: Evaluating from the interaction and trust perspectives. In Proceedings of the Americas conference on information systems (AMCIS).

Neururer, M., Schlögl Stephan, L. Brinkschulte, and A. Groth. 2018. Perceptions on authenticity in chat bots. Multimodal Technologies and Interaction 2 (3): 60–60.

Ng, M., K.P. Coopamootoo, E. Toreini, M. Aitken, K. Elliot, and A. van Moorsel. 2020. Simulating the effects of social presence on trust, privacy concerns & usage intentions in automated bots for finance. In 2020 IEEE European symposium on security and privacy workshops (EuroS&PW), 190–199. IEEE.

Nguyen, D.M., Y.T.H. Chiu, and H.D. Le. 2021. Determinants of continuance intention towards banks’ chatbot services in Vietnam: A necessity for sustainable development. Sustainability 13 (14): 7625.

Niculescu, A.I., and R.E. Banchs. 2019. Humor intelligence for virtual agents. In 2016 25th IEEE international symposium on robot and human interactive communication (RO-MAN), 285–297. IEEE.

Nunally, J.C. 1978. Psychometric theory. New York: McGraw-Hill.

Olivera-La Rosa, A., Olber Eduardo Arango-Tobón, and G.P.D. Ingram. 2019. Swiping right: Face perception in the age of Tinder. Heliyon 5(12).

Park, J.K., J. Ahn, T. Thavisay, and T. Ren. 2019. Examining the role of anxiety and social influence in multi-benefits of mobile payment service. Journal of Retailing and Consumer Services 47: 140–149.

Pavlou, P.A. 2002. Institution-based trust in interorganizational exchange relationships: The role of online b2b marketplaces on trust formation. Journal of Strategic Information Systems 11 (3–4): 215–243.

Pillai, R., and B. Sivathanu. 2020. Adoption of AI-based chatbots for hospitality and tourism. International Journal of Contemporary Hospitality Management 32 (10): 3199–3226.

Prentice, C., and M. Nguyen. 2021. Robotic service quality – Scale development and validation. Journal of Retailing and Consumer Services 62: 102661–102661.

Podsakoff, P.M., and D.W. Organ. 1986. Self-reports in organizational research: Problems and prospects. Journal of Management 12: 69–82.

Przegalinska, A., L. Ciechanowski, G. Mazurek, A. Stroz, and P. Gloor. 2019 In bot we trust: A new methodology of chatbot performance measures. Business Horizons.

Portela, M., and C. Granell-Canut. 2017. A new friend in our smartphone? Observing interactions with chatbots in the search of emotional engagement. In Paper presented at the proceedings of the XVIII international conference on human computer interaction, Cancun, Mexico.

Radziwill, N., and C. Benton. 2017. Evaluating quality of chatbots and intelligent conversational agents. Software Quality Professional 19 (3): 25–36.

Rahi, S., and A.M. Ghani. 2019. Investigating the role of UTAUT and E-service quality in internet banking adoption setting. TQM Journal 31 (3): 491–506.

Rahman, M., T.H. Ming, T.A. Baigh, and M. Sarker. 2022. Adoption of artificial intelligence in banking services: an empirical analysis. International Journal of Emerging Markets.

Rajaobelina, L., and L. Ricard. 2021. Classifying potential users of live chat services and chatbots. Journal of Financial Services Marketing 26: 81–94.

Rajaobelina, L., S. Prom Tep, M. Arcand, and L. Ricard. 2021. Creepiness: Its antecedents and impact on loyalty when interacting with a chatbot. Psychology & Marketing 38 (12): 2339–2356.

Rajaobelina, L., L. Ricard, J. Bergeron, and É. Toufaily. 2014. An integrative model of installed online trust in the financial services industry. Journal of Financial Services Marketing 19 (3): 186–197.

Rese, A., L. Ganster, and D. Baier. 2020. Chatbots in retailers’ customer communication: How to measure their acceptance? Journal of Retailing and Consumer Services 56: 102176–102176.

Richad, R., V. Vivensius, S. Sfenrianto, and E.R. Kaburuan. 2019. Analysis of factors influencing millennial’s technology acceptance of chatbot in the banking industry in Indonesia. International Journal of Civil Engineering and Technology 10 (4): 1270–1281.

Rietz, T., I. Benke, and A. Maedche. 2019. The impact of anthropomorphic and functional chatbot design features in enterprise collaboration systems on user acceptance. In Proceedings of the 14th international conference on wirtschaftsinformatik. Siegen, Germany.

Riikkinen, M., H. Saarijärvi, P. Sarlin, and I. Lähteenmäki. 2018. Using artificial intelligence to create value in insurance. International Journal of Bank Marketing 36 (6): 1145–1168.

Robson, J. 2015. General insurance marketing: A review and future research agenda. Journal of Financial Services Marketing 20 (4): 282–291.

Rodríguez Cardona D, O. Werth, S. Schönborn, and M.H. Breitner. 2019. A mixed methods analysis of the adoption and diffusion of Chatbot technology in the German insurance sector. In Twenty-fifth Americas conference on information systems, Cancun.

Rodríguez Cardona, D., A. Janssen, N. Guhr, M.H. Breitner, and J. Milde. 2021. A matter of trust? Examination of chatbot usage in insurance business. In Proceedings of the 54th Hawaii international conference on system sciences, 556.

Ruefenacht, M. 2018. The role of satisfaction and loyalty for insurers. International Journal of Bank Marketing.

Rzepka, C., B. Berger, and T. Hess. 2020. Why another customer channel? Consumers' perceived benefits and costs of voice commerce. In Proceedings of the 53rd Hawaii international conference on system sciences.

Sanny, L., A.C. Susastra, C. Roberts, and R. Yusramdaleni. 2020. The analysis of customer satisfaction factors which influence chatbot acceptance in Indonesia. Management Science Letters 10 (6): 1225–1232.

Sarbabidya, S., and T. Saha. 2020. Role of chatbot in customer service: A study from the perspectives of the banking industry of Bangladesh. International Review of Business Research Papers 16(1).

Sathiskumar, N.N., and P.H. Andersen. 2022. How does AI impact bankers’ trust-building efforts? Towards an analytical framework. of the Global Sales Science Institute, 96.

Schanke, S., G. Burtch, and G. Ray. 2021. Estimating the impact of ‘humanizing’ customer service chatbots. Information Systems Research 32 (3): 736–751.

Seiler, V., and K.M. Fanenbruck. 2021. Acceptance of digital investment solutions: the case of Robo advisory in Germany. Research in International Business and Finance, Vol. 58 (forthcoming).

Shaikh, A.A., and H. Karjaluoto. 2015. Mobile banking adoption: A literature review. Telematics and Informatics 32 (1): 129–142.

Sheehan, B., H.S. Jin, and U. Gottlieb. 2020. Customer service chatbots: Anthropomorphism and adoption. Journal of Business Research 115 (April): 14–24.

Shklovski, I., S.D. Mainwaring, H.H. Skúladóttir, and H. Borgthorsson. 2014. Leakiness and creepiness in app space: Perceptions of privacy and mobile app use. In Proceedings of the 32nd annual ACM. Conference on human factors in computing systems, 2347–2356. New York: ACM Press.

Silva, G.R.S., and E.D. Canedo. 2022. Towards user-centric guidelines for chatbot conversational design. International Journal of Human–Computer Interaction, 1–23.

Singh, S., and R.K. Srivastava. 2020. Understanding the intention to use mobile banking by existing online banking customers: An empirical study. Journal of Financial Services Marketing 25 (3–4): 86–96.

Skjuve, M., I.M. Haugstveit, A. Følstad, and P. Brandtzaeg. 2019. Help! Is my chatbot falling into the uncanny valley? An empirical study of user experience in human–chatbot interaction. Human Technology 15 (1): 30.

Sparrow, N. 2007. Quality issues in online research. Journal of Advertising Research 179–182.

Srinivasan, S.S., R. Anderson, and K. Ponnavolu. 2002. Customer loyalty in e-commerce: An exploration of its antecedents and consequences. Journal of Retailing 78 (1): 41–50.

Stardust CTG Group. 2021. How Covid is accelerating digital transformation of retail Banks. https://www2.stardust-testing.com/en/accelerating-digital-transformation-retail-banks. Accessed 5 Nov 2021.

Steiger, J.H. 2007. Understanding the limitations of global fit assessment in structural equation modeling. Personality and Individual Differences 42 (5): 893–898.

Sugumar, M. and S. Chandra. 2021. Do I desire chatbots to be like humans? Exploring factors for adoption of chatbots for financial services. Journal of International Technology and Information Management 30(3)

Tam, C., and T. Oliveira. 2017. Literature review of mobile banking and individual performance. International Journal of Bank Marketing 35 (7): 1044–1067.

Thomaz, F., C. Salge, E. Karahanna, and J. Hulland. 2020. Learning from the dark web: Leveraging conversational agents in the era of hyper-privacy to enhance marketing. Journal of the Academy of Marketing Science 48 (1): 43–63.

Utami, A.F., I.A. Ekaputra, and A. Japutra. 2021. Adoption of fintech products: A systematic literature review. Journal of Creative Communications 16 (3): 233–248.

Vailshery, S.L. 2022. Size of chatbot in banking, financial services and insurance (BFSI) market worldwide in 2019 and 2030. https://www.statista.com/statistics/1256242/worldwide-chabot-in-bfsi-revenues/. Accessed 6 Sept 2022.

Vesel, P., and V. Zabkar. 2010. Comprehension of relationship quality in the retail environment. Managing Service Quality 20 (3): 213–235.

Vividata. 2020, spring. Automotive\auto owned/leased in Hhld, Québec 18 +. https://vividata.dapresy.com/.

Voorhees, C.M., M.K. Brfady, R. Calantone, and E. Ramirez. 2016. Discriminant validity testing in marketing: An analysis, causes or concern, and proposed remedies. Journal of the Academy of Marketing Science 44 (1): 119–134.

Wang, W., and I. Benbasat. 2016. Empirical assessment of alternative designs for enhancing different types of trusting beliefs in online recommendation agents. Journal of Management Information Sys. 33 (3): 744–775.

Wang, M., S. Cho, and T. Denton. 2017. The Impact of personalization and compatibility with past experience on e-banking usage. International Journal of Bank Marketing 35 (1): 45–55.

Westland, J.C. 2010. Lower bounds on sample size in structural equation modeling. Electronic Commerce Research and Applications 9 (6): 476–487.

Wube, H.D., S.Z. Esubalew, F.F. Weldesellasie, and T.G. Debelee. 2022. Text-based chatbot in financial sector: A systematic literature review. Data Science in Finance and Economics 2 (3): 232–259.

Xiao, B., and I. Benbasat. 2007. E-commerce product recommendation agents: Use, characteristics, and impact. MIS Quarterly 31 (1): 137–209.

Yang, K., and J.C. Forney. 2013. The moderating role of consumer technology anxiety in mobile shopping adoption: Differential effects of facilitating conditions and social influences. Journal of Electronic Commerce Research 14 (4): 334–347.

Yang, Y., Y. Liu, X. Lv, J. Ai, and Y. Li. 2022. Anthropomorphism and customers’ willingness to use artificial intelligent service agents. Journal of Hospitality Marketing & Management 31 (1): 1–23.

Yen, C., and M.-C. Chiang. 2021. Trust me, if you can: A Study on the factors that influence consumers’ purchase intention triggered by chatbots based on brain image evidence and self-reported assessments. Behaviour & Information Technology 40 (11): 1177–1194.

Yousafzai, S.Y., G.R. Foxall, and J.G. Pallister. 2010. Explaining internet banking behavior: Theory of reasoned action, theory of planned behavior, or technology acceptance model? Internet banking behavior. Journal of Applied Social Psychology 40 (5): 1172–1202.

Zhang, L., I. Pentina, and Y. Fan. 2021. Who do you choose? Comparing perceptions of human vs robo-advisor in the context of financial services. Journal of Services Marketing 35 (5): 634–646.

Zhou, T. 2012. Understanding users’ initial trust in mobile banking: An elaboration likelihood perspective. Computers in Human Behavior 28 (4): 1518–1525.

Zumstein, D., and S. Hundertmark. 2017. Chatbots – An interactive technology for personalized communication, transactions and services. IADIS International Journal on WWW/Internet 15 (1): 96–109.

Zwier, S. 2021. Insurance-based marketing (IBM): A prevalent marketing strategy. Journal of Financial Services Marketing 26: 160–168.

Acknowledgements

The authors wish to thank the Social Sciences and Humanities Research Council of Canada (SSHRC) and the Fintech Research Chair AMF‐Finance Montreal of the Université du Québec à Montréal for their financial contributions to the project. The authors would like to thank the anonymous reviewers for their valuable feedback, which helped to improve the quality of this manuscript. Please note that this project is part of a larger research program on chatbot in the financial industry. Therefore, the data of this study have also been used in other published paper (Rajaobelina et al. 2021).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A

Appendix A

The chatbot used for the study (screenshot)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Dekkal, M., Arcand, M., Prom Tep, S. et al. Factors affecting user trust and intention in adopting chatbots: the moderating role of technology anxiety in insurtech. J Financ Serv Mark (2023). https://doi.org/10.1057/s41264-023-00230-y

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41264-023-00230-y