Abstract

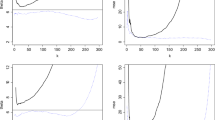

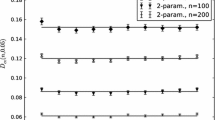

In this paper, we consider the problem of computing different types of finite time survival probabilities for a Markov-Modulated risk model and a Markov-Modulated risk model with reinsurance, both with varying premium rates. We use the multinomial approximation scheme to derive an efficient recursive algorithm to compute finite time survival probabilities and finite time draw-down survival probabilities. Numerical results show that by comparing with MCMC approximation, discretize approximation and diffusion approximation methods, the proposed scheme performs accurate results in all the considered cases and with better computation efficiency.

Similar content being viewed by others

References

Asmussen S (1989) Risk theory in a Markovian environment. Scandinavian Actuarial J 69–100

Bäuerle N (1996) Some results about the expected ruin time in Markov-modulated risk models. Insurance Mathematics & Economics 18(2):119–127

Breuer Lothar (2012) Occupation Times for Markov-Modulated Brownian Motion. Journal of Applied Probability 49(02):549–565

Chen M, Yuen KC, Guo J (2014) Survival probabilities in a discrete semi-Markov risk model. Applied Mathematics & Computation 232(3):205–215

Costabile M, Massab I, Russo E (2015) Computing finite-time survival probabilities using multinomial approximations of risk models. Scandinavian Actuarial Journal 2015(5):406–422

Delsing GA, Manjes MRH, Spreij PJC, Winands EMM (2020) Asymptotics and Approximations of Ruin Probabilities for Multivariate Risk Processes in a Markovian Environment. Methodology and Computing in Applied Probability 22:927–948

Dickson DCM, Waters HR (1991) Recursive Calculation of Survival Probabilities. ASTIN Bulletin 21(2):23

Dickson DCM (1999) On Numerical Evaluation of Finite Time Survival Probabilities. British Actuarial Journal 5(03):575–584

Dickson DCM (2016) A note on some joint distribution functions involving the time of ruin. Insurance Mathematics and Economics 67:120–124

Dickson DCM, Qazvini M (2018) Ruin problems in Markov-modulated risk models. Annals of Actuarial Sci 1-26

Ivanovs J, Palmowski Z (2012) Occupation densities in solving exit problems for Markov additive processes and their reflections. Stochastic Processes & Their Applications 122(9):3342–3360

Joshi MS, Zhu D (2016) The efficient computation and the sensitivity analysis of finite-Time ruin probabilities and the estimation of risk-based regulatory capital. Astin Bulletin 46(2):431–467

Landriault D, Li B, Li S (2015) Analysis of a drawdown-based regime-switching Lévy insurance model. Insurance Mathematics & Economics 60:98–107

Li J, Dickson D C M, Li S (2015) Some ruin problems for the MAP risk model. Ins: Mathematics Econ 65:1-8

Li J, Dickson D C M, Li S (2016) Analysis of some ruin-related quantities in a Markov-modulated risk model. Stochastic Models 1–15

Lu Y, Li S (2005) On the probability of ruin in a Markov-modulated risk model. Insurance Mathematics & Economics 2005(4):183–202

Yi Lu (2006) On the severity of ruin in a Markov-modulated risk model. Scandinavian Actuarial Journal 2006(4):183–202

Ng ACY, Yang H (2006) On the joint distribution of surplus before and after ruin under a Markovian regime switching model. Stochastic Processes & Their Applications 116(2):244–266

Osatakul D, Wu X (2021) Discrete-Time Risk Models with Claim Correlated Premiums in a Markovian Environment. Risks 9:26

Peng J, Wang S (2018) Uniform asymptotics for ruin probabilities in a dependent renewal risk model with stochastic return on investments. Stochastics: An Int J Prob Stochastic Proc 90(3):432-471

Peng G, Zhang Y (2017) On the functional and local limit theorems for Markov modulated compound Poisson processes. Statistics and Probability Letters 129:131–140

Snoussi M (2002) The severity of ruin in Markov-modulated risk models. Schweiz.aktuarver.mitt 2002(1):31-43

Tang Q (2005) The Finite-Time Ruin Probability of the Compound Poisson Model with Constant Interest Force. Journal of Applied Probability 42(3):608–619

Vylder FD, Goovaerts MJ (1988) Recursive calculation of finite-time ruin probabilities. Insurance Mathematics & Economics 7(1):1–7

Willmot GE (2015) On a partial integrodifferential equation of Seals type. Insurance Mathematics & Economics 62:54–61

Yu W, Guo P, Wang Q, Guan G, Yang Q, Huang Y, Yu X, Jin B, Cui C (2020) On a periodic capital injection and barrier dividend strategy in the compound Poisson risk model. Mathematics 8(4):511

Zhang X (2008) On the ruin problems in a Markov-modulated risk model. Methodology and Computing in Applied Probability 10(2):225–238

Zhang Z (2017) Nonparametric estimation of the finite time ruin probability in the classical risk model. Scandinavian Actuarial Journal 5:452–469

Acknowledgements

The authors are most grateful to referees for their very thorough reading of the paper and valuable suggestions. The research of Jingchao Li was supported by the National Key R&D Program of China (Grant No. 2020YFB2103503 ), the National Natural Science Foundation of China (project No. 11601344), Shenzhen peacock program (project No. 000417), Natural Science Foundation of Guangdong Province (project No. 2020A1515010372), the Humanities and Social Sciences Project of the Ministry Education of China (No. 19YJA910002), the Natural Science Foundation of Shandong Province (No. ZR2018MG002). The authors wish to express their gratitude for these financial supports.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Li, J., Su, B., Wei, Z. et al. A Multinomial Approximation Approach for the Finite Time Survival Probability Under the Markov-modulated Risk Model. Methodol Comput Appl Probab 24, 2169–2194 (2022). https://doi.org/10.1007/s11009-021-09897-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-021-09897-z