Abstract

The promotion of energy-efficient appliances is necessary to reduce the energetic and environmental burden of the household sector. However, many studies have reported that a typical consumer underestimates the benefits of energy-saving investment on the purchase of household electric appliances. To analyze this energy-efficiency-gap problem, many scholars have estimated implicit discount rates that consumers use for energy-consuming durables. Although both hedonic and choice models have been used in previous studies, a comparison between the two models has not yet been made. This study uses point-of-sale data about Japanese residential air conditioners and estimates implicit discount rates with both hedonic and choice models. Both models demonstrate that a typical consumer underinvests in energy efficiency. Although choice models generally estimate a lower implicit discount rate than hedonic models, the latter models estimate the values of other product characteristics more consistently than choice models.

Similar content being viewed by others

Notes

By contrast, some studies that analyzed the fuel economy of vehicles reported that consumers overinvested in energy saving (Greene 2010).

In addition, engineering and stated preference models are used for the estimation of implicit discount rates. In engineering models, the installation costs of energy-efficient technologies are compared and the value of the resulting energy-efficient investment is estimated. In stated preference models, surveys are conducted to elicit the willingness to pay (WTP) for energy-efficient investment.

For instance, the Energy Star label was introduced in the USA in 1992.

The “tatami mat” is used as a measurement unit for traditional Japanese rooms. The size of one tatami mat is 1.74 m by 0.87 m. Room sizes are standardized according to the number of tatami mats used.

Different consumers may rely on different pieces of energy information. Houde (2014) focuses on the refrigerator market and compares consumers’ responses to electricity costs with those to the Energy Star label. He finds that richer and smaller households respond to electricity costs but not so much to the label. He estimates that the value of energy information is around 12–17 US dollars per refrigerator sold.

The removal of observations with zero sales is likely to bias price coefficient estimates in a choice model analysis. However, AC models with zero sales are old models and their sales are recoded infrequently. For instance, we observe single-unit sales after observing zero sales for 3 months. It is difficult to handle observations with zero sales. The factions of AC models with zero sales are only about 12% in all AC classes, and AC models with even single-unit sales are included. We believe that the bias caused by their removal is not so serious. We thank the journal referee for pointing out this problem.

If the rebate was provided for the purchase of a specific AC model, we subtract it from the sales price and use the acquisition price that consumers actually paid in the following analysis.

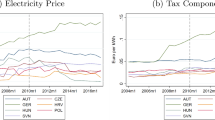

We used the electricity price of Tokyo Electric Power Company Holdings, Inc. (TEPCO), which uses block pricing. We used the second-stage rate, 21.04 yen/kW h, which is the most popular stage among general households.

Tasaki (2006) examines the usage period of ACs brought to electronics retail stores for recycling purposes and reported that more than 60% of the ACs were used for at least 8 years.

Households may not use an AC under this condition. We conduct sensitivity analysis to examine whether the relationship between two models is affected by the assumption of the intensity of AC use.

See Cockburn and Anis (1998) for further discussion.

Cropper et al. (1988) recommend the use of simple functional models if the omitted variable problem exists. Conversely, Kuminoff et al. (2010) recommend the use of flexible functional models such as a Box-Cox model when special and/or time fixed effects are included. The application of flexible functional models, however, makes the model comparison difficult. Thus, we use a simple functional model in this study.

These authors argue that the attributes attached to expensive models with limited numbers of sales are undervalued when the number of sales is used as a weighting variable.

Monthly fixed effects are not included in the choice model analysis as we compare the product choice between sampling periods.

Following the suggestion of the journal referee, we conducted sensitivity analyses. Although the implicit discount rates change with the assumptions about the future electricity cost, efficiency loss from depreciation, or usage period, the relationship between hedonic and choice models remains the same; that is, choice models estimate a lower implicit discount rate than hedonic models.

If consumers drive less, they can sell their used vehicles at higher prices at used car markets. In contrast, consumers are less likely to resell used ACs. Thus, heterogeneity in AC usage will have a greater effect on the price differentials of AC models, as original consumers are unlikely to consider resale value. Following the referees’ suggestion, we added the sensitivity analysis.

References

Allcott H (2011) Consumers’ perceptions and misperceptions of energy costs. Am Econ Rev 101:98–104. doi:10.1257/aer.101.3.98

Allcott H, Wozny N (2014) Gasoline prices, fuel economy, and the energy paradox. Rev Econ Stat 96:779–795. doi:10.1162/REST_a_00419

Arthur D. Little, Inc. (1984) Measuring the impact of residential conservation programs: An econometric analysis of utility data, Volume III. Final Report for RP1587, Electric Power Research Institute, California

Arguea NM, Hsiao C, Taylor GA (1994) Estimating consumer preferences using market data—an application to U.S. automobile demand. J Appl Econom 9:1–18. doi:10.1002/jae.3950090102

Bajari P, Benkard CL (2004) Comparing hedonic and random utility models of demand with an application to PC’s. Working paper. Graduate School of Business Stanford University. http://web.stanford.edu/~lanierb/research/Discrete_Choice_Models_WP.pdf. Accessed 8 Dec 2015

Bajari P, Benkard CL (2005) Demand estimation with heterogeneous consumers and unobserved product characteristics: a hedonic approach. J Polit Econ 113:1239–1276. doi:10.1086/498586

Bento A, Li S, Roth K (2012) Is there an energy paradox in fuel economy? A note on the role of consumer heterogeneity and sorting bias. Econ Lett 115:44–48. doi:10.1016/j.econlet.2011.09.034

Berkovec J, Hausman J, Rust J (1983) Heating system and appliance choice. Report no. MIT-EL 83-004WP. MIT Energy Laboratory, Cambridge, MA

Berry ST (1994) Estimating discrete-choice models of product differentiation. Rand J Econ 25:242–262. doi:10.2307/2555829

Cabinet Office, Government of Japan (2013) Consumer confidence survey. http://www.esri.cao.go.jp/en/stat/shouhi/shouhie.html. Accessed 4 Sept 2015

Cambridge Systematics, Inc., Charles River Associates, Inc. (1988) Investments in conservation measures, vol 1, Implicit discount rates in residential customer choices, EPRI EM-5587. Electric Power Research Institute, California

Cohen F, Glachant M, Söderberg M (2014) The impact of energy prices on energy efficiency: evidence from the UK refrigerator market. In: TIGER Forum 2014: ninth conference on energy industry at a crossroads: preparing the low carbon future, Toulouse, France, June 5–6

Cole H, Fuller R (1980) Residential energy decision-making: An overview with emphasis on individual discount rates and responsiveness to household income and prices. Report, Hittman Associates Inc, Columbia, MD

Cockburn IM, Anis AH (1998) Hedonic analysis of arthritis drugs. National Bureau of Economic Research. http://www.nber.org/papers/w6574.pdf. Accessed 2 Sept 2015

Corum KR, O’Neal DL (1982) Investment in energy-efficient houses: an estimate of discount rates implicit in new home construction practices. Energy 7:389–400. doi:10.1016/0360-5442(82)90098-6

Cropper ML, Deck LB, McConnell KE (1988) On the choice of functional form for hedonic price functions. Rev Econ Stat 70:668–675. doi:10.1080/00036849000000002

Diewert E (2003) Hedonic regressions: a review of some unsolved issues. Paper presented at conference on research in income and wealth, National Bureau of Economic Research. http://www.nber.org/CRIW/papers/diewert.pdf. Accessed 4 Aug 2014

Dubin JA (1985) Consumer durable choice and the demand for electricity. North-Holland Publishing Co., New York, Amsterdam

Dubin JA (1986) Will mandatory conservation promote energy efficiency in the section of household appliance stocks? Energy J 7:98–118. doi:10.5547/ISSN0195-6574-EJ-Vol7-No1-7

Dubin JA (1992) Market barriers to conservation: are implicit discount rates too high? Working paper, no. 802. California Institute of Technology, Division of the Humanities and Social Sciences

Eneduce (2015) Electricity costs increase by 20% in five years. http://eneduce.net/aging.html. Accessed 5 Sept 2015 (in Japanese)

Espey M, Nair S (2005) Automobile fuel economy: what is it worth? Contemp Econ Pol 23:317–323. doi:10.1093/cep/byi024

Fan Q, Rubin J (2009) Two-stage hedonic price model for light-duty vehicles: consumers’ valuation of automotive fuel economy in maine. TRR J 2157:119–128. doi:10.3141/2157-15

Fifer DPC, Bunn NP (2009) Assessing consumer valuation on fuel economy in auto markets. Honors thesis, Department of Economics, Due University, Durham, North Carolina

Gately D (1980) Individual discount rates and the purchase and utilization of energy-using durables: comment. Bell J Econ 11:373–374. doi:10.2307/3003318

GfK (2015) Retail sales tracking. http://www.gfk.com/solutions/retail-sales-tracking/Pages/default.aspx. Accessed 26 Jan 2015

Goett A (1978) Appliance fuel choice: an application of discrete multivariate analysis. Ph.D. thesis, Department of Economics, University of California at Davis

Goett A (1983) Household appliance choice: revision of REEP behavioral models. Final report for research project 1918-1. Electric Power Research Institute, California

Goett A, McFadden D (1982) Residential energy-use planning system (REEPS). Report EA-2512. Electric Power Research Institute, California

Greene DL (2010) How consumers value fuel economy: a literature review. EPA-420-R-10-008. United States Environmental Protection Agency

Hausman J (1979) Individual discount rates and the purchase and utilization of energy-using durables. Bell J Econ 10:33–54. doi:10.2307/3003422

Hausman JA (1997) Valuing the effect of regulation on new services in telecommunications. Brookings Pap Econ Act 28:1–54

Hausman JA, Taylor WE (1981) Panel data and unobservable individual effects. Econometrica 49:1377–1398. doi:10.1016/0304-4076(81)90085-3

Houde S (2014) How consumers respond to environmental certification and the value of energy information. NBER working paper no. 20019

Jaffe AB, Stavins RB (1994) The energy paradox and the diffusion of conservation technology. Resour Energy Econ 16:91–122. doi:10.1016/0928-7655(94)90001-9

Japan Refrigeration and Air Conditioning Industry Association (2014) About annual electricity consumption. http://www.jraia.or.jp/product/home_aircon/e_saving_energy.html. Accessed 8 Mar 2015

Kahn J (1986) Gasoline prices and the used automobile market: a rational expectations asset price approach. Q J Econ 101:323–340. doi:10.2307/1891118

Kim K, Petrin A (2010) Control function corrections for omitted attributes in differentiated product models. Working paper, University of Minnesota. http://www.econ.umn.edu/~petrin/research.html. Accessed 8 Dec 2012

Kuminoff NV, Parmeter CF, Popec JC (2010) Which hedonic models can we trust to recover the marginal willingness to pay for environmental amenities? J Environ Econ Manag 60:145–160. doi:10.1016/j.jeem.2010.06.001

Lin W, Hirst E, Cohn S (1976) Fuel choice in the household sector. Report no. ORNL/CON-2. Oak Ridge National Laboratory

Matsumoto S, Omata Y (2017) Consumer valuation of energy-efficiency investment: the case of Vietnamese air conditioner market. J Clean Prod 142:4001–4010. doi:10.1016/j.jclepro.2016.10.055

McManus W (2007) The link between gasoline prices and vehicle sales: economic theory trumps conventional Detroit wisdom. Bus Econ 42:54–60. doi:10.2145/20070106

Meier AK, Whittier J (1983) Consumer discount rates implied by purchases of energy-efficient refrigerators. Energy 8:957–962. doi:10.1016/0360-5442(83)90094-4

Ministry of the Environment of Japan (2008) Shinkyusan. http://shinkyusan.com/index.html. Accessed 3 Aug 2015

Morita M, Matsumoto S, Tasaki T (2014) Effect of an energy rebate program on implicit discount rate: a hedonic analysis of the Japanese Eco Point Program. Rev Environ Econ Policy Stud 7:24–36 (in Japanese)

Palmquist RB, Israngkura A (1999) Valuing air quality with hedonic and discrete choice models. Am J Agric Econ 81:1128–1133. doi:10.2307/1244096

Pendleton L (1999) Reconsidering the hedonic vs. RUM debate in the valuation of recreational environmental amenities. Resour Energy Econ 21:167–189. doi:10.1016/S0928-7655(98)00034-7

Pendleton L, Mendelsohn R (2000) Estimating recreation preferences using hedonic travel cost and random utility models. Environ Resour Econ 17:89–108. doi:10.1023/A:1008374423710

Petrin A, Train K (2010) A control function approach to endogeneity in consumer choice models. J Market Res 47:3–13. doi:10.1509/jmkr.47.1.3

Revelt D, Train K (1998) Mixed logit with repeated choices: households’ choices of appliance efficiency level. Rev Econ Stat 80:647–657. doi:10.1162/003465398557735

Rosen S (1974) Hedonic prices and implicit markets: product differentiation in pure competition. J Polit Econ 82:34–55. doi:10.1086/260169

Sanstad AH, Hanemann WM, Auffhammer M (2006) End-use energy efficiency in a ‘post-carbon’ California economy: policy issues and research frontiers. In: Hanemann MW, Farrell AE (eds) Managing greenhouse gas emissions in California. The California Climate Change Center, University of California, Berkeley

Silver M (2002) The use of weights in hedonic regressions: the measurement of quality adjusted price changes. Cardiff Business School, Cardiff University, Mimeograph

Silver M, Heravi S (2005) A failure in the measurement of inflation: results from a hedonic and matched experiment using scanner data. J Bus Econ Stat 23:269–281. doi:10.1198/073500104000000343

Sorrell S, Dimitropoulos J, Sommerville M (2009) Empirical estimates of the direct rebound effect: a review. Energy Policy 37:1356–1371. doi:10.1016/j.enpol.2008.11.026

Tasaki T (2006) An evaluation of actual effectiveness of the recycling law for electrical home appliances. No. 191, National Institute of Environmental Studies. http://www.nies.go.jp/kenkyusaizensen/r-191-2006.pdf. Accessed 15 Mar 2015

Train K (1985) Discount rates in consumers’ energy-related decisions: a review of the literature. Energy 10:1243–1254. doi:10.1016/0360-5442(85)90135-5

Tsvetanov T, Segerson K (2014) The welfare effects of energy efficiency standards when choice sets matter. J Assoc Environ Resour Econ 1:233–271. doi:10.1086/676036

U.S. Bureau of Labor Statistics (2016) Hedonic quality adjustment in the CPI. https://www.bls.gov/cpi/cpihqaitem.htm. Accessed 4 Jan 2015

U.S. Energy Information Administration (2011) International energy statistics. http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid. Accessed 20 Mar 2015

Veblen T (1899) Theory of the leisure class. Oxford University Press, Oxford

Wasi N, Carson RT (2013) The influence of rebate programs on the demand for water heaters: the case of New South Wales. Energy Econ 40:645–656. doi:10.1016/j.eneco.2013.08.009

Weitzman ML (2007) A review of the stern review on the economics of climate change. J Econ Lit 45:703–724. doi:10.1257/jel.45.3.703

Wong M (2015) A tractable framework to relate marginal willingness-to-pay in hedonic and discrete choice models. Research paper no. 81. The Wharton School Research Papers. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2605537. Accessed 11 Dec 2015

Acknowledgements

Most of this paper was written during my sabbatical at the Institute for Environmental Science and Technology (ICTA) at the Universitat Autònoma de Barcelona in the academic year of 2015. I would like to thank ICTA for its great hospitality. This work is supported financially by the Asahi Glass Foundation and the Japan Society for the Promotion of Science KAKENHI (Grant Number: 26340119).

Author information

Authors and Affiliations

Corresponding author

Appendix: Control variable construction

Appendix: Control variable construction

In this study, we solve the endogeneity problem between the price and the unobserved characteristics of ACs by applying the technique proposed by Hausman (1997) and Hausman and Taylor (1981). Consumers choose one AC among the ACs in the specific cooling capacity class suitable for their room. Therefore, AC markets are differentiated by cooling capacity classes. We initially estimate the prices of ACs in class c by analyzing the data of the remaining classes (\(-c)\). The estimated prices (after elimination of class- and brand-specific effects) are driven by underlying costs, which provide instrumental variables that are correlated with the prices of ACs in class c, but uncorrelated with the error term \(\omega _{\textit{mt}} \) in Eq. 8.

When analyzing ACs in the cth cooling capacity class, we use data of the remaining class (\(-c)\) and estimate the following hedonic function:

Here, \(P_{\textit{lt}}^{-c} \) is the average price of the lth AC model at period \(t, \textit{CAP}_l^{-c} \) is the cooling capacity, \(\textit{EC}_{{\varvec{l}}}^{-{{\varvec{c}}}} \) is annual electricity consumption, and \({\varvec{Z}}_{\textit{lt}} \) is the vector of the characteristics of the lth AC model, which include manufacture- and year-specific dummies. We use sales value as a weight. The results are presented in Table 6.

Using the estimated coefficients, we calculate

Plugging this into the exponential function, we estimate the expected price of the mth AC model in class c as follows:

We estimate the following hedonic function:

Here, the estimated price \(\hat{P} _{\textit{mt}}^c \) is used as an instrumental variable. It is correlated with the price, but uncorrelated with the error term \(\omega _{\textit{mt}} \) in Eq. 7. The results are presented in Table 7. All expected price variables become positive and statistically significant at the 1% level.

Finally, we calculate the residual of this estimation as follows:

Following Kim and Petrin (2010) and Petrin and Train (2010), we use this residual as a control function in Eq. 8.

Rights and permissions

About this article

Cite this article

Matsumoto, S. Consumer valuation of energy-saving features of residential air conditioners with hedonic and choice models. Empir Econ 55, 1779–1806 (2018). https://doi.org/10.1007/s00181-017-1327-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1327-1