Abstract

This paper explores the willingness-to-pay for energy efficiency by exploiting variation across products and countries within the EU market for household appliances. Based on scanner data at product-level, I use the hedonic method to estimate implicit prices for energy efficiency and derive implicit discount rates. The paper argues that the implicit price will be underestimated when energy consumption is not only a determinant of operating cost but also is positively associated with other features of a product. The empirical analysis confirms that estimates of the willingness-to-pay are higher when this effect is accounted for in the estimation. This is especially true of product types for which the heterogeneity of usage intensity is low. The results thus indicate that the energy efficiency gap is smaller than found in earlier studies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic actors appear to undervalue efficiency improvements relative to the theoretical cost-benefit prediction. The discrepancy between observed (under-) investment in energy efficiency and the cost savings associated with said investment is referred to as the energy efficiency gap (Jaffe et al. 2004). Existence and extent of this gap have important policy implications. For example, if energy consumption is only a question of negative externalities, then a Pigouvian tax can correct the market failure. However, if there are investment inefficiencies, i.e., consumers fail to realize savings even at current energy prices, then alternative policies through information and regulation may have merit (Allcott and Greenstone 2012; Houde and Spurlock 2016; Sonnenschein et al. 2017). Hence, understanding how consumers value energy efficiency is a pre-requisite to resource conservation policy more broadly (Gillingham et al. 2009).

The energy efficiency gap is far from a new question in empirical work, but the underlying willingness-to-pay remains a puzzle in the literature (Gerarden et al. 2017; Joskow 2016). A first set of influential studies indicates a sizable energy efficiency gap (e.g., Hausman 1979, Gately 1980, Meier and Whittier 1983, Dubin et al. 1986). These early studies have shaped the common approach. From a theoretical model of the rational consumer, the rational investment decision is derived as a trade-off between upfront investment cost and a product’s lifetime energy cost (LEC). Deviations from this hypothetical benchmark are then interpreted as evidence of the energy efficiency gap. This is frequently done in the form of an implicit discount rate. Yet, high implicit discount rates do not reveal whether the consumer or the model fail the test. Recent contributions have suggested a number of factors—other than consumer myopia—to explain why empirical estimates might diverge from expectations (see the review by Gillingham and Palmer 2020). Gerarden et al. (2017, 1487) group these explanations into three categories: “(1) Market failures, (2) Behavioral explanations, and (3) Modeling flaws.” This paper is focused on the third category: I explore how the established methodology can be refined using a new source of variation.

The paper studies the energy efficiency gap with a theory-based adaptation of the hedonic method and an application to the European market for household appliances. The hedonic method has been a workhorse model in non-market valuation for many questions in environmental economics and beyond (e.g., De Haan and Diewert 2013, Greenstone 2017). Still, a main drawback is that estimates may be biased when the attribute of interest is correlated with other attributes of the product. By revisiting the theoretical base of the method, I show how this applies for the valuation of energy efficiency: the willingness-to-pay is potentially underestimated, and accordingly, the implicit discount rate would be overestimated in favor of the energy efficiency gap. However, the derivation opens up an opportunity to empirically address this source of underestimation in settings with rich variation in operating costs. The empirical strategy then uses previously unexploited variation in electricity prices across European countries to obtain cleaner estimates of the willingness-to-pay. I estimate willingness-to-pay for seven member states of the European Union based on product-level data for two appliance categories: washing machines and freezers. The results confirm the prediction: implicit discount rates drop. For freezers in particular, the drop is substantial enough to explains most of the apparent energy efficiency gap.

My work makes two contributions to the literature. First, my approach contributes to methodology. I outline a simple adaptation of the hedonic model to formally derive the implicit price of energy consumption. The theory shows that the implicit price rests on two components: energy consumption is not only a determinant of operating cost in the budget constraint, but also an argument in the appliance’s sub-utility function. In practice, the latter effect, which I refer to as the feature effect, arises when energy consumption is associated with other product features. For example, large doors for cooling appliances make it more convenient to access food but increase energy consumption.Footnote 1 For washing machines, an example is the cycle duration, as consumers may value quick-wash-programs, although this feature typically consumes more energy. If consumers place value on unobserved attributes that drive up energy consumption, then the feature effect would be positive. On the other hand, green consumerism could imply a negative feature effect, meaning that consumers value energy savings beyond cost-effectiveness.Footnote 2 Although the feature effect is intuitively straightforward, it implies that caution must be taken in interpreting empirical results when the feature effect is omitted from estimation. Of course, the issue of unobserved product features that correlate with energy consumption has been pointed out before. It runs deep in applications of the hedonic method and any identification relying on cross-sectional variation. In the context of energy efficiency, Allcott and Greenstone (2012) refer to it as unobserved utility costs in their generalization of the LEC framework.Footnote 3 By starting from theory, I am able to turn a general concern into a specific, testable prediction. My approach incorporates the feature effect into the hedonic price function and shows how the two components can be separated. Subsequently, these insights allow me to provide empirical estimates that can reveal how big the impact is quantitatively.

Second, the empirical analysis exploits a new testing ground with the European common market. Country borders delineate consumer groups on an integrated market, where uniform labelling and regulation frameworks present all consumers with the same energy information. Yet, electricity prices are set at the national level, so consumers face different operating costs for a given level of energy consumption. The bulk of work for appliances builds identification on a single location (e.g., Cohen et al. 2017a, Galarraga et al.2011, Matsumoto 2018, Tsvetanov and Segerson 2014). Very recently, Houde and Myers (2021) have used regional electricity prices in the US to study the energy efficiency gap. They show that consumers in fact respond strongly to local energy costs for refrigerators, which does not support a large energy efficiency gap.Footnote 4 For cars, gasoline price fluctuation has become a main avenue to studying the energy efficiency gap, for example by Hughes et al. (2008), Busse et al. (2009), Klier and Linn (2010). Those studies have pushed the literature forward by going beyond the cross-sectional approach of the first wave. My work adds evidence from the context of nation states, where energy price differences are persistent and sorting across locations is a minor concern. On the downside, the variation is less fine-grained and rooted in national contexts, which may raise concerns about other unobserved forms of heterogeneity. Despite the trade-off, this paper complements the insights of the above studies with new evidence from a novel multi-country setting.

Previous work shows that variation across EU member states offers a unique opportunity for identification in several fields of economics. For example, Büttner and Madzharova (2021) use cross-country variation to study VAT pass-through for white goods.Footnote 5 Grigolon et al. (2016) study scrapping subsidies for cars where adoption dates are staggered across member states. Those studies use the EU member states to build a counterfactual for policy evaluation.

My baseline results suggest that the implicit price of energy consumption is negative but very small: in the range of 2–3 Euro for a 10 kWh reduction in annual energy consumption when all countries are pooled. There are substantial differences in implicit prices across countries, with a divide between countries with low and high energy prices. Implicit discount rates are found to be higher when the feature effect is not accounted for. This holds qualitatively for both product types, despite differences in magnitude. The main estimate for freezers gives an implicit discount rate of 12%, whereas the same specification for washing machines indicates an implicit discount rate of 62%. I argue that this discrepancy can arise through sorting bias from usage heterogeneity that is present in washing machines but minor in the case of freezers, especially when such heterogeneity is systematically related to the feature effect (see Bento et al. 2012).

The rest of the paper proceeds as follows. Section 2 derives implicit prices for individual attributes when energy services are sold in an appliance “bundle”, and summarizes implications for the interpretation of energy efficiency choices. Section 3 gives an overview of the data used for estimation, followed by the empirical methodology in Sect. 4. Section 5 presents the results, starting with descriptive evidence on country differences, followed by the main hedonic results, and finally the implicit discount rates. Sect. 6 concludes thereafter.

2 Theoretical Framework

2.1 Hedonic Prices and Appliance Choices

Consider the appliance a bundle of attributes, with the energy-related attribute E being part of this bundle. For simplification, E is defined as energy consumption, as opposed to energy efficiency.Footnote 6 Using the standard setup following Rosen (1974), the appliance is a differentiated commodity with energy consumption E and a vector of K other features \({{\textbf {z}}} = z_1, z_2 \ldots , z_K\). Let \(A=f({{\textbf {z}}},E)\) be the sub-utility from the appliance, with purchase price \(p({{\textbf {z}}},E)\), and denote c(E) the operating cost over its lifetime, as perceived by the consumer. For exposition here, I abstract from intertemporal aspects and present the consumer problem as a one-time decision in a single period (following Levinson 2019).

The consumer derives utility \(u = U(A,x)\) from the appliance and the composite x. I make two changes from the common set up of the hedonic model. First, I deviate from the convention of pricing x at unity, and instead denote its price q, as suggested by Diewert (2003a). Second, E is treated differently from the other attributes. Like any feature of A, the attribute E affects the optimal bundle directly, expressed by \(\frac{\partial f}{\partial E}\). Secondly, however, more efficient appliances have lower operating cost c(E), which shows in the budget constraint: \(Y = qx + p + c(E)\). Given prices p and q, the consumer maximizes:

Deriving the first-order conditions with respect to x, \(z_k\) and E, eliminating \(\lambda\), and re-arranging yields the implicit prices for all features:

For non-energy features, this is straightforward. The implicit price depends on the marginal rate of substitution between the appliance and the composite, the price level q, and how that particular feature generates utility within the appliance bundle. Regarding E, the implicit price has an additional component because it depends on the operating cost c(E). It therefore has a dual role: E has both a feature effect (\(\frac{\partial f}{\partial E}\)) and a cost effect (\(\frac{\partial c}{\partial E}\)). Expect c(E) to be increasing in energy prices e as the main input and in the level of energy consumption. To grasp the empirical implications, it is useful to simplify the notation for \(\frac{\partial p}{\partial E}\). Summarize the first term under a single parameter \(\delta\) and assume for simplicity that \(c(E) = \gamma e E\). With these adjustments, the implicit price consists of two additive components:

If E has no impact on the sub-utility function, then \(\delta = 0\) and thus \(\frac{\partial p}{\partial E} = -\gamma e\). However, when \(\delta \ne 0\), neither the sign nor the magnitude of the effect is obvious. \(\delta\) can capture a taste for unobserved attributes that drive up energy consumption, then it would be positive. On the other hand, pro-social behavior and environmental awareness could imply \(\delta < 0\).

To derive predictions, it is useful to start from the working hypothesis that \(\delta = 0\). Then, E is not an element of the sub-utility A, but merely a determinant of operating cost. The implicit price of E reflects the marginal change in c(E) as perceived by the consumer. The second term hence subsumes time preferences and energy prices, with or without an energy efficiency gap. Assuming preferences are stable over time, the expectation is that diverging energy prices are reflected in diverging implicit prices. Moreover, with \(\delta = 0\) and the assumption of separability, the marginal rate of substitution between A and x does not drive the implicit price. Put differently, 1 Euro in energy savings would justify the same increase in the upfront investment regardless of what appliance type delivers those savings. In practice of course, this interpretation hinges on the assumption that there are no indivisibilities, and that costless repacking is possible (as in Rosen 1974).

When there is a spectrum of products, the hedonic model is based on an equilibrium price schedule with consumers choosing the optimal bundle according to their preferences, and the energy costs they face. In equilibrium, marginal willingness-to-pay (MWTP) for an attribute equals the implicit price for that attribute, which is derived from the tangency of the price schedule and the willingness-to-pay function. Appendix 1 depicts this equilibrium price schedule. While it is a useful point of departure, the basic model is admittedly restrictive regarding differences across locations. It assumes a single price schedule with consumers sharing the same sub-utility, and price level q across locations. Conversely, consumers are able to sort across the full range of the price schedule irrespective of location.

2.2 Implications for Energy Efficiency Valuation

To connect implicit prices and the energy efficiency gap, it is useful to adopt a functional form regarding the choice of energy consumption. As is standard in the literature, the difference in operating cost is obtained by a net present value calculation. The consumer trades off the incremental investment \(\Delta p\) for a more efficient device against its lifetime energy cost (LEC), i.e., the energy savings \(\Delta E_t\) per period, which accumulate over the product’s useful life T.

Holding all other features constant, the consumer is indifferent when the present value of the LEC equals the incremental price difference. Formally,

Where r is the implicit discount rate, and \(\phi\) is usage intensity.Footnote 7

Linking this to the implicit prices, I take two simplifying assumptions: (i) The consumer uses the current price of energy to form expectations, and (ii) \(\phi = 1\), which is to assume that there is no variation along the usage margin and all consumers expect to realize an actual energy consumption of \(E_t\). Inserting the implicit price of operating costs from the hedonic model, \(\Delta p = \gamma e_{t} E\), the above simplifies to:

Note that for the above to characterize the trade-off between operating costs and upfront investment, only the second term of Eq. (2) enters on the left-hand side. Using the full implicit price of energy consumption is only equivalent with the assumption that \(\delta = 0\). If \(\delta > 0\) (\(<0\)), one would thus overestimate (underestimate) the implicit discount rate.

Linking the insight to the established literature, \(\delta\) would constitute a form of unobserved utility cost (Allcott and Greenstone 2012, 9). In this sense, the simple model leaves out several other adaptations that have been proposed. I do not specifically address behavioral phenomena that may contribute to undervaluation. That includes rational inattention (Sallee 2014), salience of energy information (Allcott and Taubinsky 2015), and uncertainty over realized savings (Alberini 2019). These aspects would be captured in \(\gamma\) and factor into the discount rate. Moreover, I retain the most basic form of the intertemporal decision, leaning on the bulk of the literature that I am seeking to help explain. This leaves out more nuanced approaches to modeling consumer expectations, as explored by Anderson et al. (2013), Rapson (2014).

3 Data

The data consist of micro-level panel data for sales of white goods in the EU. The data report the total unit sales at the product (i.e., model) level and is collected by the market research company Gesellschaft für Konsumforschung Retail and Technology GmbH (GfK). The product categories encompass washing machines and freezers for the period from January 2004 to April 2017 at monthly frequency. Geographically, the data cover the seven EU members Germany, Austria, Hungary, the Czech Republic, Poland, Slovenia and Croatia.Footnote 8 Each individual product has a unique identification number (id) that is the same over time and across countries for products sold in multiple countries. For each id, unit sales and prices are reported for each country and month. Unit sales refers to the number of units sold for each product in a specific country and month. The GfK collects the prices from multiple retailers in each country. Prices are calculated as the sales-weighted average of scanner prices across retailers in local currency and Euro, including taxes or discounts.Footnote 9

Table 1 summarizes the information on attributes for each category. The attribute of interest is energy consumption per year, which is reported in accordance with the EU-wide protocols of the Ecodesign and Energy Labelling Directives (2009/125/EC and 2010/30/EU, respectively).Footnote 10 Consequently, the reported value is an estimate based on assumptions about actual usage. My approach assumes that the reported value coincides with the consumers’ expectation of actual energy consumption from using the product (see \(\phi\) in theory). For freezers, which are plugged in 24/7, this appears reasonable. However, for washing machines, this may be a strong assumption. If consumers wash on a colder/hotter cycle, run more/less loads or operate without off-mode, the actual consumption is likely different, and this well-documented usage margin is unobservable with the scanner data. Brand refers to the specific name a product is sold under, which is more fine-grained than the manufacturer or producer. Special lines as spin-offs from an established brand are identified as separate brands, whereas trade brands cannot be distinguished by retailer.

For estimation, products with missing id and missing information on brand or energy consumption are eliminated. The focus is on the period from 2010 onward, because the countries in Central and Eastern Europe (CEE) acceded the EU only in 2004 and were granted transition periods in complying with Common Market regulations (e.g., Pelkmans 2006).Footnote 11 Additionally, reporting of energy information is incomplete in earlier years, especially for the new member states and for smaller brands, potentially inducing sample selection towards the upper end of the product spectrum. In total, the basic data set used for estimation has 371, 222 observations from 7939 unique ids. The panel is unbalanced as it picks up entry and exit of products over the time span.

Data on energy prices are obtained from Eurostat using the residential household electricity price series. Electricity prices in the Eurostat database are reported at the country-level and bi-annual frequency. Eurostat also reports the energy tax as a component of the final electricity price, which has been shown to be important as an indicator shaping long-term decisions (Sahari 2019). The member states have competence over domestic electricity markets, but must set energy taxes above a minimum rate imposed by the EU (Directive 2003/96/EC). Notably, many of the new member states have tax rates at or near the minimum, creating a cluster of countries at the lower bound. Figure 1 plots electricity prices and the respective taxes for an overview. While differences between countries dominate within-country variation over time, there are marked differences. Germany is on a continued upwards trend vis-a-vis the remaining countries, and that divergence is driven mainly by increasing taxation. The CEE countries face much lower electricity prices on average, but there are differences in levels and trends. For example, Hungary has experienced a decrease in recent years, whereas Slovenia’s electricity price is rising on the back of increased taxes.

To account for changes in price levels over time, both appliance prices and electricity prices are deflated using the Harmonized Index of Consumer Prices (HICP), a consumer price index where all European countries follow a common methodology. The HICP is a chain-linked variant of a Laspeyres-Index, where prices are updated monthly, but quantities are updated in December of each year. For details on the Eurostat data and deflation, see Appendix 3.

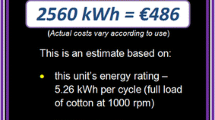

Table 2 reports descriptive statistics by category. Sales-weighted prices differ markedly from unweighted statistics, which reflects a long right tail in the distribution of prices. On average, operating costs are substantial relative to purchase prices. For example, the mean statistics for freezers, with an assumed lifetime of 18 years based on consumer surveys, add up to 725 Euro in undiscounted lifetime costs. Table 3 reports descriptive statistics separately for each country to provide an overview of the geographical variation used for identification.

Electricity Prices and Taxes by Country. The left panel plots electricity prices in Euro/kWh for each country in the sample at the national level. The series refers to final household electricity prices as reported by Eurostat (2020a). The data are reported at bi-annual frequency and inclusive of all taxes. The right panel isolates the tax component over the same sample frame. All prices are converted to Euro in 2010 constant prices and deflated using the EU’s Harmonized Index of Consumer Prices. The dashed line indicates the starting period of the estimation sample. Country codes: Austria (AUT), Czech Republic (CZE), Germany (GER), Croatia (HRV), Hungary (HUN), Poland (POL), Slovenia (SVN)

Both the sales and the electricity data are available only at country-level, which is a noted limitation as it may mask sub-national heterogeneity. For reference, the country sizes are comparable to US states with the exception of Germany (see Table 8). The (wholesale) bidding zones for the countries in the sample are nation-wide (Florence School of Regulation 2018), and so are important taxes like value-added tax and other charges, but network charges and supplier-specific pricing can still drive regional prices. Consumers are free to choose their supplier by EU law following liberalization efforts, although not all suppliers operate nationally and switching rates remain relatively low in many countries (see e.g. Pepermans 2019 for a non-technical summary). Additionally, countries’ tax and regulatory systems differ. The Eurostat data follow a common methodology for both electricity prices and price indices across countries, which is an advantage for the cross-country analysis on which the paper is built.

4 Empirical Strategy

4.1 Baseline Estimates of the Hedonic Price Function

In a first step, observations from all countries are pooled. I estimate the hedonic price schedule separately for washing machines and freezers. The outcome variable is the natural logarithm of price p paid for model i.

The basic model is:

Where j indexes countries and t indexes time at monthly frequency. \(z_i^k\) indicates the k non-energy related attributes. \(\beta\) is the implicit price of a product’s energy consumption, with \(\beta < 0\) indicating that consumers require a discount on products that use more energy, conditional on other price-relevant features. Corresponding to Eq. (2), \(\beta\) thus subsumes both components of the implicit price, which would include operating cost and feature effect.

Including country-date fixed effects \(\alpha _{jt}\) accounts for factors that are common to the country at that specific time period. The \(\alpha _{jt}\) absorb time-related factors such as seasonality or supply-side shocks, but also country-time specific factors such as value-added tax rates. As every country-date cell is a unit, this amounts to comparing the distribution of implicit prices within a cell to the observations in other cells. The implicit prices are identified from variation across country-date cells, i.e., they compare the choices of consumer groups in different countries and time periods. Think of a consumer who walks into the store in a certain period and country and chooses from the set of products available. Given electricity prices and economic conditions, he or she will pick an optimal bundle. Assuming that the Common Market is fully integrated, conditional on \(\alpha _{jt}\), each consumer choice represents a single point on the hedonic price schedule. In that point, the estimated implicit price is equal to the marginal willingness-to-pay for the respective attribute.

The semi-log model is chosen based on Diewert (2003b, 5), who notes that products with higher price points are likely to have more unobserved extra features, and thus larger errors. Hence, the semi-log form is recommended, as it assumes that the ratio of model price to mean price has constant variance, as opposed to constant variance regarding the difference between model price and mean price, which is assumed if price enters in levels. Several consumers may opt for the same model i, so observations are weighted by unit sales, as discussed by Silver and Heravi (2005). The coefficients are thus interpreted as the MWTP of the average consumer in the sample. Standard errors are clustered by product id to allow for correlation between error terms of the same bundle i sold in different countries or time periods. This is chosen to best reflect the background of the hedonic model. An alternative is to cluster by country-time groups because electricity prices vary at that level. This does not affect the results, see Appendix 5 for details. Regarding interpretation, the pooled baseline reflects the measure of interest to policy makers at the EU level, who must impose legislation uniformly on the Common Market, but have no means of harmonizing operating costs due to constraints in competence (see e.g., Delbeke et al. 2015). It gives a first indication on whether consumers are willing to pay more for products with lower energy consumption.

The next step is to examine cross-country differences. This is done in two ways. First, by including an interaction between country dummies \(a_j\) and \(E_i\). Second, by allowing the effect of the non-energy attributes in the vector z to differ across countries.

The regression equation becomes

This specification represents the average implicit price \(\frac{\partial p}{\partial E}\) in country j over the sample period, using Austria as the reference category. The expectation is that the marginal effect of energy consumption is negative, but with higher absolute values in countries with higher electricity prices, i.e., higher operating cost c(E) for a given bundle.

However, estimating a single parameter for every element of \({{\textbf {z}}}\) as in the baseline assumes homogeneous preferences across countries. Differences in household composition and demographic structure are obvious examples for heterogeneous preferences outside of the energy-related decision. After including interactions between country and the non-energy attributes, the estimates now capture differences in the implicit price for E among consumer groups (defined by country) with a different sub-utility for an appliance. In single-country settings, this distinction between common and group-specific preferences is typically not feasible without demographic information on the individual buyers, so the extension here is benefit of the EU Common Market. Nevertheless, the approach takes the assumption that there are country-wide “markets”, as sub-national segmentation is not possible given the data.

4.2 Feature and Cost Effect

The theory suggests that the implicit price has two additive components when the energy is embedded in a bundled commodity. The regressions in Sect. 4.1 reveal the total effect including \(\delta\) and \(\gamma\) (see Eq. (2)). To obtain a cleaner estimate of the operating cost effect, I separate the two components by using variation in the electricity price \(e_{jt}\). This constitutes the main result.

Adding annual operating cost \(c_{jt}(E_i) = e_{jt} E_{i}\), the regression equation is:

The specification also includes interactions between the non-energy attributes and country dummies to allow preferences to differ by country.Footnote 12 Note that adding c(E) as an explanatory variable is equivalent to adding an interaction between a product’s energy consumption and the electricity price faced by the consumer in that country-date cell. The main effect of \(e_{jt}\) is absorbed by the country-date fixed effects (see Giesselmann and Schmidt-Catran 2020). Maintaining the expectation that \(\gamma < 0\), the regression disentangles the cost effect from the feature effect. When \(\delta > 0\) (\(<0\)), excluding the added component understates (overstates) the cost effect.Footnote 13 With electricity prices reported at the national level, the identification strategy assumes that any sub-national differences in the feature effect do not drive local electricity prices.

4.3 Implicit Discount Rates

In a final step, the estimated implicit prices are used to calculate the implicit discount rate r for both categories. r is the rate that solves Eq. (3), using the estimated implicit price on the left-hand side, and making assumptions about \(\phi\) and T. I assume \(\phi = 1\), and \(T = 12\) for washing machines, \(T = 18\) for freezers, based on the consumer surveys by Faberi et al. (2007) and Stamminger et al (2007).Footnote 14

Implicit prices are evaluated at the mean electricity price \({\overline{e}}\), and the mean appliance price \({\overline{p}}\) for the respective product category. Both figures are sales-weighted, so the estimate can be interpreted as the implicit discount rate of the average consumer. This is done for three scenarios, based on Eq. (6). The first is the preferred specification in light of the theory: it measures the operating cost component \(\gamma\), while allowing for non-zero values of \(\delta\) in estimation. I compare this with two specifications that implicitly assume \(\delta = 0\) in interpreting the implicit price \(\frac{\partial p}{\partial E}\) directly as the trade-off between appliance price and operating cost.

Formally,

-

(i)

\(\Delta p = \left( {\hat{\gamma }}{\overline{e}} \right) {\overline{p}}\),

-

(ii)

\(\Delta p = \left( {\hat{\delta }} + {\hat{\gamma }}{\overline{e}} \right) {\overline{p}}\),

-

(iii)

\(\Delta p = \left( {\tilde{\gamma }}{\overline{e}} \right) {\overline{p}}\), using the restricted model.

In (ii), the estimated parameter from the full model in Eq. (6) is added back in. In (iii), the restricted model without \(\delta\) is used, as in column (2) of Tables 5 and 6.Footnote 15 To distinguish between the models used in estimation, \({\hat{\gamma }}\) refers to the coefficient from the full model, and \({\tilde{\gamma }}\) to the restricted model. The three scenarios link directly to the theory. Comparing (i) and (ii) reflects the difference between the full implicit price in Eq. (2) and separating out the operating cost component. Comparing (i) and (iii) shows the simplifying assumption that energy consumption is only an argument in the cost function, but not in the sub-utility function. If empiry and theory match, scenarios (ii) and (iii) are expected to be similar because they represent two ways of omitting \(\delta\). The evaluation at the average price is needed to convert from the semi-log specification to an implicit price expressed in Euro. Estimates of r are presented with bootstrapped standard errors.

An alternative strategy would have been to make an assumption on r, construct an estimate of the LEC and use it directly as the main explanatory variable in the hedonic price equation. This approach would relax the assumption of a linear relationship between price and energy consumption. However, given the wide range of previous estimates and the strong functional form assumptions about the trade-off made in Eq. (3), I chose to estimate the price schedule with less imposed structure and trace out the discount rate from the estimated implicit price of \(E_i\). A noted downside of my approach is that I focus on the average consumer, treating \({\overline{p}}\) and \({\overline{e}}\) as scalars. Houde and Myers (2019) show that there can be substantial heterogeneity across individual purchase decisions, which I do not model here. Instead, I supplement the main results with sensitivity analysis to show how the discount rate would vary with purchase price, implicit price, usage intensity, and product lifetime (see Figs. 5 and 6 and Appendix 7).

4.4 Robustness

To address variation over time, I also estimate a specification with separate implicit prices for each country-year pair by interacting \(E_i\) with country-by-year dummies instead of merely using country dummies. This addresses concerns that there may be a general time trend in implicit prices as documented for cars by Hughes et al. (2008), or a convergence pattern across countries from technological change.

Second, I test for income effects in light of the theory: Eq. (2) indicates that the feature effect depends on the price q of the composite good. Considering that the countries in the sample differ in this regard, I therefore re-estimate the model by including an interaction between different price level indices and energy consumption. Note that level differences are accounted for by the fixed effects in the estimation.

In a further robustness check, I restrict the sample to a more homogeneous subset, which would reduce the impact of country-specific product segments. I re-estimate the model with a sample restricted to products sold in multiple countries, and also restrict to larger brands. A key assumption behind the hedonic method in a setting with multiple locations is that there is a single equilibrium price schedule which describes the market and that implicit prices do not vary systematically across segments along the price schedule (see the discussion in Albouy et al. 2016; Sinha et al. 2018). For the context of the EU Common Market, this may be a strong assumption. Different energy prices affect market composition, as documented for vehicle fleet composition under rising gas prices (Li et al. 2009). This does not affect the main results, refer to Appendix 4 and 5 for details.

To formally disentangle composition effects from coefficient effects, I additionally employ the decomposition techniques suggested by Oaxaca (1973) and Blinder (1973). The decomposition partitions the gap in mean prices between countries into two components. The composition effect captures the part of the price gap that is attributable to differences in price-relevant attribute levels. In the context of the hedonic regression, it reflects sorting along the spectrum of available products. The coefficient effect (often referred to as the unexplained component), captures the part of the price gap that is attributable to differences in implicit prices. The hedonic model builds on variation in the latter component, hence the decomposition rules out the possibility that country differences have only level effects (see Appendix 6).

4.5 Descriptives

Figure 2 depicts appliance prices and energy consumption across countries and time. Mean values are sales-weighted, the first year (2009) is included here only as a pre-trend. First, the country ranking is relatively stable over time. In general, country differences are more pronounced than within-country changes over time. Germany and Austria form a group that is distinct from the CEE countries in the sample. The former spend more on average while opting for models with lower energy consumption. Within those broad groups, the pattern is less distinct. Hungary and Poland tend to be at the bottom of the CEE group regarding appliance prices, but there are several reversals in the ranks over time and across categories. Second, the patterns for energy consumption levels broadly correspond to electricity prices, but the developments in the two variables do not match exactly. In particular, note that Germany does not visibly diverge from Austria, despite German consumers facing increasing electricity prices over the time frame.

There is a general downward trend in mean energy consumption over time, which appears steeper for washing machines than freezers. Yet, lower mean prices do not necessarily correspond to higher energy consumption in the raw data, pointing to heterogeneity in non-energy attributes. For washing machines in panel (a), there are relatively minor differences in energy consumption across countries, especially after 2012. Slovenia is an outlier at the beginning, but converges to the group. The downward trend in 2013 coincides with the implementation of new Ecodesign regulations at the end of 2013. Mean prices decline slightly early on, but are thereafter stable despite the reduction in mean energy consumption. For freezers, Germany and Austria are separated from the CEE group in both panels. Poland has the lowest mean price, despite slightly lower mean energy consumption than Slovenia and Hungary. The patterns are notably stable over time. Croatia (in orange) falls in line with the CEE group quickly after official accession in 2013.

Appliance prices and energy consumption. The figure depicts sales-weighted mean appliances prices (left) and sales-weighted mean energy consumption in kWh/year (right) by country. Data are at monthly frequency using the full estimation sample for each category. All prices are converted to Euro in 2010 constant prices and deflated using the EU’s Harmonized Index of Consumer Prices. Energy consumption is reported in accordance with EU Ecodesign and Energy Labelling regulations

4.6 Baseline Estimates

Table 4 reports the results from the baseline regression, where all countries are pooled and the implicit price is an average over all countries and periods. The dependent variable is the log of price \(p_{ijt}\), converted to Euro and deflated to 2010 constant prices. Energy consumption \(E_i\) is defined as annual consumption as reported on the label, and scaled to 10 kWh/year as the unit. For each product category, three different specifications are reported. In column (1), prices are log-transformed, \(E_i\) is entered in levels (scaled by factor 10), and observations are weighted by sales (units sold). Column (2) reports unweighted results, so each product is treated the same irrespective of sales volume. By contrast, column (3) contains the weighted results, but the dependent variable is not log-transformed. All estimates include country-date fixed effects and the vector of product characteristics described in Table 1. The full list of coefficients is placed in Appendix 4.

Across all specifications and categories, energy consumption has a negative effect on appliance prices as expected, and the coefficient of determination is in the range of 81–92%. For washing machines, displayed in the top panel, the estimated implicit price is \(-\,0.0064\), indicating that for an additional 10 kWh of energy consumed, MWTP drops by 0.64%. Evaluated at the mean price of 431 Euro, the estimate works out to 2.76 Euro. Column (2) shows that the implicit price is substantially smaller and model fit declines when observations are not weighted. In the context of the hedonic model, this suggests that the uneven distribution of consumer choices along the hedonic price schedule is influential. When prices enter without log-transformation in column (3), the estimated implicit price is larger in absolute value, but model fit drops by 4 percentage points relative to the main estimate in column (1). The lower panel reports estimates for freezers. At \(-\,0.0080\), the coefficient is higher than for washing machines in absolute value, but the calculated implicit price of 3.13 Euro still falls within the same order of magnitude. The unweighted estimate in column (2) is only slightly lower but insignificant, whereas the level specification in column (3) yields a substantially larger estimate in absolute value. More than 90% of the variation in freezer prices is explained by the explanatory variables, about 5 percentage points higher than for washing machines.

4.7 Cross-Country Differences

Differences across countries are explored with an interaction between country and energy consumption. Figure 3 depicts the results by plotting the marginal effects for each country. Full estimates are shown in Appendix Table 13. For each category, the left panel imposes a single preference parameter for the non-energy-attributes, whereas the right panel allows for country-specific preferences. Observations are sales-weighted and kWh/year is scaled by 10 (as in column (1) of Table 4 above, this baseline is indicated by the dashed line for reference). With the hypothesis that country differences are driven by electricity prices, it is helpful to use Austria as a reference point following Fig. 1. Austria is close to the European average electricity price, whereas Germany is near the top of the range, and the CEE countries have below-average electricity prices. Hence relative to Austria, implicit prices should be greater in absolute value for Germany, but closer to zero for every other country.

Implicit prices by Country. Hedonic regressions with interaction \(E_i \times a_j\). Point estimates are marginal effects by country for \(E_i\) in kWh (scaled by 10), vertical bars indicate 95% confidence intervals. The dependent variable is log of price in Euro, deflated to 2010 constant prices. The left panel gives a single coefficient for the non-energy attributes, the right panel includes a full set of interactions between country and the vector of attributes. Red line at zero, dashed line indicates estimate from baseline. All specifications include country-by-date fixed effects (7 × 88 groups). Country codes: Austria (AUT), Czech Republic (CZE), Germany (GER), Croatia (HRV), Hungary (HUN), Poland (POL), Slovenia (SVN). Full results in Table 13

For washing machines under common preferences, there is evidence that the CEE countries are less responsive than Austria, although the confidence intervals overlap. However, the implicit price for Germany is the smallest in the sample, in contrast to expectations based on electricity prices. The blue series in the right panel shows how country-specific preferences affect implicit prices. In the flexible specification, the point estimate for Austria drops from \(-\,0.0075\) to \(-\,0.051\), whereas the German group is more responsive in this specification. The implicit prices in CEE countries decline substantially in absolute value and are no longer significantly different from zero in several cases. Turning to freezers, the implicit prices for Austria are close to the baseline from Table 4. German consumers appear to place higher value on energy efficiency than Austrians, and the discrepancy is stronger than for washing machines. The estimate for Germany with country-specific preferences is the largest absolute value among the estimated coefficients. In the CEE countries, the implicit prices are positive for the most part. This unexpected result holds for both sets, although the confidence intervals show statistical significance only in the flexible specification. For example, the results for Poland indicate that consumers are willing to pay about 1% extra in price for every 10 kWh increase in energy consumption.

Nevertheless, the results reveal that the baseline masks country-level differences. In all cases, country-specific preferences for non-energy attributes affect the estimated implicit prices for energy consumption. This is especially true for washing machines, where the results in panel (a) do not conform to expectations, but panel (b) aligns with electricity price differences. For freezers, the impact is is less pronounced, but the relative differences widen in panel (b). Comparing across the two product categories, the general pattern matches with country-specific preferences, but not when common preferences are imposed. Using the countries of the EU is one natural way to distinguish consumer groups on a common market, and despite being far from a panacea for all heterogeneity, it suggests that estimates for energy-related features are sensitive to assumptions about the non-energy preference space.

4.8 Feature and Cost Effect

Leaning on the theory, I attempt to get a cleaner estimate of the trade-off between energy cost and appliance price by separating the two components to the implicit price in Eq. (2). Formally, this tests whether \(\delta \ne 0\). Intuitively, energy consumption may reflect unobserved attributes or consumer attitudes that confound the pure operating cost effect. Tables 5 and 6 report the results by category. In each table, column (1) contains energy consumption, column (2) annual operating cost, and column (3) includes both variables. In columns (4)–(6), the estimates are displayed under the assumption of common preferences in the non-energy attributes. The main results are therefore in columns (3) and (6). The other estimates serve as a comparison that shows the link to the theoretical foundation. If only energy consumption \(E_i\) is used, the estimate captures the composite implicit price \(\frac{\partial p}{\partial E}\). If only the operating cost \(E_i \times e_{jt}\) is used, the implied assumption is that \(\delta = 0\) for the subsequent derivation of the implicit discount rate. Units are 10 kWh/year for energy consumption, and 10 Euro/year for operating cost. For washing machines in Table 5, the effect of energy consumption is negative regardless of whether it is defined as energy consumption or operating cost. The estimate of \(-\,0.0304\) in column (2) indicates that for an increase of 10 Euro in annual operating cost, appliance prices decrease by 3% on average. When both are included, the feature effect is positive though insignificant, but the negative cost effect strengthens. However, if common preferences are imposed, the signs switch and effect sizes decline, as shown in columns (4) to (6). This sensitivity matches with the observed impact of country-specific preferences in Fig. 3, and it underscores the benefit of the multi-country setting. Table 6 confirms the pattern of a negative cost effect and a positive feature effect for freezers. The single variable estimates for freezers are both larger than for washing machines, which was also detected in the baseline. Column (3) indicates that the feature effect is strongly positive at 0.0300, whereas the negative cost effect triples in absolute value relative to column (2).

To illustrate the relationship between the two effects, Fig. 4 displays the marginal effect of \(E_i\) from columns (3) (blue line) and (6) (red line) over a range of electricity prices. It shows that the marginal effect turns positive at low electricity prices. The minimum in the sample is 0.11 cents/ kWh (deflated to 2010, nominal price: 0.06 cent/kWh). At this level, the implicit price for \(E_i\) is positive in the case of freezers, and not statistically different from zero for washing machines. The stronger operating cost effect (larger absolute value of \(\gamma\)) for freezers is reflected in the steeper slope. Against the puzzle of positive implicit prices for freezers in CEE countries, \(\delta > 0\) thus offers a possible explanation.Footnote 16

Marginal effect of energy consumption. Marginal effects of energy consumption on appliance price for electricity price levels of 0.05, 0.15, 0.25, and 0.35 Euro/kWh. Estimates are based on column (3) of Tables 5 (washing machines, left panel) and 6 (freezers, right panel). Bars indicate 95% confidence intervals, based on standard errors clustered by product

4.9 Implicit Discount Rates

Table 7 presents the estimated implicit discount rates. The first row (i) is the main estimate, which is derived from the coefficients in column (3) of Tables 5 and 6, respectively. Row (ii) adds \({\hat{\delta }}\) from the same full model back in, row (iii) uses the restricted model without \(E_i\) as a separate control variable (see Sect. 4.3 for details). Comparing the estimates in row (i) with those in the rows below shows that the implicit discount rate is much higher when the feature effect is not corrected for. With \({\hat{\delta }} > 0\), the left-hand side is understated when the feature effect and the operating cost effect are not separated. Qualitatively, the mechanism holds for both product types. For freezers, the implicit discount rate for the average consumer is 12%. For reference, the loan interest rate to households in the Euro area is 6–7% and the credit card interest rate is 15–17% in the Euro area over the same period (European Central Bank 2021). The magnitude is lower than early estimates, but it falls in line with recent estimates obtained from discrete choice models for refrigerators in other countries (Matsumoto 2018; Tsvetanov and Segerson 2014; Cohen et al. 2017a). When the feature effect is added in scenarios (ii) and (iii), rates increase to 45–47%. The rates obtained from these specifications do reflect the implicit price for energy consumption, but not merely the trade-off between operating cost and purchase price. Hence, the main specification does not support a large energy efficiency gap for freezers, whereas the conventional hedonic method would support an energy efficiency gap. For washing machines, the implicit discount rate is estimated at 62% in the main specification. When the feature effect is added, rates are 76–78%. Again, not separating the components leads to higher estimates, although the difference is less pronounced for washing machines than for freezers.

The implicit discount rates quantify the economic relevance of the estimation procedure, which I develop to address the theory-based feature effect. Hence, the difference between categories follows from the regression results. For washing machines, the feature effect \({\hat{\delta }}\) is smaller than for freezers, so its impact on the implicit discount rate is expected to be weaker. Part of the discrepancy is also mechanical: since the relationship between \(\Delta p\) and r is not linear, the gap between scenarios increases when implicit prices are larger in absolute value (as is the case for freezers). Nevertheless, the main estimated rate of 62% for washing machines does exceed the conventional benchmarks, thus indicating a substantial energy efficiency gap following the LEC-approach. Assuming that time preferences do not change systematically with appliance type, the question is what distinguishes the two product categories. In his seminal paper, Hausman (1979) points to the question of differences across product categories, and following studies have indeed differed by product group. Data on two product categories for the same sample allow a useful comparison, because the setting curbs other fundamental differences across time and space that add to discrepancies.

Based on Eq. (3) in the general form, the usage parameter \(\phi\) could explain the gap between categories. The variable \(E_i\) is a standardized value based on EU testing protocols, but actual energy consumption may differ across consumers. Given that freezers are plugged in 24/7, heterogeneity in \(\phi\) plays a bigger role for washing machines. This would result in attenuation bias that pulls \({\hat{\gamma }}\) to zero and understates the implicit price. Applicably, there may be sorting bias, whereby consumers with high usage intensity select to higher quality brands. The preparatory studies specifically recognize the particular impact of usage heterogeneity for washing machines (Stamminger et al 2007; Boyano et al. 2017). The point of constant usage has been made as an advantage of cold appliances in general, for example by Cohen et al. (2017a). Similarly, Davis et al. (2014) show experimental evidence that rebound effects are stronger for air-conditioners than refrigerators, which fits with the proposed mechanism. However, European consumer surveys document that usage is a compound of many aspects, which are dispersed both within and across countries (Boyano et al. 2017). This prevents the construction of a country-specific variable from complementary data for the purpose of this paper. To show the effect on the three scenarios I present, Fig. 5 reports the sensitivity of the implicit discount rate to assumptions about \(\phi\) for the average consumer. Ceteris paribus, discount rates decrease substantially when \(\phi < 1\). Heterogeneity in (expected) usage would accordingly result in statistical dispersion in the distribution of individual discount rates as hypothesized above. The marginal effect of decreasing \(\phi\) is stronger at higher initial estimates of r and hence more pronounced for washing machines. The sensitivity plot indicates that the effect on r is substantial even at modest deviations from the benchmark \(\phi = 1\). Figure 6 shows how the discount change would change if there were attenuation bias from such heterogeneity. To make the estimates comparable, the actually estimated coefficient is set to unity and the y-axis plots percentage deviations from this index value. The downward sloping lines indicate the proposed mechanism of attenuation: if the true implicit price were higher than the estimate (\(>1\) on y-axis), the implicit discount rate would be lower. Attenuation bias therefore implies an overstatement of implicit discount rates.

Sensitivity to usage. Sensitivity of r to usage parameter \(\phi\), relative to assumed value of 1. Vertical black lines indicate main estimates for cases (i)–(iii) from Table 7. Implicit discount rates are evaluated at sales-weighted mean appliance price and energy price in the respective sample. Assumed lifetimes of \(T = 12\) for washing machines, and \(T=18\) for freezers

Sensitivity to implicit price. Sensitivity of r to attenuation bias in the implicit price. Scale sets estimated implicit price equal to 1 and refers to percentage deviations from this benchmark. Vertical black lines indicate main estimates for cases (i)–(iii) from Table 7. Implicit discount rates are evaluated at sales-weighted mean appliance price and energy price in the respective sample. Assumed lifetimes of \(T = 12\) for washing machines, and \(T=18\) for freezers

This interpretation requires a note of caution. Suppose usage intensity is correlated with brand choice, and higher quality brands have higher price points. Then the discount rate in the high-price segment would be lower than the rate that represents the average consumer, even if \({\hat{\gamma }}\) were unbiased (cf. Fig. 15). However, the qualitative mechanism above is unaffected by this complication of converting from the semi-log model, so I chose to focus on the average consumer for comparability across specifications. In brief, my results are consistent with unobserved usage, but assuredly not interpreted causally. Linking the implicit discount rates to the hedonic estimates, the feature effect is positive for both product types, but smaller and insignificant for washing machines. If there is more noise in the feature effect for washing machines, and this is correlated with usage patterns, the estimate of \({\hat{\delta }}\) could be confounded with unobserved heterogeneity in other dimensions. Anecdotally, cycle duration and water consumption are unobserved product characteristics that are discussed in the most recent revision to the EU Energy Labelling Policy (see European Commission 2019).

For discussion, washing machines are more likely to require repair during the lifecycle than freezers. Consumer surveys indicate repair rates around 30% for washing machines, but only 6% for freezers (Stamminger et al 2007, Task 3, 27). If this expectation is priced in by consumers but not modelled in the LEC, it would also lead to overstatement of the implicit discount rate for washing machines relative to freezers. This ties in with Sandler (2018), who shows that discount rates are lower for appliances that consumers expect to retain when moving. Moreover, it is also conceivable that the customer base differs across categories, since freezers may not be standard items for smaller households. Considering known problems with split incentives between landlords and tenants (see the review by Gillingham et al. 2009), as well as differences in ownership rates by income, there may be issues of selection bias that contribute to category differences. With the scanner data at hand, I cannot distinguish between these aspects. To make the relationships transparent, Appendix 7 contains sensitivity analysis for the price \({\overline{p}}\) and lifetime T as well. All else equal, implicit discount rates decrease when the estimated coefficients are evaluated for products with higher price points. Increasing the assumed lifetime corresponds to higher implicit discount rates, although the estimated rates are fairly insensitive to lifetime when the initial discount rate is high.

Finally, there is evidence that modeling risk aversion lowers estimated discount rates (Andersen et al. 2008), because risk and time preferences are inherently related in the utility function. A thorough discussion of alternative discounting is outside the scope of this paper, but incorporating quasi-hyperbolic discounting provides insights (see Laibson 1997). With the addition of a (constant) risk factor R, Eq. (3) can be expanded: \(\Delta p = \sum _{t=1}^{T} \, e_t \, \phi {{\textbf {R}}} \frac{\Delta E_t}{(1+r)^t}\).Footnote 17 Fig. 7 shows the sensitivity of the implicit discount rate to this simple form of risk aversion. Values of \(R < 1\) imply risk aversion.

Estimates from the experimental literature vary, but for the sake of discussion, a reasonable range would be \(R = 0.7\). At this rate, the main scenario (i) gives an implicit discount rate of 42% instead of the risk-neutral 62%. For freezers, the rate drops to 7%. Note that with the simple functional form, varying R has the same effect as varying \(\phi\) (compare Fig. 7). When both \(\phi\) and R vary, interactions between risk and usage become influential. In this context, the two previous points about usage patterns and repair probabilities could have relatively larger impacts on washing machines. It is straightforward to re-interpret the y-axis as a combined adjustment factor. Again using the same example of \(R = 0.7\) for washing machines, at a value of \(\phi = 0.7\), the combined adjustment factor (0.49) would imply an implicit discount rate of 29% for washing machines. Even for scenarios (ii) and (iii), the implicit discount rate for this case would be around 35%. For freezers, the implicit discount rate is already close to zero at these low values, the estimate would drop to \(< 2\)%. Of course, it is also possible the directions are opposite, but the possibility that risk aversion and unobserved heterogeneity could co-incide is nevertheless a notable observation for the two chosen categories.

Sensitivity to risk parameter. Sensitivity of r to the risk parameter R, relative to risk-neutral value of 1. Vertical black lines indicate main estimates for cases (i)–(iii) from Table 7. Implicit discount rates are evaluated at sales-weighted mean appliance price and energy price in the respective sample. Assumed lifetimes of \(T = 12\) for washing machines, and \(T=18\) for freezers

5 Conclusion

How consumers value energy efficiency is an ongoing debate in both academic research and policy discourses. Much has been written about the energy efficiency gap, but the puzzle remains. Recently, the literature has moved beyond a straight trade-off between lifetime energy costs and upfront investments. Several specific margins in the consumer decision have been put forth to explain what was previously interpreted as consumer myopia. Still, existing policy is built on the premise of a win-win situation: raising energy efficiency saves money for consumers while reducing negative externalities.

The European Union is no exception in that regard, but its integrated market does offer an exceptional setting to study consumer choices. This paper treats member states as consumer groups on an integrated market and explores differences in electricity prices to study energy efficiency investment. Using micro-level data for seven countries and two appliance types, I employ the hedonic method to estimate implicit prices for lower energy consumption. My question is: how do consumer groups facing different operating costs differ in valuation of energy efficiency, and what may be learnt from the EU setting regarding the implicit discount rate? While the baseline indicates small, negative implicit prices, there is substantial heterogeneity across countries, but also across product types. Specific to the European market, CEE countries appear to differ systematically in preferences from the two Western European countries, i.e., Austria and Germany.

Based on predictions derived from theory, I provide empirical evidence that energy consumption has both a feature and a cost effect. When these two components are separated, the effect of operating costs is unambiguously negative and counteracted by a positive feature effect. Implicit discount rates are substantially lower when the model allows for a separate feature effect that can absorb unobservables, which have troubled the literature. This fits with newer studies relying on identification with product fixed effects for cars, which tend to find lower undervaluation than the early studies using cross-sectional data. My work presents a way to address the issue within the context of the hedonic model. The empirical setting with multiple countries presents an opportunity here, because electricity price variation is sufficiently strong to identify the two effects separately.

More broadly, the paper links to the generalized framework by Allcott and Greenstone (2012), who speak of unobserved utility costs as one additional parameter in the consumer choice beyond the basic LEC formula. My approach explores this margin for a specific context and documents this aspect of the model quantitatively with empirical evidence. With data on two product types, I am also able to explore a second margin in the framework: usage intensity. The results are consistent with attenuation bias, indicating that implicit prices for product categories with high usage heterogeneity may be understated in magnitude. I discuss the potential mechanism and link usage to risk preferences, but must leave causal interpretation up for future research. The feature effect is a compound of unobserved factors within and outside of the physical product, which can be positive or negative. My work makes this compound empirically tractable, yet it also shows that more is left to be understood about the drivers of the feature effect before predictions can be generalized to other products and settings.

Taken together, my results support the emerging literature arguing that the LEC-approach is too narrow in its original form, and that interpretation in favor of consumer myopia is perhaps pre-mature. My work complements the body of evidence that is being built on the parameters that go into the consumer decision through the lenses of environmental, behavioral and industrial economics. I certainly do not claim to solve the puzzle, but hope to add one small piece towards a better understanding. As countries around the globe rely on energy efficiency in evolving climate policy, this understanding is of practical relevance for the choice of instruments that aim to guide energy efficiency adoption.

6 Supplementary information

The data is proprietary, but available from the company Gesellschaft für Konsumforschung Retail and Technology GmbH (GfK). All steps to go from the raw data to the final results, including code, are available upon request.

Data availability

The data is proprietary, but available from the company Gesellschaft für Konsumforschung Retail and Technology GmbH (GfK). All steps to go from the raw data to the final results, including code, are available from the author upon request.

Notes

The surface-to-volume-ratio is not constant. Hence, using standard controls for the size of a product does not sufficiently capture the layout.

Empirically, it has been addressed by studies using product fixed effects for cars (e.g., Busse et al. 2013, Allcott and Wozny 2014, Sallee et al. 2016). For other durable goods like houses and appliances, this may not be feasible because there is too much product turnover (appliances) or too little turnover (real estate).

In a working paper, Houde and Myers (2019) use the same variation to study heterogeneity in the energy efficiency gap with a non-parametric approach, delivering a welfare comparison of standards and taxes from a model with behavioral agents. Matsumoto and Omata (2017) contrast estimates for Vietnam with previous work for Japan. An early work using regional variation in the US to estimate implicit discount rates is Meier and Whittier (1983), but the authors do not yet have the advantage of large microdata.

The choice of energy efficiency is typically modeled as a choice over two goods: energy services s and a numeraire x (e.g., Chan and Gillingham 2015). An appliance is an investment in energy-producing capital, and efficiency is a technical parameter describing the amount of energy E required to produce the service (Gillingham et al. 2009). Conceptually, one can think of the consumer as a home producer of energy services using two inputs: energy E and energy-producing capital, represented by the durable’s efficiency. The consumer can “produce” energy services with the two inputs of energy efficiency (upfront investment) or energy/electricity (operating costs) (e.g., Thompson 2002).

Note that \(\Delta E_t = 0 - E_t\), as the reference case is a hypothetical product with zero energy consumption.

As noted by Houde (2022), retailer prices are substantially more volatile than wholesaler prices, at least in the US. While retailer prices capture the actual purchase decision, the disadvantage of the data is potential short-run variation that creates noise around the hedonic price schedule.

Croatia officially acceded in 2013. I keep it in the sample because compliance with the relevant energy policy packages was secured pre-accession.

Throughout the paper, I refer to country-specific preferences when this interaction is included, as opposed to common preferences when there is only a single parameter for each attribute.

Otherwise, the specification is relatively simple. The estimation strategy is set up to explore how the traditional hedonic method is affected by the feature effect because it is this method that has shaped the long-standing debate about the energy efficiency gap. Admittedly, others have developed the hedonic method to relax assumptions and employ machine learning (e.g., Bajari and Benkard 2005; Bajari et al. 2021).

These surveys were conducted as part of the preparatory studies for the product-specific EU regulations 1060/2010 and 1061/2010, respectively. Details are found in Tasks 3 and 5 of the respective technical reports.

Interaction terms between country and the non-energy attributes are included. Note from Eq. (3) that \({\overline{e}}\) cancels in specifications (i) and (iii), but not in specification (ii).

Comparing columns (1) and (4) across categories suggests that the implicit price is robust to country-specific preferences on average. Yet estimating separate implicit prices of E for each country does show differences (see Fig. 3 above). Ideally, I would allow \(\delta\) and/or \(\gamma\) to vary across countries, but as there is not enough variation within countries over time, it is not feasible to separate the two effects cleanly by country.

The approach is known in behavioral economics as beta-delta discounting, but it is also commonly applied in finance, where R is interpreted as the probability of realizing a cash flow.

The notation follows Diewert (2003a), this corresponds to Rosen’s bid function.

Article 290 of the TFEU allows the EU institutions (generally, the European Parliament and the Council) to “delegate to the Commission the power to adopt non-legislative acts of general application that supplement or amend certain non-essential elements of a legislative act.” For example, delegated acts may add new (non-essential) rules or involve a subsequent amendment to certain aspects of a legislative act. The legislator can thus concentrate on policy direction and objectives without entering into overly detailed and often highly technical debates. These acts are then not passed again through Parliament, but are adopted directly by the Commission, unless there is a formal objection by either the Parliament or the Council, who have to be notified every time an act is adopted (Craig 2011).

Size is a technical parameter across product classes, which potentially creates an incentive for producers to increase product size. It also gives consumers incentive to rebound by switching to a larger product (more energy services) at the same cost, rather than buy a same-size product with lower overall consumption.

simplified for illustration, full technical parameters in European Commission (2010)

In practice, weights are derived as mixed-period weights that are estimated based on known expenditure shares in \(t-2\), as updating at the member-state level is not quick enough to give full information Eurostat (2018, 172). See also Articles (2)–(3) of (EU) No 1114/2010.

For exposition, I follow the simplified notation by Jann (2018) rather than complete matrix notation. The elements in \({\textbf{x}}\) are denoted by lower-case \(x_k\), including time fixed effects and the constant (denoted \(\alpha\) below to avoid confusion).

References

Alberini A (2019) Revealed versus stated preferences: what have we learned about valuation and behavior? Rev Environ Econ Policy 13(2):283–298

Albouy D, Graf W, Kellogg R, Wolff H (2016) Climate amenities, climate change, and American quality of life. J Assoc Environ Resour Econ 3(1):205–246

Allcott H, Greenstone M (2012) Is there an energy efficiency gap? J Econ Perspect 26(1):3–28

Allcott H, Taubinsky D (2015) Evaluating behaviorally motivated policy: experimental evidence from the lightbulb market. Am Econ Rev 105(8):2501–2538. https://doi.org/10.1257/aer.20131564

Allcott H, Wozny N (2014) Gasoline prices, fuel economy, and the energy paradox. Rev Econ Stat 96(5):779–795

Ambec S, De Donder P (2022) Environmental policy with green consumerism. J Environ Econ Manag 111:102584. https://doi.org/10.1016/j.jeem.2021.102584

Andersen S, Harrison GW, Lau MI, Rutström EE (2008) Eliciting risk and time preferences. Econometrica 76(3):583–618

Anderson ST, Kellogg R, Sallee JM (2013) What do consumers believe about future gasoline prices? J Environ Econ Manag 66(3):383–403

Bajari P, Benkard LC (2005) Demand estimation with heterogeneous consumers and unobserved product characteristics: a hedonic approach. J Polit Econ 113(6):1239–1276

Bajari PL, Cen Z, Chernozhukov V, Manukonda M, Wang J, Huerta R, others (2021) Hedonic prices and quality adjusted price indices powered by AI. Cemmap working paper CWP04/21, Institute for Fiscal Studies, University College, London

Bento AM, Goulder LH, Jacobsen MR, von Haefen RH (2009) Distributional and efficiency impacts of increased us gasoline taxes. Am Econ Rev 99(3):667–99

Bento AM, Li S, Roth K (2012) Is there an energy paradox in fuel economy? a note on the role of consumer heterogeneity and sorting bias. Econ Lett 115(1):44–48

Blinder AS (1973) Wage discrimination: reduced form and structural estimates. J Human Resour 8(4):436–455

Boyano A, Cordella M, Espinosa N, Villanueva A, Graulich K, Rüdenauer I, Stamminger R (2017) Ecodesign and energy label for household washing machines and washer dryers Technical Report No. EUR28809. Brussels:Publications Office of the European Union

Busse MR, Knittel CR, Zettelmeyer F (2009) Pain at the pump: the differential effect of gasoline prices on new and used automobile markets. NBER Working Paper 15590, National Bureau of Economic Research, Cambridge, MA

Busse MR, Knittel CR, Zettelmeyer F (2013) Are consumers myopic? evidence from new and used car purchases. Am Econ Rev 103(1):220–256

Büttner T, Madzharova B (2021) Unit sales and price effects of preannounced consumption tax reforms: micro-level evidence from European vat. Am Econ J Econ Pol 13(3):103–134

Cassin L, Melindi-Ghidi P, Prieur F (2021) The impact of income inequality on public environmental expenditure with green consumerism. Retrieved from https://hal.inrae.fr/hal-03146526v3/document (HAL-INRAE Working Paper 03146526v3, National Research Institute for Agriculture, Food and Environment, Paris)

Chan NW, Gillingham K (2015) The microeconomic theory of the rebound effect and its welfare implications. J Assoc Environ Resour Econ 2(1):133–159

Cohen F, Glachant M, Söderberg M (2017) Consumer myopia, imperfect competition and the energy efficiency gap: Evidence from the UK refrigerator market. Eur Econ Rev 93:1–23

Cohen F, Glachant M, Söderberg M (2017) The impact of energy prices on product innovation: evidence from the UK refrigerator market. Energy Econ 68:81–88

Correia S (2016) ftools: Stata module to provide alternatives to common stata commands optimized for large datasets. (Statistical Software Components, S458213, Boston College Department of Economics). Retrieved from https://ideas.repec.org/c/boc/bocode/s458213.html

Correia S (2017) reghdfe: Stata module for linear and instrumental-variable/GMM regression absorbing multiple levels of fixed effects. Statistical Software Components, S457874, Boston College Department of Economics. Retrieved from https://ideas.repec.org/c/boc/bocode/s457874.html

Craig PP (2011) Delegated acts, implementing acts and the new comitology regulation. Eur Law Rev 36:671–687

Davis LW, Fuchs A, Gertler P (2014) Cash for coolers: evaluating a large-scale appliance replacement program in Mexico. Am Econ J Econ Pol 6(4):207–38

De Haan J, Diewert EW (2013) Hedonic regression methods. Handbook on residential property price indices. OECD Publishing, Paris, pp 49–64

Delbeke J, Vis P, Klaassen G (2015) EU climate policy explained. Routledge, Taylor & Francis Group, London

Diewert EW (2003a) Hedonic regressions—a consumer theory approach. In: Feenstra RR, Shapiro MD (eds) Scanner data and price indexes. University of Chicago Press, Chicago, pp 317–348

Diewert EW (2003b) Hedonic regressions: a review of some unresolved issues (Lecture Notes). Vancouver: University of British Columbia. (Last updated January 2, 2003)

Dubin JA, Miedema AK, Chandran RV (1986) Price effects of energy-efficient technologies: a study of residential demand for heating and cooling. Rand J Econ 17(3):310–325

European Central Bank (2021) Bank interest rates - euro area. Database, series 2887. Frankfurt. Retrieved from https://sdw.ecb.europa.eu/browse.do?node=bbn2887

European Commission (2010) Commission delegated regulation (eu) no 1061/2010 of 28 September 2010 supplementing directive 2010/30/eu of the European parliament and of the council with regard to energy labelling of household washing machines. Official Journal of the European Union L314:47–63

European Commission (2012) Directive 2012/27/eu of the european parliament and of the council of 25 October 2012 on energy efficiency, amending directives 2009/125/ec and 2010/30/eu and repealing directives 2004/8/ec and 2006/32/ec. Official Journal of the European Union L315:1–56

European Commission (2019) Commission delegated regulation (EU) no 2019/2014 of 11 March 2019 supplementing regulation (EU) 2017/1369 of the European parliament and of the council with regard to energy labelling of household washing machines and household washer-dryers and repealing commission delegated regulation (EU) no 1061/2010 and commission directive 96/60/ec. Official Journal of the European Union L315:29–67

Eurostat (2012) Eurostat-OECD methodological manual on purchasing power parities (Methodological Manual). Publications Office of the European Union, Luxemburg

Eurostat (2018) Harmonized index of consumer prices (hicp) (Methodological Manual). Publications Office of the European Union, Luxemburg

Eurostat (2020a). Electricity prices for household consumers. (Database, series nrg pc 204). Luxemburg

Eurostat (2020b). Euro/ecu exchange rates - monthly data. (Database, series ert-bil-eur-m)

Eurostat (2020c). Harmonized index of consumer prices. (Database, series prc_hicp_midx). Luxemburg. Retrieved 2020-03-29, from https://ec.europa.eu/eurostat/de/web/hicp/data/database

Eurostat (2020d). Purchasing power parities (ppps), price level indices and real expenditures for ESA 2010 aggregates. (Database, series prc-ppp-ind). Luxemburg

Eurostat (2020e). Statistics a-z. (Database, summary tabulation). Luxemburg