Abstract

We investigate the effect of the order canceling rule in the trading model of financial exchanges. This study employs a stochastic order-book model. Such models are widely used to study the relation between price fluctuation and price formation in continuous double auction. The model herein incorporates simple mechanisms such as limit order and trading rules without considering investors’ strategies. It captures the transaction structure used in financial exchanges. Using three simple stochastic order-book models, we indicate the comparative analysis of the effectiveness of the cancel order.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Major financial exchanges employ continuous double auctions wherein sellers and buyers simultaneously present respective prices. To determine the relation between price formation and price fluctuation, scholars use stochastic order-book models, which replicate transactions occurring under mechanisms customarily used in financial exchanges. In particular, Maslov’s proposal is a good example of its pioneering model [1]. In this model, limit and market order were chosen with equal probability. Bid and ask orders were chosen with equal probability as well. The limit order price was selected by a uniform random number within a specified range from the transaction price. By doing so, he captured the power law in the distribution of price differences gathered via simulations. Since the publication of this model, various stochastic order-book models have been proposed [2, 3].

In previous studies, the order-book models which have mechanism such as random cancel and automatic cancel due to passing specific period are introduced. T. Preis et al. incorporated the mechanism that a limit order is deleted with a probability per time unit in his model [2]. Considering the cancel order is important in the construction of a simple mechanical simulation of a continuous double auction. Using examples from Maslov’s model, we suggest three simple stochastic order-book models that incorporate the cancel order mechanism which exclude investors’ strategies. Then we focus on the cancel order and compare the effectiveness of the cancel orders in the three models.

2 Model

This section explains the structure of our three models, which incorporates financial exchanges’ basic trading rules.

2.1 Basic Trading Rules of Financial Exchanges

Major financial exchanges operate with continuous double auction that uses an electronic board (an order book) on which buyers (sellers) enter bid prices (ask prices) and transactions are matched. Investors place limit and market orders. Limit orders specify prices at which investors will execute trades, whereas market orders do not. When an exchange receives sellers’ limit orders, it matches them with buyers’ bids that equal or exceed sellers’ ask prices. Conversely, exchanges match buyers’ limit bids with sellers’ asking identical or lower prices. A market order is immediately matched with any existing order on the order book. When there are ask (bid) orders on the order book, any incoming bid (ask) market order will be matched with the lowest ask (highest bid) order on the order book. For matching the orders, the price priority rule is used. The highest bid (lowest ask) order on the order book will be given priority over all other bid (ask) orders. When the order book contains multiple orders at identical price, the oldest is executed first. This rule is called the time priority rule. Price and time priorities are standard practices at exchanges worldwide.

2.2 Simulation Models

This subsection explains how orders are selected for execution in our simulation models.

2.2.1 No-Cancel Model

We explain about a model without a order canceling rule. The model assumes an equal probability that a new order is a bid or an ask, and the price of the order is selected randomly within a specified range from the most recent transaction price. We specify a range of ± 15 from the most recent transaction price. For example, if the most recent transaction price is 0, the bid or ask price is randomly selected within the range [ − 15, 15], and one unit will be placed on the order book.

Moreover, in this study, we employ the price priority rule that is used in the trading mechanism of the major financial exchanges. The time priority rule is not meaningful in our simulation because we do not distinguish agents who send orders. Trading takes place whenever best ask ≤ best bid, where “best ask” is the lowest ask price and “best bid” is the highest bid price on the order book. The transaction price is either the price of the bid or ask order, whichever is on the order book first.

Figure 7.1 depicts a transaction. At State 1, the order book holds an order to sell three units at an ask price of 101 and an order to buy two units at a bid price of 99. The most recent transaction price is 100. At State 2, one unit of bid order at a price of 102 is entered. Because of this new order, best ask ≤ best bid; therefore, at State 3, the transaction occurs between the one unit ask order at a price of 101 and the new bid order at a price of 102. The transaction price is 101.

This model does not incorporate market orders. However, because an order is always placed in terms of one unit only, when an order is immediately executed, it could be interpreted as being a market order because it has having the same effect as a market order. This model with the above rules is called the “no-cancel model.”

2.2.2 Random Cancel Model

We explain about a model with a certain kind of order canceling rule.

First, we assort the order situations of the order book in the following cases.

-

1.

There are both ask and bid orders in the order book.

-

2.

There are orders only in the ask side in the order book.

-

3.

There are orders only in the bid side in the order book.

-

4.

There is no order in the order book.

In Case 1, the model selects an order or a cancel order in an equal probability. If the order is selected, the rule of the order is the same as the no-cancel model. If the cancel order is selected, either the ask or bid is selected in an equal probability, and an ask order or a bid order on the order book is canceled randomly. In Case 2, similar to Case 1, the order or the cancel order is selected in an equal probability. If the order is selected, the rule of the order is the same as the no-cancel model. If the cancel order is selected, a ask order on the order book is canceled randomly. Case 3 mirrors Case 2 but switches the ask and the bid. In Case 4, the order is always selected. And the rule of the order is the same as the no-cancel model. This model including the above order canceling rule is called the “random cancel model.”

2.2.3 Out-of-Range Cancel Model

We explain about a model with a order canceling rule that are outside the specified range of ± 15 from the most recent transaction price. First, existing orders are examined for prices outside the range. If there are orders outside the range, the orders will be canceled from the order book. If there is no such order, then a new order will be placed on the order book. The rule of the order is the same as the other models. This model is called the “out-of-range cancel model.”

3 Simulation Results

This section compares price movements in each model.

First, we performed simulations for the no-cancel model. Figure 7.2 shows 1, 000 tick of price data.

Next, we performed simulations for the random cancel and out-of-range cancel models. One million simulations were performed 10 times for each model. Transactions occurred with the ratios 10. 91 % ± 0. 04 % for the number of simulations using the random cancel model and 29. 03 % ± 0. 04 % for the number of simulations using the out-of-range cancel model. Figure 7.3 shows 10, 000 tick of price data.

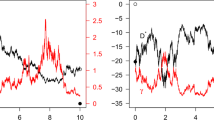

Illustrating how prices diffuse with time, Fig. 7.4 shows the relation between the standard deviation of the price gap and the time scale (tick) on a double-logarithmic graph. Also, we here estimate Hurst exponent by linearizing the points plotted on the double-logarithmic graph. Each Hurst exponent of the random cancel model and the out-of-range cancel model is 0. 499 and 0. 478. The dotted line is the one-half power of the time scale. In fact, the relationship σ(τ) between the standard deviation of the price gap and the time scale is as follows, where τ is the time scale, and H is Hurst exponent.

Double-logarithmic graph of the standard deviations of price gaps with respect to the time scale (tick) derived from the random cancel model and the out-of-range cancel model. Each Hurst exponent of the random cancel model and the out-of-range cancel model is 0. 499 and 0. 478. The dotted line is the Hurst exponent of 0. 5

Next, we analyzed the extent to which prices moved continuously in one direction. We did not differentiate between downside or upside price movements. So we obtained price data from our simulations and plotted a cumulative frequency distribution (CFD) of the absolute values of draw down and draw up. A draw down is the decline in price when prices fell continuously. A draw up is the increase in price when prices rose continuously. Their absolute values are called the draw size.

We analyzed CFDs of the draw size from the random cancel model. Figure 7.5 illustrates the CFDs that compare the draw size from the random cancel model and the draw size from shuffled price gap data from the random cancel model. The solid line depicts a linearization of CFD for draw size of 16 and larger from the random cancel model (slope = − 0. 040). The dotted line depicts a linearization of CFD for draw size of 16 and larger from the shuffled price gap data from the random cancel model (slope = − 0. 036).

Semilogarithmic graph of CFDs for a draw size from the random cancel model (Random Cancel) and shuffled price gap data from the random cancel model (Random Cancel Shuffle). The solid line depicts a linearization of CFD for draw size of 16 and larger from the random cancel model (slope = − 0. 040). The dotted line depicts a linearization of CFD for draw size of 16 and larger from the shuffled price gap data from the random cancel model (slope = − 0. 036)

Next, we analyzed the CFDs of the draw size from the out-of-range cancel model. Figure 7.6 illustrates the CFDs that compare the draw size from the out-of-range cancel model and the draw size from shuffled price gap data from the out-of-range cancel model. The chained line depicts a linearization of CFD for draw size of 16 and larger from the out-of-range cancel model (slope = − 0. 044). The double-dotted line depicts a linearization of CFD for draw size of 16 and larger from the shuffled price gap data from the out-of-range cancel model (slope = − 0. 061).

Semilogarithmic graph of CFDs for a draw size from the out-of-range cancel model (Out-of-Range Cancel) and shuffled price gap data from the out-of-range cancel model (Out-of-Range Cancel Shuffle). The chained line depicts a linearization of CFD for draw size of 16 and larger from the out-of-range cancel model (slope = − 0. 044). The double-dotted line depicts a linearization of CFD for draw size of 16 and larger from the shuffled price gap data from the out-of-range cancel model (slope = − 0. 061)

Additionally, we compared the CFD of the draw size from the random cancel model and the out-of-range cancel model (Fig. 7.7).

4 Discussion of the Numerical Results

This section examines results of the empirical analysis in Sect. 7.3.

First, Fig. 7.2 indicates that price movements in the no-cancel model vibrate within a fixed range. Transactions occurred in approximately 40 % for the number of simulations using the no-cancel model. The number of new orders exceeds that of orders annihilated by transactions; thus, orders accumulate, restraining price movements.

Second, the random cancel and out-of-range cancel models replicated the price movements that resemble actual price movements (Fig. 7.3). On the other hand, the price movement of the random cancel model is larger than the out-of-range cancel model. We think the reason of this is the random cancel model has the possibility to have bigger spread between best ask and best bid than the out-of-range cancel model because of the difference of order canceling rule. The standard deviation of the price gap for the time scale (tick) is proportional to about one-half power of the time scale for each model (Fig. 7.4). This finding indicates that price data from each model diffuse at a speed characteristic of a random walk.

Third, the CFD shape in the random cancel model deviates slightly around a draw size of 16 (Fig. 7.5). The specified range of ± 15 possibly explains this finding. A draw size of 16 and larger reflects only the effects of consecutive unidirectional price movements. Moreover, this CFD can be approximated exponentially. Additionally, the CFD of the draw size from the random cancel model shares features with that from the shuffled price gap data from the random cancel model.

Fourth, Fig. 7.6 shows that as with Fig. 7.5, the CFD shape in the out-of-range cancel model deviates around a draw size of 16. Slopes of the linearized data differ, but for draw sizes of 16 and larger, the CFD from the out-of-range cancel model resembles that of the draw size from shuffled price gap data from the out-of-range cancel model.

Fifth, we examine CFDs of draw size from the random cancel and the out-of-range cancel models. The change in CFD shape of the former exceeds that of the latter (Fig. 7.7). This difference arises from differing methods of order cancelation. For draw sizes of 16 and larger, the slope of the linearized data is nearly identical, suggesting that draw size occur less frequently as it increase with a constant probability. This finding suggests that there is no strong serial correlation among some parts.

Finally, we conclude this section by discussing the application potentiality for those models. The out-of-range canceling rule is more convenient than the random canceling rule in reality. Because investing information is abundantly and readily available to investors; therefore, it is unlikely that their orders would be left on the order book when the transaction price has moved sufficiently away from their order price. In addition, in markets led by professional traders, traders are constantly calculating the theoretical price of product; therefore, the entire trading community has similar ideas regarding appropriate pricing. Therefore, it is more realistic to remove an order whose price is placed outside the established range from the most recent transaction price [4].

5 Conclusion

This study compared the effectiveness of the cancel order in three simple stochastic order-book models. Using a simple stochastic order-book model, it showed that the method of order cancelation is important in replicating actual price movements. Also, both random cancel and out-of-range cancel models replicated the price movements that resemble actual price movements. Price movements obtained from these models closely resemble a random walk. On the other hand, because of investors’ aspect, the out-of-range canceling rule is more convenient than the random canceling rule in reality. Therefore, a comparative analysis that employs this base model with models that incorporate investors’ strategies captures how investors’ trading strategies affect price movements [4]. Future simulation analyses using these base models will deepen the understanding of investors’ trading strategies.

References

Maslov S (2000) Phys A 278:571

Preis T, Golke S, Paul W, Schneider JJ (2007) Phys Rev E 76:016108

Slanina F (2008) Eur Phys J B 61:225

Ichiki S, Nishinari K (2015) Phys A 420:304

Acknowledgements

This work was supported by JSPS KAKENHI Grant Number 25287026.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This book is distributed under the terms of the Creative Commons Attribution Non-commercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Copyright information

© 2015 The Author(s)

About this paper

Cite this paper

Ichiki, S., Nishinari, K. (2015). Effect of Cancel Order on Simple Stochastic Order-Book Model. In: Takayasu, H., Ito, N., Noda, I., Takayasu, M. (eds) Proceedings of the International Conference on Social Modeling and Simulation, plus Econophysics Colloquium 2014. Springer Proceedings in Complexity. Springer, Cham. https://doi.org/10.1007/978-3-319-20591-5_7

Download citation

DOI: https://doi.org/10.1007/978-3-319-20591-5_7

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-20590-8

Online ISBN: 978-3-319-20591-5

eBook Packages: Physics and AstronomyPhysics and Astronomy (R0)