Abstract

Taiwan, a non-contracting party to the UN Framework Convention to Climate Change, committed to Net-zero Emission goal by 2050. In implementing carbon trade schemes, forest landowners can acquire carbon credit revenue in addition to timber revenue. To assess the impacts on afforestation area in Taiwan, this study uses land expectation value (LEV) calculated from price of timber sale and carbon trading and analyzes the correlation with area of afforestation. Results indicate that timber price significantly affected the area of afforestation of Taiwania cryptomerioides (Taiwania). It suggests that to increase the afforestation by 1%, \({\text{LEV}}_{\log }^t\) must increase by an average of 100,261 NTD/ha. After conversion, the price of Taiwania increased by 240 NTD/m3 or 1.23%. The average carbon credit revenue accounts for less than 3% of the total LEV. It suggests that total LEV obtained from Taiwania is primarily determined by timber price, with minimal impacts from carbon price fluctuation.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Since the Industrial Revolution, global anthropogenic greenhouse gas (GHG) content has increased rapidly, especially carbon dioxide (CO2). From 1995 to 2005, the average annual rate of increase for CO2 was 1.9 ppm, which was greater than the average annual rate of increase of 1.4 ppm during 1960–2005. The Fourth Assessment Report by the United Nations Intergovernmental Panel on Climate Change (IPCC) stated that to control global warming, CO2 emissions must be reduced by 50–85% by 2050. In 1997, legal binding of the Kyoto Protocol (KP) signed at the Third Session of the Conference of the Parties (COP3) in Kyoto, Japan formalized the plan to cut back GHG, which was later launched in 2005.

The New Zealand Parliament passed the Climate Change Response Act in 2008 and the Climate Change Response (Moderated Emissions Trading) Amendment Act in 2009, both standardized the country’s mandatory and national carbon trading system. In addition, an international carbon market was opened in New Zealand during 2009. In a transaction where Denmark’s government agency and Norway purchased carbon units, the starting price of carbon units was set at 20 USD. Following a decline in market carbon prices, emission reduction units (ERUs), certified emission reduction units (CERs), and removal units (RMUs) were used as incentives to reduce carbon emissions in New Zealand. In December 2013, the government confirmed that after May 31, 2015, Kyoto units (i.e., CERs, ERUs, and RMUs) could no longer be applied to the New Zealand Emissions Trading Scheme (ETS). This was a result the country’s failure to sign the KP for the second commitment period (CP2) (The 18th Conference of the Parties voted to exclude countries that had not committed to CP2 and Kyoto units). The recovery of carbon prices in the country after 2013 (Fig. 2.1) reflects the emitters’ current demand for New Zealand units (NZUs). One NZU represents the release of 1 ton of CO2 into the air. In 2016, carbon prices in New Zealand were affected by the Paris COP21, promotion of the ETS by the government, cancellation of the introduction of affordable foreign carbon credit, and carbon emission credits for heavy industry. These policies led to an increase in domestic demand for carbon credit in New Zealand; thereby causing carbon prices to surge. According to the European Climate Exchange, carbon prices have recently recovered (Fig. 2.2). The EU carbon prices declined in 2008 owing to the global financial crisis. In 2012, the price was approximately 7.79 euros and continued to decrease until the beginning of 2013. This is primarily because the demand for the emissions trading system was inhibited by difficulties such as the European Union’s energy and climate policies, complex and lengthy administrative procedures, and concerns regarding environmental integrity. The EU carbon trading market’s supply far exceeded its demand, causing prices to fall. From 2018 to 2019, owing to an increase in natural gas prices and the UK’s postponement of Brexit, the EU carbon price increased rapidly. As of July 2019, EU carbon prices climbed to 29.03 euros.

Source Compiled by the authors based on International Carbon Action Partnership (ICAP)

New Zealand carbon price.

Source Compiled by the authors International Carbon Action Partnership (ICAP)

EU carbon price.

A comparative study is proposed herein with cases from two island countries: New Zealand and Taiwan. In 2015, New Zealand joined the Paris Agreement, which stipulated a commitment to reduce GHG emissions after 2020. Its total emissions in 1990 were 64.6 million tons of CO2 equivalent, and in 2015 these were 80.1 million tons, and net emissions were 56.4 million tons of CO2 equivalent (New Zealand Government 2017). After 2020, New Zealand aims to reduce its GHG emissions to 95% that of 1990; while its 2030 target is 89% of the 1990 emissions. It is committed to various reduction methods to achieve these targets, such as reducing emissions or increasing carbon sequestration by means of forests and participation in international carbon trading. According to Article 3.3 of the KP, “The amount of carbon sequestration provided by afforestation and reforestation implemented after 1990 can serve as deductions for carbon emissions.” Using this calculation method, New Zealand received emission reduction credits and carbon credits, and carbon price and timber price affected the amount of afforestation.

Taiwan participated in the UNFCCC and as a result, Taiwan passed the Greenhouse Gas Reduction and Management Act (hereafter referred to as “GHG Management Act”) in 2015 to manage and reduce GHG emissions, jointly protect the environment, and ensure sustainable development of the country. Its long-term target is set to reduce GHG emissions to less than 50% of 2005 levels by 2050. Currently, Taiwan does not have a carbon trading policy. Afforestation revenue is primarily derived from lumber production and subsidies made available through government afforestation incentive policies. Making matters worse, Taiwan is not a member of the United Nations and cannot directly engage in carbon trading in the international market using the Clean Development Mechanism (CDM). It can only employ the Verified Carbon Standard (VCS) model, using intermediaries to sell to purchasers (Leu 2019). As such, forest carbon sequestration as a policy tool for reducing CO2 emissions and converting agricultural land into afforested land to increase carbon sequestration are becoming increasingly important in countries.

Meanwhile, forest carbon sequestration has become a trend throughout the world in countries seeking to control GHG emissions (Liu et al. 2009). In response to international GHG reduction targets, mechanisms such as the introduction of a carbon tax and the establishment of carbon emissions trading or carbon payment will become incentives for the premature deforestation of existing young forests. If governments provide carbon payments for the carbon sequestration of newly planted and mature forests, premature deforestation of mature forests can be reduced. The degree of alleviation is determined by the payment levels of mature forests (Lin and Liu 2007).

Several international studies have investigated the factors affecting afforestation areas. For example, Kline et al. (2002) developed a prediction model for afforestation areas in the southern USA. The areas of reforestation and afforestation zones were estimated according to variables such as the price of standing trees or pulp, afforestation cost, land expectation value, interest rate, and the previous year’s yield. Forbes and SriRamaratnam (1995) developed a model for estimating the total forestry area in New Zealand by estimating the total area of planted forest based on time and the average export prices of logs, sawn timber, and paper pulp. Wang et al. (2008) analyzed changes in the period from 1981 to 2006 in afforestation areas in Liaoning Province and determined that afforestation areas were extensively affected by policy and that a long-term equilibrium relationship exists between afforestation area and afforestation cost, lumber price, lumber output, and interest rate. Other studies (e.g., Alig 1986; Ahn et al. 2000; Haim et al. 2011) found that changes in land use correlate with future forest areas. Horgan (2007) revealed that afforestation areas from 1991 to 2004 were highly correlated with the internal rate of return (IRR) of forestry investments. Manley and Maclaren (2009) used Horgan’s data to establish a linear relationship between afforestation area and IRR, as well as to evaluate the impact of carbon price on IRR.

Although the effect of carbon trading on afforestation has been investigated (Haim et al. 2014), few studies have analyzed the actual impact of a real carbon trading market on afforestation areas. These analyses suggest that carbon trading increases the profitability of forests and encourages afforestation. Thus, attaining an optimal afforestation method that can increase biomass production and the rotation length of afforestation. Therefore, key issues requiring discussion and motivation for this study are as follows: the additional afforestation area required to achieve the GHG Management Act target, provided that Taiwan has a carbon trading market, the relationship between afforestation revenue increase and afforestation area increases, and the severity of carbon credit revenue’s impact on afforestation areas.

2 Methods

The present study employed the land expectation value (LEV) model employed in Manley’s (2017) study to analyze the correlation and impact of timber price and afforestation amount in Taiwan. First, a relationship between LEV and afforestation amount was identified in the absence of a carbon price market. Carbon price was then included in consideration of LEV to analyze the effect of the price on LEV. Finally, we conducted a sensitivity analysis on the effects of changes in variables such as carbon price, timber price, and discount rate on LEV and afforestation areas. Next, a correlation was established between afforestation area and LEV when only timber price (\({\text{LEV}}_{\log }^t\)) was considered. Then, considering the carbon price, we studied the benefits of carbon trading in the LEV model, and conducted a correlation analysis on the afforestation area and LEV. We further calculated regression formulas, and compared differences and analyses for two formulas; one prior to and the other after the inclusion of carbon price.

2.1 LEV Model

LEV is a benchmark for the economic income of afforestation landowners. LEV implies that both the total return after land has been managed for a period of time, and the highest amount a landowner is willing to pay for the land. According to Faustmann (1849), LEV is the net present value (NPV) of future revenue and costs related to forestry on permanent land. In the existing carbon trading market, LEV comprises two major parts: LEV (\({\text{LEV}}_{\log }^t\)) for lumber revenue and LEV (\({\text{LEV}}_{{\text{carbon}}}^t\)) for carbon credit revenue.

\({\text{LEV}}_{\log }^t\) is the discount on lumber revenue and costs during infinite rotation periods. The revenue is derived from log sales at harvest, and the cost is derived from afforestation, tending, maintenance, harvest, and management of tree crops. Given the established assumptions, a linear relationship exists between \({\text{LEV}}_{\log }^t\) and timber price, as shown in Formula (2.1):

where Vt is the timber volume (m3/ha) of a stand in year t, Lt is the timber price in year t (NTD/m3), Ct is the management cost during the afforestation period in year t and includes maintenance and harvesting (NTD/ha), r is the discount rate, t is the rotation length (years), C0 is the initial afforestation cost (NTD/ha), and k is the number of rotation periods.

LEVtcarbon is the discount of carbon credit revenue and carbon trading costs during infinite rotation periods, where revenue is derived from annual carbon credit, cost derived from participation in carbon trading, and from payment for review and certification fees. All property and forestry management and maintenance fees are included in the \({\text{LEV}}_{\log }^t\). Given the established assumptions, a linear relationship exists between \({\text{LEV}}_{{\text{carbon}}}^t\) and the carbon price, as shown in Formula (2.2):

where At is the carbon stock per metric ton of CO2 in the forest in year t (t/ha); Pt is the carbon price per metric ton of CO2 in year t (NTD/t CO2), c is the unit cost of carbon trading (NTD/ha), r is the discount rate, t is the rotation length (years), and k is the number of rotation periods.

When calculating LEV, all factors except timber price (L) and carbon price (P) remained unchanged. According to a sensitivity analysis by Hsu and Liu (2017), LEV is substantially affected by carbon price, carbon release rate, and discount rate. The length of the optimal rotation decreased with increasing carbon price. Nölte et al. (2018) indicated that extending rotation length and management without thinning could increase the amount of carbon sequestration by forests. However, the economic loss caused by the rotation period elongation is exceedingly high. In the present study, for example, at a discount rate of 5%, extension of the rotation period by 50% reduced LEV by 25.1%. LEV also increases as thinning increases; however, the absence of thinning management reduces the LEV.

2.2 Relationship Between Afforestation Amount and LEV

The LEV model was employed to explore the correlation between LEV and the amount of afforestation. First, LEV considers only lumber revenue to evaluate the impact of lumber income on afforestation areas. The relationship between afforestation area and the \({\text{LEV}}_{\log }^t\) of the landowner’s LEV is shown in Formula (2.3):

where Ft represents the total afforestation of the area in year t, and \({\text{LEV}}_{\log }^t\) is the LEV of lumber revenue in year t (NTD/ha).

The following data were collected for each tree species and each year: timber price per cubic meter, timber volume equation, rotation period, management cost, initial afforestation cost, and discount rate of the current year. These data were used to calculate the \({\text{LEV}}_{\log }^t\) of each tree species in each year. Further, a correlation analysis was conducted using \({\text{LEV}}_{\log }^t\) and the afforestation amount of tree species in each year to identify the relationship between afforestation amount and \({\text{LEV}}_{\log }^t\).

When carbon price exists, LEV includes lumber and carbon revenue, as shown in Formulas (2.4) and (2.5):

where Ft represents the total afforestation amount (ha) of the area; LEVTotal is the LEV (NTD/ha) per unit area when considering lumber and carbon revenue, LEVtlog is the LEV (NTD/ha) per unit area considering only lumber revenue, and LEVtcarbon is the NPV of carbon credit revenue per unit area.

According to the model, LEV is the sum of \({\text{LEV}}_{\log }^t\) when revenue is derived from log sales at harvest and \({\text{LEV}}_{{\text{carbon}}}^t\), which is derived from future carbon costs and the NPV from carbon revenue. During the calculation, all factors remain unchanged except for the price of timber and carbon. Therefore, we can understand this as LEV = \({\text{LEV}}_{\log }^t\) + \({\text{LEV}}_{{\text{carbon}}}^t\). Because \({\text{LEV}}_{\log }^t\) has only one variable (timber price), it can be viewed as a function of timber price and expressed as \({\text{LEV}}_{\log }^t\) = \({\text{LEV}}_{\log }^t\) (L), where L represents the timber price. Similarly, because \({\text{LEV}}_{{\text{carbon}}}^t\) has only one variable (carbon price), it can be regarded as a function of carbon price and can be expressed as \({\text{LEV}}_{{\text{carbon}}}^t\) = \({\text{LEV}}_{{\text{carbon}}}^t\) (P), where P represents the carbon price.

2.3 Variable Setting

2.3.1 Tree Species Selection

Taiwania cryptomerioides, also known as Taiwania (Fig. 2.3), belongs to the Taxodiaceae family and is endemic to Taiwan. The lumber processing properties of Taiwania are exceptional and are characterized by resistance to rotting and termite. Therefore, its lumber applications are extensive, such that it is an important economic tree species in Taiwan. This, and Calocedrus formosana, Chamaecyparis taiwanensis, Chamaecyparis formosensis, and Cunninghamia konishii are collectively referred to as the “Top 5 Conifers of Taiwan” (Liu et al. 1984). The trunk of Taiwania is straight and solid, and the tree can reach heights of 60 m in natural forests. It is a crucial afforestation tree species in Taiwan because of its exceptional wood substance and wide applications (Kao 2013). Moreover, comprehensive information on Taiwania timber prices (for 20 years, from 1999 to 2018, can be found in the Wood Price Information System) facilitates the research and analysis of this study. Therefore, we selected this species for the LEV for subsequent simulations and analyses. According to the regulations, the rotation period of Taiwania is 80. Therefore, the LEV was calculated using a rotation period of 80 years.

2.3.2 Timber Volume

The Taiwania growth model by Lee et al. (2000) was employed for the timber volume equation. Equation (2.6) is as follows: V(T) is the timber volume of Taiwania at time T (m3/ha), and T is the stand age (years):

The LEV model of the study was set prior to thinning, with felling accomplished only when the rotation period had expired. According to the growth model by Lee et al. (2000), the timber volume of 80-year-old Taiwania was estimated to be 543 m3/ha (Fig. 2.4). Cheng et al. (2014) compiled various stand characteristics of Taiwania plantations in Xitou, Taiwan, among which the timber volumes of 74-year-old plantations reached 918 m3/ha with a standard error of 146 m3/ha. Therefore, the timber volume estimation employed in this study can be regarded as “conservative.”

2.3.3 Afforestation Cost

Liu et al. (2009) divided afforestation costs into planting, nurturing, and weeding costs. Because the Taiwanese government rewards afforestation, if seedlings are provided by the forestry authority and planting costs are estimated using the contractor’s contract price, the stand owner must pay 30,000 NTD (~1000 USD) per ha for planting in the first year. Mowing costs were calculated based on the stipulation by the Forestry Bureau, Council of Agriculture, Executive Yuan (2011) for plantations where it is performed twice annually for a 1-year-old plantation, with eight workers per ha each time, three times annually for 2- and 3-year-old plantations, with eight workers per ha each time, and twice annually for a 4-year-old plantation, with nine workers per ha each time. For 5- to 9-year-old plantations, 5-year-old plantations are mowed twice, with nine workers per ha each time, and 6-year-old and older plantations are mowed once, with 10 workers per ha each time. The wage for mowing workers was 1500 NTD (~$30 USD) according to the 2002 Agriculture and Forestry document No. 0910000477 issued by the Forestry Bureau, Council of Agriculture, Executive Yuan (2022a). By extension, 15,000 NTD, the wages of 10 workers per ha for one mowing of 6- to 9-year-old plantations, was used as the annual management cost of 10-year-old and older plantations.

Felling costs were calculated according to the approach proposed by Zheng and Shih (2006). Multiple regression analysis was conducted using stand felling operation cost and operation status data from the Nantou Forest District Office of 46 leased plantations of national forests. The felling costs of each leased plantation served as the response variable. The timber volume of a stand, as well as the transportation distance to the nearest lumber market and logging wages, served as explanatory variable items. After substituting the average timber volume, average transportation distance, and average logging wage of the 46 data items, the felling cost of leased plantations in national forests was estimated to be 1493 NTD/m3.

2.3.4 Amount of Carbon Sequestered

The increase in GHG emissions is considered to be the primary factor affecting climate change. Forests can store carbon by absorbing CO2, and forestation represents a critical approach for countries reducing GHG emissions. This study included carbon trading prices and incorporated this form of revenue in addition to that from forest landowners’ wood products. Following Zheng (2009), the CO2 storage conversion formula proposed by the IPCC was adopted for the estimation. The formula is as follows:

where B is the unit biomass (t/ha), V is the stand timber volume per hectare (m3/ha), VT is the conversion coefficient between the timber volume of the tree and log timber volume, WT is the conversion coefficient between weight and timber volume, R is the root–shoot ratio, \(C_{CO_2 }\) is the amount of CO2 stored per ha of stand (ton CO2/ha); CT is the conversion coefficient of carbon content; and CO2/C is the conversion coefficient of CO2 and carbon.

The required coefficients for Taiwania are listed in Table 2.1. This formula converted stand timber volume to tree timber volume and multiplied it by the wood-specific gravity and root–shoot ratio to obtain the stand biomass. The stand biomass was then multiplied by the carbon content conversion coefficient and CO2 and carbon conversion coefficients to obtain the stored CO2. Subsequently, the 30-year carbon storage per ha of was obtained; it was multiplied by the carbon price at the time to obtain the carbon credit revenue from carbon trading during one rotation period.

2.3.5 Carbon Price

Because Taiwan lacks a carbon trading market, this study referred to the research by Chiang et al. (2020) for the derivation of carbon price; they observed that the break-even carbon price of Taiwania was between 367.13 NTD and 803.58 NTD/ton CO2. The penalty for exceeding the stipulated carbon emissions was 1500 NTD/ton CO2. Therefore, calculations were performed for carbon prices of 400, 600, 800, and 1500 NTD.

2.3.6 Discount Rate

The LEV model was employ yed to analyze the impact of carbon and timber prices on afforestation. To enable a comparison at the same point in time, future revenues and costs (post-felling lumber revenue and carbon payment revenue as well as afforestation, management, cultivation, and felling costs) must be discounted. Thus, we used the current afforestation loan interest rate of 1.04% (Agriculture Department of Yunlin County Government 2019) as the discount rate.

2.3.7 Afforestation Amount

The afforestation amount represents the ratio of the afforestation area of a tree species to the total afforestation area in that year. The tree species selected were Taiwania. Considering that the growth environment of Taiwania is fairly similar to that of other cypresses, its amount of afforestation was calculated as the proportion of total cypress afforestation area in that year. According to the forestry statistics of the Forestry Bureau, Council of Agriculture, Executive Yuan (2018), the afforestation area of Taiwania from 1999 to 2018 was the sum of the areas of general afforestation and related afforestation plans. The total afforestation area of the cypress species was based on statistics published by the Forestry Bureau, which illustrate the afforestation areas during 1999–2018 for C. lanceolata, C. konishii, Cryptomeria, and Taiwania. The total afforestation area of the cypresses was calculated as the sum of the afforestation areas of these four species. This afforestation area is the sum of the areas of general afforestation and related afforestation plans.

3 Results and Discussion

3.1 Correlation Between Timber Price and Afforestation Amount

This study first examined the correlation between timber prices and afforestation amounts. A bivariate correlation analysis was performed concerning Taiwania’s timber price with its afforestation area, the ratio of this area to total afforestation area, its ratio to coniferous afforestation area, and its ratio to cypress species afforestation area over the period from 1999 to 2018. The historical data are presented in Table 2.2.

The results (Table 2.3) indicated that timber price exhibited a significant positive correlation only with the ratio to the cypress afforestation area. Therefore, for investigation and analysis “afforestation amount” was limited to the ratio of the afforestation area of Taiwania to total cypress afforestation area. Although the results of the bivariate analysis were nonsignificant for Taiwania timber price and afforestation area, ratio to total afforestation area, and ratio to coniferous afforestation area, the Pearson correlation coefficient was positive, and a positive relationship may exist between them.

As can be observed in Table 2.3, the significance between Taiwania timber price and the ratio to total afforestation area, ratio to coniferous afforestation area, and ratio to cypress afforestation area all revealed that as the denominator of Taiwania’s afforestation area ratio increased, the timber price and afforestation area became increasingly significant. Arranged in descending order by denominator, the significance of the ratio to total afforestation area, ratio to coniferous afforestation area, and ratio to cypress species afforestation area were 0.287, 0.052, and 0.011, respectively. Thus, the impact on Taiwania timber price is most significant when forest landowners select cypress species for afforestation.

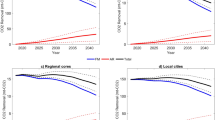

When using the Taiwania afforestation area and the proportion of cypress afforestation areas to calculate historical afforestation amounts of Taiwania, the results are shown in Table 2.4. A correlation analysis was then conducted for Taiwania timber price and afforestation amount for the period from 1999 to 2018. The results were significant (P = 0.011); the Taiwania afforestation amount exhibited an increasing trend as the timber price increased (Fig. 2.5).

We performed a simple linear regression between the timber price and afforestation amount and then analyzed the lag order. The R2 value was used to examine the impact of timber prices on future afforestation areas in each year (Table 2.5). The results indicated that timber price exhibited the greatest explanatory power for the afforestation amount in the current year (R2 = 0.272), which suggests that the timber price of the current year most substantially affected the afforestation amount in the current year, followed by the afforestation amount for the following year (R2 = 0.225). The explanatory power of timber prices declined for the afforestation amount in the second year (R2 = 0.111), and the correlation between timber price and afforestation amount became nonsignificant afterward, which indicates that timber price minimally impacted afforestation a year later.

Next, we conducted a linear regression analysis by using the averaged past timber prices and the average prices and afforestation amounts. The R2 value shown in Table 2.6 suggests that the afforestation amount and mean timber prices in the current year exhibited the greatest explanatory power (R2 = 0.272). Afforestation amount was also significantly correlated with the means of timber prices in the previous two and three years; however, significance and explanatory power both declined as the number of accumulated years increased.

These two analyses indicate that lumber price significantly affected the afforestation amount in the current and the following year; exhibiting the greatest explanatory power for the afforestation amount in the current year (R2 = 0.272). The relationship between afforestation and timber price in the earlier three years was significant. However, the afforestation amount and mean timber prices in the current year exhibited the greatest explanatory power (R2 = 0.272). The authors believe that the R2 value of the two analyses was only 0.272 because several other factors interfere with afforestation amount and area. Therefore, the explanatory power is limited when only considering the correlation between timber price and the amount of afforestation.

3.2 Correlation Between Afforestation Amount and LEV Considering Only Lumber Price

The analysis reveals that in Taiwan, the afforestation amount and the mean timber prices in the current year demonstrated the greatest explanatory power. Therefore, we further calculated \({\text{LEV}}_{\log }^t\) based on the yearly timber price and performed a regression analysis with the afforestation amount of the current year. The distributions of the calculated \({\text{LEV}}_{\log }^t\) and afforestation amounts are shown in Fig. 2.6. The regression analysis comprised a linear model, a second-order curve model, a logit model, and an exponential model. Due to the substantial gap between the \({\text{LEV}}_{\log }^t\) and values concerning afforestation amount, the natural logarithm of \({\text{LEV}}_{\log }^t\) was obtained prior to analysis. The results are listed in Table 2.7 and Fig. 2.7.

The R2 values of the linear, second-order curve, and logit models were equal to the P-value and exhibited the same explanatory power. Therefore, to distinguish whether the logarithm affected the regression model, a regression analysis was performed directly using \({\text{LEV}}_{\log }^t\) and the amount of afforestation (Table 2.8 and Fig. 2.8). We observed that the R2 value of the second-order curve model decreased, and the explanatory power of the linear model (R2 = 0.272) was slightly greater than that of the logit model (R2 = 0.271). However, the afforestation amount of the linear model continued to increase with the \({\text{LEV}}_{\log }^t\). The afforestation amount of the logit model approached a definite value as \({\text{LEV}}_{\log }^t\) increased, which conformed more to the actual situation. Thus, we consider the logit model to be the optimal explanatory model.

Although the logit model was more in line with the actual situation, its explanatory power was similar to that of the linear model (R2 = 0.271). Therefore, to facilitate the analysis, a linear model was further developed to analyze the marginal rate of increase in \({\text{LEV}}_{\log }^t\) to the afforestation amount. The results indicated that for each increase of 1,000,000 NTD/ha in \({\text{LEV}}_{\log }^t\), the afforestation amount of Taiwania increased by 9.97%. Therefore, to increase its afforestation by 1%, \({\text{LEV}}_{\log }^t\) must increase by approximately 100,261 NTD/ha on average. After conversion, its timber price must increase by 240 NTD/m3, which is an average increase of 1.23% of its original price.

Although the result of the logit model was significant (P = 0.011), its explanatory power was low (R2 = 0.271). To accurately predict afforestation amounts, other variables must be added to strengthen the explanatory power of the regression model. A study by Wang et al. (2008) determined that afforestation areas were severely affected by policy. Thus, we can consider the policy variable, which may increase the explanatory power of the model. Possible differences in afforestation in Taiwan caused by the government’s promotion of different afforestation policies can be a direction for subsequent research.

3.3 LEV Considering Both Lumber Price and Carbon Price

For the carbon trading scenario, an ex-post payment model (Liu 2008) was adopted, in which a landowner did not receive any revenue when beginning afforestation and only received revenues at the end of afforestation (rotation period) from lumber and carbon sequestration. The rotation period of Taiwania was set at 80 years. After 80 years, a one-time felling was performed. The carbon sequestration per hectare in Taiwania is shown in Fig. 2.9, which reached 619.68 ton/ha CO2 in the eighth year.

Based on the aforementioned assumptions, Taiwania afforestation could fix 619.68 tons of CO2 every 80 years. After multiplying this by carbon price, one can obtain the revenue from carbon credit and use it to calculate \({\text{LEV}}_{{\text{carbon}}}^t\). The calculation results are presented in Table 2.9, where \({\text{LEV}}_{{\text{carbon}}}^t\) is the LEV derived from carbon credit revenue, \({\text{LEV}}_{{\text{log}}}^t\) is the LEV derived from lumber revenue, and LEVTotal is the sum of the two values. Because Taiwan does not yet have a carbon trading market, carbon prices were calculated using 400, 600, 800, and 1500 NTD/ton CO2 separately.

When the carbon price was 400 NTD/ton CO2, 600 NTD/ton CO2, 800 NTD/ton CO2, and 1500 NTD/ton CO2, the mean \({\text{LEV}}_{{\text{carbon}}}^t\) was 0.73%, 1.09%, 1.45%, and 2.68% of the LEVTotal, respectively. The results indicate that when the ex-post payment model was adopted for the carbon trading scenario, the LEV of Taiwania afforestation derived from carbon credit revenue (\({\text{LEV}}_{{\text{carbon}}}^t\)) accounted for less than 3% of the total LEV (LEVTotal). Therefore, the authors believe that LEV is primarily affected by the LEV derived from lumber revenue (\({\text{LEV}}_{{\text{log}}}^t\)). The total LEV is primarily determined by the timber price, and the impact of carbon price is minimal. It is speculated that the low ratio of Taiwania’s LEV derived from carbon credit revenue is caused by its higher timber price. Thus, the use of tree species with rapid growth and short rotation periods for afforestation, such as Acacia confusa, can result in greater proportions of carbon credit revenue.

The impact of LEV derived from carbon credit revenue (\({\text{LEV}}_{{\text{carbon}}}^t\)) was also considered under different rotation periods. The carbon price was calculated at 1500 NTD/ton CO2, and the results are listed in Table 2.10. The results revealed that when the rotation period was extended, the ratio of LEV derived from carbon credit revenue (\({\text{LEV}}_{{\text{carbon}}}^t\)) increased (Fig. 2.10), which means that the portion derived from carbon credit revenue should be of interest to the landowners of the forest. However, an increased rotation period also decreased the discounted revenue. For every 10-year increase in the rotation period, the total LEV decreased by an average of 17.38%. Thus, the maximum income can only be obtained by the timely shortening of the rotation periods.

4 Conclusion and Recommendations

This study referenced the LEV model of Manley (Manley 2017) to analyze the correlation between afforestation amount and LEV in Taiwan and to examine Taiwania’s afforestation amount. The model was also adopted to estimate lumber and carbon prices to identify approaches for increasing afforestation areas. This study obtained conclusions with respect to its three goals:

4.1 Investigation of the Correlation Between Timber Price and Afforestation Amount

In the past, the relationship between Taiwania’s timber prices and new afforestation areas was nonsignificant. The authors believe that new afforestation areas are affected not only by timber price but also by diverse factors such as policy, lumber output, and discount rate (Wang et al. 2008). Therefore, if only timber price is considered, the explanatory power for the new afforestation area of Taiwania is insufficient and renders the relationship between the two nonsignificant. Meanwhile, a significant correlation was identified between timber price of Taiwania and its ratio to the afforestation amount of the cypress species. The afforestation amount can be considered the forest landowner’s intention to select Taiwania. A related analysis involving lag order was conducted to further examine whether timber prices affected future afforestation amounts. The timber price of Taiwania significantly affected its afforestation amount in the current and following year, but exhibited a particularly significant impact in the current year.

Accordingly, if governments wish to increase afforestation areas, increasing timber prices and suppliers’ afforestation intention would not be effective. This should be pursued through other means, such as policies and interest rates. However, if governments wish to promote a certain tree species, then finding methods to increase the price of timber of that species can effectively increase suppliers’ intention to select the species for afforestation.

4.2 Correlation Between Afforestation Amount of the LEV Considering Only Timber Price

A regression analysis was performed using the afforestation amount of Taiwania and LEV with the inclusion of only lumber revenue (\({\text{LEV}}_{{\text{log}}}^t\)). Regression analysis was conducted separately using a linear regression model, a second-order curve model, an exponential model, and a logit model. The results were all significant, and the R2 values of the linear model, second-order curve model, and exponential model were all 0.271. The authors considered the logit model as the optimal explanatory model, as follows:

where F represents the afforestation amount of Taiwania, and \({\text{LEV}}_{{\text{log}}}^t\) is the LEV derived from lumber revenue (NTD/ha). The R2 value of this logit model was 0.271, and the P-value was 0.011.

The logit model was considered the optimal explanatory model for the following reasons. First, the fit of the linear model continuously increases with LEV, and the afforestation amount also increases continuously; however, the afforestation amount has an upper limit (100%). Thus, the linear model was deemed to be inconsistent with real situations and was excluded from consideration. Although the explanatory power of the second-curve model was identical to that of the logit model, this was the result of a regression analysis using the logarithm of LEV. Because the explanatory powers of the three models were identical, a regression analysis was performed directly on the LEV and afforestation amount. The explanatory power of the second-order curve model declined, possibly owing to changes in the log-transformed data. However, the explanatory power of the logit model did not decline in the second regression analysis. The accuracy of the logit model continued to increase with LEV; although the afforestation amount also increased, it approached a limiting value (not 100%, however). Thus, the logit model was more consistent with real situations and was regarded as the optimal explanatory model. The authors recommend that subsequent studies include other factors in the regression analysis to enhance the explanatory power of the models.

4.3 LEV Considering Both Timber Price and Carbon Price

Carbon prices in this study accounted for four scenarios—400 NTD, 600 NTD, 800 NTD, and 1500 NTD per ton; at these prices, the mean carbon credit revenue accounted for 0.73%, 1.09%, 1.45%, and 2.68% of LEV, respectively. With the adoption of an ex-post payment model in a carbon trading scenario, the LEV of Taiwania afforestation derived from carbon credit revenue (\({\text{LEV}}_{{\text{carbon}}}^t\)) accounted for less than 3% of the total LEV (LEVTotal). Therefore, the LEV that primarily affects LEV is derived from lumber revenue (\({\text{LEV}}_{{\text{log}}}^t\)), meaning that the total LEV is largely determined by timber price and that the impact of carbon price is minimal. The authors speculate that the low ratio for Taiwania LEV derived from carbon credit revenue results from its higher timber price. Thus, the use of tree species with rapid growth and short rotation periods for afforestation, such as A. confusa, can lead to greater carbon credit revenue.

Finally, the impact of LEV derived from carbon credit revenue (\({\text{LEV}}_{{\text{carbon}}}^t\)) was considered under different rotation periods. The results indicated that when the rotation period was extended, the ratio of LEV derived from carbon credit revenue (\({\text{LEV}}_{{\text{carbon}}}^t\)) increases, which means that the portion derived from carbon credit revenue should gradually become valued by the forest landowner. However, an increase in the rotation period also decreased the discounted revenue, and for every 10-year increase in the rotation period, the total LEV decreases by an average of 17.38%. Thus, maximum revenue can only be achieved by a timely reduction in the rotation period. This result is consistent with previously reported results (Lin and Liu 2007). If governments intend to extend the rotation period to increase forest carbon sequestration, then governments should provide forest landowners subsidies to offset the economic losses caused by increases in the rotation period, which would in turn increase their willingness to elongate rotation periods.

References

Agriculture Department of Yunlin County Government (2019) Afforestation loan interest rate, from http://www4.yunlin.gov.tw/agriculture/home.jsp?mserno=200710140016&serno=200710140016&menudata=AgricultureMenu&contlink=ap/down_view.jsp&dataserno=201807100001. Accessed 28 Jun 2022

Ahn S, Plantinga A, Alig R (2000) Predicting future forestland area: a comparison of econometric approaches. Forest Sci 46(3):363–376. https://doi.org/10.1093/forestscience/46.3.363

Alig R (1986) Econometric analysis of the factors influencing forest acreage trends in the Southeast. For Sci 32(1):119–134. https://doi.org/10.1093/forestscience/32.1.119

Cheng CH, Hung CY, Lee CY, Chen CP, Pai CW (2014) Stand properties and development of “Taiwania cryptomerioides” plantations in Xitou, Central Taiwan. Q J Chin For 47(2):155–168. https://doi.org/10.30064/QJCF

Chiang YH, Liu WY, Lin HW (2020) Economic analysis of the carbon credit price considering opportunity cost of the carbon sequestration. Green Econ 6:18–60. https://doi.org/10.6858/GE.202007_6.0002

Faustmann M (1849) Calculation of the value which forest land and immature stands possess for forestry. Allgemeine Forstund Jagdzeitung 15:441–455. https://doi.org/10.4324/9781315182681

Forbes R, SriRamaratnam R (1995) Exotic forest areas in New Zealand: towards an econometric model. Policy Services, Ministry of Agriculture and Fisheries

Forestry Bureau, Taiwan (2011) Seedling project table. Luodong Forest District Office, from https://luodong.forest.gov.tw/afrtt. Accessed 28 Jun 2022

Forestry Bureau, Taiwan (2018) Forestry Statistics, from https://www.forest.gov.tw/0002835. Accessed 28 Jun 2022

Forestry Bureau, Taiwan (2022a) Key points for rewarding afforestation, Forestry Bureau, Council of Agriculture, Executive Yuan, Taiwan, from https://www.forest.gov.tw/0000062/0000708. Accessed 28 Jun 2022

Forestry Bureau, Taiwan (2022b) Price wood information system, Forestry Bureau, Council of Agriculture, Executive Yuan, Taiwan, from https://woodprice.forest.gov.tw/Summary/Q_SummarySingleWoodPrice.aspx. Accessed 28 Jun 2022

Haim D, Alig RJ, Plantinga AJ, Sohngen B (2011) Climate change and future land use in the United States: an economic approach. Clim Change Econ 202(1):27–51. https://doi.org/10.1142/S2010007811000218

Haim D, White EM, Alig RJ (2014) Permanence of agricultural afforestation for carbon sequestration under stylized carbon markets in the U.S. Forest Polic Econ 41:12–21. https://doi.org/10.1016/j.forpol.2013.12.008

Horgan G (2007) Financial returns and forestry planting rates, from: http://maxa.maf.govt.nz/climatechange/reports/returns/. Ministry of Agriculture and Forestry, Wellington, 7 pp http://maxa.maf.govt.nz/climate/reports/returns/. Accessed 28 Jun 2022

Hsu K, Liu WY (2017) Land expected value and optimal forest rotation considering the carbon release of dead organic matter and harvested wood products. Taiwanese Agric Econ Rev 23(2):73–104. https://doi.org/10.6196/TAER.2017.23.2.3

International Carbon Action Partnership (ICAP). https://icapcarbonaction.com/en/ets-prices

Kao JL (2013) The comparison of the growth of Cunninghamia lanceolata plantation in Taiwan and China. National Taiwan University, Department of Forestry and Resource, Conservation, Master Thesis. https://doi.org/10.6342/NTU.2013.02593

Kline J, Butler B, Alig R (2002) Tree planting in the South: what does the future hold? South J Appl for 26(2):99–107. https://doi.org/10.1093/sjaf/26.2.99

Lee KJ, Lin JC, Chen LC, Chen LC (2000) The potential of carbon sequestration and its cost-benefit analysis for Taiwania plantations. For Sci 15:115–123. https://doi.org/10.7075/TJFS.200003.0115

Leu JH (2019) The study of international carbon emission trading market and special situation in Taiwan. J Chin Manag Dev 8(1):1–8. https://doi.org/10.6631/JCMD.201906_8(1).0001

Lin KC, Liu WY (2007) An analysis of optimal rotation and expected land values under carbon pricing in Taiwan. Taiwanese Agric Econ Rev 13(1):1–35. https://doi.org/10.6196/TAER.2007.13.1.1

Lin YJ, Liu CP, Lin JC (2002) Measurement of specific gravity and carbon content of important timber species in Taiwan. Taiwan J for Sci 17(3):291–299. https://doi.org/10.7075/TJFS.200209.0291

Liu WY (2008) The economic analysis of landowners’ participation in carbon sequestration programs and mechanisms. National Taiwan University, Agricultural Economics College of Bioresources and Agricultural, Doctoral Dissertation, Doctoral Dissertation. https://doi.org/10.6342/NTU.2008.02790

Liu WY, Lu YM, Lin KC (2009) Measuring the optimal rotation period under carbon price and timber price uncertainty. Taiwanese Agric Econ Rev 15(1):1–35. https://doi.org/10.6196/TAER.2009.15.1.4

Liu SC, Lin KC, Tang JL (1984) Growth and wood properties of planted Taiwania cryptomerioides at Lu-Kuei. Bulletin 408

Manley B (2017) Forecasting the effect of carbon price and timber price on the afforestation amount in New Zealand. J for Econ 33(1):112–120. https://doi.org/10.1016/j.jfe.2017.11.002

Manley B, Maclaren P (2009) Modelling the impact of carbon trading legislation on New Zealand’s plantation estate. New Zealand J For 54(1):3–44. http://www.nzjf.org.nz/free_issues/NZJF54_1_2009/557D6FC2-B5B5-4ec9-8A1B-43F4CC4B97C4.pdf. Accessed 28 Jun 2022

New Zealand Government (2017) New Zealand’s greenhouse gas inventory 1990–2015. Ministry for of the Environment 542, from https://environment.govt.nz/publications/new-zealands-greenhouse-gas-inventory-19902015/. Accessed 28 Jun 2022

Nölte A, Meiby H, Yousefpour R (2018) Multi-purpose forest management in the tropics: Incorporating values of carbon, biodiversity and timber in managing Tectona grandis (teak) plantations in Costa Rica. For Ecol Manage 422(15):345–357. https://doi.org/10.1016/j.foreco.2018.04.036

Wang HY, Zhai YL, Shi HX (2008) Changing trend and influential factors of afforestation area in liaoning province trend and influencing factors of afforestation area in Liaoning Province. J Shenyang Agric Univ 6:664–667

Zheng CL (2009) Carbon reduction policy report of the optimal management plan of national forest management. Forestry Bureau, Taiwan

Zheng CL, Shih Y (2006) An analysis of the timber logging cost of leased forestland in Nantou. Q J Chin For 39(3):315–327. https://doi.org/10.30064/QJCF.200609.0003

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 The Author(s)

About this chapter

Cite this chapter

Liu, WY., Yu, HW., Chu, MY. (2023). Potential Impacts of Afforestation Expansion Under Price Fluctuations of Carbon and Timber. In: Wu, HH., Liu, WY., Huang, M.C. (eds) Moving Toward Net-Zero Carbon Society. Springer Climate. Springer, Cham. https://doi.org/10.1007/978-3-031-24545-9_2

Download citation

DOI: https://doi.org/10.1007/978-3-031-24545-9_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-24544-2

Online ISBN: 978-3-031-24545-9

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)