Abstract

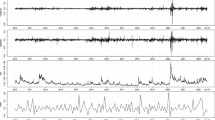

The increasing volatility experienced in financial and commodity markets has motivated the search of frequency functions with more complex attributes to characterize their asset returns distribution. In this research, two semi-nonparametric distributions are proposed and compared, the Gram-Charlier expansion and a novel Edgeworth expansion for the Student’s t, to estimate the value-at-risk and the expected shortfall in four indices related to energy, metals, mining, and physical commodities. Backtesting performance is assessed in terms of Kupiec and Independence tests for value at risk and the recent proposal by Acerbi and Székely for the expected shortfall. Our results indicate that the Student’s t expansion density adequately fits the returns of different indices and exhibits the best performance for value at risk and expected shortfall backtesting. Consequently, the Student’s t expansion density, which encompasses the Gram-Charlier distribution as the degrees of freedom parameter tends to infinity, reveals as a flexible and accurate methodology for risk management purposes in energy and commodity markets.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Hansen, B.E.: Autoregressive conditional density estimation. Int. Econ. Rev. 35, 705–730 (1994)

Fernández, C., Steel, M.F.: On Bayesian modeling of fat tails and skewness. J. Am. Stat. Assoc. 93(441), 359–371 (1998)

Theodossiou, P.: Financial data and the skewed generalized t distribution. Manag. Sci. 44(12-part-1), 1650–1661 (1998)

Jones, M.C., Faddy, M.J.: A skew extension of the t-distribution, with applications. J. R. Stat. Soc., B: Stat. Methodol. 65(1), 159–174 (2003)

Bauwens, L., Laurent, S.: A new class of multivariate skew densities, with application to generalized autoregressive conditional heteroscedasticity models. J. Bus. Econ. Stat. 23(3), 346–354 (2005)

Cardona, E., Mora-Valencia, A., Velásquez-Gaviria, D.: Testing expected shortfall: an application to emerging market stock indices. Risk Manag. 21(3), 153–182 (2019)

Jørgensen, B.: Statistical Properties of the Generalized Inverse Gaussian Distribution, vol. 9. Springer (1982)

Barndorff-Nielsen, O.E.: Normal inverse Gaussian distributions and stochastic volatility modelling. Scand. J. Stat. 24(1), 1–13 (1997)

Mencía, J., Sentana, E.: Estimation and testing of dynamic models with generalized hyperbolic innovations. Available at SSRN 790704 (2005)

Gupta, R.D., Kundu, D.: Generalized exponential distribution: different method of estimations. J. Stat. Comput. Simul. 69(4), 315–337 (2001)

Carrasco, J.M., Ortega, E.M., Cordeiro, G.M.: A generalized modified Weibull distribution for lifetime modeling. Comput. Stat. Data Anal. 53(2), 450–462 (2008)

Ñíguez, T.-M., Paya, I., Peel, D., Perote, J.: Flexible distribution functions, higher-order preferences and optimal portfolio allocation. Quant. Finance. 19, 669–703 (2019)

Edgeworth, F.: The asymmetrical probability-curve. The London, Edinburgh, and Dublin Philosophical Magazine and J. Sci. 41(249), 90–99 (1896)

Barton, D.E., Dennis, K.E.: The conditions under which Gram-Charlier and Edgeworth curves are positive definite and unimodal. Biometrika. 39(3/4), 425–427 (1952)

Jondeau, E., Rockinger, M.: Gram–Charlier densities. J. Econ. Dyn. Control. 25(10), 1457–1483 (2001)

León, Á., Mencía, J., Sentana, E.: Parametric properties of semi-nonparametric distributions, with applications to option valuation. J. Bus. Econ. Stat. 27(2), 176–192 (2009)

Abramowitz, M., Stegun, I. A.: Handbook of Mathematical Functions with Formulas, Graphs, and Mathematical Tables. Series 55, Tenth Printing. National Bureau of Standards Appl. Math. (1972)

Kendall, M., Stuart, A.: Distribution Theory The Advanced Theory of Statistics, vol. 1. Griffin, London (1977)

Trespalacios, A., Cortés, L.M., Perote, J.: Uncertainty in electricity markets from a semi-nonparametric approach. Energy Policy. 137, 111091 (2020)

Ñíguez, T.-M., Perote, J.: Moments expansion densities for quantifying financial risk. N. Am. J. Econ. Finance. 42, 56–69 (2017)

Cortés, L.M., Mora-Valencia, A., Perote, J.: The productivity of top researchers: a semi-nonparametric approach. Scientometrics. 109(2), 891–915 (2016)

Mauleon, I., Perote, J.: Testing densities with financial data: an empirical comparison of the Edgeworth-Sargan density to the Students t. Eur. J. Financ. 6, 225–239 (2000)

Del Brio, E.B., Perote, J.: Gram–Charlier densities: maximum likelihood versus the method of moments. Insur.: Math. Econ. 51(3), 531–537 (2012)

Del Brio, E.B., Mora-Valencia, A., Perote, J.: Risk quantification for commodity ETFs: backtesting value-at-risk and expected shortfall. Int. Rev. Financ. Anal. 70, 101163 (2020)

Kupiec, P.: Techniques for verifying the accuracy of risk measurement models. J. Deriv. 3(2) (1995)

Christoffersen, P.F.: Evaluating interval forecasts. Int. Econ. Rev. 39, 841–862 (1998)

Acerbi, C., Szekely, B.: General properties of backtestable statistics. Available at SSRN 2905109 (2017)

Velásquez-Gaviria, D., Mora-Valencia, A., Perote, J.: A comparison of the risk quantification in traditional and renewable markets. Energies. 13(11), 2805 (2020)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Velásquez-Gaviria, D., Mora-Valencia, A., Perote, J. (2023). Asymptotic Expansions for Market Risk Assessment: Evidence in Energy and Commodity Indices. In: Valenzuela, O., Rojas, F., Herrera, L.J., Pomares, H., Rojas, I. (eds) Theory and Applications of Time Series Analysis and Forecasting. ITISE 2021. Contributions to Statistics. Springer, Cham. https://doi.org/10.1007/978-3-031-14197-3_9

Download citation

DOI: https://doi.org/10.1007/978-3-031-14197-3_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-14196-6

Online ISBN: 978-3-031-14197-3

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)