Abstract

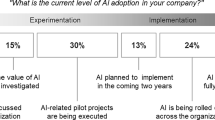

Investments are influenced by the cognitive biases and heuristics of investors in the face of a hyper-competitive market caused by capital overabundance pushing deal sizes, startup valuations, and deal activity. This exploratory study outlines the challenges, opportunities, current methods, and future potential of AI adoption in line with the VC investment funnel. A qualitative analysis was conducted based on 17 expert interviews with early-stage VC investors and academic researchers. The findings reveal that most firms do not yet leverage AI, even though they already adopt data-driven decision support, due to resource scarcity in terms of people, time, and budget. Those VC firms that already apply AI predominantly aim at making their sourcing and screening processes more efficient and increasing their portfolio diversity. The interviews also reveal that the number of VCs adopting AI will significantly increase in the next few years—independently of firm size and resource availability. The catalyst for this will be emerging third-party software providers offering affordable AI tools developed primarily to enhance the VC investment decision process.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Retterath, A., Braun, R.: Benchmarking venture capital databases. SSRN Electron. J. (2020). https://doi.org/10.2139/ssrn.3706108

Corea, F.: AI and venture capital. In: An Introduction to Data. SBD, vol. 50, pp. 101–110. Springer, Cham (2019). https://doi.org/10.1007/978-3-030-04468-8_15

Sheehan, P., Sheehan, A.: The paradox of experience. ETF Partners White Paper (2017)

Hastie, T., Tibshirani, R., Friedman, J.: Unsupervised learning. In: The Elements of Statistical Learning, pp. 485–585. Springer, New York (2009). https://doi.org/10.1007/978-3-540-28650-9_5

Jordan, M., Mitchell, T.: Machine learning: trends, perspectives, and prospects. Science 349, 255–260 (2015). https://doi.org/10.1126/science.aaa8415

Agarwal, R., Dhar, V.: Editorial—Big data, data science, and analytics: the opportunity and challenge for IS research. Inf. Syst. Res. 25, 443–448 (2014). https://doi.org/10.1287/isre.2014.0546

Blattberg, R.C., Hoch, S.J.: Database models and managerial intuition: 50% model + 50% manager. Manage. Sci. 36, 887–899 (1990). https://doi.org/10.1142/9789814287067_0014

Blohm, I., Antretter, T., Sirén, C., Grichnik, D., Wincent, J.: It’s a peoples game, isn’t it?! A comparison between the investment returns of business angels and machine learning algorithms. Entrep. Theory Pract. (2020). https://doi.org/10.1177/1042258720945206

Obschonka, M., Audretsch, D.B.: Artificial intelligence and big data in entrepreneurship: a new era has begun. Small Bus. Econ. 55(3), 529–539 (2019). https://doi.org/10.1007/s11187-019-00202-4

Schwab, A., Zhang, Z.: A new methodological frontier in entrepreneurship research: Big data studies. Entrep. Theory Pract. 43, 843–854 (2019). https://doi.org/10.1177/1042258718760841

Fried, V., Hisrich, R.: Toward a model of venture capital investment decision making. Financ. Manage. 23, 28–37 (1994)

Tyebjee, T.T., Bruno, A.: A model of venture capitalist investment activity. Manage. Sci. 30, 1051–1066 (1984). https://doi.org/10.1287/mnsc.30.9.1051

Hisrich, R., Jankowicz, A.: Intuition in venture capital decisions: an exploratory study using a new technique. J. Bus. Ventur. 5, 49–62 (1990). https://doi.org/10.1016/0883-9026(90)90026-P

Macmillan, I., Zemann, L., Subbanarasimha, P.: Criteria distinguishing successful from unsuccessful ventures in the venture screening process. J. Bus. Ventur. 2, 123–137 (1987). https://doi.org/10.1016/0883-9026(87)90003-6

Khan, A.: Assessing venture capital investments with noncompensatory behavioral decision models. J. Bus. Ventur. 2, 193–205 (1987). https://doi.org/10.1016/0883-9026(87)90008-5

Shepherd, D.A., Zacharakis, A., Baron, R.A.: VCs’ decision processes: evidence suggesting more experience may not always be better. J. Bus. Ventur. 18, 381–401 (2003). https://doi.org/10.1016/S0883-9026(02)00099-X

Zacharakis, A., Meyer, G.: A lack of insight: do venture capitalists really understand their own decision process? J. Bus. Ventur. 13, 57–76 (1998). https://doi.org/10.1016/S0883-9026(02)00099-X

Achleitner, A.: Venture capital. In: Breuer, R.E. (ed.) Handbuch Finanzierung, pp. 513–529. Gabler Verlag, Wiesbaden (2001). https://doi.org/10.1007/978-3-322-89933-0_20

Bender, M.: Spatial Proximity in Venture Capital Financing: A Theoretical and Empirical Analysis of Germany. Gabler Verlag, Wiesbaden (2010). https://doi.org/10.1007/978-3-8349-6172-3

Kaserer, C., Achleitner, A., von Einem, C., Schiereck, D.: Private equity in Deutschland - Rahmenbedingungen, ökonomische Bedeutung und Handlungsempfehlungen. Books on Demand GmbH, Norderstedt (2007)

Metrick, A., Yasuda, A.: Venture Capital and the Finance of Innovation. Wiley, Hoboken (2021)

Hansen, D.: How VCs deploy operating talent to build better startups. https://www.forbes.com/sites/drewhansen/2012/12/26/how-vcs-deploy-operating-talent-to-build-better-startups/?sh=3822207836ef. Accessed 09 Feb 2022

Wagner, A.: The venture capital lifecycle. https://pitchbook.com/news/articles/the-venture-capital-lifecycle. Accessed 09 Feb 2022

Gompers, P., Lerner, J.: What drives venture capital fundraising? Nat. Bureau Econ. Res. (1999). https://doi.org/10.3386/w6906

Feld, B., Mendelson, J.: Venture Deals: Be Smarter Than your Lawyer and Venture Capitalist. Wiley, Hoboken (2019)

Hodgkinson, G., Bown, N., Maule, A., Glaister, W., Pearman, A.: Breaking the frame: an analysis of strategic cognition and decision making under uncertainty. Strateg. Manag. J. 20, 977–985 (1999). https://doi.org/10.1002/(SICI)1097-0266(199910)20:10%3c977::AID-SMJ58%3e3.0.CO;2-X

Barber, B., Odean, T.: Boys will be boys: gender, overconfidence, and common stock investment. Q. J. Econ. 116, 261–292 (2001). https://doi.org/10.1162/003355301556400

Milkman, K., Chugh, D., Bazerman, M.: How can decision making be improved? Perspect. Psychol. Sci. 4, 379–383 (2009). https://doi.org/10.1111/j.1745-6924.2009.01142.x

Ritter, J.: To fly, to fall, to fly again. https://www.economist.com/briefing/2015/07/25/to-fly-to-fall-to-fly-again. Accessed 10 Feb 2022

Tversky, A., Kahneman, D.: Variants of uncertainty. Cognition 11, 143–157 (1982). https://doi.org/10.1016/0010-0277(82)90023-3

Waweru, N., Munyoki, E., Uliana, E.: The effects of behavioural factors in investment decision-making: a survey of institutional investors operating at the Nairobi stock exchange. Int. J. Busi. Emerg. Markets. 1, 24–41 (2008). https://doi.org/10.1504/IJBEM.2008.019243

Huang, L.: The role of investor gut feel in managing complexity and extreme risk. Acad. Manage. J. 61, 1821–1847 (2018).https://doi.org/10.5465/amj.2016.1009

Huang, L., Pearce, J.: Managing the unknowable: the effectiveness of early-stage investor gut feel in entrepreneurial investment decisions. Adm. Sci. Q. 60, 634–670 (2015). https://doi.org/10.1177/0001839215597270

Shepherd, D., Zacharakis, A.: Venture capitalists’ expertise: a call for research into decision aids and cognitive feedback. J. Bus. Ventur. 17, 1–20 (2002). https://doi.org/10.1016/S0883-9026(00)00051-3

Franke, N., Gruber, M., Harhoff, D., Henkel, J.: What you are is what you like— similarity biases in venture capitalists’ evaluations of start-up teams. J. Bus. Ventur. 21, 802–826 (2006). https://doi.org/10.1016/j.jbusvent.2005.07.001

Zacharakis, A., Meyer, G.: The potential of actuarial decision models: can they improve the venture capital investment decision? J. Bus. Ventur. 15, 323–346 (2000). https://doi.org/10.1016/S0883-9026(98)00016-0

Cumming, D., Dai, N.: Local bias in venture capital investments. J. Empir. Financ. 17, 362–380 (2010). https://doi.org/10.1016/j.jempfin.2009.11.001

Jääskeläinen, M., Maula, M.: Do networks of financial intermediaries help reduce local bias? Evidence from cross-border venture capital exits. J. Bus. Ventur. 29, 704–721 (2014). https://doi.org/10.1016/j.jbusvent.2013.09.001

Amornsiripanitch, N., Gompers, P., Xuan, Y.: More than money: venture capitalists on boards. J. Law Econ. Organizat. 35, 513–543 (2019). https://doi.org/10.1093/jleo/ewz010

de Clercq, D., Manigart, S.: The venture capital post-investment phase: opening the black box of involvement. In: Landström, H. (ed.) Handbook of Research on Venture Capital, pp. 193–218. Edward Elgar, Cheltenham (2007). https://doi.org/10.4337/9781847208781.00015

Elango, B., Fried, V., Hisrich, R., Polonchek, A.: How venture capital firms differ. J. Bus. Ventur. 10, 157–179 (1995). https://doi.org/10.1016/0883-9026(94)00019-Q

Wells, W.: Venture capital decision-making (1974)

Sørensen, M.: How smart is smart money? A two-sided matching model of venture capital. J. Financ. 62, 2725–2762 (2007). https://doi.org/10.1111/j.1540-6261.2007.01291.x

Gompers, P., Gornall, W., Kaplan, S., Strebulaev, I.: How venture capitalists make decisions. Harvard Business Review. March-April 2021

Kollmann, T., Kuckertz, A.: Evaluation uncertainty of venture capitalists’ investment criteria. J. Bus. Res. 63, 741–747 (2010). https://doi.org/10.1016/j.jbusres.2009.06.004

Gompers, P., Gornall, W., Kaplan, S., Strebulaev, I.: How do venture capitalists make decisions? J. Financ. Econ. 135, 169–190 (2020). https://doi.org/10.1016/j.jfineco.2019.06.011

Brown, K.C., Wiles, K.W.: Opaque financial contracting and toxic term sheets in venture capital. J. Appl. Corp. Financ. 28, 72–85 (2016). https://doi.org/10.1111/jacf.12160

Busenitz, L.W., Fiet, J.O., Moesel, D.D.: Reconsidering the venture capitalists’ “value added” proposition: an interorganizational learning perspective. J. Bus. Ventur. 19, 787–807 (2004). https://doi.org/10.1016/j.jbusvent.2003.06.005

Longhurst, R.: Semi-structured interviews and focus groups. In: Clifford, N., Cope, M., Gillespie, T., French, S. (eds.) Key Methods in Geography, pp. 143–156. SAGE, London (2010)

Niebert, K., Gropengießer, H.: Leitfadengestützte interviews. In: Krüger, D., Parchmann, I., Schecker, H. (eds.) Methoden in der naturwissenschaftsdidaktischen Forschung, pp. 121–132. Springer, Heidelberg (2014). https://doi.org/10.1007/978-3-642-37827-0_10

Strauss, A., Corbin, J.: Basics of Qualitative Research: Grounded Theory Procedures and Techniques. SAGE, London (1990)

Lincoln, Y.S., Guba, E.G.: Naturalistic Inquiry. SAGE, Newbury Park (1985)

Denzin, N.: Sociological Methods: A Sourcebook. McGraw Hill, New York (1978)

Trochim, W.M.K.: Qualitative validity. https://conjointly.com/kb/qualitative-validity/. Accessed 10 Feb 2022

Spradley, J.: The Ethnographic Interview. Thomson Wadsworth, Belmont (1979)

Smith, R.: The key differences between rule-based AI and machine learning, https://becominghuman.ai/the-key-differences-between-rule-based-ai-and-machine-learning-8792e545e6. Accessed 10 Feb 2022

Rimol, M., Costello, C.: Gartner says tech investors will prioritize data science and artificial intelligence above “gut feel” for investment decisions by 2025. https://www.gartner.com/en/newsroom/press-releases/2021-03-10-gartner-says-tech-investors-will-prioritize-data-science-and-artificial-intelligence-above-gut-feel-for-investment-decisions-by-20250. Accessed 10 Feb 2022

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Röhm, S., Bick, M., Boeckle, M. (2022). The Impact of Artificial Intelligence on the Investment Decision Process in Venture Capital Firms . In: Degen, H., Ntoa, S. (eds) Artificial Intelligence in HCI. HCII 2022. Lecture Notes in Computer Science(), vol 13336. Springer, Cham. https://doi.org/10.1007/978-3-031-05643-7_27

Download citation

DOI: https://doi.org/10.1007/978-3-031-05643-7_27

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-05642-0

Online ISBN: 978-3-031-05643-7

eBook Packages: Computer ScienceComputer Science (R0)