Abstract

The status quo in the global oil, gas, and coal industries in terms of their economic value, geographic distribution, and company structures is given. The current fossil fuel production volumes and decline rates required under 1.5 °C-compatible pathways for coal, oil, and natural gas are discussed. The assumptions made when calculating scope 1 and 2 emissions and current and future energy intensities are defined. The role of power and gas utilities under the OECM 1.5 °C scenario is discussed, together with the projected trajectories for renewable power- and heat-generating plants and those for hydrogen and synthetic fuel. Future structures of the global primary and secondary energy industries are suggested.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- Global oil, gas, and coal industries

- International production trajectory

- Fossil fuel decline rates

- 1.5 °C fossil fuel trajectories

- Utilities

1 Introduction

The Paris Agreement achieved consensus among all member states to maintain global warming well below 2 °C above pre-industrial levels while pursuing efforts to limit the increase to 1.5 ° C, because this will significantly reduce the risk and impacts of climate change (UNFCCC, 2015). The role of governments in implementing national climate targets and endeavours to reduce emissions at the country level is crucial for achieving global success. Considering the current concentration of CO2 in the atmosphere (416.2 parts per million) (US DC, 2021), a global effort is required to reduce emissions to as close as possible to zero while removing atmospheric CO2 by restoring ecosystems.

To reduce emissions to zero in line with a 1.5 °C increase, the use of coal, oil, and gas must be phased out by at least 56% by 2030. However, current climate debates have not involved an open discussion of the orderly withdrawal from the coal, oil, and gas industries. Instead, the political debate about coal, oil, and gas has continued to focus on supply and price security, neglecting the fact that mitigating climate change is only possible when fossil fuels are phased out.

The finance industry set various ‘net-zero’ targets in the run up to the Climate Conference COP26 in Glasgow in November 2021. One of these target setting organizations is the Net-Zero Asset Owner Alliance (NZAOA) (see Chap. 2). But what does this mean for the primary energy industry?

This section focuses on the fossil fuel trajectory of the OECM 1.5 °C pathways presented in this book and what it means for the primary energy industry and electricity and (natural) gas utilities to supply end users—customers from industry, services, or private households.

2 The Energy Industry: Overview

Oil, gas, and coal are all hydrocarbons—combinations of hydrogen and carbon—that originate in decomposed organic materials. Different combinations of heat and pressure—depending on geological conditions—create different forms of hydrocarbons: oil, gas, and brown or hard coal (NG, 2021).

Oil and gas often occur together, and with the proximity of both fossil resources, primary energy companies are active in oil and gas extraction. Geographically, the largest extraction companies for oil and gas are based in the USA, Saudi Arabia, and Russia, which were responsible for 43% of global production in 2020 (IEA OIL, 2021). By far the largest producer of coal is China, which contributed 53% of global production in 2018 (Statista, 2021c).

The geographic distribution of fossil fuels is also reflected in the structure of the industry. In 2020, the top five oil and gas companies were as follows: (1) China Petroleum & Chemical Corp. (SNP); (2) PetroChina Co. Ltd. (PTR); (3) Saudi Arabian Oil Co. (Saudi Aramco); (4) Royal Dutch Shell PLC (RDS.A); and (5) BP PLC (BP). Only Shell and BP are involved in some coal mining, whereas the top three companies focus on oil, gas, and related products for the chemical industry (IN, 2020).

The largest coal companies are BHP and Rio Tinto, both based in Australia, and China Shenhua Energy and have no or only relatively minor involvement in oil and gas extraction.

The Global Industry Classification System (GICS) category 10 Energy includes all steps in the value chain for the production of primary energy from fossil fuels (oil, gas, and coal), from exploration and extraction to the refinement and processing of fuels as commodity for industry clients, such as the chemical industry and utilities.

Oil, gas, and coal are among the most fundamental commodities of the current global economy. Oil is not only used as a fuel for cars, planes, and ships but also as a commodity to produce, for example, asphalt, plastics, and a variety of other products. In response to the COVID-19 pandemic, the global market size for oil and gas exploration and production in 2020 was at a 10-year low, at US$1.8 trillion, compared with US$2.9 trillion in 2019. The market size a decade earlier (2011) was estimated to be US$5.3 trillion (IBIS, 2021), more than twice as high as 2020. In comparison, the global market value of coal mining companies was US$0.66 trillion in 2020 and US$0.79 trillion in 2021 (Statista, 2021a), about half the value of US$1.27 trillion a decade earlier (2011).

2.1 1.5 °C Pathway for the Primary Energy Industry

The primary energy demand analysis—and therefore the projections for the primary energy industry and possible future operation strategies—is the product of the energy demand projections for all end-use sectors, as presented in previous chapters, and the energy supply concept. The challenge for the primary energy industry is to supply energy services for sustained economic development and a growing global population while remaining within the global carbon budget to limit the global temperature rise to 1.5 °C.

The trajectory for oil, gas, and coal depends on how quickly an alternative energy supply can be built up and how energy consumption can be reduced technically and/or by behavioural changes. The OECM 1.5 °C pathway represents such a trajectory and is based on a detailed bottom-up sectorial demand and supply analysis, as documented in previous chapters.

However, for the primary energy industry, it is important to assess whether or not new oil, gas, or coal extraction projects are required to meet the demand, even under an ambitious fossil-fuel phase-out scenario.

A specific analysis was undertaken in parallel with the development of the OECM 1.5 °C pathway and with scenario data from a previous version of the OneEarth Climate Model (OECM), published in 2019 (Teske et al., 2019). On the basis of publicly available oil, gas, and coal extraction data, future production volumes were calculated and compared with the 1.5 °C trajectory (Teske & Niklas, 2021).

The calculation was based on the assumptions that no new fossil fuel extraction projects would be developed from 2021 onwards and that all existing projects will see a production decline at standard industry rates. These assumptions are supported by the IEA Net-Zero by 2050 report, which concludes that there can be ‘no new oil, gas or coal development if world is to reach net zero by 2050’ (IEA NZ, 2021b).

A scenario designated the Existing International Production Trajectory (‘no expansion’) was developed and modelled, specifically to understand what global fossil fuel production will look like under the following assumptions:

-

No new fossil fuel projects are developed.

-

Existing fossil fuel production projects stop producing once the resource at the existing site is exhausted, and no new mines are dug or wells are drilled in the surrounding field.

-

Production at existing projects declines at standard industry rates:

-

Coal: −2% per year

-

Oil: −4% per year onshore and 6% per year offshore

-

Gas: −4% per year on- and offshore

-

The no expansion scenario was compared with the OECM 1.5 °C pathway for coal, oil, and gas to understand whether security of supply is possible under an immediate implementation of a ‘stop exploration’ policy.

The decline rates for oil, gas, and coal that would result from the implementation of the 1.5 °C pathway and the assumed annual production decline rates for oil, gas, and coal are compared in Table 10.1.

-

Coal production will must decline by 9.5% per year between 2021 and 2030, and then by at least 5% per year beyond 2030. By 2025, global coal production must fall to 3.7 billion tonnes, equivalent to China’s production in 2017.

-

Oil production must fall by 8.5% per year until 2030, and by 6% thereafter. By 2040, global oil production must fall to the equivalent of the production volume of just one of the three largest oil producers (the USA, Saudi Arabia, or Russia). The oil demand for non-energy use, such as the petrochemical industry, is not included in this analysis.

-

Gas production must decline by 3.5% per year between 2021 and 2030, and decline even further to 9% per year beyond 2030. The 1.5 °C scenario also projects that the existing gas infrastructure, including gas pipelines and power plants, will be retrofitted after the gas phase-out to accommodate hydrogen and/or renewable methane produced with electricity from renewable sources.

Table 10.2 shows the modelled trajectories for global coal, oil, and gas production under the 1.5 °C scenario and the no expansion scenario. Projections beyond 2025 are extrapolated based on the fossil fuel production values for 2018 and 2019, taken from the BP Statistical Review and IEA World Energy Balances (IEA WEB, 2021).

The highest rates of overproduction are for hard coal and brown coal (lignite). On a global average, even existing mines cannot remain in operation until their resources are depleted, when calculations are made under the assumed production decline rates. No new mines need be opened to supply the remaining demand for coal.

The results for natural gas are less clear, and the production decline rates vary significantly. Shale gas production wells, in particular, have significantly higher production decline rates than conventional onshore or offshore natural gas extraction wells. The demand and supply values under a 1.5 °C scenario are similar, and a large overproduction of gas under the defined scenarios seems unlikely. However, a more detailed and production-side-specific analysis is required. The demand and supply for oil on a global level are similar—meaning that the assumed average production decline rates for oil wells and the reduction in demand are in the same order of magnitude.

Our analysis shows that even with no expansion of fossil fuel production, the current productions levels—especially for coal—will exhaust the carbon budget associated with the 1.5 °C target before 2030. Without the active phase-out of fossil-fuel production, production will significantly surpass what can be produced under a 1.5 °C scenario by 2025 onwards, for all fossil-fuel types.

The following section provides an overview of the breakdown of gross production, the losses during fuel processing, refinement, or the production of other fossil fuel products for hard coal, brown coal (lignite), gas, and oil. These parameters are required to calculate the scope 1 and 2 emissions of the primary energy industry and are therefore documented. All parameters for the base year (2019) in Tables 10.3, 10.5, 10.6, and 10.8 are based on IEA World Energy Balances Statistics and projections under the OECM 1.5 °C pathway. Losses are calculated with statistical data from previous years and remain stable over the entire modelling period until 2050.

2.1.1 1.5 °C Trajectory: Hard Coal

The gross production of hard coal is the second highest for any fossil fuel, after oil. Around 35,000 PJ/yr of all the coal consumed globally is imported from other countries, or in other words, the coal consumed is not a regional energy resource. The main coal producers are China, Indonesia, and Australia. Interestingly, the largest importer of coal in 2019 was China, followed by India and the European Community (IEA Coal, 2020) (Table 10.3).

Table 10.4 shows the assumed losses in the coal industry and ‘own energy uses’, which are required for secondary projects, such as coking coal and coal liquification. The current shares of coal export and import for hard coal are also shown. All parameters are calculated on the basis of 2019 values and remain at the same level for the entire modelling period.

2.1.2 1.5 °C Trajectory: Brown Coal

Brown coal (or lignite) mines are in direct proximity to power plants, so the fuel is on-site and not exported. The use of brown coal is limited to fewer countries than that of hard coal (Table 10.5).

2.1.3 1.5 °C Trajectory: Oil

Crude oil is the largest single energy source globally. Its production is regionally concentrated, and more than 60% of all oil produced crosses borders between its production and consumption. In 2019, about 0.3% of the oil produced was consumed by the extraction process itself—generating part of the scope 1 emissions of the oil industry—and another 1.7% was losses in refineries and other prediction-related processes (Table 10.6).

Table 10.7 provides an overview of assumptions for transport shares and technical losses in percent as well as the specific emissions that are assumed for the calculation of the scope 1 emissions for oil production.

The assumed methane emissions are based on the IEA Methane Tracker (IEA MT, 2021). It is assumed that methane emissions will be reduced by 30% according to the Global Methane Pledge (EU-US, 2021), as announced at the Climate Conference COP26 in Glasgow, which has been supported by 44 countries (GMI, 2021) at the time of writing (December 2021).

2.1.4 1.5 °C Trajectory: Natural Gas

About one-third of all-natural gas produced crosses a national border between extraction and consumption (Table 10.8). The vast majority is transported via pipelines, which leads to a fractured world market with different prices, roughly broken down into the Americas, Europe, and the Middle East and Russia, as well as the Asia Pacific Region, which is more focused on liquified natural gas (LNG) transported by ships.

The share of gas flaring in the total production is part of the scope 1 emissions of the gas industry and is assumed to decrease from 4% currently to 2% in 2025 and to end by 2030, according to Zero Routine Flaring by 2030 by the World Bank (ZRF, 2030).

Finally, the assumed shares for import and export and various losses, as well as the transport modes, for natural gas are shown in Table 10.9.

2.1.5 Global Renewables Trajectory (Power, Heat, and Fuels) Under OECM 1.5 °C

The primary energy industry—oil and gas companies and coal companies—is at the crossroads. The fossil fuel demand and therefore its extraction must decline sharply to remain within the carbon budget. However, both the global population and the global economy are projected to increase over the next three decades. Therefore, the energy demand will remain high. Even under the ambitious energy efficiency assumptions of the OECM 1.5 °C pathway, the global final energy demand will decrease by less than 10%. Therefore, the (primary) energy industry has an important role to play.

However, the way energy is produced must change and if primary energy companies transition to renewable energy—not just electricity but also heat and fuels—the energy industry must move towards new business models that are closer to those of utilities, renewable project developers, and energy technology companies. Large-scale renewable energy projects, such as offshore wind farms, are in regard to investment needs within the same order of magnitude as offshore oil and gas projects. The skill sets of the offshore oil and gas workforce can also be accommodated well within the offshore wind industry (see Box 10.2).

Table 10.10 shows the global renewable power, heat, and fuel generation requirements under the OECM 1.5 °C trajectory. The overall renewable energy intensity—in petajoules (PJ) per billion $GDP—is compared with the overall current coal energy intensity. Renewables will take over the role of coal in supplying the global economy with energy by around 2030. The overall renewable energy required to supply the needs of industry, services, transport, and buildings will reach the levels of oil, gas, and coal, at around 150,000 PJ/yr, between 2030 and 2035.

Only 5 years later, renewables will provide energy equal to the current contributions of oil and gas combined. Therefore, the potential new market opportunities for both the ‘traditional’ primary energy industry and utilities are significant, whereas the borders between the primary and secondary energy industries (= utilities) will start to blur.

3 Global Utilities Sector

Power and gas utilities are a secondary energy industry. Until now, utilities have purchased (fossil) fuels from the primary energy industry and converted them to electricity in power plants or distributed the fuels—mainly gas—directly to customers to meet their demand for power and heat. Therefore, utilities are positioned between the primary energy industry and the end-use sector. Electricity generation is among the core businesses of utilities. Therefore, the significant increase in the electricity demand due to the electrification of transport and heat under the OECM 1.5 °C pathway can be seen as a business opportunity.

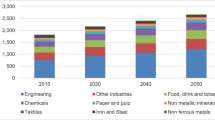

The global market for the generation, transmission, and distribution of electric power was estimated to be US$3.2 trillion in 2020 (PRN, 2021). The 20 largest electric utilities had a cumulative market value of US$686 million (Statista, 2021b). Market analysts expect a significant increase in the electricity demand (IEA EMR, 2021a; IRENA & JRC, 2021) (Fig. 10.1).

World’s largest electric utility companies. (Statista, 2021c)

In a comparison of 14 global and regional energy scenarios, the International Renewable Energy Agency (IRENA) found that all projections agree that the demand for electricity will increase sharply:

Total global electricity generated in 2040 ranges from around 40,000 terawatt hours (TWh) in the IEA Sustainable Development Scenario (SDS) to nearly 70,000 TWh in the Bloomberg New Energy Outlook 2021 (BNEF NCS) where electricity generation grows two-and-a-half times from 2019 to 2040. This is due to electric vehicle uptake, electrification in industry and buildings and green hydrogen production. (IRENA & JRC, 2021)

The OECM 1.5 °C pathway will lead to an annual increase in electricity generation from about 26,000 TWh in 2019 to 76,000 TWh. Although there is clear agreement that the global electricity demand will increase, the predictions on how this electricity will be generated are very different. Despite the significant growth in renewable power generation during the last decade, short-term projections still expect that fossil-fuel-based power generation will continue to grow.

The Electricity Market Report of the International Energy Agency (IEA) expects that fossil-fuel-based electricity will provide 40% of the additional electricity demand in 2022 and that coal-fired power generation will jump back to 2019 levels after a 4.6% decline in 2020 (IEA EMR, 2021a). Therefore, the lead of renewable power generation is fragile.

3.1 Global Power and Natural Gas Utilities: Infrastructural Changes Under the 1.5 °C Scenario

The assumed development of new manufacturing technologies, vehicle technologies, and building standards to achieve lower energy intensities for products and services has been presented in Part IV—Sector-Specific Pathways (Chaps. 5, 6, 7, and 8). Power and gas utilities will be significantly affected by the suggested changes. Therefore, the business model must be adapted, as well as the operational organization, to supply secure electricity to all customers.

Throughout the description of the OECM 1.5 °C pathway in this book, the increased electrification of the transport and heating sectors is the overarching scenario narrative and runs across all sectors. Increased electrification will lead to ‘sector coupling’, i.e. the interconnection of the heating and transport sectors with the electricity sector. The sectors are still largely separate at the time of writing. However, the interconnection of these sectors offers significant advantages in terms of the management of the energy demand and the utilization of generation management with storage technologies. The synergies of sector coupling in terms of the infrastructural changes required to transition to 100% renewable energy systems are well-documented in the literature (e.g. Brown et al., 2018; Bogdanov et al., 2021; Bermúdez et al., 2021; Jacobson, 2020).

3.1.1 Power Utilities

Power utilities undertake three main tasks: power generation, the transmission and distribution of electricity, and electricity services. In countries in which the electricity market is liberalized, these tasks are separated and are performed by three independent (unbundeled) companies, for generation, transmission, and distribution. All three areas of responsibility will change significantly under the 1.5 °C scenario.

3.1.1.1 Power Generation

Fossil-based and nuclear power generation with average sizes of 500–1000 MW per production site require only a small number of power plants at few locations. Widely distributed solar photovoltaic generation, with an average size of 3–5 kW per system, will often be located at customers’ premises or private homes, leading to thousands or even millions of decentralized power plants. Utilities and/or power-plant operators have access to a coal power plant for maintenance, for example, but decentralized power generation is different. Solar photovoltaic generators are usually neither owned by utilities, nor are they serviced by them in terms of technical maintenance, and utilities therefore have little influence on the quantity of electricity generated or the time of generation. Electricity is also consumed partly locally and may not even reach the public power grid.

Offshore wind farms, in contrast, are centralized power plants with installed capacities within the range of an average conventional coal power plant and are usually not in direct proximity to the electricity demand. In contrast to oil and gas companies, utilities usually have no experience of working offshore, so the skills of the workforce must change.

3.1.1.2 Transmission

Under the 1.5 °C scenario, the power grid will change significantly over the next decade in response to three major changes: in the volume, load, and the location of generation.

First, the amount of electricity that must be transported will increase significantly. Electricity will replace fuels for heating and mobility, and the additional energy previously transported by other energy infrastructure, such as pipelines, will flow at least partly via power grids. End users—both private households that use heat and charge vehicles with electricity and industry clients—will not just increase the amount of electricity they use in kilowatt hours per outlet but also the loads required in kilowatts or even megawatts.

A home charger for Tesla vehicles, for example, operates at 230 V and 8–32 A, depending on the location and model (Tesla, 2021), resulting in a load of 1.8–7 kW. Therefore, the load of an average household will approximately double. The replacement of a coal-fired process (such as replacing a heating oven for steel production with an electric arc furnace) can increase the load by ≥300 MW.

Higher loads at the customer connection point and increased on-site generation will require a significantly stronger power grid. Furthermore, on days of higher wind and/or solar electricity production, electricity can ‘reverse the flow’. With centralized power plants, the electricity is fed into the system—the transmission grid— at high- or medium-voltage levels and is taken out at medium-voltage levels by industry customers and at low-voltage levels (from the distribution grid) by residential or commercial customers. Solar rooftop systems feed electricity in at a low-voltage level. During times of high production, solar electricity can flow from a low-voltage level to a medium-voltage level, although this requires special transformer stations.

3.1.1.3 Electricity System Services

Like the sites of electricity in- and output, also the time of generation is not centrally managed by a power-plant operator (who would ramp up and down the power plant) but by a ‘swarm’ of solar electricity generators and onshore wind turbines, whose operation depends on the availability of sunshine and wind. Weather forecasts, the related power generated, and demand projections will be increasingly important for utilities and grid operators. The operation and management of decentralized storage systems, often operated by private households, must also be considered. Power grid operators are among the most important enablers of the energy transition, because an efficient and safe power grid is the backbone of the decarbonized energy industry.

3.1.1.4 Distribution

Widely distributed generation and storage capacities, in increasing proximity to the electricity demand, will change the relationship between the utility and the customer. The customer is no longer just a consumer but a ‘prosumer’—a producer and consumer of electricity. Therefore, the business concept must change significantly, and utilities may see themselves competing with the electricity produced their own customers. A utility must increase its services and integrate local electricity generation (Table 10.11).

3.1.2 Gas Utilities

The changes in gas utilities under the OECM 1.5 °C scenario are more profound than those for power utilities, because the main product—natural gas—will be phased out globally by 2050. Tables 10.8 and 10.9 show the projected trajectories. However, the OECM acknowledges the significant value of the existing gas infrastructure and recommends that the gas distribution network be repurposed to utilize it for the future decarbonized energy supply. According to the Global Energy Monitor, 900,757 km of natural gas transmission pipelines were in operation globally at the end of 2020. Research has shown that there are no fundamental technical barriers to the conversion of natural gas pipelines for the transport of pure hydrogen.

Box 10.1 summarizes the key results of the comprehensive research project ‘Repurposing Existing Gas Infrastructure: Overview of existing studies and reflections on the conditions for repurposing’ by the European Union Agency for the Cooperation of Energy Regulators (ACER), published in July 2021.

Therefore, the OECM assumes the conversion of natural gas pipelines to transport hydrogen, either for direct use as a replacement for natural gas in (process) heating systems, as feedstock for chemical processes, or for energy storage purposes. Therefore, the calculation of scope 1 and 2 emissions (Chap. 13) factors in a transition to hydrogen and synthetic fuels, with the provided factors repurposed for conversion losses (Table 10.9).

Box 10.1 Conversion of Existing Natural Gas Pipelines to Transport Hydrogen

Key results from the research of the European Union Agency for the Cooperation of Energy Regulators ( ACER, 2021 )

Pipeline transport capacity: natural gas vs pure hydrogen—technical aspects

-

In a gaseous state, the energy density of hydrogen is only slightly lower (10–20%) than that of natural gas, under the same pressure and temperature conditions.

-

A pure hydrogen pipeline can have up to 80% of the maximum energy flow capacity of a natural gas pipeline, depending on the operating conditions.

-

The capacity for compression power must be increased by a factor of three to transport pure hydrogen in a natural gas pipeline to achieve a similar transport capacity.

-

If the compressor power capacity is not increased, the transport capacity will decrease.… This could be an option when the volumes of hydrogen to be transported are low, during the early stages of the hydrogen market uptake.

-

Hydrogen can accelerate the degradation of steel pipelines, which occurs primarily in the form of embrittlement, which causes cracks and may eventually result in pipeline failure. However, technical remedies to prevent embrittlement are readily available:

-

(i)

Inner coating to chemically protect the steel layer

-

(ii)

Intelligent pigging (monitoring)

-

(iii)

Operational pressure management (avoiding large pressure changes)

-

(iv)

Admixing degradation inhibitors (e.g. 1000 ppm oxygen)

-

(i)

Transmission pipeline conversion

The main advantages of repurposing pipelines are:

-

Natural gas pipeline networks are already available and socially accepted (routes, including rights of way and use).

-

Natural gas networks can be converted to carry hydrogen less expensively than the building new, dedicated hydrogen pipes. Such conversion can also be done gradually, depending on the development of the hydrogen supply demand. This will confer new uses on parts of the existing natural gas network, which has extensive geographic coverage throughout the EU.

-

Technologies for converting the natural gas infrastructure to hydrogen operation are already largely available and tested.

3.2 1.5 °°C Trajectory for Power and Gas Utilities

Table 10.12 shows the development of the demand and supply of natural gas and electricity for the global utilities sector—including combined heat and power (CHP)—under the OECM 1.5 °C pathway. Figure 10.2 shows the significant increase—by a factor of 10—in the global generation of renewable electricity. The projected transition of gas utilities to the distribution of hydrogen and synthetic fuels will represent 50% of their sales by 2045. Therefore, the transition is assumed to have a lead time of about 10 years for the implementation of the required technical and regulatory changes (Fig. 10.3).

4 Energy and Utilities Sectors: A Possible Structure

Of all the industries analysed, the energy industry—often referred to in this book as the primary energy sector—classified as GICS 10 Energy, will experience the most drastic changes. The decarbonization of the global energy sector requires the complete phase-out of fossil fuels in combustion processes to generate energy —the very core business of the energy industry.

The OneEarth Climate Model (OECM) 1.5 °C scenario assumes that 100% of the fossil-fuel-based energy supply will be replaced by renewable energy by 2050—complete transition within one generation—which is unprecedented in modern human history.

The purpose of this book is to document the development, calculation, and results of the OECM to provide benchmark key performance indicators for specific industries. These will support target setting by the finance industry and those who develop the net-zero targets and/or the National Determined Contributions (NDCs) required under the Paris Climate Agreement.

To develop new business concepts for industry sectors is not the task of this research. Instead, we aim to support our assumptions with technical details and scenario narratives, which have been discussed with the scientific advisory board of the Net-Zero Asset Owner Alliance (NZAOA) (see Chap. 2).

The energy and utility sectors must grow together to implement the global energy transition within only three decades. Utility-scale solar power plants and onshore and offshore wind farms are large infrastructural projects that require investments in the range of several hundred millions to billions of dollars. The operation and maintenance of offshore wind farms are very similar to those of offshore oil and gas rigs. The transport and distribution of natural gas from the point of its extraction to the end user is the core business activity of (natural) gas utilities. Power utilities oversee the entire gamut of production, from generation to distribution. Based on the OECM decarbonization pathway described in this book, we propose a horizontal integration of all three sub-sectors, which integrates the core areas of expertise and avoids stranded assets by repurposing the existing fossil-fuel infrastructure, such as pipelines.

Figure 10.4 shows a possible structure for the decarbonized energy and utility sectors. The (primary) energy industry will focus on utility-scale power generation and the production of hydrogen and synthetic fuels for the supply of energy and chemical feedstock. Gas utilities will focus on the transport of hydrogen and fuels and offer decentralized hydrogen production and storage services to the power sector. Power utilities will concentrate on the power grid, the management of the electricity system, and the integration of decentralized renewable power generation and storage systems, including those from ‘prosumers’.

Box 10.2 Occupational Match between Offshore Oil and Gas, and Offshore Wind energy (Briggs et al., 2021)

Briggs et al. (2021) found that the main occupational pathways into offshore wind with are from other technically related sectors (such as offshore industries and the energy sector), as new entrant apprentices or graduates, and from a workforce with skills that cut across sectors (e.g. business/commercial, IT and data analytics, drone and underwater remotely operated vehicle (ROV) operators, etc.).

Consequently, the development of offshore wind energy could be an important source of alternative employment for the offshore oil and gas workforce.

A major UK study of offshore wind found that there are three main pathways for workers into the industry:

-

Movement from other, technically related industries (offshore industries, energy sector)

-

Apprenticeships and graduates

-

Movement of workers with cross-sector skills (e.g. business/commercial, IT and data analytics, drone/ROV operators, etc.)

A range of studies have found significant movement has occurred from the offshore oil and gas workforce into the offshore wind industry, because these workers often have the foundation skills required to work on offshore installation vessels and offshore platforms and the specialized knowledge of the environmental challenges associated with operating and maintaining offshore infrastructure (IRENA, 2018).

A Scottish study found that only 15% of jobs in these industries have no skills match. For around two-thirds of jobs, there is a ‘good’ or ‘some’ skills match, including in many professional jobs, construction and installation, electrical and mechanical trades, technicians, and subsea pipelines. For a range of administrative, quality control, logistic, and project management jobs, there are ‘partial’ skills overlaps, which suggests that these workers could be transitioned with training (Fig. 10.5).

Occupational match between offshore oil and gas and offshore wind energy. (Friends of the Earth; Global Witness and Greener Jobs Alliance, 2019)

References

ACER. (2021, July 16). Transporting pure hydrogen by repurposing existing gas infrastructure: Overview of existing studies and reflections on the conditions for repurposing. European Union Agency for the Cooperation of Energy Regulators, Trg republike 3, 1000 Ljubljana, Slovenia. https://extranet.acer.europa.eu/official_documents/acts_of_the_agency/publication/transporting%20pure%20hydrogen%20by%20repurposing%20existing%20gas%20infrastructure_overview%20of%20studies.pdf

Bermúdez, J., Jensen, I., Münster, M., Koivisto, M., Kirkerud, J. G., Chen, Y.-K., & Ravn, H. (2021). The role of sector coupling in the green transition: A least-cost energy system development in northern-central Europe towards 2050. Applied Energy, 289, 116685. https://doi.org/10.1016/j.apenergy.2021.116685

Bogdanov, D., Gulagi, A., Fasihi, M., & Breyer, C. (2021). Full energy sector transition towards 100% renewable energy supply: Integrating power, heat, transport and industry sectors including desalination. Applied Energy, 283, 116273. ISSN 0306-2619. https://doi.org/10.1016/j.apenergy.2020.116273

Briggs, C., Hemer, M., Howard, P., Langdon, R., Marsh, P., Teske, S., & Carrascosa, D. (2021). Offshore wind energy in Australia (92 pp.). Blue Economy Cooperative Research Centre.

Brown, T., Schlachtberger, D., Kies, A., Schramm, S., & Greiner, M. (2018). Synergies of sector coupling and transmission reinforcement in a cost-optimised, highly renewable European energy system. Energy, 160, 720–739. ISSN 0360-5442. https://doi.org/10.1016/j.energy.2018.06.222

EU-US. (2021, September 18). Joint EU-US press release on the global methane pledge. https://ec.europa.eu/commission/presscorner/detail/en/IP_21_4785

Friends of the Earth (FoE), Global Witness and Greener Jobs Alliance. (2019). Sea change: Climate emergency, jobs and managing the phase-out of UK oil and gas extraction (May Issue).

GMI. (2021). Global Methane Initiative (GMI). https://www.globalmethane.org/

IBIS. (2021, February 18). Industry Statistics—Global; Global oil & gas exploration & production—Market size 2005–2027. Online https://www.ibisworld.com/global/market-size/global-oil-gas-exploration-production/

IEA. (2021a). Electricity market report, July 2021. IEA. https://www.iea.org/reports/electricity-market-report-july-2021

IEA. (2021b). Net zero by 2050. IEA. https://www.iea.org/reports/net-zero-by-2050

IEA Coal. (2020) Coal 2020. IEA. https://www.iea.org/reports/coal-2020

IEA MT. (2021). Methane tracker 2021. IEA. https://www.iea.org/reports/methane-tracker-2021

IEA OIL. (2021). International Energy Agency, Oil information overview, Supply and demand. https://www.iea.org/reports/oil-information-overview/supply-and-demand

IEA WEB. (2021). IEA World Energy Balances. https://www.iea.org/data-and-statistics

IN. (2020, September 10). Investopedia, 10 biggest oil companies, Nathan Reiff. Online https://www.investopedia.com/articles/personal-finance/010715/worlds-top-10-oil-companies.asp

IRENA. (2018). Offshore wind investment, policies and job creation—Review of key findings for G7 ministerial meetings (September Issue).

IRENA and JRC. (2021). Benchmarking scenario comparisons: Key indicators for the clean energy transition. International Renewable Energy Agency, European Commission’s Joint Research Centre.

Jacobson, M. (2020). 100% clean, renewable energy and storage for everything. Cambridge University Press. https://doi.org/10.1017/9781108786713

NG. (2021). National Geographic, Resource Library, Petroleum, website viewed December 2021 https://education.nationalgeographic.org/resource/petroleum

PRN. (2021, March). Online news Cision PR Newswire, Global electric power generation, transmission, and distribution market report (2021 to 2030)—COVID-19 impact and recovery. https://www.prnewswire.com/news-releases/global-electric-power-generation-transmission-and-distribution-market-report-2021-to-2030%2D%2D-covid-19-impact-and-recovery-301248676.html

Statista. (2021a). Leading hard coal producing countries worldwide in 2018. https://www.statista.com/statistics/264775/top-10-countries-based-on-hard-coal-production/

Statista. (2021b). https://www.statista.com/statistics/274670/biggest-electric-utilities-in-the-world-based-on-sales/

Statista. (2021c). Market value of coal mining worldwide from 2010 to 2021 (in billion U.S. dollars). https://www.statista.com/statistics/1137437/coal-mining-market-size-worldwide/

Teske, S., & Niklas, S. (2021). Fossil fuel exit strategy: An orderly wind down of coal, oil and gas to meet the Paris Agreement, June 2021. UTS, February 2021. https://adobeindd.com/view/publications/e0092323-3e91-4e5c-95e0-098ee42f9dd1/z7xq/publication-web-resources/pdf/Fossil_Fuel_Exit_Strategy.pdf

Teske, S., Pregger, T., Naegler, T., et al (2019). Energy Scenario Results. In: Teske, S. (ed.) Achieving the Paris Climate Agreement Goals. In: Teske, S. (ed.) Global and Regional 100% Renewable Energy Scenarios with Non-energy GHG Pathways for +1.5°C and +2°C. Springer Open https://link.springer.com/book/10.1007/978-3-030-05843-2

Tesla. (2021). GEN 2 mobile connector owner’s manual, Australia. https://www.tesla.com/sites/default/files/pdfs/charging_docs/gen_2_umc/gen2_mobile_connector_en_au.pdf

UNFCCC. (2015). Paris Agreement to the United Nations Framework Convention on Climate Change.

US DC. (2021). US Department of Commerce, “ESRL Global Monitoring Laboratory—Research Areas.” https://gml.noaa.gov/about/theme1.html

ZRF. (2030). Zero Routine Flaring by 2030. World Bank. Website https://www.worldbank.org/en/programs/zero-routine-flaring-by-2030#5

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this chapter

Cite this chapter

Teske, S. (2022). Transition of the Energy Industry to (Net)-Zero Emissions. In: Teske, S. (eds) Achieving the Paris Climate Agreement Goals . Springer, Cham. https://doi.org/10.1007/978-3-030-99177-7_10

Download citation

DOI: https://doi.org/10.1007/978-3-030-99177-7_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-99176-0

Online ISBN: 978-3-030-99177-7

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)