Abstract

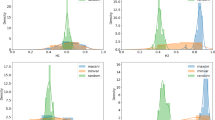

In this paper, we analyze the nonlinear properties of investor activity using the multifractal detrended fluctuation analysis (MF-DFA) method. Using the aggregated trading volumes of buying, selling, and normalized net investor trading (NIT) to quantify the characteristics of trader behavior in the KOSPI market, we find that the cumulative distribution functions of all NIT time series, except for individual traders, follow a power-law distribution with an exponent in the range of 2.92 ≤ γ ≤ 3.87. To observe the nonlinear features of investor activity, we also calculate the multifractal spectra for the buyer, seller, and NIT data sets and find that a multifractal structure exists in all of the data, regardless of the investor type studied.

Similar content being viewed by others

References

K. Yim, G. Oh and S. Kim, PLOS ONE 11, e0152608 (2016).

A. S. Kyle, Econometrica 53, 1315 (1985).

F. Black, Journal of Finance 41, 529 (1986).

J. B. DeLong, A. Shleifer, L. H. Summers and R. J.Waldmann, Journal of Political Economy 98, 703 (1990).

J. B. DeLong, A. Shleifer, L. H. Summers and R. J.Waldmann, The Journal of Finance 45, 379 (1990).

S. Benartzi and R. H. Thale, Quartely Journal of Economics 110, 73 (1995).

K. Daniel, D. Harshleifer and A. Subrahmanyam, The Journal of Finance 53, 1839 (1998).

N. Barberis, M. Huang and T. Santos, Quartely Journal of Economics 116, 1 (2001)).

N. Barberis and N, Huang, The Journal of Finance 56, 1247 (2001).

J. D. Coval and T. Shumway, The Journal of Finance 60, 1 (2005).

R. N. Mantegna and H. E. Stanley, Nature 376, 46 (1995).

R. N. Mantegna and H. E. Stanley, Nature 383, 587 (1996).

V. Plerou, P. Gopikrishnan and H. E. Stanley, Nature 421, 130 (2003).

X. Gabaix, P. Gopikrishnan, V. Plerou and H. E. Stanley Nature 423, 267 (2003).

Y. Liu, P. Gopikrishnan, Cizeau, Meyer, Peng and H. E. Stanley, Phys. Rev. E 60, 1390 (1999).

K. Yamasaki, L. Muchnik, S. Havlin, A. Bunde and H. E. Stanley, Proc. Natl. Acad. Sci. USA 102, 9424 (2005).

G. Oh, S. Kim and C. Eom, J. Korean Phys. Soc. 48, 197 (2006).

W. C. Jun, G. Oh and S. Kim, Phys. Rev. E 73, 066128 (2006).

P. Norouzzadeh and B. Rahmani, Physica A 367, 328 (2006).

H. Kim, G. Oh and S. Kim, physica A 30, 4286 (2011).

G. Oh, J. of the Korean Phys. Soc. 64, 1751 (2014).

C. K. Peng, S. V. Buldyrev, S. Havlin, M. Simons, H. E. Stanley and A. L. Goldberger, Phys. Rev. E 49 1685 (1994).

S. V. Buldyrev, A. L. Goldberger, S. Havlin, R. N. Mantegna, M. E. Matsa, C-K. Peng, M. Simons and H. E. Stanley, Phys. Rev. E 24, 5084 (1995).

C. K. Peng, S. V. Buldyrev, S. Havlin, M. Simons, H. E. Stanley and A. L. Goldberger, Phys. Rev. E 49 1685 (1994).

A. Bunde, S. Havlin, J. W. Kantelhardt, T. Penzel, J-H. Pete and K. Voigt, Phys. Rev. Lett. 85. 3736 (2000).

P. Talkner and R. O. Weber, Phys. Rev. E 62, 150 (2000).

P. Ch. Ivanov, L. A. N. Amaral, A. L. Goldberger, S. Havlin, M. G. Rosenblum, Z. R. Struzik and H. E. Stanley, Nature 399, 461 (1999).

Z. R. Struzik and A. P. J. M. Siebes, Physica A 309, 388 (2002).

Z. Q. Jiang and W. X. Zhou, Physica A 387, 1585 (2008).

D. Grech and Z Mazur, Physica A 336, 133 (2004).

J. W. Kantelhardt, S. A. Zschiegner, E. K. Bunde, S. Havlin, A. Bunde and H. E. Stanley, Physica A 316, 87 (2002).

Z. Q. Jiang and W. X. Zhou, Physica A 387, 1585 (2008).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Oh, G. Multifractals of investor behavior in stock market. Journal of the Korean Physical Society 71, 19–27 (2017). https://doi.org/10.3938/jkps.71.19

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.3938/jkps.71.19