Abstract

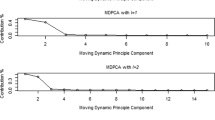

We propose a methodology for decomposing time series data into multiple components, including constrained components and remaining components containing cyclical variation. Our approach employs a moving linear model and utilizes state space representation, allowing for estimation of the components using the Kalman filter. The key parameter in our model is the width of the time interval, which can be estimated using the maximum likelihood method. Notably, our approach only requires a local linear model for the constrained component, while a strict model is not necessary for the remaining component. By applying our approach iteratively, we can decompose a time series into multiple components. Furthermore, we introduce a procedure to transform the decomposed components into uncorrelated components using principal component analysis. The proposed methodology demonstrates its applicability in analyzing business cycles. To illustrate its performance, we apply it to analyze two sets of monthly time series data from Japan.

Similar content being viewed by others

Notes

In this study, k plays a critical role as an essential parameter referred to as the width of the time interval. The process of parameter estimation involves transitioning the state incrementally, one step at a time, while applying filtering techniques. Specifically, k represents the number of observations associated with the constrained component in the local linear model for each shift. When k is larger, it imposes stronger constraints on the constrained component, minimizing its deviation from the local linear model across numerous time points. As consequence, the constrained component becomes smoother, while the remaining component exhibits increased variability.

In the aforementioned settings, \(t = 1,2,\ldots ,N\) represents the time points which are as the indices for the time series. \(n = 1, 2, \ldots , N - k + 1\) corresponds to the number of time intervals in the sequence of Eq. (2). With a fixed value of n, Eq. (3) represents a model that pertains to k observations within \(t = n, n+1, \ldots , n+k-1\). During the parameter estimation process using a state-space model, n is incremented by one from 1 to \(N - k + 1\), and the Kalman filter algorithm is recursively applied.

In the local linear model of Eq. (3), \(\alpha _n\) and \(\beta _n\) represent the intercept and slope, respectively. These parameters are dependent on the value of n. It is important to note the following: as n changes, the set of observations corresponding to these parameters also changes, leading to variations in their values. For instance, let’s consider \(\alpha _2\) and \(\beta _2\) as examples. When \(n = 1\), these parameters correspond to the set of observations for \(t = 1, 2, \ldots , k\). However, when \(n = 2\), they relate to the set of observations for \(t = 2, 3, \ldots , k+1\), resulting in different estimated values. Additionally, for \(n > 2\), there are no corresponding observations available.

It is worth noting that this study primarily focuses on the trend-cycle decomposition problem, where we apply the linear model to the constrained component. However, if different models are assigned to the constrained component, the proposed constrained-remaining components decomposition can be applied to various other scenarios as well. Therefore, the framework presented in this paper has the potential for extension to other cases.

The data collection process is as follows: First, go to “Statistics”. Then, navigate to “Indexes of Business Conditions” within the Economic and Social Research Institute. Furthermore, click on the “Coincident Index” under the “Data” section, and by opening the file named “0607ci2.xlsx” you can locate the series labeled as C1.

The data collection process is as follows: First, go to “Statistics”. Then, navigate to “Indexes of Business Conditions” within the Economic and Social Research Institute. Furthermore, click on the “Coincident Index” under the “Data” section, and by opening the file named “0607ci3.xlsx” you can locate the series labeled as Lg3.

References

Baxter, M., & King, R. (1999). Measuring business cycles: Approximate band-pass filter for economic time series. Review of Economics and Economic Statistics, 81, 575–593.

Beveridge, S., & Nelson, C. R. (1981). A new approach to decomposition of economic time series into permanent and transitory components with particular attention to measurement of the business cycle. Journal of Monetary Economics, 7, 151–174.

Canova, F., & Ferroni, F. (2010). Has the great moderation changed the business cycle? Evidence and explanations. Economic Policy, 25, 311–352.

Clark, P. K. (1987). The cyclical component of U.S. economic activity. The Quarterly Journal of Economics, 102, 797–814.

Cleveland, W. S. (1979). Robust locally weighted regression and smoothing scatterplots. Journal of the American Statistical Association, 74, 829–836.

Cleveland, W. S. (1981). LOWESS: A program for smoothing scatterplots by robust locally weighted regression. The American Statistician, 35, 54–54.

Cleveland, W. S., & Devlin, S. J. (1988). Locally weighted regression: An approach to regression analysis by local fitting. Journal of the American Statistical Association, 83, 596–610.

Hamilton, J. D. (2018). Why you should never use the Hodrick–Prescott filter. Review of Economics and Statistics, 100, 831–843.

Harvey, A. C. (1989). Forecasting, structural time series models and the Kalman filter. Cambridge: Cambridge University Press.

Hotrick, R. J., & Prescott, E. C. (1997). Postwar U.S. business sycles: An empirical investigation. Journal of Money, Credit and Banking, 29, 1–16.

Kestin, T. S., Karoly, D. J., Yang, J. I., & Rayner, N. A. (1998). Time–frequency variability of ENSO and stochastic simulations. Journal of Climate, 11, 2258–2272.

Kim, C. J. (2006). A variance-ratio test of a random walk in the presence of serially correlated errors. Journal of Econometrics, 132, 155–192.

Kitagawa, G. (2020). Introduction to time series modeling with application in R (2nd ed.). Boca Raton: Chapman and Hall.

Kitagawa, G., & Gersch, W. (1984). A smoothness priors-state space modeling of time series with trends and seasonality. Journal of the American Statistical Association, 79, 378–389.

Kyo, K., & Kitagawa, G. (2022). Hyper-trend method for seasonal adjustment and trend-cycle decomposition of time series containing long-period cycles. Asian Journal of Management Analysis Science and Applications, 6, 134–162.

Kyo, K., Noda, H., & Kitagawa, G. (2022). Co-movement of cyclical component approach to construct a coincident index of business cycles. Journal of Business Cycle Research, 18, 101–127.

Mankiw, G. (2010). Macroecomics (7th ed.). Belper: Worth Publishers.

Morley, J. C., Nelson, C. R., & Zivot, E. (2003). Why are the Beveridge–Nelson and unobserved-components decompositions of GDP so different? The Review of Economics and Statistics, 85, 235–243.

Watson, M. W. (1986). Univariate detrending methods with stochastic trends. Journal of Monetary Economics, 18, 49–75.

Wills, R. C., Schneider, T., Wallace, J. M., BattistiD, S., & Hartmann, D. L. (2018). Disentangling global warming, multidecadal variability, and El Nino in pacific temperatures. Geophysical Research Letters, 45, 2487–2496.

Zarnowitz, V., & Ozyildirim, A. (2006). Time series decomposition and measurement of business cycles, trends and growth cycles. Journal of Monetary Economics, 53, 1717–1739.

Acknowledgements

This work was supported by a Grant-in-Aid for Scientific Research (C) (19K01583) from the Japan Society for the Promotion of Science. We would like to thank the anonymous reviewers for their constructive comments and advice.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kyo, K., Kitagawa, G. A Moving Linear Model Approach for Extracting Cyclical Variation from Time Series Data. J Bus Cycle Res 19, 373–397 (2023). https://doi.org/10.1007/s41549-023-00089-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41549-023-00089-x

Keywords

- Cyclical variation

- Moving linear model approach

- Constrained-remaining components decomposition

- State-space model

- Economic time series