Abstract

Background

Comprehensive trends in Medicare reimbursement, increasingly relevant to current and future surgical oncology practice, have not been well studied.

Objective

The aim of this study was to analyze Medicare reimbursement for index surgical oncology procedures between 2007 and 2021.

Methods

Using the Physician Fee Schedule Look-Up Tool from the Centers for Medicare and Medicaid Services, reimbursement data from 2007 to 2021 were obtained for 23 index surgical oncology procedures. Total change in Medicare reimbursement, yearly rates of change, and compound annual growth rate were then calculated. All data were corrected for inflation using the consumer price index. Subset analysis was performed to assess the most recent 5-year trends.

Results

Overall reimbursement for the index surgical oncology procedures increased by an average of 21.6% from 2007 to 2021. After correcting for inflation, average reimbursement decreased to − 8.6%, with the greatest decline seen for thyroid surgery (− 16.9%). Breast surgery was the only category to experience an increase in adjusted reimbursement (9.0%). The average compound annual growth rate for all procedures was − 0.68% from 2007 to 2021. In the most recent 5-year subanalysis, the yearly decrease in inflation-adjusted Medicare reimbursement averaged − 2.47% per year, in comparison with the − 0.60% overall rate of yearly decline (p < 0.005).

Conclusion

Adjusted Medicare reimbursement for surgical oncology procedures decreased steadily from 2007 to 2021, with an accelerating trend over the last 5 years. As the Medicare population increases, surgical oncologists need to understand these trends so they may consider practice implications, advocate for proper reimbursement models, and preserve access to surgical oncology services.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Medicare is projected to insure over 77 million beneficiaries by the year 2029, driven by the aging of the ‘Baby Boomer’ generation.1 During this timeframe, spending is forecast to double and spending per beneficiary is forecast to increase by 60%.2 The median age of cancer diagnoses is 66 years, just after becoming eligible to receive Medicare benefits, and advancing age is one of the most significant risk factors for the development of many different cancers.3 Surveillance, Epidemiology, and End Results (SEER) 9 data show the age-adjusted incidence of new cancer diagnoses have been falling faster than overall mortality from 2009 to 2018. Over the same timeframe, 5-year cancer survival rates have slowly increased.4 The current demographic and epidemiologic trends clearly indicate that surgical oncologists will serve an increasing number of Medicare-insured patients as the number of Americans living with cancer continues to rise.

Given these projections, it is no surprise that Medicare reimbursement has been a target for government spending reform legislation. Medicare payments have been the subject of several recent congressional bills such as the Medicare Access and CHIP Reauthorization Act (MACRA) in 2015, which repealed the sustainable growth rate (SGR), and more recently the Consolidated Appropriations Act in 2021, which helped reduce dramatic decreases in reimbursement during the coronavirus disease 2019 (COVID-19) pandemic.5,6,7 There remains great uncertainty regarding future regulation of Medicare reimbursements.8,9

Several medical and surgical specialties have shown significant decreases in Medicare reimbursement;10,11,12,13 however, there is a paucity of literature addressing trends in Medicare reimbursement for surgical oncology procedures. Understanding how reimbursement has changed over recent years is important for surgical oncologists so that they may understand implications for current and future practice. In this study, we examine trends in Medicare reimbursement for surgical oncology procedures over the last two decades. Our hypothesis is that reimbursement for index surgical oncology procedures has decreased during this time.

Methods

The Centers for Medicare and Medicaid Services (CMS) Physician Fee Schedule Look-Up Tool was queried using all Medicare Administrative Contractor options and modifiers for 25 surgical oncology procedures according to their respective Current Procedural Terminology (CPT) codes (Table 1). Codes representing index operations for breast, foregut, hepatobiliary, and thyroid surgery were selected. Physicians bill Medicare using CPT codes for procedural reimbursement.14 Each CPT code corresponds with a specific procedure and is designated a Relative Value Unit (RVU). These RVUs are allocated based on the amount of work, practice expense, and malpractice costs associated with each CPT code. Individual RVU amounts are then multiplied by a geographic practice cost index (GPCI) in order to adjust each RVU value to reflect local market conditions. The summation of these geographically adjusted RVUs is then multiplied by the yearly Medicare conversion factor to arrive at the payment amount in dollars, not accounting for additional add-on or modifying codes.15 The Fee Schedule Look-Up Tool lists reimbursement schedules for every iteration of adjusted RVU amounts to reflect each geographic region across the United States (US).

For the years 2007–2021, the national average Medicare reimbursement for each procedure was obtained by normalizing all GPCI values to 1.0 to reflect a neutral RVU allocation unaffected by regional adjustments. Using the raw payment data, overall change was calculated and averaged for each procedure between 2007 and 2021. Two esophagectomy codes (43286, 43288) were excluded from final analysis since fee schedule data for these operations were incomplete. The raw change in reimbursement for the final 23 codes was then compared against the change in the consumer price index (CPI) over the same interval using a two-tailed t-test comparison of means. The most current CPI data (May 2021) were utilized from the US Department of Labor, Bureau of Labor Statistics. These CPI data were used to adjust all raw reimbursement rates to reflect compensation in 2021 dollars.16 The 2021 adjusted data were then used to calculate total change in adjusted reimbursement, yearly percentage change, and compound annual growth rate (CAGR). The CAGR is used in finance to demonstrate annual growth needed to reach final value from original value, taking financial compounding into account. This helps to accurately evaluate financial trends when year-to-year growth may be erratic.17 The CAGR was calculated in 2021 dollars using the following formula:

A subanalysis was then performed to evaluate the average rate of change over the past 5 years versus the 15-year average rate of change. This allowed for comparison of current short-term trends in reimbursement to the long-term trends found in the initial analysis. The 5-year rates of change were compared with the 15-year rates of change using a two-tailed t-test comparison of means. All data were retrospectively gathered from a publicly available database that contains no identifying patient information. Therefore, this study was exempt from Institutional Review Board approval.

Results

Unadjusted Medicare Reimbursement

From 2007 to 2021, overall reimbursement for the included 23 surgical oncology procedures increased by an average of 21.6% (p < 0.005) [Table 2]. The greatest increase in reimbursement was seen in breast procedures (45.0%), followed by hepatopancreatobiliary (HPB; 20.8%) and foregut procedures (15.8%). Thyroid procedures saw the smallest raw increase in reimbursement (10.6%). During the same time period, from 2007 to 2021, the CPI increased by 33%. This change in CPI was significantly greater than the average increase in reimbursement of 21.6% (p < 0.005).

Inflation-Adjusted Medicare Reimbursement

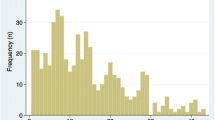

The average reimbursement rate for the index surgical oncology procedures decreased by − 8.6% from 2007 to 2021 following correction for inflation. The greatest decline was for thyroid surgery (− 16.9%), followed by HPB surgery (− 13%) and foregut surgery (− 9.1%). Breast surgery experienced an increase in inflation-adjusted reimbursement overall (+9.0%), driven largely by an increase of 39.3% in reimbursement for partial mastectomy. A visual representation of the average reimbursement trend in each group of procedures is provided in Fig. 1.

Compound Annual Growth Rate

The adjusted CAGR was 0.5% for breast procedures, −0.99% for HPB procedures, − 0.7% for foregut procedures, and − 1.31% for thyroid procedures (Table 3). The overall CAGR was − 0.68%, suggesting a downward trend even when accounting for yearly variation.

5-Year Recent Subanalysis

In the most recent 5-year subanalysis, the average yearly decrease in inflation-adjusted Medicare reimbursement was 2.47% per year, in comparison with the − 0.60% overall rate of yearly decline (p < 0.005). In this timeframe, all codes except one experienced an average decrease of over 2% per year. Similarly, each group of procedures, including breast, saw an average yearly decrease of over 2% per year. If recent trends continue, then at the end of the next decade reimbursement will decrease an average of 24.7% for all procedures.

Discussion

As the US population ages and the number of federally insured patients continues to rise, Medicare reimbursement is slated to become increasingly relevant to surgical oncologists. Prior to this study, there was a lack of information regarding Medicare reimbursement trends in surgical oncology procedures. This analysis of Medicare reimbursement trends for surgical oncology procedures shows consistent decline across time and multiple procedure groups. This trend of decreasing reimbursement contrasts current projections that healthcare spending in the US will increase at an average rate of 5.4% per year from 2019 to 2028.18 As healthcare spending rises, fee schedule payments for all procedure groups have been declining more than 100% faster during the past 5 years compared with the 15-year rates. Reimbursement decline has been most dramatic for thyroid procedures, but HPB and foregut procedures have similarly experienced significant reductions.

Understanding recent Medicare legislation adds context to the trends seen in this study. The SGR was implemented in 1998 to reign-in Medicare spending by tying increases in spending per beneficiary to increases in the national gross domestic product (GDP).19 The SGR governed yearly adjustments to Medicare spending until it was eliminated in 2015, with the passage of the MACRA. The MACRA also consolidated multiple quality programs into the Merit-Based Incentive Payment System and incentivized participation in alternative payment models.5 Prior to the passage of the MACRA, congressional action was often required to stop or patch potential massive decreases in Medicare reimbursement. This often left very little political capital for introducing positive reimbursement changes.20 In 2020, Congress passed the annual Medicare payment rule for 2021, which combined policies for Medicare fee-for-service reimbursement with quality performance programs established by the MACRA. This would have meant a 10.2% decrease meant to offset RVU increases for primary care billing, as the yearly conversion factor was scheduled to be cut from $36.09 to $32.41.21 After backlash surrounding large pay cuts during the COVID-19 pandemic, Congress passed the Consolidated Appropriations Act 2021 including temporary provisions that ‘increased’ the conversion factor by 3.75%, and reinstated a 1.0 floor on the work GPCI through 2021. It also further delayed a 2% sequestration to all Medicare spending for 2021. These 2% cuts to Medicare payments are now scheduled to take effect after 2021, and the temporary 3.75% payment increases as a result of the Consolidated Appropriations Act of 2021 are set to expire. This is reflected in the 2022 proposed fee schedule recently introduced by the CMS, which decreases the Medicare general conversion factor to $33.58 for surgical and procedural codes, a scheduled decrease of $1.31, (−3.75%) from the 2021 rate of $34.89.22 This may serve as a signal to physicians that further cuts are on the horizon. The American College of Surgeons recently responded to this proposed fee schedule ruling with the following public statement of general disapproval in July 2021:

“Surgical care continues to be under threat in the proposed Medicare Physician Fee Schedule for calendar year 2022 (CY2022) released yesterday by the Centers for Medicare and Medicaid Services (CMS). The American College of Surgeons (ACS) strongly opposes the cuts to surgical care contained within the proposed CMS fee schedule and urges Congress to address systemic challenges to stop the annual reductions in patient care. Our patients deserve a health care system that invests in surgical care. CMS is taking notable strides to improve health equity; however, this proposal would achieve the opposite by threatening patient access to critical treatments and procedures. The ACS stands ready to work with Congress toward a sustainable, long-term solution in the interest of all patients.”23

It remains to be seen if efforts to stabilize reimbursement will be successful moving forward, but these recent decreases in the Medicare conversion factor echo the short-term trends in our study. The rates of decreasing reimbursement for these procedures are accelerating, which could have implications for surgical oncologists and their hospitals. Previous studies have shown similar trends in declining physician reimbursement in surgical and oncologic fields.10,11,12,13 This trend of decreasing reimbursement contrasts starkly with current projections that healthcare spending in the US will increase at an average rate of 5.4% per year from 2019 to 2028.18 Our data strongly suggest that reimbursement levels are not contributing to increased healthcare spending. In fact, opposite trends are seen—an upward trend in healthcare spending correlates with the downward trend in reimbursement levels during the time period of our study. Furthermore, this study illustrates that recent reimbursement policy has been insufficient in addressing the accelerating reimbursement decline seen in surgical oncology, despite increases in federal healthcare spending. Although hospital-employed physicians compensated on RVU productivity may be shielded to some extent from these cuts, salary-based compensation models and independent practitioners are likely to bear the full brunt. In particular, the viability of the private practice model will be increasingly threatened and the current shift towards hospital employment will be accelerated. Implications for patients include limited access to surgical oncology care as practices may cherry-pick privately insured patients, and by default, poorly reimbursed surgeries will get shifted to larger systems that can absorb the cost differential.

Although across the board decreases in reimbursement were seen in our study, the one category that experienced an increase was breast surgery. The relative increase in breast procedural reimbursement can be largely attributed to a single-year adjustment in code 19301 (Partial Mastectomy). This adjustment increased the work RVUs for 19301 from 6.03 to 10.0. This meant that code 19301 now reflected an amount of work that between codes 19125 and 19303. This single-year RVU adjustment resulted in a significant proportional increase in payment that is reflected when analyzing overall trends for all breast procedures, as well as when examining the individual code reimbursement trends. However, when examining the same trends over the past 5 years, this effect disappears. The data for breast procedure reimbursement over the past 5 years mirrors the accelerating decline in reimbursement seen with the other procedure groups.

This investigation has potential limitations. The study looks at Medicare reimbursement only and therefore may not be representative of the entire surgical oncology patient cohort. However, CMS policy often dictates private health insurance policies and is therefore applicable to current total market trends. The procedures analyzed may not be wholly representative of all surgeries performed in surgical oncology, but the large number of major operations examined gives a good proxy for general practice patterns in the field, allowing investigators to draw important conclusions about the overall compensation trends. Total compensation to hospitals for complex multidisciplinary cancer care has many components in addition to physician reimbursement, such as hospital or facility fees. For the purposes of this study, we did not account for charges related to facility fees or other downstream specialties due to the differing treatment pathways involved and the difficulty in accounting for the accuracy and variation in payment patterns. Finally, this study looked at average reimbursement for each procedure and did not examine microtrends. It is possible that these trends may vary across regions, but by looking at the geographically averaged data for each procedure, we were better able to draw conclusions about national trends in reimbursement.

Conclusion

Adjusted Medicare reimbursement for surgical oncology procedures decreased steadily from 2007 to 2021, accelerating over the past 5 years. As the Medicare population increases, surgical oncologists should understand these trends so they may consider practice implications, advocate proper reimbursement models, and preserve access to surgical oncology services.

References

Medicare—CBO’s Baseline as of March 6, 2020. https://www.cbo.gov/system/files/2020-03/51302-2020-03-medicare.pdf

2020 Annual Report of the Boards of Trustees of The Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds 2020. https://www.cms.gov/files/document/2020-medicare-trustees-report.pdf. Accessed 20 Jun 2021.

Risk Factors: Age - National Cancer Institute. Published 29 Apr 2015. https://www.cancer.gov/about-cancer/causes-prevention/risk/age. Accessed 20 Jun 2021.

Cancer of Any Site – Cancer Stat Facts. SEER. https://seer.cancer.gov/statfacts/html/all.html. Accessed 20 Jun 2021.

Wilensky GR. Will MACRA improve physician reimbursement? N Engl J Med. 2018;378(14):1269–71. https://doi.org/10.1056/NEJMp1801673.

AMA Summary of Select Provisions in the Consolidated Appropriations Act, 2021 (H.R. 133). https://www.ama-assn.org/system/files/2021-01/ama-summary-of-select-provisions-of-the-consolidated-appropriations-act.pdf.

Aaron HJ. The SGR for physician payment –an indispensable abomination. N Engl J Med. 2010;363(5):403–5.

Mulcahy AW, Merrell K, Mehrotra A. Payment for services rendered: updating medicare’s valuation of procedures. N Engl J Med. 2020;382(4):303–6. https://doi.org/10.1056/NEJMp1908706.

Chernew ME. The role of market forces in US health care. N Engl J Med. 2020;383(15):1401–4. https://doi.org/10.1056/NEJMp2006097.

Eltorai AEM, Durand WM, Haglin JM, Rubin LE, Weiss APC, Daniels AH. Trends in medicare reimbursement for orthopedic procedures: 2000 to 2016. Orthopedics. 2018;41(2):95–102. https://doi.org/10.3928/01477447-20180226-04.

Haglin JM, Richter KR, Patel NP. Trends in Medicare reimbursement for neurosurgical procedures: 2000 to 2018. J Neurosurg. 2019;132(2):649–55. https://doi.org/10.3171/2018.8.JNS181949.

Siotos C, Cheah MA, Damoulakis G, et al. Trends of medicare reimbursement rates for common plastic surgery procedures. Plast Reconstr Surg. 2021;147(5):1220–5. https://doi.org/10.1097/PRS.0000000000007878.

Vu CC, Lanni TB, Nandalur SR. Trends in medicare reimbursement and work relative value unit production in radiation oncology. J Am Coll Radiol. 2018;15(6):870–5. https://doi.org/10.1016/j.jacr.2018.02.005.

Physician Fee Schedule Look-Up Tool | CMS. https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PFSlookup. Accessed 20 Jun 2021.

How_to_MPFS_Booklet_ICN901344.pdf. https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/Downloads/How_to_MPFS_Booklet_ICN901344.pdf. Accessed 20 Jun 2021.

CPI Inflation Calculator. https://www.bls.gov/data/inflation_calculator.htm. Accessed 20 Jun 2021.

Fernando J. Understanding the Compound Annual Growth Rate — CAGR. Investopedia. https://www.investopedia.com/terms/c/cagr.asp. Accessed 20 Jun 2021.

National health expenditure projections 2019-2028. Forecast summary. https://www.cms.gov/files/document/nhe-projections-2019-2028-forecast-summary.pdf. Accessed 20 Jun 2021.

Aaron HJ. The SGR for physician payment: an indispensable abomination. N Engl J Med. 2010;363(5):403–5. https://doi.org/10.1056/NEJMp1007200.

Medicare physician payment on the decline: it’s not your imagination. The Bulletin. Published 1 Sep 2019. https://bulletin.facs.org/2019/09/medicare-physician-payment-on-the-decline-its-not-your-imagination/. Accessed 22 Aug 2021.

Final Policy, Payment, and Quality Provisions Changes to the Medicare Physician Fee Schedule for Calendar Year 2021 | CMS. https://www.cms.gov/newsroom/fact-sheets/final-policy-payment-and-quality-provisions-changes-medicare-physician-fee-schedule-calendar-year-1. Accessed 20 Jun 2021.

Physician Fee Schedule | CMS. https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched. Accessed 20 Jun 2021.

American College of Surgeons. American College of Surgeons strongly opposes proposed cuts to surgical patient care. http://www.facs.org/media/press-releases/2021/cms-rule-071421. Accessed 8 Feb 2022.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Disclosures

Thomas C. Hydrick, Jack Haglin, and Nabil Wasif declare no conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hydrick, T.C., Haglin, J. & Wasif, N. Trends in Reimbursement for Index Surgical Oncology Procedures in Contemporary Practice: Declining Reimbursement for Surgical Oncology Procedures—How Low Do We Go?. Ann Surg Oncol 29, 8099–8106 (2022). https://doi.org/10.1245/s10434-022-12561-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1245/s10434-022-12561-6