Abstract

Gross Domestic Product is regarded as the major indicator which determines the standards of living in a country. Consequently, energy use is far regarded as one of the major determinants of economic growth in an economy. However, fossil fuel energy greatly contributes to environmental degradation, global warming and the spread of various diseases. The present-day research is aimed at examining the effect of energy efficiency, renewable energy and effective capital on Gross Domestic Product in the emerging seven countries (Brazil, Russia, Mexico, Turkiye, Indonesia, China and India), during the period 1990 to 2019. The main novelty of the research is that it examines the effect of effective capital on Gross Domestic Product, a study which has not been done. Effective capital which is the combined effect of energy and physical capital in the production process is inevitable in raising economic growth. Additionally, the effect of energy efficiency on economic growth in the emerging seven countries has been partially investigated. The findings of this research are robust and unique to those of past researches, because Cross-sectional Augmented Autoregressive Distributive Lag technique which is strong in the presence of cross-sectional dependence, heterogeneity and dynamics is employed. The outcomes provided in this research shows that, energy efficiency and effective capital significantly promotes economic growth, while non-renewable energy provides significant positive effect in the short-run, with no significant effect in the long-run. This study recommends the efficient utilization of energy, ensuring that each single unit of energy employed produces the highest possible output.

Similar content being viewed by others

Introduction

Economic growth remains one of the most crucial economic indicators for measuring the success of a nation, as well as its ability to ensure citizens enjoy the best quality of life. Due to this reason each and every nation strives toward raising the growth of their economies, and the emerging nations are not an exceptional. In the past years emerging nations have strived toward raising economic growth of their nations, hence enabling them to move from being developing to emerging countries. Thus, it is vital to investigate on the various factors that raises economic growth of a nation for correct policy making. Energy has been identified as a main and substantial driving force of Gross Domestic Product (GDP) growth [47]. The traditional theories of production indicate the importance of capital, together with labor, knowledge and technology, in raising the output level in an economy [32, 51, 52], while recent studies have emphasized on the importance of energy in raising the level of output production in a nation, Zweifel, et al. [57]. Capital, physical capital, such as machinery to be specific, and energy are complements. Machinery requires energy as a source of fuel to function. However, despite that energy and machinery are complements, studies that have examined the effect of energy and capital on economic growth have not specified these factors as such in the model [57]. Therefore, it is crucial to consider that these factors are complements and specify them as a single factor, showing the combined effect of the two in raising output. The present research attempts to examine the combined effect of energy and capital, that is, effective capital, on the economic growth of the emerging seven nations.

The present-day research is aimed at examining the effect of energy efficiency, renewable energy (RE) and effective capital on GDP in the emerging seven countries (E7), during the period 1990 to 2019. The efficient utilization of energy (energy efficiency), producing the maximum possible level of output from each single unit of energy used, is very crucial for the purpose of generating the highest output level per each unit of energy used. Moreover, effective capital, the interaction between capital and energy, is crucial in the production process. The research on how energy efficiency impacts GDP has been partially done in the emerging seven countries. Moreover, the research on how effective capital affect GDP, has not been done, hence the major novelty of the research. The present research uses the Cross-sectional Augmented Autoregressive Distributive Lag (CS-ARDL) technique which is strong in the presence of cross-sectional dependence (CD), dynamics and heterogeneity [31], thus robust and crucial results for policy making are produced. The cointegration regressions of Fully Modified Ordinary Least Square (FMOLS) and Dynamic Ordinary Least Square (DOLS) are used to verify the long-run outcomes of the CS-ARDL technique. The following research questions are sort to be answered: what is the role of energy efficiency and effective capital in enhancing economic growth among the seven emerging countries? What is the link between the major types of energy, that is, non-renewable energy (NRE) and RE on economic growth among the seven emerging nations? What is the role of labor force in encouraging GDP growth among the seven emerging nations?

Literature review

Energy, economic growth and the environment

The connection between energy and GDP growth is essential because energy, like other elements of the production function (labor, capital, technology and human capital [32, 51, 52], is a crucial element in raising the output level of a nation. Researchers have advocated for a strong association between the utilization of energy and GDP increase [5, 10, 29, 42, 45, 47], among many others. As an instance [5] in China, discovered a bilateral causal link among gross regional product increase and energy investment. Furthermore, a significant link, in the long-run, between GDP growth and energy intake among top 10 nations of CE is discovered [10]. Consistent with Bulut and Apergis [29] in a research carried out within the US, GDP is found to be positively associated with intake of solar power. Adebayo [1], in a research carried out in Japan, articulates that power use triggers GDP boom, while a further causality from power use to GDP increase is found. The findings of Ben [23] in Tunisia, concurs with the above postulations, since it presents for the presence of a substantial unidirectional causal association from electricity use to GDP growth, within the short-run. In the BRIs countries, the consumption of electricity invigorates GDP increase, Ashraf et al. [10]. In a research of the European-28, Balsalobre-Lorente and Leitao [18] additionally alludes that GDP boom is improved with the aid of power use. Accordingly, GDP increase is supported with the aid of energy intake, Aslan et al. [13].

Similar outcomes on the effect of energy efficiency on GDP growth are also discovered within the emerging economies. As an example, Bayar and Gavriletea [20] discovered that in the end, GDP growth is positively impacted by energy efficiency. One-way causality is discovered from energy efficiency to GDP boom, Bayar and Gavriletea [20]. Within the BRICS nations, power efficient fosters GDP boom, Akram et al. [8]. The results of Akram et al. [8] indicates that the impact of energy efficiency throughout all quantiles is positive and substantial. Within the fifty-one African nations, Adom et al. [3] additionally presents that energy efficiency development induces GDP growth. Energy efficiency overall impact on GDP boom is low in nations which have excessive income equality, in comparison with low-income equality nations, Adom et al. [3]. Different researchers additionally present a no significant link among energy intake and GDP growth. Consistent with Ahmad et al. [6] in a research in Myanmar, general electricity use is found not to offer a great effect on GDP increase. Consequently, the postulations of Asif et al. [16], depicts that the variations on the connection of GDP increase and the explanatory variables is because of earnings, in addition to regional classifications, is supported.

On the link between energy intake and carbon emission (CE), the research of Bekhet et al. [22], Li et al. [42], Deka et al. [34], Wang et al. [54], Banga et al. [19] observed that the growth of GDP among nations encourages CE. Specifically, Li et al. [42], Wang et al. [54] depicts that economic growth presents a significant positive effect on CE. China is among the biggest emitters of CE, because of its wide use of fossil gasoline to attain GDP growth, Ahmad et al. [5]. In line with Ahmad et al. [5] in the research of China, investment in power induces the impact of emission merchandising. Power intake enhance CE, which additionally degrades the surroundings [46]. Ali et al. [9] postulates that, environmental degradation is enhanced by energy innovation. Ahmad et al. [5] additionally alludes that, power investment and pollutant emissions have substantial bilateral causality, while pollutant emissions and power investment have a negative bidirectional causal connection. Asiedu et al. [15] in a research of 26 EU nations gives that, power and CE have a unidirectional causality. Apeaning [11] in a research of 134 nations, depicts that power system in developing nations is discovered to be carbonizing at a quicker rate, in contrast to developed nations. A revolutionary transition in the direction of vulnerable decoupling is found in emerging economies. In contrast to developed nations, developing countries have very low signs of de-carbonization and decoupling, Apeaning [11]. Wang et al. [53], Wang et al. [23] depict that RE is vital for reducing the emissions of carbon to the environment. As a result, it is vital for countries to adopt power sources that does not offer dangerous consequences to the surroundings.

To this end, we observed that energy use is essential in fostering the growth of economies by raising GDP, though it is associated with the degradation of the environment. We also observed that due to the significant positive effects of energy in raising output level of a nation, therefore, it is a significant factor of production, just like other factors provided in the traditional theories of production. We also observe that energy and capital (physical capital) are separately specified in the models presented in the past studies, yet these factors are complements. Energy on its own in the absence machinery cannot help in the production of goods and services. Machinery too, requires the energy for them to be effective in the production of goods and services. Therefore, specifying energy and capital separately in a model is somewhat not applicable in the real world considering that these factors are complements. Therefore, it is essential to come up with a model that considers the complementarity between energy and capital. The present research attempts to cover the research gap existing in the literature by combining energy and capital in a model which examines their effect on economic growth. Such a model is more applicable to real life considering that energy and capital are complements. The combined effects of capital and energy in the present research is termed “effective capital” and is a product of the two variables.

The RE and NRE on economic growth

The postulations in the above sections indicate the presence of a trade-off among GDP boom and environmental improvement. Raising GDP through the use of power results in environmental degradation, as this in flip results in global warming. As a result, a dilemma is arrived at wherein governments need to select a single aim and forgo the other; either raising GDP at the expense of the surroundings or guard the surroundings at the cost of low GDP increase. It's far possible to obtain both goals via the usage of clean power. Many researchers offer for the presence of a superb link between RE and GDP growth [15, 17, 30, 38, 56], alludes that RE and GDP boom have bidirectional causality. A long-term association among GDP growth, renewable electricity engineering and RE is discovered, Asiedu et al. [15]. A bidirectional causal impact among GDP increases and RE intake is found, Akram et al. [8]. Further to that, Ben Youssef [24] in the United States of America, discovered the presence of a longer-term unidirectional causality from intake of RE to GDP growth. Thus, in line with Ahmad et al. [6], RE use notably promotes GDP growth. Furthermore, Afroz and Muhibbullah [4] in Malaysia alludes that within the short-run and longer term the uneven impact of RE on GDP growth is shown. Superb shocks, in the short and longer term of RE are much less than that of NRE. Bouyghrissi et al. [27] alludes that RE positively impacts GDP growth. A substantial causality from intake of RE to GDP increase is discovered, Bouyghrissi et al. [27]. Another research done in the European-28 depicts that GDP growth is fostered by means of renewable electricity, Balsalobre-Lorente and Leitao (2020). Furthermore, Bayar and Gavriletea [20] in emerging economies discovered a one-way causality from RE to GDP growth.

Asif et al. [16] in a research carried out in ninety-nine nations, RE is determined to affect GDP growth undoubtedly. RE is taken into consideration as the great source of energy that promotes GDP growth without inflicting damage to the surroundings, Asif et al. [16]. Arain et al. [12] in a research in China additionally alludes that GDP growth is improved by means of the intake of RE. The findings affirm the presence of RE led boom proposition, Ali et al. [9]. Moreover, Ahmed et al. [7] within the South Asian international locations additionally confirms that green GDP increase is positively impacted by means of the manufacturing of green innovation safe power and green trade. However, different research offers for an insignificant link between GDP growth and RE, de Oliveira and Moutinho [37]. Bayar and Gavriletea [20] found that in the emerging economies, GDP growth is not substantially impacted by RE in the long-run, at the same time Bhat [25] within the BRICS observes that the effect of RE on GDP growth is insignificant. Different researchers additionally allude for a significant negative link among GDP growth and RE, see Akram et al. [8] who alludes that RE intake is determined to decrease GDP drastically within the BRICS. Bilgili et al. [26] within the US alludes that, because of a rise of GDP, the increase in RE rises at a diminishing rate. GDP growth in Malaysia relies less on RE intake in comparison with NRE, and a decrease in RE intake improves GDP increase, Afroz and Muhibbullah [4].

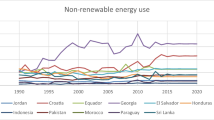

The intake of NRE source of power within the globe has been discovered to raise GDP growth, no matter its terrible results to the environment [2, 37, 41]. Boukhelkhal [28] within the 35 African international locations, discovered a two-way directional association between GDP growth and the intake of NRE. Alternatively, Afroz and Muhibbullah [4] discovered that, in the case of Malaysia, the uneven impact of NRE intake on GDP is shown, in both short- and long-run. According to Afroz and Muhibbullah [4], shocks from NRE that are positive are greater than the positive shocks of RE in both short- and long-run. GDP growth in Malaysia depends more on NRE than RE intake. Ben Youssef [24], provides that fossil gasoline energy cause a significant influence on GDP increase in the long-run. Inside the G7 international locations, the intake of NRE causes GDP increase in short-run, Behera and Mishra [21]. NRE is also found to positively impact GDP growth among the BRICS nations, Bhat [25]. Asif et al. [16] among the selected world nations determined that NRE offer a huge positive impact on GDP increase. However, different research verifies the negative impact on GDP growth. Ahmad et al. [6] in a research carried out in Myanmar, discovered that NRE offers a negative effect on GDP increase.

Methodology and data

Model

The traditional production function gives labor and capital, together with technological advancement as the major drivers of output production [32, 51, 52],for review see, [44]. One of the most famous models of production is the Cobb Douglas production function [32], which gives that labor, capital and technology are the major factors that determines output production. On top of including capital and labor in modeling GDP, Zweifel et al. [57] also included energy use and materials. To this day, energy has been regarded as the major factor that improves economic growth of a nation. Various studies have been undertaken to ascertain this proposition and it has been observed as a valid assertion, Bulut and Apergis [29], Namahoro, et al. [47], Alper et al. [10], Ahmad et al. [5]. Balsalobre-Lorente and Leitao (2020), on top of the above-mentioned determinants of GDP, added CE, trade and tourism, while Adebayo [1] also added globalization, trade openness, urban population and CE in modeling GDP. The current research considers energy efficiency, NREC, REC and labor in modeling GD, and adds effective capital which is the complementary effect of energy and capital. This is shown in the mathematical model given in Eq. 1.

where GDP is short for Gross Domestic Product, LF is labor force, REC is the intake of renewable energy, NREC is the intake of non-renewable power, EU is the energy use, while CAP is the physical capital used in the production process. It also follows that, GDP ÷ EU represents the energy efficiency indicator, while EU × CAP is the effective capital indicator. Consequently, the statistical representation of this model is illustrated in Eq. 2.

In Eq. 2, EE is energy efficiency, EC is effective capital, ln represents the log value of a variable, \(\beta_{0}\) is the constant value, while \(\beta_{0}\) to \(\beta_{0}\) are the coefficient of the independent variables, and et is the white noise error term.

Data

The data employed is panel data of the E7, Turkiye, Russia, Mexico, Indonesia, India, China and Brazil, for the time frame which ranges from 1990 through to 2019. The data are obtained from World Bank, https://data.worldbank.org and includes the indicators, GDP, labor force, REC, energy efficiency, effective capital and NREC. GDP is the total market value of goods and services that are produced in an economy in a specific given time period, Mankiw [44]. The GDP value used in this research is measured as a total value per year in US dollars. Labor force refers to the number of people that are able and willing to work, it involves the total of the employed and unemployed [44]. REC is the use of energy sources that are clean, which can be used over and over again [33, 35]. NREC is the use of sources of energy that diminishes with use and generally pollutes the surroundings [36]. Energy efficiency refers to the amount of output produced from each unit of energy used [40]. It is obtained by dividing GDP with energy use. Effective capital is the complementary effect of capital and energy in the production process. Effective capital is paramount, since capital goods, such as machinery used in the production industry are complementary goods. They are used together to produce goods and services. The value of effective capital in this research is a product of energy use and capital. Table 1 of this research gives a summary of the mean, median, standard deviation and maximum of all variables used.

Method

The methodology of this research, starts by running the preliminary testing of cross-sectional dependence (CD), slope heterogeneity, unit root test and cointegration test, to identify the best model to employ for data analysis. The Pesaran [48] CD test is employed to investigate the presence of CD in each panel variable. If there exist CD, then unit root test techniques and models that overcomes CD can be used. To test the integration order of the indicators, the second-generation (SG) techniques, Levin-Lin-Chu and Im-Pesaran-Shin, which overcomes CD problems are used. Checking the order of integration is very crucial since other models require all variables to be stationary, for the purpose of avoiding the occurrence of spurious regressions. Other models, such as the ARDL technique accept factors that have mixed order of integration, that is, zero or one, Pesaran et al. [49], while cointegration regressions requires all indicators to have one order of integration [39]. The third preliminary test employed is the Kao SG test of cointegration. Therefore, the findings of the Kao test of cointegration in this research helps in understanding if the indicators are cointegrated and hence select the best model.

Due to the presence of CD problems in the model, as well as the existence of cointegration, this research employs the CS-ARDL model, which overcomes CD problems and gives the short- and long-run coefficients. The CS-ARDL model is attributed to the work of Chudik and Pesaran [31] and is a modification of the traditional ARDL model, which is structured to overcome CD, dynamics and heterogeneity problems. It is observed that many panel datasets exhibit for CD and a model that corrects this problem, such as the CS-ARDL technique is required. Moreover, the CS-ARDL technique overcomes heterogeneity problems and dynamics, hence gives the best outcomes. To verify the findings of the CS-ARDL technique the cointegration regression techniques are employed. Cointegration regression models are paramount in giving long-run outcomes that are essential for making policies. The FMOLS and DOLS techniques are cointegration regression models which requires indicators to be integrated of order one and to be cointegrated.

Results of the study

The findings in Table 2 are the outcomes of the CD test and the slope heterogeneity test results of the model. The outcomes in Table 2, shows that, all the panel indicators in this research have CD problems. This depicts that all the variables have CD problems, hence the SG unit root tests are employed, since they overcome CD problems. Moreover, the slope heterogeneity test results in Table 2 depicts that, the model expressed in this research suffers from heterogeneity problems. Therefore, this study employs the CS-ARDL technique which is strong in the presence of CD, heterogeneity and dynamics.

Due to the presence of CD among factors, as shown in Table 2, this study employs the Levin-Lin-Chu and Im-Pesaran-Shin test examining unit root in variables. The findings of the Levin-Lin-Chu and Im-Pesaran-Shin tests are provided in Table 3 and they show that, the log of GDP, log of REC, NREC, log of energy efficiency and the log of effective capital are not stationary at level, however at first difference they are stationary. These findings depict that the variables under study are integrated of order one. The variable log of labor force, according to the Levin-Lin-Chu test of unit root is stationary at level. However, the findings provided for by Im-Pesaran-Shin test of unit root shows that log of labor force is not stationary at first-difference. Therefore, log of labor force is also integrated of order one. Thus, we conclude that all the variables employed in the model of this research are integrated of order one.

The findings of the test of cointegration in this research are presented in Table 4. The Kao test results of cointegration show that the factors expressed have significant cointegration. Therefore, we conclude that the factors employed, have a significant long-run association and as a result these variables can be expressed in a short- and long-run CS-ARDL technique, while the cointegration regression techniques are used to verify the findings of the CS-ARDL.

The findings of the CS-ARDL technique in Table 5 depicts that labor force and REC exhibit for no significant effect on GDP of the E7 countries, both in the short- and long-run. These outcomes imply that, any change from labor force and REC, will not have any influence on GDP. In essence labor and REC are regarded as the main factors influencing economic growth, but in this case, it is not so. NREC is observed to exhibit for a significant positive link with GDP in the short-run, while the long-run outcomes of the CS-ARDL technique shows that NREC do not significantly impact GDP. A rise in NREC by 1% in the short-run, will tend to increase GDP by 0.012%, see Table 5. On the other hand, Effective capital and energy efficiency are observed to exhibit for a significant positive effect on GDP of the E7 countries, both in the short-run and long-run. A 1% increase in energy efficiency has the effect of raising GDP by 0.856% in the short-run and by 0.852% in the long-run. A 1% increase in effective capital in the E7 countries is found to significantly raise GDP by 0.176% in the short-run and by 0.176% in the long-run, see Table 5. These findings give that energy efficiency and effective capital are the major factors which promote economic growth in the E7 countries.

The findings of the FMOLS and DOLS techniques provided for in Table 6, depicts that NREC, energy efficiency and effective capital have a significant positive impact on GDP in the E7 economies. The coefficient values of NRE, effective capital and energy efficiency for both FMOLS and DOLS techniques show positive coefficients that are statistically significant, see Table 6. This depicts that, in the emerging 7 economies, in order to improve GDP, NREC, energy efficiency and effective capital should be enhanced. An increase in NREC by 1% results causes an increase in GDP by 0.00066% and 0.01%, as depicted by FMOLS and the DOLS techniques respectively. Moreover, an increase by 1% of energy efficiency has the effect of increasing GDP by 0.6% or 0.59%, as depicted by FMOLS and the DOLS techniques respectively. The findings in Table 6 also shows that an increase in 1% of effective capital has the tendency of increasing GDP by 0.36% or 0.32%, as depicted by FMOLS and DOLS techniques respectively. In addition to that, the FMOLS technique outcomes show that the indicator labor force provides a significant positive impact on GDP, while the findings of the DOLS technique shows that the relationship is insignificant. A rise by 1% in labor force has the tendency of increasing GDP by 0.08%, as per FMOLS results. Moreover, REC according to the findings of the FMOLS technique has a significant negative impact on GDP, while the findings of the DOLS technique show that REC does not significantly impact GDP in the emerging 7 economies. An increase in REC by 1%, according to the FMOLS results, reduces GDP by 0.14%. The findings of the FMOLS techniques do not concur with the postulations of many past studies, which alludes that REC positively impacts GDP, thus great care has to be taken when making policies.

Discussion

This research provides that effective capital and energy efficiency in the E7 countries significantly enhance GDP. The CS-ARDL, DOLS and FMOLS techniques employed concurs that energy efficiency and effective capital, indeed gives a strong positive effect on GDP. The postulations of this research which shows that energy efficiency positively impacts GDP supports the results of past studies of Bayar and Gavriletea [20] within the emerging economies, Akram et al. [8] within the BRICS nations, Adom et al. [3] in Africa and Kadir et al. [40] in the E7 countries, who alludes that energy efficiency positively affects GDP. Therefore, energy should be efficiently utilized to produce the highest level of output per each energy unit employed, as well as avoiding wastage of energy. Effective capital’s positive impact on GDP in this research shows that the complementary effect of physical capital and energy significantly promotes GDP. Effective capital is vital and significant in the production industry, since machinery and energy are complementary goods, that are used together. Energy is used to fuel machinery used in the production process. The research outcomes support the postulations of studies done prior to this, Bulut and Apergis [29], Namahoro et al. [47], Alper et al. [10], Ahmad et al. [5], which provide for a positive association among energy intake and GDP increase. The theories of production, such as the Cobb Douglas production function, which gives capital as the major determinant of output are also supported.

The positive effect of NREC on GDP in the E7 countries supports the postulations of previous researches [2, 37, 41] which offers for a strong positive impact of NREC on GDP. The findings of the CS-ARDL technique gives that NREC positively affects GDP in the short-run, while in the long-run, no significant effect is observed. However, the FMOLS and DOLS techniques concurs that NREC, in the long-run positively impacts GDP. Generally speaking, NREC positively impacts GDP, in as much as it is not encouraged because of its negative consequences to the environment. In this study we show that CS-ARDL and DOLS techniques concur that, REC and labor force in the E7 countries, do not significantly affect GDP. However, FMOLS technique shows that REC negatively affects GDP, while labor force is observed to positively affect GDP. Generally speaking, REC and labor force ought to promote GDP growth. The findings given in this research on the insignificant effect of REC on GDP, as per CS-ARDL and DOLS techniques and significant negative, as per FMOLS technique, differs from the postulations of past different researches, Eicke and Weko [38], Zhang et al. [56], Chen et al. [10], Rahman and Sultana [50], Kadir et al. [40], Namaharo et al. [6], Aydin [17], who gives that REC promotes GDP. Therefore, great care should be observed when making policies. REC does not only encourage economic growth,it also reduces the emission of carbon in the air. Therefore, the consumption of RE must be promoted.

Conclusion

The present research adds theoretically to the growing body of literature by providing the importance of effective capital and energy efficiency in fostering economic growth of the E7 countries, that is, Russia, Turkiye, India, China, Indonesia, Brazil and Mexico. The findings of the CS-ARDL, DOLS and FMOLS techniques are also compared. In this research we give that energy efficiency and effective capital are the major determinants of GDP in the E7 economies, as per the findings of all the techniques used. Labor force is also observed to be a major driver of GDP in the E7 countries, as per the FMOLS outcomes. The outcomes presented in the present research are robust because it employs the CS-ARDL technique, which is strong in the presence of heterogeneity, dynamics and CD. The CS-ARDL technique is also capable of providing the model’s short- and long-run coefficients which are used to understand the asymmetric effects of the explanatory factors on GDP. In addition to that, the DOLS and FMOLS techniques which gives robust long-run outcomes, that are crucial for policy making, are also employed. The policy implications of this study are as follows: energy should be efficiently used in the production process, avoiding any wastage, to obtain the highest level of output per each unit of energy employed. Effective capital and human capital should be enhanced. NREC in as much as it positively impacts GDP, it should be discouraged because of its positive effect on CE. Future studies are recommended to further explore the effect of effective capital on economic growth of various nations, since this topic is yet to be investigated well.

Availability of data and materials

The data used in this paper are secondary data and were retrieved from the World Bank https://data.worldbank.org/

Abbreviations

- ARDL:

-

Autoregressive Distributive Lag

- BRIs:

-

Brazil, Russia and India

- BRICS:

-

Brazil, Russia, India, China and South Africa

- CAP:

-

Capital

- CE:

-

Carbon emissions

- CO2:

-

Carbon-dioxide

- DOLS:

-

Dynamic Ordinary Least Square

- CD:

-

Cross-sectional dependence

- CS-ARDL:

-

Cross-sectional Augmented Autoregressive Distributive Lag

- E7:

-

Emerging 7 nations

- EE:

-

Effective capital

- EE:

-

Energy efficiency

- EU:

-

European Union

- EU:

-

Total energy use

- FMOLS:

-

Fully Modified Ordinary Least Square

- G7:

-

7 Most developed nations

- GDP:

-

Gross Domestic Product

- LF:

-

Labor force

- Ln:

-

Log value of a variable

- NRE:

-

Non-renewable energy

- NREC:

-

Non-renewable energy consumption

- RE:

-

Renewable energy

- REC:

-

Renewable energy consumption

References

Adebayo TS (2021) Do CO2 emissions, energy consumption and globalization promote economic growth? empirical evidence from Japan. Environ Sci Pollut Res 28(26):34714–34729

Adedoyin FF, Ozturk I, Agboola MO, Agboola PO, Bekun FV (2021) The implications of renewable and non-renewable energy generating in Sub-Saharan Africa: the role of economic policy uncertainties. Energy Policy 150:112115

Adom PK, Agradi M, Vezzulli A (2021) Energy efficiency-economic growth nexus: What is the role of income inequality? J Clean Prod 310:127382

Afroz R, Muhibbullah M (2021) Dynamic linkages between Non-renewable energy, Renewable energy and Economic growth through nonlinear ARDL approach: evidence from Malaysia. Science 5:89

Ahmad M, Jabeen G, Irfan M, Mukeshimana MC, Ahmed N, Jabeen M (2020) Modeling causal interactions between energy investment, pollutant emissions, and economic growth: China study. Biophys Econ Sustain 5(1):1–12

Ahmad M, Zhao ZY, Irfan M, Mukeshimana MC, Rehman A, Jabeen G, Li H (2020) Modeling heterogeneous dynamic interactions among energy investment, SO2 emissions and economic performance in regional China. Environ Sci Pollut Res 27(3):2730–2744

Ahmed F, Kousar S, Pervaiz A, Trinidad-Segovia JE, del Pilar Casado-Belmonte M, Ahmed W (2022) Role of green innovation, trade and energy to promote green economic growth: a case of South Asian Nations. Environ Sci Pollut Res 29(5):6871–6885

Akram R, Chen F, Khalid F, Huang G, Irfan M (2021) Heterogeneous effects of energy efficiency and renewable energy on economic growth of BRICS countries: a fixed effect panel quantile regression analysis. Energy 215:119019

Ali M, Raza SA, Khamis B (2020) Environmental degradation, economic growth, and energy innovation: evidence from European countries. Environ Sci Pollut Res 27(22):28306–28315

Alper AE, Alper FO, Ozayturk G, Mike F (2022) Testing the long-run impact of economic growth, energy consumption, and globalization on ecological footprint: new evidence from Fourier bootstrap ARDL and Fourier bootstrap Toda-Yamamoto test results. Environ Sci Pollut Res 5:1–16

Apeaning RW (2021) Technological constraints to energy-related carbon emissions and economic growth decoupling: a retrospective and prospective analysis. J Clean Prod 291:125706

Arain H, Sharif A, Akbar B, Younis M (2020) Dynamic connection between inward foreign direct investment, renewable energy, economic growth and carbon emission in China: evidence from partial and multiple wavelet coherence. Environ Sci Pollut Res 27(32):40456–40474

Aslan A, Altinoz B, Özsolak B (2021) The nexus between economic growth, tourism development, energy consumption, and CO2 emissions in Mediterranean countries. Environ Sci Pollut Res 28(3):3243–3252

Ashraf J, Luo L, Anser MK (2021) Do BRI policy and institutional quality influence economic growth and environmental quality? An empirical analysis from South Asian countries affiliated with the Belt and Road Initiative. Environ Sci Poll Res 5:1–14

Asiedu BA, Hassan AA, Bein MA (2021) Renewable energy, non-renewable energy, and economic growth: evidence from 26 European countries. Environ Sci Pollut Res 28(9):11119–11128

Asif M, Bashir S, Khan S (2021) Impact of non-renewable and renewable energy consumption on economic growth: evidence from income and regional groups of countries. Environ Sci Pollut Res 28(29):38764–38773

Aydin M (2022) The impacts of political stability, renewable energy consumption, and economic growth on tourism in Turkey: new evidence from Fourier Bootstrap ARDL approach. Renew Energy 5:12

Balsalobre-Lorente D, Leitão NC (2020) The role of tourism, trade, renewable energy use and carbon dioxide emissions on economic growth: evidence of tourism-led growth hypothesis in EU-28. Environ Sci Pollut Res 27(36):45883–45896

Banga C, Deka A, Kilic H, Ozturen A, Ozdeser H (2022) The role of clean energy in the development of sustainable tourism: does renewable energy use help mitigate environmental pollution? A panel data analysis. Environ Sci Pollut Res 2:1–11

Bayar Y, Gavriletea MD (2019) Energy efficiency, renewable energy, economic growth: evidence from emerging market economies. Qual Quant 53(4):2221–2234

Behera J, Mishra AK (2020) Renewable and non-renewable energy consumption and economic growth in G7 countries: evidence from panel autoregressive distributed lag (P-ARDL) model. IEEP 17(1):241–258

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renew Sustain Energy Rev 70:117–132

Ben Mbarek M, Saidi K, Rahman MM (2018) Renewable and non-renewable energy consumption, environmental degradation and economic growth in Tunisia. Qual Quant 52(3):1105–1119

Ben Youssef S (2020) Non-resident and resident patents, renewable and fossil energy, pollution, and economic growth in the USA. Environ Sci Pollut Res 27(32):40795–40810

Bhat JA (2018) Renewable and non-renewable energy consumption—impact on economic growth and CO2 emissions in five emerging market economies. Environ Sci Pollut Res 25(35):35515–35530

Bilgili F, Kuşkaya S, Ünlü F, Gençoğlu P (2022) Export quality, economic growth, and renewable-nonrenewable energy use: non-linear evidence through regime shifts. Environ Sci Pollut Res 5:1–19

Bouyghrissi S, Berjaoui A, Khanniba M (2021) The nexus between renewable energy consumption and economic growth in Morocco. Environ Sci Pollut Res 28(5):5693–5703

Boukhelkhal A (2021) Energy use, economic growth and CO2 emissions in Africa: does the environmental Kuznets curve hypothesis exist? New evidence from heterogeneous panel under cross-sectional dependence. Environ Dev Sustain 5:1–28

Bulut U, Apergis N (2021) A new methodological perspective on the impact of energy consumption on economic growth: time series evidence based on the Fourier approximation for solar energy in the USA. GeoJournal 86(4):1969–1980

Chen Y, Mamon R, Spagnolo F, Spagnolo N (2022) Renewable-energy and economic growth: a Markov-switching approach. Energy 6:123089

Chudik A, Pesaran MH (2015) Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J Econ 188(2):393–420

Cobb CW, Douglas PH (1928) A theory of production. Am Econ Rev 18:139–165

Deka A, Dube S (2021) Analyzing the causal relationship between exchange rate, renewable energy and inflation of Mexico (1990–2019) with ARDL bounds test approach. Renew Energy Focus 37:78–83

Deka A, Ozdeser H, Seraj M (2023) The effect of GDP, renewable energy and total energy supply on carbon emissions in the EU-27: new evidence from panel GMM. Environ Sci Pollut Res 30(10):28206–28216

Deka A, Cavusoglu B (2022) Examining the role of renewable energy on the foreign exchange rate of the OECD economies with dynamic panel GMM and Bayesian VAR model. SN Bus Econ 2(9):1–19

Deka A, Cavusoglu B, Dube S (2022) Does renewable energy use enhance exchange rate appreciation and stable rate of inflation? Environ Sci Pollut Res 29(10):14185–14194

de Oliveira HVE, Moutinho V (2022) Do renewable, non-renewable energy, carbon emission and KOF globalization influencing economic growth? Evidence from BRICS’countries. Energy Rep 8:48–53

Eicke L, Weko S (2022) Does green growth foster green policies? Value chain upgrading and feedback mechanisms on renewable energy policies. Energy Policy 165:112948

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econ J Econ Soc 5:251–276

Kadir MO, Deka A, Ozdeser H, Seraj M, Turuc F (2023) The impact of energy efficiency and renewable energy on GDP growth: new evidence from RALS-EG cointegration test and QARDL technique. Energ Effi 16(5):46

Karaaslan A, Camkaya S (2022) The relationship between CO2 emissions, economic growth, health expenditure, and renewable and non-renewable energy consumption: empirical evidence from Turkey. Renew Energy. 5:869

Li R, Wang Q, Liu Y, Jiang R (2021) Per-capita carbon emissions in 147 countries: the effect of economic, energy, social, and trade structural changes. Sustain Prod Consum 27:1149–1164

Li R, Wang X, Wang Q (2022) Does renewable energy reduce ecological footprint at the expense of economic growth? An empirical analysis of 120 countries. J Clean Prod 346:131207

Mankiw, N. G. (2010). Macroeconomics, (7th Int. ed.).

Matar A (2020) Does electricity consumption impacting financial development? Wavelet analysis. Fut Bus J 6(1):1–9

Matar A, Fareed Z, Magazzino C, Al-Rdaydeh M, Schneider N (2023) Assessing the co-movements between electricity use and carbon emissions in the GCC area: evidence from a wavelet coherence method. Environ Model Assess 5:1–22

Namahoro JP, Nzabanita J, Wu Q (2021) The impact of total and renewable energy consumption on economic growth in lower and middle-and upper-middle-income groups: Evidence from CS-DL and CCEMG analysis. Energy 237:121536

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Economet Rev 34(6–10):1089–1117

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326

Rahman MM, Sultana N (2022) Impacts of institutional quality, economic growth, and exports on renewable energy: Emerging countries perspective. Renewable Energy 189:938–951

Romer PM (1990) Endogenous technological change. J Political Econ 98(5):S71–S102

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94

Wang Q, Zhang F, Li R (2023) Revisiting the environmental kuznets curve hypothesis in 208 counties: the roles of trade openness, human capital, renewable energy and natural resource rent. Environ Res 216:114637

Wang Q, Wang X, Li R (2022) Does urbanization redefine the environmental Kuznets curve? An empirical analysis of 134 Countries. Sustain Cities Soc 76:103382

Wang J, Zhang S, Zhang Q (2021) The relationship of renewable energy consumption to financial development and economic growth in China. Renew Energy 170:897–904

Zhang D, Mohsin M, Rasheed AK, Chang Y, Taghizadeh-Hesary F (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153:112256

Zweifel PZ, Praktiknjo AP, Erdmann GE (2017) Energy economics: theory and applications. Springer, Berlin

Acknowledgments

The authors would like to acknowledge the authors of past papers as cited and referenced in this paper. Their contribution to the growing body of literature has made this paper a success

Funding

No funding was received from any organization.

Author information

Authors and Affiliations

Contributions

AD contributed to conceptualization, methodology, writing – original draft; HO contributed to editing, supervision; MOK contributed to software, data curation, writing – review; MS contributed to visualization, investigation.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not Applicable.

Consent for publication

The authors guarantee that this manuscript has not been previously published in other journals and is not under consideration by other journals. The authors also guarantee that this manuscript is original and is their own work.

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Deka, A., Ozdeser, H., Seraj, M. et al. Does energy efficiency, renewable energy and effective capital promote economic growth in the emerging 7 economies? New evidence from CS-ARDL model. Futur Bus J 9, 52 (2023). https://doi.org/10.1186/s43093-023-00235-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-023-00235-y