Abstract

The article discusses the role of gastronomy in shaping a sustainable future and highlights the importance of food as a fundamental resource for sustainable development. It emphasizes the need to reevaluate food production, sales, and consumption cycles to minimize their economic, environmental, and social impact on the planet. The concept of sustainability has evolved beyond its initial definition and now focuses on rejuvenating compromised environments. The critique of 20th-century food production methods and the cultural dominance of maximizing yields and standardizing production is mentioned. The text also mentions the resurgence of interest in local and indigenous gastronomies and the potential risks of oversimplification and underestimation in valuing these culinary traditions. The vulnerabilities and strengths of short agrifood chains in Italy are analyzed, and the article suggests ways forward for utilizing traditional gastronomy for economic and rural development. The analysis is part of the “NODES- Nord Ovest Digitale e Sostenibile” project funded by the Italian Ministry of University and Research.

Similar content being viewed by others

Is gastronomy the future?

The United Nations’ Agenda 2030 emphasizes the significance of food in shaping a sustainable future for Earth. The goals underscore food as a fundamental resource that should ensure reliable access to communities (SDG 2: Zero Hunger) [1]. Simultaneously, food is recognized as a commodity with production, sales, and consumption cycles that require reevaluation to diminish their economic, environmental, and social impact on the planet (SDG 12: responsible consumption and production) [2]. Food serves as both a means and an end in achieving sustainability. Surpassing the semantic boundaries set by the United Nations Brundtland Commission in 1987, sustainability has evolved into a contemporary keyword [3], extending beyond its initial definition of “meeting the needs of the present without compromising the ability of future generations to meet their own needs” [4]. Presently, sustainability embodies a process of regeneration severely compromised environments.

Within this framework, a profound critique has emerged against the methods of food production developed during the 20th century, which were introduced during the Green Revolution [5]. In today’s context, institutions, companies, and consumers are increasingly redirecting their attention toward rediscovering the value of species, varieties, and practices that have been marginalized due to the cultural dominance of an agricultural model focused on maximizing and standardizing yields and production through the introduction of new species and varieties, the intensification of mechanization and the use of fertilizers and pesticides [6]. Overall, the ecological transition in the food sector now centers on recovering, revitalizing, and promoting elements of communities’ gastronomic heritage. This approach includes production aspects that are more mindful, compatible, and resilient in relation to local environmental specificities [7]. It also recognizes products capable of expressing distinct narratives and cultural and environmental connections between a community and its surroundings as crucial resources for local development within a global market context [8]. Food has transformed into an object of contemporary desire, stirring emotions and mobilizing people in an era of consumerism and excess [9,10,11], where desire is no longer driven by the fear of hunger or experiences of insecurity [12] but rather by the pursuit of authenticity and uniqueness [13].

In this cultural climate, there is a resurgence of interest in local and indigenous gastronomy. Progressive measures are being implemented to enhance and promote these culinary traditions, establishing new economic models that increasingly intertwine the agri-food sector with tourism [e.g. 14, 15, 16]. However, there is a risk of oversimplifying the dynamic reality underpinning the production of these products while simultaneously underestimating the resilience of their (often) Short Agrifood Chains [hereafter SACs. They are the production system that brings together economic and social stakeholders who participate in coordinated activities that add value to a particular food product, from its production until it reaches the consumer: [17] associated with small-scale enterprises that form the foundation of these newly valued products.

Considering this context, this contribution aims to draw attention to the vulnerabilities of these production systems by analyzing ongoing processes in Italy. Specifically, the article introduces the characteristics of the Italian foodscape and its SACs. Based on the data recently produced concerning a thorough analysis of forty cases of SACs [ie. 18, 19], the article proposes a comparative analysis of the Italian foodscape to highlight its main weakness and strength. These are then discussed in the final paragraph to indicate a viable way forward both for Italy and more generally for any territory that aims at or is using its traditional gastronomy as pillar for its economic and rural development.

The Italian foodscape

Why Italy? Italy enjoys a well-established international reputation for its gastronomy [which is the combination of food products and gastronomies that characterize a specific community or territory: [20]. Parasecoli points out that “the world seems to be so in love with Italian food that many tend to think of it as exquisitely traditional, almost timeless, untouched by the events that have shaped what many consider a broken food system” [21]. Producers and chefs have played a significant role in establishing this fame throughout the 20th century [22], while the unique history of Italian migration has allowed products and culinary preparations to become a global phenomenon [23, 24]. The economic success of Italian gastronomy is evident both in the continuous growth of the sector’s exports, which reached €60 billion in revenue in 2022 [25], and in the increasing influx of tourists who annually visit the country, not only to experience its cultural peculiarities but specifically to explore and appreciate elements of local gastronomy [26]. These results are achieved thanks to the specificity of the Italian foodscape [which is the combination of production system, actors and places that represents a food system spatially: [27]. It is characterized by environmental and cultural diversity that provides a distinctive rich variety of products, preparations, and culinary styles [22, 28, 29]. In 2023, this richness will be underscored by the Italian government, which sponsored the candidacy of Italian gastronomy(ies) as the world’s intangible heritage [30], reiterating the image of a unique foodscape based on a plurality of unique, local products based on short, and heavily territorialized agrifood chains. This is exemplified by the extensive presence of traditional products, protected by indications of origin (such as 5450 Traditional Agri-food Products in 2022), or subject to local initiatives for protection and promotion (including 369 Slow Food Presidia in 2022). While some of these local products have experienced strengthening within their production chains in recent decades, often promoted in an industrial context [31], most of these realities are connected to short production chains, frequently confined to a single municipality, comprising a limited number of small-scale economic actors with low financial capitalization. Nonetheless, they base their activities on the capacity to interpret and enhance the specificities of the territory in which they operate [32], providing economic resources in the most marginalized rural areas [33]. Thus, the products are, indeed, examples of those food resources at the center of the international debate, those that are indicated as the key to a new, rural renaissance [34], and the consistency, density and plurality of these products and their agrifood chains indicate Italy as a privileged case to investigate in order to assess the limits of this understanding.

Moreover, most of the Italian SACs are in marginal rural areas, specifically in the mountain areas of the Alps and the Apennines and the Mediterranean islands [35]. They are often one of if not the pillar of the economy of these territories [36]. However, despite their value, the phenomena of marginalization and abandonment that have afflicted the rural reality of the country since the postwar period raise concerns about their future [37]. Slow Food drew attention to the risk of these realities disappearing as early as the late 1990s due to the influence of both the McDonaldization of taste and the standardization of agricultural practices, along with the intrinsic fragility of these local production systems [38].

Over the past three decades, numerous public and private initiatives have sought to promote and preserve these SACs by supporting companies in various processes, such as production, transformation, marketing, and product commercialization [39]. Despite the successes achieved through these initiatives, enabling these enterprises to reinforce their structure and modernize their processes, the process is still ongoing. Evident challenges persist and intertwine structural socioeconomic trends linked to population aging and rural depopulation [40]. These challenges raise significant questions about the present and future of these local production systems and enterprises, although the public debate tends to rely on a certitude of the durability and resilience of the Italian food system [28].

Italian SACs: the discussion thus far

In the past decade, growing attention has been given to the analysis of short Italian SACs in light of the structural socioeconomic phenomena affecting the country [41]. This debate has highlighted a few criticalities concerning the entrepreneurial and geographical characteristics of these systems. The first is the characteristic small scale of these enterprises. Since at least the 1980s, this aspect has been interpreted in an ambivalent manner. While it can represent a competitive advantage by ensuring greater versatility and production flexibility for companies [42], it has also been seen as a sign of delayed sector development in the European context, characterized by low capitalization and corporate structure [43], and is often tied to family dynamics [44]and artisanal practices [e.g. 45, 46, 47]. Within this framework, the debate has highlighted the economic fragility of these enterprises, particularly in terms of human capital, as many of them struggle with knowledge and activity transfer across generations. A second attains infrastructure limitations and distance from major market centers [33, 48, 49]. This manifests in difficulties accessing and establishing a presence in markets, where logistical aspects complicate a landscape already characterized by the limited overall production capacity of individual supply chains, often composed of a small number of companies and producers.

Despite these limits, the debate suggested an overall positive trajectory for SACs. Faced with these structural difficulties, enterprises were able to transform and enhance their commercial strategy and form alternative networks and commercial channels that meet the development needs of these enterprises [50], fully leveraging the communication possibilities offered by new channels and interpreting production in the context of tourism as well [51,52,53]. Therefore, in contrast to the broader Italian context, where small businesses often struggle to undertake collective actions [e.g. 54, 55, 56], these supply chains express their specificity and achieve their business success primarily through collective processes of commercial promotion and product protection [57,58,59], establishing collaboration in a framework of overall horizontal coopetition at the local level, as well as vertical coopetition along the product value chain [60]. Instead, there are only a few cases in which collaboration led to joint investments in production, where the sector as a whole still appears to lag behind in processes related to automation and Industry 4.0 [61].

Approaching a comparative analysis

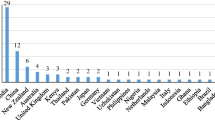

The contribution in the debate has commonly taken to divergent approaches. On the one hand, the research has produced comprehensive analyses of the Italian sector, based on aggregated regional and national data, primarily aimed at identifying the main socioeconomic factors, without delving into the specificities of individual SACs [62, 63]. On the other hand, the studies have delved into specific case studies, exploring the dynamics of local sociocultural contexts; the diversity of methodologies and approaches employed in these studies, however, restricts their comparison [57,58,59]. Addressing the gap between these two clusters of studies, two interconnected studies published in 2021 offered new insight. The first “La condizione delle filiere corte: studio pilota sul territorio italiano” [“The condition of the short agrifood chains: a pilot study conducted in Italy”] [18] explored the characteristics and dynamics characterizing 20 case studies chosen across the country. For this study, a qualitative methodology of enquiry was developed and used in a second study, “Atlante delle filiere. Analisi e prospettive per il rilancio delle filiere marginali sul territorio nazionale” [“The Atlas of the agrifood chains: Analysis and perspective for the relaunch of marginal agrifood chains in Italy”] [19], further the research investigating other 20 SACs across Northern Italy. Overall, the two books provide a coherent dataset analyzing forty short supply chains across the country (Table 1) predominantly located in “internal areas”, which are fragile territories, distant from the main centers offering essential services and too often left to their own devices, which, however, cover 60% of the entire national territory, 52% of municipalities, and 22% of the population [64].

The research employed a qualitative approach to create a base of knowledge usable for a comparative case analysis (Eisenhardt, 1989). Each of the SACs was preliminarily investigated by completing a literary review of the materials available in the EBSCO, Scopus, and Google Scholar databases in both Italian and English, as well as regional and national databases and archives related to specific projects promoted by the Ministry of Agricultural, Food, and Forestry Policies, the project of the Municipal Designations of Origin [39], and the archives developed by Slow Food Italia within the Arca del Gusto and Presìdi projects [38]. This information provided a preliminary description of the SAC. This was further implemented through fieldwork research. Semi structured interviews were conducted with the actors from each supply chain. The interviews employed a questionnaire consisting of 53 open-ended questions, aiming to explore the main potentials and vulnerabilities of the supply chains, with a particular focus on company structure, market access capabilities, presence and visibility of the actors involved, their capacity for collaboration, and the use of technological and digital resources in company management, promotion, and sales activities. The collected data were qualitatively processed and analyzed to assess the alignment of each reality with the following five descriptors of fragility:

-

Structure: This descriptor examines difficulties related to the organization of the supply chain, company scale, number of employees, average age, turnover, and capitalization.

-

Market Access: This descriptor considers challenges associated with logistics and the commercial network in terms of reach, intensity, and diversification.

-

Communication: This descriptor assesses media coverage and the consistency of multichannel communication and promotion strategies, as well as tourism promotion initiatives organized within the territory.

-

Innovation: This descriptor evaluates the implementation of business strategies aimed at product and process innovation, including the development of Industry 4.0 (such as production automation, e-commerce, etc.

-

Collaboration: This descriptor examines the presence of social and relational capital within companies, as expressed through their inclination to collaborate with other actors in the local and nonlocal supply chain.

The results of the analysis were then visualized through a traffic light system to indicate the presence and urgency of specific issues. Specifically, green signifies the absence of notable problems, yellow indicates the emergence of specific issues identified through the literature or qualitative analysis, and red denotes significant challenges that demand priority support. The outcomes of this analysis are summarized in Table 1.

The publications present a unique database without providing a thorough comparative case-study analysis [65]. In these pages, however, the data are analyzed to explore the broader patterns concerning the strengths and weaknesses of the SACs and, overall, their role in building a sustainable future.

Weakness and strength of the Italian SACs

If the cornerstone of the Italian foodscape is the diversity of products guaranteed by the SACs [66], the data highlight a complex and nuanced situation that confirms existing trajectories identified in the literature while also uncovering new elements (Fig. 1). While public debates and scientific discussions often interpret the difficulties faced by territories as a result of exogenous pressures and globalization, which can homogenize tastes and impoverish the gastronomic landscape [28, 67, 68], sociocultural analyses of traditional product promotion in the past have demonstrated a more intricate picture closely tied to local dynamics [59]. The research underscores this point by emphasizing that the fragilities of the supply chains are not solely influenced by external factors but rather arise from a combination of spatial, affective, and relational elements unique to each context.

The first and main critical issue is related to the structure of SAC companies. This fragility arises from the small scale of the companies, resulting in limited capitalization and challenges in making investments and accessing credit. Additionally, there is a high age of entrepreneurs and sector employees (often over fifty years old) in a context of limited generational turnover, especially in marginalized territories. These factors also impact the willingness, ability, and feasibility of increasing production since sociocultural factors influence investment inclination and medium- to long-term planning and hinder innovation processes [69]. In this context, firms face difficulties in accessing the market, primarily linked to the lack of infrastructure that characterizes the rural areas where the firms operate. Additionally, they encounter intense price competition from wholesalers and large-scale distribution networks, particularly in the fruit and vegetable sector.

While these aspects align with the literature, data on access, communication, and digitalization offer an innovative contribution. In fact, another noteworthy challenge is the need for diversifying sales channels and commercial networks. Encouragingly, data show a progressive disintermediation driven by local actors through the development of e-commerce tools and participation in alternative agri-food networks, such as solidarity purchasing groups and agricultural markets in urban centers. This strengthening process goes hand in hand with the implementation of communication strategies primarily developed at the association level to generate interest and awareness of local products among urban consumers. The challenge that firms face thus lies in making their products known and differentiating them in the eyes of consumers. In this regard, local entities have initiated initiatives, typically at the local or regional level, aimed at increasing their presence and media visibility, often targeting niche markets. These projects are associated with the implementation of initial concrete actions in the field of digitalization, particularly in terms of communication and sales. The COVID-19 pandemic has accelerated the process of digitizing commerce, forcing companies to reevaluate their sales models and engagement with urban consumers. This has led to the rapid adoption of more effective online communication through social channels and proprietary websites, as well as the development of online sales tools, such as listing products on e-commerce platforms or creating proprietary services.

While technological innovation represents one aspect of supply chain innovation, local entities have demonstrated a strong capacity for product innovation aimed at expanding and diversifying the range of products derived from local sources and utilizing local raw materials. Although this process is not always fully established and consolidated, there are few cases where no experimentation is taking place.

Finally, the dataset highlights limited difficulties in terms of collaboration, noting persistent networking practices among companies and territorial stakeholders, despite isolated cases of conflict or challenging collaboration even within consortia and associations. Difficulties also arise regarding expanding collaboration to involve new entities and strengthening existing partnerships. Overall, the territories are concerned about finding secure ways to reinforce territorial collaborations and socioeconomically inclusive processes related to production. However, a stable response over time has not always been developed. Furthermore, while the overall data collected are not alarming, they should be interpreted considering the specific characteristics of the analyzed sample, composed of supply chains characterized by years of collaboration aimed at valorizing local products. In this sense, a more complex situation can be hypothesized when traditional productions are developed through fragmented and individual entrepreneurial activities.

Within this general framework, a more detailed analysis of the type of supply chain production (plant-based or animal-based) provides an additional aspect to consider (Fig. 2). Overall, except for the communication aspect, the health status of animal supply chains is more critical. These data are primarily linked to the economic characteristics of these supply chains, including higher hidden costs for establishing and maintaining such productions, as well as limited scalability. Managing animals and their derivatives requires specific spaces and facilities that are not required for the majority of analyzed plant-based products, such as livestock housing, storage, and processing facilities. Moreover, animal-based supply chains require longer-term capital investment to generate profit due to a more limited natural multiplication factor, as well as greater difficulties in maintaining specific species/breeds and their genetic diversity due to limited existing populations and biological reproductive limits. Consequently, accessing the market becomes more challenging, particularly in a market context marked by a reduction in red meat consumption and struggles to diversify into other meats, such as sheep and waterfowl. Additionally, collaboration between actors in these SACs tends to be more complex, which aligns with findings in the literature related to livestock farming and cheese production.

While the analysis of marketing reveals some structural elements that are not always addressed, there is also an investigable connection between forms of fragility and strategies of local valorization (Fig. 3). Specifically, the research has examined products protected by European “Protected Designation of Origin” brands [hereafter PDO], “Protected Geographic Indication” brands [hereafter PGI], or other forms of more local valorization, such as Slow Food Presidia or producer consortia. From this comparison, two dimensions of fragility emerge as particularly relevant: structure and collaboration. SACs associated with PGI appear to face fewer issues related to the structure of their companies compared to other examined realities. These companies are more organized and capitalized, enabling them to handle the administrative and logistical requirements associated with maintaining a PGI designation. Companies with less structure and administrative burden tend to prefer other forms of promotion, such as PDO or commercial brands. Additionally, the scale of these companies and their collective ability to have an impact on the political-administrative scene are implicit prerequisites for obtaining geographical indications. The regulations governing these brands precisely regulate production aspects and require punctual collaboration among companies in the form of consortia, leading to more stable and structured forms of collaboration. This finding is also observed when analyzing SACs associated with protection consortia and Slow Food Presidia. The presence of intermediary bodies is a source of strength for SACs, although it is not without historical and occasional limitations. The realities of PDO, where these forms of coordination are absent, highlight a more complex situation, often characterized by local conflicts, especially for SACs whose commercial network operates at a local-regional scale.

The way forward

What are the conditions of the SACs in Italy? What is the condition of its foodscape? These pages offer a contribution to addressing these questions, moving beyond the common discourse. The data analysis highlights the intrinsic vulnerabilities of this reality, dictated not by contingency or external agencies but by the actions of local actors and the weight of historical and socioeconomic processes that have eroded communities and territories. In fact, the present and future of SACs are burdened by the impact of growing rural marginalization, expressed through the progressive impoverishment, depopulation, and aging of communities, which narrows the anthropic frontier of cultivation and crops. In this context, companies face daily challenges that touch various dimensions of their enterprise, starting with their structure.

The research clearly highlights the limitations of small-scale and aging entrepreneurship. In this regard, demographic data cast substantial shadows on the future of these realities. The Italian National Institute of Statistics [40] projects a declining population growth curve, with an estimated loss of at least 10% of the national population (59.2 million in 2021 -> 54.2 million in 2050) and an increase of approximately 5 years in the average age of the population (45.9 -> 50.6). Considering the ongoing depopulation of rural areas, considering the entrepreneurs in the sector being over the age of fifty, as well as the already challenging generational turnover, a structural crisis can be envisioned within a few years for this economic sector: a mass closure of these artisanal and family businesses. Whereas these businesses currently represent a significant resource for the development and maintenance of rural areas, this resource has become fragile and dwindling. However, the impact of their disappearance cannot simply be seen as another process of rural abandonment; it signifies the concrete risk of the disintegration of a product offering that defines the profile of the Italian gastronomic landscape. In the face of this problematic outlook, these realities in the present demonstrate their capacity for product innovation and commercial techniques, a vitality that is building and consolidating market spaces alongside the mass distribution sector, expressing an alternative paradigm of agriculture to that which emerged during the twentieth century, based on the promotion of small-scale productions, direct customer relationships, and hospitality. Considering production volumes, this model cannot be deemed a substitute for agro-industrial farming but rather an alternative that can better adapt to the needs of territories incapable of being competitive from a mass production perspective. In this sense, the contribution made by these realities toward achieving a sustainable food system primarily lies in the preservation of biodiversity and the governance of the territory.

What to do so? Individual SACs have developed bottom-up solutions to cope with the market, to increase their competitiveness and preserve the specificities of their products and environments. These include the establishment of specific agrifood chain agreements aimed at ensuring the participation of producers in the project and involving stakeholders downstream in the agrifood chains; collaboration with research entities within the SACs, aimed at studying and characterizing the product as well as developing new references in dialog with scientific experimentation; the organization of public and open training-information courses to enhance the professionalism of operators and promote the culture of the product within the sector and with the general public; the organization of marketing platforms capable of reaching urban realities and audiences without the intermediation of mediators or large-scale distribution; the implementation of circular economy principles both in the field and within the SACs; the expansion of the range of processed products and sales areas beyond the traditional perimeter of sales and consumption; the strengthening of relationships with institutions and research bodies to support innovation processes; and the intersection of production with aspects related to the third sector, such as the involvement and promotion of the contribution of vulnerable subjects. While these experiences offer a first response, institutional and structural responses should be put in place. These should aim to overcome the material and economic obstacles that hinder the potential return of habitation and production to marginal territories, as well as the reinforced involvement of new generations in these reactivation processes. This requires not only new paths, new connections, new minds, and new hands but also new incentives for entrepreneurial strengthening, not only through the repetition of the mantra of implementing Industry 4.0 protocols and technologies but especially through new informational interconnection between urban worlds and their needs and rural worlds and their possibilities. In this sense, the way forward for policy-making appears to be both the revision and expansion of national and regional policy concerning rural development (among which is the National Strategy for Inner Areas, going beyond its specific applicative nature, and the implementation of the National Recovery and Resilience Plan) with a focus on infrastructure development and, above all, the strengthening of public‒private and business-research synergies. In this process, recommendations point at:

-

Implementing financial incentives aimed at promoting the recovery and/or reactivation of local production, processing, and sales entities, thereby facilitating the involvement of new generations, whether local or from other parts of the Italian territory, in entrepreneurial activities.

-

Developing credit systems designed to incentivize innovation and/or enhancement of individual production entities, thereby enabling the continuation of innovation processes already in place.

-

Promoting meetings and/or activities among companies operating in the different SACs of the same territory to create “multi-supply chain” projects which can reinforce the networking among the local actors, thus, strengthening their social and cultural capital, as well as generating a shared vision of the local reality, its needs, potential and future.

-

Organizing interregional working groups among actors within SACs that share similarities in terms of dynamics and challenges so as to exchange and disseminate good practices and develop local bottom-up solutions based on this new shared knowledge.

-

Delivering training courses aimed at improving the general digital skills of all the actors within the SACs, with a particular focus on communication and marketing.

-

Implementing enhancement of e-commerce platforms and/or digital applications targeted at integrating the offer of all the actors within the same SAC, and among multiple SACs of the same territory to avoid fragmentation, improve general visibility and foster a coherent communication of the productions and the territory itself.

These interventions, which look at the most important criticalities affecting the SACs as emerged in the research [18, 19], respond to the critical issues of the structure and collaboration discussed above, and foster processes of digitalization that are compatible and integrated with the business models of the SAC’s without imposing technologies and practices alien to the know-how and entrepreneurial culture of the SACs’ firms.

From a perspective that goes beyond national specificity, the Italian case study serves as a more general warning. Today, traditional gastronomy and traditional products have become essential assets for policies and diplomacy. However, the analyzed data warn about the possible fragility of this heritage. The erosion of this heritage is caused not only by local socioeconomic changes within the country but also by climate change. In this sense, the sustainability of this heritage cannot be taken for granted but must be strengthened by identifying weaknesses and factors of deterioration to act upon. The Italian case also indicates that solutions can arise from grassroots movements and communities. However, these solutions lack a regional and national framework to integrate into, risk dissipating quickly and not being replicated.

Therefore, in a broader reasoning aimed at rethinking food as a tool for sustainability, there is a need to place policies at the center of the discussion, serving widespread entrepreneurship and territories. These policies should be capable of preserving the necessary biological and cultural diversity to ensure a more resilient future for the planet.

Data Availability

All the data analyzed in the article are available online to the following addresses:

https://www.filierafutura.it/cosa-facciamo/#ricerche (Last access, 20.7.2023).

https://www.unisg.it/ricerca/atlante-delle-filiere-analisi-e-prospettive-per-il-rilancio-delle-filiere-marginali-sul-territorio-nazionale/ (Last access, 20.7.2023).

The questionnaire is published in Italian and downloadable from: https://www.unisg.it/assets/Atlante-delle-Filiere-min.pdf (Last access, 20.7.2023).

References

Leal Filho WA, Anabela Marisa, Brandli L, Salvia AL, Özuyar PG, Wall T, editors. Zero Hunger. Encyclopedia of the UN Sustainable Development Goals. Cham: Springer; 2020.

Leal Filho WA, Anabela Marisa, Brandli L, Salvia AL, Özuyar PG, Wall T, editors. Responsible consumption and production. Encyclopedia of the UN Sustainable Development Goals. Cham: Springer; 2020.

Durant A. Raymond Williams’s keywords: investigating meanings ‘offered, felt for, tested, confirmed, asserted, qualified, changed’. Crit Q. 2006;48(4):1–26.

United Nations. Report of the World Commission on Environment and Development: our common future. New York: United Nations; 1987.

Kilby P. The Green Revolution: narratives of politics, technology and gender. Taylor & Francis; 2019.

Zocchi DM, Fontefrancesco MF, Corvo P, Pieroni A, Recognising. Safeguarding, and promoting Food Heritage: Challenges and prospects for the future of sustainable Food Systems. Sustainability. 2021;13(17). https://doi.org/10.3390/su13179510.

Moore HL. Global prosperity and Sustainable Development Goals. J Int Dev. 2015;27(6):801–15. https://doi.org/10.1002/jid.3114.

Almansouri M, Verkerk R, Fogliano V, Luning PA. Exploration of heritage food concept. Trends Food Sci Technol. 2021;111:790–7. https://doi.org/10.1016/j.tifs.2021.01.013.

Corvo P. Food Culture, Consumption and Society. London: Palgrave Mcmillan; 2015.

Jameson SM. Televisual senses: the embodied pleasures of Food Advertising. J Popular Cult. 2015;48(6):1068–88. https://doi.org/10.1111/jpcu.12349.

Meneley A, Consumerism. Annual Rev Anthropol. 2018;47:117–32.

Camporesi P. The land of hunger. Cambridge: Polity Press; 1995.

Warde A. The practice of eating. Cambridge: Polity Press; 2016.

Forné FF. Food tourism: authenticity and local development in rural areas. Documents d’Analisi Geografica. 2015;61(2):289–304. https://doi.org/10.5565/rev/dag.218.

Schulp JA. Reducing the food miles: locavorism and seasonal eating. In: Sloan P, Legrand W, Hindley C, editors. The Routledge Handbook of sustainable food and gastronomy. London: Routledge; 2015.

Fontefrancesco MF. Food festivals in Italy: a festive strategy against rural marginalization. Food Cult Soc. 2022;25(1):3–17. https://doi.org/10.1080/15528014.2021.1884421.

García-Winder LR, Goñi-Cedeño S, Olguín-Lara PA, Díaz-Salgado G, Arriaga-Jordán CM. Huizache (Acacia farnesiana) whole pods (flesh and seeds) as an alternative feed for sheep in Mexico. Trop Anim Health Prod. 2009;41(8):1615–21. https://doi.org/10.1007/s11250-009-9355-2.

Fontefrancesco MF, Zocchi DM, editors. La condizione delle filiere corte: studio pilota sul territorio italiano. Bra: Associazione Filiera Futura; 2021.

Fontefrancesco MF, Zocchi DM, editors. Atlante delle filiere. Analisi e prospettive per il rilancio delle filiere marginali sul territorio nazionale. Bra: Università degli Studi di Scienze Gastronomiche; 2021.

De-Miguel-Molina M, De-Miguel-Molina B, Santamarina V, Segarra-Oña M. Intangible Heritage and Gastronomy: the impact of UNESCO Gastronomy Elements. J Culin Sci Technol. 2016;14(4):293–310. https://doi.org/10.1080/15428052.2015.1129008.

Parasecoli F. Al dente: a history of food in Italy. First edition. ed. London: Reaktion Books; 2014.

Capatti A, Montanari M. La cucina italiana. Storia di una cultura. Roma - Bari: Laterza; 1998.

Cinotto S. The italian american table: food, family, and community in New York City. Champaign: University of Illinois Press; 2013.

Cinotto S. Terra soffice, uva nera: vitivinicoltori Piedmontsi in California prima e dopo il proibizionismo. 1. Ed. Nova americana. Torino: Otto; 2008.

ISTAT. Contributi alla ripresa del made in Italy e segnali di vulnerabilità dei Sistemi Locali del Lavoro: i dati sull’export. Roma: Istituto nazionale di statistica; 2023.

Garibaldi R. Rapporto sul turismo enogastronomico italiano: Trend e tendenze del turismo enogastronomico. Bergamo: Associazione Italiana Turismo Enogastronomico; 2022.

Bossio D, Obersteiner M, Wironen M, Jung M, Wood S, Folberth C, et al. Foodscape. Toward Food System Transition. Arlington: The Nature Conservancy; 2021.

Sassatelli R, editor. Italians and Food. London: Palgrave; 2019.

Montanari M. Italian identity in the kitchen, or, Food and the nation. New York: Columbia University Press; 2013.

Editorial Staff. Italian Cuisine Unesco Heritage: The Candidacy Is Official. La Cucina Italiana. https://www.lacucinaitaliana.com/trends/news/italian-cuisine-unesco-heritage-candidacy-is-official2023.

Ballarini G. La forma dell’oro. Viaggio nella storia del Parmigiano Reggiano un’avventura sociale. Bra - Roma: Slow Food Editore; 2021.

Agostini S. Identità territoriali della filiera agroalimentare. La produzione del luogo e del patrimonio. In: Corti M, De la Pierre S, Agostini S, editors. Cibo e identità locale Sistemi agroalimentari e rigernerazioni di comunità Sei esperienze lombarde a confronto. Sant’Omobono Terme: Centro Studi Valle Imagna; 2015. pp. 431–500.

De Rossi A, editor. Riabitare l’Italia. Le aree interne tra abbandoni e riconquiste. Roma: Donzelli; 2018.

Barberis C, editor. Ruritalia. La rivincita delle campagne. Rome: Donzelli; 2009.

Gho P, editor. Dizionario delle cucine regionali italiane bra. Slow Food Editore; 2010.

León-Bravo V, Caniato F, Caridi M, Johnsen T. Collaboration for sustainability in the Food Supply Chain: a multi-stage study in Italy. Sustainability. 2017 doi: https://doi.org/10.3390/su9071253.

Macchi Janica G, Palumbo A, editors. Territori Spezzati. Spopolamento e Abbandono nelle Aree Interne dell’Italia Contemporanea. Roma: Centro Italiano per gli Studi Storico-Geografici; 2019.

Fontefrancesco MF, Good. Fair and Clean Food for all. In: Brinkmann R, editor. The Palgrave Handbook of Global sustainability. Cham: Springer International Publishing; 2023. pp. 2533–41.

Fino MA, Cecconi AC, Gastronazionalismo. Busto Arsizio: People; 2021.

ISTAT. Previsione della popolazione residente e delle famiglie. Statistiche Rep Istat. 2022;2022(22/09/2022).

Storti D, Ascari M, Arzeni A, Provenzano V. Sostenibilità e innovazione delle filiere agricole nelle aree interne: Scenari, politiche e strategie. Milano: Franco Angeli; 2020.

Porter ME. Competitive advantage: creating and sustaining superior performance. New York: Free Press; 1985.

Fua G. L’industrializzazione del Nord Est e nel Centro. In: Fua G, Carlo Z, editors. Industrializzazione senza fratture. Bologna: Il Mulino; 1983.

Yanagisako SJ, Princeton NJ. ; Woodstock: Princeton University Press; 2002.

Ghezzi S. Etnografia storica dell’imprenditorialità in Brianza. Antropologia di un’economia regionale. Milan: Franco Angeli; 2007.

Cento Bull A, Corner P. From peasant to entrepreneur: the survival of the family economy in Italy. Oxford: Berg; 1993.

Guaschino M, Martinotti M, editors. Contadini di collina: viticoltura e condizioni materiali nella cultura orale del Basso Monferrato casalese. Torino: Regione Piedmont Assessorato all’Agricoltura e Foreste; 1984.

Garzia C. Settore italiano del food nello scenario post-pandemia. Analisi delle performance e dei modelli di business delle imprese italiane. Milano: Egea; 2022.

D’Alessandro S, Salvatore R, Bortoletto N, editors. Ripartire dai borghi per cambiare le cittÃ. Milano: Franco Angeli; 2020.

Martindale L, Matacena R, Jonathan, Beacham. Varieties of Alterity: alternative food networks in the UK, Italy and China. Sociologia Urbana e Rurale. 2018;2018(115):27–41. https://doi.org/10.3280/SUR2018-115-S1003.

Giampietri E, Triestini S. Analysing farmers’ intention to adopt web marketing under a technology-organisation-environment perspective: a case study in Italy. Agricoultural Econ. 2020;66:226–33.

Menna C, Gandolfi F, Passari M, Marcello, Cannellini, Trentin G, et al. Farm advisory services and knowledge growth in Italy: comparison among three regional intervention models. Italian Rev Agricultural Econ. 2020;75(1):61–70.

Privitera D, Nedelcu A, Nicula V. Gastronomic and food tourism as an economic local resource: case studies from Romania and Italy. Geoj Tourism Geosites. 2018;21(1):143–57.

Blim M. Made in Italy: Small-Scale Industrialization and its consequences. New York: Praeger Pub; 1990.

Ginsborg P. Italy and its discontents. Family, Civil Society, State 1980–2001. London: Penguin; 2001.

Putnam RD, Robert L, Nanetti RY. Making Democracy Work. Civic tradition in modern Italy. Princeton: Princeton University Press; 1993.

Parisi R. Food in action. Patrimoni alimentari e costruzione delle localitÃ. Palaver. 2023;12(1):95–107.

Leitch A. Slow food and the politics of pork fat: italian food and european identity. Ethnos. 2003;68(4):437–62.

Grasseni C. The heritage arena: reinventing cheese in the italian Alps. New York - Oxford: Berghahn; 2016.

Machado H, Vareiro L, Caldas I, Sousa B. Supply diversification and coopetition in rural tourism. In: de Carvalho JV, Rocha Á, Liberato P, Peña A, editors. Advances in Tourism, Technology and Systems. Singapore: Springer Singapore; 2021. pp. 192–206.

Bigliardi B, Bottani E, Casella G, Filippelli S, Petroni A, Pini B, et al. Industry 4.0 in the agrifood supply chain: a review. Procedia Comput Sci. 2023;217:1755–64. https://doi.org/10.1016/j.procs.2022.12.375.

Brunori G, Galli F, Barjolle D, Van Broekhuizen R, Colombo L, Giampietro M, et al. Are local Food Chains more sustainable than global food chains? Considerations for Assessment. Sustainability. 2016. https://doi.org/10.3390/su8050449.

Galli F, Bartolini F, Brunori G, Colombo L, Gava O, Grando S, et al. Sustainability assessment of food supply chains: an application to local and global bread in Italy. Agricultural and Food Economics. 2015;3(1):21. https://doi.org/10.1186/s40100-015-0039-0.

Meloni B. Aree interne: strategie di sviluppo locale. Aree interne e progetti d’area - (Bisogni & risorse). [Turin]: Rosenberg & Sellier; 2015.

Eisenhardt KM. Building Theories from Case Study Research. The Academy of Management Review1989. p. 532 – 50.

Naccarato, Pe. Nowak Ze, Eckert EKe. Representing Italy through food. London: Bloomsbury; 2017.

Wilk RR. Fast food/slow food: the cultural economy of the global food system. Lanham, MD ; Plymouth, England: Altamira Press; 2006.

Counihan C. Italian food activism in urban Sardinia: place, taste, and community. New York: Bloomsbury; 2018.

Vassallo M, Scalvedi ML, Saba A. Investigating psychosocial determinants in influencing sustainable food consumption in Italy. Int J Consumer Stud. 2016;40(4):422–34. https://doi.org/10.1111/ijcs.12268.

Acknowledgements

Special thanks to Andrea Pieroni, to have me introduced to this journal and its editorial team. To Dauro M. Zocchi for the preparation of the dataset concerning the two publications discussed in the article, and to Fondazione Filiera Futura and Fondazione Cariplo.

Funding

The present article, and its analysis, is part of the project NODES which has received funding from the MUR – M4C2 1.5 of PNRR with grant agreement no. ECS00000036, funded by the Italian Ministry of University and Research as part of the National Recovery and Resilience Plan. Preliminary research was funded by Associazione Filiera Futura, and Fondazione Cariplo.

Author information

Authors and Affiliations

Contributions

The article is entirely written by the author.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable

Consent for publication

Not applicable

Competing interests

The author declares that he has no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fontefrancesco, M.F. Traditional food for a sustainable future? exploring vulnerabilities and strengths in Italy’s foodscape and short agrifood chains. Sustain Earth Reviews 6, 7 (2023). https://doi.org/10.1186/s42055-023-00056-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s42055-023-00056-5