Abstract

This study examines how subsidiaries in multinational corporations (MNCs) experience interactions with corporate headquarters. We conceptualize such interactions in terms of organizing costs, focusing on two key types of costs: bargaining costs and information costs. Specifically, we examine how distance, coordination mechanisms, and atmosphere influence the level of organizing costs in the headquarter-subsidiary relationship. Using survey data collected among 104 subsidiary managers in two MNCs, we show that relationship atmosphere significantly reduces both types of organizing costs, whereas distance increases bargaining costs. We also find that centralization and formalization reduce information costs, whereas social integration, contrary to our hypothesis, increases bargaining costs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

“Jimmy had worked in the Shanghai subsidiary more than a year. He had spent his early career at headquarters, and in countless top management team meetings he always heard about the problematic subsidiaries opposing alignment with corporate strategic initiatives. Looking back on his first year in Shanghai, he reflected on how different the subsidiary perspective was from that of HQ. He saw how extensive energy and endless hours were dedicated to coordinating and negotiating activities with HQ, and that information coming from HQ was incomplete, difficult to understand and that it seldom came when needed. This time and energy could be so much better spent on developing new products and improving their local strategic positioning. He had been to two regional MNE meetings and observed how plans and proposals from global headquarters created confusion and lack of clarity among subsidiary managers, although some central HQ managers managed to create a good atmosphere that eased coordination and negotiation efforts. Clear and agreed upon standards, rules and communication systems gave subsidiary managers direction and signaled fairness in all HQ dealings. Consequently, there were many things HQ could do to reduce the organizing costs for subsidiaries, although, he pondered, probably, the two worlds were simply so different that these costs, very real in the minds of subsidiary managers, probably never could be totally eradicated”

(This is a compiled text based on interview material from the Terella project, which this study is based on.)

Introduction

The dominant perspective of the multinational corporation (MNC) has assumed, if not taken for granted, that headquarters (HQ) aim at making cogent decisions that maximize the benefits for the whole corporation (Foss 2019; Hoenen and Kostova 2015; Menz et al. 2015). While the corporate view certainly is a frequently applied and legitimate perspective on MNCs, it does not convey the complete picture of how such large and complex organizations actually work. This article offers a contrasting perspective focusing on the costs experienced by subsidiaries in their dealings with corporate headquarters and the factors that drive these costs. A “subsidiary approach,” in which an organization is looked at from the viewpoint of a given subsidiary unit, has gradually become more prevalent among scholars interested in the MNC organization (Holm and Pedersen 2000; Perri et al. 2013). Such an approach has the potential to significantly increase our understanding of how subsidiaries are affected by various governance mechanisms installed by HQ.

The headquarter-subsidiary relationship is crucial for the overall functioning of MNCs (Kostova et al. 2016). Importantly, operating at low organizing costs is of paramount significance for any MNC as this has a direct effect on MNCs’ performance (Benito and Tomassen 2003; Tomassen and Benito 2009). As HQ introduce various governance mechanisms to manage subsidiaries, such as social and formal coordination, the subsequent responses from subsidiaries may lead to costs as they attempt to organize their activities accordingly. Previous research has identified a range of factors explaining variation in organizing costs (see, e.g., Tomassen et al. 2012), but has looked at such costs from the viewpoint of corporate HQ. Here, we turn the table and examine how such costs appear from the perspective of subsidiaries.

Richter (2014), Tomassen and Benito (2009), and Tomassen et al. (2012) demonstrate how operating through foreign subsidiaries is not a panacea, especially in terms of organizing costs (Schweiger et al. 2003). Making a foreign direct investment (FDI) does not rule out positive organizing costs or per se ensure such costs reach their lowest feasible level. MNCs are complex organizations; they are per definition multi-unit, multi-location organizations, and geographical space as well as cultural and institutional diversity poses challenges for how headquarters and subsidiaries relate to each other (Hoenen and Kostova 2015).Footnote 1 These challenges expose themselves in terms of organizing costs: Adaptation problems, bargaining issues, resources spent on developing common norms and goals, and communication distortions are all common traits of international business activities. From a subsidiary’s perspective, such costs in terms of resources and time will impede its possibilities to attend to its assigned undertakings as well as hamper its possibilities to discover and purposefully act on opportunities arising in the local environment. Since there is an element of opportunity costs involved, these are not easily measured as accounting costs, and it is essential to capture managers’ views about alternative uses of time and resources.

Even if the choice of FDI is based on a comparative efficiency assessment across alternative modes of operation, the level of organizing costs can still be improved for the chosen (and presumably more efficient) mode, after entry. Moving towards the lowest feasible cost level implies a competitive advantage for companies (irrespective of their strategy), but getting there requires an understanding of organizing costs. This involves knowing more about their antecedents and learning how to organize and manage foreign operations in ways that minimize such costs.

In this study, we zoom in on the relationship between HQ and subsidiaries, and examine what drives organizing costs as seen from the perspective of subsidiaries. This is a novel vantage point (Lunnan et al. 2016), and empirically examining how organizing costs may vary depending on characteristics of the HQ-subsidiary relationship advances “our understanding of the costs and benefits of hierarchical organization” (Foss 2019, p.1). Specifically, a favorable relationship atmosphere may facilitate communication and as such reduce costs, whereas distance should be expected to increase these costs (Casson 1999). In addition, corporate headquarters implement various coordination mechanisms to direct subsidiary behavior (Baliga and Jaeger 1984; Foss 2019), which may also affect organizing costs. We do not, of course, propose that the subsidiary view may supplant a HQ perspective. We see them as complementary. However, whereas the HQ perspective is established, the subsidiary view is not, which provides an opportunity for contributing to the literature on HQ-subsidiary relations.

Our empirical context consists of HQ-subsidiary dyads within two Norwegian MNCs, operating in the certification business. This research context gives us the opportunity to control for variation in terms of nationality and industry—which the two firms have in common—and at the same time offers variation on key aspects of subsidiary control and coordination (see, e.g., Geppert and Matten (2006) and Schweiger et al. (2003)). Our empirical data comprise 104 responses from a survey among subsidiary managers in the two companies.

Our findings suggest that organizing costs in MNCs have distinct drivers. This study focuses on two types of costs, information and bargaining costs, both having the potential to cause considerable inefficiencies in subsidiaries. Due to their different characters, HQ managers must attend to formal mechanisms that simplify coordination and control for subsidiary managers, but must also overcome and mitigate relational tensions occurring in social interactions in culturally heterogeneous settings.

Theory and hypotheses

A central tenet in the governance perspective of organizations is that efficient organization involves the alignment of transactions to different governance structures conveying different levels of governance costs. These costs occur both ex ante and ex post (Williamson 1985). The former are the costs of drafting, negotiating, and safeguarding a governance arrangement. The latter are the costs related to (i) maladaptation when transactions drift out of alignment, (ii) haggling to correct misalignments, (iii) monitoring the operation, and (iv) bonding the parties involved in it. Managers make decisions about how to organize and supposedly select the most efficient governance structure available, i.e., the one that minimizes organizing costs in the long run (Buckley and Casson 1976; Hennart 1982; Williamson 1979).Footnote 2

Such decisions are decidedly strategic and hence principally made by managers at HQ (Menz et al. 2015; see also Foss 2019). Foss et al. (2012) argue that the existing literature on the MNC and its headquarters fundamentally considers the HQ as well informed—if not omnipotent—and benign in its activities and managerial actions (see also Vardi and Wiener (1996) and Poynter (1986)). This is reasonable as headquarters ought to make sensible decisions, also in the long run. Still, the research interest seldom extends beyond the point at which major decisions are taken. For example, major decisions for MNCs are where and how to enter a foreign country and how to organize their activities there. Making an FDI is such a decision and implies choosing to internalize, i.e., carrying out activities that involve cross-border transactions within the boundaries of the firm (Brouthers and Hennart 2007).

Agency issues are bound to arise between HQ and subsidiaries (Foss 2019; Hoenen and Kostova 2015), and previous studies have indeed documented the presence of various types of organizing costs within MNCs (Tomassen et al. 2012). While governance structures may promote or curb certain behaviors, they do not fundamentally transform human nature. This means that organizing costs should be expected to vary depending on characteristics of the HQ-subsidiary relationship as well as on local subsidiary conditions.

Ex post organizing costs have been classified into four main types: bargaining costs, information costs, monitoring cots, and bonding costs (Benito and Tomassen 2010; Tomassen and Benito 2009). In this study, we focus on the first two types of costs—bargaining costs and information costs—since they are the ones that are most clearly relevant from a subsidiary perspective. Monitoring and bonding costs in a HQ-subsidiary relationship reflect costs of misalignment from a HQ point of view and involve efforts typically initiated by HQ.

Bargaining costs arise due to renegotiations and changes in agreements between the MNC HQ and its various subsidiaries (Andersson et al. 2007). Both time and resources spent on bargaining and losses that occur due to non-efficient agreements can be classified as bargaining costs (Dahlstrom and Nygaard 1999). Typical examples include disagreements regarding various aspects of the transfer prices and deliberate withholding of knowledge.

Information costs arise from communication and coordination failures between HQ and subsidiaries (Casson 1999; Fisch and Zschoche 2011; Richter 2014). These costs are significant if they, in turn, make subsidiaries less capable of reacting rapidly to changing conditions. When the environment is diverse and volatile, adaptation issues are of special importance. Appropriate responses to environmental changes require prompt but correct information, and incomplete, inaccurate, or poorly formulated information prepared by the subsidiary may lead to suboptimal decisions.

As we are dealing with ex post organizing costs as perceived by subsidiary managers, our study draws on the idea of subsidiary agency, which based on corporate entrepreneurship (Birkinshaw 2000), has spurred a literature on subsidiary initiatives in the context of international business (e.g., Ambos et al. 2010). A subsidiary initiative is defined as “entrepreneurial proactive behavior in organizational subunits aiming to influence strategy-making in the organization” (Strutzenberger and Ambos 2014, p. 314). Subsidiary initiatives depend on HQ monitoring; Ambos et al. (2010) report a positive association between subsidiary initiatives and HQ monitoring. However, excess monitoring from HQ limits subsidiary autonomy, which in turn affects subsidiary initiatives negatively (Bouquet and Birkinshaw 2008b). Following this reasoning, we argue that subsidiary managers’ perceptions of ex post organizing costs influence their willingness and ability to formulate and carry out strategies locally. High organizing costs vis-à-vis their corporate headquarters suggest that a lot of time and effort is spent on bargaining agreements, on securing timely and accurate information, and on communicating with HQ. Conversely, if the relationship with HQ is perceived as being friction-free and maintained with low costs, the subsidiary manager can spend time and resources on initiatives with the potential to boost subsidiary performance.

A key reason for emphasizing managers’ perceived information and bargaining costs is that such perceptions are the true drivers of subsidiary behavior (Nell and Andersson 2012). The core argument is that managers will act based on what they believe and perceive rather than on some objective truth (Day and Nedungadi 1994; Weick and Roberts 1993). Firms’ interaction with their business environment is influenced by how such environments are perceived (Pfeffer 1987; Pfeffer and Salancik 1978), and this goes for the external environment as well as for the (MNC) internal one. In order to understand what drives a subsidiary’s actions and its possibilities to develop and perform in their local market, it is crucial to account for the subsidiary’s perception of organizing costs in its dealings with HQ.Footnote 3

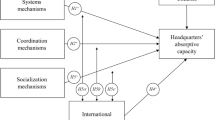

The main roles of HQ in an MNC are to handle the company’s overall strategy and to secure control and coordination of subsidiaries (Chandler 1991). Ideally, HQ should provide value-adding benefits to the subsidiary, which they do to the extent that they are good parents (Ambos and Mahnke 2010; Campbell et al. 1995), i.e., by being able to understand the challenges of subsidiaries as well as support the resources that subsidiaries need to develop. However, subsidiaries may find dealing with HQ to be difficult, time consuming, and costly for a variety of reasons. Previous studies mention the lack of HQ attention (Bouquet and Birkinshaw 2008b), HQ ignorance (Holm et al. 1995), lack of understanding (Campbell et al. 1995), and subsidiaries falling off the HQ radar (Monteiro et al. 2008). Such conditions potentially disturb subsidiary value creation by directing valuable time and effort towards renegotiations with HQ as well as coping with coordination failures. What factors are likely to drive or mitigate them? Building on Hoenen and Kostova’s (2015) notion of a broader agency perspective, in this study, we focus on three antecedents: (i) the distance between HQ and subsidiaries, which could strain their relation; (ii) the coordination mechanisms that are introduced by HQ with the aim to ease coordination and control; and (iii) the general atmosphere between HQ and subsidiaries, which should ease communication. We elaborate on their possible effects in the following. Our research framework is depicted in Fig. 1.

Distance and subsidiaries’ perception of ex post organizing costs

The concept of distance is central in the international business literature (e.g., Ghemawat 2001). The costs of overcoming distance include those of moving goods to foreign markets (geographical distance) and learning about as well as operating in new markets (cultural/psychic distance) (Benito and Gripsrud 1992; Ellis 2007). Both cultural and geographical distance indicates that the firm has less control due to unfamiliarity with language, customs, and behavior. In addition, time zones and physical distance make it difficult for headquarters to exert direct control.

Distance generally limits subsidiary visibility from HQ and increases costs of activity coordination (Richter 2014). Distance between headquarters and subsidiaries decreases interaction and thereby communication and information (Casson 1999; Fisch and Zschoche 2011). The more different the regions are in terms of culture, growth, and competitive conditions, the more this information asymmetry prevents corporate headquarters from performing value-adding activities, and we would expect high information costs as a result. Parenting becomes more complex as new locations are different from the home region opening up for communication failures and maladaptation, and leading to bargaining about which investments and resource dispositions are best. Bouquet and Birkinshaw (2008a) argue that as distance increases, subsidiaries have to work harder in getting headquarters’ attention. While subsidiaries close to home have various readily accessible avenues for getting attention from HQ, distant subsidiary managers have to put concerted efforts into getting attention from HQ. However, because such initiatives are bottom up—i.e., driven by the subsidiary—they will be outside the scope envisioned by HQ (Bouquet and Birkinshaw 2008a) and consequently incur costs of renegotiation. We therefore expect that:

-

H1: Distance between HQ and subsidiaries increases organizing costs related to (a) information and (b) bargaining.

Coordination mechanisms and subsidiaries’ perception of ex post organizing costs

In line with organization theory, international business literature (see, e.g., Baliga and Jaeger 1984; Dörrenbächer and Gammelgaard 2006) generally divides coordination mechanisms into centralization (i.e., HQ take critical decisions), formal mechanisms (such as common rules and standards, and organization-wide information systems), and social mechanisms (i.e., committees, meetings, liaisons). While formal mechanisms are pervasive in hierarchies (Williamson 1985), social mechanisms are becoming more widespread in MNCs, albeit used differently as they are perceived as more costly (O’Donnell 2000).

Formal and social coordination mechanisms define norms and expectations, with the aim to clarify behavior and performance (Roth et al. 1991), which should contribute to reduce frictions in an organization. Hence, it seems reasonable to expect that the more these mechanisms are in place, the lower ex post organizing costs. Overall, we therefore expect that:

-

H2a: Social coordination mechanisms in HQ-subsidiary relationships decrease organizing costs related to (a) information and (b) bargaining.

-

H2b: Formal coordination mechanisms in HQ-subsidiary relationships decrease organizing costs related to (a) information and (b) bargaining.

Centralization refers to a set up where headquarters make major strategy and policy decisions. Centralization could be a double-edged sword as it explicitly shifts the locus of power firmly in favor of the HQ, limiting actions of subsidiaries (Ghoshal and Nohria 1989). Whereas the scope for agency would be large in decentralized MNCs, such as allowing subsidiaries to pursue own initiatives, in a centralized MNC, the HQ strongly influences what subsidiaries do and how they do it, for example, what projects they decide to pursue, how they allocate resources, and how they deliver services. Because centralization limits the opportunities for individual subsidiaries to seek locally oriented solutions, centralization could lead to disagreements, especially in situations where a subsidiary is growing strong and becoming less dependent on headquarters (Bartlett and Ghoshal 1998). Then again, centralization economizes on decision-making costs (HQ makes decisions) and provides a structure in which authority as well as responsibility is made clear. Centralization may also contribute to settle lateral disagreements within MNCs, such as when different subsidiaries compete for resources and/or position. On balance, we therefore propose:

-

H2c: Centralized decision-making in HQ-subsidiary relationships decreases organizing costs related to (a) information and (b) bargaining.

Relationship atmosphere and subsidiaries’ perception of ex post organizing costs

The social aspect of the relation between subsidiaries and HQ has been the focus of much international business literature, in either the shape of general trust or a shared philosophy (Roth et al. 1991), or what we may call business atmosphere. A beneficial relationship atmosphere is characterized by shared identity, common norms, and trust and is particularly relevant in an MNC due to geographical, cultural, and linguistic differences (Mäkelä et al. 2007). Development of a good relationship atmosphere usually happens when the MNC over time has initiated a set of activities, including actions like establishing personal ties between parties, developing common identities, building incentive systems, and spending time together to solve third party problems (Rabbiosi 2011). When subsidiary managers perceive the relationship to HQ as characterized by trust and mutual understanding, renegotiations should be taken on in a more conducive environment, and exchanged information would be more trusted. Conversely, when subsidiary managers experience that HQ hide and alter information in order to carry out things their own way, neglecting subsidiary interests, and are inconsistent in company policies towards subsidiaries, the organizing costs perceived by the subsidiary will tend to increase. Hence:

-

H3: A positive relationship atmosphere with the HQ decreases organizing costs related to (a) information and (b) bargaining.

Data and measures

Empirical context and data collection

The data in this study originate from two multinational companies in the consulting and certification services industry. We followed these companies over several years through a larger research project. In this study, we mainly rely on quantitative data, collected through a questionnaire. However, the interpretation of both the variables and statistical results is also influenced by our in-depth knowledge obtained from a rich set of qualitative interviews in the two organizations with managers at various levels across several geographic regions.

Both companies are headquartered in Norway.Footnote 4 ALPHA is an experienced and well-recognized international actor, having established its first foreign office as early as 1873 in London. At the time of the survey, the company had 177 wholly owned business units located in 24 different countries across Asia, North and South America, Europe, and Australia. We sent the questionnaire to the leaders of each of these units and received responses from 115 out of the 177, hence a response rate of over 60%. We have complete data from 93 managers (listwise deletion) located in 17 countries in ALPHA. The other organization, BETA, is substantially smaller and has a shorter international presence and recognition, although its history in Norway can be traced back to the early 1930s. BETA was until the early 1990s a national monopoly protected by law. However, because of a deregulation of the industry for testing and approval of electrical components, BETA was transformed into an independent, self-owned private foundation in 1991 with headquarters in Oslo. The first international step came just after the formation of the new company. By the time the survey was conducted, BETA had 13 wholly owned business units located in nine different countries in Europe, North America, and Asia, and all the 13 unit leaders completed the questionnaire, i.e., a 100% response rate. However, due to missing data on some key variables, the final dataset from BETA included 11 of those 13 managers. Together, these two organizations provide an excellent setting for testing our hypotheses. On the one hand, they share important similarities as both are Norwegian and operate in overlapping industries. On the other hand, they are different in terms of their international experiences and the complexity of their international operations.Footnote 5 Moreover, perhaps more importantly, there are significant differences within each organization. The subsidiaries differ with respect to the size, experience, knowledge, age, general atmosphere between subsidiary and HQ, manager characteristics, and mode of establishment, which will generate variation in how HQ controls and manage those units (Ambos et al. 2019) as well as in how subsidiaries perceive HQ governance.

Measures

Whenever possible, we used well-established measures for both independent and dependent variables. In order to be contextually relevant, we discussed the measurements with a reference group consisting of practitioners, randomly selected managers from the companies (not included in our final sample), and researchers informed on professional service firms. Based on these insights, we adapted the wording of the measures to the type of industry the two firms are in. See Appendix 1 for the full set of measures and reliability values.

To validate our measures, we conducted both unidimensionality and reliability analyses. We ran exploratory principal component analyses with oblique (promax) rotation resulting in seven distinct factors from a total of 35 items—all in accordance with our theoretical model. Using Cronbach’s α to assess reliability, all variables were well above the .70 threshold (Nunnally and Bernstein 1994, pp. 264–265).

Following current practice, we took precautions to reduce common method bias issues: (a) some of the scales were reversed and (b) questions of interest for this study were mixed with other less relevant questions. We also run a Harman single factor test (Podsakoff et al. 2003; Podsakoff and Organ 1986). Seven factors with an eigenvalue over one emerged from the factor solution, and no first factor explained the majority of the variance in the variables (e.g., the first factor explained less than 30% of the variance). This suggests that the problem of common method bias should not significantly influence our results.

Dependent variables: organizing costs

Seven-point multi-item reflective scales were used to measure organizing costs (Bollen and Lennox 1991). Some of the measures were adapted from well-established scales, and others were self-developed (see below for further details).

Bargaining costs are perceived costs related to negotiations between the subsidiary and the HQ. According to Milgrom and Roberts (1992), these costs could be time spent on bargaining, resources and expenses (for example travel expenses) used during bargaining, and losses that occur as a result of failure in reaching efficient agreements. The first two items are self-developed, but the idea is taken from Rindfleisch and Heide (1997). The third item is taken from Buvik and John (2000) and adapted to the research setting. Three items were used to measure this variable (Cronbach’s α = .76).

Information costs are perceived communication and coordination costs related to information from HQ to subsidiary. When the information from headquarters is incomplete, too voluminous, or poorly formulated, then there is greater risk for adaptation problems. The variable is measured by four items taken from Dahlstrom and Nygaard (1999) and Tomassen and Benito (2009), but slightly modified for this study (Cronbach’s α = .90).

Our measurement of organizing costs is consistent with our aim to capture perceptions of conditions in the HQ-subsidiary relationship as drivers of subsidiary behavior (Boyd et al. 1993; Weick and Roberts 1993).

Independent variables

For (i) common rules, (ii) communication systems, and (iii) centralization, we adapted measurements from Gupta and Govindarajan (2000), Kim et al. (2003), and Martinez and Jarillo (1989, 1991). A seven-point scale was used for all items.

Common rules capture whether the companies have specified rules, standards, and procedures across business units. Two items constitute this variable (Cronbach’s α = .86).

Communication systems measure to what extent the organizations have systems that support seamless communication across organizational units. The variable is measured by five items (Cronbach’s α = .79).

Centralization is a composite variable measured by 12 different items that describe HQ vs. subsidiary influence regarding important decision areas such as R&D, project selection and priorities, resource allocation, pricing, marketing, and services (see Appendix 1 for a full list of items) (Cronbach’s α = .88).

The variable social coordination mechanisms measure the extent of social interaction across organizational units and to what extent the organization promotes informal social contact across the organization (Kim et al. 2003). It is measured by 3 different items (Cronbach’s α = .83).

Relationship atmosphere is a 6-item construct taken from Tomassen et al. (2012), but reversed and slightly adapted in order to provide a more pertinent understanding of the variable in the particular setting of this study. It describes whether the relationship between HQ and the local unit can be characterized as open and supportive or as a relationship where attitudes such as ignorance and broken promises illustrate the relation (Cronbach’s α = .91).

Distance is a categorical variable, and the measurement is based on a clustering approach inspired by Ronen and Shenkar (1985, 2013). Due to the small sample size and few observations within some of the eight original clusters, we pooled the subsidiaries into three different clusters clearly indicating the geographical as well as cultural/psychic distance between the HQ and the focal subsidiary (1 = Nordic countries, 2 = Europe, 3 = rest of the world).Footnote 6

Control variables

We included four control variables that might lead to variation in bargaining as well as information costs: (1) size of the local unit (measured as “number of employees in the local unit”), (2) local experience (measured as “number of years in the particular location”), (3) establishment mode (1 = acquisition, 2 = merger, 3 = organic), and (4) a firm dummy (1 = ALPHA, 0 = BETA).

Estimation

Before estimating the models, we tested for the assumptions of normality and linearity; see also Appendix 2 for descriptive statistics. To check multicollinearity, we run regressions with all variables included. The highest VIF values obtained were 2.25 and 2.18 for “communication systems” and “common rules,” respectively. All other VIF values were below 2.0. While such low values indicate the absence of multicollinearity, the correlation matrix (Appendix 2) shows that there is a fairly high correlation (.68) between “common rules” and “communication systems.” This can affect the OLS estimation with the two variables concealing or even canceling out the effects of each other. Indeed, estimating models with both variables entered simultaneously weakens the effects of “common rules” and “communication systems” on both bargaining and information costs although not to the extent that all effects become insignificant; also, the effects of other variables remain unchanged. Hence, we decided to run models with alternate specifications. Specifically, models 3 and 5 include “common rules,” whereas models 4 and 6 include “communication systems.” However, as a further check, we also estimate the models with a composite measure comprising both variables, thereby checking where the overall effect of the two variables is robust.

Results

The results of the OLS regressions are reported in Table 1.Footnote 7 The two first estimated models (model 1 for bargaining costs and model 2 for information costs), which only include control variables, reveal that size (number of employees in local unit) has a negative effect on both bargaining and information costs. Subsequently, four full models were estimated. Since communication systems and common rules may have a substituting effect (r = .684), and the significant effects disappeared when both were included in the same model, we decided to separate the two variables into different models.

All four full models are significant with F values of 3.50 (sig. F < .000) for model 3, F = 3.21 (sig. F < .001) for model 4, F = 3.92 (sig. F < .000) for model 5, and F = 3.48 (sig. F < .001) for model 6.

The results for model 3 and model 4 reveal that both distance and social coordination mechanisms have significant positive effects on bargaining costs (βDistance_Model3 = .29, p < .01; βDistance_Model4 = .28, p < .05; βSocial_Model3 = .30, p < .01; βDistance_Model4 = .28, p < .05). The positive effect of distance is in accordance with our hypothesis (H1). Concerning social coordination mechanisms (H2a), we hypothesized a negative effect but uncovered the opposite effect—a strong positive relationship towards bargaining costs. Conversely, neither distance nor socialization mechanisms are associated with information costs (model 5 and 6).

Hypothesis H2b on the relationship between formal coordination and organizing costs is generally supported. First, model 3 reveals that there is a significant negative relationship between common rules and bargaining costs (βCommon_rules_Model3 = − .20, p < .05). Likewise, model 5 shows a significant negative effect of common rules towards information costs (βCommon-rules_Model5 = − .34, p < .01). Finally, model 6 shows a negative association between communication systems and information costs (βCommunication_Model6 = − .30, p < .01).

Looking at the effects of centralization, we find a mixed picture. On the one hand, the data suggest that there is no significant effect between centralization and bargaining cost. On the other hand, the hypothesized negative effect of centralization effect is significant for information costs (βCentralization_Model5 = − .17, p < .10; βCentralization_Model6 = − .21, p < .05). Hence, H2c is partly supported.

Regarding relationship atmosphere, our data demonstrate strong negative effects through all four models for both bargaining costs and information costs as hypothesized (βAtmosphere_Model3 = − .31, p < .01; βAtmosphere_Model4 = − .31, p < .01; βAtmosphere_Model5 = − .30, p < .01; βAtmosphere_Model6 = − .30, p < .01). H3 is therefore supported.

Regarding control variables, most were statistically non-significant. The exception was subsidiary size that negatively relates to bargaining costs. This suggests that when bargaining with HQ, smaller units are somewhat more likely to recognize the draining on time and resources that could otherwise have been spent on other activities. This effect, however, weakens considerably when the independent variables are added.

As robustness checks, we first ran the models including a composite measure of “common rules” and “communication systems” to validate our alternate specifications. The estimated models largely reproduced the original results in terms of both coefficient values and statistical significance. This installs confidence in the robustness of our findings. An additional robustness check involved measuring geographic distance in kilometers between Oslo and capital cities of countries where the two companies had subsidiaries. No significant differences were observed (small changes in coefficient betas, but no changes in significance levels).

Discussion and implications

In this study, we set out to examine the concept of ex post organizing costs in HQ-subsidiary relationships as seen from the perspective of subsidiary managers. Our empirical analysis exposes the existence of ex post organizing costs and demonstrates that they indeed vary across subsidiaries. These costs are important as dealing with them takes time away from other tasks and reduces the attention that potentially can be allocated to other performance-enhancing undertakings. As subsidiaries are important drivers of MNC innovation and strategy implementation, these costs have real consequences beyond the performance of an individual unit and hence for the entire MNC. In addition, unlike HQ that indeed specialize and are competent in governing multiple subsidiaries, for subsidiary managers, such costs represent direct drains on their ability to pursue courses of action locally that contribute to the overall value creation of the parent MNC. Understanding these costs is hence paramount.

Previous studies have studied organizing costs as perceived from the perspective of corporate HQ. This study is among the very few that, to our knowledge, examine these costs from the subsidiaries’ point of view. MNCs use control and coordination mechanisms to achieve consistency of activities overseas (Kim et al. 2003). MNCs’ preferences for certain types of control mechanisms has been linked to culture, for example, distinguishing between Japanese companies’ tendency to use social control compared to formalized control by Western companies (Baliga and Jaeger 1984), or size of a company (Child 1973), pointing to MNC-specific preferences for control and coordination across all subsidiaries. Kim et al. (2003) found that control and coordination mechanisms varied between units with different functional tasks. Other studies have argued that control and coordination may vary at the subsidiary level depending on issues such as the strategic role of the subsidiary (Gupta and Govindarajan 1991) or the use of expatriates performing network roles (Harzing 2001). This literature suggests that a mix of MNC-specific and subsidiary-level factors determines the choice of control and coordination mechanisms.

In this study, we hold home country culture and industry constant, and examine coordination mechanisms in two MNCs. Despite controlling for industry, culture, and firm effects, our findings show the association between subsidiary managers’ perceptions of coordination mechanisms and organizing costs, which supports the actuality of a subsidiary perspective on organizing costs. Subsidiary managers’ perceptions of organizing costs underscore Husted and Folger’s (2004) claim that economic transactions are fundamentally human activities. As a corollary, to understand subsidiary actions and performance, we need to analyze what factors compete for the attention of subsidiary managers, such as responding to HQ governance mechanisms. Further, a critical ability of corporate HQ managers is to understand and deal with subsidiary organizing costs associated with MNC governance mechanisms. Our study has demonstrated that these costs are not uniform across subsidiaries and should be taken into account as a vital factor in the management of the MNC. One element that could play a role is subsidiary size, as larger subsidiaries seem to perceive costs to be lower than smaller subsidiaries. Larger subsidiaries could get more leverage from HQ and be more professionally managed, hence spend less time on bargaining. The effect of size in our study is, however, not very strong, which suggests that other factors, such as coordination mechanisms, matter more. However, the size and role of the subsidiary within the MNC could be an interesting research avenue to pursue further.

Our study shows that coordination mechanisms lead to organizing costs in distinct patterns. Strong (centralized) corporate HQ with formalized processes and well-developed internal databases and communication structures curb information costs. Likewise, clear and specific formalized processes and communication protocols help securing timely and correct information as well as facilitating coordination. The strategic consultancy Roland Berger reported in their 2013 report of 86 large multinational companies that there is a trend towards stronger and more centralized HQ (Zimmermann and Huhle 2013), which has also been noted in other studies (Kunisch et al. 2012, 2014; Schmitt et al. 2019; Young and Goold 1993; Young et al. 2000). Based on results from our study, this trend supports increased value creation in subsidiaries through a reduction in information costs.

Another type of organizing costs, those due to bargaining, are mainly driven by relational factors, namely geographical and cultural distances and personal differences revealed through social interactions. Subsidiaries in different locations offering services are exposed to different market conditions and opportunities for growth. Potential projects are held up against each other in social settings such as common meetings and discussed in ways that subsidiaries may see as unfair or not beneficial to their operations. In such cases, subsidiaries seek to bargain with headquarters that not only fail to understand local market conditions due to distance and cultural biases, but also, due to resource constraints, need to compare subsidiary needs and requests with those of other subsidiaries. Common settings, such as global business meetings, allow for information exchanges and exposures to a multitude of investment opportunities, and the subsidiaries have to pitch their ideas well when competing for resources from HQ. Overall, this results in increased time and effort that subsidiaries spend bargaining for resources with other subsidiaries as well as with HQ. Next, we discuss the coordination mechanisms and their implications on organizing costs more in detail.

Structure: centralization, formalization, and the lowering of organizing costs

Centralization shifts the locus of power in favor of HQ, leaving to HQ to define crucial strategy and policy decisions (Ghoshal and Nohria 1989). A centralized HQ influences what subsidiaries do and how they do it, for example, what projects they decide to take on, how they allocate resources, and how they deliver services. Although conceptually different from formalization (Terpstra 1977), centralization has been associated with formalization (Bartlett and Ghoshal 1998); this is supported by our data as both variables demonstrate similar implications. In a centralized MNC, one might expect that HQ is counting on precise and timely information from the subsidiaries, thereby increasing reporting efforts that trigger information costs. We find the opposite. The more decisions are taken at HQ, relying on common standards across subsidiaries, the clearer and less contestable the information received from HQ is perceived by the subsidiaries, which lowers their overall information costs.

Centralization of decision-making in MNCs has been extensively studied in the international business literature (see, e.g., Doz and Prahalad 1981; Gates and Egelhoff 1986; Hedlund 1986). Although research on centralization in MNCs has reported mixed findings (Gates and Egelhoff 1986), it has typically been found to be negatively related to size (e.g., Blau and Schoenherr 1971), complexity (e.g., Thompson 1967), and environmental change (e.g., Lawrence and Lorsch 1967). Centralized decisions also hinge on experiences accumulated through international activities, which over time fine-tune an organization’s structure and consequently its capabilities and routines associated with carrying out international activities. The more experienced the MNC, the more competent and confident it typically gets regarding managing its international activities, and consequently the more centralized it becomes.

Centralization is common when complexity in the subsidiary’s environment is relatively low, when changes are predictable, and when subsidiaries depend on HQ for resources. Because the certification firms in our study rely on standards, they tend to centralize core procedures and modes of delivery. Yet, our sample covers quite some variation, and units that experience less centralization find information costs to be higher. Also, processes that differ substantially across subsidiaries and over time result in higher perceived information and bargaining costs. We may conclude that given relatively predictable external conditions, as HQ centralizes decision-making, subsidiaries experience lower costs due to unclear and disputed information, which in turn should make them better at allocating time to other value creating tasks. However, future studies should explore information costs in MNCs that operate in more volatile environments and under different resource dependency conditions.

An important aspect of formalization is the routinization of decision-making. Regulating exchanges between headquarters and subsidiaries through clear procedures in a structured context (Burgelman 1984) increase predictability and expectations. Our study supports these predictions. Implementing common rules, policies, and procedures as well as sharing information through common databases, intranet, etc. results in clearer information from HQ. Information gets more complete, understandable, and more readily available, which significantly reduces information costs.

Formalization in the sense of common rules also reduces bargaining costs, whereas a common communication system (such as databases, intranet, etc.) per se has no significant effect. Brockner (2006) argues that there is a strong link between management control and perceived fairness, with consistent fair outcomes depending on control (Luo 2007). Because procedural fairness is associated with formalized control (Long et al. 2011), common rules promote the belief that company procedures are fair, thereby reducing bargaining costs.

Social coordination and distance: social complexity as driver of organizing costs

International business studies have discussed and typically found positive effects of normative integration (Ghoshal and Nohria 1989), social control (O'Donnell 2000), and boundary spanning interpersonal interaction (Kostova and Roth 2003; Nohria and Eccles 1992; Rabbiosi 2011). The common mechanisms driving these issues are personal meetings and the facilitation of human interaction that enables two-way communication as opposed to formal and more detached mechanisms (Mäkelä and Brewster 2009) leading to knowledge sharing (Tsai 2002).

Our findings take this research a step further and suggest that normative/social integration mechanisms do not only create common norms and culture, but also provide platforms for subsidiaries to engage in activities and gain experiences that may subsequently result in higher bargaining costs with their HQ. There are at least two plausible explanations for these findings. One explanation builds on the perception of fairness. Fairness concerns the perception that a decision, outcome, or procedure is both balanced and correct (Husted and Folger 2004; Sheppard et al. 1992). Social interaction, in our study, includes transfers of people across subsidiary units, interaction through meetings and committees, and personal interactions across units. Hence, the more subsidiary managers and employees engage in face-to-face interactions with HQ representatives or managers and employees from other subsidiaries, the more likely it is they will discover resource allocations to other subsidiaries that they may deem unreasonable or unfair. As they engage in discussions with HQ to gain what they see as fair allocations of resources for them, the result becomes higher perceived bargaining costs. We should not disregard the negative effects of human interaction among people who may not personally like each other or who have different opinions and experiences, which may trigger perceptions of unfairness.

Another explanation suggests lateral cooperation that, in turn, may lead to increased bargaining costs towards headquarters. Social interactions lead to knowledge transfer among subsidiaries (Mäkelä and Brewster 2009; Tsai 2002) which may stimulate subsidiary collaboration and new initiatives. Gupta and Govindarajan (1991) point to a body of research arguing that social lateral coordination mechanisms open up for interaction and communication between subsidiaries that facilitate knowledge flows and facilitate innovation. Headquarters are generally more powerful than single subsidiaries. Subsidiaries may collaborate and increase their bargaining power by providing new initiatives towards HQ, and their success hinges on subsidiary characteristics as well as the attention they are able to attract from HQ (Ambos et al. 2010). Building on Dörrenbächer and Gammelgaard (2006), we argue that joint initiatives from a coalition of subsidiaries may also invoke HQ reactions, leading to increased bargaining costs for individual subsidiaries that either are part of the coalition or operate in isolation. Both cases involve extensive bargaining between subsidiaries and HQ, resulting in the individual subsidiary fighting for scarce resources. Our study shows that such bargaining endeavors may surface and accelerate through MNE socialization arenas.

Our findings suggest that the positive effects from social interaction that are generally taken for granted in the international business literature may be much more complex. This study demonstrates that the commonly assumed positive effects of face-to-face lateral interactions may have a flip side, as they in our study significantly increase the subsidiaries’ perceived bargaining costs. However, social interactions do not affect information costs, which seem to occur as a side effect of organizing activities and projects outside daily general information and coordination processes. We have suggested two plausible explanations for the increased bargaining costs detected here: first, a negative effect by triggering subsidiary managers’ sense of unfairness towards HQs’ resource dispositions; and second, a potential positive effect by stimulating subsidiary initiatives, which are facilitated by social lateral meetings and networks.

When involvement of headquarters is limited due to distance, it is more difficult to unveil shirking (Foss 1997; Hennart 1991). Higher cultural and geographical distances suggest that the firm has less control due to unfamiliarity with languages, customs, and behaviors. In addition, time zones and physical distance make it difficult for headquarters to exert direct control. The more different locations are in terms of culture, growth, and competitive conditions, the more the resulting information asymmetry hinders global headquarters in performing value-adding activities. Viewed from the perspective of subsidiaries, this study finds that organizing costs due to increasing distance are linked to bargaining costs not information costs. Interestingly, information sent out from HQ is not seen as more distorted as distance increases, but subsidiaries find it increasingly time consuming to renegotiate activities and resources. Foreign language, culture, and differences in market conditions over distance challenge the understanding from HQ of local needs, hence the increasing need for bargaining and renegotiation.

The role of relationship atmosphere in reducing organizing costs

Atmosphere relates to behavioral and motivational assets in relationships, such as trust, norms of behavior, and expectations (Kang et al. 2007; Nahapiet and Ghoshal 1998). Trust is particularly relevant in MNCs due to added complexity from distance and cultural differences (Westney 2001). Trust denotes a willingness to be vulnerable to the actions of another party (e.g., Mayer et al. 1995) and has been shown to be positive for collaboration and performance (e.g., Zaheer et al. 1998). Trust develops through cognitive, behavioral, and affective mechanisms (Gambetta 1988; Lewicki et al. 2006), which means that in order to develop favorable expectations about HQ, subsidiaries rely not only on formal and written information (cognitive), but also on deeper relational expectations and affections that emerge from observations of behavior.

Our data suggests that atmosphere does not develop through social coordination mechanisms. On the contrary, frequent meetings between MNC managers are not associated with a better atmosphere. This suggests that it is not the social meeting per se, but rather what actually happens in these personal relations when companies interact socially that matters.

Managing organizing costs in the MNC

Results from our study suggest that the level of organizing costs in the MNC depends, firstly, on the ability to deal with complexity through standardization and formalized information channels and, secondly, on managing distances and social meeting places. The latter, in particular, is a challenge since social interaction is necessary for trust and the development of common norms and identity that, subsequently, leads to a positive business atmosphere. As such, social interaction can have two effects: first, inducing a good atmosphere that reduces organizing costs; and second, creating scope for disagreements and conflicts, which increases bargaining costs. A major challenge for HQ is therefore to create arenas for social interaction that facilitate trust and limit bargaining. Of course, some bargaining may still be beneficial and necessary, but when bargaining turns into excessive time usage and unproductive interactions, subsidiary management attention could be spent on more productive tasks. This finding implies that HQ managers have to think not only about the structure of their organizations, but also about how they interact with subsidiaries in social arenas and particularly how they identify and prioritize subsidiary investment projects and outline processes for dealing with them.

Facilitating the development of trust not only requires a careful scrutiny of what takes place in common meetings, but also points to the need for attention to subsidiary management recruitment and training. Securing a platform of trust before the manager even accepts the position can be essential. In addition, our data clearly suggest that the consistency of HQ behaving in a transparent, predictable, and fair manner improves the likelihood of developing a good atmosphere in HQ-subsidiary relationships.

Limitations, avenues for further research, and conclusion

So far, the handful of studies that have focused on organizing costs in international operations have taken the view of the parent corporation when looking at organizing costs in headquarter-subsidiary relationships. Those valuable insights notwithstanding, in this study, we have turned the table around and examined how subsidiaries observe organizing costs as they deal with demands from and interactions with headquarters in MNCs. Specifically, we examine how distance, mechanisms of integration, and atmosphere influence the organizing costs in the headquarter-subsidiary relationship.

This study does not come without limitations. Notably, our study includes only two multinational corporations. Our approach keeps the industry and country of origin constant, which effectively “rule out” variation along such characteristics. However, the companies and the industry in our study may have particularities that are less widespread in other industries and countries, and which, consequently lower our opportunity to generalize the results from this study.

Several issues, which may be subject to further research, arise from our study. One exciting avenue is to study whether industry effects influence ex post organizing costs in HQ-subsidiary relationships. For instance; are information costs positively related to the degree of technological intensity in the industry? Do global industries face lower bargaining costs than industries where local adaptation is more prominent? Another interesting issue concerns the question of how intracompany networks between subsidiaries, and more complex HQ configurations such as regional and divisional HQ (see for instance Ambos et al. 2019; Benito et al. 2011; Nell et al. 2017; Schulte Steinberg and Kunisch 2016), affect ex post organizing costs as perceived by subsidiaries. Of course, this phenomenon is not limited to MNCs, but applicable more generally to HQ-business unit relations in any organization comprising a portfolio of dispersed units (Menz et al. 2015).

The primary contribution of this study is the examination of the antecedents (distance, coordination mechanisms, atmosphere, and centralization) of perceived organizing (information and bargaining) costs. Understanding how these costs, at the subsidiary level, vary with the studied antecedents should enhance subsidiary managers’ ability to strategize around their future initiatives and to reflect on how pursuing such initiatives may affect organizing costs. As a result, they may also gain insights into how to prevent or minimize such costs. Theoretically, we add to the literature on HQ-subsidiary relationships in complex MNCs as well as to transaction cost theory, which has only sporadically looked into what drives ex post organizing costs.

Notes

As such, any MNC is more complex than its otherwise identical but purely domestic twin and is hence highly suitable “laboratories” for examining governance issues arising from complexity.

In our further discussion, the attention is on ex post costs—i.e., the costs that occur after the governance structure has been decided upon.

Even if it had been possible to calculate the actual costs of bargaining and information, induced by HQ, through for example time and hourly wages for involved personnel, such costs would not reflect the opportunity costs recognized by subsidiary management regarding the time and effort which would otherwise be put into developing local opportunities, advancing initiatives, etc. Our study deals with costs, which from a subsidiary’s perspective also include opportunity costs of a nature that would not be readily recognized from an HQ’s perspective.

For confidentiality reasons, the names of the companies are disguised.

While the firms are very different with regard to size and international experience, one might argue that it makes little sense to lump them together. However, as the number of observations is relatively low to start with, and running the regression without BETA did not make any significant difference (see endnote 7 below), we have decided to include both companies in the analysis.

As a robustness check, we alternatively measured distance as the geographic distance in kilometers between Oslo and the relevant capital cities.

In addition to a firm dummy (controlling for a firm effect), regressions using only data from ALPHA (n = 93) were also conducted. The results remained virtually unchanged for the reduced sample.

References

Ambos B, Kunisch S, Leicht-Deobald U, Schulte Steinberg A (2019) Unravelling agency relations inside the MNC: the roles of socialization, goal conflicts and second principals in headquarters-subsidiary relationships. J World Bus 54:67–81

Ambos B, Mahnke V (2010) How do MNC headquarters add value? Manag Int Rev 50:403–412

Ambos TC, Andersson U, Birkinshaw J (2010) What are the consequences of initiative-taking in multinational subsidiaries? J Int Bus Stud 41:1099–1118

Andersson U, Forsgren M, Holm U (2007) Balancing subsidiary influence in the federative MNC: a business network view. J Int Bus Stud 38:802–818

Baliga BR, Jaeger AM (1984) Multinational corporations: control systems and delegation issues. J Int Bus Stud 15:25–40

Bartlett CA, Ghoshal S (1998) Managing ccross borders: the transnational solution, 2nd edn. Harvard Business School Press, Boston

Benito GRG, Gripsrud G (1992) The expansion of foreign direct investments: discrete rational location choices or a cultural learning process? J Int Bus Stud 23:461–476

Benito GRG, Lunnan R, Tomassen S (2011) Distant encounters of the third kind: multinational companies locating divisional headquarters abroad. J Manag Stud 48:373–394

Benito GRG, Tomassen S (2003) The micro-mechanics of foreign operations’ performance: an analysis based on the OLI framework. In: Cantwell J, Narula R (eds) International business and the eclectic paradigm: developing the OLI framework. Routledge, London, pp 174–199

Benito GRG, Tomassen S (2010) Governance costs in headquarters-subsidiary relationships. In: Andersson U, Holm U (eds) Managing the contemporary multinational: the role of headquarters. Edward Elgar, Cheltenham, pp 138–160

Birkinshaw J (2000) Entrepreneurship in the global firm. Sage, London

Blau PM, Schoenherr RA (1971) The structure of organizations. Basic Books, New York

Bollen KA, Lennox R (1991) Conventional wisdom on measurement: a structural equation perspective. Psychol Bull 110:305–314

Bouquet C, Birkinshaw J (2008a) Managing power in the multinational corporation: how low-power actors gain influence. J Manag 34:477–508

Bouquet C, Birkinshaw J (2008b) Weight versus voice: how foreign subsidiaries gain attention from corporate headquarters. Acad Manag J 51:577–601

Boyd BK, Dess GG, Rasheed AMA (1993) Divergence between archival and perceptual measures of the environment: causes and consequences. Acad Manag Rev 18:204–226

Brockner J (2006) Why it’s so hard to be fair. Harv Bus Rev 84:122–129

Brouthers KD, Hennart J-F (2007) Boundaries of the firm: insights from international entry mode research. J Manag 33:395–425

Buckley PJ, Casson MC (1976) The future of the multinational enterprise. Macmillan, London

Burgelman RA (1984) Designs for corporate entrepreneurship in established firms. Calif Manag Rev 26:154–166

Buvik A, John G (2000) When does vertical coordination improve industrial purchasing relationships? J Mark 64:52–64

Campbell A, Goold M, Alexander M (1995) Corporate strategy: the quest for parenting advantage. Harv Bus Rev 73:120–132

Casson M (1999) The organisation and evolution of the multinational enterprise: an information cost approach. Manag Int Rev 39:77–121

Chandler AD Jr (1991) The functions of the HQ unit in the multibusiness firm. Strateg Manag J 12:31–50

Child J (1973) Predicting and understanding organization structure. Adm Sci Q 18:168–185

Dahlstrom R, Nygaard A (1999) An empirical investigation of ex post transaction costs in franchized distribution channels. J Mark Res 36:160–170

Day GS, Nedungadi P (1994) Managerial representations of competitive advantage. J Mark 58:31–44

Dörrenbächer C, Gammelgaard J (2006) Subsidiary role development: the effect of micro-political headquarters-subsidiary negotiations on the product, market and value-added scope of foreign-owned subsidiaries. J Int Manag 12:266–283

Doz YL, Prahalad CK (1981) Headquarters influence and strategic control in MNCs. Sloan Manag Rev 23:15–29

Ellis PD (2007) Paths to foreign markets: does distance to market affect firm internationalisation? Int Bus Rev 16:573–593

Fisch JH, Zschoche M (2011) The effects of liabilities of foreignness, economies of scale, and multinationality on firm performance: an information cost view. Schmalenbach Bus Rev 63:51–68

Foss K, Foss NJ, Nell PC (2012) MNC organizational form and subsidiary motivation problems: controlling intervention hazards in the network MNC. J Int Manag 18:247–259

Foss NJ (1997) On the rationales of corporate headquarters. Ind Corp Chang 6:313–338

Foss NJ (2019) The corporate headquarters in organization design theory: an organizational economics perspective. J Organ Des 8(1):8

Gambetta D (1988) Can we trust trust? In: Gambetta D (ed) Trust: making and mraking cooperative relations. Basil Blackwell, New York, pp 213–237

Gates SR, Egelhoff WG (1986) Centralization in headquarters - subsidiary relationships. J Int Bus Stud 17:71–92

Geppert M, Matten D (2006) Institutional influences on manufacturing organization in multinational corporations: the ‘cherrypicking’ approach. Organ Stud 27:491–515

Ghemawat P (2001) Distance still matters. The hard reality of global expansion. Harv Bus Rev 79:137–147

Ghoshal S, Nohria N (1989) Internal differentiation within multinational corporations. Strateg Manag J 10:323–337

Gupta AK, Govindarajan V (1991) Knowledge flows and the structure of control within multinational corporations. Acad Manag Rev 16:768–792

Gupta AK, Govindarajan V (2000) Knowledge flows within multinational corporations. Strateg Manag J 21:473–496

Harzing AW (2001) Who's in charge? An empirical study of executive staffing practices in foreign subsidiaries. Hum Resour Manag 40:139–158.

Hedlund G (1986) The hypermodern MNC - a heterarchy. Hum Resour Manag 25:9–35

Hennart J-F (1982) A theory of multinational enterprise. University of Michigan Press, Ann Arbor

Hennart J-F (1991) Control in multinational firms: the role of price and hierarchy. Manag Int Rev 31(Special Issue):71–96

Hoenen AK, Kostova T (2015) Utilizing the broader agency perspective for studying headquarters-subsidiary relations in multinational companies. J Int Bus Stud 46:104–113

Holm U, Johanson J, Thilenius P (1995) Headquarters’ knowledge of subsidiary network contexts in the multinational corporation. Int Stud Manag Organ 25:97–119

Holm U, Pedersen T (eds) (2000) The emergence and impact of MNC centers of excellence: a subsidiary perspective. Macmillan, London

Husted BW, Folger R (2004) Fairness and transaction costs: the contribution of organizational justice theory to an integrative model of economic organization. Organ Sci 15:719–729

Kang S-C, Morris SS, Snell SA (2007) Relational archetypes, organizational learning, and value creation: extending the human resource architecture. Acad Manag Rev 32:236–256

Kim K, Park JH, Prescott JE (2003) The global integration of business functions: a study of multinational businesses in integrated global industries. J Int Bus Stud 34:327–344

Kostova T, Marano V, Tallman S (2016) Headquarters–subsidiary relationships in MNCs: fifty years of evolving research. J World Bus 51:176–184

Kostova T, Roth K (2003) Social capital in multinational corporations and a micro-macro model of its formation. Acad Manag Rev 28:297–317

Kunisch S, Müller-Stewens G, Campbell A (2014) Why corporate functions stumble. Harv Bus Rev 92(12):110–117

Kunisch S, Müller-Stewens G, Collis DJ (2012) Housekeeping at corporate headquarters: international trends in optimizing the size and scope of corporate headquarters. In: Survey report. University of St.Gallen/Harvard Business School, St.Gallen/Cambridge

Lawrence PR, Lorsch JW (1967) Differentiation and integration in complex organizations. Adm Sci Q 12:1–47

Lewicki RJ, Tomlinson EC, Gillespie N (2006) Models of interpersonal trust development: theoretical approaches, empirical evidence, and future directions. J Manag 32:991–1022

Long CP, Bendersky C, Morrill C (2011) Fairness monitoring: linking managerial controls and fairness judgments in organizations. Acad Manag J 54:1045–1068

Lunnan R, Tomassen S, Benito GRG (2016) Exploring subsidiaries’ perceptions of corporate headquarters: subsidiary initiatives and organizing costs. Res Glob Strat Manag 17:165–189

Luo Y (2007) The independent and interactive roles of procedural, distributive, and interactional justice in strategic alliances. Acad Manag J 50:644–664

Mäkelä K, Brewster C (2009) Interunit interaction contexts, interpersonal social capital, and the differing levels of knowledge sharing. Hum Resour Manag 48:591–613

Mäkelä K, Kalla HK, Piekkari R (2007) Interpersonal similarity as a driver of knowledge sharing within multinational corporations. Int Bus Rev 16:1–22

Martinez JI, Jarillo JC (1989) The evolution of research on coordination mechanisms in multnational corporations. J Int Bus Stud 20:489–514

Martinez JI, Jarillo JC (1991) Coordination demands of international strategies. J Int Bus Stud 22:429–444

Mayer RC, Davis JH, Schoorman FD (1995) An integrative model of organizational trust. Acad Manag Rev 20:709–734

Menz M, Kunisch S, Collis DJ (2015) The corporate headquarters in the contemporary corporation: advancing a multimarket firm perspective. Acad Manag Ann 9:633–714

Milgrom P, Roberts J (1992) Economics, organization and management. Prentice-Hall International, Englewood Cliffs

Monteiro LF, Arvidsson N, Birkinshaw J (2008) Knowledge flows within multinational corporations: explaining subsidiary isolation and its performance implications. Organ Sci 19:90–107

Nahapiet J, Ghoshal S (1998) Social capital, intellectual capital, and the organizational advantage. Acad Manag Rev 23:242–266

Nell PC, Andersson U (2012) The complexity of the business network context and its effect on subsidiary relational (over-)embeddedness. Int Bus Rev 21:1087–1098

Nell PC, Kappen P, Laamanen T (2017) Reconceptualising hierarchies: the disaggregation and dispersion of headquarters in multinational corporations. J Manag Stud 54:1121–1143

Nohria N, Eccles R (1992) Face to face: making network organizations work. In: Nohria N, Eccles R (eds) Networks and organizations. Harvard Business School Press, Cambridge

Nunnally JC, Bernstein IH (1994) Psychometric theory, 3rd edn. McGraw-Hill, New York

O'Donnell SW (2000) Managing foreign subsidiaries: agents of headquarters, or an interdependent network? Strateg Manag J 21:525–548

Perri A, Andersson U, Nell PC, Santangelo GD (2013) Balancing the trade-off between learning prospects and spillover risks: MNC subsidiaries’ vertical linkage patterns in developed countries. J World Bus 48:503–514

Pfeffer J (1987) A resource dependence perspective on interorganizational relations. In: Mizruchi MS, Schwartz M (eds) Intercorporate relations: the structural analysis of business. Cambridge University Press, Cambridge, pp 25–55

Pfeffer J, Salancik GR (1978) The external control of organizations: a resource dependence perspective. Harper and Row, New York

Podsakoff PM, MacKenzie SB, Lee J-Y, Podsakoff NP (2003) Common method biases in behavioral research: a critical review of the literature and recommended remedies. J Appl Psychol 88:879–903

Podsakoff PM, Organ DW (1986) Self-reports in organizational research: problems and prospects. J Manag 12:531–542

Poynter TA (1986) Managing government intervention: a strategy for defending the subsidiary. Columbia J World Bus 21:55–65

Rabbiosi L (2011) Subsidiary roles and reverse knowledge transfer: an investigation of the effects of coordination mechanisms. J Int Manag 17:97–113

Richter NF (2014) Information costs in international business: analyzing the effects of economies of scale, cultural diversity and decentralization. Manag Int Rev 54:171–193

Rindfleisch A, Heide JB (1997) Transaction cost analysis: past, present, and future applications. J Mark 61:30–54

Ronen S, Shenkar O (1985) Clustering countries on attitudinal dimensions: a review and synthesis. Acad Manag Rev 10:435–454

Ronen S, Shenkar O (2013) Mapping world cultures: cluster formation, sources and implications. J Int Bus Stud 44:867–897

Roth K, Schweiger DM, Morrison AJ (1991) Global strategy implementation at the business unit level: operational capabilities and administrative mechanisms. J Int Bus Stud 22:369–402

Schmitt J, Decreton B, Nell PC (2019) How corporate headquarters add value in the digital age. J Organ Des 8(1):9

Schulte Steinberg A, Kunisch S (2016) The agency perspective for studying headquarters-subsidiary relations: an assessment and considerations for future research. Res Glob Strat Manag 17:87–120

Schweiger DM, Atamer T, Calori R (2003) Transnational project teams and networks: making the multinational organization more effective. J World Bus 38:127–140

Sheppard BH, Lewicki RJ, Minton JW (1992) Organizational justice: the search for fairness in the workplace. Macmillan, New York

Strutzenberger A, Ambos TC (2014) Unravelling the subsidiary initiative process: a multilevel approach. Int J Manag Rev 16:314–339

Terpstra V (1977) International product policy: the role of foreign R&D. Columbia J World Bus 12:24–32

Thompson JD (1967) Organizations in action. McGraw-Hill, New York

Tomassen S, Benito GRG (2009) The costs of governance in international companies. Int Bus Rev 18:292–304

Tomassen S, Benito GRG, Lunnan R (2012) Governance costs in foreign direct investments: a MNC headquarters challenge. J Int Manag 18:233–246

Tsai W (2002) Social structure of “coopetition” within a multiunit organization: coordination, competition, and intraorganizational knowledge sharing. Organ Sci 13:179–190

Vardi Y, Wiener V (1996) Misbehavior in organizations: a motivational framework. Organ Sci 7:151–165

Weick KE, Roberts KH (1993) Collective mind in organizations: heedful interrelating on flight decks. Adm Sci Q 38:357–381

Westney DE (2001) Multinational enterprises and cross-border knowledge creation. In: Nonaka I, Nishiguchi T (eds) Knowledge emergence: social, technical, and evolutionary dimensions of knowledge creation. Oxford University Press, Oxford, pp 147–175

Williamson OE (1979) Transaction-cost economics: the governance of contractual relations. J Law Econ 22:233–261

Williamson OE (1985) The economic institutions of capitalism: firms, markets, relational contracting. Free Press, New York

Young D, Goold M (1993) Effective headquarters staff: a guide to size, structure and role of corporate headquarters staff. Ashridge Strategic Management Centre, London

Young D, Goold M, Blanc G, Buehner R, Collis DJ, Eppink J, Tadao K, Seminario GJ (2000) Corporate headquarters: an international analysis of their roles and staffing. Pearson Education, London

Zaheer A, McEvily B, Perrone V (1998) Does trust matter? Exploring the effects of interorganizational and interpersonal trust on performance. Organ Sci 9:141–159

Zimmermann T, Huhle F (2013) Corporate headquarters study 2012 – developing value adding capabilities to overcome the parenting advantage paradox. Roland Berger, Münich

Acknowledgments

We thank the Special Issue Editors; Professors David Collis, Markus Menz, and Sven Kunisch; and two anonymous reviewers for constructive feedback and recommendations. Previous versions of this work were presented at the 2016 Academy of International Business annual conference, New Orleans (LA), and at the 2016 European International Business Academy annual conference, Vienna, Austria.

Funding

Research funding from Norwegian Research Council (the Terrella project) is gratefully acknowledged.

Author information

Authors and Affiliations

Contributions

RL, ST, UA, and GB developed the research idea and wrote the introduction, theory, methods, results, and discussion sections. ST collected the data and performed the statistical analysis. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Appendix 2

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Lunnan, R., Tomassen, S., Andersson, U. et al. Dealing with headquarters in the multinational corporation: a subsidiary perspective on organizing costs. J Org Design 8, 12 (2019). https://doi.org/10.1186/s41469-019-0052-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s41469-019-0052-y