Abstract

This study examined the influence of networks on the development of technological capabilities of 90 technology-based companies (TBCs) graduated by Brazilian incubators. The relational-based view theoretically supported the study. The data were processed via Structural Equation Modeling (SEM). A model with three hypotheses was tested. Two hypotheses were validated, proving that technological and financial networks built by those firms with external agents explained 70.6% of their capacity to innovate. The insertion into technology networks of licensing, universities, suppliers, and consulting shows that the TBCs are making use of relationships of high technical content, which is expected according to previous literature. As for the financial networks, it was observed that the insertion into networks of venture capital and economic subvention demonstrates that the innovation ecosystem presents advancements in the well-known challenge of financial support for technology-based startups. A third hypothesis was not validated, which provides another important finding: the planning effort presented a negative relationship on the technological capability, but a positive relationship on the insertion into relationship networks. This means that only direct planning is not able to support technological capabilities. In other words, planning is more effective when indirectly applied to relational resources of technical and financial networks, rather than when directly applied to technological capabilities. The insertion into technical and financial networks, in turn, positively affects the TBC’s innovation capability. Results demonstrate that this change in planning focus, from inside to outside of the company, could improve technological capabilities in R&D, patent, people, and products. Future studies could investigate the entrepreneur’s competencies in managing networks and further understanding of how networks could be constructed through formal and informal cooperation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Technology-Based Companies (TBCs) are characterized by higher technical and market risks. They are usually created by highly-qualified people, and they tend to demand substantial capital investments (Tidd et al., 2008). They may originate from other companies, universities, or research centers (spin-offs), or they can start their activities connected to incubators of technology bases (Tidd et al., 2008). The post-incubated companies are the focus of this study, in which the entrepreneur’s importance is evident. In the pre-incubation stage, besides having the idea, the entrepreneur has to draw up a business plan, which will show if the idea is feasible or not. Subsequently, incubation is the stage where the entrepreneur starts the product marketing, receives the first financing, builds the organizational routines, and plans the company’s task performance (Fiates et al., 2008). Finally, the third stage of a TBC, the post-incubation stage (its graduation), is the crucial phase for the company’s success. At this stage, the company has already undergone the maximum incubation period and must leave the incubator so that it operates independently. A new set of relationship networks is required in order to improve technological capability and survival.

Technological capability is understood here as all the skills, knowledge, technology, and learning experiences accumulated and developed by the firm, both internally and through external relationships with other institutional players that are oriented to innovation (Bell & Pavitt, 1995). More specifically, technological capability is understood in this study according to four management perspectives: research and development (R&D), inventions patenting, technical staff hiring, and introduction of new products in the market. It is well-known that all these perspectives must be strategically planned (Reichert et al., 2012); for this reason, the current study takes into account a hypothesis relating to planning effort and technological capability. However, the literature suggests more research gaps, as it follows below.

We advocate that, for technological capability, the entrepreneur has to be a networks manager once the company is no longer formally connected to the incubator. The relational-based view theory (Dyer and Singh, 1996) supports this assumption. As for the TBC life cycle, the entrepreneur’s actions require the skills that lead to the founding of the company; this means a significant change, more precisely for creative relationship arrangements that may be needed in so far as technological and financial complexities are emerging (Lee et al., 2001; Collinson & Gregoson 2003; Tahvanainen, 2004; Lichtenthaler, 2005; Dettwiler et al., 2006; Cornnelius & Persson, 2006; Lee & Park, 2006; Dahlstrand, 2007; McAdam & McAdam, 2008; West & Noel, 2009; Jones & Jayawarna, 2010; Cheng & Huizingh, 2014; Du et al., 2014; Fernandes et al., 2017).

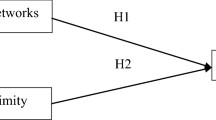

Therefore, the central hypothesis of this paper is that the development of technological capabilities in post-incubated TBCs is associated with insertion into financial and technological networks. These assumptions allowed the proposition of the following research question: “to what extent is the technological capability of post-incubated TBCs dependent on the insertion into financial and technological networks?” Two research objectives were defined: (i) to verify the influence of insertion into financial and technological networks on the technological capability of post-incubated TBCs; and (ii) to verify the influence of planning effort on insertion into financial and technological networks, and on the technological capability of post-incubated TBCs.

We analyzed the data collected from 90 post-incubated TBCs in Brazil using Structural Equation Modeling (SEM). As for the results, we have shown that planning effort is not direct associated with technological capabilities. However, the planning effort used to build technological and financial networks is associated with the development of firm’s technological capabilities.

Our study shows that insertion into networks to engage agents for innovation is essential in the company’s post-incubation stage. This is a great challenge for TBC management, because in the short time from founding to graduation (for example, in Brazil the average is three years), the entrepreneur has to leave the role of innovative and self-sufficient manager, focused on the company’s activities, and be a networks manager. Therefore, with the development of technological capabilities as the objective, the role of a post-incubated TBC’s manager is to plan the insertion into relationship networks. By contrast, the development of technological capabilities of a post-incubated TBC is harmed by a management model characterized by the absence of integration in networks—that is, a model focused only on the entrepreneur’s technical knowledge and on the planning of hierarchical functions in the company.

Our study also shows that the planning effort needs to be guided to construct these relationships, in order to build financial and technological capabilities. Previous studies of TBCs tended to be heavily focused in the early stages of company creation and development (Preece et al., 1999; Knockaert et al., 2010), while our study investigated companies in the post-incubation stage. When focusing on the post-incubation stage, the study confirms that the entrepreneur’s planning is essential for technological capabilities development in TBCs, and ratifies that this stage also requires the development of relational abilities. In management terms, the contribution of this study intends to alert TBCs entrepreneurs, as well as their investors, that in a post-incubation stage a change of competencies is essential to ensure business evolution. If the technical experience was the main resource in the beginning being supplemented by the business planning capability, then the ability to build and manage networks in the post-incubation stage is essential for the development of TBCs’ technological capabilities.

The second section of this study presents the theoretical framework and the research hypotheses. The third and fourth sections present respectively the methodology and the results analysis. Finally, the fifth section presents the conclusions, limitations, and recommendations for future studies.

Theoretical framework

A review of TBCs’ technological capabilities will be presented first, which will allow the introduction of the second topic about relationship networks. A third topic ends the review, presenting the hypothesized relationships among the variables of the study.

Technological capabilities in TBCs

TBCs are, by nature, technology-intensive and innovative companies. Hence, their main intangible asset is a set of technological capabilities, such as skills, knowledge, and experiences, built up not only to operate already-existing production systems but also to generate new products, processes, and services (Figueiredo, 2008). Bell and Pavitt (1995) point out that those capabilities are developed and accumulated through continuous and systematic investments, carried out by the company, of knowledge-based assets. These, in turn, are built by firm’s efforts in research and development (R&D) activities, patenting, product design, production engineering, quality control, personal training, and inter-relationships with external technology suppliers and specialized people (experts) (Lall, 1992; Figueiredo, 2009; Reichert et al., 2012). All these knowledge-based assets (in particular skilled people)—in conjunction with a firm’s financial structure, business strategy, and alliances among other firms or universities—would enable the company to master new technologies and to innovate (OECD, 2005). Thus, TBCs enable a comprehensive analysis of the technological capabilities, since they include diversified complementary efforts and networking strategies for innovation. Technological capability is taken as the dependent variable construct in this study. For the construct definition, we considered the orientation of Reichert et al., (2012), who, after careful theoretical review, defined four indicators for measurement: research and development (R&D), inventions patenting, technical staff hiring, and introduction of new products in the market.

The intensity of efforts undertaken in the construction, absorption, and management of knowledge-based assets will result in different types and levels of technological capabilities (Lall, 1992; Bell & Pavitt, 1995). When considering TBCs specifically at their graduated stage, it is assumed that the organizational skills and particularly the relational competences of the innovative entrepreneur tend to be crucial in integrating the diversity of those learning processes and players (internal and external to the company) involved in technological capacity-building. This is so because even though they have high degree of innovativeness, graduated TBCs are emerging, small-sized companies that generally comes into the market competing with strong brands and larger-sized companies. In this sense, they need not only to legitimize their innovation in the market but also to complement their internal resources and competencies with external sources of knowledge and physical, human, and financial capital (Lee et al., 2001). As a result, the practices of interaction and cooperation in business networks are extremely important for competitiveness and for development of technological capabilities in these companies (La Rocca & Snehota, 2014). In this way, relational capabilities (Dyer & Singh, 1996) to manage external players are essential for graduated TBCs.

Relationship networks in TBCs

For TBCs to survive in the market after graduation, it is necessary to guide the efforts of strategic planning to establish relations with partners, in order to obtain technologies and funding. The image of a lone-wolf entrepreneur that single-handedly solves all problems needs to be discarded, in favor of an image of an entrepreneur responsible for managing networks. This means developing new capabilities related to external relationships (O’Connor & DeMartino, 2006). The objectives of these partnerships with external players involve gaining specific assets, knowledge-sharing routines, and access to complementary resources. Planning efforts need to take into account the ability of managing these networks (Dyer & Singh, 1996). If the TBC can take advantage of the incubator network in the early stages of pre-incubation and incubation, then in the post-incubation stage it is up to the TBC to keep the previously-established relationships while managing a new range of partnerships that enable the acquisition of knowledge and resources to develop their innovation capacity. On the one hand, graduated TBCs need to build partnerships to sustain their commercial or market risks associated with expanding their activities. On the other hand, they need these partnerships to increase their levels of efficiency and market share by developing radical or significantly-improved innovations (Story et al., 2009). If entrepreneurs develop these relational capabilities, they can obtain competitive advantages from learning, from the flow of information, and from the economy of scale (Ebers & Jarillo, 1998). In sum, it is the new ranges of competencies for the entrepreneurs that change the way to manage their enterprises. In the lines below, we present our hypotheses, in order to show how these relational competences are essential for TBC innovativeness.

Hypotheses

Research has shed light on the fact that TBCs are growing more dependent on external knowledge sources (Stam & Wennberg, 2009; Fernandes et al., 2017). For this reason, these companies started to join technological networks, especially those based in knowledge and innovation. These technological networks could be understood according to their: (i) internationalization degree (Autio et al., 2000; Castells, 2000; Chesbrough, 2007; Soetanto & Geenhuizen, 2005); (ii) openness to innovation, from open to closed degree (Chesbrough, 2007; Cheng & Huizingh, 2014; Du et al., 2014); or (iii) orientation, from market to science. The latter orientation was chosen as a construct in this study. In the market orientation, the main agents with whom a company usually maintains technological relationship are customers, suppliers, licensing offices, and consulting companies, among others (Collinson & Gregoson, 2003; Lichtenthaler, 2005; Cheng & Huizingh, 2014). In the science orientation, the main agents are universities, institutes of science and technology (IST), technological incubators, and commercial labs, among others (Lee & Park, 2006; Dahlstrand, 2007; McAdam & McAdam, 2008; Du et al., 2014).

The technological networks help TBCs’ performance and adaptability, and often are vital for these companies’ survival (Collinson & Gregoson, 2003, West & Noel, 2009; Tumelero et al., 2016). Small-sized technology-based companies have greater limitations related to knowledge (Collinson & Gregoson, 2003, West & Noel, 2009). Appropriate integration into a technological network is a powerful investment for a TBC and should not be neglected, once it is clear that a network provides information, knowledge (Elfring & Hulsink, 2003), and/or generation of new capabilities and growth for the company (Macpherson & Holt, 2007). Apprenticeship and innovation via technological networks evolve from the so-called knowledge nodes, through individuals, teams, and interactions, both within and between agents (Castells, 2000; Davenport & Prusak, 1998).

Thus, the more complex the technology, the more TBCs seek cooperation network alternatives. Technological networks can act as capturing sources of many knowledge forms, both tacit and codified (explicit). Knowledge in TBCs converges in the tacit format from the accumulated experience of the entrepreneurs, technicians, and/or scientists; in the explicit format, it converges from formal knowledge of universities and research centers to these companies. However, one also has to assume that other forms of knowledge convergence can be incorporated into these companies activities, such as the knowledge exchange with other companies inserted into incubators as well as suppliers, strategic partners, and their own customer products, in the process of being developed or already being commercialized (Tumelero et al., 2012). The strengthening of informal networks in the learning process, through the convergence of communities that hold the knowledge, will allow relation to one another through common interests (Davenport & Prusak, 1998).

It is feasible that the insertion capability in technological networks is a powerful intangible asset to competitiveness, and it is able to provide knowledge of new markets for products and services to innovations and new business practices (Elfring & Hulsink, 2003). Moreover, external relationships contribute to maintaining sustainable technological capability in the long term (Widding, 2005).

In this way, despite relational risk and partnership governance (that is, the differentiated trajectory that the network association enables), networks tend to present more gains for learning and innovation than losses (Nooteboom, 2000). The ability to combine knowledge, mainly for technological purposes, might be posed as an important competitive advantage. This competence of knowledge appropriation and recombination makes it difficult for other companies to copy such innovative capability (Wernerfelt, 1984).

Is important to note that is not just relationships for technology acquisition that matter to the innovative capacities of a graduated TBC. TBCs need financial capital for innovation, which is achieved through financial networks, another construct object of this study. Other entrepreneurs who want to be co-partners of a TBC (Hogan & Hutson, 2005; Manigart & Struyf, 1997) can own this capital for innovation. However, it is unlikely that TBCs will always have resources from a co-partner for technology investments. As such, it will be necessary to find external sources of financing (Tahvanainen, 2004). Private banks are afraid to invest in TBCs (Huyghebaert & Van de Gucht, 2007). Thus, typical alternatives include public banks or business partners who can make loans or co-investments, especially partners related to a TBC value chain (Jones & Jayawarna, 2010). Despite all these possibilities, venture capital funds are still the main source of funds (Collinson & Gregoson 2003; Cornnelius & Persson, 2006).

In summary, TBCs are constrained by lack of knowledge and lack of funds. As a result, TBCs have to access these resources from others, through relationship networks (Lee et al., 2001; Collinson & Gregoson 2003; Tahvanainen, 2004; Lichtenthaler, 2005; Cornnelius & Persson, 2006; Lee & Park, 2006; Dahlstrand, 2007; McAdam & McAdam, 2008; West & Noel, 2009; Jones & Jayawarna, 2010; Cheng & Huizingh, 2014; Du et al., 2014; Fernandes et al., 2017). For this reason, in the current study, technical (knowledge) and financial networks were chosen as independent variables to be tested. In view of the above arguments, we hypothesized that insertion into financial and technological networks is associated with the technological capability of post-incubated TBCs, as follows:

H1a – The insertion into the financial network is positively associated with the technological capability of post-incubated TBCs.

H1b – The insertion into the technological network is positively associated with the technological capability of post-incubated TBCs.

As already highlighted, the entrepreneur in the pre-incubation phase is largely responsible for the innovation. It is his/her responsibility to search for business opportunity and explain how he/she will take advantage this opportunity (Bhave, 1994). Undoubtedly in this stage, the entrepreneur’s experience is directly associated with the technological capability development. At the moment of incubation, it is up to the entrepreneur to structure the company and plan its growth. Although the association is no longer with the creation of innovation, the concern is to implement the innovation (Reynolds and Miller, 1994). Thus, the association of planning with technological capability development is evident. However, the issue that lingers is the association of these two roles of the entrepreneur, creator and planner, in the stage of TBC graduation. We use the assumption that insertion into external financial and technological networks is an essential condition for the development of technological capabilities; we do not question the role of the entrepreneur in the growth of TBC, especially because Pereira and Sbragia (2004) and Colombo and Grilli (2005) make this condition pretty clear and evident. However, what remains is the direct association of these two entrepreneurial roles with developing technological capability.

In our conception, the entrepreneur’s technical and isolated experience ceases to have direct relevance to technological capability development. It is worth noting that we are not recommending the entrepreneur’s departure, but rather the diffusion of entrepreneurial competence among the company human resources and among external sources, that is, obtained from the network insertion. This means that the competence of the company’s human resources is associated with the planning, the survival, and the maintenance of the company. However, this planning capability is not directly associated with the development of new organizational capabilities (Aspelund et al., 2005; Benzing et al., 2009; Gimmon & Levie, 2010). Studies of technology-based companies (Aspelund et al., 2005; Tumelero et al., 2016) emphasize that the experience of a group of people, including the founders’ experience, allows for making specialized and quick decisions, that is, efficient planning and execution, which becomes an advantage for the new business and therefore increases the likelihood of the company’s survival. In turn, Benzing et al. (2009) state that psychological and personality traits, and technical and managerial competences, of entrepreneurs are elements that may facilitate the survival of a company. However, Gimmon and Levie (2010) and Tumelero et al. (2016) present the effects of human capital in the survival of post-incubated TBCs; it is, in essence, related to the survival of these companies, through the planning and execution of management routines. In short, the entrepreneurial experience—which in the second stage was transferred to the organizational capability of planning and maintaining the organizational functions—is essential for maintaining the company’s functioning as well as ensuring the company’s survival (Gimmon & Levie, 2010; Tumelero et al., 2016).

However, no evidence links the development of technological capability to these planning competences. On the contrary, the evidence shows that it is insertion into the network, and the heterogeneity of the innovation trajectory provided by the multiple network links, that lead to the development of technological capabilities. The role of planning and maintaining the company functioning directs the entrepreneur and his team toward more routine and bureaucratic tasks in such a way that they become averse to all that is new (Nootebbom, 2000). Then, when the company has graduated, the entrepreneur’s planning role should be directed to seeking insertion into financial and technological networks, rather than focusing on organizational innovation in a closed manner, as these networks can lead to technological capability development. This means planning how to overcome the obstacles to building a strong network (Story et al., 2007; Story et al., 2009)—in other words, how to overcome the lack of embeddedness in the external network (Birkinshaw et al., 2007).

A well-planned human resources team of a graduated TBC is one whose role is not only executing and maintaining the organizational routines but, above all, managing insertion into external networks and establishing and maintaining the technological and financial inter-relationships that are essential to stimulating technological innovation capability. In this study, the planning construct was taken in the marketing and strategic view, and was named planning effort. In marketing, as per the classification of Coviello et al. (2000), we consider two managerial dimensions: market (intend) and brand (focus). In strategy, a unified indicator was considered, following the relationship between strategic planning and technological capability as studied by Panda and Ramanathan (1997). Then, the above arguments allowed us hypothesized that:

H2a – The planning effort is positively associated with the insertion into financial network of post-incubated TBCs.

H2b – The planning effort is positively associated with the insertion into technological network of post-incubated TBCs.

H2c – The planning effort is negatively associated with the technological capability of post-incubated TBCs.

Taking into account the above conceptual background, Fig. 1 presents the study’s theoretical model and its respective hypotheses to be tested. As it can be seen, in addition to the relationships established by the hypotheses, it is used to model the entrepreneur’s technical experience as a variable of control in relation to the technological capability development. The arguments previously presented point towards the change of the entrepreneur’s role, to a role more related to the planning of the company’s functions and—at the company’s graduation—to a role of an articulator of inter-organizational relationships. However, at no time was the founder-entrepreneur’s departure proposed; if he now works as a driving piece for the inter-organizational relationships that will lead to the development of technological capabilities, his figure can still interfere or not interfere in this activity. The expectation is that he does have interference, as this would place the entrepreneur more absorbed in the network management, and even if he had ideas, these ideas would be infinitely less voluminous when compared to those arising from the partners. However, the element of being the founder and sometimes the holder of equity and managerial power within the company leads us to put entrepreneurial experience as a control variable before the development of technological capabilities.

Research method

To meet the quantitative approach the survey method was defined for this study (Sampieri et al., 2006). The population was defined as technology-based companies from different economic sectors, located in Brazil, post-incubated by mixed-based and technology-based incubators. The TBCs spent an average time of three years in incubation. We located the contacts of 1025 technology-based companies post-incubated by 73 incubators. The criteria for micro- and small-sized considered companies employing from 0 to 49 people, according to the classification of the Brazilian Institute of Geography and Statistics (IBGE). The final sample was constituted in a non-probabilistic way, since it did not depend on probability or random choice, but from other reasons related to the research features, mainly accessibility to the respondents’ entrepreneurs (Sampieri et al., 2006).

The chosen data-collection instrument was the questionnaire, developed based on the identification of the variable components of each construct in the literature, with the reference being a theoretical conceptual model. Three rounds of pre-testing procedures were properly carried out to eliminate potential problems in the collection instrument, as suggested by Malhotra (2001). In the final version of the instrument, we used an interval scale of 11 points (0 to 10) for all indicators belonging to the independent, dependent, and moderating constructs (Table 1). For demographic questions, an ordinal scale was used.

The data were collected in the year 2013, through the QuestionPro® software. From telephone follow-up up to charging the questionnaires, returning and clarifying questions of potential respondents, we obtained a general sample of 99 responses, representing 9.66% of the total questionnaires sent. Respondents were TBC entrepreneurs and executives. The great majority held a postgraduate degree of Doctorate (31.5%), Lato Sensu/ executive education (22.8%) or Masters (20.7%). The remainder held Higher education (21.7%) and High school (3.3%). From the established criteria and the withdrawal of questionnaires with missing values, we obtained a final sample of 90 valid questionnaires for descriptive analysis and other statistical analysis.

The data were analyzed using the software SmartPLS®. The analyses from the final sample, as from the contributions of Hair Jr. et al. (2009), Henseler et al. (2009), Ringle et al. (2014) and Hair Jr. et al. (2014), were performed through the Structural Equation Modeling (SEM) with estimation by the Partial Least Squares (PLS).

The specifications for the use of the PLS method and modeling via the SmartPLS® were properly followed and no restrictions were observed, as follows: (1) the routes model is recursive, in other words, there is no causal relationship within the model; (2) all latent variable (construct) has at least one assigned indicator; (3) the indicators were assigned only once for each latent variable; and (4) the model consists of only one structure, in other words, there are no multiple unrelated templates.

From Table 1 the categorization of the model components was carried out.

Results

This study obtained 90 valid questionnaires, from which study analyses were carried out. The five main sectors of TBCs’ activity were information technology (33.3%), technology services (16.7%), electro-electronics (16.7%), biotechnology (8.9%), automation (5.6%), and other (18.9%). In terms of size, 74.4% employed between 1 and 19 people, 17.8% employed between 20 and 39 people, and 7.8% employed 40–59 people. Most of the TBCs (90%) were located in the Southeast and South regions, where the important technological poles are located in Brazil.

Structural equation modeling (SEM) with estimations by the partial least squares (PLS)

Considering what Henseler et al. (2009) and Hair Jr. et al. (2014) suggest, we proceeded to the presentation and evaluation of the structural equation modeling results in two stages. The first evaluation was the measurement model from the latent variable statistics, and the second evaluation was the structural model.

Evaluation of the measurement model

The following statistics were performed to evaluate the reflective latent variables of the model: (1) factorial weight, (2) reliability of the internal consistency and convergent validity, and (3) discriminant validity (Henseler et al., 2009, Hair Jr. et al., 2014).

Factorial weight

The factorial weight for analyzing the consistency of the reflective variables consists of the exposition of the load of each reflective variable in the model composition. This statistic is intended to prioritize variables with values above 0.7 (Henseler et al., 2009, Hair Jr. et al., 2014). In the initial tested model, the variables family-friends (0.457) (Financial network), customer (0.388) (Technological network), and incubator (0.420) (Technological network) were excluded from the model due to not presenting factorial weight higher than 0.7.

From the exclusion of the three variables, it was possible to advance to the processing of the second model. The factor loadings can be seen in Table 2.

For presenting factorial weight statistically equal or higher than 0.7, the other variables were kept in the model composition.

Reliability of the internal consistency and of the convergent validity

From the internal consistency and from the convergent validity three indicators are evaluated:

Average Variance Extracted - AVE: it aims to measure the variance proportion of the explained dimension from the variables that comprise it. For the dimension to be valid, values above 0.5 are accepted (Fornel & Larcker, 1981, Hair Jr. et al., 2014).

Composite Reliability: it aims to measure the reliability level of each variable in the dimension construction to which it belongs. For the dimension to have an acceptable degree of reliability, desirable values are above 0.7 (Fornel & Larcker, 1981, Hair Jr. et al., 2014).

Cronbach’s Alpha reliability (α): it is the most remarkable inner-reliability indicator and indirectly estimates the reliability degree where the set of indicators measures a single VL. Values (α) above 0.7 are desirable; however, values above 0.6 are considered acceptable to measure the set of indicators’ reliability (Hair Jr. et al., 2009, Hair Jr. et al., 2014).

In Table 3, it is possible to verify the values of AVE, Composite Reliability, and Cronbach’s Alpha of the latent variables.

It can be seen that the AVE values are higher than 0.5, Reliability Composite are higher than 0.8, and Cronbach’s Alpha are higher than 0.6 for all the latent variables. Such results validate the latent variables for the model composition.

Criteria of discriminant validity

The discriminant validity seeks to demonstrate whether a construct is truly distinct among the other constructs of the model. Two evaluation measures are used:

-

(i).

Cross loadings of indicators. It shows if the load shared with the construct to which the indicator is associated is larger than the loads associated with other constructs.

-

(ii).

Fornell-Larcker criteria. It shows if the square root of the extracted variance from each construct is larger than the correlations with the other constructs.

If both cases are positively verified, then there is discriminant validity of the model (Fornel & Larcker, 1981; Hair Jr. et al., 2014).

Table 2 shows the indicators’ cross loads. It can be seen that the greatest shared load of each indicator is related to the respective constructs to which they are associated. Such results provide a first indication of discriminant validity of the constructs. For the Fornell-Larcker Criterion, the square root of the AVE was evaluated in Table 4.

In Table 4, it is noted that all variables present AVE Square Root values higher than their correlation coefficients, which provide the second and final indication of discriminant validity.

Model validation

Finally, two more statistics were necessary in order to demonstrate the relationships between the constructs and the model validity.

Coefficients of determination

According to Chin (1998) and Hair Jr. et al. (2014), coefficients (beta/β) of R2 = 0.67, 0.33, and 0.19 are considered, respectively, as substantial, moderate, and weak. In Fig. 2, it is possible to verify the present model values of R2.

It can be seen in Fig. 2 that the R2 value equals 0.706 for the dependent variable Technological capability. In presenting a substantial result, it is possible to consider that the determination coefficient is suitable for the model validation. The results indicate that: insertion into financial networks, insertion into technological networks, and planning effort explain 70.6% of the technological capability of the companies surveyed.

Additionally, a value of R2 = 0.167 is observed for the variable financial network, showing that the planning effort influences 16.7% of the insertion into financial networks. An R2 value = 0.260 is also observed for the variable technological network, demonstrating that the planning effort influences 26% of the insertion into technological networks.

Student t-test and verification of the research hypotheses

For the validation of the final model, we observed the estimate for the coefficients which represented the research hypotheses paths. The estimate for the path coefficient was performed using the student t-test and the bootstrapping technique with 500 repetitions. Results can be seen in Fig. 3.

To test the hypotheses, the p-value and path coefficient criteria were chosen. For the p-value, a minimum confidence level of 95% (α = or < 0.05) was defined, what is an error probability equal to or lower than 5%, aiming t-values higher than 1.96. For the path coefficients (Betas), values higher than 0.20 were defined (Hair Jr. et al., 2014). According to Fig. 3, we can conclude:

The value of t = 13.605 > 1.96 and the factorial weight of 0.389 validate H1a, demonstrating that "Insertion into the financial network is positively associated with the technological capability of post-incubated TBCs".

The value of t = 24.597 > 1.96 and the factorial weight of 0.648 validate H1b, demonstrating that "Insertion into technological network is positively associated with the technological capability of post-incubated TBCs".

The value of t = 10.496 > 1.96 and the factorial weight of 0.408 validate H2a, demonstrating that "Planning effort is positively associated with insertion into the financial network of post-incubated TBCs".

The values of t = 13.169 > 1.96 and the factorial weight of 0.510 validate H2b, demonstrating that "Planning effort is positively associated with insertion into the technological network of post-incubated TBCs".

The value of t = 4.835 > 1.96, however, with the factorial weight of − 0.162 does not validate the relationship, and therefore H2c cannot establish an association, either negative or positive, in such a way that the more correct sentence would be that “Planning effort is not associated with the technological capability of post-incubated TBCs".

Except for H2c, the paths present values higher than 1.96 and factorial weight higher than 0.2, which are valid relationships for composing the proposed model. Thus, it is concluded that the model’s positive correlations are valid at a confidence level of 95%.

Discussion

This study aims to answer the following question: “to what extent is the technological capability of post-incubated TBCs dependent on its insertion into financial and technological networks?” When the significant number of endogenous and exogenous variables that possibly influence the technological capability of TBCs is considered, the model results are satisfactory because they demonstrate that insertion into relationship networks influence 70.6% of the technological capability of technology-based companies. This truly significant result is achieved based on the capacity of the SEM technique in capturing greater complexity among different relationships at the same time, as well as on the choice of the indicators of each network construct, which cover important agents of the value chain in the technological and financial fields. In turn, the planning effort in the graduated companies is relevant for the development of technological capabilities, but indirectly, that is, promoting the insertion of the TBC into networks, which will lead to technological capability.

Supporting the research question, we defined research objective one: “to verify the influence of insertion into financial and technological networks on the technological capability of post-incubated TBCs”. To achieve this objective, hypothesis H1a and H1b were proposed and validated, proving that both financial and technological networks positively influence the technological capability of post-incubated TBCs. The literature is clear when describing relationships between insertion into social networks and business results. However, the theoretical gap investigated in this study presents findings related to the more specific importance of these networks’ integration on technological capability. This reinforces the theory of relational-based view (Dyer and Singh, 1996), whose guidance is the study of the importance of relational resources in businesses’ performance and competitiveness.

It is important to emphasize that this study did not aim to check to what extent network insertion was formalized or not. The rationale is clear, in that companies are dynamic organizations comprised of and operated by people. This means that, either through a contract or through creative conversations, relationships can and should occur freely between individuals and companies, according to the convergence of interests.

Related to the technological capability construct, the fact that TBCs are no longer in formal relationship with the incubator, physically or virtually, justifies the non-validation of the incubator variable. While the relationship between incubator and TBC would be beneficial, even after graduation, the fact is that TBCs start to form new relationship arrangements, and the maintenance of this old relationship (incubator and TBC) could decrease in intensity, since the incubator has already fulfilled its protective role of the incubated company. The relationship opportunity turns now to other players in the company’s network. The non-validation of the customer variable shows that the TBCs surveyed are taking advantage of upstream relationships in the value chain, since the relationship with suppliers has been validated and the relationship with consumers has not.

The insertion into technological relationship networks stood out as the most influential variable in the technological capability of the surveyed TBCs. Technology networks with companies for licensing, university laboratories, technical consulting, and suppliers show that TBCs are resorting to relationships with nodes of high technological knowledge, which makes sense for companies based on highly sophisticated, advanced, and updated technological innovations. These are transversal relationships, which in turn strengthen new technological arrangements, particularly of open innovation processes. The relationship validation with universities stands out, given the well-known complexity of the relationships of these universities with small businesses. A relationship with universities is already known to be a difficult task for large companies with sufficient availability of resources for the establishment of such relationships. This reality is not only of the Brazilian National System of Science, Technology and Innovation (NSCT&I), but it is also a challenge pointed out in the literature of other more technologically-advanced countries as well.

As for the financial networks, it was observed that the non-validation of the family-friends variable demonstrates that the companies did not prioritize the finance capital network of family and friends in the post-incubation stage. Insertion into venture capital networks and into economic subvention networks show that Brazil’s innovation ecosystem presents advancements in the known challenge of financial support to technology-based startups. This is due to government policies for support via federal government agencies such as the National Council for Scientific and Technological Development (CNPq) and the Financier of Studies and Projects (FINEP), and via state agencies, such as the foundations of support to research (FSRs). However, in the private sector, the support of the “angel investor” stands out, a fairly recent network in the Brazilian innovation ecosystem, but which may be making a significant difference in the financing for startups.

On the other hand, it is known that the entrepreneur may be making use of the equity capital that comes from his/her personal savings and loans. This variable, however, was not an object of verification, since the purpose of the study was to verify the activation of capital via relationship networks.

To further support the research question, we defined research objective two: “to verify the influence of the planning effort in insertion into financial and technological networks, and in the technological capability of post-incubated TBCs”.

To achieve this objective, hypotheses H2a, H2b, and H2c were proposed. Hypothesis H2a and H2b were validated, proving that planning effort is positively associated with the insertion into both financial and technological networks of post-incubated TBCs. However, hypothesis H2c was not validated, proving that planning effort is not directly associated with the technological capability of post-incubated TBCs.

This finding of the study, on the influence of the planning effort over the other proposed variables, is noteworthy. The negative relationship between planning effort and technological capability demonstrates that the planning itself is not directly influential. In other words, relationships need to be planned. Planning is undoubtedly a remarkable entrepreneurial competence. Even when the operating characteristic with high technological risk is considered, and the strategy of a TBC is, in large part, emerging, the need to plan is noticed. It is known that the reality is complex and dynamic, yet from having to emerge and to deconstruct itself at every moment, the planning continues to be the basis for a TBC’s performance.

The whole context of networks hitherto depicted could be being controlled by an important feature of a technology-based entrepreneur: his/her technical experience. This arrangement as control variable was not validated in this study. Obviously, it is not possible to state that the entrepreneur’s technical experience is not important to technological capability. With the results of the study, it involves only saying that, in the sample of the surveyed companies, the technological capability did not directly depend on this variable. It is possible to assume that the technological capability of a graduated TBC is less dependent on the entrepreneur’s knowledge itself and more dependent on the entrepreneur’s competence in planning and in articulating financial and technological networks.

To finalize the discussions, we highlight the limitations. The results are restricted to the sample of post-incubated TBCs, and, in light of statistics, they should not be expanded to the universe of companies operating in traditional sectors and of medium and large sizes.

Conclusions

In managerial terms, the change in the entrepreneur’s role is evident at the time the TBC gets its graduation. The development of technological capabilities is not the result of isolated efforts of this entrepreneur based on his/her technical and past experience, but rather is articulated through his/her role as master articulator of strategic planning. It is up to the entrepreneur at this stage of the TBC to be a manager of networks. His/her core function is to plan the company’s routines for its survival and to plan inter-organizational relationships, in order to afford the development of new technological capabilities.

In academic terms, the study is an important contribution to understanding the entrepreneur’s role in TBCs. The studies of Aspelund et al. (2005), Colombo and Grilli (2005), Benzing et al. (2009), and Gimmon and Levie (2010) unequivocally show the entrepreneur’s importance for the TBC’s survival. Our study supports the importance of the entrepreneur for TBCs and adds an important result in this direction: the entrepreneur’s role in graduated TBCs is no longer the role of direct agent of innovation. Our study shows that the survival of the company, when measured by technological capabilities development, depends on the entrepreneur’s role as a planner of inter-organizational relationships. It is clear that what leads here to innovation are the inputs coming from the technological and financial partnerships; innovation is no longer closed and it becomes cooperative. Furthermore, this result shows that the understanding of TBCs undergoing incubation needs to be analyzed at its different moments – pre-incubation, incubation and graduation - because the entrepreneur’s role in relation to organizational innovation changes at each stage.

Finally, future research can be recommended based on these conclusions. Opportunities for further studies are identified in order to investigate the entrepreneur’s competencies to manage networks and to understand how networks could be constructed through formal and informal cooperation. In addition, further studies could focus on how insertion into networks influences TBCs’ economic performance. Other studies may also show how the insertion into networks gives legitimacy to the TBCs before its stakeholders and enables cooperation in research and development (R & D).

References

Aspelund, A, Berg-Utby, T, Skjevdal, R. (2005). Initial resourcesʼ influence on new venture survival: A longitudinal study of new technology-based firms. Technovation, 25(11), 1337–1347.

Autio, E, Sapienza, HJ, Almeida, JG. (2000). Effects of age at entry, knowledge intensity and imitability on internacional growth. Academy of Management Journal, 43(5), 909–924.

Bell, M, & Pavitt, K (1995). The development of technological capabilities. In I. U. Haque, Trade, Technology and International Competitiveness (p. 69–101). Washington, D.C: EDI Development Studies.

Benzing, C, Chu, HM, Kara, O. (2009). Entrepreneurs in Turkey: A factor analysis of motivations, success factors, and problems. Journal of Small Business Management, 47(1), 58–91.

Bhave, MP. (1994). A process model of entrepreneurial venture creation. Journal of Business Venturing, 9(3), 223–242.

Birkinshaw, J, Bessant, J, Delbridge, R. (2007). Finding, forming, and performing: Creating networks for discontinuous innovation. California Management Review, 49(3), 67–84.

Castells, M (2000). A Sociedade em Rede. São Paulo: Paz e Terra.

Cheng, CCJ, & Huizingh, KRE. (2014). When is open innovation beneficial? The role of strategic orientation. Product Development & Management Association, 31(6), 1235–1253.

Chesbrough, HW. (2007). Why companies should have open business models. MIT Sloan Management Review, 48(2), 22–32.

Chin, WW. (1998). Issues and opinions on SEM. Management Information Systems Quarterly, 22(1), vii–xvi.

Collinson, S, & Gregson, G. (2003). Knowledge networks for new technology-based firms: An international comparison of local entrepreneurship promotion. R&D Management, 33(2), 189–208.

Colombo, MG, & Grilli, L. (2005). Founders’ human capital and the growth of new technology-based firms: A competence-based view. Research Policy, 34(6), 795–816.

Cornnelius, B, & Persson, O. (2006). Who’s who in venture capital research. Technovation, 26(2), 142–150.

Coviello, NE, Brodie, RJ, Munro, HJ. (2000). An investigation of marketing practice by firm size. Journal of Business Venturing., 15(5–6), 523–545.

Dahlstrand, AL. (2007). Technology-based entrepreneurship and regional development: The case of Sweden. European Business Review, 19(5), 373–386.

Davenport, T, & Prusak, L (1998). Conhecimento empresarial: como as organizações gerenciam o seu capital intelectual. Rio de Janeiro: Campus.

Dettwiler, P, Lindelof, P, Lofsten, H. (2006). Utility of location: A comparative survey between small new technology-based firms located on and off science parks—Implications for facilities management. Technovation, 26(4), 506–517.

Du, J, Leten, B, Vanhaverbeke, W. (2014). Managing open innovation projects with science-based and market-based partners. Research Policy, 43(5), 828–840.

Dyer, JH, & Singh, H. (1996). The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Academy of Management, 23(4), 660–679.

Ebers, M, & Jarillo, JC. (1998). The construction, forms, and consequences of industry networks. International Studies of Management & Organization, 27(4), 3–21.

Elfring, T, & Hulsink, W. (2003). Networks in entrepreneurship: The case of high-technology firms. Small Business Economics, 21(4), 409–422.

Fernandes, CC, Oliveira Jr, MM, Sbragia, R, Borini, FM. (2017). Strategic assets in technology-based incubators in Brazil. European Journal of Innovation Management, 20(1), 153–170.

Fiates, JEA, Souza, AR, Chieriguini, T, Prim, CH, Ueno, AT. (2008). Modelo de aceleração do desenvolvimento de empresas de base tecnológica: Da geração da ideia à consolidação do negócio. Locus Científico, 2(8), 54–62.

Figueiredo, P (2009). Gestão da inovação: conceitos, métricas e experiências de empresas no Brasil. Rio de Janeiro: LTC.

Figueiredo, PN. (2008). Industrial policy changes and firm-level technological capability development: Evidence from northern Brazil. World Development, 36(1), 55–88.

Fornel, C, & Larcker, D. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing, 18(1), 39–50.

Gimmon, E, & Levie, J. (2010). Founder’s human capital, external investment, and the survival of new technology based ventures. Research Policy, 39(9), 1214–1226.

Hair Jr, F, Black, WC, Babin, BJ, Anderson, RE, Tatham, RL (2009). Análise multivariada de dados, (6th ed., ). Porto Alegre: Bookman.

Hair Jr, FJ, Hult, GTM, Ringle, CM, Sarstedt, M (2014). A primer on partial least squares structural equation modelling (PLS-SEM). California: Sage Publications.

Henseler, J, Ringle, CM, Sinkovics, RR. (2009). The use of partial least squares path modeling in international marketing. Advances in International Marketing, 20, 277–319.

Hogan, T, & Hutson, E. (2005). Capital structure in new technology-based firms: Evidence from the Irish software sector. Global Finance Journal, 15(3), 369–387.

Huyghebaert, N, & Van de Gucht, LM. (2007). The determinants of financial structure: New insights from business start-ups. European Financial Management, 13(1), 101–133.

Jones, O, & Jayawarna, D. (2010). Resourcing new businesses: Social networks, bootstrapping and firm performance. Venture Capital, 12(2), 127–152.

Knockaert, M, Clarysse, B, Wright, M. (2010). The extent and nature of heterogeneity of venture capital selection behavior in new technology-based firms. R&D Management, 40(4), 357–371.

La Rocca, A, & Snehota, I. (2014). Relating in business networks: Innovation in practice. Industrial Marketing Management, 43(3), 441–447.

Lall, S. (1992). Technological capabilities and industrialization. World Development, 20(2), 165–186.

Lee, C, Lee, K, Pennings, JM. (2001). Internal capabilities, external networks, and performance: A study on technology-based ventures. Strategic Management Journal, 22(6–7), 615–640.

Lee, D-L, & Park, C. (2006). Research and development linkages in a national innovation system: Factors affecting success and failure in Korea. Technovation, 26(9), 1045–1054.

Lichtenthaler, U. (2005). External commercialization of knowledge: Review and research agenda. International Journal of Management Review, 7(4), 231–255.

Macpherson, A, & Holt, R. (2007). Knowledge, learning and small firm growth: A systematic review of the evidence. Research Policy, 36(2), 172–192.

Malhotra, N (2001). Pesquisa de marketing: uma orientação aplicada, (3rd ed., ). Porto Alegre: Bookman.

Manigart, S, & Struyf, C. (1997). Financing high technology startups in Belgium: An explorative study. Small Business Economics, 9(2), 125–135.

McAdam, M, & McAdam, R. (2008). High tech start-ups in university Science Park incubators: The relationship between the start-up's lifecycle progression and use of the incubator's resources. Technovation, 28(5), 277–290.

Nooteboom, B. (2000). Learning and innovation in organizations and economies. New York: Oxford University Press.

O’Connor, GC, & DeMartino, R. (2006). Organizing for radical innovation: An exploratory study of the structural aspects of RI management systems in large established firms. The Journal of Product Innovation Management, 23(6), 475–497.

OECD. (2005). Oslo Manual: Guidelines for collecting and interpreting innovation data: OECD publishing.

Panda, H, & Ramanathan, K. (1997). Technological capability assessment as an input for strategic planning: Case studies at Electricite de France and Electricity Generating Authority of Thailand. Technovation, 17(7), 359–390.

Pereira, ECS, & Sbragia, R. (2004). Determinantes de êxito de empresas tecnológicas de base universitária: um estudo de casos múltiplos no âmbito do CIETEC/USP. Revista Espacios Digital, 25(3), 5–20.

Preece, SB, Miles, G, Baetz, MC. (1999). Explaining the international intensity and global diversity of early-stage technology-based firms. Journal of Business Venturing, 14(3), 259–281.

Reichert, F. M., Zawislak, P. A., & Pufal, N. A. (2012). Os 4Ps da capacidade tecnológica – uma análise de indicadores de medição. XXVII Simpósio de Gestão da Inovação Tecnológica.

Reynolds, PD, & Miller, B. (1994). New firm gestation: Conception, birth and implications for research. Journal of Business Venturing, 7(5), 405–417.

Ringle, CM, Silva, D, Bido, D. (2014). Modelagem em equações estruturais com utilização do SmartPLS. Brazilian Journal of Marketing, 13(2), 54–71.

Sampieri, RH, Collado, CF, Lucio, PB (2006). Metodologia de pesquisa, (3rd ed., ). São Paulo: Mcgraw-Hill.

Soetanto, D., & Geenhuizen, M. V. (2005). Technology incubators as nodes in knowledge networks. 45th Congress of the European Regional Science Association. Land Use and Water Management in a Sustainable Network Society. Amsterdam: Free University Amsterdam.

Stam, E, & Wennberg, K. (2009). The roles of R&D in new firm growth. Small Business Economics, 33(1), 77–89.

Story, V, Hart, S, O’Malley, L. (2009). Relational resources and competences for radical product innovation. Journal of Marketing Management, 25(5–6), 461–481.

Story, VM, Cameron, EC, Walsh, K (2007). The Importance of Relationships and Networks for Successful Radical Innovation. In Exploiting the b2b knowledge network: new perspectives and core concepts, 23rd Industrial Marketing and Purchasing (IMP) Conference.

Tahvanainen, AJ. (2004). Growth inhibitors of entrepreneurial academic spin-offs: The case of Finnish biotechnology. International Journal of Innovation and Technology Management, 1(4), 455–475.

Tidd, J, Bessant, J, Pavitt, K (2008). Gestão da Inovação, (3rd ed., ). Porto Alegre: Bookman.

Tumelero, C, Santos, SA, Kuniyoshi, MS. (2016). Sobrevivência de empresas de base tecnológica pós-incubadas: estudo sobre a ação empreendedora na mobilização e uso de recursos. REGE - Revista de Gestão, 23(1), 31–40.

Tumelero, C, Santos, SA, Plonsky, GA. (2012). Technological innovation in intensive companies in the use of technical and scientific knowledge: A study from the resource based view (RBV). RAI: Revista de Administração e Inovação, 9(4), 202–220.

Wernerfelt, B. (1984). Resource based view of the firm. Strategic Management Journal, 5(2), 171–180.

West, GP, & Noel, TW. (2009). The impact of knowledge resources on new venture performance. Journal of Small Business Management, 47(1), 1–22.

Widding, LOO. (2005). Building entrepreneurial knowledge reservoirs. Journal of Small Business and Enterprise Development, 4(12), 595–612.

Author information

Authors and Affiliations

Contributions

CT conceived the study, participated in its design and theoretical review, performed the statistical analysis and drafted the manuscript. RS participated in the coordination and design of the study and in the sequence alignment. FB participated in the design of the study, sequence alignment and in the statistical analysis. EF participated in the design of the study, sequence alignment and theoretical review. All authors read, reviewed the intermediate versions and approved the final version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Tumelero, C., Sbragia, R., Borini, F.M. et al. The role of networks in technological capability: a technology-based companies perspective. J Glob Entrepr Res 8, 7 (2018). https://doi.org/10.1186/s40497-018-0095-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40497-018-0095-5