Abstract

We undertake to estimate the effects of real exchange rate misalignment and regional integration on the service sector performance in selected countries from East Africa during the period of 1991–2017. The main findings, based on the traditional Pooled Mean Group ARDL technique as well as the alternative panel Cross-Sectional Autoregressive distributed lag (CS-ARDL) approach render support for an undervaluation-led services sector performance as well as the importance of regional integration in the observed linkage. Additional evidence reveals that both the monetary policy and the fiscal policy are key channels via which currency undervaluation impacts on the services sector output. The existence of non-linearities in an inverted U-shaped curve is equally confirmed in the data, where small and moderate undervaluations spur service sector performance just as large undervaluations after some threshold hinder it. Exchange rate volatility is found detrimental to the services sector in the long run. Policies that would help promote the underlying catalysts of undervaluation, curtail exchange rate volatility as well as those that promote deeper regional integration should be strengthened. Likewise, undervaluation policies would yield optimal benefits to the services sector once they are accompanied by well-calculated monetary and fiscal policies.

Similar content being viewed by others

1 Introduction

The merits and costs, as well as consequences of real exchange rate misalignment are well-highlighted in literature (e.g., Rapetti 2020; Contractor 2019; Ndlela 2010) but their implications for sectoral growth are still unclear in the empirics. Nonetheless, theory contends that by distorting resource allocation away from productive activities, sustained real exchange rate overvaluation will eventually lead to drastic adjustments of relative prices and reduction of aggregate economic growth (Ndlela 2010). Additionally, overvalued exchange rates are known to potentially undermine exports, harm agriculture, services and the industrial sectors, stimulate imports, breed protection against imports, promote rent-seeking economies, and to destabilize the capital account as well as often precipitating debt crises (Rodrik 2008).

For the services sector in particular, an overvalued exchange rate is likely to adversely affect components such as the tourism (Dubas 2009), whereby the tourism-dependent countries suffer loss in export revenues as local currency is overvalued, making these countries undesirable destinations for international tourists. On the contrary, an undervalued currency is credited not only for reducing unemployment and lowering the risk of financial crises (Steinberg 2015), but also acting as an implicit subsidy to firms that sell abroad (The Economist 2020). While in the services sector, an undervalued currency may attract tourists to the country since it becomes cheaper for them to visit, consequently leading to more foreign exchange flowing into the country, undervaluation could be considered anathema to firms in the service sector given its likelihood of upscaling their costs without improving their competitiveness (Steinberg 2015). For industries that rely on some imported inputs, and others that borrow from foreign banks to finance their investments in services, the effect of undervaluation may be deleterious. Nevertheless, the empirical association between undervaluation and sectoral performance is still an inconclusive debate.

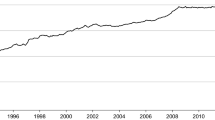

The main purpose of the current study is to examine the effect of undervaluation on the service sector performance in East Africa, a region that is now considered the fastest growing in the world, with the services sector, which includes everything from finance, insurance, communication, restaurants and tourism to real estate, and therefore an archetypal nontradable sector, taking the lead (UNECA 2018). For example, the regional statistics for the year 2018 indicate that the sector dominated the composition of GDP, averaging 59% and only followed by the agricultural sector, averaging 25.7%. The average contribution of the service sector to GDP over the period 1991–2017, was 42.9% followed by the agricultural sector with 30.7% and the manufacturing sector with 7.8% and industrial sector at 18.2%. In fact, a steady performance of the sector is witnessed since 1991 when it contributed about 39% to GDP, proceeding to 42.3%, 45.7% and 59% in 2001, 2011, and 2018 respectively, compared to a deteriorating contribution from the agriculture and manufacturing sectors that in 1991, 2001, 2011, and 2017, respectively stood at 10%, 6.8%, 8.4% and 6.7%, for the latter, and 37.4%, 29.7%, 26.1% and 29.8% for the former sector. This relatively better performance of the service sector has taken place against a backdrop of a weakening currency and growing interest in deeper regional integration that begun with the signing of the treaty for the establishment of the East African Community by the heads of State of Kenya, Tanzania and Uganda in November 1999, and the coming into force of the same in July 2000.

While a plethora of studies document findings in support of an undervaluation-real-exchange-led growth (e.g., Seraj and Coskuner 2021; Missio et al. 2015; Couharde and Sallenave 2013), empirical support underpinning the negative growth impact of undervalued and overvalued exchange rate is equally traceable (e.g., Mbaye 2013; Conrad and Jagessar 2018). On the contrary, a later study by Brixiová and Ncube (2014) finds no evidence of a facilitative role of undervaluation, where the latter is measured from the stock flow approach. Yet, arguments in defense of an overvalued find basis too in literature (e.g., Steinberg 2010; Dutta and Leon 2002). The exact explanation for the divergences is not straight forward but as Rapetti et al. (2012) suggest, the source of diversion appears entrenched in sample differences as well as measurement variations and the type of growth indicator selected (Mazorodze and Tewari 2018).

We consider the above issues central in the current study. First, we explore one sector at a regional level to determine both the shortrun and longrun effects of undervaluation, taking into consideration both endogeneity and heterogeneity as well as homogeneity issues in addition to cross-sectional dependence among countries. More importantly, and as a nuance to the study, we additionally investigate both the direct and indirect effects of regional integration on the service sector performance, as well as the feedback effects from the monetary and fiscal policy. Previous studies have mainly focused on the savings channel (e.g., Levy-Yeyati and Sturzenegger 2007), the capital accumulation channel (e.g., Mazorodze and Tewari 2018), as well as the currency regime channel (e.g., Brixiová and Ncube 2014), and, total factor productivity channel (e.g., Mbaye 2013). Finally, given the documented evidence in previous studies such as Mazorodze and Tewari (2018), of a non-linear effect of currency or exchange rate misalignment on economic growth, we also test for this possibility in our data.

The contribution of the above analysis falls into various categories. First, it is envisaged that the findings from our study could provide an evidence-base for relevant policies directed towards the relevant sector rather than would have been the case where a one-size-fits-all-blanket policy would emanate from aggregating sectors together. For, we argue that different sectors are affected differently by undervaluation/overvaluation, thus justifying a sector-wide approach. On the other hand, the study outcome could add to the scanty evidence in existence for East Africa, in addition to providing avenues for further research. In a region that entertains the hope of becoming a monetary union, where an adoption of a single currency is on the agenda in an effort to foster deeper integration and better manage the prices of goods and services, understanding the dynamics of the exchange rate movement for specific sectors is critical for the future stability of the East African Monetary Union (EAMU).

The main conclusion is that there is significant influence of undervaluation as well as regional integration and real exchange volatility on services sector performance. The East Africa community as well as monetary and fiscal policy channels play a critical role in the undervaluation-services sector linkage. We also note that the relationship between currency undervaluation and service sector performance follows an inverted U-shaped curve, whereby beyond a threshold of about 6.3, the undervaluation effect turns out negative, otherwise smaller and moderate undervaluation from about 1–6.3 is still good for the service sector development in the selected EAC countries.

In the next section, is the review of literature, followed by the methodological section incorporation data and the estimation strategy. Section 4 then entails the results and discussion while Sect. 5 concludes.

2 Empirical literature

There exists a plethora of literature investigating the association between real exchange rate and economic growth albeit divergent and often conflicting. For example, in Aguirre and Calderón (2005), real exchange rate misalignments are found to hinder growth but the effect is non-linear in 60 countries over the period 1965–2003. A seminal work by Rodrik (2008) also observes that in the seven high growth rate countries over the period 1950–2004, while overvaluation hurts growth, undervaluation enhances it. Similarly, a study by Mbaye (2013) on a sample of 72 countries over 1970–2008 finds that a 10% increase in undervaluation enhances growth on average by 0.14% via an improvement in total factor productivity. In Rapetti et al. (2012) too, the effect of currency undervaluation on growth is found positive, larger and more robust for developing economies. Likewise, Bermúdez and Dabús (2018), using a wide sample of countries over the period 1960–2009 and the system-GMM estimation technique, records evidence of a positive link between an undervalued RER and growth but only for non-industrial countries that fall in the upper-middle and high income categories. Similar findings of a positive undervaluation effect are documented in Elbadawi et al. (2012), Missio et al. (2015), Couharde and Sallenave (2013). Conrad and Jagessar (2018) on the other hand documents a negative growth effect of undervaluation for Trinidad and Tobago over the period 1960 to 2016.

A recent study by Seraj and Coskuner (2021) reproduces the work of Dani Rodrik on real exchange rate undervaluation and economic growth for 93 countries over the period 1990–2018. Still here, in line with Rodrik’s conclusions, the authors find undervaluation to significantly impact economic growth. However, the results from the fundamental equilibrium exchange rate model are observed to be more significant than those of Balassa–Samuelson-based Rodrik approach. Additionally, the first lag of undervaluation is found to exhibit a significant effect on economic growth. On the other hand, Rapetti (2020) found a positive relationship between real exchange rate volatility on economic growth for developing countries in particular. Nevertheless, the author notes a negative effect of real exchange rate volatility and economic growth. An earlier study by Habib et al. (2017), based on a 5-year average data for a panel of over 150 countries in the post Bretton Woods period, similarly documents a positive effect of real exchange rate depreciation on annual growth of gross domestic output, just as real appreciation is found to reduce significantly annual real GDP growth for developing countries.

On the contrary, sectoral studies on the effects of real exchange rate misalignment are scarce but also differ in their findings. For example, a recent study by Mazorodze and Tewari (2018), adopts a system generalized method of moments (GMM) approach on South African data spanning from 1984 to 2014 to register a positive impact of undervaluation on sectoral growth up to a point beyond which a retardation in growth takes course. The influence of capital accumulation is likewise found significant in the observed linkage. These findings are in line with an earlier analysis by Njindan Iyke (2017), who decomposes the South African economy into the agriculture, industry and services sectors and, with the help of the Ordinary least squares (OLS) and GMM estimation techniques finds that during the period 1962–2014, real exchange rate undervaluation exerted a positive effect on the agriculture as well as the industrial sectors, but a negative effect on the services sector. It is interesting to note that while Njindan Iyke (2017) provides evidence for a positive undervaluation effect on the agriculture sector, an earlier study by Rodrik (2008) documents a contrary finding for a similar sector. In Zimbabwe however, during the period stretching from 1980 to 2003, results obtained from a feasible generalized least squares (FGLS) framework, which does not adequately address problems of endogeneity, Masunda (2011) finds a significant deleterious role of undervaluation on agriculture, mining and manufacturing sectors.

On the other hand, a later study still on Zimbabwe by Brixiová and Ncube (2014) reveals detrimental role played by overvalued exchange rates on the same sectors, viz., agriculture, mining and manufacturing sectoral growth but find no evidence of a facilitative role of undervaluation measured from the stock flow approach. Also in their analysis of 39 Latin American countries during the period 1995–2008, Vaz and Baer (2014), find that currency undervaluation had significantly positive effect of the 22 2-digit manufacturing sector growth. Similarly, Freund and Pierola (2008) report a positive real exchange rate undervaluation effect on the manufacturing exports in developing countries, but a less pronounced role of exchange rate for developed economies. Likewise, Nouira et al. (2011), document a positive effect of undervaluation on price competitiveness of manufactured exports for 52 developing countries over the period 1991–2005. A related study by Ozyurt (2013), using a panel of 66 countries over the period 1983–2007, and basing on alternative measures of currency misalignment show that in addition to productivity and income per capita, an undervalued currency significantly drives the total employment share of services, but exerts a negative impact on the development of a service sector.

Meanwhile, Ybrayev (2021), with focus on Kazakhstan between 2009 and 2019, show that a 10% undervaluation of the real exchange rate (RER) leads to a 0.05% points increase in the growth rate of manufacturing exports. Similarly, the study notes that a one percent increase in RER leads to a 0.08% points growth in primary products industries, whereas a depreciation of the RER by one percent is found to lead to a rise of 0.14% points in the growth rate of high-tech manufacturing industries. The development of capital-intensive sectors is observed adversely affected by a highly volatile exchange rate regime of the exchange rate. An earlier study by Masunda (2011) finds a significant deleterious role of undervaluation on agriculture, mining and manufacturing sectors. Elsewhers in Ozyurt (2013), however, an undervalued currency is observed to exert a negative impact on the development of a service sector.

Overall, apart from Njindan Iyke (2017), Mazorodze and Tewari (2018), and Ozyurt (2013), the other studies, though informative, never address the services sector directly but focus on the manufacturing, agricultural and mining sectors, if not aggregate economic growth. Nevertheless, the majority center around individual countries and less any East African country. To our knowledge, the East African Community as a region is not represented, despite the need to understand the dynamics of undervaluation for the region given the unique trends of exchange rate movements vis a vis service sector performance amidst growing attention for deeper integration, as earlier discussed. More important, missing channels in literature, viz., the monetary and fiscal policy as well as the regional integration channels, would help explain further the linkage between undervaluation and service sector performance. Unlike the previous studies, we implement our strategy by employing an estimation technique that affords us to capture both the shortrun and longrun effects of undervaluation on a non-aggregated output, to escape aggregation bias, while taking into consideration endogeneity, heterogeneity, homogeneity as well as cross-dependency issues. The panel auto-regressive distributed lag (ARDL) explored later, is well-known to achieve these benefits amidst a small sample size relative to time periods (Pesaran et al. 2001) as in our case. The majority of the existing studies have adopted techniques (e.g., FGLS, OLS) that fail to take into consideration these important issues, yet they affect the reliability and consistency of the findings.

3 Empirical model, data and methodology

3.1 Empirical model

To determine the nature of exchange rate misalignment, we follow three steps as in previous studies (e.g., Rodrik 2008; Mazorodze and Tewari 2018). Step one encompasses a calculation of the real exchange rate (RXRAT) via the purchasing power parity (PPP) conversion factor. Specifically, step one is represented in the Eq. (1):

Here \(i\) denotes country and \(t\) is time period. The exchange rate (XRAT) and PPP are each expressed in the national currency units per US dollar. For the currency to be termed more depreciated than the is indicated by purchasing-power parity, the value of RXRAT would have to be greater unity.

Next, we regress he computed real exchange rate on real GDP per capita (RGDPPC) for purposes of controlling for the Balassa-Samuelson effect, since non-traded goods (and services) are in practice normally cheaper in poorer countries relative to rich countries (Choi et al. 2018). In consideration of this factor, the subsequent equation then turns out to be:

where \(v_{t}\) is time fixed effects and \(\varepsilon_{it}\) denotes the error term. Equation (2) is estimated using the auto regressive distributed lag (ARDL) model to take care of the lagged effect of the dependent variable as well as RGDPPC.

In the last step, undervaluation/overvaluation (misalignment) is calculated as the difference between the actual real exchange rate and the value of the predicted real exchange rate. The specification is:

where, \({\text{VRER\_DEV}}\) denotes valuation, which can either be under- or overvaluation. The expression (3) enables comparison of misalignment of real exchange rate across countries as well as over time; when the value index exceeds one, the currency is said to be undervalued; otherwise overvalued if below one. \(\overline{{{\text{RXRAT}}}}\) are the predicted values of real exchange rate (logged if non-negative).

The basic estimation equation to evaluate the effect of real exchange rate undervaluation on the one hand, and regional integration on the other, on service sector output takes the form:

Here \(Y_{it}\) is our dependent variable, the service sector performance, proxied by services value added share of GDP; \(Y_{it - 1}\) is the convergence term (i.e. initial income level); \({\text{EAC}}\) is a dummy for membership to the East African Community; the period before a country joined the integration is considered 0, otherwise 1; \(X\) is a vector of standard fundamental output determinants (control variables) here limited to key sector-specific factors, viz., labor and capital, proxied respectively by employment in the service sector and gross fixed capital formation.

To control for macroeconomic instability, the model also includes the rate of inflation and GDP per capital growth. In a separate variant regression, we incorporate fiscal policy and monetary policy proxied respectively by government expenditure and money supply (M2) to examine the extent to which they mediate the observed relationship between undervaluation and service sector performance. \(\gamma ,\,\beta ,\,\theta ,\,\varpi\) are the slope coefficients, while \(\kappa\) is the constant term; \(\varepsilon_{it}\) is the error term. A priori, we expect a positive sign on the relevant coefficient of capital since in theory investment has a positive multiplier effect, adding up to the existing capital stock, and thereby facilitate increased output. Similarly, in accordance with standard theory, employment is expected to positively affect sector output a priori. However, the quality of labor also matters especially in developing countries where skilled vis a vis unskilled labor are major issues. In the event that the latter happens to be the type of employment in dominance, an adverse effect may not be surprising. In a separate model, and following from literature (e.g., Rodrik 2008), we also evaluate the impact of exchange the volatility on the service sector to compare the outcome with the undervaluation effect.

Following the likes of Mazorodze and Tewari (2018), we test for non-linearity of the undervaluation effect on the services sector performance, thereby determining whether there is a threshold beyond which the regression curve changes direction. To achieve this objective, we formulate a quadratic-form model as in Eq. (5):

where:\(\ln {\text{UNDERV}}_{it}^{2}\) is the squared term of real exchange rate undervaluation. The undervaluation effect is deemed non-linear if the relevant coefficient of the linear term (\(\theta_{1}\)) is positive while that of the non-linear term (\(\theta_{2}\)) is significantly negative. The threshold or turning point is then determined as in Checherita and Rother (2010) and Aswata et al. (2018) inter alia, by the formula:

3.2 Data

The main focus of our study is the service sector performance here proxied by the service sector value added output as a share of GDP. The data collected spans from 1991 to 2017, where the 1990s characterize a period when the majority of the East African countries adopted the flexible exchange rate regime post the breakdown of the Bretton Woods system of pegged rates: Rwanda in 1995; Uganda in 1993; Kenya in 1990; and, Tanzania in 1986. The end date 2017 is chosen based on data availability. Moreover, we are cognizant of the launch date for the East African Community that took place in 1999 and implementation commencing in 2000. We define performance of the services sector by the service value added (% of GDP), with data extracted from World Bank World Development Indicators (WDI 2019). Data on PPP is got from Penn World Tables, version 9.1 compiled by Feenstra et al. (2015). For the remaining variables, viz., capital, measured as gross capital formation as a percentage of GDP, labor, measured as employment in the services sector, inflation rate, GDP per capita, and GDP per capita growth, data is sourced from the World Bank World Development Indicators (WDI 2019). We performed descriptive evaluation of the data—descriptive statistics and correlation matrix. The average performance for the service sector between 1991 and 2017 was 3.7 per cent. Similarly, the explanatory variables were found to exhibit no high correlations (see Tables 11 and 12 in the Appendix section).

3.3 Econometric methodology

3.3.1 Cross-sectional dependency and slope homogeneity

An important check required to perform to guide in the selection of the appropriate unit root tests and eventual estimation technique is cross-sectional dependence test. The possibility of cross-dependence (CD) in the model series is basically due to the observation that the countries in consideration are regionally interlinked, as well as culturally, historically and geographically associated. Therefore, the likelihood of being affected by any global shocks such as the recent financial crisis of 2007–2009, with possible heterogeneous impact across countries, may not be far-fetched in causing a cross-sectional dependency type of correlation. When CD and slope heterogeneity occur, first-generation econometric methods can be biased and unreliable (Pesaran 2007). The study employs the Breusch and Pagan (1980) LM test, Pesaran (2007) CD test and Pesaran (2007) Scaled LM for testing the cross dependencies. On the other hand, Pesaran and Yamagata (2008) test is employed to examine the presence of slope heterogeneity in the data between the selected variables. The null hypothesis is ‘slope homogeneity’.

3.3.2 Panel unit root tests

Note that, before employing any estimation approach, we need to establish the order of integration in the series. Due to the presence of cross dependence detected among the variables, as we later show in the results, the second generation panel unit root tests, viz., CADF and CIPS were employed. Both tests are capable of controlling the issue of cross-section dependence.

3.3.3 Panel cointegration tests

The next step was to analyze the results of cointegration test. We perform the Kao (1999) test of cointegration, given the short number of periods characterizing our data. The test is performed to examine the long run relationship among the variables. The alternative Westerlund-Edgerton test would perform better for longer time periods (Westerlund 2007). The null hypothesis of ‘No cointegration’ is tested against the alternation ‘All panels are cointegrated’.

3.3.4 Estimation technique

Panel estimations can generate unreliable results because of the existence of cross-sectional dependence and slope heterogeneity issues. Therefore, the choice of an appropriate estimation technique depends on the outcome of the latter tests. Otherwise, Models (2), (4) and (5) including their variants would be estimated using dynamic panel data estimators such as the system generalized method of moments (system-GMM), autoregressive distributed models, viz., Dynamic Fixed Effects, (DFE), Mean Group (MG), Pooled Mean Group (PMG). In case of the presence of cross-sectional dependence (CD) in the model, the aforementioned techniques do not take care of such issues. According to Ditzen (2019) and Chudik et al. (2015), the issue of slope heterogeneity and CD is efficiently handled by the Cross-Sectional ARDL (CS-ARDL) model considered a more advanced econometric approaches rather than the traditional ARDL. As the results will show shortly, cross-sectional dependence was rejected. We therefore employed the PMG-ARDL approach, as chosen on the basis of the Hausman test outcome. Nevertheless, for robustness purposes, we also present results from the upgraded version of the traditional ARDL approach, the CS-ARDL method. Both approaches cater for heterogeneity issue too. In the CS-ARDL approach, the economy achieves an equilibrium state as soon as the value of the error correction mechanism (ECM) approaches − 1 [see Chudik et al. (2015), for details on the model]. One disadvantage with the CS-ARDL method however, is that the technique may not work in the case of small number of cross-sectional units as these might not be enough to approximate the strong common factors, and the factor structure in particular (Ditzen 2019).

For the lag determination, we followed the Schwarz information criterion (SIC). Table 13 in the appendix presents the details.

4 Results and discussion

4.1 Cross-sectional dependence test results

Based on the results in Table 1, we reject the null hypothesis of no cross-sectional independencies at 1% significance level for each case. In other words, the models exhibit cross-sectional independence.

4.2 Panel unit root test results

It is evident from the results in Table 2 that there is a mixture of \(I\left( 0 \right)\) and \(I\left( 1 \right)\) in the series. This is further proof that an adoption of ARDL technique is the best choice. Note that under the CIPS test, while services, undervaluation, labor and fiscal policy are non-stationary at levels, the CIPS confirms that all the variables are stationary at first difference. For the CADF test, it is only inflation and monetary policy variables that stationary in levels; the rest are stationary at first difference.

For the lag determination, the optimal lag length of panel ARDL (1, 0, 0, 0, 0, 0, 0) is chosen for both the PMG-ARDL and CS-ARDL estimations following the Schwarz information criterion (SIC). Table 13 in the appendix presents the details.

4.3 Panel cointegration test results

The Kao (1999) cointegration test result reported in Table 3 suggested that we reject the null hypothesis of no cointegration at 1% significance level and accept the alterative hypothesis in both cases when cointegration equation is specified by including a trend. Based on these results, we can conclude that in the long run there exist a valid equilibrium relationship of the selected series across countries.

4.4 Balassa-Samuelson effect and undervaluation

It is evident from Table 4 that the estimation of Eq. (2) yields a longrun coefficient \(\lambda_{1} = - 0.20\) that is highly significant at 1% statistical level, implying that when per capita income increases by 10%, real exchange rates appreciate by about 2%. This is a confirmation of the Balassa-Samuelson effect, and is in line with the finding in Rodrik (2008). The shortrun effect is, however, larger in magnitude but less significant. Specifically, a 10% increase in income is expected to result into a real exchange rate appreciation of about 3.8%—still suggesting a strong and well-estimated Balassa-Samuelson effect as aforementioned.

Our calculations, thus reveal that the period 1991–2017 was characterized on average by an undervaluation of the real exchange rate. Based on the descriptive statistics in Table 11, the mean of UNDERVAL is 0.797, suggesting an average Undervaluation of roughly 6.3 (i.e., the antilog of 0.797). By implication, since this value is above unity, then we can conclude that the currency was on average undervalued.

4.5 Undervaluation and services sector performance

With regard to our first main explanatory variable, viz., undervaluation, the results presented in Table 5 are a confirmation of our earlier hypothesis that undervaluing the real exchange rate matters for the service sector performance. In the baseline model (1), a 10% increase in undervaluation is expected to yield about 6.3% increase in services sector output ceteris paribus. This finding contradicts what Njindan Iyke (2017) documents for South Africa, but is in line with Mazorodze and Tewari (2018) and Özyurt (2013) as well as the theoretical argument earlier on alluded to that if an undervalued currency lowers the costs of production, then firms in the services sector, just as in other sectors are likely to increase their investment and output. Since the services sector in the East African Community is dominated by the tourism subsector, where for example, arrivals increased from 3.5 million persons in 2006 to 5.7 million persons in 2017, this may not be surprising because an undervalued currency, is a ‘hook’ that attracts foreign tourists as it becomes cheaper for them to visit the region, given that their now stronger currency can be exchanged for more local currency.

In corroboration of our finding, the results from the alternative estimation technique in (CS-ARDL) specification (2), emphasize the positive effect of an increase in undervaluation on the services sector output. One important observation here is that the relevant coefficient is bigger in magnitude (0.857) but equally significant at 1% level. In either the baseline model estimated by the PMG-ARDL estimator nor a similar model estimated by the CS-ARDL estimator, we fail to find evidence of the shortrun undervaluation effect on the service sector performance. From the sectoral perspective, our findings render support for an undervalued-led-growth propagated in inter alia, Seraj and Coskuner (2021), Habib et al. (2017).

Besides undervaluation, the fundamental factors considered as controls reveal additional information. As expected, capital accumulation is positively associated with service sector output. Specifically, in the longrun, a 1% increase in investment is observed to enhance service sector performance by 0.532% ceteris paribus. This finding is robust under the alternative estimator in Column (2), with equal significance at 1% level, and consistent with previous studies (e.g., Njindan Iyke 2017; Mazorodze and Tewari 2018). However, contrary to our expectation, the relevant coefficient on labor is negative and highly significant at 1% in both the baseline model (1) and the alternative specification (2). A 1% increase in employment is likely to produce 0.279% reduction in the service sector output. The explanation for the unexpected result could lie in the quality of labor, particularly in terms of skills. Since our measure captures quantity and not the quality of employment, the finding may not be surprising. In fact, in Mazorodze and Tewari (2018), though the coefficient on labor is reported positive the effect is only statistically significant in two out of four cases. In skill-intensive service sectors such as finance and information technology, employing low-skilled labor could worsen sector productivity. One would rightly argue that in the EAC, the period 1991–2017, ceteris paribus, the service sector depended mostly on capital accumulation as opposed to employment for its overall performance. The negative employment effect can also be traced in Njindan Iyke (2017), where the proxy (population) used is negative though insignificant.

The effect of inflation on the sector is similarly negative and significant at 1% level in the longrun, while positive but weakly significant at 10%, in the shortrun. In the former case, with a 1-unit increase in inflation rate, the service sector performance would be expected to reduce by about 0.6%, for the PMG-ARDL results, and 0.4 for the CS-ARDL alternative estimator. On the other hand, a similar increase in inflation would produce a positive marginal effect of 0.1% in the shortrun. In essence, inflation is found detrimental to the service sector in the longrun but beneficial in the shortrun. The finding is consistent with what Elbadawi et al. (2012) report.

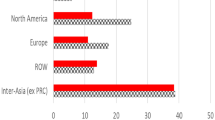

4.6 Regional integration and the service sector performance

Turning to our second major explanatory variable, the results presented in Table 6, show that contrary to our expectation, in the longrun, regional integration exhibited a direct deleterious effect on the service sector performance member countries of the EAC during the period under study. In the longrun, a one-unit increase in regional integration, would facilitate a reduction in the service sector performance by about 23.4%, \(\left[ {exp\left( {0.21} \right)} \right]\), where the relevant coefficient is significant at 1%. However, in the shortrun, the direct effect of regional integration is significantly positive. Specifically, it can be said that service sector performance will be 10.6% \(\left[ {exp\left( {0.101} \right)} \right]\) higher for member countries in EAC than for those outside. The finding is significant at 5% level and is supported by the results from the cross-sectional ARDL estimator albeit with a lower effect in absolute terms. Here, for a 1-unit increase in regional integration, we expect to see about a 6.7% increase in the service sector performance, since \(exp\left( {0.065} \right) = 1.067\). This finding is consistent with earlier studies by Rouis and Tabor (2012), Gluezmann et al. (2012).

4.7 Regional integration, fiscal and monetary policy interactions with undervaluation

We further tested for the conditional effects of undervaluation on service sector performance by introducing three interactions separately. In Table 6, the total marginal effect of undervaluation on the service sector performance in the presence of regional integration is about 1.145 [i.e., 0.682 + 0.769(0.602)], where the sample mean of EAC is 0.602. This result is greater than the marginal effect of undervaluation of 0.756 when no interaction is considered in Column (1), suggesting a moderating role of regional integration in the undervaluation-services linkage in the longrun. In concrete terms, a sample mean of regional integration of 0.602 implies that a 50% undervaluation results into a service sector performance of 0.57% points on average (50% * 1.145). This evidence is a confirmation of the importance of regional integration on economic performance for the East African countries as reported in Bong and Premaratne (2018) and te Velde (2011). To be more specific, given a 50% undervaluation, with every 10% increase in regional integration, the marginal effect on the services sector performance is amplified by about 3.8% points on average (0.5 * 0.1 * 0.769). Muriuki and Kosimbei (2015) document a similar finding.

Additionally, as evident in Table 7, in the presence of an accommodating monetary policy, here proxied by money supply (M2), the total marginal effect of undervaluation on the service sector output is about 0.3, instead of 7.9 if money supply changes are not considered a conditional factor. The drop is large in magnitude but the effect maintains positivity of the association between the undervaluation and service sector output. This result is supported by the outcomes from the alternative CS-ARDL technique, but also consistent with earlier documentation in Goldfajn and Gupta (2003). On the other hand, a mitigation of an expansionary fiscal policy, here proxied by government expenditure, leads the total marginal undervaluation effect to be negative (− 0.0024), and significantly lower than 3.4 when we fiscal policy is a constant. It could be argued as in Steinberg (2015), that since expansionary fiscal policies typically increase inflation, and inflation appreciates the real exchange rate, undervaluation tends to be inconsistent with expansionary fiscal policies, thereby suggesting a reduced effect of the former on services sector output in the presence of the latter. Therefore, keeping the exchange rate undervalued for purposes of improving the service sector performance would require maintenance of relatively conservative fiscal policies.

On the contrary, the effectiveness of the monetary policy in controlling the undervaluation effects on the service sector performance in the longrun without doing away with the benefits of exchange rate overshooting on the sector, is clearly visible in the findings based on Column 2. Whereas a tight monetary policy could facilitate the reversal of currency undervaluation through nominal appreciation (Goldfajn and Gupta 2003), it is arguably possible that an accommodative monetary policy via increasing money supply, would produce positive moderating effects on the linkage between currency undervaluation and service sector output in the longrun.

4.8 Non-linear effects of exchange rate misalignment on service sector performance

From Table 8, the coefficient on undervaluation is positive, while that of the non-linear term is significantly negative, suggesting a non-linear relationship between real exchange rate undervaluation and service sector performance that follows an inverted U-shaped curve, as reported in previous studies (e.g., Mazordize and Tewari 2019; Aguirre and Calderón 2005). Similarly, Rapetti et al. (2012) finds the relationship between RER undervaluation and per capita GDP to be non-monotonic in the least developed countries. Our results suggest that when real exchange rate undervaluation reaches a threshold of 6.3 (the antilog of 0.8 derived in turn from Eq. (6) and based on Model (2) of Table 8), which is considered too high, the effect on service sector performance turns out to be negative but when it is small or moderate (from 1 to less than 6.3), it can be key in enhancing the sector. Nevertheless, it is important to emphasize here that thresholds are sometimes sensitive to the time dimension, the variables used, the set of countries under consideration as well as their economic characteristics (Panizza and Presbitero 2013; Égert 2015). Therefore, the threshold level reported here ought to be interpreted with some caution. Our results are robust to alternative technique used here, the CS-ARDL approach. The finding is, however, consistent with an earlier study by Rapetti et al. (2012).

4.9 Real exchange rate volatility and the service sector performance

In line with our expectations, the exchange rate volatility is here found to adversely affect the service sector performance in the longrun, according to our baseline results in Table 9, Column (1). It is expected that a 1% increase in volatility would lead to a reduction in service sector performance by about 0.492%, which effect is significant at 5 level. Note here that in terms of magnitude and significance, the longrun undervaluation effect outperforms the volatility effect though the direction differs. The results obtained from the alternative estimation technique, the CS-ARDL approach, are substantially similar. But also an earlier study by Njindan Iyke (2017) equally reports a similar finding for the South Sudanese economy.

4.10 Sensitivity analysis

According to Woodford (2009) the Balassa–Samuelson effect adjusted measure of undervaluation that hinges on regressing the real exchange rate on GDP per capita, suffers from measurement error thereby presenting the possibility of an exaggerated outcome in tracking its effect on growth. We therefore present results for the undervaluation measure not adjusted for the Balassa–Samuelson effect in Table 10 to check for the sensitivity of our findings. In confirmation of Woodford’s (2009) argument, the relevant coefficient on the unadjusted undervaluation index is significantly smaller (0.297) than in the previous model with an adjusted measure in Table 5, where the coefficient is almost double (0.627). Results from the CS-ARDL estimator in Column (2) render support for this finding, providing a positive effect equivalent to 0.430% increase in the services sector output in response to a 1% increase in an unadjusted undervaluation measure. The PMG-ARDL result is significantly lower than the 0.756 previously recorded for the adjusted undervaluation index in Table 5. Although the robustness check unveils a substantial reduction in the effect of undervaluation on services sector performance, implying an exaggerated impact of the Rodrik’s (2008) adjusted undervaluation measure on the services sector output, the relevant coefficients are still positive and significant at 1% level in the longrun.

5 Concluding remarks

The present study reveals several important findings. First, contrary to the argument that non-tradable sector does not gain from undervaluation, the current study confirms the importance of an undervalued currency in propelling the service sector performance for the selected East African countries in the long run. Other factors constant, a 10% increase in undervaluation is expected to yield about 6.3% increase in services sector output. However, exchange volatility is found to impact negatively on service sector performance. These findings are robust to alternative estimation technique as well as to the employment of a different measure of undervaluation that is not adjusted for the Balassa-Samuelson effect. Earlier studies (e.g., Seraj and Coskuner 2021; Habib et al. 2017; Özyurt 2013) have documented similar findings. The relationship is between currency undervaluation and service sector performance is notably found to follow an inverted U-shaped curve. This non-linearity test result reveals that beyond a threshold of about 6.3, the undervaluation effect turns out negative, otherwise smaller and moderate undervaluation from about 1–6.3 is still good for the service sector development in the selected EAC countries. A previous work by Rapetti et al. (2012) as well as Mazorodze and Tewari (2018) have reported similar findings. The second conclusion is that regional integration is crucial for the services sector performance. However, the effect differs between the long run and short run. While in the short run we observe a positive direct effect, the opposite is the case for the long run results. A deeper analysis reveals that in the long run, regional integration plays a key moderating role in the relationship between undervaluation and the service sector performance. These findings are consistent with earlier works by Bong and Premaratne (2018) and te Velde (2011) inter alia. Relatedly, both the accommodating monetary policy, as well as an expansionary fiscal policy, respectively proxied by money supply and government expenditure, are found important in mitigating this relationship. This finding does not differ from what is reported in the earlier study by Goldfajn and Gupta (2003).

Given these findings, it is important to design and promote policies that would keep local currencies undervalued if unleashing the potential of the service sector performance is to be realized to full capacity. More importantly, however, policies that would help promote the underlying catalysts of undervaluation may be deemed more desirable than policies that directly support undervaluation for purposes of the service sector expansion. In addition, efforts to further deepen regional integration should be supported. Meanwhile, member countries could help facilitate undervaluation policies with well-calculated monetary and fiscal policies in the effort to propel their indirect effect on service sector contribution to GDP, without neglecting the other sectors such as the manufacturing sector. In doing all this, however, the UNECA’s (2018) warning against excessive dependence on the services sector at the expense of the manufacturing sector ought to be taken seriously, as the former may not generate sufficient employment opportunities to sustain inclusive growth as manufacturing sector would. Similarly, policies to curtail exchange rate volatility would go a long way in promoting the service sector in the region.

Future studies could focus on the comparison among different types of service sectors in terms of the undervaluation effect for East African countries. It would also be interesting to delve deeper into what actually drives real exchange rate undervaluation in the region, given its empirical significance in precipitating service sector performance.

Availability of data and materials

The study uses data on several variables spanning a period 1991 to 2017 for selected countries from East Africa. All data is available from the relevant sources, including the World Bank World Development Indicators, accessible at https://data.worldbank.org; Penn World Tables, version 9.1, and freely available online.

References

Aguirre A, Calderón C (2005) Real exchange rate misalignments and economic performance, Central Bank of Chile, Economic Research Division

Aswata MB, Nnyanzi JB, Bbale JM (2018) Debt, corruption and investment in East Africa: a panel ARDL analysis. Mod Econ 9(12):2012–2038. https://doi.org/10.4236/me.2018.912126

Bermúdez C, Dabús C (2018) Going under to stay on top: How much real exchange rate undervaluation is needed to boost growth in developing countries, Estudios de Economia, University of Chile, Department of Economics. 45(1):5–28

Bong A, Premaratne G (2018) Regional integration and economic growth in Southeast Asia. Glob Bus Rev 19(6):1403–1415. https://doi.org/10.1177/0972150918794568

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47:239–253.

Brixiová Z, Ncube M (2014) The real exchange rate and growth in Zimbabwe: does the currency regime matter? African Development Bank Working Paper No. 210, Tunis

Checherita C, Rother P (2010) The impact of high and growing government debt on economic growth an empirical investigation for the euro area. European Central Bank

Choi Y, Jin H, Choi EK (2018) Why are nontraded goods cheaper in poor countries? Econ Publications. 653. https://lib.dr.iastate.edu/econ_las_pubs/653

Chudik et al (2015) The cross-sectionally augmented distributed lag and the cross-sectionally augmented autoregressive distributed lag estimator. Adv Econ 36:85–135

Conrad D, Jagessar J (2018) Real exchange rate misalignment and economic growth: the case of Trinidad and Tobago, Economies, MDPI. Open Access J 6(4):1–23

Contractor FJ (2019) What do we mean by undervalued or overvalued currencies? Rutgers Bus Rev 4(1):1–9

Couharde C, Sallenave A (2013) How do currency misalignments’ threshold affect economic growth? J Macroecon 36(1):106–120

Ditzen J (2019) Estimating long run effects in models with cross-sectional dependence using xtdcce2. CEERP Working Paper No. 7. https://ceerp.hw.ac.uk/RePEc/hwc/wpaper/007.pdf. Accessed 1 Sept 2020

Dubas JM (2009) The importance of the exchange rate regime in limiting misalignment. World Dev 37(10):1612–1622

Dutta J, Leon H (2002) Dread of depreciation: measuring real exchange rate. IMF Work Pap. https://doi.org/10.5089/9781451848434.001

Égert B (2015) Public debt, economic growth and nonlinear effects: myth or reality? J Macroecon 43:226–238

Elbadawi IA, Kaltani L, Soto R (2012) Aid, real exchange rate misalignment, and economic growth in Sub-Saharan Africa. World Dev 40(4):681–700

Feenstra RC, Inklaar R, Timmer MP (2015) The next generation of the Penn world table. Am Econ Rev 105(10):3150–3182

Freund C, Pierola MD (2008) Export surges: the power of a competitive currency. The World Bank Policy Research Working Paper 4750. https://ssrn.com/abstract=1293163. Accessed 20 Aug 2020

Gluezmann PA, Levy-Yeyati E, Sturzenegger F (2012) Exchange rate undervaluation and economic growth: Diaz Alejandro (1965) revisited. Econ Lett 117(2012):666–672

Goldfajn I, Gupta P (2003) Does monetary policy stabilize the exchange rate following a currency crisis? IMF Staff Papers 50(1):90–114

Habib MM, Mileva E, Stracca L (2017) The real exchange rate and economic growth: revisiting the case using external instruments. J Int Money Financ 73:386–398

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90:1–44

Levy-Yeyati E, Sturzenegger F (2007) Fear of floating in reverse: exchange rate policy in the 2000s, Kennedy School of Government, Working Paper RW07-047, October

Masunda S (2011) Real exchange rate misalignment and sectoral output in Zimbabwe. Int J Res Econ 2(4):59–74

Mazorodze BT, Tewari DV (2018) Real exchange rate undervaluation and sectoral growth in South Africa. Afr J Econ Manag Stud 9(4):462–476. https://doi.org/10.1108/AJEMS-06-2017-0132

Mbaye S (2013) Currency undervaluation and growth: is there a productivity channel? International Economics 133:8–28

Missio FJ, Jayme FG, Britto G, Oreiro JL (2015) Real exchange rate and economic growth: new empirical evidence. Metroeconomica 66:686–714

Muriuki TK, George Kosimbei G (2015) Effects of regional integration on economic growth of East African Community. Int J Econ Comme Manag UK III(11):1090–1113

Ndlela T (2010) Implications of real exchange rate misalignment in developing countries: theory, empirical evidence and application to growth performance in Zimbabwe. SSRN J. https://doi.org/10.2139/ssrn.1641227

NjindanIyke B (2017) Exchange rate undervaluation and sectoral performance of the South African economy. J Econ Stud 44(4):636–649. https://doi.org/10.1108/JES-03-2016-0052

Nouira R, Plane P, Sekkat K (2011) Exchange rate undervaluation and manufactured exports: a deliberate strategy? CERDI, Etudes et Documents, E 2011.25. halshs-00617573

Ozyurt S (2013) Currency undervaluation and economic rebalancing towards services: is China an exception? Chin World Econ 21:47–63

Panizza U, Presbitero AF (2013) Public debt and economic growth in advanced economies: a survey. Mo.Fi.R. Working Papers 78, Money and Finance Research group (Mo.Fi.R.)—Univ. Politecnica Marche—Dept. Economic and Social Sciences

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22:265–312

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(289–326):2001

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econom 142(1):50–93

Rapetti M (2020) The real exchange rate and economic growth: a survey. J Glob Dev. https://doi.org/10.1515/jgd-2019-0024

Rapetti M, Skott P, Razmi A (2012) The real exchange rate and economic growth: are developing countries different? Int Rev Appl Econ 26(6):735–753. https://doi.org/10.1080/02692171.2012.686483

Rodrik D (2008) The real exchange rate and economic growth. Brookings Papers on Economic Activity, Fall. pp. 365–412

Rouis M, Tabor ST (2012) Regional integration through trade in services. In: Rouis M, Tabor ST (eds) Regional economic integration in the Middle East and North. International Bank for Reconstruction and Development, The World Bank, pp 25–38. https://doi.org/10.1596/9780821397268_CH03

Seraj M, Coskuner C (2021) Real exchange rate effect on economic growth: comparison of fundamental equilibrium exchange rate and Balassa-Samuelson based Rodrik approach. J Appl Econ 24(1):541–554. https://doi.org/10.1080/15140326.2021.1977083

Steinberg D (2010) The reversal of political parties' support for overvalued exchange rates. APSA 2010 Annual Meeting Paper. https://ssrn.com/abstract=1642066

Steinberg D (2015) A conditional preference theory of undervalued exchange rates. In Demanding devaluation: exchange rate politics in the developing world. Cornell University Press: Ithaca. pp. 20–54. www.jstor.org/stable/10.7591/j.ctt15hvrzp.8.

te Velde DW (2011) Regional integration, growth and convergence. J Econ Integr 26(1):1–28. https://doi.org/10.11130/jei.2011.26.1.1

UNECA (2018) Macroeconomic and social developments in Eastern Africa. Report by United Nations Economic Commission for Africa, Kigali, Rwanda. https://www.uneca.org/sites/default/files/images/SROs/EA/macroeconomic_social_developments_in_eastern_africa_2018.pdf. Accessed 20 Aug 2020

Vaz PH, Baer W (2014) Real exchange rate and manufacturing growth in Latin America. Latin Am Econ Rev 23(1):2

WDI (2019) World Development Indicator. World Bank Database. https://databank.worldbank.org/reports.aspx?source=world-development-indicators#. Accessed 16 Aug 2020

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69:709–748

Woodford M (2009) Information-constrained state-dependent pricing. J Monet Econ 56:100–124

Ybrayev Z (2021) Real exchange rate management and economic growth: export performance in Kazakhstan, 2009–2019. Int Rev Appl Econ 35(1):64–90

Acknowledgements

Not applicable.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

We are three authors of this manuscript. JBN identified the research gap, did a background analysis and performed the analysis. JBO and NK reviewed the existing literature and performed the interpretations. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

We hereby consent to the publication of this article in your esteemed journal. All authors have consented to this submission.

Competing interests

The authors of this manuscript declare no competing interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Nnyanzi, J.B., Oryema, J.B. & Kilimani, N. Real exchange rate undervaluation, regional integration and services sector performance: evidence from the East African Community. Economic Structures 11, 17 (2022). https://doi.org/10.1186/s40008-022-00279-3

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40008-022-00279-3