Abstract

This paper studies the equilibrium of an extended case of the classical Samuelson’s multiplier–accelerator model for national economy. This case has incorporated some kind of memory into the system. We assume that total consumption and private investment depend upon the national income values. Then, delayed difference equations of third order are employed to describe the model, while the respective solutions of third-order polynomial correspond to the typical observed business cycles of real economy. We focus on the case that the equilibrium is not unique and provide a method to obtain the optimal equilibrium.

Similar content being viewed by others

1 Introduction

Keynesian macroeconomics inspired the seminal work of Samuelson, who actually introduced the business cycle theory. Although primitive and using only the demand point of view, the Samuelson’s prospect still provides an excellent insight into the problem and justification of business cycles appearing in national economies. In the past decades, other models have been proposed and studied by other researchers for several applications, see Chari (1994), Chow (1985), Dassios et al. (2014a), Dassios and Zimbidis (2014), Dassios and Kalogeropoulos (2014), Dassios and Baleanu (2018), Dassios (2018b), Dassios and Devine (2016), Dorf (1983), Kuo (1996), Milano and Dassios (2016), Liu et al. (2017, 2019a, b), Puu et al. (2004), Rosser (2000), Samuelson (1939), Schinnar (1978), Westerhoff (2006), and Wincoop (1996). All these models use mechanisms involving monetary aspects, inventory issues, business expectation, borrowing constraints, welfare gains, and multi-country consumption correlations. Some of the previous articles also contribute to the discussion for the inadequacies of Samuelson’s model. The basic shortcoming of the original model is: the incapability to produce a stable path for the national income when realistic values for the different parameters (multiplier and accelerator parameters) are entered into the system of equations. Of course, this statement contradicts with the empirical evidence which supports temporary or long-lasting business cycles. In this article, we propose a special case, i.e., a modification of the typical model incorporating delayed variables into the system of equations and focusing on consumption and investments.

Actually, the proposed modification succeeds to provide a more comprehensive explanation for the emergence of business cycles while also producing a stable trajectory for national income. The final model is a discrete time system of first order and its equilibrium, i.e., equilibrium of the proposed reformulated Samuelson economical model, is not always unique. For the case that we have infinite equilibriums, we provide an optimal equilibrium for the model.

2 The model

The original version of Samuelson’s model is based on the following assumptions:

Assumption 1

National income \(T_k\) at time k equals to the summation of three elements: consumption, \(C_k\), private investment, \(I_k\), and governmental expenditure \(G_k\):

Assumption 2

Consumption \(C_k\) at time k depends on past income (only on last year’s value) and on marginal tendency to consume, modelled with a, the multiplier parameter, where \(0< a < 1\):

Assumption 3

Private investment at time k depends on consumption changes and on the accelerator factor b, where \(b>0\). Consequently, \(I_k\) depends on national income changes:

Assumption 4

Governmental expenditure \(G_k\) at time k remains constant:

Hence, the national income is determined via the following second-order linear difference equation:

Our reformulated (delayed) version of Samuelson’s model is based on the following assumptions:

Assumption 5

National income \(T_k\) at time k equals to the summation of two elements: consumption, \(C_k\) and private investment, \(I_k\):

Assumption 6

Consumption \(C_k\) at time k is a linear function of the incomes of the two preceding periods. The governmental expenditures in our model are included in the consumption \(C_k\):

or, equivalently,

Here, P, \(c_1\), and \(c_2\) are constant, and \(c_1>0\), \(c_2>0\), and \(0<c_1+c_2<1\).

Assumption 7

Private investment \(I_k\) at time k, depends on consumption changes and on the positive accelerator factors b . Consequently, \(I_k\) depends on the respective national income changes:

or, using (2), we get the following:

or, equivalently,

Hence, using (2) and (3) into (1), the national income is determined via the following high-order linear difference equation:

3 The equilibrium

Consumption, \(C_k\), depends only on past year’s income value, while private investment \(I_k\), depends on consumption changes within the last 2 years and governmental expenditure, \(G_k\), depends on past year’s income value. From (4), the national income is then determined via the following third-order linear difference equation:

Lemma 1

The difference equation (4) is equivalent to the following matrix difference equation

Here

and

Proof

We consider (4) and adopt the following notations:

and

Then

or, equivalently,

or, equivalently,

or, equivalently,

The proof is completed.

The discrete time system of first order can be studied in terms of solutions, stability, and control, see Apostolopoulos and Ortega (2018), Dai (1988), Dassios (2012, 2015a, 2018a), Dassios and Szajowski (2016), Dassios and Kalogeropoulos (2013), Dassios et al. (2017), Leonard (1996), Ogata (1987), Ortega and Apostolopoulos (2018), Rugh (1996), Sandefur (1990), Steward and Sun (1990), and Verde-Star (1994). Next, we provide a Lemma for the equilibrium of this system.

Lemma 2

The equilibrium(s) \(s_e\) of the reformulated Samuelson economical model (4) is given by the solution of the following algebraic system:

where

Proof

From Lemma 1, the reformulated Samuelson economical model (4) is equivalent to (5). Then, to find the equilibrium state of this matrix difference equation, we have the following:

that is

and hence,

or, equivalently,

The proof is completed.

If the equilibrium is unique, we can study its stability based on the eigenvalues of matrix F, see Boutarfa and Dassios (2017), Cheng and Yau (1997), Datta (1995), Dassios (2015b), Milano and Dassios (2017), and Lewis (1986, 1987, 1992). Next, we provide a Lemma which determines when the equilibrium of (5) and consequently of (4) is unique.

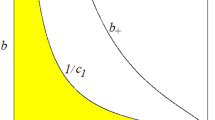

Lemma 3

Consider the system (5) and let \(G=I_3-F\). Then, G is a regular matrix if and only if

Proof

We consider (5), and then

The determinant of G is equal to

or, equivalently,

Hence, the matrix G is regular if and only if

or, equivalently,

The proof is completed.

We are now ready to state our main Theorem:

Theorem 1

Consider the system (5) and the matrices F, V, and G as defined in (6) and (7) respectively, i.e., let \(G=I_3-F\). Then

-

(a)

If G is full rank, the solution \(Y^{*}\) of (5) is given by the following:

$$\begin{aligned} Y^{*}=(I_3-F)^{-1}V, \end{aligned}$$and consequently, the unique equilibrium of the reformulated Samuelson economical model (4) is given by the following:

$$\begin{aligned} s_e=(1-c_2-c_1)^{-1}P. \end{aligned}$$ -

(b)

If G is rank deficient, then an optimal solution \({{\hat{Y}}}^*\) of (5) is given by the following:

$$\begin{aligned} {{\hat{Y}}}^*=(G^TG+E^TE)^{-1}G^TV. \end{aligned}$$(8)Here, E is a matrix, such that \(G^TG+E^TE\) is invertible and \(\left\| E\right\| _2=\theta \), \(0<\theta \ll 1\). Where \(\left\| \cdot \right\| _2\) is the Euclidean norm.

Proof

Let \(G=I_3-F\). For the proof of (a), since G is full rank, from Lemma 3, we have \(1-c_2-c_1\ne 0\). Then, where G is equal to the following:

Hence, the equilibrium \(Y^*\) is given by the unique solution of system (5), that is

or, equivalently, since

we have the following:

or, equivalently,

or, equivalently,

For the proof of (b), since G is rank deficient, if \(V\notin colspan G\) system (5) has no solutions and if \(V\in colspan G\) system (5) has infinite solutions. Let

such that the linear system

or, equivalently the system

has a unique solution. Where E is a matrix, such that \(G^TG+E^TE\) is invertible, \(\left\| E\right\| _2=\theta \), \(0<\theta \ll 1,\) and \(E{{\hat{Y}}}_{n}^*\) is orthogonal to \({{\hat{V}}} -G{{\hat{Y}}}_{n}^*\). We use E, because G is rank deficient, i.e., the matrix \(G^TG\) is singular and not invertible. We want to solve the following optimization problem:

or, equivalently,

or, equivalently,

To sum up, we seek a solution \({{\hat{Y}}}_{n}^*\) minimising the functional

Expanding \(D_1({{\hat{Y}}}_{n}^*)\) gives the following:

or, equivalently,

because \(V^TG{{\hat{Y}}}_{n}^*=({{\hat{Y}}}_{n}^*)^TG^TV\). Furthermore

Setting the derivative to zero, \(\frac{\partial }{\partial {{\hat{Y}}}_{n}^*}D_1({{\hat{Y}}}_{n}^*)=0\), we get the following:

The solution is then given by the following:

Hence, the optimal equilibrium is given by (8). Note that similar optimization techniques have been applied to several problems of this type of algebraic systems, see Cuffe et al. (2016), Dassios et al. (2015), Dassios (2015c, 2019) and Dassios and Baleanu (2019). The proof is completed.

Further research is carried out for even higher order equations investigating qualitative results. For this purpose, we may use an interesting tool applied to difference equations with many delays, the fractional nabla operator, see Atici and Eloe (2011), Dassios and Baleanu (2013, 2015), Dassios et al. (2014b), Dassios (2017, 2015d), Klamka and Wyrwał (2008), Klamka (2010) and Podlubny (1999). The fractional nabla operator is a very interesting tool for this, since it succeeds to provide information from a specific year in the past until the current year. The nabla operator of nth order, n Natural, applied to a vector of sequences \(Y_k:{\mathbb {N}}_\alpha \rightarrow {\mathbb {C}}^{m}\) is defined by the following:

where \(a_j=(-1)^j\frac{1}{\Gamma (n+1)\Gamma (j+1)\Gamma (n-j+1)}\). The nabla fractional operator of nth order, n Fractional, applied to a vector of sequences \(Y_k:{\mathbb {N}}_\alpha \rightarrow {\mathbb {C}}^{m}\) is defined by the following:

where \(b_j=\frac{1}{\Gamma (-n)}(k-j+1)^{\overline{-n-1}}\) and \((k-j+1)^{\overline{-n-1}}=\frac{\Gamma (k-j-n)}{\Gamma (k-j+1)}\). For all this, there is already some ongoing research.

4 Conclusions

Closing this paper, we may argue that it is not only a theoretical extension of the basic version of Samuelson’s model, but also a practical guide for obtaining the optimal equilibrium of this model; in the case, we have infinite many equilibriums. We studied the equilibrium of an extended case of the classical Samuelson’s multiplier–accelerator model for national economy. We also focused on the case that the equilibrium is not unique and provided a method to obtain the optimal equilibrium.

Availability of data and materials

Data sharing was not applicable to this article as no data sets were generated or analysed during the current study.

References

Apostolopoulos N, Ortega F (2018) The stability of systems of difference equation with non-consistent initial conditions. Dyn Contin Discret Impuls Syst Ser A Math Anal 25:31–40

Atici FM, Eloe PW (2011) Linear systems of fractional nabla difference equations. Rocky Mt J Math 41(2):353–370

Boutarfa Bariza, Dassios Ioannis K (2017) A stability result for a network of two triple junctions on the plane. Math Methods Appl Sci 40(17):6076–6084

Chari VV (1994) Optimal fiscal policy in a business cycle model. J Polit Econ 102(4):52–61

Cheng H-W, Yau SS-T (1997) More explicit formulas for the matrix exponential. Linear Algebra Appl 262:131–163

Chow GC (1985) A model of Chinese national income determination. J Polit Econ 93(4):782–792

Cuffe P, Dassios I, Keane A (2016) Analytic loss minimization: a proof. IEEE Trans Power Syst 31(4):3322–3323

Dai L (1988) Singular control systems. In: Thoma M, Wyner A (ed) Lecture notes in control and information sciences

Dassios IK (2012) On non-homogeneous linear generalized linear discrete time systems. Circuits Syst Signal Process 31(5):1699–1712

Dassios I (2015a) On a boundary value problem of a singular discrete time system with a singular pencil, dynamics of continuous. Discret Impuls Syst Ser A Math Anal 22(3):211–231

Dassios I (2015b) Stability of basic steady states of networks in bounded domains. Comput Math Appl 70(9):2177–2196

Dassios IK (2015c) Optimal solutions for non-consistent singular linear systems of fractional nabla difference equations. Circuits Syst Signal Process 34(6):1769–1797. https://doi.org/10.1007/s00034-014-9930-2

Dassios I (2015d) Geometric relation between two different types of initial conditions of singular systems of fractional nabla difference equations. Math Methods Appl Sci. https://doi.org/10.1002/mma.3771

Dassios I (2017) Stability and robustness of singular systems of fractional nabla difference equations. Circuits Syst Signal Process 36(1):49–64. https://doi.org/10.1007/s00034-016-0291-x

Dassios I (2018a) Stability of bounded dynamical networks with symmetry. Symmetry 10(4):121

Dassios I (2018b) A practical formula of solutions for a family of linear non-autonomous fractional nabla difference equations. J Comput Appl Math 339:317–328

Dassios I (2019) Analytic loss minimization: theoretical framework of a second order optimization method. Symmetry 11(2):136

Dassios IK, Baleanu D (2013) On a singular system of fractional nabla difference equations with boundary conditions. Bound Value Probl 2013:148

Dassios IK, Baleanu DI (2015) Duality of singular linear systems of fractional nabla difference equations. Appl Math Model 39(14):4180–4195. https://doi.org/10.1016/j.apm.2014.12.039

Dassios I, Baleanu D (2018) Caputo and related fractional derivatives in singular systems. Appl Math Comput 337:591–606

Dassios I, Baleanu D (2019) Optimal solutions for singular linear systems of Caputo fractional differential equations. Math Methods Appl Sci

Dassios I, Devine M (2016) A macroeconomic mathematical model for the national income of a union of countries with interaction and trade. J Econ Struct 5:18

Dassios IK, Kalogeropoulos G (2013) On a non-homogeneous singular linear discrete time system with a singular matrix pencil. Circuits Syst Signal Process 32(4):1615–1635

Dassios I, Kalogeropoulos G (2014) On the stability of equilibrium for a reformulated foreign trade model of three countries. J Ind Eng Int 10(3):71

Dassios IK, Szajowski K (2016) Bayesian optimal control for a non-autonomous stochastic discrete time system. Appl Math Comput 274:556–564

Dassios I, Zimbidis A (2014) The classical Samuelson’s model in a multi-country context under a delayed framework with interaction. Dyn Contin Discret Impuls Syst Ser B Appl Algorithms 21(4–5b):261–274

Dassios I, Zimbidis A, Kontzalis C (2014a) The delay effect in a stochastic multiplier–accelerator model. J Econ Struct 3:7

Dassios I, Baleanu D, Kalogeropoulos G (2014b) On non-homogeneous singular systems of fractional nabla difference equations. Appl Math Comput 227:112–131

Dassios I, Fountoulakis K, Gondzio J (2015) A preconditioner for a primal-dual newton conjugate gradients method for compressed sensing problems. SIAM J Sci Comput 37:A2783–A2812

Dassios I, Jivkov AP, Abu-Muharib A, James P (2017) A mathematical model for plasticity and damage: a discrete calculus formulation. J Comput Appl Math 312:27–38

Datta BN (1995) Numerical linear algebra and applications. Cole Publishing Company, Three Lakes

Dorf RC (1983) Modern control systems, 3rd edn. Addison-Wesley, Boston

Klamka J (2010) Controllability and minimum energy control problem of fractional discrete-time systems. In: New trends in nanotechnology and fractional calculus. Springer, New York, pp 503–509

Klamka J, Wyrwał J (2008) Controllability of second-order infinite-dimensional systems. Syst Control Lett 57(5):386–391

Kuo BC (1996) Automatic control systems, 5th edn. Prentice Hall, Upper Saddle River

Leonard IE (1996) The matrix exponential. SIAM Rev 38(3):507–512

Lewis FL (1986) A survey of linear singular systems. Circuits Syst Signal Process 5:3–36

Lewis FL (1987) Recent work in singular systems. In: Proc. Int. Symp. singular systems, Atlanta, GA, pp 20-24

Lewis FL (1992) A review of 2D implicit systems. Automatica 28(2):345–354

Liu M, Dassios I, Milano F (2017) Small-signal stability analysis of neutral delay differential equations. In: IECON 2017-43rd annual conference of the IEEE industrial electronics society. IEEE, New York, pp 5644–5649

Liu M, Dassios I, Milano F (2019a) On the stability analysis of systems of neutral delay differential equations. Circuits Syst Signal Process 38(4):1639–1653

Liu M, Dassios I, Tzounas G, Milano F (2019b) Stability analysis of power systems with inclusion of realistic-modeling of WAMS delays. IEEE Trans Power Syst 34(1):627–636

Milano F, Dassios I (2016) Small-signal stability analysis for non-index 1 Hessenberg form systems of delay differential-algebraic equations. IEEE Trans Circuits Syst I Regul Pap 63(9):1521–1530

Milano F, Dassios I (2017) Primal and dual generalized eigenvalue problems for power systems small-signal stability analysis. IEEE Trans Power Syst 32(6):4626–4635

Ogata K (1987) Discrete time control systems. Prentice Hall, Upper Saddle River

Ortega F, Apostolopoulos N (2018) A generalised linear system of difference equations with infinite many solutions. Dyn Contin Discret Impuls Syst Ser B Appl Algorithms 25:397–407

Podlubny I (1999) Fractional differential equations, mathematics in science and engineering. Academic Press, San Diego, p xxiv+340

Puu T, Gardini L, Sushko I (2004) A Hicksian multiplier–accelerator model with floor determined by capital stock. J Econ Behav Organ 56:331–348

Rosser JB (2000) From catastrophe to chaos: a general theory of economic discontinuities. Academic Publishers, Boston

Rugh WJ (1996) Linear system theory. Prentice Hall International, London

Samuelson P (1939) Interactions between the multiplier analysis and the principle of acceleration. Rev Econ Stat 21:7578

Sandefur JT (1990) Discrete dynamical systems. Academic Press, Cambridge

Schinnar AP (1978) The Leontief dynamic generalized inverse. Q J Econ 92(4):641–652

Steward GW, Sun JG (1990) Matrix perturbation theory. Oxford University Press, Oxford

Verde-Star L (1994) Operator identities and the solution of linear matrix difference and differential equations. Stud Appl Math 91:153–177

Westerhoff FH (2006) Samuelson’s multiplier–accelerator model revisited. Appl Econ Lett 56:86–92

Wincoop E (1996) A multi-country real business cycle model. Scand J Econ 23:233–251

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

Both authors contributed equally to the writing of this paper. Both authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Barros, M.F., Ortega, F. An optimal equilibrium for a reformulated Samuelson economic discrete time system. Economic Structures 8, 29 (2019). https://doi.org/10.1186/s40008-019-0162-2

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40008-019-0162-2