Abstract

Background

Introducing more generics has been a successful strategy for lowering pharmaceutical prices and expenditure. However, the effect of the strategy depends on the pricing schemes for generics. We aimed to update the South Korean generic markets in terms of effective competition, and to examine the effects of number of manufacturers and price variance on pharmaceutical expenditure.

Methods

We constructed balanced panel data provided by the Health Insurance Review and Assessment Service covering 726 reimbursed substances from 2019 to 2023. We developed original indicators to analyze the generic markets: the maximum-minimum price variance (MMPV) and the maximum-weighted price variance (MWPV). Panel regression with fixed and time-fixed effects was used.

Results

Over the study period, the number of manufacturers increased from 17.81 in 2019 to 20.98 in 2020 and then decreased to 18.70 in 2023. The MMPV increased from 204.70 in 2019 to 230.07 in 2022 and then decreased slightly to 225.34 in 2023. The MWPV increased from 59.70 in 2019 to 72.58 in 2023. Two types of segmented markets were noteworthy: low use of low-cost generics with sufficient manufacturers and high use of low-cost generics with insufficient manufacturers. In the fixed and time-fixed effects panel analyses, the MWPV presented a negative association with the number of manufacturers and a positive association with the MMPV.

Conclusions

A newly introduced tiered pricing scheme, designed to differentiate generic prices, was associated with a decrease in the number of manufacturers and an increase in price dispersion. The pricing schemes for generics should be designed with price variance in mind and limit the number of too many generics in South Korea.

Similar content being viewed by others

Introduction

Rising pharmaceutical expenditure, which accounts for a significant proportion of health expenditure, is a major concern for health systems in most developed countries [1]. Health systems have emphasized competition as a means of managing expenditure [2]. Competition between manufacturers can lead to lower prices and more efficient use of resources [3]. Introducing more generics has been a successful strategy for lowering price and expenditure [4]. However, the effect of the strategy depends on the pricing schemes for generics.

The effect of the increased number of generics on pharmaceutical expenditure has been well reported in the US market, where the price of generics can be freely set [4,5,6]. Much of the literature reports that the number of manufacturers affects a change in the price of generics and pharmaceutical expenditure [7,8,9]. Median generic-to-brand price ratios and their ranges were associated with the number of manufacturers [6,7,8]. The US market shows effective generic competition, including sufficient market entrants, dramatic price reductions, large shifts in prescription of low-cost generics, and significant uptake of generics [6,7,8,9]. However, ineffective generic competition was also observed in the specialty and orphan drug markets [10,11,12]. These markets reported fewer market entrants, smaller-than-expected price reductions, and marginalized uptakes of generics.

Pricing of pharmaceuticals in South Korea

South Korea has introduced a unique National Health Insurance (NHI) system that covers 97% of the population. Prescription drugs are reimbursed by the NHI. The reimbursed prices of new drugs and their generics are regulated. For generic drugs, South Korea had adopted the same compound, same maximum reimbursed price scheme [13]. The maximum reimbursed price of generics is set by regulation, regardless of the order of entry. Note that manufacturers can freely set the reimbursed price of the drug below the maximum reimbursed price. However, the scheme had not provided incentives for manufacturers to compete with prices below the regulated maximum reimbursed price [5, 14]. The price of generics is fixed at the maximum reimbursed price [15], which is a feature of the South Korean market.

In July 2020, the government revised the pricing model for new generic drugs to address ineffective competition [16]. The revised model is a tiered pricing model, which sets the price of generics according to the generic development effort and the order of market entry. Two requirements for generic development efforts are biological equivalence testing and registration of the active pharmaceutical ingredient. For generics entering the market before the 20th, the price of the new generic is determined by the number of requirements met. The price of generics that meet both requirements is 53.55% of the price of the originator product before generic entry. The price of generics that meet one or none of the requirements is 45.52% and 38.69% of the price of the originator product, respectively. For generics entering the market after the 20th, the generic price will be 85% of the lowest. The tiered pricing model is expected to link the number of generics to price reductions. The revised pricing model will be implemented in September 2023 for generics launched before July 2020.

The South Korean market is characterized by many generic manufacturers with rare price competition [15, 17,18,19]. The association between the number of generic manufacturers and price variance has been reported [18]. However, the literature has several limitations. First, it does not consider the context of generic markets in South Korea. The market, where the maximum reimbursed price of generics is set by regulation, does not provide sufficient incentives to compete with prices below the regulated maximum reimbursed price [14, 20, 21]. The cheapest generic would be an outlier in the South Korean market, indicating that price dispersion does not reflect the true dispersion of generic prices. Second, generic sales information was not used, resulting in a lack of understanding of the use of low-cost or high-cost reimbursed generics. The lack of sales data made it difficult to understand the impact of the increased number of generics and their price dispersion on pharmaceutical expenditure. Third, a cross-sectional approach was used to analyze the association between the number of generics and price variance. This approach may have made it difficult to interpret the results as causal.

To address these limitations, this study updates the generic drug markets in South Korea. This study aims to analyze the generic markets in terms of effective competition and to examine the effect of the number of manufacturers and price variance on pharmaceutical expenditure. To this end, we developed original indicators to analyze the markets and constructed panel data to conduct a panel analysis to control for unobserved variables [22].

Method

Data sources

This study merged two datasets provided by the Health Insurance Review and Assessment Service (HIRA) to construct balanced panel data for substances that had reimbursed from 2019 to 2023. First, the list of all drugs reimbursed by the National Health Insurance Service (NHIS) was retrieved [23]. The list contains information on reimbursed drugs, including the generic and proprietary name of the drug, its strength, route of administration, manufacturer, and reimbursed price. The list categorizes drugs according to their generic name, strength, and route of administration. We have defined the drugs in the same categories as the substance. HIRA updates the list monthly and publishes it on the website. From 2019 to 2023, we selected 1 July each year to retrieve the list. Second, we obtained the weighted price of the substance, which reflects the selection of drugs of the same substance [24]. HIRA updates the weighted price of the substance containing at least three reimbursed drugs three times a year, including the first half, second half, and annual. We selected the annual data for each year to obtain the list. The annual data allowed us to obtain a stable weighted price of the substance. The construct dataset excludes parallel traded medicines that are not currently available in South Korea, and includes generic drugs produced by originator companies.

Study design

Original indicators

Figure 1 shows the original indicators used in this study. First, we developed the Maximum-Weighted Price Variance (MWPV), calculated as the difference between the maximum reimbursed price and the weighted reimbursed price of the substance divided by the maximum reimbursed price in thousands. The MWPV reflects the degree of utilization of low-cost or high-cost reimbursed drugs within the same substance, complementing sales data. Next, we developed the Maximum-Minimum Price Variance (MMPV), calculated as the difference between the maximum and minimum reimbursed price of the substance divided by the maximum reimbursed price in thousands. The MMPV reflects price dispersion and/or the degree of competition in terms of discounted price. Using these two indicators, we calculated the Price Variance Ratio (PVR) by dividing the MWPV by the MMPV. The PVR is a standardized version of the MWPV.

Other variables

Based on the literature analyzing pharmaceutical markets in South Korea [17, 18, 25], we used a number of variables to understand the characteristics of the substance and perform subgroup analyses: anatomical therapeutic chemical (ATC) classification, route of administration, year of first approval, and maximum reimbursed price of the substance. These variables are expected to categorize the substance according to their characteristics. The ATC classification of the substance was merged from the dataset provided by the HIRA [26] and categorized as follows: Alimentary tract and metabolism/Blood and blood forming organs/Cardiovascular system (A/B/C), Antiinfectives for systemic use/Antineoplastic and immunomodulating agents (J/L), Musculo-skeletal system/Nervous system (M/N), and other. The route of administration was categorized as oral, injection, and other. The year of first approval of the substance was categorized as before 1990, 1991–2000, 2001–2010, and after 2011. In South Korea, medicines enter the market following regulatory approval and reimbursement decisions. In 2007, a positive list system was introduced that defines prescription drugs that are reimbursed by the NHI [27]. We used the year of first approval rather than the year of reimbursement decisions to correctly categorize drugs. The maximum reimbursed price was categorized as less than KRW 1 K (USD 0.74), 1–10 K (USD 0.74–7.4), 10-100 K (USD 7.4–74), and more than 100 K (USD 74). We used the maximum reimbursed price in 2019 to categorize the substance.

Statistical analysis

This study used descriptive and panel analyses. Descriptive analysis was used to present trends in the mean number of manufacturers, MMPV, MWPV, and PVR from 2019 to 2023. Trends were also presented by ATC classification, route of administration, year of first approval, and maximum price. We segmented the markets into four types according to the number of manufacturers and PVR: A) high use of low-cost generics with sufficient manufacturers, B) low use of low-cost generics with sufficient manufacturers, C) low use of low-cost generics with insufficient manufacturers, and D) high use of low-cost generics with insufficient manufacturers.

MWPVit = β0 + αi + γt + β1*Nit + β2*MMPVit + εit

MWPV: maximum-weighted prive variance;

MMPV: maximum-minimum prive variance;

N: number of manufacturers

We used panel analysis to examine the effect of the number of manufacturers and their price variance on the selection of low-cost medicines. Panel analysis allows us to control for heterogeneity of substances and to identify effects that could not be detected from cross-sectional data [22, 28]. We constructed balanced panel data to control for unobserved variables that could bias the estimation. Based on the results of the Hausman test, the relationships between MWPV and the two independent variables (number of manufacturers and MMPV) were analyzed using panel regression with fixed effects (FE) and time-fixed effects [28]. The model controls for all observed time-variant and time-invariant variables and unobserved time-invariant variables. Finally, we estimated heteroskedasticity-consistent covariance after confirming the result of the Breusch-Pagan test [28]. The results of the pooled OLS and FE models are presented as the main analysis. For sensitivity analyses, we separated the markets according to their characteristics and performed FE regressions with heteroskedasticity-consistent covariance for each market.

Results

Subjects of the study

The number of substances included in the study was 726. Many of the substances were A/B/C (n = 249, 34%) in the ATC classification, oral forms (n = 448, 62%), approved 2001–2010 (n = 264, 32%), and price less than KRW 1 K (n = 464, 64%).

Descriptive analysis

We present the trends in the number of manufacturers, MMPV, and MWPV from 2019 to 2023. Table 1 shows the mean number of manufacturers of substances and their standard deviation by type and year. The mean number of manufacturers increased from 17.81 in 2019 to 20.98 in 2020 and then decreased to 18.70 in 2023. The mean number of manufacturers was consistently high for substances with ATC classification A/B/C, oral forms, year of first approval 2001–2010, and price less than KRW 1 K. In contrast, the mean number of manufacturers was consistently low for substances in injectable forms and prices above KRW 100 K.

Supplementary Table 1 shows the mean MMPV of substances and their standard deviation by type and year. The MMPV increased from 204.70 in 2019 to 230.07 in 2022 and then decreased slightly to 225.34 in 2023. The MMPV was consistently high for substances with ATC classification J/L, oral forms, year of first approval before 1990, and price less than KRW 1 K. In contrast, the MMPV was consistently low for substances in ATC classification Others, other routes of administration, year of first approval after 2011, and price KRW 10–100 K. Supplementary Table 2 shows the mean of MWPV of substances and their standard deviation by type and year. The MWPV increased from 59.70 in 2019 to 72.58 in 2023. The MWPV was consistently high for substances with ATC classification M/N, injectable forms, year of first approval before 1990, and price above KRW 100 K. In contrast, the MWPV was consistently low for substances with ATC classification A/B/C and a year of first approval after 2011.

Figure 2 presents the PVR of substances by type and year. The first graph in the first row shows the overall PVR and the separate PVR by route of administration and year. The overall PVR varied from 0.27 in 2022 to 0.33 in 2023. In general, the PVR of injectable drugs was higher than that of oral drugs. Similarly, the PVR of drugs with ATC classifications J/L and M/N was higher than that of drugs with ATC classifications A/B/C. More recently approved medicines and cheaper medicines tended to have decreased PVR values.

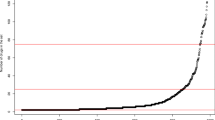

Figure 3 shows the markets according to the number of manufacturers and the PVR. The mean number of manufacturers and the PVR for 726 substances were 19.69 and 0.30, respectively. To simplify the figure, the values for each market are presented as averages over the years. A breakdown of the markets with specific values for each year can be found in Supplementary Fig. 1–4. Two types of markets are noteworthy: low use of low-cost generics with sufficient manufacturers (type B) and high use of low-cost generics with insufficient manufacturers (type D). Type B markets include substances with ATC classifications A/B/C, oral forms, price less than KRW 1 K, and year of first approval between 2001 and 2010. Type D markets include substances with ATC classifications J/L and M/N; injectable forms; prices between KRW 1-10 K, 10-100 K, and over 100 K; and year of first approval before 1990.

Main and sensitivity analyses

Table 2 shows the results of the pooled OLS and FE regressions. The models are estimated with robust standard errors. The MWPV presented a negative association with the number of manufacturers and a positive association with the MMPV. However, the estimate was reduced when using FE models. In the sensitivity analyses, the effects of number of manufacturers and MMPV on MWPV varied according to the characteristics of the markets.

Discussion

Summary of findings

Several findings are noteworthy. First, we found that the number of manufacturers tended to decrease over the study period, while MMPV and MWPV tended to increase. Although the number of manufacturers has decreased, the generic market competition in South Korea has evolved effectively after introducing a tiered pricing scheme. Second, we introduced a new variable, PVR, and used it to categorize markets into four types. Two types of markets are noteworthy. Type B markets represent low use of low-cost generics with a sufficient number of manufacturers. Type D markets represent high use of low-cost generics with an insufficient number of manufacturers. The type B market, indicating inefficient competition, includes substances with ATC classification A/B/C, oral forms, price less than KRW 1 K, and year of first approval 2001–2010. Third, we used panel analysis to examine the effect of number of manufacturers and price variance on pharmaceutical expenditure. We found that MWPV was negatively associated with the number of manufacturers and positively associated with MMPV.

Impact of a tiered pricing model

The characteristics of generic markets are closely related to the pricing schemes. As explained, the South Korean government revised the pricing schemes for generics from a same compound, same maximum reimbursed price to a tiered pricing scheme in July 2020. The new pricing scheme is designed to limit the number of generics and differentiate the price of generics. The price of new generics entering the market after July 2020 will be set according to the generic development effort and the order of generic entry. In contrast, the price of generics entering the market before July 2020 will be changed in September 2023, according to the new pricing scheme. Under the new scheme, the price of new generics entering the market after the 20th would be 85% of the lowest price. The price of the cheapest generic will continue to fall to an unprofitable level for manufacturers as more generics enter the market. Our observations show that the tired pricing has been effective in reducing the number of generics and increasing price dispersion among generics.

Segmenting generic markets for tailored policy options

Generic markets vary greatly depending on the characteristics of the originator drug. This study proposed the PVR and number of manufacturers as key variables for segmenting generic markets. We defined four types of markets and provided insights for tailored policy options to manage generic markets.

Supplementary Fig. 2 shows the characteristics of the oral and injectable markets. Injectables are administered directly into a blood vessel and their quality is a major concern [29,30,31]. For this reason, generic penetration in injectable forms has been lower than in oral forms, with generic penetration rates of 33% and 17% respectively [32]. However, the increased penetration of oral generics has not led to a reduction in expenditure due to their high reimbursed price. These findings suggest that the oral generics market can maximize cost savings if an effective pricing model is implemented.

Supplementary Fig. 3 shows the evolution of generic markets. The market with first approval after 2011 indicates an emerging market, whereas the market with first approval before 1990 indicates a mature market. In the emerging market, the number of manufacturers and the PVR were 15.73 and 0.24, respectively. As the market developed, these variables increased in the next decade, but then decreased in the following two decades. These findings suggest that timely generic entry is an urgent issue for the emerging market [33, 34]. Several policy options could be implemented to improve generic entry in the emerging market [35]. The regulatory authority should maximize scientific and regulatory clarity regarding generics [36], while manufacturers should improve the efficiency of the generic development and approval process [37].

Supplementary Fig. 4 describes the negative relationship between the number of manufacturers and the PVR when the markets are categorized by price. We found inefficient competition in the market where the price of a branded drug was less than KRW 1 K and efficient competition in the market where the price of a branded drug was more than KRW 100 K. These findings may be explained by the cost-sharing schemes for prescription drugs and the price-conscious behaviors of patients and physicians [38,39,40]. In South Korea, a patient pays 30% of the total pharmaceutical expenditure [41]. The cost-sharing for drugs costing less than KRW 1 K would be less than KRW 300, and a 10% price variation would reduce the cost-sharing for patients by KRW 30, which is 3% of the drug price. In this situation, patients and physicians would not be price-sensitive. However, for a drug costing KRW 100 K, the difference in cost-sharing would be KRW 3 K. In this situation, patients and physicians would be price-sensitive. A discounted co-insurance program or a subsidiary for selecting low-cost generics could be introduced to address this issue.

Managing the number of generics without hindering price variance

This study examined the associations between the selection of low-cost generics and other variables, including number of manufacturers and price variance. In the US market, the number of generics has been associated with a dramatic price reduction and a large shift in the prescription of lost-cost generics [6]. It is realistic to assume that the number of manufacturers in South Korea is positively associated with the selection of low-cost generics. However, this study found that the selection of low-cost generics was negatively associated with the number of manufacturers and positively associated with price variance.

The negative association between selection of low-cost generics and number of manufacturers reflects the pricing system for generics in South Korea. The same compound, same maximum reimbursed price scheme did not provide sufficient incentives for manufacturers to compete with prices below the regulated maximum reimbursed price [5, 14]. The price of generics was fixed at the maximum price, even when many generics entered the market [15]. A newly introduced tiered pricing scheme still allows the same maximum reimbursed price for generics entering the market before the 20th generic. In addition, generic uptake in South Korea is delayed and limited compared to the US market [32]. Generic penetration has been reported to be around 30%, which is much lower than in the US market [32, 42]. Marginalized generic penetration does not provide an incentive for manufacturers to initiate price competition. The positive association between the selection of low-cost generics and price variance suggests that price competition may be associated with lower pharmaceutical expenditure in the South Korean market. The low-cost generics that were priced below the regulated reimbursed price behave like that of generics in the US market.

These positive and negative associations suggest that pricing schemes for generics should be designed with price variability in mind and limit the number of too many generics. The current tiered pricing scheme guarantees a same compound, same maximum reimbursed price for generics that enter the market before the 20th generic, if the generic meets the requirements. The cut-off point of 20 should be reduced to manage the number of too many generics.

Study limitations

This study used data provided by the HIRA and included 726 substances to analyze the generics markets in South Korea. The 726 substances include all substances that had reimbursed by the NHI from 2019 to 2023. The representative data and subjects included indicate that the results of the study can be generalized to all types of medicines in South Korea. However, this study has limitations. First, this study used MWPV, an aggregated data provided by the HIRA, to understand the selection of low-cost generics and pharmaceutical expenditures. However, aggregated data have limitations in explaining the selection of low-cost generics by patients and physicians. Second, we used annual data to analyze generic markets, which may not accurately reflect the entry of new generics or generic competition. However, the annual data allowed us to obtain a stable weighted price of the substance. Third, this study analyzed the generic market in South Korea, which is characterized by many manufacturers with rare price competition. The results of the study should be interpreted with caution. However, the lack of price competition among generics is a common phenomenon where the price of generics is regulated.

Conclusion

Introducing more generics has been a successful strategy for lowering pharmaceutical prices and expenditure. However, the strategy depends on the pricing schemes for generics. The South Korean government revised the pricing schemes for generics from a same compound, same maximum reimbursed price to a tiered pricing scheme in July 2020. A tiered pricing scheme, designed to differentiate generic prices, was associated with a decrease in the number of manufacturers and an increase in price dispersion. The selection of low-cost generics was positively associated with price variance and negatively associated with the number of manufacturers. The pricing schemes for generics should be designed with price variance in mind and should limit the number of too many generics in South Korea.

Availability of data and materials

Not applicable (this manuscript does not report data generation or analysis).

Data availability

No datasets were generated or analysed during the current study.

References

Belloni A, Morgan D, Paris V. Pharmaceutical expenditure and policies: past trends and future challenges. 2016.

Morton FS, Boller LT. Enabling competition in pharmaceutical markets. Brookings: Brookings; 2017. p. 2.

Kanavos P, Costa-Font J, Seeley E. Competition in off-patent drug markets: issues, regulation and evidence. Econ Policy. 2008;23(55):500–44.

Wouters OJ, Kanavos PG, McKee M. Comparing generic drug markets in Europe and the United States: prices, volumes, and spending. Milbank Q. 2017;95(3):554–601.

Medicines for Europe. New pricing models for generic medicines to ensure long-term healthy competitiveness in Europe. 2022.

Conrad R, Lutter R. Generic competition and drug prices: new evidence linking greater generic competition and lower generic drug prices. U.S. Food & Drug Administration; 2019.

Grabowski H, Long G, Mortimer R, Boyo A. Updated trends in US brand-name and generic drug competition. J Med Econ. 2016;19(9):836–44.

Li DG, Joyce C, Mostaghimi A. Association between market competition and prices of generic topical dermatology drugs. JAMA Dermatol. 2018;154(12):1441–6.

Dave CV, Kesselheim AS, Fox ER, Qiu P, Hartzema A. High generic drug prices and market competition: a retrospective cohort study. Ann Intern Med. 2017;167(3):145–51.

Cole AL, Dusetzina SB. Generic price competition for specialty drugs: too little, too late? Health Aff (Millwood). 2018;37(5):738–42.

Gupta R, Kesselheim AS, Downing N, Greene J, Ross JS. Generic drug approvals since the 1984 Hatch-Waxman Act. JAMA Intern Med. 2016;176(9):1391–3.

Cole AL, Sanoff HK, Dusetzina SB. Possible insufficiency of generic price competition to contain prices for orally administered anticancer therapies. JAMA Intern Med. 2017;177(11):1679–80.

Jang S, Byun J, Song I, Cho H. PPRI pharma profile South Korea 2018. Incheon: College of Pharmacy, Gachon University; 2019.

Francois C, Gawlik G, Mestre-Ferrandiz J, Pana A, Perelman J, Yfantopoulos J, Simoens S. New pricing models for generic medicines to ensure long-term sustainable competition in Europe. Front Pharmacol. 2023;14: 1200641.

Park J, Bae S, Lee T-J, Son K-B. Marketing and pricing strategies of blockbuster drugs in the South Korean market: a 15-year retrospective cohort study for choline alfoscerate. Front Pharmacol. 2020;11: 232.

Ministry of Health and Welfare. Implementation of a differential reimbursement system for generic drugs from the second half of 2019. Sejong: Ministry of Health and Welfare; 2019.

Son K-B. Understanding long-listed pharmaceutical products without competition in South Korea: policy implications in managing generic entrants and pharmaceutical expenditures. Expert Rev Pharmacoecon Outcomes Res. 2022;22(5):815–22.

Son K-B. Is greater generic competition also linked to lower drug prices in South Korea? Heal Econ Rev. 2020;10:1–9.

Son K-B. Who initiates price competition when generic entrants are introduced into the South Korean pharmaceutical market? Front Public Health. 2022;10: 934161.

Hollis A, Grootendorst P. Canada’s new generic pricing policy: a reasoned approach to a challenging problem. Healthcare Policy. 2015;11(1):10.

Hollis A, Grootendorst P. A comparison of mechanisms for setting generic drug prices in Canada. Jo Generic Medicines. 2017;13(1):19–27.

Baltagi BH, Baltagi BH. Econometric analysis of panel data. Springer; 2008.

Health Insurance Review and Assessment Service. The list of drugs reimbursed by the National Health Insurance Service. 2024. Available from: https://www.hira.or.kr/bbsDummy.do?pgmid=HIRAA030014050000.

Health Insurance Review and Assessment Service. The weighted price of the substance. 2024. Available from: https://www.hira.or.kr/bbsDummy.do?pgmid=HIRAA030017000000.

Son K-B. Market exclusivity of the originator drugs in South Korea: a retrospective cohort study. Front Public Health. 2021;9: 654952.

Health Insurance Review and Assessment Service ATC, EDI code mapping 2021. Available from: https://www.hira.or.kr/bbsDummy.do?pgmid=HIRAA020002000100&brdScnBltNo=4&brdBltNo=9137.

Son K-B. Understanding the adoption of new drugs decided by several stakeholders in the South Korean market: a nonparametric event history analysis. Heal Econ Rev. 2018;8:1–10.

Croissant Y, Millo G. Panel data econometrics with R. Wiley Online Library; 2019.

Dill S, Ahn J. Drug shortages in developed countries—reasons, therapeutic consequences, and handling. Eur J Clin Pharmacol. 2014;70:1405–12.

Davies BJ, Hwang TJ, Kesselheim AS. Ensuring access to injectable generic drugs—the case of intravesical BCG for bladder cancer. N Engl J Med. 2017;376(15):1401–3.

Mazer-Amirshahi M, Pourmand A, Singer S, Pines JM, van den Anker J. Critical drug shortages: implications for emergency medicine. Acad Emerg Med. 2014;21(6):704–11.

Son K-B. Does the first generic exclusivity system provide an economic incentive for early generic entrance under the patent linkage system? Front Public Health. 2023;11: 1120729.

Kesselheim AS, Sinha MS, Avorn J. Determinants of market exclusivity for prescription drugs in the United States. JAMA Intern Med. 2017;177(11):1658–64.

Treasure CL, Kesselheim AS. How patent troll legislation can increase timely access to generic drugs. JAMA Intern Med. 2016;176(6):729–30.

FDA. FDA drug competition action plan. 2024. Available from: https://www.fda.gov/drugs/guidance-compliance-regulatory-information/fda-drug-competition-action-plan.

Toufanian M, Peters JR, Uhl K. Prioritization of generic drug review. JAMA Intern Med. 2017;177(1):140–1.

Lee C-Y, Chen X, Romanelli RJ, Segal JB. Forces influencing generic drug development in the United States: a narrative review. Journal of Pharmaceutical Policy and practice. 2016;9(1):26.

González López-Valcárcel B, Librero J, Sanfélix-Gimeno G, Peiró S, Group for Drug Utilization Research in the Spanish National Health S. Are prescribing doctors sensitive to the price that their patients have to pay in the Spanish National Health System? BMC Health Services Research. 2011;11:1–9.

Simonsen M, Skipper L, Skipper N. Price sensitivity of demand for prescription drugs: exploiting a regression kink design. J Appl Economet. 2016;31(2):320–37.

Magno C, Guzman RRS. Drug price sensitivity among physicians in a developing healthcare system: evidence from the Philippine market for statins and beta blockers. Economic Analysis and Policy. 2019;62:268–79.

Son K-B, Lee E-K, Lee S-W. Understanding patient and physician responses to various cost-sharing programs for prescription drugs in South Korea: a multilevel analysis. Front Public Health. 2022;10: 924992.

Yang D, Kim H, Lee T. Trend in the market share of generic drugs after the first generic entry. Korean J Health Econ Policy. 2017;23:23–43.

Funding

This study was supported by the National Research Foundation of Korea (NRF-2022R1F1A1071338 and NRF-2020R1A6A1A03042854).

Author information

Authors and Affiliations

Contributions

K-BS developed the concept of the manuscript, performed the analysis, and wrote the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Son, KB. Which factor reduces pharmaceutical expenditure, number of entrants or price variance? Updated generic drug markets in South Korea. Health Econ Rev 14, 64 (2024). https://doi.org/10.1186/s13561-024-00545-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s13561-024-00545-z