Abstract

Background

The private health insurance (PHI) market in Republic of Korea has instituted indemnity insurance plans that provide partial reimbursements for some medical services or costs that are not covered by the National Health Insurance (NHI). To date, no study has estimated the extent to which PHI coverage lowers the economic burden of households’ access to health care. The current study aims to evaluate the design of Korea’s PHI system in terms of coverage using a catastrophic health expenditure (CHE) indicator and compare it with NHI.

Methods

This study determined the difference between the number of households that were subscribed to PHI and those that received reimbursements from PHI. Additionally, it compared the effects of reduced CHE by NHI benefits with PHI reimbursements. Furthermore, it compared PHI reimbursements based on income class. Finally, it analyzed the contribution of NHI and PHI to CHE reduction through a two-part model with hierarchical regression.

Results

The results indicated that of the 5644 households examined, 3769 subscribed to PHI, but only 246 households received reimbursements. Notably, NHI reduced CHE incidence by 15.17%, whereas PHI only reduced CHE by 1.22%. The NHI scheme indicated reduced inequality as it provided more benefits to the low-income class for their used medical services, whereas PHI paid more reimbursements to the high-income class. Accordingly, NHI coverage has protected households from CHE and improved equality to some extent; however, PHI coverage has had a relatively low effect on relieving CHE and has increased inequality.

Conclusions

The indemnity health insurance plans of PHI companies in Korea only cover partial medical costs or services, and so, most patients do not receive reimbursements. Thus, Korea’s PHI system needs to improve to provide benefits to patients more generously and alleviate their financial burden.

Similar content being viewed by others

Background

Since the early 2000s, it has become a major trend that the health care systems of developed nations move to a mixed version of public and private insurance systems [1,2,3]. This is because compulsory social insurance for essential packages of health care services alone cannot satisfy all medical needs, and it is challenging for households to bear the burden of high medical costs for other non-essential health care services. Therefore, many countries with public health care systems have introduced supplementary private insurance, topping up any remaining services with copayments [4].

Republic of Korea (hereafter, Korea) has introduced a national health insurance (NHI) scheme that includes the compulsory coverage of 97% of the population, except those recipients of Medical Aid that protect the accessibility of care for the poor [5]. However, the benefit coverage of NHI is rather low, indicating that the proportion of out-of-pocket (OOP) payments, including copayments for services that have been insured and full payments for uncovered services, is approximately 32.2% of the health expenditure in 2018. This metric is relatively higher than those of Japan (13%), Germany (12.6%), the UK (15.9%), and France (10.2%) [6]. If OOP payments increase excessively, catastrophic consequences for households and the economy may ensue [7]. The World Health Organization (WHO) [8] states that if the ratio of OOP expenses to a household’s ability to pay exceeds a specific threshold, it is considered as “catastrophic health expenditures (CHE),” and this has been adopted as a measure of fairness in financial contribution indicators [8, 9]. Consequently, many studies on CHE have been conducted in Korea for more than a decade, and almost all of these studies have criticized the financial functioning of the Korean NHI scheme, which barely protects households from high OOP expenses [10,11,12].

The pricing system of the health care service market in Korea is based on a fee-for-service scheme and NHI is a third-party payer that covers some proportion of medical fees. There are many services in the medical market, most of which are “covered” services managed by NHI, and other “non-covered” services. Notably, NHI covers some proportion of medical costs for services that are covered according to the coinsurance rates, and the rest of the expenses become statutory copayments of patients [13]. At the same time, the patients must make full payments for services such as dental prosthetics, vision correction surgery, manual therapy, and other treatments or medicine based on new health technologies. These uncovered services may have clinical evidence for their treatment effects. However, the NHI does not pay for them due to low economic efficiency or the existence of other alternative medical services.

Moreover, private health insurance (PHI) in Korea covers OOP expenses, the sum of statutory copayments, and costs for uncovered services [10]. Notably, PHI mainly sells two types of insurance plans—fixed benefits and indemnity. The indemnity health insurance plan partially reimburses the patient’s OOP payments. The fixed benefit insurance plan pays the precontracted amount in consideration of medical expenses, loss of income, and other expenses in the case of death, disability, or a few critical illnesses. Some of them are combined with private pension plans. Therefore, the WHO does not regard the fixed benefit plan as a component of the health care system because it coverage is beyond that of the health coverage scheme [14].

Many Koreans additionally purchase PHI plans, a supplementary scheme covering services not covered by NHI. Although some variations exist, depending on research data, it has been reported that approximately 65–80% of households have PHI plans [10, 15, 16]. Moreover, PHI premiums have averaged US$ 184.9 per household with PHI per month, which is 2.1 times higher than NHI contributions (US$ 89.9 per month) [16]. Given this difference in premiums, it would be reasonable for households insured with PHI to be able to significantly reduce their OOP expenses. Furthermore, NHI benefits (benefit-in-cash and benefit-in-kind) are the amounts that NHI pays for medical services according to coinsurance rates; PHI reimbursements are a part of the OOP expenses reimbursed by PHI.

Previous studies have argued that poorly-designed PHI systems increase the prevalence of challenging issues like inequality, insuring only young and healthy people, and causing cost escalation [4, 17]. Such studies have also suggested that well-designed PHI systems can help households avoid the financial shock of large OOP expenditures when accessing health care. However, studies that analyze the extent to which PHI relieves households’ economic burden are rare. Previous studies related to PHI have mainly focused on the effects of PHI subscriptions and the increase in health care use, including adverse selections and moral hazard issues [10, 18,19,20] as well as care-seeking behavior [21, 22]. Most studies have shown that PHI increases health care use [23,24,25]. However, these studies have limitations because they analyze the effects of PHI subscriptions on health care use without considering the possibility of receiving reimbursements and the attendant amount. Additionally, unlike NHI, the indemnity plans of PHI pay only a portion of statutory copayments and make special reimbursement contracts for some expensive medical services that are uncovered by NHI. Furthermore, PHI’s claim process and exact condition of reimbursements are strict. Therefore, only a small percentage of the insured would receive reimbursements. In order to establish the hypothesis that PHI increases medical service or health care use, the possibility that PHI reimbursements significantly reduce the financial burden on consumers must first be determined. However, in the previous research, there has been no indication of the level of PHI coverage in Korea.

Furthermore, previous studies analyzed only the CHE incidence when estimating the economic burden of households due to medical expenses. However, this method had limitations. First, it was calculated only by using OOP expenses relative to household income; thus, the level of health insurance coverage could not be found. Second, as the unit of CHE incidence is the number of households, it was difficult to adequately measure the economic burden and insurance coverage level. Recently, Jung and Lee [26] developed methods by recalculating the incidence and positive gap of CHE to estimate the effectiveness of insurance in covering CHE. Therefore, this study applied the methods of Jung and Lee [26] and aimed to evaluate the design of the PHI schemes in terms of coverage by estimating how significantly the private indemnity health insurance mitigates CHE in Korea. Through this, we will compare the effects of Korea’s NHI and PHI in reducing CHE and suggest directions for enhancing the coverage and role of PHI.

Methods

Study design

First, we investigated whether there was a difference between the number of households subscribed to PHI and the number of households that received reimbursements. We expected the households that received reimbursements to be few. Next, we compared the effects of reduced CHE through NHI benefits with PHI reimbursements. Third, we compared NHI benefits and PHI reimbursements based on income class. It may be that the higher the income class, the higher the likelihood of the reimbursement rate. Next, this study aimed to analyze the contributions of NHI and PHI in reducing CHE through a two-part model using hierarchical regression. The expected result was that the contribution of NHI toward mitigating CHE may be substantial and would offset the sociodemographic differences. Conversely, the contribution of PHI may be insignificant.

Data source and study population

The present research used data of 2017 from the Korea Health Panel Study (KHPS), conducted by the National Health Insurance Services and the Korea Institute for Health and Social Affairs. The KHPS is a representative data source for analyzing health care use and expenditures that is open to the public. First, the KHPS employs two-stage stratified random cluster sampling based on the Population and Housing Census, which covers the entire Korean population in the relevant year. Second, the data include various variables, such as individuals’ socioeconomic characteristics, health behavior, and other related aspects of health care use, including NHI benefits, statutory copayments, PHI reimbursements, hospital visits, length of stay, payment for uncovered services, and disease code. In addition, the KHPS uses health insurance data and receipt checks at the National Health Insurance Services to prevent loss of information and recall bias errors. The number of household samples from the 2017 KHPS dataset was 6392. We excluded 748 households that were surveyed for OOP expenses but not for total health care payments (THP; OOP expenses + NHI benefits). These cases may include health care use outside of the formal institutional health system, such as alternative therapies. This study was approved by the Institutional Review Board of Yonsei University (approval number: 1041849–202,108-SB-127-01).

Measuring CHE and the effectiveness of insurance coverage

Traditionally, CHE is calculated as the ratio of OOP expenses to the income level of household units [7, 27]. If the ratio of OOP expenses/income is greater than or equal to a threshold Z, it is considered “catastrophic.” This can be expressed as:

Wagstaff and van Doorslaer [7] suggested three approaches for estimating CHE: incidence, positive gap, and mean positive gap. First, the incidence of CHE (Hcat) is the proportion of CHE-occurring households to the total number of households (N). This is calculated as:

Second, the positive gap of CHE (Gcat) indicates the height of the OOP expenses as a share of the income based on the total population. The height of OOP shares (O1i) is calculated as \(\frac{\mathrm{OOP}}{\mathrm{Income}}-\mathrm{Z}\). The Gcat is given as:

However, the positive gap approach has limitations vis-à-vis estimating the economic burden of households with CHE, as it is based on the total population, including households with no health care use. Therefore, Wagstaff and van Doorslear [7] suggested another approach called the mean positive gap (MGcat). This is calculated as:

Recently, Jung and Lee [26] developed methods to estimate the effectiveness of insurance in covering CHE. This method uses the difference between THP and OOP expenses to estimate the extent to which health insurance benefit payments reduce CHE.

First, it adopts the same processes as in Eqs. 1–4, except that OOP is substituted with THP. That is:

Subsequently, the effectiveness of NHI coverage in reducing the incidence of CHE (SHcat) was calculated by Kcat − Hcat, and the positive gap of CHE (TScat) was calculated by Jcat − Gcat. The mean positive gap of TScat, MTScat is (\(\sum_{i=1}^NO{2}_i-\sum_{i=1}^NO{1}_i\Big)/\sum_{i=1}^NE{2}_i\) (for a more detailed explanation, refer to Jung and Lee [26]).

To estimate the effectiveness of PHI coverage in reducing CHE, we used private health care payments (PHP; OOP expenses + PHI reimbursements). We define PHI benefit payments as the indemnity PHI products only because the WHO does not count flat-rate insurance as a component of the health care system [14].

Similarly, the effectiveness of PHI coverage in reducing the incidence of CHE (SPcat) was calculated using Pcat − Hcat, and the positive gap of CHE (TPcat) was calculated using Silcat − Gcat. The mean positive gap of TScat, MTPcat was computed as \(\left(\sum_{i=1}^NO{3}_i-\sum_{i=1}^NO{1}_i\right)/\sum_{i=1}^NE{3}_i\).

Statistical analysis

Descriptive statistics

Regarding the descriptive statistics, the characteristics of all the study subjects were shown using frequency and mean tests. All the study subjects were NHI subscribers because NHI subscription is compulsory for all citizens in Korea. To understand the PHI subscription and reimbursement rates, we separately presented households with PHI and households who received reimbursements from PHI, checking whether they differed according to the characteristics of the subjects through a chi-square test. We graphed the level at which NHI benefits reduced CHE and that at which PHI reimbursements reduced CHE.

Two-part model

When the dependent variable does not show a normal distribution and when the lower bound, usually 0, occupies a larger portion of the sample, the two-part model is an alternative method that overcomes the limitations of non-normality by dividing a single regression equation into two parts and analyzing it [28]. The first part is a logit or probit model that analyzes the effects of factors, such as the use of health care services. The second part is an ordinary least squares regression model, which estimates the effects of factors on the amount of health care use in those who embrace the health care system. The two-part model assumes that the determinants of health care use decisions and the amount of health care services are different. This model assumes that health care use decisions are mainly determined by predisposition factors, such as gender, marital status, and health status, and the amount is determined by economic factors, such as health insurance type or income level.

Hierarchical regression model

Hierarchical regression is a model that goes one step further from the multiple regression model that measures the relationship between various independent and dependent variables [29]. The hierarchical regression model considers a systematic order and hierarchy in the process of independent variables affecting the dependent variable. The method is simple. We can just add independent variables in the hierarchical order determined by the researcher to the existing regression model. In this process, the researcher can check the adjusted coefficient whenever a new independent variable is added and understand the relationship among the independent variables better as well as effectively comprehend the magnitude of the influence of a specific independent variable on the dependent variable [29]. The most significant advantage of the hierarchical regression model expands when new independent variables are discovered in the traditional model. The hierarchical regression can reveal the conventional model’s shortcomings and show how the model improves the precision of the estimation by adding new predictors.

Strategies for statistical analysis

We employed a two-part model to determine the factors of the incidence and positive gap of CHE (Model 1). Furthermore, to estimate and compare the effectiveness of NHI and PHI coverage, we applied hierarchical regression analysis to the two-part model. Model 2 adds NHI coverage (O2i − O1i) to CHE in Model 1. Model 3 adds PHI coverage (O3i − O1i) to CHE in Model 2.

Model 1

P: E2i (threshold: 10%), Y: O2i (threshold: 10%), X1i: predisposing factors (gender, age, educational level, marital status, job type of household head), X2i: needs factors (with or without disabled, number of chronic diseases, and the experience of health care use of four major diseases (cancers, cerebrovascular diseases, cardiac diseases, rare diseases), X3i: enabling factors (income adjusted by household equalization index (number of adults + 0.5 × number of children)0.56 [8], with or without PHI, type of NHI, and region), and ϵi: error term.

We used the incidence of CHE based on THP and E2i as the dependent variable for the logistic regression in the two-part model and used the positive gap of CHE based on THP, O2i for the linear regression in the two-part model. In the case of O2i, we applied a logarithmic transformation. Regarding the four major diseases, the NHI of Korea has increased the coverage rate as a special plan owing to high mortality and medical expenses. In Model 2, we added NHI coverage to CHE (O2i − O1i) to Model 1, and in Model 3, we added PHI coverage to CHE (O3i − O1i) to Model 2. We used the statistical software program Stata/SE version 14.0 (Stata Corp., Texas, USA) for all the analyses.

Results

General characteristics of the samples

By examining the general characteristics, 3769 out of 5644 households had PHI, and 246 households received PHI benefits. We described relationships between paid benefits and other characteristics in households with PHI (Table 1).

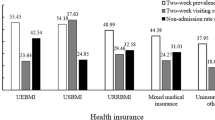

NHI benefits, OOP payments, and PHI reimbursements by income quintile

There were differences in NHI benefits and PHI reimbursements according to income class. First, regarding NHI benefits, the average of the poor and the near-poor was the highest, decreasing for the higher income group. Second, there were few households who received reimbursements from PHI in the lower class, and the number of beneficiary households increased with the income class. In addition, the higher the income group, the higher the PHI reimbursement average. Finally, as for OOP expenses, the average payment among the poor was slightly lower than that of other groups; however, the other groups showed similar results (Table 2).

The level of protection from CHE of households with NHI and PHI coverage

In the OOP-based CHE results that were derived based on the traditional CHE calculation method, when the threshold was 10%, Hcat and Gcat were the highest at 19.26 and 2.76%, respectively, as the threshold increased to 20 and 40%, respectively. In contrast, MGcat increased with the threshold. The results of the THP-based CHE suggested by Jung and Lee [26] and the PHP-based CHE included in this study were higher than the OOP-based CHE, but there was a difference in the level. The results of NHI and PHI coverage on CHE are presented in the right tab. First, NHI reduced the incidence of CHE (SHcat) by 15.17% at a threshold of 10%, while it reduced the proportion of health care expenses to income of households with CHE (MTScat) by 33.46% (23.46% + threshold 10%). In contrast, PHI reduced the incidence of CHE (SPcat) by 1.22% at a threshold of 10% as well as the proportion of health care expenses to income of households with CHE (MTPcat) by 11.39% (1.39 + threshold 10%) (Table 3).

Figure 1 is a composite graph that visually shows the extent to which each NHI and PHI reduces CHE for each household. A smooth curve lying under the bars represents the ratio of OOP expenses to the income level of households in the order of highest to lowest. The heights of the blue and red bars represent the drop rates of CHE, which are covered by NHI and PHI, respectively. The bars fluctuate because they are all based on the ratio of OOP expenses to income. This means that someone may receive fewer NHI benefits, even if they pay higher OOP expenses. Evidently, compared to NHI coverage, PHI coverage was relatively infrequent and low in height. In addition, NHI coverage increased with the ratio of OOP expenses to income, whereas PHI coverage was irregular (Fig. 1).

The role of national health insurance and private health insurance in protecting households from catastrophic health expenditure. The y-axis is the out-of-pocket payments as a share of the household’s income. The x-axis is arranged from left to right in the order of households with the highest out-of-pocket-to-income ratio. The red and blue bar graph represents the private healthcare payment (out-of-pocket + private health insurance benefit) and the total healthcare payment (out-of-pocket + national health insurance benefit) share of the household’s income. The smooth curve is the households’ out-of-pocket income

Coverage effects of NHI and private insurance on CHE

Model 1 is a typical factor analysis model for CHE (Table 4). Only the dependent variable CHE is based on THP and not the OOP expenses because this analysis aims to compare the impacts of the magnitude of NHI and PHI coverage. According to the results of the CHE incidence, logistic regression revealed that educational level, marital status, the household heads’ job type, household income level, type of NHI, presence (or absence) of the four major diseases, and the number of chronic diseases that affected CHE.

Model 2 adds NHI coverage (O2i − O1i), which is the drop rate of CHE and the NHI coverage (Table 4). Notably, NHI coverage had an effect of 16.743 odds ratio in the logistic regression and a coefficient of 0.936 in the linear regression. After computing NHI coverage (O2i − O1i), many social variables became insignificant except for household income level, type of NHI, presence of the four major diseases, and the number of chronic diseases. Moreover, there were significant changes among the variables. Compared to Model 1, the difference between income groups (odds, coefficient) was significantly reduced, and the positive gap for Medical Aid recipients was changed to a statistically significant decrease (coefficient: −0.188, p < 0.001). In addition, the effect of the four major diseases on the positive gap of CHE becomes insignificant.

Discussion

This study evaluated the coverage of PHI for households by applying a modified CHE calculation method and compared it with the NHI coverage in Korea. A total of 3769 out of 5644 households subscribed to the indemnity plans of PHI, and only 246 households received PHI reimbursements. This revealed that NHI reduced health care inequality by providing more benefits to lower-income households. Conversely, the indemnity products of PHI provided reimbursements more to the higher-income households. This could be interpreted as an indication of the income-regressive aspect of PHI. In particular, the contribution of PHI to CHE reduction was relatively low compared to that of NHI in terms of incidence and positive gap indicators. The number and height of the bar graph in Fig. 1 show that the number of households with beneficiaries and the PHI reimbursements, which represents the effects of reduced CHE, is quite small compared to that of NHI.

The findings of the two-part model with the hierarchical analyses in Table 4 are presented as follows: Model 2 is the case whereby NHI coverage (O2i − O1i) is added to Model 1. Moreover, NHI coverage had the most influence among all variables in the incidence and positive gap of CHE. When NHI coverage (O2i − O1i) was added to Model 2, it offset the effects of other variables, which were significant in Model 1. Educational level, marital status, and job type were significant among the incidence of CHE in Model 1 but not in Model 2. This indicates that NHI effectively reduces the differences in health care expenses according to socioeconomic status. This interpretation can be validated by acknowledging that Korea operates a fee-for-service system, whereby NHI provides benefits according to the amount of health care used. In Model 2, the odds ratio and coefficient values of income decreased overall compared to those in Model 1 (Table 4). This can be interpreted as the maximum OOP expenses policy, which differentiates the burden of health care expenses according to income level, which has an effect to some extent. However, as the maximum OOP expense policy in Korea is only applied to the health care services covered by the NHI, excluding uncovered services, it seems that the difference in influence based on income level may not be completely offset.

Additionally, in the positive gap analysis, Medical Aid was not significant in Model 1 but decreased significantly in Model 2, and the presence of the four major diseases was significantly higher in Model 1 but not significant in Model 2 (Table 4). Medical Aid recipients in Korea pay only $1 or $2 as OOP expenses; thus, their health care expenses are very low compared to those covered by NHI. Therefore, the results of the positive gap, which appeared significantly negative (−), reflected reality more accurately. Second, Korea is implementing a policy (expansion coverage plan for the four major diseases) to lower the ratio of statutory OOP expenses to the total health care expenses to 5% for four specific diseases (cancers, cerebrovascular diseases, cardiac diseases, and rare diseases) that have high mortality and a high probability of causing high health care expenses [30,31,32]. Most Korean studies have concluded that the expansion coverage policy for these four major diseases is ineffective when analyzing CHE. However, we consider these results to be biased because the incidence rates do not change significantly. Studies that have analyzed the effects of policy on the four major diseases using OOP expenses or NHI benefits as a dependent variable tend to report that there is a policy effect [30, 33]; however, studies that adopt CHE incidence as a dependent variable tend to report no effect at all [34, 35]. In this regard, Jung and Lee [26] confirmed that the positive gap can be viewed more accurately than the incidence approach when considering policy effects. Overall, the fact that the four major diseases did not appear to be significant in Model 2 could be understood as the lowering of medical cost burdens by NHI.

The changes between Model 1 to Model 2 were dramatic, but not so in Model 3, which added PHI coverage (O3i − O1i). Nonetheless, there are four significant results. First, all the regression coefficients for income in Model 3 were larger than those in Model 2, which indicated increasing inequality. In addition, the odds ratio of the four major diseases decreased from Model 2 to Model 3. This decrease can be interpreted to mean that the PHI coverage effect for these diseases exists because they are the covered under the main plans offered by PHI. In addition, the odds ratio of the number of chronic diseases was higher in Model 3 than in Model 2. This can be interpreted to be based on PHI’s non-acceptance of a high-risk group that may have many chronic diseases. Finally, the most important result was that PHI did not significantly contribute to the reduction of CHE. The reasons for the low coverage of PHI seem to be that indemnity insurance plans reimburse only for a small portion of statutory copayments and some uncovered medical services as well as the strict PHI claim process and detailed conditions of reimbursements.

According to the results of this study, most households were subscribed to PHI and paid premiums that were approximately twice that of NHI; however, the level of PHI coverage was rather low. The purpose of supplementary PHI was not only to meet the diversity of medical service demands but also to supplement the limitations of NHI coverage. Given that PHI in Korea is a part of the wider health insurance system, it cannot avoid the responsibility of protecting households. Therefore, it is necessary to enhance the coverage of indemnity insurance. To do so, the following issues should be addressed.

First, private insurance companies need to disclose transparent data. For example, PHI companies in Korea provide only part of their financial information to several PHI associations, and these PHI associations analyze the financial data and report them on the news. However, there is a lack of trust in such public domain disclosures because there are possibilities that the companies may hide certain information. The data on PHI used in this study were also collected from the patients rather than provided by private insurance companies. In particular, the major PHI companies in Korea announced in 2021 that they would significantly increase insurance premiums due to fiscal deficits. However, it is unknown whether the deficit is due to a large amount of reimbursements being paid to subscribers. In fact, it is possible that insurance plan sales performance is reduced because of the COVID-19 social distancing measures, which limit sales conducted by home salespersons, or that insurance cancellation increases due to the subscribers’ financial deterioration during the COVID-19 pandemic.

Second, it is necessary to establish a unified management system for mutual adjustments between NHI and PHI. For instance, in Ireland, PHI is managed by the Health Insurance Authority under the Ministry of Health and Central Bank of Ireland; hence, it is possible to understand and respond to the insurance market accurately [36]. However, in Korea, PHI is managed by the Ministry of Economy and Finance, and the Ministry of Health and Welfare governs NHI. Under this segmented system, managing the PHI market effectively is demanding. Even if an issue of insurance premium increase emerges, it would be impossible to duly determine whether there has been collusion among the PHI companies.

Third, there is no risk equalization scheme in Korea. It had been argued that the PHI plans made in the early 2000s were designed with generous coverage (combined with pensions), thereby causing deterioration of finance for private insurers over time. Now, albeit those plans have expired, the people who have subscribed since the 2000s have gradually become older and started to use more health care services, hence creating financial deficits for PHI. In Ireland, the Health Insurance Authority operates the “Risk Equalization Fund” [36]. This fund, raised through taxes from all the PHI companies, compensates insurance companies with a higher risk from the elderly. Likewise, a risk equalization scheme could be an option for stabilizing the financial soundness of the PHI companies in Korea. In summary, a new approach is necessary to reestablish the protective role of PHI by simultaneously expanding the benefits and solving funding problems.

To date, the level of practical PHI coverage has been filled with knowledge gaps, and this study provides basic data that aim to fill that gap for the first time. Most studies claim that PHI increases health care use when only considering enrollment status [10, 21,22,23, 37]; therefore, the level of reimbursements has not been included in the analysis. As a result of estimating the level of PHI coverage in this study, the coverage was found to be insignificant and the use of health care services was not problematic. In addition, it is difficult to assume if this would affect the NHI fund.

This study presents several limitations. First, although PHI is based on individual subscriptions, CHE is calculated at the household level; therefore, the PHI effect is also calculated at the household level. Second, the level of PHI coverage was somewhat underestimated due to the exclusion of fixed benefit insurance, savings insurance, and other types of plans, which were not included in the WHO’s standards for medical insurance. Third, this study did not conduct a longitudinal analysis because the PHI enrollment rate did not change, and the analysis mainly focused on the comparisons of NHI and PHI coverage. Fourth, this study did not consider the endogeneity issues rooted in sophisticated behavioral health economic theories such as adverse selection, favorable selection, and cream skimming. Because this study focuses on comparing the coverage rates of PHI and NHI, it is unnecessary to ensure homogeneity between groups. If follow-up studies investigate whether NHI pays more than PHI, in cases where patients have the same condition, they must consider the endogeneity issues using statistical techniques such as propensity score matching.

Conclusion

This study reveals that PHI barely protects households from CHE. For private insurance to play the role of medical coverage that subsidizes NHI and reduce the burden of medical expenses of households, it is necessary to improve the benefit coverage of indemnity insurance. The Korean private insurance system needs institutional reforms throughout Korea’s private insurance market structure. In this regard, we propose disclosing transparent data for PHI and implementing a unifying management system and a risk equalization scheme.

Availability of data and materials

The raw data supporting this study’s findings are publicly available from the Korea Health Panel Survey with a permission. However, data availability for processed data is limited because the free sharing of data between individuals is prohibited according to the bylaws of the Korea Health Panel Survey. The processed data are available upon reasonable request and with the National Health Insurance Services and the Korea Institute for Health and Social Affairs’ permission.

Abbreviations

- NHI:

-

National Health Insurance

- OOP:

-

Out-of-Pocket

- WHO:

-

World Health Organization

- CHE:

-

Catastrophic Health Expenditures

- PHI:

-

Private Health Insurance

- PHP:

-

Private Healthcare Payments

- KHPS:

-

Korea Health Panel Study

References

Besley T, Gouveia M. Alternative systems of health care provision. Econ Policy. 1994;9(19):199–258.

Petretto A. Optimal social health insurance with supplementary private insurance. J Health Econ. 1999;18(6):727–45.

Zweifel P, Breyer F. The individual as the producer of his health. Health Economics. New York: Oxford University Press; 1997. p. 52–89.

Sekhri N, Savedoff W. Private health insurance: implications for developing countries. Bull World Health Organ. 2005;83:127–34.

Kim E, Kwon S. The effect of catastrophic health expenditure on exit from poverty among the poor in South Korea. Int J Health Plann Manag. 2021;36(2):482–97.

OECD, Health expenditure and financing. https://stats.oecd.org/index.aspx?ThemeTreeld=9. Access 2 Jan 2022.

Wagstaff A, Doorslaer E. Catastrophe and impoverishment in paying for health care: with applications to Vietnam 1993–1998. Health Econ. 2003;12(11):921–33.

World Health Organization. The world health report 2000: health systems: improving performance: World Health Organization; 2000.

Kawabata K, Xu K, Carrin G. Preventing impoverishment through protection against catastrophic health expenditure. SciELO Public Health. 2002;80(8):612.

Jeon B, Kwon S. Effect of private health insurance on health care utilization in a universal public insurance system: a case of South Korea. Health Policy. 2013;113(1–2):69–76.

Choi J-W, Choi J-W, Kim J-H, Yoo K-B, Park E-C. Association between chronic disease and catastrophic health expenditure in Korea. BMC Health Serv Res. 2015;15(1):1–8.

Sohn M, Jung M. Effects of public and private health insurance on medical service utilization in the National Health Insurance System: national panel study in the Republic of Korea. BMC Health Serv Res. 2016;16(1):1–11.

Kwon S. Thirty years of national health insurance in South Korea: lessons for achieving universal health care coverage. Health Policy Plan. 2009;24(1):63–71.

World Health Organization. A system of Health Accounts 2011 Edition: OECD Publishing; 2011.

You C-H, Kang S-W, Choi J-H, Kwon Y-D. Effect of private health insurance on medical care utilization: six year unbalanced panel data model. Kor J Health Serv Manage. 2017;11(3):51–64.

Moon S-W, Kang TE, Oh H, Seo N, Jang SH, Jung D-I, et al. A report on the Korea health panel survey of 2017; 2019.

Zigora T. Current issues, prospects, and programs in health insurance in Zimbabwe: sustainable health care financing in southern Africa. Washington, DC: The World Bank; 1996. p. 117–23.

Mitchell JM. Utilization trends for advanced imaging procedures: evidence from individuals with private insurance coverage in California. Med Care. 2008;46(5):460–6.

Kratzer J, Cheng L, Allin S, Law MR. The impact of private insurance coverage on prescription drug use in Ontario, Canada. Healthcare Policy. 2015;10(4):62.

Sommers BD, Blendon RJ, Orav EJ, Epstein AM. Changes in utilization and health among low-income adults after Medicaid expansion or expanded private insurance. JAMA Intern Med. 2016;176(10):1501–9.

Al-Hanawi MK, Mwale ML, Kamninga TM. The effects of health insurance on health-seeking behaviour: evidence from the kingdom of Saudi Arabia. Risk Manage Healthcare Policy. 2020;13:595.

Rana RH, Alam K, Gow J. Selection of private or public hospital care: examining the care-seeking behaviour of patients with private health insurance. BMC Health Serv Res. 2020;20(1):1–17.

Ettner SL. Adverse selection and the purchase of Medigap insurance by the elderly. J Health Econ. 1997;16(5):543–62.

Tian W-H, Tien JJ, Chen C-S, Liu T-C. Private health insurance and inpatient service utilisation among adults and elderly people under Taiwan’s National Insurance Programme. Geneva Papers Risk Insurance-Issues Pract. 2012;37(4):655–77.

Buchmueller TC, Couffinhal A, Grignon M, Perronnin M. Access to physician services: does supplemental insurance matter? Evidence from France. Health Econ. 2004;13(7):669–87.

Jung H, Lee J. Estimating the effectiveness of national health insurance in covering catastrophic health expenditure: evidence from South Korea. PLoS One. 2021;16(8):e0255677.

Wagstaff A. Measuring catastrophic medical expenditures: reflections on three issues. Health Econ. 2019;28(6):765–81.

Yardim MS, Cilingiroglu N, Yardim N. Financial protection in health in Turkey: the effects of the Health Transformation Programme. Health Policy Plan. 2014;29(2):177–92.

Mbaluka MK, Muriithi DK, Njoroge GG. Application of principal component analysis and hierarchical regression model on Kenya macroeconomic indicators. Eur J Math Stat. 2022;3(1):24–35.

Kim KO, Shin YJ. The effect of the policy of expanding coverage for four major diseases: focused on out-of-pocket payment. Health Soc Welfare Rev. 2017;37(2):452–76.

Lee H. Effect of four major severe diseases benefit expansion policies on the health care utilization and catastrophic health expenditure. Korean J Soc Welf. 2018;70(1):89–116.

Cho H, Jung H, Lee J. Effect of four major severe disease benefit expansion policy in 2013. Kor Soc Secur Stud. 2020;36(1):71–89.

Park JH, Jung KT. Analysis of Changes in medical use of people with severe illness after health insurance policy for 4 major diseases. Health Serv Manage. 2019;13(3):9–23.

Choi J, Jeong H. Impacts of the benefit extension policy on financial burden and catastrophic health care expenditure. Kor J Health Econ Policy. 2012;18(4):1–19.

Jung HW, Lee K-S. What policy approaches were effective in reducing catastrophic health expenditure? A systematic review of studies from multiple countries. Appl Health Econ Health Policy. 2022. https://doi.org/10.1007/s40258-022-00727-y.

Sagan A, Thomson S. Voluntary health insurance in Europe: country experience: World Health Organization; 2016.

Kang S, You CH, Kwon YD, Oh E-H. Effects of supplementary private health insurance on physician visits in Korea. J Formos Med Assoc. 2009;108(12):912–20.

Acknowledgments

We would like to thank Editage (http://www.editage.co.kr, accessed on 8 November 2021) for the English language editing.

Funding

This research was supported by a grant of Patient-Centered Clinical Research Coordinating Center (PACEN) funded by the Ministry of Health & Welfare, Republic of Korea (grant number: HC21C0059).

Author information

Authors and Affiliations

Contributions

Hyun Woo Jung: Conceptualization, Writing – Original draft preparation, Formal analysis. Young Dae Kwon: Methodology, Writing – Review & editing. Jin-Won Noh: Supervision, Validation, Writing – Review & editing, Funding acquisition. The authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Approval of IRB exemption for this study was granted by the Yonsei University Institutional Review Board (approval number: 1041849–202108-SB-127-01) given the retrospective nature of the study. This study was carried out in accordance with the ethical standards laid down in the 1964 Declaration of Helsinki and its later amendments. We received a waiver of informed consent because the data were obtained from a public database and analyzed in de-identified samples. We used reliable raw data from the Korea Health Panel Study (https://www.khp.re.kr:444/eng/main.do), available on the condition of granted permission from the Korea Institute for Health and Social Affairs.

Consent for publication

Not applicable.

Competing interests

The authors declare no potential conflicts of interest with respect to the research, authorship, and publication of this article.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/. The Creative Commons Public Domain Dedication waiver (http://creativecommons.org/publicdomain/zero/1.0/) applies to the data made available in this article, unless otherwise stated in a credit line to the data.

About this article

Cite this article

Jung, H.W., Kwon, Y.D. & Noh, JW. How public and private health insurance coverage mitigates catastrophic health expenditures in Republic of Korea. BMC Health Serv Res 22, 1042 (2022). https://doi.org/10.1186/s12913-022-08405-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s12913-022-08405-4