Abstract

Background

The UK Soft Drinks Industry Levy (SDIL) was announced in March 2016, became law in April 2017, and was implemented in April 2018. Empirical analyses of commercial responses have not been undertaken to establish the scale, direction or nuance of industry media messaging around fiscal policies. We aimed to develop a detailed understanding of industry reactions to the SDIL in publicly available media, including whether and how these changed from announcement to implementation.

Methods

We searched Factiva to identify articles related to sugar, soft-drinks, and the SDIL, between 16th March 2016–5th April 2018. Articles included were UK publications written in English and reporting a quotation from an industry actor in response to the SDIL. We used a longitudinal thematic analysis of public statements by the soft-drinks industry that covered their reactions in relation to key policy milestones.

Results

Two hundred and ninety-eight articles were included. After the announcement in March 2016, there was strong opposition to the SDIL. After the public consultation, evolving opposition narratives were seen. After the SDIL became law, reactions reflected a shift to adapting to the SDIL. Following the publication of the final regulations, statements sought to emphasise industry opportunities and ensure the perceived profitability of the soft drinks sector. The most significant change in message (from opposition to adapting to the SDIL) occurred when the SDIL was implemented (6th April 2018).

Conclusion

Reactions to the SDIL changed over time. Industry modified its media responses from a position of strong opposition to one that appeared to focus on adaptation and maximising perceived profitability after the SDIL became law. This shift suggests that the forces that shape industry media responses to fiscal policies do not remain constant but evolve in response to policy characteristics and the stage of the policy process to maximise beneficial framing.

Similar content being viewed by others

Background

On 16th March 2016, as part of his Spring Budget Statement, the UK Chancellor of the Exchequer announced a new levy on soft drinks to help tackle childhood obesity [1] – the Soft Drinks Industry Levy (SDIL). The SDIL came into effect on 6th April 2018, two years after its announcement, which allowed time for public consultation and for industry to adapt. The SDIL is a levy on companies (rather than consumers directly) that applies to any soft drink with added sugar. It has two-tiers: £0.24/L for drinks containing ≥ 8 g/100ml of added sugar, £0.18/L for drinks containing ≥ 5 g/100ml and < 8 g/100ml. There is no levy on soft drinks containing < 5 g/100ml and exemptions for drinks that are 100% fruit juice, ≥ 75% milk (or milk-replacement), ≥ 1.2% alcohol by volume, alcoholic beverage replacements, or are produced or distributed by manufacturers/importers with < 1 million L/year in UK sales [2]. Regular consumption of sugar-sweetened beverages (SSBs) is associated with total energy intake, and increased incidence of dental caries, obesity, type 2 diabetes and cardiovascular disease [3,4,5,6]. In response to these health risks, fiscal dietary policies like the SDIL have been identified as promising tools to reduce consumption [7]. Several SSB taxes of varying designs have been implemented and evaluated internationally [8,9,10,11,12,13]. These SSB taxes are mainly sales taxes that aim primarily to disincentivise purchases of SSBs. In contrast, the SDIL was designed primarily to incentivise reformulation to reduce the sugar content of drinks.

A reluctance to implement SSB taxes globally can be partially explained by the reactions of the sugary drinks industry to fiscal food policies. Broadly, a range of discursive (i.e. argument based) and instrumental (i.e. action-based) strategies have been used in industry corporate political activity to oppose the imposition of these [14,15,16]. For example, there have been documented efforts to pre-empt local tax legislation by lobbying municipalities to prohibit levying taxes on foods and beverages in a number of US states [17,18,19,20]. In other cases, where local tax bans were not successful, alternative oppositional tactics have been sustained over several years [21, 22]. In Mexico industry funded research was published that casted doubt on whether soda taxes would reduce consumption or improve health, and industry lobbied politicians to vote against SSB taxation [23].

Industry has been reported to make use of media coverage to advocate for industry perspectives, influence societal discourse and policymaking [24,25,26]. SSBs and fiscal policy more broadly are frequently discussed in the British press, and articles include both public health advocacy and pro-industry messaging [27]. Concerning the SDIL, a media analysis starting a year before the announcement of the policy suggested that articles supportive of SSB taxation (23.5%) outnumbered those that were oppositional (14.2%) [28] and that arguments underpinning proponents and opponents of the SDIL were broadly consistent with those used within the alcohol and tobacco industry [29]. While most of the research examining media representations of industry and their discursive strategies is focused on message framing [30], there is evidence that industry messaging can shift depending on the audience, with conflicting or contradictory debates and responses to regulation [31, 32]. Therefore, examining industry reactions throughout policy development and implementation processes could offer novel insights into how industry messaging evolves in a changing political landscape over time. These insights could inform policy responses to industry attempts to influence the public discourse and subsequently new health policy.

In this paper, we set out to develop a detailed understanding of what approaches were used by industry, and whether and how industry discourse evolved and adapted over time between the announcement and implementation of the SDIL, through qualitative analysis of quotes in the news media and trade press.

Methods

Study design

We undertook a longitudinal thematic media analysis from the announcement to the implementation of the Soft Drinks Industry Levy (SDIL).

Identification and selection of articles

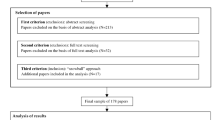

We searched the UK news media (e.g. The Daily Telegraph) and trade press (e.g. The Grocer) in the Factiva database [33]. Searches were conducted in local and global newspapers, newswires, trade journals, newsletters, magazines and transcripts (supplementary file 1) [34]. We sought articles concerning sugar or soft drinks, and the SDIL. As we wanted to capture articles that were primarily about the SDIL, search terms were developed for ‘levy’ and one or more of the following terms: tax*, sugar*, soft drink* and soda* appearing in the title.

All articles were independently screened by two researchers (Researcher 1 and Researcher 3) using predefined inclusion criteria: (a) articles covering the period between the day that the SDIL was announced (16th March 2016) to the day before it was implemented (5th April 2018); (b) articles from UK publications; (c) articles that reported a quotation from an industry, industry-associated think-tank, industry campaign group (e.g. ‘face the facts, can the tax’), or trade body spokesperson in response to the SDIL either from a named individual or non-named spokesperson; and (d) articles published in English (supplementary file 1). Duplicate articles were excluded if they: (a) were a short lead-in to a main story captured in a more in-depth version in the same publication; or (b) were an exact duplicate, for example, articles derived and syndicated from news services such as Reuters.

Longitudinal analysis

Eligible articles were organised chronologically to allow an analysis that explored potential change in industry response over time (a full list of actors is available on request from the corresponding author). We applied thematic analysis [35] involving six stages: (a) familiarisation; (b) coding; (c) generating initial themes; (d) developing and reviewing themes; (e) refining, defining and naming themes; and (f) writing up. Themes were generated inductively using a data-driven approach as opposed to applying an a priori coding framework informed by previous research or existing theory. This approach was adopted because it allowed us to adopt an exploratory stance appropriate to the context of a novel food tax with a unique structure. Taking a longitudinal and naturalistic perspective of industry media concerning the SDIL enabled qualitative description exploring the who, what, and where of events or experiences [36]. The analysis was not intended to offer a comprehensive account of all industry statements, but to reflect evidence of shifts among important statements that represent the majority of the conversation. No a priori timeline of intermediate events was imposed, allowing for observed shifts in industry responses to be driven by the data. However, the relationship between shifts in messages and events was later identified and documented.

Researcher 1 undertook familiarisation, initial coding and generation of initial themes with input from Researcher 10. Researcher 1, Researcher 2, Researcher 10 & Researcher 4 developed and reviewed the themes while defining and naming themes and the selection of illustrative quotations were derived via consensus with other co-authors. Searching for themes was based on the most salient statements informed by the context of the article. The analysis was aided by Atlas.Ti software [37].

Results

Eight hundred and twenty-four articles were screened and 298 met the inclusion criteria (245 news media and 53 trade press from 72 sources). These articles covered the reactions of the soft drinks industry, industry associations, industry movements (e.g. ‘Can the Tax’) and think-tanks. Table 1 describes the key policy development milestones derived inductively from this analysis and Table 2 describes the number of eligible articles found for each time period. The temporal sequencing of the relative salience of these themes are shown in relation to these milestones. Five themes reflecting industry reactions to the SDIL emerged from our analysis; these are summarised in Fig. 1.

After the announcement on 16th March 2016, there was strong opposition. Following the public consultation (18th August-13th October 2016), reactions demonstrated continued opposition but with important shifts in the narrative. After the finance bill was passed and received Royal Assent (i.e. the SDIL became UK law) on 27th April 2017, reactions reflected adapting to the SDIL. Following the publication of the final regulations on 15th January 2018, and as the date of implementation approached (6th April 2018), industry statements sought to demonstrate opportunities and reassurance concerning perceived profitability of the soft drinks sector. Overall, reactions were consistent across different industry actors in each of these time periods. The most significant change in message (from opposition to tolerance and reassurance concerning the impact of the SDIL on industry) occurred after the passing of the Finance Bill.

Prior to the SDIL becoming UK Law (March 2016 to April 2017)

Immediately after the announcement of the SDIL, as part of the March 2016 budget and before the SDIL become UK law, industry reacted with strong opposition to the introduction of the SDIL.

Strong opposition

The initial oppositional stance comprised multiple dimensions, primarily with statements questioning the evidence base underlying the use of SSB taxes to support behaviour change and reductions in obesity. For example, Coca-Cola European Partners Vice President and General Manager, said: “We don’t believe the sugar tax is the right thing to be done. We are not debating the issue, we are debating the solution. The facts don’t suggest that a sugar tax works to change behaviour.” (The Guardian, 17th March 2016). The chief executive of Nichols, said: “While we recognise sugar consumption is a shared responsibility, we do not believe that a tax on soft drinks is an effective solution or fair to consumers.” (The Guardian, 17th March 2016). Statements questioning the underlying evidence were accompanied by claims that the SDIL would increase costs for the public, regardless of what they drink. For example, the General Manager of Coca-Cola UK & Ireland said: “It will also hit consumers in the pocket regardless of what they drink.” (The Daily Telegraph, 26th May 2016). Industry also discussed the progress already made in reducing sugar, and suggested SSBs were unfairly targeted; AG Barr chief executive stated: “It is extremely disappointing that soft drinks have been singled out given it is the only food and drink category to have made any real progress in reducing sugar intake in recent years, down 13.6 per cent since 2012.” (Daily Record.co.uk, 17th March, 2016).

Industry associations also made statements on behalf of their membership and the industry more broadly. For example, Food and Drink Federation Director General, said: “For nearly a year we have waited for an holistic strategy to tackle obesity. What we’ve got today instead is a piece of political theatre. … The imposition of this tax will, sadly, result in less innovation and product reformulation, and for some manufacturers is certain to cost jobs. Nor will it make a difference to obesity.” (Daily Mirror Online, 17th March, 2016) In addition, a spokesperson for the pro-industry think-tank, the Institute of Economic Affairs, said: “It is astonishing that the Chancellor has announced a tax on sugary drinks when there is no evidence from anywhere in the world that such taxes have the slightest effect on obesity.” … “Whether dressed up as a direct tax or a levy on industry, the effect will be that the Government will be picking the pockets of the poor for no benefit.” (Mail Online, 17th March 2016) During this time, there was also one mention of the potential for legal action by the soft drinks industry, reported as from a “senior industry source”: “It’s fair to say we are more than just considering legal action. This has been rushed through without warning”. (The Sunday Times, 20th March, 2016)

Evolving opposition narratives

In the months leading up to the launch of the public consultation in August 2016 and until the consultation closed in October 2016, the immediate and primarily strong oppositional stance continued. Industry continued to highlight the impact on jobs and added pressure on their business, continuing to question the legislation, with a desire to have an open dialogue between government and industry. For example, a Coca-Cola spokesman said: “Coca-Cola works with governments and civil society around the world on calorie reduction initiatives that we believe are more effective than discriminatory taxes. … We believe it is important that industry and government keep an open and constructive dialogue on this issue.” (The Sunday Times, 16th October, 2016). The British Soft Drinks Association Director General, said: “Given current increases in the cost of goods, we’re surprised the Treasury wishes to put more pressure on businesses and raise prices for hard-pressed consumers.” … “It’s also ironic that the tax hits the soft drinks category, which has led the way in helping consumers reduce sugar intake - down nearly 18% since 2012. We are also the only sector with a calorie reduction target for 2020.” … “We support the need to address the public health challenge the country faces, but it’s worth bearing in mind that there is no evidence taxing a single product or ingredient has reduced levels of obesity anywhere in the world.” (Mail Online, 9th March, 2017).

The narrative also subtly shifted and increasingly highlighted existing commitments of the soft drinks industry, such as voluntary actions supporting government public health policies on sugar and calorie reduction and obesity. AG Barr’s chief executive, said “Our job is to understand and have relationships with our customers, which we have had for over 100 years, making sure we offer them choices. If they want standard Irn-Bru they can have that just as they do at the moment,” … “I would continue to be disappointed that despite the considerable voluntary initiatives and the significant progress that our industry and the company have made, a punitive levy on a specific single category has been brought out where, in stark contrast to other food and drink categories, we have been reducing sugar content and have a strong [commitment] to do so.” (The Guardian, 6th May, 2016). The Chief Executive of Britvic said that two-thirds of the group’s UK portfolio already fell outside the tax: “Britvic already offers a broad range of products and has taken significant steps in recent years to reduce added sugar and reformulate drinks, using Stevia for example, and remains committed to a 20 per cent calorie reduction by 2020.” (Financial Times, 19th May, 2016).

After the SDIL became UK Law (April 2017 to April 2018)

In the immediate lead up to, and after, the SDIL became UK law on 27th April 2017, the industry narrative shifted to one of adaptation to the SDIL, outlining strategies in reaction to potential financial impacts, and statements about ensuring perceived profitability.

Adapting to the SDIL

While the underlying opposition remained, statements were more focused on explaining their company specific strategies for adapting to the SDIL, particularly to preserve profits. These included reformulation efforts, diversification and other actions that would be used to offset the cost of the SDIL to manufacturers. Lucozade Ribena Suntory’s Director of Research and Development, said: “We are taking out 50% of sugar this year across the whole portfolio and that actually means that for each drink they’ll be 4.5 g of sugar per 100ml or less…So we are going to make sure for each brand that we have a zero calorie or no added sugar variant. That’s a massive change for us, but we also recognise that that is not enough, so we are actually committing £30 M of investment across the next three years to get more people exercising and starting that with our own employees.” (Food Manufacture, 1st June 2017). Coca-Cola European Partners Marketing Director said: “For those who like the taste of Coke but want zero sugar we have Coke Zero Sugar, which is now the fastest-growing cola in Britain. We’re already seeing a shift in mix.” (The Grocer, 22nd April 2017).

Similarly, Britvic’s Chief Executive made various statements indicating that while he admitted the SDIL would bring uncertainty to the industry, they were prepared. For example, he said: “94% of our own brands will be unaffected by the sugar levy. Pepsi and 7UP are the prime brands that can be affected but they also have low sugar offers”. He also said that the company raised prices to offset the impact of a weaker pound and higher raw material costs, and added that the company also reduced costs by £8 million ($10.7 million) in the year (Reuters News, 29th November 2017). Chief Financial Officer for Vimto (owned by Nichols plc), made a statement about a recipe reformulation project that would mean none of its products would be vulnerable to the SDIL. They said: “Last year, 70pc of our UK growth came from no added sugar and zero variants,” … “It has also been helpful that the acquisitions [of Noisy Drinks and Feel Good] have produced drinks which are below the levy.” (The Telegraph Online, 21st July 2017).

Opportunities and reassurance about perceived profitability

After the final regulations had been published on 15th January 2018, and as the implementation date for the SDIL approached on 6th April 2018, media statements appeared to be aimed at reassuring the public and shareholders about the perceived profitability of the soft drinks sector, and excitement about the future. However, underlying opposition remained. For example, Britvic’s Chief Executive, said: “We have delivered a solid start to the new financial year, with group revenue growing 3.3% ahead of a strong first quarter last year. As we said at our preliminary results, the introduction of a Soft Drinks Industry Levy in the UK and Ireland brings a level of uncertainty, but we are well placed to navigate this given the strength and breadth of our brand portfolio and exciting marketing and innovation plans.” Additional statements were about how the combination of cost management and progress will ensure a bright future. “In addition, our continued focus on revenue and cost management and the delivery of the final phase of our business capability programme means we remain confident of making further progress in 2018.” (Mail Online, 31st January 2018) While statements around profitability continued, additional statements regarding future opportunities for the business were also highlighted. For example, referring to new product launches in the UK the General Manager of Coca-Cola for Britain and Ireland said: “These launches have moved much quicker through the business than before, this is a sign of things to come.” (The Telegraph Online, 29th January 2018).

Discussion

Summary of main findings

The purpose of this analysis was to examine in what ways the soft drinks industry reacted to the SDIL in the public media, and how this industry narrative changed over a two-year period spanning the development and implementation of the policy. Our findings suggest that soft drinks industry sentiment in the news and trade media was orchestrated across the industry and evolved over time, with a significant shift in prevailing sentiment once the SDIL had achieved Royal Assent in April 2017. Before this, industry demonstrated strong opposition and advocated for slowing or halting the policy. Arguments centred on the economic impact of the policy, suggesting that it would undermine industry, cost jobs and threaten the UK economy, as well as a prevailing narrative that it would not be effective for public health. Post-April 2017, sentiment shifted to focus on commercial strategies that could counter the potential financial impact of the SDIL and ensure continued profitability in the sector.

Strengths and limitations

A strength of this analysis is the longitudinal approach, which permits an examination of how industry messaging about the SDIL evolved over time. Previous analyses of media responses to the SDIL span from 11 months pre-announcement to 8 months post-announcement and used content and discourse network analyses to explore sentiment around the SDIL announcement [28, 29, 43]. Our analysis complements and extends this work by examining industry media sentiment until the implementation of the SDIL in April 2018, as well as using thematic analysis inductively to explore how this changed throughout this period. Media data is curated by journalists, editors and actors but our focus on specific statements made by industry actors sought to reduce the impact of editorial content and achieve greater fidelity than by analysing entire articles. By focusing on these direct statements, we were able to attain insights into industry reactions to the SDIL that they wished to make public. To ensure that the broadest range of industry views was reflected, we also included quotes from industry associations, industry movements and industry-associated think-tanks, as well as quotes in the trade press. Including trade press gives unique insights into industry conversations with competitors and shareholders, as well as the more public-facing messaging to shape public opinion and policy debates in news media. Across media sources, statements by industry may reflect a wider communication strategy to position themselves in a particular way in the eyes of policymakers/potential consumers, rather than reflecting the true positions, values or behaviours of either individuals or organisations with regard to SSB taxes.

There are some limitations to this work however. Although we aimed to explore industry reaction to the policy process through the news media (i.e. how they sought to influence policymaking through this medium), we did not explore industry reaction once the policy was implemented. Further, whilst comprehensive searches were conducted in news and trade press, this work does not include industry statements given through other forms of communication, for example social media. Finally, this work takes a higher-level position exploring ‘industry’ reaction as a whole and there may be some nuance missed by approaching the research in this way.

Relationship to prior knowledge

News media provides industry with a platform to present messages favourable to their strategy. Some of these messages given in response to unfavourable policy, have been described as an industry ‘playbook’ of typical responses, which primarily centre around complexity arguments as well as framing evidence-using techniques such as ‘siloing’ (the separation of contradictory arguments) or ‘boomeranging’ (the weaponisation of logic from their opponents) [44, 45]. Our findings suggest that the industry ‘playbook’ was used prior to the SDIL becoming law; however, once the SDIL was certain to be introduced, media messaging started to transition away from this playbook, and sought to emphasise that they are not only adapting to the SDIL but it could be used as an opportunity to increase profit. Alternatively, as opposed to a transition away from the playbook, our research could highlight an area that has been underexplored previously: reassuring shareholders that they will still be profitable following new fiscal policy. Exploration of news media in South Africa following the announcement of plans to introduce an SSB tax identified less negative media coverage than we found in the UK in relation to the SDIL [46]. It could be that an alternative playbook strategy to ‘strong opposition’ is ‘reassurance of profitability’, but this was not the initial preferred response to the UK SDIL by industry representatives speaking to the news media.

Following the implementation of the SDIL, evidence suggests that these concerns from the ‘industry playbook’ did not materialise. Although a negative impact on domestic turnover occurred in the short-term, this was not sustained following implementation in April 2018 [47], and although there was an negative stock market reaction immediately after the announcement of the SDIL (for the four UK soft drink firms listed on the London Stock Exchange), after four days this effect had dissipated [48]. Evidence examining SSB taxation internationally corroborates these findings, that little negative economic impact occurs following implementation [49]. Early industry claims of adverse economic impacts and job losses, therefore, did not occur.

Interpretation and implications for policy and practice

Overall, articles suggested that industry actors took a strategic approach to monitoring and change. Although this approach showed similarities with previous work exploring the ‘industry playbook’, the design of the SDIL was somewhat different from the majority of previous SSB taxes, which tended to be direct taxes on sales, and thus led directly to price increases for consumers. The SDIL is levied on manufacturers and importers in two tiers, according to the sugar concentration of drinks, and is intended to incentivise industry to reformulate SSBs [42]. In contrast to a tax designed only to reduce demand for SSBs via increased product price, this approach provides an opportunity for industry to avoid the paying the levy by reformulating their drinks. Findings exploring industry responses to the SDIL from 2015 to 2019 support this and show a large reduction in sugar content in eligible drinks, demonstrating that many companies were able to avoid paying the levy [50]. The shift in sentiment from one of opposition to one of adaptation and ensuring perceived profitability could be attributed to this response – that industry were able to avoid the SDIL unlike SSB taxes implemented elsewhere. However, this shift in sentiment also occurred after the SDIL was given Royal Assent and became law. Industry appears to have collectively changed their narrative around the SDIL once it was unavoidable, as public oppositional stances could no longer prevent its implementation after April 2017. The stance adopted once the SDIL became inevitable (from April 2017), in contrast, appeared to be aimed at reassuring shareholders concerning profitability. This work highlights that strong industry opposition to policies prior to them becoming law may not reflect real threats to industry but merely be tactical expressions aimed at hindering or modifying policy that could impact their profits and operations. Policymakers designing food taxes, or other regulatory food policies, need to be aware of industry media responses, including how these typically adhere to a standard ‘playbook’ of oppositional tactics. Alongside the shift in content we describe, this change in volume could indicate a shift in the industry prioritisation of resources to responding internally and adapting to the policy, rather than commenting externally. Policymakers should also be aware, therefore, that oppositional responses may reduce in volume once a policy is made law and is inevitable.

Unanswered questions and future research

Similar to work conducted on the UK Public Health Responsibility Deal [51, 52], future research could use Freedom of Information (FOI) requests to explore food industry communication regarding the SDIL. This would allow insights to be gained into the non-public positions of industry regarding the SDIL and the relationship of these positions could be compared to the findings from this research. Comparisons could also be made between industry reactions to the SDIL through the news media or FOI requests and similar responses to other health policies, for example for tobacco or alcohol control. This would allow researchers to explore whether the patterns found in this paper represent a standard industry playbook, or whether they express real adaptations and learning by industry in response to the SDIL specifically. Future research could explore industry reaction through quotes given to the news media following the implementation of the SDIL in April 2018, as well as exploring in more detail the differences between industry actors, types of press (general news vs. trade press), and also examine the reaction expressed via industry press releases or industry umbrella groups.

Availability of data and materials

The datasets used and/or analysed during the current study are available as supplementary materials.

References

HM Treasury and The RT Hon George Osborne. Budget 2016: George Osborne’s speech - GOV.UK. 2016. https://www.gov.uk/government/speeches/budget-2016-george-osbornes-speech. Accessed 18 Nov 2020.

HM Revenue & Customs. Soft Drinks Industry Levy. 2016. https://www.gov.uk/government/publications/soft-drinks-industry-levy/soft-drinks-industry-levy#:~:text=from%20the%20levy.-,Policy%20objective,to%20reduce%20the%20sugar%20content. Accessed 16 June 2020.

Moynihan PJ, Kelly SAM. Effect on caries of restricting sugars intake: systematic review to inform WHO guidelines. J Dent Res. 2014;93:8–18.

Imamura F, O’Connor L, Ye Z, Mursu J, Hayashino Y, Bhupathiraju SN, et al. Consumption of sugar sweetened beverages, artificially sweetened beverages, and fruit juice and incidence of type 2 diabetes: systematic review, meta-analysis, and estimation of population attributable fraction. BMJ. 2015;351:h3576.

Xi B, Huang Y, Reilly KH, Li S, Zheng R, Barrio-Lopez MT, et al. Sugar-sweetened beverages and risk of hypertension and CVD: a dose–response meta-analysis. Br J Nutr. 2015;113:709–17.

Malik VS, Pan A, Willett WC, Hu FB. Sugar-sweetened beverages and weight gain in children and adults: a systematic review and meta-analysis. Am J Clin Nutr. 2013;98:1084–102.

Brownell KD, Farley TA, Willett WC, Popkin BM, Chaloupka FJ, Thompson JW, et al. The public health and economic benefits of taxing sugar-sweetened beverages. N Engl J Med. 2009;361:1599–605.

Colchero MA, Popkin BM, Rivera JA, Ng SW. Beverage purchases from stores in Mexico under the excise tax on sugar sweetened beverages: observational study. BMJ. 2016;352:1–9.

Falbe J, Thompson HR, Becker CM, Rojas N, McCulloch CE, Madsen KA. Impact of the Berkeley excise tax on sugar-sweetened beverage consumption. Am J Public Health. 2016;106(10):1865–71. https://doi.org/10.2105/AJPH.2016.303362.

Colchero MA, Guerrero-Lopez CM, Molina M, Rivera JA. Beverages sales in Mexico before and after implementation of a sugar sweetened beverage tax. PLoS One. 2016;11:4–11.

Alvarado M, Unwin N, Sharp SJ, Hambleton I, Murphy MM, Samuels TA, et al. Assessing the impact of the Barbados sugar-sweetened beverage tax on beverage sales: an observational study. Int J Behav Nutr Phys Act. 2019;16:13.

Redondo M, Hernández-Aguado I, Lumbreras B. The impact of the tax on sweetened beverages: a systematic review. Am J Clin Nutr. 2018;108:548–63.

Ng SW, Colchero MA, White M. How should we evaluate sweetened beverage tax policies? A review of worldwide experience. BMC Public Health. 2021;21(1):1941.

Du M, Tugendhaft A, Erzse A, Hofman KJ. Sugar-sweetened beverage taxes: industry response and tactics. Yale J Biol Med. 2018;91:185–90.

Barlow P, Serôdio P, Ruskin G, McKee M, Stuckler D. Science organisations and Coca-Cola’s “war” with the public health community: Insights from an internal industry document. J Epidemiol Community Health. 2018;72:761–3.

Ulucanlar S, Fooks GJ, Gilmore AB. The policy dystopia model: an interpretive analysis of tobacco industry political activity. PLoS Med. 2016;13:1–21.

Snyder signs bill to prohibit local food, beverage taxes. New York City: Associated Press; 2017. https://apnews.com/article/b27f3b9f5f4e4eb9a3890c2f373dba35.

Gardiner D. Arizona bans extra taxes on soda, sugary drinks. Phoenix: azcentral; 2018.

Prentice C. California prohibits city soda taxes through 2030 - Reuters. Toronto: Reuters; 2018.

Golgowski N. Washington state votes against taxing soda, sugary drinks. New York City: Huffpost; 2018.

Tanenbaum M. Pennsylvania lawmaker introduces bill to invalidate Philly soda tax. Philadelphia: Voice Philly; 2018.

McCrystal L. A timeline of Philadelphia’s soda tax. Philadelphia: The Inquirer Daily News; 2019.

Gómez EJ. Coca-Cola’s political and policy influence in Mexico: understanding the role of institutions, interests and divided society. Health Policy Plan. 2019;34:520–8.

Morrell B, Forsyth R, Lipworth W, Kerridge I, Jordens CFC. Rules of engagement: journalists’ attitudes to industry influence in health news reporting. Journalism. 2015;16:596–614.

Miller D, Harkins C. Corporate strategy, corporate capture: food and alcohol industry lobbying and public health. Crit Soc Policy. 2010;30:564–89.

Douglas N, Knai C, Petticrew M, Eastmure E, Durand MA, Mays N. How the food, beverage and alcohol industries presented the Public Health Responsibility Deal in UK print and online media reports. Crit Public Health. 2018;28:377–87.

Elliott-Green A, Hyseni L, Lloyd-Williams F, Bromley H, Capewell S. Sugar-sweetened beverages coverage in the British media: an analysis of public health advocacy versus pro-industry messaging. BMJ Open. 2016;6:e011295.

Buckton CH, Patterson C, Hyseni L, Katikireddi SV, Lloyd-Williams F, Elliott-Green A, et al. The palatability of sugar-sweetened beverage taxation: a content analysis of newspaper coverage of the UK sugar debate. PLoS One. 2018;13:1–15.

Hilton S, Buckton CH, Patterson C, Vittal Katikireddi S, Lloyd-Williams F, Hyseni L, et al. Following in the footsteps of tobacco and alcohol? Stakeholder discourse in UK newspaper coverage of the Soft Drinks Industry Levy. Public Health Nutr. 2019;22:2317–28.

Weishaar H, Dorfman L, Freudenberg N, Hawkins B, Smith K, Razum O, et al. Why media representations of corporations matter for public health policy: a scoping review. BMC Public Health. 2016;16:899.

Thornton M, Hawkins B. Between a rock and a hard place: economic expansion and social responsibility in UK media discourses on the global alcohol industry. Soc Sci Med. 2017;175:169–76.

Hector D, McGill E, Grace D, Egan M. Challenging, co-operating and splitting: a qualitative analysis of how the trade press responded to cumulative impact policies in England and Wales. Drugs Educ Prev Policy. 2019;26:104–12.

ProQuest: LibGuides. Dow Jones Factiva. https://proquest.libguides.com/factiva. Accessed 6 July 2022.

Dow Jones. Factiva | Global News Database. https://www.dowjones.com/products/factiva/. Accessed 18 Nov 2020.

Braun V, Clarke V. Thematic analysis: a practical guide. London: Sage; 2021.

Kim H, Sefcik JS, Bradway C. Characteristics of qualitative descriptive studies: a systematic review. Res Nurs Health. 2017;40:23–42.

ATLAS.ti Scientific Software Development GmbH [ATLAS.ti Windows]. 2022. Retrieved from https://atlasti.com. Taken from: https://atlasti.com/research-hub/citing-atlas-ti-in-your-research.

HM Treasury, Osborne TRHG. Budget 2016: George Osborne’s speech - oral statement to parliament. 2016. https://www.gov.uk/government/speeches/budget-2016-george-osbornes-speech. Accessed 6 Nov 2020.

HM Revenue & Customs, HM Treasury. Soft Drinks Industry Levy - consultation outcome. 2016. https://www.gov.uk/government/consultations/soft-drinks-industry-levy. Accessed 6 Nov 2020.

House of Commons Hansard. Finance (No.2) Bill - 25 April 2017 Volume 624. 2017. https://hansard.parliament.uk/Commons/2017-04-25/debates/5594F8AC-8C9F-4BEE-80D6-5F4B9F1875AE/Finance(No2)Bill. Accessed 6 Nov 2020.

UK Parliament. Royal assent. 2020.

HM Revenue & Customs. The Soft Drinks Industry Levy regulations 2018. Statutory instruments. 2018. https://www.legislation.gov.uk/uksi/2018/41/made. Accessed 6 Nov 2020.

Buckton CH, Fergie G, Leifeld P, Hilton S. A discourse network analysis of UK newspaper coverage of the “sugar tax” debate before and after the announcement of the Soft Drinks Industry Levy. BMC Public Health. 2019;19:1–14.

Petticrew M, Katikireddi SV, Knai C, Cassidy R, Hessari NM, Thomas J, et al. “Nothing can be done until everything is done”: the use of complexity arguments by food, beverage, alcohol and gambling industries. J Epidemiol Community Health. 2017;71:1078–83.

Campbell N, Mialon M, Reilly K, Browne S, Finucane F. How are frames generated? Insights from the industry lobby against the sugar tax in Ireland. Soc Sci Med. 2020;264:113215.

Essman M, Stoltze FM, Carpentier FD, Swart EC, Taillie LS. Examining the news media reaction to a national sugary beverage tax in South Africa: a quantitative content analysis. BMC Public Health. 2021;21(1):454.

Law C, Cornelsen L, Adams J, Pell D, Rutter H, White M, et al. The impact of UK Soft Drinks Industry Levy on manufacturers’ domestic turnover. Econ Hum Biol. 2020;37:100866.

Law C, Cornelsen L, Adams J, Penney T, Rutter H, White M, et al. An analysis of the stock market reaction to the announcements of the UK Soft Drinks Industry Levy. Econ Hum Biol. 2020. https://doi.org/10.1016/j.ehb.2019.100834.

Lawman HG, Bleich SN, Yan J, LeVasseur MT, Mitra N, Roberto CA. Unemployment claims in Philadelphia one year after implementation of the sweetened beverage tax. PLoS One. 2019;14:1–10.

Scarborough P, Adhikari V, Harrington RA, Elhussein A, Briggs A, Rayner M, et al. Impact of the announcement and implementation of the UK Soft Drinks Industry Levy on sugar content, price, product size and number of available soft drinks in the UK, 2015-19: a controlled interrupted time series analysis. PLoS Med. 2020;17:e1003025.

Ralston R. The informal governance of public-private partnerships in UK obesity policy: Collaborating on calorie reduction or reducing effectiveness? Soc Sci Med. 2021;289:114451.

Panjwani C, Caraher M. The Public Health Responsibility Deal: brokering a deal for public health, but on whose terms? Health Policy. 2014;114:163–73.

Acknowledgements

The authors would like to thank Vyas Adhikari and Nina Rogers for their assistance in data processing and management during this research.

Funding

This project was funded by the NIHR Public Health Research programme (Grant Nos. 16/49/01 and 16/130/01). At the time this study was conducted TLP, CPJ, DP, JA, HF, OM & MW were also supported in part by: Programme grants to the MRC Epidemiology Unit from the Medical Research Council (grant No. MC_UU_12015/6 and MC_UU_00006/7); and the Centre for Diet and Activity Research (CEDAR), a UKCRC Public Health Research Centre of Excellence – funding from the British Heart Foundation, Cancer Research UK, the Economic and Social Research Council, the Medical Research Council, the National Institute for Health Research, and the Wellcome Trust, under the auspices of the UK Clinical Research Collaboration is gratefully acknowledged. The views expressed are those of the authors and not necessarily those of the any of the above named funders. The funders had no role in study design, data collection and analysis, decision to publish, or preparation of the manuscript.

Author information

Authors and Affiliations

Contributions

MW, SC, JA, OM, HR & RS secured funding and planned the overall SDIL evaluation of which this research is a part. TLP, SC, MW designed the study, TLP led the data collection supported by HF & DP. TLP led the design and conduct of the data analysis supported by CPJ, MW, SC. TLP and CPJ led the interpretation with input from MW, SC, DP, JA, HF, OM, HR & RS. TLP and CPJ wrote up the findings, with input from MW, SC, DP, JA, HF, OM, HR & RS. The author(s) read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

Professor Richard Smith is a Non-Executive Director, South West Academic Health Science Network, Pynes Hill, Exeter and a Non-Executive Director, Royal Cornwall Hospitals Trust, Truro. No other interests are declared by the authors.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Additional file 1: Supplementary File 1.

Number of included articles per media publication, categorised by trade and news media. Supplementary File 2. List of news media articles included in the analysis. Supplementary File 3. Full List of actors and the frequency of inclusion in included articles.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/. The Creative Commons Public Domain Dedication waiver (http://creativecommons.org/publicdomain/zero/1.0/) applies to the data made available in this article, unless otherwise stated in a credit line to the data.

About this article

Cite this article

Penney, T.L., Jones, C.P., Pell, D. et al. Reactions of industry and associated organisations to the announcement of the UK Soft Drinks Industry Levy: longitudinal thematic analysis of UK media articles, 2016-18. BMC Public Health 23, 280 (2023). https://doi.org/10.1186/s12889-023-15190-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s12889-023-15190-0