Abstract

This article proposes an efficient numerical method for solving nonlinear stochastic differential equations. Using the operational matrices of block pulse functions, stochastic differential equations can be reduced to a system of algebraic equations. Computation of presented method is very simple and attractive. In addition, convergence analysis and numerical examples that illustrate accuracy and efficiency of the method are presented.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Real problems are mathematically modeled by stochastic differential equations (SDE) or, in more complicated cases, by nonlinear stochastic differential equations of the Itô type. Most of these equations do not have analytical solution, so it is important to find their approximate solution. In recent years, some different numerical methods for solving stochastic differential or stochastic integral equations have been presented [1–8]. The topic of our study is the integral form of SDE as follows:

where x0 is a random variable independent of B(t), B = (B(t),t ≥ 0) is a Brownian motion, and stochastic process x is a strong solution of Equation 1 which is adapted to {г t ,t ≥ 0} Furthermore, all Lebesgue’s and Itô’s integrals in Equation 1 are well defined [9].

Block pulse functions (BPFs) have been studied by many authors and applied for solving different problems [10–12]. In this paper, we used the stochastic operational matrix of BPFs for reducing the nonlinear stochastic differential equation to a set of algebraic equations.

The paper is ordered as follows: In ‘BPFs and their properties properties’ section, a brief review of the BPFs is presented. The ‘Implementation in stochastic integral equation’ section is devoted to the formulation of nonlinear SDE. In the ‘Error analysis’ section, convergence analysis of the method is discussed. In the ‘Numerical examples’ section, some numerical examples are provided. Finally, the ‘Conclusion’ section gives a brief conclusion.

BPFs and their properties

In this paper, BPFs are defined over [0,1). We consider m-set of BPFs as

where . The BPFs have the following properties:

-

1.

Disjointness

where i,j = 1,2,…,m and δ ij is the Kronecker delta.

-

2.

Orthogonality

-

3.

Completeness

If m → ∞, then the BPF set is complete, i.e., for every f ∈ L2([0,1)), Parseval’s identity holds,

where

Let

so

and

where v is the m-vector, is the m × m matrix, and It is easy to see that

where A is the m × m matrix and is the m-vector with elements equal to the diagonal entries of matrix A.

An arbitrary real bounded function f(t), which is square integrable in the interval t ∈ [0,1), can be expanded as

where f i is the block pulse coefficient that is defined by (2). Let k(t,s) be a function of two variables in L2 ([0,1) × [0,1)). It can be similarly expanded with respect to BPFs as

where Ψ(s) and Φ(t) are m1,m2-dimensional block pulse vectors, respectively. Also, K is the m1 × m2 block pulse coefficient matrix with

For convenience, we put m1 = m2 = m.

Lebesgue and Itô integral can be approximated as

and

where operational matrices P and P s are given in [6]. So we can write

and

Implementation in stochastic integral equation

Using the block pulse operational matrices, first, we find the collocation approximation to the functions z1(t) and z2(t) defined by

From Equations 1 and 10, we get

and

We approximate z1(t),z2(t), and k i (t,s),i = 1,2, by block pulse series as follows:

such that m-vectors Z1, Z2, and m × m matrix K i are block pulse coefficients of z1(t) and z2(t) and k i (t,s), respectively. By substituting Equations 13 and 14 in Equation 11, we get

also, the Itô integral of Equation 11 can be written as

where . By substituting (16) and (17) into (12) and replacing ≃ with =, we obtain

Now, we collocate Equation 18 in m nodes as

After solving nonlinear system (19), we obtain Z1 and Z2. Then, we can approximate the solution of Equation 11 as follows:

Error analysis

In the following theorems, suppose that the functions b(x,y),σ(x,y) satisfy the Lipschitz and linear growth conditions such that

and

Theorem 1

Let f (t) be an arbitrary real bounded function, which is square integrable in the interval [0,1), and, t ∈ [0,1), where, is the block pulse series of f(t). Then,

Proof

See [8]. □

Theorem 2

Suppose that f(t,s) ∈ [0,1) × [0,1), and, (t,s) ∈ J, where, is the block pulse series of f(t,s) Then,

Proof

See [8]. □

Theorem 3

Let x(t) and x m (t) be the exact solution and approximate solution of (1), respectively; furthermore, let conditions (21), (22), and (i) ∥x(t) ∥ ≤ M, t ∈ I = [0,1), (ii) ∥ k i (t,s) ∥ ≤ M i , (t,s) ∈ I × I, i = 1,2, hold; then,

where

Proof

Let be the error function, where z i (t) is defined in (10) and is the approximated form of z i (t) by BPFs, i.e.,

and

From Lipschitz condition and Theorem 2, we get

where i = 1,2. Let e m (t) = x(t) - x m (t). We can write

where

For I1, we get

From Itô isometry, we can write

Equations 26, 27, and 24 conclude that

where α = L(M1 + c3h) + L(M2 + c4h). Hence, from (28) and Gronwall inequality, we get

and then we get ; by increasing m, it implies ∥e m (t) ∥ → 0 as m → ∞. □

Numerical examples

To illustrate efficiency and accuracy of presented method, we solve some real-world problems.

Example 1

A simple model for the size x of a population at time t is the model of exponential growth

where a is the growth coefficient. An appropriate modification of Equation 29 is given as a linear quadratic Verhulst equation:

where the population growth a is replaced by λ - x. By randomizing the parameter λ in Equation 30 to λ + σ ξ (t), where is a white noise of zero mean, we have the usual stochastic Verhulst equation describing more precisely the population dynamics

in which λ and σ are positive constants [13–15]. The exact solution of Equation 31 is given as follows [1]:

Let X i denote the block pulse coefficient of exact solution and Y i be the block pulse coefficient of computed solutions by the presented method. The error is defined as

In Table 1, is the error mean and s E is the standard deviation of errors in k iteration. In addition, we consider x0 = 0.5, λ = 1,and σ = 0.25.

Example 2

In finance, the Vasicek model is a mathematical model describing the evolution of interest rates. This model can be used for interest rate derivative valuation and also adapted for credit market. Vasicek’s pioneering work (1977), which is based on the Ornstein-Uhlenbeck process, is the first account of a bond pricing model that incorporates stochastic interest rate and can be also seen as a stochastic investment model. The short-term interest rate process solves the equation

where B(t),t ≥ 0 is a standard Brownian motion, d r(t) is the change in the short-term interest rate, a is the speed of mean reversion, b is the average interest rate, and σ is the volatility of the short rate. The main disadvantage is that, under Vasicek’s model, it is theoretically possible for the interest rate to become negative, which is an undesirable feature. This shortcoming was fixed in the Cox-Ingersoll-Ross (CIR) model. The CIR process is a Markov process with continuous paths defined by the following SDE:

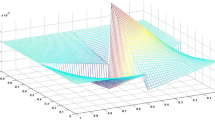

The parameter β corresponds to the speed of adjustment, α to the mean and σ to volatility. Equation 33 has no analytical solution. This process is widely used in finance to model short-term interest rate. The approximated solution by the presented method is shown in Figure 1.

Conclusion

The aim of the presented paper is to apply a method for solving nonlinear stochastic differential equations. The properties of the BPFs with the collocation method are used to reduce the problem to a system of nonlinear algebraic equations. The advantage of this method is the low cost of setting up the equations due to the properties of BPFs. For showing efficiency, the method is applied to some practical problems. The results show accuracy of the method.

References

Kloeden PE, Platen E: Numerical Solution of Stochastic Differential Equations. Springer-Verlag, Berlin; 1999.

Oksendal B: Stochastic Differential Equations: An Introduction with Application. Springer-Verlag, New York; 1998.

Jankovic S, Ilic D: One linear analytic approximation for stochastic integro-differential equations. Acta Mathematica Scientia 2010,30(4):1073–1085. 10.1016/S0252-9602(10)60104-X

Zhang X: Euler schemes and large deviations for stochastic Volterra equations with singular kernels. J. Differential Equations 2008, 244: 2226–2250. 10.1016/j.jde.2008.02.019

Khodabin M, Maleknejad K, Rostami M, Nouri M: Numerical solution of stochastic differential equations by second order Runge-Kutta methods. Math Comput. Model 2011, 53: 1910–1920. 10.1016/j.mcm.2011.01.018

Maleknejad K, Khodabin M, Rostami M: Numerical solution of stochastic Volterra integral equations by stochastic operational matrix based on block pulse functions. Math Comput. Model 2011, 55: 791–800.

Cortes JC, Jodar L, Villafuerte L: Mean square numerical solution of random differential equations facts and possibilities. Comput. Math. Appl 2007, 53: 1098–1106. 10.1016/j.camwa.2006.05.030

Maleknejad K, Khodabin M, Rostami M: A numerical method for solving m-dimensional stochastic Itô-Volterra integral equations by stochastic operational matrix. Comput Math. Appl 2012, 63: 133–143. 10.1016/j.camwa.2011.10.079

Klebaner F: Introduction to stochastic calculus with applications. Imperial College Press, London; 2005.

Maleknejad K, Shahrezaee M, Khatami H: Numerical solution of integral equations system of the second kind by block-pulse functions. Appl. Math. Comput 2005, 166: 15–24. 10.1016/j.amc.2004.04.118

Babolian E, Salami Shamloo A: Numerical solution of Volterra integro-differential equations of convolution type by using operational matrices of piecewise constant orthogonal functions. J. Comput. Appl. Math 2008, 212: 495–508.

Babolian E, Masouri Z: Direct method to solve Volterra integral equation of the first kind using operational matrix with block pulse functions. J. Comput. Appl. Math 2007, 220: 51–57.

Gard TC: Introduction to Stochastic Differential Equations. Marcel Dekker, New York; 1988.

Gard TC, Kannan D: On a stochastic differential equations modeling of prey-predator evolution. J. Appl. Prob 1976, 13: 413–429.

Schoener TW: Population growth regulated by intraspecific competition for energy or time: some simple representations. Theor. Pop. Biol 1973, 4: 56–84. 10.1016/0040-5809(73)90006-3

Acknowledgements

We would like to thank the referees for their useful comments that led to improvement of our manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

Competing interests

Both authors declare that they have no competing interest.

Authors’ contributions

Both authors contributed extensively to the work presented in this paper.

Authors’ original submitted files for images

Below are the links to the authors’ original submitted files for images.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License (https://creativecommons.org/licenses/by/2.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Asgari, M., Shekarabi, F.H. Numerical solution of nonlinear stochastic differential equations using the block pulse operational matrices. Math Sci 7, 47 (2013). https://doi.org/10.1186/2251-7456-7-47

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/2251-7456-7-47