Abstract

This study focuses on the short-run wealth of listed firms’ shareholders. Currently, all of the resulting organizations offer competitive pricing tactics to create a superior environment for our ongoing establishment. Some time ago, it was noted that a merger occurred, although some functions and technology integration remained with the previous structure. In this paper, it has been discovered that merger and acquisition deals have an impact on the firm’s value; in other words, we can view it as shareholders’ wealth or unit depending on the stock price after the announcement of merger and acquisition deals in the short term. Furthermore, we focused on influencing variables on stock prices after the announcement of merger and acquisition transactions, which is measured as a percentage change in the stock prices of the listed resulting firms. Furthermore, this research is based on secondary data sources from reputable organizations. It primarily uses the NSE database and website to evaluate announcements and stock prices of the twenty-nine publicly traded companies. Markets respond to investors’ emotions and market expertise. When acquirers have a strong market position, market capitalization rises in other segments. However, it is declining due to a lack of supportive finances. To determine the impact of merger and acquisition announcement deals on stock price changes, average abnormal return and cumulative average abnormal return with the capital asset pricing model (CAPM) (CAPM reaction to changes) were used to identify the acquiring company’s stock price reaction. We investigated its impact on the fluctuation of share prices posted on stock exchanges using fractal interpolation functions. This is due to greater investment by acquirer businesses in target companies as well as investor expectations for specific stock market strongholds.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

India has a prominent position in the global economy and is regarded as the world’s market leader in various sectors of the Indian economy. Now, the country has the capacity to boost its GDP in order to bridge the gap between the Indian diaspora and a strong competitive sector. Many firms are modernizing their operations in order to expand quickly. By redesigning their operations, they imply reorganizing the firm, which might occur through mergers and acquisitions. The administration has taken several steps to strengthen our economy and make it competitive in the global market, see, for instance [26, 32, 33, 50].

Despite the wealth of technical advantages, Indian stock markets have struggled to develop a name among national stocks. Products, solutions, and services for stock and commodity exchanges, intermediary brokerage houses, merchant banking operations, and financial services in India and beyond are examples of software products for the financial and capital markets. Because of their national reach, corporations desire to be registered with a few stock exchanges that cover the cream of the corporate sector in India. The Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) have captured the majority of the stock markets. Companies are utilizing all available resources to develop their operations. By expanding their most important lines of work, firms may boost their overall worth. Even more, businesses make preparations for possible mergers or acquisitions. M &As are focused on modifying a company’s business or financial structure. Mergers and acquisitions are extensive processes in which a firm consolidates its business activities and enhances its position to accomplish corporate objectives, and synergies, and to remain a competitive organization [9, 16, 20, 21, 34, 35].

The principle of merger and acquisition was not generally understood in India till 1988. One of India’s earliest business acquisitions or firm mergers happened in 1988. The volume is rising, with more than $100 billion in transactions predicted in 2007.

Nowadays, fractals play an important role in the area of finance. The importance of the fractal function in this field has grown as a result of the large number of mergers and acquisitions transactions that have occurred.

In 1986, Barnsley [6, 7] introduced continuous interpolation functions, called fractal interpolation functions (FIFs) using the concept of iterated function systems [29]. The calculus of bivariate FIFs is given in [13]. In contrast to the classical approach, these functions possess a self-similarity nature on small scales and are not essentially smooth. Due to advancements in its properties, this theory has gained appreciable attention in mathematical modeling. Following that Navascués [39] introduced \(\alpha\)-fractal interpolation function on a real compact interval. The fractal operator has been proven an important entity in the fractal approximation theory. Using this, many well-known classes of functions are fractalized and used to approximate a non-smooth function. For example, fractal polynomials, fractal rational functions, and fractal rational trigonometric functions have been introduced via the fractal operator and studied some of their approximation aspects [1, 12, 37,38,39,40, 44, 45]. Results on the non-stationary version of FIFs and other fractal domains can be seen in [2, 41, 42, 49, 52, 54, 55]. The fractal interpolation function has numerous applications in real life and medical science [22, 23, 56]. Finally, we encourage the reader to see the books [4, 5] written by Banerjee et al. for some recent developments and applications of fractal theory.

The term “fractal dimension” in Fractal Geometry is an index for characterizing fractal patterns or sets by quantifying their complexity as a ratio of the change in detail to the change in scale. Fractal dimension may also give information about the density and sparsity of a set. Various fractal dimensions can be estimated theoretically and empirically. Fractal dimensions are used to characterize a broad spectrum of objects varying from the abstract to practical phenomena, including turbulence, river networks, urban growth, human physiology, medicine, and market trends, see, for instance, [4,5,6,7, 17, 19, 22,23,24, 56]. Jha and Verma [30] studied fractal dimensional results of \(\alpha\)-fractal function on various function spaces. In this order, Chandra and Abbas [11] estimated the fractal dimensions of linear FIFs on convex-Lipschitz space and oscillation space. Sahu and Priyadarshi [48] computed the box dimension of the graphs of the harmonic functions on the Sierpiński gasket. Verma and Sahu [55] introduced the notion of bounded variation on the Sierpiński gasket. Verma et al. gave fractal dimensional results of vector-valued functions and showed a connection with fractional calculus in [53]. In [53], they studied the fractal dimension of complex-valued FIFs. Verma and Massopust [51] introduced a new notion of dimension-preserving approximation for continuous functions and initiated the study of it.

The remainder of the paper is structured as follows. Section 2 contains the literature review on researches of stock prices after mergers and acquisitions. Section 3 discusses the construction of FIFs and \(\alpha\)-fractal functions. Section 4 collects the data of stock price fluctuations during mergers and acquisitions, and Sect. 5 concerns our main study of fractal analysis with the help of \(\alpha\)-fractal functions. Lastly, Sect. 6 concludes the paper with future directions.

2 Literature review

The Fama and French Three-Factor Model is an asset pricing model that was created in 1992. The capital asset pricing model (CAPM) incorporates size and value risk aspects into the market risk component. This model considers the fact that value and small-cap companies consistently outperform the market. By integrating these two additional characteristics, the model accounts for this outperformance proclivity. They used the Fama-French three-factor and Carhart four-factor models to account for long-run anomalous returns. Hunter and Ali [28] examined the dollar-yen exchange rate using two forms of the monetary model. Reddy [46], on the other hand, defined growth strategies in terms of organic and inorganic growth.

This study analyzed several research articles to give the precise technique to be investigated, as well as a detailed assessment of the main or minor aspects of the element or component of market behavior. Ding et al. [16] used the efficient market hypothesis to estimate the short-run impact of a given event on a firm’s shareholder value. Non-GAAP financial metrics, according to Laurion [35], can assist investors to evaluate a company’s performance and worth. Although there are no laws controlling non-GAAP profits per share (EPS), corporations must exercise caution in how these figures are displayed. Larkin and Lyandres [34] discovered that complementarity advantages from putting the acquirer’s and target’s goods and technology under one roof are less likely to result in inefficient mergers.

Our research makes an important contribution to the academic literature and ought to be recognized more widely. The graph analysis is based on the stock price of the listed resultant firms on M &A, which is extensive, up-to-date, and distinct from previous academic literature. Anwar et al. [3] examined operating performance, Yeh and Hoshino [57] studied firm efficiency, controlling conflict of interest, crude oil market, and the risk associated with the international exchange market. However, Labban [9] focused on the business combination, but few of the studies considered different aspect, i.e., inefficient merger, accounting aspect of merger and acquisitions, performance, and shareholders value, see [10, 27, 34,35,36, 57]. Comment and Schwert [15] examined the anti-takeover measures, and stock return volatility [3], whereas Clarke et al. [14] emphasized shareholder maximization. Elnahas et al. [18] concentrated on a specific reference linked to the influence of religion on M &A activity. we concentrated on the fractal dimensional model to check sensitivity.

Fractal interpolation is used to describe the fluctuation pattern and its impact on shareholders’ wealth. Few of the studies have examined the COVID-19, pandemic, and omicron using fractal function. In particular, Kavitha et al. [31], Pacurar [43] and Gowrisankar et al. [17] have considered some applications of fractal functions for modelling COVID-19 using fractal dimensions. Our current study is motivated by these results. So, we try to study stock prices with the help of FIFs and fractal dimension.

3 Fractal functions

Consider a set of data points \(\{(x_i,y_i)\in I\times {\mathbb {R}}:i=0,1,2,\dots ,N\}\) where \(I= [x_0,x_N] \subset {\mathbb {R}}\) and \(x_0<x_1<\dots <x_N\). Define set \(I_n=[x_{n-1},x_n]\) and \(n\in \{1,2,\dots ,N\}\), consider contraction homeomorphisms \(L_n:I\rightarrow I_n\) such that

Again for \(n\in \{1,2,\dots ,N\}\), consider continuous functions \(F_n:I\times {\mathbb {R}} \rightarrow {\mathbb {R}}\) which are contraction in second co-ordinate:

where \(-1< \alpha _n<1\), \((x,y),(x,y_*)\in I\times {\mathbb {R}}\) and satisfy the join-up conditions:

We call \(\alpha =(\alpha _1, \alpha _2,\dots ,\alpha _N)\) as the vertical scaling vector. Define functions \(\mathcal {W}_n:I\times {\mathbb {R}}\rightarrow I\times {\mathbb {R}}\) as

Therefore, \(\{I\times {\mathbb {R}}:\mathcal {W}_1,\mathcal {W}_2,\dots ,\mathcal {W}_N\}\) is an IFS. Using Theorem 1 of [6], the IFS defined has a unique attractor which is the graph of the continuous function \(h:I\rightarrow {\mathbb {R}}\) satisfying the interpolation points is given by

i.e.,

Following the above work many authors defined fractal interpolation functions on the various sets [1, 37, 47, 49, 52]. In this way, Navascués [40, 41] introduced parametrized fractal interpolation functions with the help of vector scale function \((\alpha _1, \alpha _2,\dots ,\alpha _N)\) and a base function, called \(\alpha\)-fractal interpolation function described ahead.

Now for \(n\in \{1,2,\dots ,N\}\), the function \(L_n:I\rightarrow I_n\) and \(F_n:I\times {\mathbb {R}}\rightarrow {\mathbb {R}}\) mentioned above can be in particular written as

where \(a_n,b_n\in {\mathbb {R}}\) can be determined as \(L_n(x_0)=x_{n-1},L_n(x_N)=x_n\). The scaling vector \(\alpha =(\alpha _1,\alpha _2,\dots ,\alpha _N)\) such that \(\max _{n=1,2,\dots ,N}|\alpha _n|<1\) and \(b:I\rightarrow {\mathbb {R}}\) is a continuous function called base function which satisfies

Also \(f:I\rightarrow {\mathbb {R}}\) is the original function satisfying the interpolation points, called germ function. Thus IFS \(\{I\times {\mathbb {R}}:\mathcal {W}_1,\mathcal {W}_2,\dots ,\mathcal {W}_N\}\) has a unique attractor given by the graph of the continuous function \(f_{\Delta ,b}^\alpha :I\rightarrow {\mathbb {R}}\) given by

Therefore, for any partition \(\Delta\) of the interval \(I=[x_0,x_N]\), scaling vector \(\alpha =(\alpha _1,\alpha _2,\dots ,\alpha _N)\) and base function b we get a FIF \(f_{\Delta ,b}^\alpha\).

Note 3.1

[39] The above FIF \(f_{\Delta ,b}^\alpha\) (in short denoted by \(f^\alpha\)) is called \(\alpha\)-fractal function.

Definition 3.2

Let A be a non-empty bounded subset of the metric space (X, d). The box dimension of A is defined as

where \(N_{\delta }(A)\) denotes the smallest number of sets of diameter at most \(\delta\) that can cover A, provided the limit exists. If this limit does not exist then the upper and the lower box dimension, respectively, are defined as

The following result is a special case of Theorem 3 in [8] applied to Lipschitz functions.

Theorem 3.3

Let \(\Delta =\left( x_0, x_1, \ldots , x_N\right)\) be a partition of \(I=\left[ x_0, x_N\right]\) satisfying \(x_0<x_1<\cdots <x_N\) and let \(\alpha =\left( \alpha _1, \alpha _2, \ldots , \alpha _N\right) \in (-1,1)^N\). Assume that f and b are Lipschitz functions defined on I with \(b\left( x_0\right) =f\left( x_0\right)\) and \(b\left( x_N\right) =f\left( x_N\right)\). If the data points \(\left\{ \left( x_i, f\left( x_i\right) \right) : i=0,1 \ldots , N\right\}\) are not collinear, then

where D is the unique positive solution of \(\sum _{i=1}^N\left| \alpha _i\right| a_i^{D-1}=1\). Here, \(Gr(f_{\Delta , b}^{\alpha })\) denotes the graph of \(f_{\Delta , b}^\alpha\).

Note 3.4

We denote the graph of a function f by Gr(f) throughout this paper.

4 Data description: fluctuation of stock prices

Our goal is to comprehend the variation of stock prices from a fractal perspective, which will be a better approach to analyse the growth of the shareholder’s fund. In this regard, we gathered data from the NSE database in India over the previous three financial years (2018–2019 to 2020–2021) to assess the impact on shareholders’ wealth in relation to the resultant firms and construct the \(\alpha\)-fractal interpolation function following the procedure mentioned before. Number of positive cases at a difference of ten days starting from the announcement date is taken as shown in a table. All the data that is shown in the below table is gathered from NSE database [25].

We examined data from 27 publicly traded firms over 30 days, 15 days before and 15 days after the merger. In this study, every substantial movement in the stock price of a certain firm is considered for analysing average abnormal return and cumulative average abnormal return to determine any big response in a specific stock. To compute the slope of the firms and NIFTY, the capital asset pricing model (CAPM) is employed. The equation is as follows:

where, \(R_t\) represents returns over time \(\textrm{t}, \textrm{AR}\) represents the average return over time \(\textrm{t}\) (provided by \(\textrm{Ri} / \textrm{N}\) ), and \(\textrm{N}\) represents the number of observations.

The Bank Fixed Deposit rate for the stated date or period has been viewed as the risk-free return. In the equation, the beta is derived using the formula Covariance of stock and market/ Variance of market. The change in stock price for the supplied periods is used to determine the rate of return on stock. We computed the projected rate of return by following the processes outlined above. We estimated AAR and CAR using anticipated return to examine the influence of stock price on shareholder wealth in the short term.

According to the analysis, pre-merger AAR was positive for the majority of the days, however, post-merger AAR was negative for the majority of the days, indicating that the actual return was smaller than the predicted return.

5 Fractal analysis using \(\alpha\)-fractal functions

As shown in Table 1, the data from 27 NSE-listed businesses was analysed to estimate the short-run stock price reaction, which was taken into account for the evaluation of M &A impact during the previous 3 years. In this context, the volatility of stock prices before and after the merger is assessed. As can be seen from the AAR trend, it was somewhat negative prior to the merger, but it first became positive post-merger, resulting in a negative AAR only. If we compare the mean of the company’s stock price before and after the merger, we can observe a significant difference: before the merger, the mean was negative on most days, but after the merger, it was positive.

The germ function f is taken as

We choose the base function as \(b_1(x)= f_1(x^2)\).

We consider the base function as \(b_2(x)= f_2(x^2)\).

We select the base function as \(b_3(x)= f_3(x^2)\).

We take the base function as \(b_4(x)= f_4(x^2)\).

We choose the base function as \(b_5(x)= f_5(x^2)\).

Let us note the following:

-

All functions \(f_i\) and \(b_i\) are Lipschitz functions for each \(i=1,2,\dots ,5.\)

-

The data sets \(\{(x_i,y_{ki}): i=0,1,2, \dots ,N\}\) are not collinear for each \(k=1,2, \dots ,5.\)

In view of the above, we can apply Theorem 3.3 to compute fractal dimension of the graphs of the \(\alpha\)-fractal functions associated with these data sets and considered functions to analyze fluctuation in stock prices of selected listed Indian resulting companies after mergers and acquisitions.

Since \(a_i=0.1\) and \(\alpha _i=0.3\), that is, \(\sum _{i=1}^{10} 0.3 = 3> 1,\) we have

After taking logs on both sides, we get

which is the fractal dimension of the graph of \(\alpha\)-fractal function associated with the average abnormal return (AAR) and cumulative average abnormal return (CAAR) accordingly. Considering the above fractal function, we put the statistical result into the graph function and accordingly summarized the results and interpretation of shareholders’ wealth and stock price variations. Further, stock price influences market capitalization, sometimes, we can see that the value of the firm itself describes the position of the vitality with a dimension of the particular stock price. Whenever we use to estimate the interpolation based on actual changes that occurred and further implementation of the same through statistical results. Our results show that, \(\alpha _i=0.3\),\(\alpha _i=0.5\) in respect of AAR, Mean, SE, SD and CAAR variables respectively.

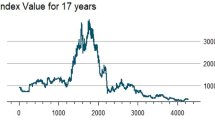

Figure 1 depicts how the average abnormal return (AAR) swings with alpha = 0.3, indicating that it plays a significant role in understanding the dimension of the stock price at different levels to decode short- and long-term stability and the risk linked to it. However, it also aids in the synthesis of risk in alpha depending on market volatility.

Figure 2 displays how the average abnormal return (AAR) swings with alpha = 0.5, suggesting that it is important in comprehending the dimension of the stock price at different levels to interpret short- and long-term stability and the risk associated with it. However depending on market volatility, it also contributes to the formulation of risk in alpha.

Figure 3 demonstrates how the mean swings with alpha = 0.3, suggesting that it is important in comprehending the dimension of the stock price at different levels to interpret short- and long-term stability and the risk associated with it. However, depending on market volatility, it also helps in the synthesis of risk in alpha.

Figure 4 illustrates how the mean swings with alpha = 0.5, suggesting that it plays a vital role in comprehending the dimension of the stock price at different levels to interpret short- and long-term stability and the risk associated with it. However, it also assists in the synthesis of risk in alpha based on market volatility.

Figure 5 represents the standard error of the result computed through regression which denotes the accuracy of the sample distribution. At alpha 0.3 associated with risk shows how the fluctuation of population from sample based on market capitalisation. That’s why the graph is showing an upward increasing trend.

The standard error of the result that was computed by regression can be found in Fig. 6. This error gives an indication of how accurate the sample distribution is. The volatility of the population based on the sample size is shown to be connected with risk at a level of alpha 0.5. Because of this, the graph displays a trend that is going in an upward and growing direction.

Figure 7 shows the standard deviation of the result computed considering 27 NSE-listed companies. The SD reflects that the listed companies’ prices deviated during the merger and acquisition deals announcement. The prices of the companies are exhibiting a trend toward growth just before the announcement of the merger and acquisition. On the other hand, following the news, the price appears to be stable before demonstrating a declining tendency.

Figure 8 consists standard deviation based on the event study of resulting companies’. At alpha = 0.5 associated with the deviation between the prices of resulting companies during the merger and acquisition deals announcement. Before the merger and acquisition announcement the prices of the companies’ are showing an increasing trend. However, post-announcement the price seems to be consistent.

The cumulative average abnormal return (CAAR) of the stock price is shown at alpha =0.3 in Fig. 9. Prior to the announcement of the merger and acquisition, there is a trend toward an increase in the price of the stock. However, following the news of mergers and acquisitions, stock prices have been shooting through the roof, which demonstrates a significant upward tendency. We can clearly see these results due to the help of the fractal dimension graph model.

The cumulative average abnormal return (CAAR) of the stock prices with an alpha value of 0.5 is depicted in Fig. 10. In comparison to the time after the announcement, the level of volatility is significantly lower before the day of the announcement. When we look at Fig. 10, we can see very clearly that the stock CAAR ranges from \(-0.5\) to 5 before the announcement date. Despite the fact that post-announcement CAAR values range anywhere from 2.5 to 7.

Fractal dimension is used to describe the stock prices fluctuation with different perspectives. With the help of interpolation at different scales and time we have identified the effect of stock price pre and post-merger and acquisition announcement. This methodology has been exclusively used to understand the effect of stock price of the companies on 30 days event study using various factors at \(\alpha = 0.3 \text { and } 0.5.\)

6 Conclusion

In the short run, the resulting firms have a beneficial influence on share prices; nonetheless, the majority of the companies have failed to meet their pre-M &A targets. Even yet, mergers and acquisitions have fared well due to the future expansion of acquiring firms. It was discovered that investor prospective thinking about hope in the acquiring firms was a significant element in increasing the share price of the merging companies.

This study will assist in understanding the usage of fractals in financial modelling for future aspects of study based on industry and specific firm with unique assumptions to build strategy for merger and acquisition transactions before execution.

Data availability statement

Data analyzed in the paper can be accessed on https://www1.nseindia.com/products/content/equities/indices.

References

V. Agrawal, T. Som, S. Verma, A note on stability and fractal dimension of bivariate alpha-fractal functions. Num. Algor. 1–23 (2023). https://doi.org/10.1007/s11075-022-01490-w

Amit, V. Basotia, A. Prajapati, Non-stationary \(\phi\)-contractions and associated fractals. J. Anal. 31(20), 1375–1391 (2023)

S. Anwar, S. Singh, P.K. Jain, Cash dividend announcements and stock return volatility: evidence from India. Procedia Econ. Finance 30(15), 38–49 (2015). https://doi.org/10.1016/s2212-5671(15)01253-8

S. Banerjee, M.K. Hassan, S. Mukherjee, A. Gowrisankar, Fractal Patterns in Nonlinear Dynamics and Applications: Patterns in Nonlinear Dynamics and Applications (CRC Press, Florida, 2020)

S. Banerjee, D. Easwaramoorthy, A. Gowrisankar, Fractal Functions, Dimensions and Signal Analysis (Springer, Geneva, 2021)

M.F. Barnsley, Fractal functions and interpolation. Constr. Approx. 2, 303–332 (1986)

M.F. Barnsley, Fractals Everywhere (Academic Press, Orlando, 1988)

M.F. Barnsley, J. Elton, D.P. Hardin, P.R. Massopust, Hidden variable fractal interpolation functions. SIAM J. Math. Anal. 20(5), 1218–1248 (1989)

G. Bernile, E. Lyandres, The effects of horizontal merger operating efficiencies on rivals, customers, and suppliers. Rev. Finance 23(1), 117–160 (2019). https://doi.org/10.1093/rof/rfy017

Y. Cai, Y. Kim, J.C. Park, H.D. White, Common auditors in M and A transactions. J. Account. Econ. 61(1), 77–99 (2016). https://doi.org/10.1016/j.jacceco.2015.01.004

S. Chandra, S. Abbas, On fractal dimensions of fractal functions using functions spaces. Bull. Aust. Math. Soc. 1–11 (2022)

S. Chandra, S. Abbas, S. Verma, Bernstein super fractal interpolation function for countable data systems. Num. Algor. 92(4), 2457–2481 (2023)

S. Chandra, S. Abbas, The calculus of bivariate fractal interpolation surfaces. Fractals 29(3), 2150066 (2021)

T. Clarke, W. Jarvis, S. Gholamshahi, The impact of corporate governance on compounding inequality: maximising shareholder value and inflating executive pay. Crit. Perspect. Account. 63, 102049 (2015). https://doi.org/10.1016/j.cpa.2018.06.002

R. Comment, G.W. Schwert, Poison or placebo? Evidence on the deterrence and wealth effects of modern anti takeover measures. J. Finance Econ. 39(1), 3–43 (1995). https://doi.org/10.1016/0304-405X(94)00823-J

L. Ding, H.K.S. Lam, T.C.E. Cheng, H. Zhou, A review of short-term event studies in operations and supply chain management. Int. J. Prod. Econ. 200, 329–342 (2018). https://doi.org/10.1016/j.ijpe.2018.04.006

D. Easwaramoorthy, A. Gowrisankar, A. Manimaran, S. Nandhini, L. Rondoni, S. Banerjee, An exploration of fractal-based prognostic model and comparative analysis for second wave of COVID-19 diffusion. Nonlinear Dyn. 106(2), 1375–1395 (2021)

A.M. Elnahas, M. Kabir Hassan, G.M. Ismail, Religion and mergers and acquisitions contracting: the case of earnout agreements. J. Corp. Finan. 42, 221–246 (2017). https://doi.org/10.1016/j.jcorpfin.2016.11.012

K.J. Falconer, Fractal Geometry: Mathematical Foundations and Applications (John Wiley and Sons, 2004)

Y. Feng, K. Lai, Q. Zhu, Legitimacy in operations: How sustainability certification announcements by Chinese listed enterprises influence their market value? Int. J. Prod. Econ. (2020). https://doi.org/10.1016/j.ijpe.2019.107563

L.P. Fields, D.R. Fraser, J.W. Kolari, Bidder returns in bancassurance mergers: Is there evidence of synergy? J. Bank. Finance 31(12), 3646–3662 (2007). https://doi.org/10.1016/j.jbankfin.2007.01.014

Y. Fisher, Fractal Image Compression: Theory and Application (Springer, New York, 1995)

A.L. Goldberger, L.A. Amaral, J.M. Hausdorff, P.C. Ivanov, C.K. Peng, H.E. Stanley, Fractal dynamics in physiology: alterations with disease and aging. Proc. Natl. Acad. Sci. 99(suppl1), 2466–2472 (2002)

A. Gowrisankar, T.M.C. Priyanka, S. Banerjee, Omicron: a mysterious variant of concern. Eur. Phys. J. Plus 137(1), 1–8 (2022)

M. Hu, J. Mou, M. Tuilautala, How trade credit affects mergers and acquisitions. Int. Rev. Econ. Finance 67(2019), 112 (2020). https://doi.org/10.1016/j.iref.2019.12.004

K.S. Huh, The performances of acquired firms in the steel industry: Do financial institutions cause bubbles? Quart. Rev. Econ. Finance 58, 143–153 (2015). https://doi.org/10.1016/j.qref.2015.03.001

J. Hunter, F. Menla Ali, Money demand instability and real exchange rate persistence in the monetary model of USD-JPY exchange rate. Econ. Modell. 40, 42–51 (2014). https://doi.org/10.1016/j.econmod.2014.03.019

J.E. Hutchinson, Fractals and self-similarity. Indiana Univ. Math. J. 30, 713–747 (1981)

S. Jha, S. Verma, Dimensional analysis of \(\alpha\) -fractal functions. RM 76(4), 1–24 (2021)

C. Kavitha, A. Gowrisankar, S. Banerjee, The second and third waves in India: when will the pandemic be culminated? Eur. Phys. J. Plus 136(5), 1–12 (2021)

S. Kumar, S. K. Verma, Impact of M &A on the shareholders wealth of the listed companies in short-run. Int. J. Res. Anal. Rev. (2021)

M. Labban, Oil in parallax: scarcity, markets, and the financialization of accumulation. Geoforum 41(4), 541–552 (2010). https://doi.org/10.1016/j.geoforum.2009.12.002

Y. Larkin, E. Lyandres, Inefficient mergers. J. Bank. Finance (2019). https://doi.org/10.1016/j.jbankfin.2019.105648

H. Laurion, Implications of non-GAAP earnings for real activities and accounting choices. J. Account. Econ. (2020). https://doi.org/10.1016/j.jacceco.2020.101333

J.D. Martin, A. Sayrak, Corporate diversification and shareholder value: a survey of recent literature. J. Corp. Finance 9(2), 37–57 (2003). https://doi.org/10.1016/s0929-1199(01)00053-0

P.R. Massopust, Fractal functions and their applications. Chaos Solitons Fractals 8(2), 171–190 (1997)

P.R. Massopust, Fractal Functions, Fractal Surfaces, and Wavelets, 2nd edn. (Academic Press, 2016)

M.A. Navascués, Fractal polynomial interpolation. Z. Anal. Anwend. 25(2), 401–418 (2005)

M.A. Navascués, Fractal approximation. Complex Anal. Oper. Theory 4(4), 953–974 (2010)

M.A. Navascués, New equilibria of non-autonomous discrete dynamical systems. Chaos Solitons Fractals 152, 111413 (2021)

M.A. Navascués, S. Verma, Non-stationary alpha-fractal surfaces. Mediterr. J. Math. 20, 48 (2023)

C.M. Păcurar, B.R. Necula, An analysis of COVID-19 spread based on fractal interpolation and fractal dimension. Chaos Solitons Fractals 139, 110073 (2020)

M. Pandey, T. Som, S. Verma, Fractal dimension of Katugampola fractional integral of vector-valued functions. Eur. Phys. J. Special Topics 1–8 (2021)

M. Pandey, T. Som, S. Verma, Set-valued \(\alpha\)-fractal functions. arXiv preprint arXiv:2207.02635 (2022)

K.S. Reddy, Pot the ball? Sovereign wealth funds’ outward FDI in times of global financial market turbulence: a yield institutions-based view. Central Bank Rev. 19(4), 129–139 (2019). https://doi.org/10.1016/j.cbrev.2019.08.003

S. Ri, A new idea to construct the fractal interpolation function. Indag. Math. 29(3), 962–971 (2018)

A. Sahu, A. Priyadarshi, On the box-counting dimension of Graphs of harmonic functions on the Sierpiński gasket. J. Math. Anal. Appl. 487(2), 124036 (2020)

S. Verma, S. Jha, A study on fractal operator corresponding to non-stationary fractal interpolation functions. Front. Fractal Anal. Recent Adv. Challenges 50–66 (2022)

S. K. Verma, S. Kumar, An analysis of financing pattern of resulting companies after mergers and acquisitions. Int. Conf. Energy Infrastruct. Manage. 250–259 (2022)

S. Verma, P. R. Massopust, Dimension preserving approximation. Aequationes Math. 96(6), 1233–1247 (2022)

M. Verma, A. Priyadarshi, S. Verma, Analytical and dimensional properties of fractal interpolation functions on the Sierpiński Gasket. Fract. Calculus Appl. Anal. 1–32 (2023). https://doi.org/10.1007/s13540-023-00148-1

M. Verma, A. Priyadarshi, S. Verma, Fractal dimension for a class of complex-valued fractal interpolation functions (2022). https://doi.org/10.48550/arXiv.2204.03622

M. Verma, A. Priyadarshi, S. Verma, Vector-valued fractal functions: fractal dimension and fractional calculus. Indagationes Math. 34(4), 830–853 (2023)

S. Verma, A. Sahu, Bounded variation on the Sierpiński Gasket. Fractals 30(07), 2250147 (2022)

B.J. West, A.L. Goldberger, Physiology in fractal dimensions. Am. Sci. 75(4), 354–365 (1987)

T. Yeh, Y. Hoshino, Productivity and operating performance of Japanese merging firms: Keiretsu-related and independent mergers. Jpn. World Econ. 14(3), 347–366 (2002). https://doi.org/10.1016/S0922-1425(01)00081-0

Acknowledgements

The authors are also very thankful to the referees and the editor for critically reading the manuscript.

Funding

There is no funding for this work.

Author information

Authors and Affiliations

Contributions

All authors contributed equally to this manuscript.

Corresponding author

Ethics declarations

Conflict of interest

We declare that we do not have any conflict of interest.

Additional information

Framework of Fractals in Data Analysis: Theory and Interpretation. Guest editors: Santo Banerjee, A. Gowrisankar.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Verma, S.K., Kumar, S. Fractal dimension analysis of stock prices of selected resulting companies after mergers and acquisitions. Eur. Phys. J. Spec. Top. 232, 1093–1103 (2023). https://doi.org/10.1140/epjs/s11734-023-00863-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1140/epjs/s11734-023-00863-z