Abstract

Employing the kinetic theory, we investigate the mutual role of knowledge accumulation and individual wealth growth. For the accumulation of individual knowledge, we introduce a learning function with the spirit of prospect theory to describe the microscopic variation of agents’ knowledge and develop a kinetic model of knowledge evolution. Considering the wealth depending on knowledge and their mutual dependence, we construct a joint evolutionary model of knowledge and individual wealth. Our numerical experiments demonstrate that if knowledge reduces the risk of individual wealth growth or increases the wealth of low-wealth groups, wealth inequality decreases. In the case that the wealthy have more opportunities to choose good educational environment to learn knowledge, both knowledge and wealth inequality increase. When considering the government or state educational input, the inequality of knowledge and wealth decreases.

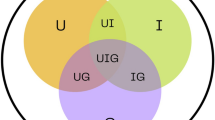

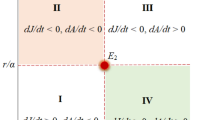

Graphic Abstract

Similar content being viewed by others

Data availability statement

Data sharing is not applicable to this article as no datasets were generated or analyzed during the current study.

Notes

The data in Table 1 are from [17], where the second column shows the number of citizens in per type of school degree, and the fourth column shows the (inverse) cumulated number of people for school degrees. The first basic level of school knowledge includes every citizen who holds the middle school degree. The second and third levels include those who get a high school degree and an undergraduate degree, respectively. The fourth level includes Italians with a “short” (less than 1 year of study) post graduate degree. The last two levels are for citizens who hold a “specialization” or PhD degree.

The knowledge interaction rule (2) considers the selection and learning behavior of agents. Based on (2), we introduce the influence of the agent’s psychological factors on knowledge accumulation and obtain the interaction rule (1) by choosing a suitable learning function \(\psi ^{\epsilon }_{\vartheta }(\cdot )\) to model the agent’s selection and learning behaviors as well as psychological factors. Actually, the interaction rule (1) is derived from (2).

The graph of the function \(\sigma (x)\) is analogous to that of \(\delta (x),\) since they have similar expression form.

References

G. Albi, L. Pareschi, M. Zanella, Boltzmann games in heterogeneous consensus dynamics. J. Stat. Phys. 175, 97–125 (2019)

A.K. Bartscher, M. Kuhn, M. Schularick, The college wealth divide: education and inequality in America. Review 102(1), 19–49 (2020)

N. Berger, P. Fisher, A well-educated workforce is key to state prosperity, economic analysis and research network (EARN), (2013)

L. Boudin, L. Trussardi, Consentration effects in a kinetic model with wealth and knowledge exchanges, 2021. https://hal.archives-ouvertes.fr/hal-02470191v2

D.H.C. Chen, C.J. Dahlman, The knowledge economy, the KAM methodology and world bank operations, World Bank Institute Working Paper, (2005)

S. Cordier, L. Pareschi, G. Toscani, On a kinetic model for a simple market economy. J. Stat. Phys. 120, 253–277 (2005)

B. Düring, G. Toscani, International and domestic trading and wealth distribution. Commun. Math. Sci. 6, 1043–1058 (2008)

B. Düring, A. Jüngel, L. Trussardi, A kinetic equation for economic value estimation with irrationality and herding. Kinet. Relat. Mod. 10(1), 239–261 (2017)

B. Düring, L. Pareschi, G. Toscani, Kinetic models for optimal control of wealth inequalities. Eur. Phys. J. B. 91(10), 265 (2018)

B. Düring, O. Wright, On a kinetic opinion formation model for pre-election polling. Phil. Trans. R. Soc. A. 380, 20210154 (2022)

G. Dimarco, G. Toscani, Social climbing and Amoroso distribution. Math. Mod. Methods Appl. Sci. 30(11), 2229–2262 (2020)

G. Dimarco, G. Toscani, M. Zanella, A multi-agent description of the influence of higher education on social stratification. J. Econ. Interact. Coor. (2022). https://doi.org/10.1007/s11403-022-00358-5

U. Eco, Memoria e dimenticanza [in Italian], 2011. http://www.3dnews.it/node

G. Furioli, A. Pulvirenti, E. Terraneo, G. Toscani, Non-Maxwellian kinetic equations modeling the dynamics of wealth distribution. Math. Mod. Methods Appl. Sci. 30, 685–725 (2020)

G. Furioli, A. Pulvirenti, E. Terraneo, G. Toscani, Fokker-Planck equations in the modelling of socio-economic phenomena. Math. Mod. Methods Appl. Sci. 27, 115–158 (2017)

S. Gualandi, G. Toscani, Call center service times are lognormal. A Fokker–Planck description. Math. Mod. Methods Appl. Sci. 28, 1513–1527 (2018)

S. Gualandi, G. Toscani, Pareto tails in socio-economic phenomena: a kinetic description. Economics 12, 1–17 (2018)

S. Gualandi, G. Toscani, The size distribution of cities: a kinetic explanation. Physica A. 524, 221–234 (2019)

S. Gualandi, G. Toscani, Human behavior and lognormal distribution. A kinetic description. Math. Mod. Methods Appl. Sci. 29, 717–753 (2019)

S. Gualandi, G. Toscani, E. Vercesi, A kinetic description of the body size distributions of species, 2022. https://arxiv.org/pdf/2206.00495.pdf

D. Helbing, Stochastic and Boltzmann-like models for behavioral changes, and their relation to game theory. Phys. A. 193(2), 241–258 (1993)

D. Helbing, Boltzmann-like and Boltzmann–Fokker–Planck equations as a foundation of behavioral models. Phys. A. 196(4), 546–573 (1993)

C. Hu, S. Lai, The influence of knowledge level on the proportion of wealth in the stock market. Proc. R. Soc. A. 478, 20210841 (2022)

D. Kahneman, A. Tversky, Prospect theory: an analysis of decision under risk. Econometrica 47(2), 263–292 (1979)

D. Kahneman, A. Tversky, Choices, values, and frames (Cambridge University Press, Cambridge, 2000)

A. Killewald, F.T. Pfeffer, J.N. Schachner, Wealth inequality and accumulation. Annu. Rev. Sociol. 43, 379–404 (2017)

A. Lusardi, P.C. Michaud, O.S. Mitchell, Optimal financial knowledge and wealth inequality. J. Polit. Econ 125(2), 431–477 (2017)

D. Maldarella, L. Pareschi, Kinetic models for socio-economic dynamics of speculative markets. Phys. A. 391, 715–730 (2012)

C.T. Morgan, A brief introduction to psychology (McGraw-Hill, New York, 1974)

L. Pareschi, G. Toscani, Wealth distribution and collective knowledge. A Boltzmann approach. Phils. Trans. R. Soc. A. 372, 1–15 (2014)

L. Pareschi, G. Toscani, Interacting multiagent systems: kinetic equations and Monte Carlo methods (Oxford University Press, Oxford, 2013)

L. Pareschi, G. Russo, An introduction to Monte Carlo method for the Boltzmann equation. ESAIM Proc. 10, 35–75 (2002)

L. Pareschi, M. Zanella, Structure preserving schemes for nonlinear Fokker–Planck equations and applications. J. Sci. Comput. 74(3), 1575–1600 (2018)

V. Pareto, Cours d’economie politique (Macmillan, Lausanne, 1897)

F.T. Pfeffer, Growing wealth gaps in education. Demography 55(3), 1033–1068 (2018)

D.S. Quevedoa, C.J. Quimbay, Non-conservative kinetic model of wealth exchange with saving of production. Eur. Phys. J. B. 93, 186 (2020)

E. Rauscher, W. Elliott-III, The effect of wealth inequality on higher education outcomes: a critical review. Soci. Mind. 4(4), 282–297 (2014)

M.V. Rooij, A. Lusardi, R.J. Alessie, Financial literacy, retirement planning and household wealth. Econ. J. 122, 449–478 (2012)

R. Sagiyeva, A. Zhuparova, R. Ruzanov, R. Doszhan, A. Askerov, Intellectual input of development by knowledge-based economy: problems of measuring in countries with developings markets. Entrep. Sustain. Iss. 6(2), 711–728 (2018)

J. Tobin, S. Golub, Money, credit and capital (McGraw-Hill, Irwin, 1998)

G. Toscani, Kinetic models of opinion formation. Commun. Math. Sci. 4(3), 481–496 (2006)

C. Villani, On a new class of weak solutions to the spatially homogeneous Boltzmann and Landau equations. Arch. Ration. Mech. An. 143, 273–307 (1998)

C. Villani, A review of mathematical topics in collisional kinetic theory. Handbook of mathematical fluid dynamics (Elsevier Press, New York, 2002)

A. Watkins, From knowledge to wealth: Transforming russian science and technology for a moden knowledge economy, World Bank Policy Research Working Paper, (2003)

P.G. Zimbardo, F.L. Ruch, Psychology and life (Brief ninth edition), (1976)

X. Zhou, S. Lai, A kinetic description of individual wealth growth and control. J. Stat. Phys. 188, 30 (2022)

Acknowledgements

This research is supported by the National Natural Science Foundation of China (No. 11471263). The authors are very grateful to the reviewers for their helpful and valuable comments, which have led to a meaningful improvement of the paper.

Author information

Authors and Affiliations

Contributions

Both authors have contributed equally to the model construction and theoretical results in this paper. The numerical analysis is presented by XZ.

Corresponding author

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhou, X., Lai, S. The mutual influence of knowledge and individual wealth growth. Eur. Phys. J. B 96, 73 (2023). https://doi.org/10.1140/epjb/s10051-023-00543-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1140/epjb/s10051-023-00543-w