Abstract

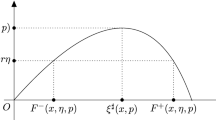

Amortization systems are used widely in economy to generate payment schedules to repaid an initial debt with its interest. We present a generalization of these amortization systems by introducing the mathematical formalism of quantum mechanics based on vector spaces. Operators are defined for debt, amortization, interest and periodic payment and their mean values are computed in different orthonormal basis. The vector space of the amortization system will have dimension M, where M is the loan maturity and the vectors will have a SO(M) symmetry, yielding the possibility of rotating the basis of the vector space while preserving the distance among vectors. The results obtained are useful to add degrees of freedom to the usual amortization systems without affecting the interest profits of the lender while also benefitting the borrower who is able to alter the payment schedules. Furthermore, using the tensor product of algebras, we introduce loans entanglement in which two borrowers can correlate the payment schedules without altering the total repaid.

Graphical abstract

Similar content being viewed by others

Data availability statement

This manuscript has no associated data or the data will not be deposited. [Authors’ comment: The data sets used during the investigation are available from the author on reasonable request.]

Notes

Finite dimensional Hilbert spaces has been widely used to model the stock market that are isomorphic to \( {\mathbb {C}} ^{d}\), where d is the discrete number of possible rates of return [44].

Symmetry considerations have been explored in econophysics, where the different choice of basis of the vector space has been used to define invariant matrix rates of returns [47].

References

J.S. Ardenghi, Phys. A 567, 125656 (2021)

E.W. Piotrowski, J. Sladkowski, Quantum game theoretical frameworks in economics (In The Palgrave Handbook of Quantum Models in Social Science, Palgrave Macmillan), London, 2017)

J. R. Busemeyer, and P. D. Bruza, Quantum Models of Cognition and Decision (Cambridge University Press), (2014)

D. Aerts, Journ. Math. Psychology 53(5), 314–348 (2009)

A.L. Mogiliansky, S. Zamir, H. Zwirn, J. Math. Psychology 53(5), 349–361 (2009)

V. Yukalov, D. Sornette, Theory and Decision 70(3), 283–328 (2011)

A. Khrennikov, Ubiquitous quantum structure: from psychology to finance (Springer, Berlin, 2010)

E.M. Pothos, J.R. Busemeyer, Proc. R. Soc. B 276, 2171 (2009)

Z. Wang, J.R. Busemeyer, H. Atmanspacher, E.M. Pothos, Top. Cogn. Sci. 5(4), 672–688 (2013)

W.M. Gervais, A. Norenzayan, Science 336, 493 (2012)

T. Boyer-Kassema, S. Duchênec, E. Guerci, Math. Soc. Sci. 80, 33–46 (2016)

M. Schaden, A quantum approach to stock price fluctuations, arXiv:physics/0205053

F. Bagarello, A quantum statistical approach to simplified stock markets. Physica A 388(20), 4397–4406 (2009)

O.A. Choustova, Quantum Bohmian model for financial market. Physica A 374(1), 304–314 (2007)

A. Atalluah, I. Davidson, M. Tippett, Physica A 388(4), 455–461 (2009)

B. E Baaquie, Path Integrals and Hamiltonians: Principles and Methods. Cambridge University Press, (2014)

E.W. Piotrowski, J. Sładkowski, Physica A 387, 3949–3953 (2008)

E.W. Piotrowski, J. Sładkowski, Quant. Finance 4(6), 61–67 (2004)

K. Ahn, M.Y. Choi, B. Dai, S. Sohn, B. Yang, Europhys. Lett. 120, 3 (2018)

L. Smolin, arXiv:0902.4274v1 (2009)

B. E. Baaquie, Quantum Field Theory for Economics and Finance, Cambridge University Press (2018)

D.A. Meyer, Phys. Rev. Lett. 82, 1052–1055 (1999)

E. Klarreich, Nature 414, 244–245 (2001)

J. Eisert, M. Wilkens, M. Lewenstein, Phys. Rev. Lett. 83, 3077–3080 (1999)

J. Du, X. Xu, H. Li, X. Zhou, R. Han, Phys. Lett. A 289, 9–15 (2001)

L. Marinatto, T. Weber, Phys. Lett. A 27, 291–303 (2000)

D. Aerts, The entity and modern physics: the creation discovery view of reality. In E. Castellani (Ed.), Interpreting bodies: Classical and quantum objects in modern physics (pp. 223–257). Princeton: Princeton Unversity Press (1998)

R.F. Bordley, Oper. Res. 46, 923–926 (1998)

D. Aerts, S. Aerts, Found. Sci. 1, 85–97 (1994)

D. Aerts, J. Broekaert, L. Gabora, S. Sozzo, Behav. Brain Sci. 36, 274–276 (2013)

A.Y. Khrennikov, Found. Phys. 29, 1065–1098 (1999)

H. Atmanspacher, H. Römer, H. Walach, Found. Phys. 32, 379–406 (2002)

J. Bell, Physics 1, 195–200 (1964)

A. Aspect, P. Grangier, G. Roger, Phys. Rev. Lett. 49, 91–94 (1982)

A. Aspect, J. Dalibard, G. Roger, Phys. Rev. Lett. 49, 1804–1807 (1982)

M. Giustina, A.Mech, S. Ramelow, B. Wittmann, J. Kofler, J. Beyer, A. Lita, B. Calkins, T. Gerrits, S. Woo Nam, R. Ursin and A. Zeilinger, Nature 497, 227–230 (2013)

J.Yin et.al. Science 16, 1140–1144 (2017)

P. D. Bruza, K. Kitto, D. McEvoy and C. McEvoy, Entangling words and meaning In Proceedings of the second quantum interaction symposium (118–124). Oxford: Oxford University Press (2008)

P. D. Bruza, P. D., Kitto, K., Nelson, D. & McEvoy, C. (2009). Extracting spooky-activation-at-a-distance from considerations of entanglement. In: Quantum interaction. Lecture notes in computer science, 5494 (71–83) Berlin: Springer (2009)

P. Ney, S. Notarnicola, S. Montangero, G. Morigi, Phys. Rev. A 104, 062607 (2022)

G. Morri, A. Mazza, Property finance, Wiley Online Library (2015), Chapter 4

J. de Souza, E.M.F. Curado, M.A. Rego-Monteiro, J. Phys. A 39, 10415 (2006)

E.M.F. Curado, M.A. Rego-Monteiro, J. Phys. A 34, 3253 (2001)

L.A. Cotfas, Physica A 392, 371–380 (2013)

K. Berrada, M. El Baz, Y. Hassouni, Phys. Lett. A 375(3), 298–302 (2011)

H. Georgi, Lie Algebras in Particle Physics, 2nd edition, Front. Phys. (WestView Press) (1999)

A. Zambrzycka, E.W. Piotrowski, Physica A 382(1), 347–353 (2007)

M. Caglayan, B. Xu, J. Financial Stab. 24, 27–39 (2016)

E.W. Piotrowski, J. Sładkowski, Physica A 312, 208 (2002)

A.P. Flitney, D. Abbott, Physica A 324, 152 (2003)

J. Eisert, M. Wilkens, M. Lewenstein, Quantum Games and Quantum Strategies. Phys. Rev. Lett. 83, 3077 (1999)

M.J. Szopa, Opt. Eono. Stud. 5(71), 90–102 (2014)

A.A. Altintas, F. Ozaydin, C. Bayindir, V. Bayracki, Photonics 9, 617 (2022)

T.L. Curtright, D.B. Fairlie, C.K. Zachos, SIGMA 10, 084 (2014)

M.B. Plenio, S. Virmani, Quant. Inf. Comput. 7, 1–51 (2007)

J. Du, X. Xu, H. Li, X. Zhou, R. Han, Fluctuation Noise Lett. 2, 4 (2022)

A.M. Guren, A. Khrishnamurty, T.J. McQuade, J. Finance 76(1), 113–168 (2021)

J.C. Hatchondo, L. Martinez, Y.K. Onder, J. Int. Econ. 105, 217–229 (2017)

J. Aspinwall, G. Chaplin, M. Venn, Life Settlements and Longevity Structures: Pricing and Risk Management, Wiley Online Library (2012)

D. Wu, M. Fang, Q. Wang, J. Financial Stab. 39, 79–89 (2018)

D.J. Feen, M.A. Porter, S. Willimams, M. McDonald, N.F. Johnson, N.S. Jones, Phys. Rev. E 84, 026109 (2011)

J. Shim, J. Bank. Finance 104, 103–115 (2019)

C. Demiroglu, C. James, J. Finance Econ. 118(1), 192–210 (2015)

C. Park, J. Finance 55, 5 (2000)

M. Schaden, Physica A 316(1–4), 511–538 (2002)

V. Buzek, A.D. Wilson-Gordon, P.L. Knight, W.K. Lai, Phys. Rev. A 45, 11 (1992)

T. Gao, Y. Chen, Physica A 468, 307–314 (2017)

D. Orrell, Physica A 539, 122928 (2020)

Acknowledgements

This paper was partially supported by grants of CONICET (Argentina National Research Council) and Universidad Nacional del Sur (UNS) and by ANPCyT through PICT 2019-03491 Res. No. 015/2021 and PIP-CONICET 2021-2023 Grant No.11220200100941CO. J. S. A. is a member of CONICET.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ardenghi, J.S. Modeling amortization systems with vector spaces. Eur. Phys. J. B 96, 11 (2023). https://doi.org/10.1140/epjb/s10051-023-00479-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1140/epjb/s10051-023-00479-1