Abstract

We show that the moments of the distribution of historic stock returns are in excellent agreement with the Heston model and not with the multiplicative model, which predicts power-law tails of volatility and stock returns. We also show that the mean realized variance of returns is a linear function of the number of days over which the returns are calculated. The slope is determined by the mean value of the variance (squared volatility) in the mean-reverting stochastic volatility models, such as Heston and multiplicative, independent of stochasticity. The distribution function of stock returns, which rescales with the increase of the number of days of return, is obtained from the steady-state variance distribution function using the product distribution with the normal distribution.

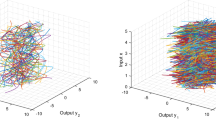

Graphical abstract

Similar content being viewed by others

References

S.L. Heston, Rev. Financ. Stud. 6, 327 (1993)

A.A. Dragulescu, V.M. Yakovenko, Quant. Finance 2, 445 (2002)

J.C. Hull, A. White, J. Finance 42, 281 (1987)

D. Nelson, J. Econom. 45, 7 (1990)

S. Miccichè, G. Bonanno, F. Lillo, R.N. Mantegna, Physica A 314, 756 (2002)

T. Ma, R.A. Serota, Physica A 398, 89 (2014)

J. Perelló, J.M. Porraa, M. Monteroa, J. Masoliver, Physica A 278, 260 (2000)

M. Dashti Moghaddam, R.A. Serota, arXiv:1807.10793 (2018)

J.P. Bouchaud, A. Matacz, M. Potters, Phys. Rev. Lett. 87, 228701 (2001)

J. Perelló, J. Masoliver, Int. J. Theor. Appl. Finance 5, 541 (2002)

J. Perelló, J. Masoliver, J.P. Bouchaud, Appl. Math. Finance 11, 27 (2004)

K. Demeterfi, E. Derman, M. Kamal, J. Zou, Tech. rep., Goldman Sachs, 1999

O.E. Barndorff-Nielsen, N. Shephard, J. Roy. Stat. Soc. Ser. B 64, 253 (2002)

P.D. Praetz, J. Bus. 1972, 49 (1972)

A.C. Silva, V.M. Yakovenko, Physica A 382, 278 (2007)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Liu, Z., Dashti Moghaddam, M. & Serota, R.A. Distributions of historic market data – stock returns. Eur. Phys. J. B 92, 60 (2019). https://doi.org/10.1140/epjb/e2019-90218-8

Received:

Revised:

Published:

DOI: https://doi.org/10.1140/epjb/e2019-90218-8