Abstract:

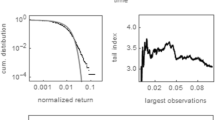

We define and study a rather complex market model, inspired from the Santa Fe artificial market and the Minority Game. Agents have different strategies among which they can choose, according to their relative profitability, with the possibility of not participating to the market. The price is updated according to the excess demand, and the wealth of the agents is properly accounted for. Only two parameters play a significant role: one describes the impact of trading on the price, and the other describes the propensity of agents to be trend following or contrarian. We observe three different regimes, depending on the value of these two parameters: an oscillating phase with bubbles and crashes, an intermittent phase and a stable `rational' market phase. The statistics of price changes in the intermittent phase resembles that of real price changes, with small linear correlations, fat tails and long range volatility clustering. We discuss how the time dependence of these two parameters spontaneously drives the system in the intermittent region. We analyze quantitatively the temporal correlation of activity in the intermittent phase, and show that the `random time strategy shift' mechanism that we proposed earlier allows one to understand the observed long ranged correlations. Other mechanisms leading to long ranged correlations are also reviewed. We discuss several other issues, such as the formation of bubbles and crashes, the influence of transaction costs and the distribution of agents wealth.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received 5 July 2002 / Received in final form 9 December 2002 Published online 14 February 2003

RID="a"

ID="a"e-mail: irene.giardina@roma1.infn.it

Rights and permissions

About this article

Cite this article

Giardina, I., Bouchaud, JP. Bubbles, crashes and intermittency in agent based market models. Eur. Phys. J. B 31, 421–437 (2003). https://doi.org/10.1140/epjb/e2003-00050-6

Issue Date:

DOI: https://doi.org/10.1140/epjb/e2003-00050-6