Abstract

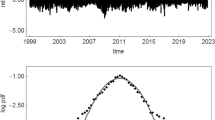

We propose a novel agent-based financial market framework in which speculators usually follow their own individual technical and fundamental trading rules to determine their orders. However, there are also sunspot-initiated periods in which their trading behavior is correlated. We are able to convert our (very) simple large-scale agent-based model into a simple small-scale agent-based model and show that our framework is able to produce bubbles and crashes, excess volatility, fat-tailed return distributions, serially uncorrelated returns and volatility clustering. While lasting volatility outbursts occur if the mass of speculators switches to technical analysis, extreme price changes emerge if sunspots coordinate temporarily the behavior of speculators.

Similar content being viewed by others

Notes

For a review of large-scale agent-based financial market models see, for instance, LeBaron (2006), while important contributions in this direction include LeBaron et al. (1999), Chen and Yeh (2001) and Raberto et al. (2001). See Hommes (2006) for a review of small-scale agent-based models and Day and Huang (1990), Brock and Hommes (1998), Lux and Marchesi (1999) and Chiarella et al. (2007) for some seminal benchmark contributions. The boundary between large-scale and small-scale agent-based models is not clear cut. Examples of models with intermediate complexity include Cont and Bouchaud (2000), Farmer and Joshi (2002) and LeBaron (2012). Moreover, Brock et al. (2005) and Diks and van der Weide (2005) also propose agent-based models with many different trader types and transform these models into small-scale models.

To be precise, Franke and Westerhoff (2012) propose a family of agent-based models and check via an empirical model contest which member of this family has the greatest ability to mimic the behavior of actual financial markets. The model specification DCA-HPM is the winner of this model contest and, for simplicity, we call this model the FW model. Overall, the FW model has a remarkable ability to match the stylized facts of financial markets.

It may be helpful to put these numbers into perspective. Suppose that the moments were independent from each other. Then we would expect the true data-generating process to imply a JMCR score of 0.9510 = 0.60. More conservatively, if we assume that five of the 10 moments are independent, then a JMCR score of 0.955 = 0.77 would be obtained.

Since the performance of our large-scale model is practically identical to the performance of our small-scale model, the greater heterogeneity of the large-scale model does not seem to be very relevant in explaining the stylized facts of financial markets. As pointed out by an anonymous referee, this suggests that, in order to improve the matching of the stylized facts, one has to consider more trading rules or more complex trading rules or both.

Note that there are some contributions in which random terms are added to the demand functions of speculators to capture the diversity of their trading strategies, e.g. in Westerhoff and Dieci (2006), Franke (2010) and Franke and Westerhoff (2016). Moreover, Schmitt and Westerhoff (2014) consider a multi-asset market model in which the random components consist of idiosyncratic, rule-specific, market-wide and general shocks.

One example of a sunspot signal could be the investment advice provided by a financial guru. In fact, Shiller (2015, p. 109) argues that Joseph Granville, “a flamboyant market forecaster”, may have caused a couple of major market moves. Another example of a sunspot signal could be the emergence of a famous chart signal, such as a clear head-and-shoulders pattern. Analyzing the stock market crash on October 19, 1987, Shiller (2015, p. 118) ventures that two plots that appeared in the Wall Street Journal on the morning of the 1987 crash might have actually triggered the crash. One plot showed the evolution of the Dow in the 1980s, and the other one the evolution of the Dow in the 1920s. Together, both plots suggested that the crash of 1929 might be about to repeat itself. Clearly, chart traders who saw these plots might have thought along similar lines.

For simplicity, we keep the fundamental value in our model constant. In future work, it may be interesting to link the coordination of fundamentalists to the evolution of the fundamental value. For instance, the coordination of fundamentalists may increase with the size of fundamental shocks. We are aware that such a modification stretches the original meaning of sunspots.

The example about the price dynamics of the Dow in the 1920s and 1980s, given in footnote 6, may also influence fundamentalists since it indicates that a fundamental price correction may occur. Whether sunspots affect the behavior of chartists or fundamentalists more strongly is ultimately an empirical question that will be addressed in Section 5. An interesting model extension may be to include sunspots that affect fundamentalists and chartists alike.

The fitness functions in Brock and Hommes (1998) include a constant that may be regarded as a predisposition parameter. In the model of Lux (1995), speculators’ rule selection is subject to herding behavior, while in that of de De Grauwe et al. (1993), the market impact of fundamental analysis depends on misalignments.

Recall that the variance of the sum of correlated random variables, say \(\delta _{t}^{C,i}\), is given by the sum of their covariances, i.e. \(Var({\sum }_{i=1}^{N} \delta _{t}^{C,i})={\sum }_{i=1}^{N}{\sum }_{j=1}^{N} Cov(\delta _{t}^{C,i}, \delta _{t}^{C,j})={\sum }_{i=1}^{N} Var(\delta _{t}^{C,i})+2{\sum }_{i=1}^{N-1} {\sum }_{j=i+1}^{N} Cov(\delta _{t}^{C,i}, \delta _{t}^{C,j})\). In our case, random variables \(\delta _{t}^{C,i}\) have equal variances \(Var(\delta _{t}^{C,i})=(\sigma ^{C})^{2}\) and their covariances are given by \(Cov(\delta _{t}^{C,i}, \delta _{t}^{C,j})={\rho _{t}^{C}}(\sigma ^{C})^{2}\). Therefore, we can write \(Var({\sum }_{i=1}^{N} \delta _{t}^{C,i})=N(\sigma ^{C})^{2}+2\frac {N(N-1)}{2}{\rho _{t}^{C}}(\sigma ^{C})^{2}=(\sigma ^{C})^{2}(N+N(N-1){\rho _{t}^{C}})\). Accordingly, \(Var({\sum }_{i=1}^{N} {I_{t}^{i}}\delta _{t}^{C,i})=(\sigma ^{C})^{2}{N_{t}^{C}} (1+({N_{t}^{C}}-1){\rho _{t}^{C}})\) . The same argument applies for the derivation of \(Var({\sum }_{i=1}^{N} \lvert {I_{t}^{i}}-1 \rvert \delta _{t}^{F,i})=(\sigma ^{F})^{2}{N_{t}^{F}} (1+({N_{t}^{F}}-1){\rho _{t}^{F}})\).

By “virtually independent” we mean that we want to express the dynamical system of our model independently of N. Of course, restrictions \({X_{t}^{C}}\le N\) and \({X_{t}^{F}}\le N\) remain, i.e. \({X_{t}^{C}}\) and \({X_{t}^{F}}\) implicitly define a lower limit for N.

Since our calibration strategy relies on the moments’ confidence intervals, different methods to compute these intervals may lead to different parameter settings, different performance values and, eventually, different model rankings.

By paying greater attention to the tail behavior of the distribution of returns, these values may be further improved. However, we determine the model parameters by trying to maximize the JMCR(10) score, and in this sense there is a trade-off between matching of two tail indices and matching the other eight summary statistics.

To give an example, we use Mathematica 10 to simulate our models. The time taken to compute a single time series with 6750 observations increases from about 0.4 seconds to about 45 seconds if we switch from a small-scale model to a large-scale model with 100 speculators, and to about 800 seconds if we set N = 400.

We thank an anonymous referee for pointing this out.

References

Alfarano S, Lux T (2010) Extreme value theory as a theoretical background for power law behavior. Kiel Working Paper 1648, Kiel Institute for the World Economy

Arifovic J, Jiang J, Xu Y (2013) Experimental evidence of bank runs as pure coordination failures. J Econ Dyn Control 37:2446–2465

Arifovic J, Jiang J (2014) Do sunspots matter? Evidence from an experimental study of bank runs. Bank of Canada, Working Paper No. 2014-12

Avrutin V, Gardini L, Schanz M, Sushko I, Tramontana F (2016) Continuous and discontinuous piecewise-smooth one-dimensional maps: invariant sets and bifurcation structures. World Scientific, Singapore

Azariadis C (1981) Self-fulfilling prophecies. J Econ Theory 25:380–396

Brock W, Hommes C (1998) Heterogeneous beliefs and routes to chaos in a simple asset pricing model. Journal of Economic Dynamics Control 22:1235–1274

Brock W, Hommes C, Wagener F (2005) Evolutionary dynamics in markets with many trader types. J Math Econ 41:7–42

Cass D, Shell K (1983) Do sunspots matter? J Polit Econ 91:193–227

Chen S-H, Yeh C-H (2001) Evolving traders and the business school with genetic programming: a new architecture of the agent-based artificial stock market. J Econ Dyn Control 25:363–393

Chen Z, Lux T (2015) Estimation of sentiment effects in financial markets: A simulated method of moments approach. FinMaP-Working Paper, No. 37, University of Kiel

Chiarella C, Dieci R, He X-Z (2007) Heterogeneous expectations and speculative behaviour in a dynamic multi-asset framework. J Econ Behav Organ 62:408–427

Cont R (2001) Empirical properties of asset returns: stylized facts and statistical issues. Quant Finan 1:223–236

Cont R, Bouchaud J-P (2000) Herd behavior and aggregate fluctuations in financial markets. Macroecon Dyn 4:170–196

Cutler D, Poterba J, Summers L (1989) What moves stock prices? J Portf Manag 15:4–12

Day R, Huang W (1990) Bulls, bears and market sheep. J Econ Behav Organ 14:299–329

De Grauwe P, Dewachter H, Embrechts M (1993) Exchange rate theory - chaotic models of foreign exchange markets. Blackwell, Oxford

Diks C, van der Weide R (2005) Herding, a-synchronous updating and heterogeneity in memory in a CBS. J Econ Dyn Control 29:741–763

Duffy J, Fisher E (2005) Sunspots in the laboratory. Am Econ Rev 95:510–529

Fair R (2002) Events that shook the market. J Bus 75:713–731

Farmer D, Joshi S (2002) The price dynamics of common trading strategies. J Econ Behav Organ 49:149–171

Fehr D, Heinemann F, Llorente-Saguer A (2012) The power of sunspots: an experimental analysis. Federal Reserve Bank of Boston, Working Paper No. 13-2

Franke R (2009a) Applying the method of simulated moments to estimate a small agent-based asset pricing model. J Empir Financ 16:804–815

Franke R (2009b) A prototype model of speculative dynamics with position-based trading. J Econ Dyn Control 33:1134–1158

Franke R (2010) On the specification of noise in two agent-based asset-pricing models. J Econ Dyn Control 34:1140–1152

Franke R, Asada T (2008) Incorporating positions into asset pricing models with order-based strategies. J Econ Interac Coord 3:201–227

Franke R, Westerhoff F (2012) Structural stochastic volatility in asset pricing dynamics: estimation and model contest. J Econ Dyn Control 36:1193–1211

Franke R, Westerhoff F (2016) Why a simple herding model may generate the stylized facts of daily returns: explanation and estimation. J Econ Interac Coord 11:1–34

Graham B, Dodd D (1951) Security analysis. McGraw-Hill, New York

Gopikrishnan P, Plerou V, Amaral L, Meyer M, Stanley E (1999) Scaling of the distributions of fluctuations of financial market indices. Phys Rev E 60:5305–5316

Hill B (1975) A simple general approach to inference about the tail of a distribution. Ann Stat 3:1163–1174

Hommes C (2006) Heterogeneous agent models in economics and finance. In: Tesfatsion L, Judd K (eds) Handbook of computational economics: agent-based computational economics. North-Holland, Amsterdam, pp 1109–1186

Huang W, Zheng H, Chia WM (2010) Financial crisis and interacting heterogeneous agents. J Econ Dyn Control 34:1105–1122

LeBaron B (2006) Agent-based computational finance. In: Tesfatsion L, Judd K (eds) Handbook of computational economics: agent-based computational economics. North-Holland, Amsterdam, pp 1187–1233

LeBaron B (2009) Robust properties of stock return tails. Brandeis University, Working Paper

LeBaron B (2012) Heterogeneous gain learning and the dynamics of asset prices. J Econ Behav Organ 83:424–445

LeBaron B, Arthur B, Palmer R (1999) Time series properties of an artificial stock market. J Econ Dyn Control 23:1487–1516

Lux T (1995) Herd behaviour, bubbles and crashes. Econ J 105:881–896

Lux T, Marchesi M (1999) Scaling and criticality in a stochastic multi-agent model of a financial market. Nature 397:498–500

Lux T, Ausloos M (2002) Market fluctuations I: scaling, multiscaling, and their possible origins. In: Bunde A, Kropp J, Schellnhuber H (eds) Science of disaster: climate disruptions, heart attacks, and market crashes. Springer, Berlin, pp 373–410

Manski C, McFadden D (1981) Structural analysis of discrete data with econometric applications. MIT Press, Cambridge

Mantegna R, Stanley E (2000) An introduction to econophysics. Cambridge University Press, Cambridge

Marimon R, Sunder S (1993) Expectationally driven market volatility: an experimental study. J Econ Theory 61:74–103

Murphy J (1999) Technical analysis of financial markets. New York Institute of Finance, New York

Niederhoffer V (1971) The analysis of world events and stock prices. J Bus 44:193–219

Plerou V, Gopikrishnan P, Amaral L, Meyer M, Stanley E (1999) Scaling of the distribution of price fluctuations of individual companies. Phys Rev E 60:6519–6529

Raberto M, Cincotti S, Focardi S, Marchesi M (2001) Agent-based simulation of a financial market. Physica 299:319–327

Schmitt N, Westerhoff F (2014) Speculative behavior and the dynamics of interacting stock markets. J Econ Dyn Control 45:262–288

Schmitt N, Westerhoff F (2017) Herding behavior and volatility clustering in financial markets. Quant Finan, forthcoming. doi:10.1080/14697688.2016.1267391

Shiller R (2015) Irrational exuberance. Princeton University Press, Princeton

Stanley E, Gabaix X, Gopikrishnan P, Plerou V (2007) Economic fluctuations and statistical physics: quantifying extremely rare and less rare events in finance. Physica A 382:286–301

Tramontana F, Westerhoff F, Gardini L (2010) On the complicated price dynamics of a simple one-dimensional discontinuous financial market model with heterogeneous interacting traders. J Econ Behav Organ 74:187–205

Westerhoff F, Dieci R (2006) The effectiveness of Keynes-Tobin transaction taxes when heterogeneous agents can trade in different markets: a behavioral finance approach. J Econ Dyn Control 30:293–322

Winker P, Gilli M, Jeleskovic V (2007) An objective function for simulation based inference on exchange rate data. J Econ Interac Coord 2:125–145

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

This study was funded by ISCH COST Action IS1104: “The EU in the new complex geography of economic systems: models, tools, and policy evaluation”. The authors declare that they have no conflict of interest.

Additional information

Presented at the Dynamic Macroeconomics Workshop, Kiel Institute for the World Economy, November 2015. We thank Simone Alfarano, Reiner Franke, Thomas Lux and Christian Proaño for their valuable feedback and comments. The paper also benefitted from a number of constructive remarks from two anonymous referees.

Rights and permissions

About this article

Cite this article

Schmitt, N., Westerhoff, F. Heterogeneity, spontaneous coordination and extreme events within large-scale and small-scale agent-based financial market models. J Evol Econ 27, 1041–1070 (2017). https://doi.org/10.1007/s00191-017-0504-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-017-0504-x

Keywords

- Financial markets

- Stylized facts

- Agent-based models

- Technical and fundamental analysis

- Heterogeneity and coordination

- Sunspots and extreme events