Abstract—

This article analyzes the current state and development trends of the warehouse property market in Moscow and Moscow oblast, the geography of large warehouse facilities, and the density of their distribution within the Moscow urban agglomeration. It is found that the most popular logistics directions are the northwest (Zelenograd and Radumlya), south (Domodedovo and Belye Stolby) and east (Balashikha and Noginsk) with the largest freight traffic flows and free areas for construction, as well as the Central Ring Road (Belyi Rast, Sever-4) due to the increased speed and time of freight delivery. High demand for warehouse property is also observed for the southwest (Vorsino) and northeast (Sofrino and Pushkino) sectors. In the west (Istra) and north (Dmitrov) directions, new warehousing facilities appear mostly between the Moscow Ring Road and the Central Ring Road due to relatively low transit cargo flows in these directions and the prevalence of water and forested land in the land use structure. The logistical influence of the Moscow urban agglomeration extends beyond the borders of Moscow oblast in the southwestern (Obninsk), northeastern (Pereslavl-Zalessky), and western (Gagarin) directions. These conclusions are based on statistical information and mathematical calculations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION AND FORMULATION OF THE PROBLEM

Urban agglomerations generate an increased demand for logistics services due to the strong consumer market in their cores and large subcenters, as well as the high demand for logistics from the industrial periphery (Li et al., 2017). Therefore, logistics centers occupy an important place in their spatial structure and specialization (McKinnon, 2009).

Logistics services are common in most major Russian cities, but Moscow and its urban agglomeration have the largest capacity and a geographically dispersed network of logistics centers. The logistics services market in Moscow oblast continues to grow. Therefore, studying current trends in the location of logistics infrastructure (using warehousing as an example) within it is an urgent problem. This has determined the purpose of the study, which is to identify current trends and territorial differences in the development of warehouse property in the Moscow urban agglomeration.

The study tested the following hypotheses:

(1) Warehousing facilities are located in the Moscow urban agglomeration (a) closer to the Moscow Ring Road (MKAD) because of the priority of the Moscow market and its higher margins; (b) at the intersection of major roads due to the existing high infrastructure availability of the agglomeration zone and the lower cost of finding customers; and (c) near large industrial zones and industrial parks.

(2) The main demand for warehousing property closer to the core of the urban agglomeration is generated by retailers and on the periphery, by industrial enterprises.

REVIEW OF PREVIOUS STUDIES

Modern logistics science and practice are dominated by the understanding of logistics as the basis of supply chain management, it is the integration of key business processes starting from the end user and encompassing all suppliers of goods, services, and information adding value to consumers and other stakeholders (Dybskaya and Sergeev, 2019). In this regard, logistics is understood as the science of managing material and related information and financial flows in a particular micro-, meso-, or macroeconomic system in order to achieve its objectives with optimal resource costs (Dybskaya and Sergeev, 2019).

In this article, the logistics infrastructure refers to offices and production and technical bases of transport and logistics companies (as transportation routing and dispatching centers), warehouse property (as storage facilities), and transport infrastructure facilities (Brodetskii et al., 2017). Existing research on the logistics infrastructure location represents both theoretical developments on the geography of logistics (Sun et al., 2018), factors in the formation of logistics centers’ clusters (Rietveld, 1994), and empirical studies on examples of specific cities and urban agglomerations (Rietveld et al., 2014). The authors of this study focus on warehouse property as a geographically understudied element of logistics infrastructure.

The Italian economist I. Mariotti (2015) noted that the factors that influence the location of transport and logistics companies are closely related to the demand for final goods and services and market size (with the overall growth of consumer and industrial demand, there will be complementary growth in the transport and logistics industry), the need to bring business services closer to the consumer, internal economies of scale (the cost of placing goods in specialized logistics centers is lower than maintaining own storage facilities or own fleet of vehicles). Calculations for American cities and urban agglomerations conducted by Sun et al. (2018) from 2007 to 2014 showed that the concentration of logistics activities leads to an increase in industrial productivity: if logistics productivity increases by 1%, industrial productivity increases by 4%.

Retailers and distributors are an equally important participant in the agglomeration economy and logistics market, as Glasmeier and Kibler (1996) pointed out; this is also relevant for the Moscow urban agglomeration. As a rule, they have their own facilities for storage and delivery of products to their own stores. Their location is characterized by both the closest possible proximity to the largest consumer markets near the transport infrastructure, and the boundary position between the two major markets (Li et al., 2017). At the same time, the complexes located close to Moscow can also serve neighboring regions.

Dablanc et al. (2014) noted that the concentration of logistics infrastructure near megalopolises accelerates the spatial restructuring of logistics activities, increases the share of logistics centers in the land use structure, and generally redistributes freight flows. Over time, the development of logistics infrastructure shifts to urban agglomeration subcenters (Kolko, 2010). However, the existing pattern of logistics centers’ distribution in the largest cities and urban agglomerations of the world (including the Moscow urban agglomeration) generates problems related to the allocation of sites between residential and industrial developers as well as congestion of transport hubs and roads (Li et al., 2017); therefore, transport and logistics functions are increasingly transferred to the periphery of urban agglomerations.

In the second half of the 1980s, Baburin et al. (1985, 1988) proposed promising directions for the development of the territorial structure of the Moscow urban agglomeration, including its transport and logistics facilities. Their works reflected the main vectors of the spatial development of the logistics infrastructure of the Moscow urban agglomeration which serves its needs. However, at the time of this writing, the market for logistics services in Russia was just emerging; therefore, a number of trends highlighted by the authors need to be updated.

Domnina and Levina (2017) analyzed data on the level of development and spatial distribution of warehouse property in Moscow oblast, while they focused on the management of logistics infrastructure development. The territorial features of the logistics infrastructure market in the context of optimizing the system of warehouse network in Moscow oblast were noted in (Shoshinov and Sapozhnikov, 2013). The authors focus more on the analysis of transport problems and opportunities for their solution rather than on the storage facilities themselves.

Prokof’eva and Klimenko (2012) considered the prospects of logistics infrastructure development in Moscow oblast due to its position at the intersection of international transport corridors (ITC) North–South and West–East, the trend toward multimodal transportation (the program of creating a network of multimodal transport and logistics centers (TLCs) and containerization of transportation was proposed).

The impact of transport infrastructure development on the economic growth was assessed in a report by the Center for Infrastructure Economics (Transportnaya …, 2019). It considered the need to develop logistics infrastructure for both passenger and freight transportation, especially focusing on Moscow oblast, which is one of the key generators of passenger and freight traffic in Russia. The authors of the report focus on the creation of high-speed roads and multimodal TLCs as the most demanded for the optimization of transportation and supply chains of transport projects. Meanwhile, individual TLC projects and their “freight village” counterparts have been approved since the 2010s, but the first phase of the Belyi Rast TLC in the Dmitrovsky urban okrug of Moscow oblast was launched only in 2020.

The main trends and features of the warehouse property market as of 2009 were analyzed in detail in (Prokof’eva et al., 2011). However, the market for logistics services, especially in the Moscow urban agglomeration, is developing at a very fast pace. The COVID-19 pandemic has caused an explosive growth of demand for logistics infrastructure on the part of online retailers. All of this necessitates the updating of a number of trends characteristic of this market.

THE PARTICIPANTS IN THE WAREHOUSE PROPERTY MARKET

As mentioned above, this article focuses on the warehouse property market, as well as on the features of participation in this market from a legal and economic point of view (Fig. 1). Thus, a warehouse complex can be built by a commercial property developer as a contractor (fee-development). In this case, the developer is the executor, bears no financial risks, and receives a fixed payment for the created project. The customer remains the owner of the developed property and land. For example, this model was used to build the Ozon warehouse on the territory of the Orientir Zapad complex.

In another case, the developer acts as the initiator and developer of the project and assumes all the risks associated with its implementation (speculative development). If the developer remains as the owner of the property and leases it out their activity is called speculative rent (e.g., the Wildberries distribution center in the Pushkino logopark); if the property is sold, the operation is called speculative sell (e.g., the Mistral warehouse complex in the PNK Park Kaledino). Speculative facilities are often built as close to the MKAD as possible and in the busiest directions in order to increase rental or purchase demand guarantees and to reduce the costs of tenant search.

The built-to-suit (BTS-development) model, where a developer builds a project for a specific customer and then sells it (e.g., Valishchevo Park for Marvel Logistics) or leases the built object to them (while retaining ownership rights to it), is gaining popularity. Such facilities are more often built in less popular areas for specific purposes and requirements of a particular customer; the demand for this model is determined by the desire to guarantee the reliability of the project and its quality in order to balance the risks for both parties.

THE DATA AND RESEARCH METHODOLOGY

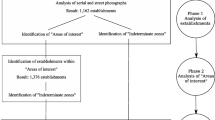

The main sources of information for the study are data from the Database of Municipal Indicators (DMI) of the Federal State Statistics Service (Rosstat), CIAN (database of property listings for rent and sale in Moscow oblast), and Open Street Map (OSM). The block of statistical methods is supplemented by cartographic and field methods. In this work, transport industry, transport sector, and transportation and storage are synonyms of the transport and logistics sector. In the context of the study, the terms logistics center, logistics complex, and storage facility are also synonymous. The borders of the Moscow urban agglomeration are compared to the basic version of its delimitation presented in (Antonov and Makhrova, 2019).

A number of indicators were calculated:

(1) The density of storage facilities (on a regular grid): \({{\rho }_{{ind}}} = \frac{{{{c}_{i}}}}{{{{s}_{i}}}}\),

where C is the number of storage facilities according to the OSM data, S is the area, and i is the regular grid cell. The size of one regular grid cell is 15 × 15 km = 225 km2 (in this article, it is considered approximately equal to 250 km2). The area of the storage facilities themselves is not taken into account. Logistics density is the synonym for this indicator in the article. Interpolation was carried out using the Inverse Distance Weighting (IDW) method by determining cell values using a linearly weighted combination of values from a subset of reference points (Watson and Philip, 1985); in our case, using a regular grid:

where z(s0) is the estimated value of a point at some location s0, and z(s1), z(s2), …, z(sm) are the values of the reference points, and wi are the weights proportional to the inverse distance (d) raised to the power of p. We restricted the point search area to a circle with a radius of 100 km. The density characteristics will help to identify territorial differences in the location of logistics business within the Moscow urban agglomeration.

(2) The rental price gradient for warehousing property was calculated using CIAN data on the annual rental price per m2 in rubles using the IDW method. This indicator makes it possible to identify the territories in the Moscow urban agglomeration most demanded for logistics business.

(3) The share of those employed in the transport and manufacturing sectors of a municipality was calculated as the ratio of the number of those employed in these sectors (sections N and S under OKVED-2,Footnote 1 respectively) to the number of those employed in the municipality’s economy as a whole. For a municipality, the distance to the MKAD is equated to the distance from the center of the municipality to the MKAD, and the shares of those employed in the above sectors are averaged over 10-km intervals.

On the basis of density characteristics of the spatial distribution of warehouse property, the logic of the choice of warehouse location within the borders of the Moscow urban agglomeration and the factors of demand for warehouse property and its supply, which is primarily explained by differences in traffic on key roads and prices of rental and purchase of industrial land plots, are considered.

RESULTS AND DISCUSSION

The Moscow region within the borders of Moscow and Moscow oblast has developed logistics functions: the share of transportation and storage in its GRP in 2018 was 7%, in employment, 7.9%, with an increasing share of employment (the period from 2010 to 2019 saw an increase in employment in transportation by 25%). Against the background of increasing investment attractiveness of Moscow oblast, 20–25% of investment in fixed assets comes from the transport industry.

The main concentration of employment in the transport sector is observed in the 10–20-km zone (this zone is mostly formed by large infrastructure facilities: airports, railway terminals, etc.) and the 60–90-km zone from the MKAD (Fig. 2). At the same time, the main industry of Moscow oblast is concentrated in the zone of 30–50 and 70–90-km from the MKAD. Therefore, in the zone closest to the MKAD, the transport and logistics sector dominates over industrial functions, which is due to the increased demand for logistics infrastructure from retailers and distributors, the transformation of industrial sites into logistics ones, and the high concentration of transport infrastructure (primarily airports).

In the zone 70–90 km from the MKAD, it is industrial enterprises that determine the demand for logistics infrastructure, which leads to an increase in the share of employment in both the industrial sector and the transport sector. However, the number of those employed in transport in the analyzed zone is in any case not comparable to the nearest zone from the MKAD. The priorities of investment in warehousing infrastructure are generally shifted to the periphery (including large retailers) due to the lack of available attractive land plots for logistics purposes and their high cost. In the 5-year outlook, we can expect further shifts of the transport and logistics sector to the periphery of the region.

Supply and Demand in the Warehouse Property Market

At the end of 2020, the total supply in Moscow oblast warehouse property market reached 16.04 mln m2, with the market growing annually by 4.5–5%; the share of vacant space has been actively decreasing since 2015 and in 2020 it was 2.2% (Table 1). In the crisis years (e.g., 2009 and 2014), there was an excess of supply over demand, which is associated with a change in investment priorities of companies during the crisis and the departure of some users of warehouse property from the market. The exception was 2020, when, in the face of COVID-19 restrictions, companies switched from direct in-store sales to a delivery format. The pandemic-induced shift in public consumption and logistics models of retailers stirred up the warehouse property market, especially due to high demand from online commerce and retailers (Table 2).

There is a 1-year lag between the trends in demand and supply dynamics, because construction companies continue building storage facilities during the recession and slower respond to its growth (Fig. 3): developers need to complete construction under their contracts, regardless of the increase or decrease in supply. At the same time, when there is an increase in demand, developers are the first to sell the facilities that have already been commissioned.

Commissioning, purchase, and lease of the warehouse facilities in the Moscow oblast market. Source: See the note to Table 1.

The greatest growth in demand for warehouse property was observed until 2014 (including due to the effect of a low base). After a slight decline in 2015, demand increased until 2018, and from 2019 the growth rate slowed, although the market is far from saturation. At the same time, the supply growth rate declined until 2017, after which there was a short growth. In 2020, companies were generally more cautious about investing in capital facilities: growth was mostly due to the commissioning of their own storage facilities and facilities built using the build-to-suit technology (Table 3).

The high demand for warehouse property in 2020 was generated primarily by e-commerce companies: large warehouse projects were implemented by digital retailers, such as Ozon, Wildberries, and Vseinstrumenti.ru. A number of large deals were made by retailers, such as X5 Retail Group (Logopark Novaya Riga in the west and Orientir Sever-4 in the northwest of the MKAD). Manufacturing and logistics companies made 27% of all deals with warehouse property in 2020.Footnote 2

The Geographical Patterns of the Warehouse Property Market

Warehousing geography covers all sectors and belts of Moscow oblast. The largest share of warehouses available for tenants is located in the northeastern (Pushkino, Sofrino) and western (Odintsovo, Mozhaisk) directions (Fig. 4). Very congested warehousing areas but with significant potential for development are to the south (Serpukhov, Kashira, and Domodedovo) and southwest (Novaya Moskva (Troitsk), Selyatino, and Naro-Fominsk). The northwest is also one of the least extended and very busy areas (the main belt of warehouses reaches Istra).

Share of vacant warehouse space in Moscow oblast by direction: (a) by the end of 2019 and (b) by the end of 2020. Source: See note to Table 1.

The most popular area for warehouse complexes is between 15 and 30 km from the MKAD (Fig. 5). This area also accounts for the major growth in the supply in 2020. The main zone of development by logistics companies is 15–45 km away from the MKAD; the largest total increase in supply is observed here. Their activity is decreasing further and closer, because there are fewer vacant lots in the immediate proximity to Moscow and one has to compete with developers of residential property. Nevertheless, the attractiveness of warehouses near Moscow remains high, because many companies work for the Moscow market and try to minimize transportation and time costs of product delivery to consumers.

Distribution of the total warehouse property by distance from the MKAD. Source: Knight Frank Research. Warehousing property market. https://www.knightfrank.ru/research/rynok-skladskoy-nedvizhimosti-moskva-2020-7824.aspx?search -id=3ec97431-bba0-4f3f-8ac8-c11d72661ef7&report-id= 596&rank=1#archived-reports-year-1. Cited January 20, 2022.

The main freight traffic flows are toward Moscow; therefore, the area within the MKAD is the most attractive for warehouse users (last mile warehouses); the highest rental rates are observed here (6000 RUB/m2 per year or more). A prerequisite for the formation of this zone was the introduction in 2017 of restrictions on the passage of heavy trucks weighing more than 12 tons on the MKAD and within the MKAD, as well as light trucks on the Third Ring Road (TRR) and within the TRR from 06:00 to 22:00.Footnote 3 Since 2021, special permits were introduced for medium-duty trucks weighing over 3.5 tons and it will be impossible to enter without a pass even at night.Footnote 4 Therefore, companies began to more actively occupy a cheaper area around the MKAD, where they could deliver goods throughout the day and from there to the destination after 22:00. Rental rates grow most rapidly in areas with high demand and low supply growth rates (in 2019, there was an increase in rates in the north and west of the MKAD and in 2020, in the southwest and east) (Fig. 6).

The next tariff zone (5000–6000 RUB/m2 per year), nominally limited by the Central Ring Road, is the territory of the most active development of logistics infrastructure: during 2017–2020, many class A and B warehouse facilities were created, including the ones for major investors (Leroy Merlin, VkusVill, and IKEA). This is largely due to the fact that the Central Ring Road became a new transit road bypassing Moscow and the desire of companies to restructure their supplies as early as possible by building storage facilities or leasing them at lower rates. The zone is actively expanding in the direction of the main roads: the most significant shifts occurred on the CRR sections which were first put into operation: on the Varshavskoye highway direction and along the M-4 road (an increase of 30–40 km in 2020 compared to 2018) as well as on the Yaroslavskoye highway direction (by 15–25 km). Some peaks in the vicinity of Chekhov, Klin, and Volokolamsk highway are due to the emergence of new class A warehouse facilities. The attention of large retailers to a particular direction within a given tariff zone can be explained by their desire to be as close to the MKAD as possible on a cheaper site in optimal proximity to the last mile warehouses in the corresponding part of Moscow. For example, Auchan hypermarkets act as warehouses for smaller stores; their greatest concentration is in the south of Moscow; therefore, one of the new large Auchan warehouses is built exactly to the south of Moscow, in Belye Stolby.

The following areas are those in Moscow oblast with traditionally low rental rates for warehouse property: the southeast on the border with Vladimir and Ryazan oblasts (the Egorevsk direction with low traffic capacity and the direction of the R-22 road with low industrial demand for warehouse infrastructure). Demand for logistics facilities is higher in the Ryazan direction thanks to such large industrial centers as Kolomna, Voskresensk, and Ramenskoye. Low rental rates are also typical for the south of the Serpukhov urban okrug on the border with Tula oblast because of the low quality of warehousing properties (classes C and D) and for the west of Moscow oblast on the border with Smolensk and Tver oblasts, where there is little industrial development of these territories. A similar situation is typical for the north of Moscow oblast on the border with Tver oblast.

At the periphery of the urban agglomeration, the largest warehouse facilities (for the scale effect) of classes A and B are commissioned (Fig. 7). Closer to the core, there are small storage facilities that allow tenants to save on storage costs and utility payments, including small self-storage warehouses for personal belongings. The concentration of warehouse facilities is observed near large shopping centers and markets (market Sadovod and shopping malls Shchelkovo, TPZ Altufievo, and Mega-Teply Stan) as well as former and existing industrial sites (the LEMZ site, industrial sites Reutov, Ochakovo-Matveevskoe, Biryulevo, and the warehouse complex Severnyi Terminal).

The Logistics Density of the Moscow Urban Agglomeration

Among the factors contributing to the formation of the densest areas of warehouse property in the Moscow urban agglomeration are the size and intensity of cargo traffic along the route, the density of the resident population (which has two effects: on the one hand, it creates demand for retail services and, consequently, for logistics services; on the other hand, it increases competition for land resources with residential development) and the amount of available land plots for construction.

Moscow (Fig. 8) and the area adjacent to the MKAD (Khimki, Mytishchi, and Lyubertsy) are the main centers for warehouse complexes. Since Moscow continues to generate the bulk of demand from retail and online retailers, the area around Moscow remains the most densely developed with over 100 units per 1000 km2.

The high density of warehouse property (25–50 and 50–100 units/1000 km2) is typical for the area between the MKAD and the CRR (see Fig. 8). The area around Kashira (Stupino Kvadrat Industrial Park–SEZ) has a higher density of warehouse property. First, the popularity of northwestern direction and the area around the CRR is due to the construction of the toll relief road of the Leningradskoe highway (M-11) and A-107 (CRR), which reduce the traffic load on the roads and increase the average speed on them, thus reducing the time of cargo delivery (which is a very important factor in logistics and supply chain management). Second, the increase in freight traffic from Europe (including within the Europe–Western China International Transport Corridor) during this period of time. New Moscow is less attractive for logistics companies because of higher land prices and high rental rates; the main growth of supply is noted near the Kievskoe highway. At the same time, the southwestern direction has become one of the most densely populated areas, because neighboring Kaluga oblast (Obninsk, Vorsino) has taken over warehousing functions.

The west of Moscow oblast is traditionally an area with recreational and ecological functions, with a high proportion of forest lands (Gnedenko and Kazmin, 2013); therefore, logistics functions are less developed in this sector. The Egorevsk direction is not the most convenient for logistical purposes (small road width and high industrial development). The north of Moscow oblast is dominated by water and forest land (Gnedenko and Kazmin, 2013); therefore, the logistics functions of the Dmitrov road after Dmitrov are not developed. Nevertheless, the north of Moscow oblast receives the functions of a major logistics center due to the construction of the Belyi Rast TLC on its territory.

Despite the pronounced monocentricity, from a logistical point of view the Moscow urban agglomeration is heterogeneous and decentralized. In addition to Moscow as a first-order logistics center, there are second-order logistics centers with a density of 5–25 units per 250 km2 (Zelenograd, Domodedovo, Serpukhov, Sergiev Posad, and Noginsk) and third order centers with 2–5 units per 250 km2 (Kolomna, Gagarin, Obninsk, and Pereslavl-Zalessky) against the background of the lower values of the density of storage facilities around these centers. The logistical influence of the Moscow urban agglomeration is gradually spreading beyond Moscow oblast to the border municipalities of Kaluga (Borovsk and Obninsk), Smolensk (Gagarin), and Yaroslavl (Pereslavl-Zalessky) oblasts (see Fig. 8).

CONCLUSIONS

There are several main reasons for building warehouse facilities within the Moscow urban agglomeration:

(a) The high demand for finished goods and services, as well as the high capacity and solvency of the Moscow urban agglomeration market (against the background of the general growth of consumer and industrial demand there will be growth in the transport and logistics industry as well).

(b) Individualization of logistics services and their desire to be geographically close to the client, which within the agglomeration is balanced by high land prices and competition with residential developers, which leads to increased rental rates for warehousing property.

(c) Economies of scale, due to which the cost of placing goods in specialized logistics centers is lower than maintaining their own storage facilities.

Logistics companies are also gravitating toward industrial zones, where customers are ready to outsource transportation services; the proximity of industrial parks as actors of industrial property is one of the leading factors in the location of warehouse property.

The main factors in the development of logistics infrastructure in the Moscow urban agglomeration include

(1) The predominance of demand for warehouse property from retailers (23% of the deals in 2020) and online commerce (35% of the deals in 2020).

(2) The focus on the Moscow market and desire to be close to the MKAD (also due to restrictions on access to the MKAD and within it for large and medium-sized trucks).

(3) The lack of land resources and, as a consequence, a gradual shift in the construction of new warehouse facilities to the periphery of the urban agglomeration.

Own-account construction remains the most popular method for building warehouse facilities (48% of buildings commissioned in 2020), with speculative development in the second place (37% of warehouses commissioned in 2020). Speculative facilities are concentrated in the most popular and busy directions. The built-to-suit technology is gaining popularity (15% of warehouses commissioned in 2020) due to the individualization of development services and the desire of customers to reduce the construction property risks.

Price differentiation of the warehouse property rental market shows that the busiest logistics sectors are west and southwest (New Moscow) of Moscow oblast. The highest growth of rental rates is observed against the background of the development of transport infrastructure and legal regulation of freight transportation: the maximum growth of rates is typical for the zone close to the MKAD (due to the high level of MKAD’s servicing infrastructure as well as for institutional reasons) and the zone of influence of the CCR (due to the completion of the project and the fact that CCR gained the functions of a transit road). Rental rates growth is also observed for the New Moscow territory which has access to the Kievskoe highway. The lowest rental rates are typical for industrial and less logistically convenient southeastern sector. Logistics companies are most actively developing southern and northeastern sectors in 15–30 km from the MKAD.

Notes

All-Russian Classifier of Types of Economic Activity.

Knight Frank Research. Warehouse property market. Moscow. 2020. https://www.knightfrank.ru/research/rynok-skladskoy-nedvizhimosti-moskva-2020-7824.aspx?search-id=3ec97431-bba0-4f3f-8ac8-c11d72661ef7&report-id=596&rank=1# archived-reports-year-1. Cited January 20, 2022.

The official portal of the Moscow Mayor and Moscow Government. Moscow Government Decree no. 379-PP of August 22, 2011, On Restriction of Truck Traffic in Moscow and Annulment of Certain Acts of Legislation of the Moscow Government. https://www.mos.ru/authority/documents/doc/ 9882220/. Cited Januar 20, 2022.

M. Khasanov, Logistics without the MKAD: New Conditions and New Solutions, Vedomosti. https://www.vedomosti.ru/business/articles/2021/03/25/863238-logistika-mkad. Cited March 7, 2022.

REFERENCES

Antonov, E.V. and Makhrova, A.G., Largest Urban Agglomerations and Forms of Settlement Pattern at the Supra-Agglomeration Level in Russia, Reg. Res. Russ., 2019, vol. 9, no. 4, pp. 370–382. https://doi.org/10.1134/S2079970519040038

Baburin, V.L., Gorlov, V.N., and Shuvalov, V.E., Improving the territorial structure of the Moscow region. Economic and geographical aspects, Vestn. Mosk. Univ. Ser. 5: Geogr., 1985, no. 1, pp. 26–31.

Baburin, V.L., Gorlov, V.N., and Shuvalov, V.E., Role and main functions of the outer zone in the territorial structure of the Moscow region, Vestn. Mosk. Univ. Ser. 5: Geogr., 1988, no. 4, pp. 24–30.

Brodetskii, G.L., Dybskaya, V.V., Gusev, D.A., and Kuleshova, E.S., Distribution of goods in a warehouse network: Optimal solutions for many criteria, Logistika i Upravlenie Tsepyami Postavok, 2017, no. 1, pp. 67–81.

Dablanc, L., Ogilvie, S., and Goodchild, A., Logistics sprawl: Differential warehousing development patterns in Los Angeles, California, and Seattle, Washington, Transport. Res. Record, 2014, vol. 2410, no. 1, pp. 105–112. https://doi.org/10.3141/2410-12

Domnina, S.V. and Levina, T.V., Transport and logistics system of the Moscow urban agglomeration: Analysis of the state and development prospects, Logistika i Upravlenie Tsepyami Postavok, 2017, no. 5, pp. 51–70.

Dybskaya, V.V. and Sergeev, V.V., Logistika v 2 ch. Ch. 1 (Logistics in 2 Parts. Part 1), Sergeev, V.I., Ed., Moscow: Yurait, 2019.

Glasmeier, A.K. and Kibler, J., Power shift: The rising control of distributors and retailers in the supply chain for manufactured goods, Urban Geogr., 1996, vol. 17, no. 8, pp. 740–757. https://doi.org/10.2747/0272-3638.17.8.740

Gnedenko, E.D. and Kazmin, M.A., Land reform and problems of development of the Moscow capital region, Gos. Upravl. Elektron. Vestn., 2013, no. 36, pp. 143–156.

Kolko, J. Urbanization, agglomeration, and coagglomeration of service industries, in Agglomeration Economics, Chicago: University of Chicago Press, 2010, pp. 151–180. https://doi.org/10.7208/9780226297927-007

Li, G., et al., Location characteristics and differentiation mechanism of logistics nodes and logistics enterprises based on points of interest (POI): A case study of Beijing, J. Geogr. Sci., 2017, vol. 27, no. 7, pp. 879–896. https://doi.org/10.1007/s11442-017-1411-7

Mariotti, I., Transport and Logistics in a Globalizing World. A Focus on Italy, Springer Verlag, 2015. https://doi.org/10.1007/978-3-319-00011-4

McKinnon, A., Logistics and land: The changing land use requirements of logistical activity, 14th Annual Logistics Research Network Conference, Cardiff, 2009, pp. 767–775. https://www.abtslogistics.co.uk/green-logistics-resources/4e82c1db-cf3b-4d8a-bf5c-716512 cb90c6_McKinnon.pdf. Cited January 20, 2022

Prokof’eva, T.A., Karnaukhov, S.B., and Arkhipov, A.P., Development of logistics infrastructure in the Moscow transport hub, RISK: Resursy, Informatsiya, Snabzhenie, Konkurentsiya, 2011, no. 4, pp. 70–83.

Prokof’eva, T.A. and Klimenko, V.V., Strategy for the development of the transport and logistics system in the Moscow region, Logistika i Upravlenie Tsepyami Postavok, 2012, vol. 50, no. 3, pp. 57–63.

Rietveld, P., Spatial economic impacts of transport infrastructure supply, Transport. Res. Part A: Policy and Practice, 1994, vol. 28, no. 4, pp. 329–341. https://doi.org/10.1016/0965-8564(94)90007-8

Rivera, L., Sheffi, Y., and Welsch, R., Logistics agglomeration in the US, Transport. Res. Part A: Policy and Practice, 2014, vol. 59, pp. 222–238. https://doi.org/10.1016/j.tra.2013.11.009

Shoshinov, V.V. and Sapozhnikov, V.N., Development of the transport and logistics system in the Moscow region in 2013–2015, Probl. Ekon. Yuridicheskoi Prakt., 2013, no. 2, pp. 253–256.

Sun, B., Li, H., and Zhao, Q., Logistics agglomeration and logistics productivity in the USA, Ann. Reg. Sci., 2018, vol. 61, no. 2, pp. 273–293. https://doi.org/10.1007/s00168-018-0867-4

Transportnaya infrastruktura i ekonomicheskii rost (Transport Infrastructure and Economic Growth), Moscow: Pero, 2019.

Watson, D.F. and Philip, G.M., A refinement of inverse distance weighted interpolation, Geo-processing, 1985, vol. 2, no. 4, pp. 315–327.

ACKNOWLEDGMENTS

We are grateful to A.A. Popov for the provided data.

Funding

This work was supported by the Russian Science Foundation, project no. 22-27-00425 (“Center-Peripherality in the Russian Industrial Space”).

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

The authors declare that they have no conflicts of interest.

Additional information

Translated by O. Pismenov

Rights and permissions

About this article

Cite this article

Makushin, M.A., Goryachko, M.D. The Geographical Patterns of the Warehouse Property Market in the Moscow Urban Agglomeration. Reg. Res. Russ. 12, 520–530 (2022). https://doi.org/10.1134/S2079970522700253

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S2079970522700253