Abstract

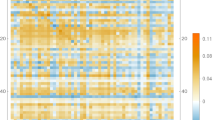

The article is devoted to the assessment of the matrix of import capital cost coefficients in the framework of the dynamic input–output model for the economy of the Republic of Belarus according to the data for 2016–2020. The assessment was carried out on the basis of the capital intensity of gross output and the technological structure of fixed capital in 19 integrated sectors of the Belarusian economy, the share of the import component in gross fixed capital formation and the average depreciation rate by the type of capital goods. As one of the applied results of the obtained matrix, the article presents calculations of the import intensity of domestic products for each of the industries—not only in terms of current costs, but also the capital component. The article also considers the directions for improving the results obtained, including for the tasks of macroeconomic forecasting.

Similar content being viewed by others

Notes

The matrix is also called the capital matrix or the investment matrix. Its estimate for the United States was first published in the 1950s [2]. From the point of view of the theoretical views of those years, the logic of the model is quite reasonable: a number of well-known single-product models directly linked the amount of induced investment with national income [3–7].

To eliminate the problem, a number of mathematical methods have been proposed for inverting the singular matrix of incremental capital intensity [15].

System of input–output tables. https://www.belstat.gov.by/ofitsialnaya-statistika/realny-sector-ekonomiki/natsionalnye-scheta/sistema-tablits-zatraty-vypusk/.

Availability of fixed assets at historical cost at the end of the year. http://dataportal.belstat.gov.by/Indicators/Preview?key=231589.

Index of physical volume of fixed assets at historical cost in constant prices, % to the previous year. http://dataportal.belstat.gov.by/Indicators/Preview?key=175053.

Agriculture of the Republic of Belarus, 2022. www.belstat.gov.by/ofitsialnaya-statistika/realny-sector-ekonomiki/-selskoe-hozyaistvo/selskoe-khozyaystvo/statisticheskie-izdaniya/-index_57446/.

The specific structure of fixed assets of commercial organizations in the Russian Federation at the end of the year. https://rosstat.gov.ru/folder/14304.

Industry of the Republic of Belarus, 2022. www.belstat.gov.by/ofitsialnaya-statistika/realny-sector-ekonomiki/-promyshlennost/publikatsii_13/index_55945/.

Transport in the Republic of Belarus, 2022. https://www.belstat.gov.by/ofitsialnaya-statistika/publications/izdania/public_brochures/index_52718/.

Decree of the Ministry of Economy of the Republic of Belarus of September 30, 2011 no. 161 On the Establishment of Standard Service Life of Fixed Assets and the Invalidation of Some Resolutions of the Ministry of Economy of the Republic of Belarus. https://pravo.by/document/?guid=3961&p0=W21124359.

As a result, the coefficients in such a matrix are given per ruble of final demand, with the exception of the demand for capital goods to compensate for the depreciation of fixed capital.

REFERENCES

V. V. Leont’ev, “Dynamic analysis,” in Selected Papers in 3 Volumes, vol. 1: General Economic Problems of Intersectoral Analysis (Ekonomika, Moscow, 2006), pp. 95–144.

W. Leontief, Studies in the Structure of the American Economy. Theoretical and Empirical Explorations in Input-Output Analysis, Ed. by W. Leontief, H. B. Chenery, and P. G. Clark (Oxford Univ. Press, New York, 1953; Gosstatizdat, Moscow, 1958).

P. Samuelson, “A synthesis of the principle of acceleration and the multiplier,” J. Polit. Econ. 47, 786–797 (1939). https://doi.org/10.1086/255469

R. F. Harrod, “An essay in dynamic theory,” Econ. J. 49, 14–33 (1939).

J. R. Hicks, A Contribution to the Theory of the Trade Cycle (Oxford Univ. Press, Oxford, 1950).

R. M. Goodwin, “The business cycle as a self-sustaining oscillation,” Econometrica 17, 184–185 (1949).

R. M. Goodwin, “The nonlinear accelerator and the persistence of business cycles,” Econometrica 19, 1–17 (1951).

W. Leontief, “Lags and the stability of dynamic systems,” Econometrica 29, 659–669 (1961). https://doi.org/0012-9682(196110)29:4%3C659:LATSOD%3E2.0.CO;2-J

F. Duchin, Structural Economics: Measuring Change in Technology, Lifestyles, and the Environment (Island Press, Washington, D.C., 1998).

W. Leontief, “Dynamic inverse matrix,” in Essays in Economics Theories: Theorizing, Facts, and Policies (Routledge, London, 1985; Politizdat, Moscow, 1990), pp. 294–318.

G. O. Kuranov, L. A. Strizhkova, and L. I. Tishina, “Factor, intersectoral and cyclical models in economic analysis and forecasting,” Ross. Vneshneekon. Vestn., No. 11, 17–38 (2022).

A. Brody, “A simplified growth model,” Q. J. Econ. 80, 137–146 (1966). https://doi.org/10.2307/1880584

H. Gurgul and Ł. Lach, “On approximating the accelerator part in dynamic input-output models,” Centr. Eur. J. Oper. Res. 27, 219–239 (2019). https://doi.org/10.1007/s10100-017-0502-y

R. Miller and P. Blair, Input–Output Analysis: Foundations and Extensions (Cambridge Univ. Press, Cambridge, 2022). https://doi.org/10.1017/9781108676212

I. Ábel and I. Dobos, “Singularity in the discrete dynamic Leontief model,” Period. Polytech. Soc. Manage. Sci. 25, 158–164 (2017). https://doi.org/10.3311/PPso.8432

W. Leontief and F. Duchin, The Future Impact of Automation on Workers (Oxford Univ. Press, New York, 1986).

F. Duchin and D. B. Szyld, “A dynamic input-output model with assured positive output,” Metroeconomica 37, 269–282 (1985). https://doi.org/10.1111/j.1467-999X.1985.tb00415.x

E. F. Baranov, “Problems of developing a scheme for a dynamic model of interbranch balance,” Ekon. Mat. Metody 4 (1), 26–41 (1968).

A. G. Granberg, Dynamic Models of the National Economy (Ekonomika, Moscow, 1985) [in Russian].

A. O. Baranov and A. V. Goreev, “Analysis of the multiplier effects produced by investment in a dynamic input–output model,” Stud. Russ. Econ. Dev. 33, 687–696 (2022). https://doi.org/10.1134/S107570072206003X

D. Meade, The LIFT Model. http://inforumweb.inforumecon.com/papers/wp/wp/2001/wp01002.pdf.

A. R. Sayapova and A. A. Shirov, Fundamentals of the Input-Output Method. Textbook (MAKS, Moscow, 2019) [in Russian].

M. K. Kravtsov, A. A. Gladkaya, and T. A. Dekhtyar’, “Forecasting the main parameters of the socio-economic development of the Republic of Belarus on the basis of a dynamic intersectoral model,” Beloruss. Ekon. Zh., No. 2, 4–24 (2020). https://doi.org/10.46782/1818-4510-2020-2-4-24

A. Steenge and R. Reyes, “Return of the capital coefficients matrix,” Econ. Syst. Res. 32, 439–450 (2022). https://doi.org/10.1080/09535314.2020.1731682

K. Safr, “Pilot application of the dynamic input-output model. Case study of the Czech Republic 2005–2013,” Stat.: Stat. Econ. J. 96 (2), 15–31 (2016).

A. Dharmadhikary-Yadwadkar, “Estimation of capital coefficient ma-trix for organised and unorganised manufacturing sectors of the Indian economy,” Artha Vijnana: J. Gokhale Inst. Politics Econ. 54 (2), 178–196 (1989).

E. L. Zlotnikova, “Import intensity and intersectoral cooperation in the Belarusian economy,” Bank. Vestn., No. 12, 27–30 (2010).

A. V. Belousov, “Import intensity of exports of the Republic of Belarus as a factor of participation in global value chains,” Beloruss. Ekon. Zh., No. 3, 63–80 (2016).

O. S. Radyuk, “Development of cooperation in the industry of the EAEU countries: Assessment based on import intensity indicators,” Beloruss. Ekon. Zh., No. 1, 35–51 (2018).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The author declares that he has no conflicts of interest.

Additional information

Translated by S. Avodkova

Rights and permissions

About this article

Cite this article

Parkhimenko, V.A. Experimental Estimation of the Matrix of Import Capital Cost Coefficients in the Dynamic Leontief Model for the Belarusian Economy in 2016–2020. Stud. Russ. Econ. Dev. 34, 543–553 (2023). https://doi.org/10.1134/S1075700723040123

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S1075700723040123