Abstract—

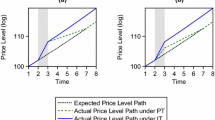

The article compares the effectiveness of various monetary policy regimes in terms of controlling inflation. It is shown that the hybrid inflation targeting regime, which combines the management of inflation as the main goal and the exchange rate as an additional one, makes it possible to simultaneously reduce the volatility of both inflation and the exchange rate. Thus, it is preferable to the pure inflation targeting regime in order to ensure the stability of the financial conditions for the development of the economy. Hypothesis testing was carried out by modeling the joint dynamics of inflation, exchange rate, and oil price volatilities in the VAR model. Volatility estimates were obtained using EGARCH models on monthly data for the period 1980–2021, for oil prices, 1992–2021, for the consumer price index, and 1995–2021 for the exchange rate.

Similar content being viewed by others

Notes

In [14], the behavior of various volatility models was studied and showed that in terms of predictive abilities, the GARCH model is in no way inferior to the ARCH models. GARCH models are less demanding and more accurate than ARCH. When analyzing financial and macroeconomic time series, the GARCH (1.1) small-order model is usually used.

REFERENCES

N. Antonakakis, C. Christou, L. A. Gil-Alana, and R. Gupta, “Inflation-targeting and inflation volatility: International evidence from the cosine-squared cepstrum,” Int. Econ. 167, 29–38 (2021).

J. B. Taylor, “Inflation targeting in high inflation emerging economies: Lessons about rules and instruments,” J. Appl. Econ. 22, 103–116 (2019).

L. E. O. Svensson, Inflation targeting, in Handbook of Monetary Economics, Ed. by B. M. Friedman and M. Woodford (Elsevier, Amsterdam, 2010), Vol. 3, Chap. 22, pp. 1237–1302.

L. E. O. Svensson, “Inflation targeting as a monetary policy rule,” J. Monetary Econ. 43, 607–654 (1999).

B. S. Bernanke and F. S. Mishkin, “Inflation targeting: A new framework for monetary policy?,” J. Econ. Perspect. 11 (2), 97–116 (1997).

S. R. Moiseev, “Odyssey of inflation targeting: Towards new challenges of monetary policy,” Vopr. Ekon., No. 10, 50–70 (2017).

M. Pourroy, “Does exchange rate control improve infation targeting in emerging economies?,” Econ. Lett. 116, 448–450 (2012).

F. S. Kartaev and Yu. I. Yakimova, “Influence of inflation targeting on the exchange rate carryover effect,” Vopr. Ekon., No. 11, 70–84 (2018).

F. S. Kartaev, “Does exchange rate management increase the effectiveness of inflation targeting?,” Den’gi Kredit, No. 2, 63–68 (2017).

F. S. Kartaev and I. M. Luneva, “Shake, but do not mix: Comparison of the effectiveness of pure and mixed inflation targeting,” Den’gi Kredit, No. 3, 65–75 (2018).

Draft main directions of the unified state monetary policy for 2023 and the period of 2024 and 2025, Bank of Russia, September 27, 2022. https://www.cbr.ru/Content/Document/File/139691/-on_2023(2024-2025).pdf.

R. F. Engle, “Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation,” Econometrica 50, 987–1007 (1982).

T. Bollerslev, “Generalized autoregressive conditional heteroskedasticity,” J. Econometrics 31 (3), 307–327 (1986).

P. R. Hansen and A. Lunde, “A forecast comparison of volatility models: Does anything beat a GARCH(1,1)?,” J. Appl. Econ. 20, 873–889 (2005).

B. T. Ewing and F. Malik, “Modelling asymmetric volatility in oil prices under structural breaks,” Energy Econ. 63, 227–233 (2017).

S. Fountas, M. Karanasos, and J. Kim, “Inflation uncertainty, output growth uncertainty and macroeconomic performance,” Oxford Bull. Econ. Stat. 68, 319–343 (2006).

S. K. A.Rizvi, B. Naqvi, C. Bordes and M. Nawazish, “Inflation volatility: An Asian perspective,” Econ. Res. 27 (1), 280–303 (2014).

J.-X. Wang and M. Yang, Asymmetric volatility in the foreign exchange markets, August 2006. https://doi.org/10.2139/ssrn.927173

D. B. Nelson, “Conditional heteroskedasticity in asset returns: A new approach,” Econometrica 59, 347–370 (1991).

A. A. Pestova, “Monetary policy regimes of the Bank of Russia: Recommendations for quantitative research,” Vopr. Ekon., No. 4, 38–60 (2017).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The author declares that he has no conflicts of interest.

Appendix A

Appendix A

The results of estimation of the VAR-model of the joint volatility dynamics, full specification

Index | Dependent variable | ||

|---|---|---|---|

\(Vol\_in{{f}_{t}}\) | \(Vol\_e{{r}_{t}}\) | \(Vol\_oi{{l}_{t}}\) | |

\(Vol\_in{{f}_{{t - 1}}}\) | 0.93*** | ||

(0.0233) | |||

\(Vol\_e{{r}_{{t - 1}}}\) | 0.090*** | 0.901*** | |

(0.027) | (0.033) | ||

\(Vol\_oi{{l}_{{t - 1}}}\) | 0.032 | 0.075 | 0.949*** |

(0.044) | (0.069) | (0.013) | |

\(inf\_cycl{{e}_{t}}\) | 0.304 | ||

(0.689) | |||

\(\log \left( {e{{r}_{t}}} \right)\) | 0.002 | –0.007 | |

(0.004) | (0.006) | ||

\(\log \left( {oi{{l}_{t}}} \right)\) | 0.0014 | –0.003** | –0.003*** |

(0.0012) | (0.002) | (0.0008) | |

\(d\_09\_13\) | –0.273*** | 0.294** | 0.008 |

(0.091) | (0.135) | (0.039) | |

\(d\_14\_16\) | –0.309** | 0.444* | –0.022 |

(0.171) | (0.234) | (0.044) | |

\(d\_17\_21\) | –0.326** | 0.360* | –0.034 |

(0.182) | (0.278) | (0.034) | |

R2 | 0.90 | 0.88 | 0.89 |

Residual sum of squares | 12.9 | 40.3 | 7.4 |

Mean value of dependent variable | –10.9 | –6.6 | –4.3 |

Standard deviation of dependent variable | 0.79 | 1.28 | 0.55 |

Covariance determinant of random error matrices | 0.000412 | ||

Logarithmic maximum likelihood function | –62.5 | ||

AIC | 0.788 | ||

SIC | 1.120 | ||

Number of coefficients | 21 | ||

Number of constraints | 6 | ||

***, **, and * are the significance levels of 1, 5, and 10%, respectively. In parentheses under the estimated coefficients are their standard errors. | |||

Appendix B

Analysis of the Impulse-Responses Functions

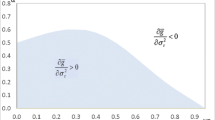

The analysis of the impulse-responses functions was carried out according to the most complete specification of the model in order to avoid the exclusion of important relationships during their construction. Function graphs are shown in Fig. 2. A significant response of inflation volatility to a shock (single innovation) of exchange rate volatility is delayed, begins to operate from the second month and continues for 20 months. A similar response of inflation volatility is also observed to the shock of oil price volatility, however, it is somewhat lower in level. The response of exchange rate volatility to an oil price volatility shock is immediate and remains significant for 8 months. A significant inertial response of inflation volatility to its own shock persists for 14 months, for the exchange rate for 12, and for oil prices for 20 months.

Inflation Volatility Impulse Response Functions, exchange rate and oil prices obtained using the Cholesky decomposition (responses to single innovations ± 2 standard errors).

The vertical axis represents the responses of the variables listed at the top of the table to single innovations in each of these variables. The boundaries of the confidence interval are determined by twice the standard error. The horizontal axis indicates the number of the period corresponding to the number of months that have passed since the innovation.

Rights and permissions

About this article

Cite this article

Medvedev, I.D. Comparison of the Efficiency of Pure and of Hybrid Inflation Targeting from the Point of View of Inflation Control. Stud. Russ. Econ. Dev. 34, 274–283 (2023). https://doi.org/10.1134/S1075700723020089

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S1075700723020089