Abstract

In this study, we examine how sectors of the National Stock Exchange from India respond to the uncertainties introduced by the COVID-19 pandemic. By examining the synchronization between the sector-specific and overall market index (NIFTY 50) reaction to COVID-19, we contribute to the inconclusive ongoing academic literature regarding the impact of COVID-19 on the stock market, especially in the context of persistence in an emerging market. To analyze the persistence of sectoral indices, we apply multifractal detrended fluctuation analysis (MFDFA). We use the generalized Hurst exponent and singularity spectrum as indicators for persistence and spectral width as a measure of volatility. Our analysis shows that the sample sectoral indices are persistent before and after the announcement of COVID-19; however, volatility in some sectors reduces post-announcement of COVID-19. The findings will enrich the academic literature on the relationship between sector-specific and overall market indexes. In practice, the paper will guide investors to organize their portfolios, especially during future economic uncertainty.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Uncertainty in the economy is a significant reason for fluctuations in financial markets (Segal et al. 2015). There exist ripples in stock markets when new information constantly enters into the market. In particular, during the uncertainty, market participants take time to assess the impact of sudden new information in the financial market (Antonakakis et al. 2013). However, the performance of the sector and the overall market depends on the new information and uncertainty (Dang and Nguyen 2020). Prior literature finds that specific sectors and the stock market always react to the uncertainty introduced by political instability or economic crisis (Mei and Guo 2004; Robert 2013). However, an adverse reaction is experienced in the US and the UK stock market in response to the uncertainty created by the COVID-19 pandemic (Altig et al. 2020). An increase in volatility in one particular leading stock market could impact the worldwide financial market because of the global connection between the stock markets (Zhang et al. 2020). The Indian economy is not an exception to the above phenomena, similar to the developed markets.

The financial instability in the share market creates fear among investors (Adekoya and Oliyide 2022). This fear is translated into the market and generates anomalies. The market participants always try to maintain efficiency, and they often use their persistence behavior to determine their response to the new information (Espinosa-Méndez and Arias 2021). Persistence refers to a long-term correlation among past events. A financial market depends on its past behavior leading to a long-term memory (Bouchaud et al. 2004). Because of the extensive damage created by the uncertainties during the pandemic and the continuing impact of COVID-19, there is a need for a better understanding of the persistence behavior of the stock market. To our best knowledge, there is no conclusive finding in the literature related to the capital market in specific and the financial sector in general about the impact of COVID-19 on persistence behavior in an emerging market. Thus, in this study, we overcome the void in the literature by examining the following question: How does the sector-specific persistence behavior in the National Stock Exchange in India affect the stock market during COVID-19 uncertainty?

The efficient market hypothesis states that security prices follow a random walk; they are independent and do not have a long memory (Lillo and Farmer 2004; Sánchez Granero et al. 2008). Thus, security returns are unpredictable. When any new information is available, they are instantly captured in the security prices, and there is no hidden information that can be utilized to forecast future market development (Fama 1965). However, many researchers argue that the security returns are not random; they are correlated (Peters 1991; Shiller 2000; Shleifer 2003). These correlated phenomena of returns are known as the persistence. According to the persistence, past trend influences the future trend. Essentially, when a system attains higher value, the system tends to maintain a higher value (Menkveld 2013; Voss 2013). Thus, a persistent time series helps in the estimation of future trends. In a highly volatile market, it is imperative to know whether the market dynamics depends on the past behavior of the same market and to what extent the behavior of market participants is persistent (Bentes 2021; Saleem et al. 2021). Therefore, an investigation on persistence would be beneficial for an investor to make an informed decision during an uncertain period in the market. In addition, a better understanding of persistency allows policymakers to control the market volatility during economic uncertainty. The existing literature regarding the impact of COVID-19 pandemic on financial performance either investigates the relationship between the number of COVID-19 cases and the performance of stock indices (Erdem 2020) or the impact of COVID-19 on the stock market, in general, without capturing the sector-specific differences in the context of an emerging market (Zhang et al. 2020). To the best of our knowledge, these studies are not examining whether the performance of stock markets reflects the persistence behavior of the market participants. Thus, our study captures the impact of sector-specific differences in persistence behavior in the Indian stock market. Furthermore, there is a need to understand persistency or self-similarity in the market index during uncertainty. Persistence or self-similarity property refers to a characteristic where the future trend is likely to follow the past trend (Skjeltorp 2000). During the global financial crisis of 2008, we find evidence of discussion about these features of the market index (Shalini and Prasanna 2016). We also find a similar practice in developed countries during the recent pandemic (Bentes 2021; Malik et al. 2021). Thus, we extend the existing literature to examine the persistence or self-similarity in the market index in a leading emerging country, India.

During the uncertainty, the financial market remains dynamic at different time scales (Mantegena and Stanley 1995). Because of the added complexity in the financial market during this uncertain time, we need extra precautions before suggesting any changes in the financial and economic policy. In other words, the analysis should consider various time scales (consideration of various intervals of time) to capture the fluctuation in the complex financial market during uncertain periods. The existing studies on the market index are limited, as their findings of fluctuation in the financial market are not related to different time scales in different sectors (Erdem 2020; Zhang et al. 2020). Sector-wise analysis would provide better insight into the country's economic status than the analysis based on a composite market index (Bhuiyan and Chowdhury 2020). Moreover, studies show that the returns of securities in the capital market are not random; they are correlated or persistent (Raimundo and Okamoto 2018). Additionally, persistence also explains the self-similarity or fractal behavior. Fractal is a property of a smaller portion of an object being similar to the larger part of it (Goldberger et al. 2002). For instance, the structure of trees, the pattern of a coastline or the mountains are self-similar. Fractals are the self-similar shape or structures. If a self-similar structure is uniform in all scales, i.e., a consistent behavior in all scales, it is known as monofractal. On the contrary, if the scaling structure is not uniform, then the self-similarity is multifractal by nature. The scale refers to levels of enlargement or reduction of a self-similar object. In the case of monofractal behavior, only one variable (termed as fractal dimension) is sufficient to describe a system. Multifractals system requires a range of fractal dimensions to describe its behavior (Kantelhardt et al. 2002; Mandelbrot 1977).

Multifractal detrended fluctuation analysis (MFDFA) is an approach for finding long-term correlation and explaining the scaling behavior of a self-similar series. This method is better than other methods since it can be applied to non-stationary time series and can explain nonlinear correlation of the present and the future data which are the limitations of the traditional methods of econometrics, i.e., GARCH model, Brownian motion, spectrum method, etc. (Dmitriev et al. 2022; Milos et al. 2020). It provides a set of indicators known as the generalized Hurst exponent to explain the behavior of the data at different time scales. Moreover, this method also has power to describe the intensity of self-similarity by the indicators like singularity spectrum or spectral width. MFDFA has wide application across various disciplines, e.g., agriculture, commodity market, financial behavior of stock market, physiology, etc. (Patil and Rastogi 2020; Zhang and Fang 2021). In our research, return series are nonlinear by nature, and hence it is difficult to explain the time varying dynamics of the series and analyze its trend at different time scales by using any standard method. Thus, we analyze market trends by MFDFA at different time scales. In addition, to assess the persistence of the market index, we also apply the Hurst exponentFootnote 1 to quantify market inefficiency.

We use historical stock price data from the National Stock Exchange of India from September 2019 to September 2020 to empirically examine the research question proposed in this paper. The idea is to see the impact of the first wave of COVID-19 on the persistence of the leading stock market of India. Our results show that the market remains persistent despite the uncertainty created by the pandemic. However, some individual sectors have shown an increase in the persistence indicator, which is a matter of concern as increased persistence may occur due to investors' fear during the pandemic.

Further, a deeper analysis by MFDFA can result in measuring the sector-wise risk of investment. The findings of this study contribute to the existing body of knowledge by focusing on the persistence of the stock market during uncertainty. Some earlier studies report sectoral analysis on IT, consumer goods, cement and cement products, automobile sector, pharmaceutical sector, NIFTY 50, etc., by event study (Varma et al. 2021). They provide details about the reaction of these sectors to the crisis created by COVID-19, but these studies do not explore the market dynamics in the context of persistence or long-term correlation, which guides the investors' expected market behavior.

Moreover, these studies do not provide any information about the transition of sectoral index dynamics from anti-persistent to persistent or vis-a-vis. Under the uncertainty introduced by COVID-19 in the financial market, investors would probably be interested to know a comparatively safer investment choice. In persistence, system follows its own behavior, and thus it is favorable to the investors to estimate the market trend. The present work focuses on exploring market dynamics in the light of persistence or long-term correlation among stocks to understand the market trend and provide guidance to the investors.

Our study focuses on a detailed analysis of persistence in the individual sector and compares it with the behavior of the overall market index. In the existing literature, we find an application of multifractality in discussing herding behavior in the stock market (Wang and Zhang 2005). Usually, individuals in an uncertain period prefer to suppress their beliefs and support market consensus; thus, we could observe herding in the financial market (Han et al. 2022; Sornette and Zhou 2006). However, there is no definite evidence of persistence in herding in the financial market during highly uncertain times. Thus, there is a high possibility that the size of the movement in the financial time series during uncertain times could be responsible for multifractality. The movement in different sectors could vary depending on the sector's association with the uncertain event (Hwang and Salmon 2004). Following the above argument, we apply the MFDFA to investigate the persistence in the sample sectors during COVID-19. In the present study, persistence is measured by MFDFA since it provides measures at various scales to analyze a complex time series at various scales. Zhang and Hamori (2021) investigate the volatility spillover among crude oil and stock market in the US, Japan and Germany, and their study reports that COVID-19 poses unprecedented changes in the financial market across the world. The MFDFA helps understand not just the past behavior of stock traders in a particular industry but also guides future trading (Caporale et al. 2022). Unlike the existing literature, this study compares the scaling behavior of various sectors to their association with the overall market index to understand the correlation among the sectors for investment opportunities and also to see the impact of COVID-19 on the market trend. Such analysis will allow investors to develop a better investment strategy in an uncertain time.

The rest of the paper is structured as follows: The ongoing section provides a brief introduction and background of the work, followed by a literature review in Sect. "Literature review," and data description is discussed in Sect. "Methodology." Section "Empirical analysis and findings" explains the methodology. Section "Conclusion" illustrates the analysis and findings, and finally, Sect. 6 presents the conclusion.

Literature review

The stock market is a preferred option for investment due to high returns, and equities are the choice of the investors because of their profitability (Takahashi and Yamada 2021; Homaifar et al. 2013; Mullins and Wadhwani 1989). COVID-19 impacts are observed in all financial markets worldwide, leading to a stock market crash in the USA, followed by the UK and Asia's stock markets. FTSE, the main index of the UK, drops by 10%, whereas Japan observes a drop of 20%. S&P index falls more than 30% from February to March 2020 (Zhang et al. 2020). Another study on the dynamics of stock indices and oil futures in select countries like China, the UK, Australia, Germany, the USA and Japan states that the pandemic has a significant negative correlation between the daily number of COVID cases and stock indices (Erdem 2020). In addition, the study also reports that the financial market continues to be volatile after this pandemic (Erdem 2020). Liu et al. (2020) present a short-term impact of COVID-19 on the stock market of 21 leading countries like Japan, Korea, USA, UK, China, etc. (Liu et al. 2020). Their study shows that all these countries experience a declining trend after the virus outbreak, and countries in Asia experience more negative abnormal returns than other countries.

Studies on the Indian financial market compare the effect of COVID-19, Demonetization and Goods and Service Tax (GST) (Mishra et al. 2020). Unlike Demonetization and GST, negative stock returns seem quite obvious after COVID-19, and the impact of COVID-19 proves to be significant when we compare it with the effect of Demonetization and GST. Research on the Indian banking sector shows how strong the effect persists in the market during the pandemic (Bhatia & Gupta 2020; Thomas et al. 2020). All of these studies mainly focus on the status of the financial market due to the emergence of COVID-19. Investigation of the impact of COVID-19 on persistence of financial data is not much discussed in the extant literature, and to the best of our knowledge, in the Indian stock market, there is no evidence of the same. Moreover, we do not find the impact of the pandemic on the sector-wise index or comparative analysis of various sectors in the context of persistence. Thus, this work attempts to analyze the Indian stock market concerning specific sectors in the light of market efficiency to guide a comparatively safer investment option in future.

Methodology

In the present work, we focus on the Indian stock market to see the impact of COVID-19 on the domestic investment pattern. Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) are the two major stock exchanges in India where buyers and sellers trade (Sinha and Pan 2006). BSE is the oldest stock market; however, maximum trading takes place in the NSE. Thus, for empirical analysis, historical data of stock prices of four selected sectors of the National Stock Exchange (www.nseindia.com) are considered in the study. The sectors in the present study are information technology (IT), pharmaceutical, fast-moving consumer goods (FMCG) and automobile since these sectors perform abnormally during COVID-19 (Alam et al. 2020; Buszko et al. 2021). IT sector plays a vital role during the pandemic due to increased demand for high-tech applications, whereas the pharmaceutical industry is part of the sample industries because of the ongoing and surged demand for pharmaceutical products during the pandemic (He et al. 2020).

On the other hand, in FMCG, we observe a continuous demand for mass production, and thus it qualifies as a sample candidate. In the automobile sector, the demand becomes less due to the cascading effect of joblessness, fear of death or uncertainty in human life (Mittal and Sharma 2021). The NIFTY 50 index captures the overall stock market behavior, and all individual sectors are compared to examine the persistence. India has experienced a significant number of cases from March 2020, and the number of infected people increased in the subsequent time. March 2020–February 2021 has been considered as the first wave of COVID-19 in India (Hazra et al. 2022; Sarkar et al. 2021). In our study, we intend to see the immediate impact of the pandemic across the sector and thus consider a very short time period—before and after the first wave of the pandemic in India—(i) pre-COVID-19: from September 2019–February 2020 and (ii) post-COVID-19: from March 2020 to September 2020. Post-COVID-19 refers to the time period after the official declaration of emergence of the first wave of COVID-19 in India. We finally compare the result of each sector with the computed result of NIFTY 50 since NIFTY 50 captures the overall market trend. Since consecutive prices may be correlated, we investigate the price dynamics in terms of change in price or returns. Considering the logarithmic return of the price is a common practice in technical analysis of stock prices since it assumes the series to be Normally distributed (Aas and Dimakos 2004). In our analysis, we compute the logarithmic return of stock prices as follows and consider it for further analysis:

where \({P}_{t}\) is the price of a stock at time t.

Mandelbrot first introduced the notion of the fractal in 1968 to quantify the self-similar structure of a complex system (Mandelbrot 1982; Mandelbrot et al. 1997)… Multifractals are more general and adapted to fully describe self-similarity and scale-invariant characteristics across various domains, including economic (Carbone et al. 2004; Mantegena and Stanley 1995; Muzy et al. 2000) systems.

Following is a brief outline of the MFDFA applied in this paper.

We follow Kantelhardt et al., (2002) to develop the model for this study.

Let us denote the time series by \(\left\{{x}_{t}\right\}\) and calculate the mean \(\langle x\rangle\). Then,

Dividing \(y(i)\) into \({N}_{s}=\text{int}(\frac{N}{s})\) non-overlapping parts of equal length, we compute the trend \({y}_{v}(i)\) using a quadratic fit and obtain the local variance as:

for each part \(v, v=\text{1,2},\dots ,{N}_{s}\). Next, we find the generalized fluctuation function root mean squared fluctuation (RMS), \({F}_{q}\left(s\right), q\ne 0,\) by averaging over all the parts as follows:

For \(q=0\), a logarithmic averaging procedure is employed to find the fluctuation function \({F}_{0}(s)\) as:

If there exist long-range correlations in the series, \({F}_{q}(s)\) scales with \(s\), as a power law,

where \({H}_{q}\) defines the generalized Hurst exponent, where \(q\) represents the order of fluctuation. For the monofractal case, \({H}_{q}\) is a constant, while for the multifractal behavior of the system, it provides a set of values which vary with \(q\). MFDFA provides two additional measures, the singularity index \({\tau }_{q}\) and singularity spectrum \({D}_{q}\), which are defined as follows:

Here, \({h}_{q}\) is the singularity strength or Holder exponent, while \({D}_{q}\) encodes all the global scaling information. The singularity index captures the changes in the multifractal behavior when the level of multifractality changes from one scale to the other, whereas the singularity spectrum explains the visualization of the multifractal behavior.

Empirical analysis and findings

Equation 1 computes the daily return of all selected sectoral indices. Further, we compute each dataset in both periods, i.e., pre-COVID-19 and post- COVID-19. Table 1 presents the descriptive statistics of the data.

Arithmetic mean, standard deviation, skewness, kurtosis and coefficient of variation (CV) estimate central tendency, measures of dispersion, measure of shape and relative measure of dispersion separately for each dataset. In Table 1, the kurtosis of all sectors is greater than the standard value of Normal distribution. This indicates that the return distribution is fat-tailed, and hence there is a possibility of an increase in extreme (Maximum or Minimum) return. We also notice CV to reduce for pharmaceutical, auto and IT sectors in post-COVID time, whereas it increases in FMCG and NIFTY 50. Less CV indicates more consistency in the data, leading to a stable market. Although the notion of a stable market is based on constant variance, the variance in the market data changes with time. All this intrigues the question of the existence of persistence in the return dynamics. The following section deals with the variation of the data with different time scales and intends to explain the data dynamics in terms of persistence.

Persistent test

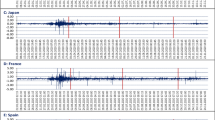

This work intends to explain persistence by computing scaling function, generalized Hurst exponent, singularity exponent and singularity spectrum, and MFDFA provides all such measures at various scales. Thus, for computation, we follow the methodology of MFDFA using MATLAB. For example, we report the results of the pharmaceutical sector in Figs. 1 and 2. Other sector details are reported on request.

Figure 1 shows the result of the pharmaceutical sector before COVID-19. In this figure, the generalized fluctuation function \({F}_{q}(s)\) or q-order RMS is the plot for various values of \(q\) at the top left panel. Here, s is the various time scale of data (daily, weekly, monthly, etc.), and q is the various orders of fluctuation. Negative and positive values of q refer to small and large fluctuations. The slope of these lines indicates a generalized Hurst exponent. The difference between \(q\)-order RMS for positive and negative \(q\)'s is more apparent at the small scale than at the large scale. Generalized Hurst exponent \({H}_{q}\) is the plot against \(q\) at the top right panel showing the dependence of \({H}_{q}\) on \(q\). Further, the singularity index \({(\tau }_{q})\) and singularity spectrum \(({D}_{q})\) are the plots in the bottom panel from left to right, respectively, and explain the multifractal behavior of the data. According to Kantelhardt et al., (2002), a curved q-dependence in \({(\tau }_{q})\) and large spectrum width in \(\left({D}_{q}\right)\) characterize a multifractal behavior. Spectrum width measures the difference between maximum and minimum \({h}_{q}\). \(\Delta D_{q} = D_{q} \left[ {hq_{{{\text{Max}}}} } \right] - D_{q} \left[ {hq_{{{\text{Min}}}} } \right]\) represents the probability of the highest or lowest rate of return. A positive or negative \(\Delta {D}_{q}\) indicates the probability of high return of low return, respectively. In the present work, we perform a multifractal analysis with order q which varies from − 5 to + 5 to measure the degree of volatility. Spectral width provides more details on multifractality since an increase in spectral width indicates an increase in multifractality, essentially indicating a less efficient market (Ihlen 2012). Therefore, an increased spectrum width is an indication of an increase in persistence.

Figure 1 displays multifractal characterization of the pharmaceutical sector before COVID-19. Among the four panels in the figure, the top left panel plots the relation between the local variance \({F}_{q}\) vs. its order \(q\) for various scale (or sample size)\(s\). It is evident from the plot that the local variance \({F}_{q}\) is more sensitive toward the lower scale for all orders of \(q\). In the top right panel, the generalized Hurst exponent \({H}_{q}\) varies with q; specifically, \({H}_{q}\) decreases with the increasing order of \(q\). This is an indication that the pharmaceutical sector has multifractal behavior since for monofractal, \({H}_{q}\) is constant. This multifractal nature is further verified by a curvilinear relationship between q and \({t}_{q}\) in the bottom left panel. The bottom right panel is the singularity spectrum, which emphasizes the multifractal nature of the sector. The spectrum is single-peaked but asymmetric. The extended right tail is visible in the spectrum. Thus, the spectrum provides \(\Delta {D}_{q}={[D}_{q}\left(5\right)-{D}_{q}(-5)]>0\), indicating the probability of higher return before COVID-19. Moreover, spectral width \({(hq}_{\text{Max}}-h{q}_{\text{Min}})=1.1899\) provides the intensity of multifractal behavior within the daily return series The MFDFA analysis of the daily return of the pharmaceutical sector for the post-first wave of COVID-19 (c.f. Figure 2) also exhibits dependence of \({H}_{q}\) on \(q\); however, the spectral width is less (0.81889) as compared to pre-COVID time. Dependence of \({H}_{q}\) on \(q\) indicates the existence of multifractality leading to self-similarity or persistence. In the present case, the spectral width decreases after COVID-19, and hence the intensity of multifractal nature decreases, and thus the degree of persistence decreases.

Likewise, we analyze all sectors and tabulate the results in Table 2. Generalized Hurst exponents \({H}_{q}\) versus \(q\) before and after COVID-19 for all sectors in Table 2 provide strong evidence of persistence. The table shows that \({H}_{q}\) decreases with an increase of \(q\) from − 5 to 5 for all datasets in both periods, indicating \({H}_{q}\)'s dependence on \(q\). This proves that the market is always multifractal; however, the degree of multifractal nature changes. These results are quite similar to the results of the study of the China Stock Exchange and S&P 500 index of US during the before and after the first panic of COVID-19 (Zhang and Fang 2021), which confirms that both markets are multifractal and fractality intensified after the first wave of COVID-19.

In the next stage, we examine the sector-wise generalized Hurst exponent.

In Table 2, \({H}_{q}\) for \(q<1\) represents the small fluctuation, and \({H}_{q}\) for \(q>1\) refers to a large fluctuation. \({H}_{q=2}\) is the classical Hurst exponent which characterizes long-range correlation of the series as a whole. \({H}_{q=2}>0.5\) refers to a persistence, whereas for \({H}_{q=2}<0.5\), it indicates an anti-persistence behavior. From Table 2, we find that \({H}_{q=2}\) for all cases is more than 0.5 in both pre- and post-COVID duration (c.f. Figure 3) except IT and NIFTY 50. Moreover, in each sector, this indicator increases from pre-COVID to post-COVID time. In addition, unlike pharmaceutical, automobile and FMCG sectors, in IT and NIFTY 50, \({H}_{q=2}\) is less than 0.5 before COVID-19 and more than 0.5 after COVID-19. This shows a transition from anti-persistence to persistence behavior. Moreover, we observe a significant increase in \({H}_{q=2},\) in the cases of pharmaceutical, automobile and FMCG sectors. This indicates an increase in persistence after the outbreak of the COVID-19 in these three sectors. On the contrary, \({H}_{q=2}\) for IT and NIFTY 50 shows a transition from anti-persistence (\({H}_{q=2}<0.5)\) to persistence (\({H}_{q=2}>0.5)\) behavior in post-COVID-19. An increase in Hurst exponent in all the above cases indicates that the increase in market inefficiency leads to an increase in persistence. Previous research states that the shock of COVID-19 increases persistence in the stock market (Bentes 2021; Vera-Valdes 2022), and our results exhibit that the Indian stock market reacts similarly in response to the shock of COVID-19. Moreover, the multifractal analysis of the daily return series presents more detail about this inefficient market providing a probable solution to the investors about the comparatively safe investment.

Though Table 2 displays a spectrum of Hurst exponents of daily returns for all sectors concerning various scales, providing an evidence of multifractal nature, we conduct a detailed analysis to examine multifractal behavior with regard to the singularity spectrum and the respective width. Table 3 shows the result.

We find a reduction in the spectral width in the pharmaceutical, automobile and FMCG sectors in post-COVID time (Fig. 4).

Our study reveals that the multifractality in these three sectors reduces after the outbreak of COVID-19. A reduction in multifractality indicates a reduction in volatility (Ihlen 2012). Loss of business, lay-off, imposed quarantine and a fear of unprecedented risk to lives led to less consumption, followed by less economic output (Mazur et al. 2021). This may have reduced the volatility of these sectors during the pandemic. On the contrary, spectral width increases after COVID-19 in IT sector and in NIFTY 50 which points out an increase in multifractality leading to an increase in volatility. A significant change in the usage and application of IT products and services for information sharing during the pandemic could be attributed as a rationale for drawing investors' attention, leading to an increase in volatility in this sector (He et al. 2020). Sector-wise analysis reveals the existence of multifractality or self-similarity in all sectors; however, the multifractality of only IT sector mimics the composite market index NIFTY 50. Thus, only the IT sector is in tune with NIFTY 50 out of the selected sectors considered in this research.

Conclusion

The paper examines the persistence of specific sectors of the Indian stock market in the context of the first wave of COVID-19. The COVID-19 outbreak has created panic among investors, which has led to instability in the worldwide stock market. However, there needs to be more study on emerging market efficiency during COVID-19. Thus, in this paper, we conduct a detailed analysis of the daily returns of specific sectors in the Indian stock market to understand market efficiency during uncertainty better. Furthermore, the study compares the result of each sectorial catalog with the market index, which is NIFTY 50 in this case. Previous studies show that the stock market experiences negative returns during high uncertainties in the market (Bekaert and Hoerova 2014). Following the previous literature, the recent papers examining the impact of COVID-19 on stock market performance or industry-specific behavior find similar results (Baek et al. 2020). However, these studies mainly focus on stock markets from leading developed countries. The construction and regulation of developed markets are different from those of emerging markets. Thus, it is important to examine whether the stakeholders in the emerging stock market react or respond based on their previous experience when they process complex information during uncertainty.

Usually, exploring the market condition in the context of persistence is useful for investors, as persistency could enhance confidence among traders and signal the capacity of the market to deal with the chaos created by uncertainty. Thus, in the present work, we attempt to characterize the stock market concerning persistence. Moreover, we apply MFDFA to focus on the sector-wise investigation of the National Stock Exchange to identify the sectors that could be safe for trading during uncertainty. Multifractality can be quantified by measuring the generalized Hurst exponent and by the width of the singularity spectrum. An increase in multifractality indicates self-affine characteristics, which result in a long-range correlation. On the other hand, a reduction in multifractality hints at a less volatile market. Empirical analysis shows that multifractality reduces in the automobile, FMCG and pharmaceutical sectors; on the contrary, the IT sector and NIFTY 50 have shown an increase in multifractal behavior.

In the current stressful situation, it is expected that fear or anxiety in investors' minds would affect their investment decision, leading to a behavioral bias. In this regard, all sectors in the sample are trying to be persistent and experiencing herding behavior as expected. The overall behavior of all selected stocks shows that sector inefficiency increases after the outbreak of COVID-19 in India as we observe an increase in the Hurst exponent across all sectors in the study sample. Thus, our findings indicate to the investors that they can maximize their portfolio return by adding a certain weight percentage among different stocks from the industries mentioned in this paper. However, our sector-specific analysis of the daily return using multifractal theory shows that spectral width has been reduced in some stocks. In contrast, in others, it has increased during and after COVID-19. The findings of this study give a positive signal to the policymakers about which sectors they should focus on to experience overall growth in the economy.

Moreover, instead of a blanket approach to assess the stock market during uncertainty, like the post-COVID-19 era, investors should take an approach to assess sector-specific stock performance in their portfolio maximization decision-making. As a reduction in spectral width hints at a less volatile market, we assist the international investor in considering the Indian stock market as a safe option even in the ongoing COVID-19 market inefficiencies. A reduced spectral width in automobile, pharmaceutical and FMCG sectors can generate confidence among investors during uncertain times. In that case, it is possible for the market regulating authorities to strengthen their COVID-19 recovery plan sometime in the near future. Like any other study, this paper is not free from limitations. Examining additional characteristics of each stock for more sectors, which are becoming vulnerable in the ongoing COVID situation, could increase the confidence among investors in the Indian stock market. Moreover, the impact of higher inflation and a geopolitical crisis could also be interesting for investors with limited capital to invest in information processing. We expect to extend the literature in the future by analyzing persistence using MFDFA in another uncertain period to gain more insights into the stock market stakeholders and assist them in developing practical trading strategies, even during uncertain events dominating the financial market.

Data availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Notes

Hurst exponent(H) is a quantitative measure which characterizes the behavior of a time series. An independent and identically distributed asset price follows Normal distribution where the standard deviation of the process \(\sigma \left(t\right)\approx {t}^{H}\), and t is the increment in time. H is known as Hurst exponent (Coulliard and Davison 2005). The exponent H indicates the scaling relationship of the asset price variation with the change in time. Scaling property characterizes the economic and financial time series as self-similar, i.e., persistent (0.5 < H ≤ 1) and anti-persistent (0 < H < 0.5) or random (H = 0.5).

References

Aas, K, and Xeni K. Dimakos. 2004. Statistical modelling of financial time series : An introduction (Issue March). Norwegian Computing Center. https://www.uni-ulm.de/fileadmin/website_uni_ulm/mawi.inst.050/Courses/Winter0708/risk/Statistical_modelling_of_financial_time_series_01.pdf

Adekoya, O.B., and J.A. Oliyide. 2022. Commodity and financial markets’ fear before and during COVID-19 pandemic: Persistence and causality analyses. Resources Policy 76: 102598.

Alam, M.N., M.S. Alam, and K. Chavali. 2020. Stock market response during COVID-19 lockdown period in India: An event study. Journal of Asian Finance, Economics and Business 7 (7): 131–137.

Altig, D., S. Baker, J.M. Barrero, N. Bloom, P. Bunn, S. Chen, S.J. Davis, J. Leather, B. Meyer, E. Mihaylov, P. Mizen, N. Parker, T. Renault, P. Smietanka, and G. Thwaites. 2020. Economic uncertainty before and during the COVID-19 pandemic. Journal of Public Economics 191: 104274.

Antonakakis, N., I. Chatziantoniou, and G. Filis. 2013. Dynamic co-movements of stock market returns, implied volatility and policy uncertainty. Economics Letters 120 (1): 87–92.

Baek, S., S.K. Mohanty, and M. Glambosky. 2020. COVID-19 and stock market volatility: An industry level analysis. Finance Research Letters 37: 101748.

Bekaert, G., and M. Hoerova. 2014. The VIX, the variance premium and stock market volatility. Journal of Econometrics 183 (2): 181–192.

Bentes, S.R. 2021. How COVID-19 has affected stock market persistence? Evidence from the G7’s. Physica a: Statistical Mechanics and Its Applications 581: 126210.

Bhatia, P., and P. Gupta. 2020. Sub-prime crisis or COVID-19: A comparative analysis of volatility in indian banking sectoral indices. FIIB Business Review 9 (4): 286–299.

Bhuiyan, E.M., and M. Chowdhury. 2020. Macroeconomic variables and stock market indices: Asymmetric dynamics in the US and Canada. Quarterly Review of Economics and Finance 77: 62–74.

Bouchaud, J.-P., Y. Gefen, M. Potters, and M. Wyart. 2004. Fluctuations and response in financial markets: The subtle nature of ‘random’ price changes. Quantitative Finance 4 (2): 176–190.

Buszko, M., W. Orzeszko, and M. Stawarz. 2021. COVID-19 pandemic and stability of stock market-a sectoral approach. PLoS ONE 16: 1–26.

Caporale, G.M., L. Gil-Alana, A. Plastun, and I. Makarenko. 2022. Persistence in ESG and conventional stock market indices. Journal of Economics and Finance 678: 1–26.

Carbone, A., G. Castelli, and H.E. Stanley. 2004. Time-dependent Hurst exponent in financial time series. Physica a: Statistical Mechanics and Its Applications 344 (1–2): 267–271.

Coulliard, M., and M. Davison. 2005. A comment on measuring the Hurst exponent of financial time series. Physica a: Statistical Mechanics and Its Applications 348: 404–418.

Dang, T.L., and T.M.H. Nguyen. 2020. Liquidity risk and stock performance during the financial crisis. Research in International Business and Finance 52: 101165.

Dmitriev, A., A. Lebedev, V. Kornilov, and V. Dmitriev. 2022. Multifractal early warning signals about sudden changes in the stock exchange states. Complexity 2022: 8177307.

Erdem, O. 2020. Freedom and stock market performance during Covid-19 outbreak. Finance Research Letters 36: 101671.

Espinosa-Méndez, C., and J. Arias. 2021. Herding behavior in Asutralian stock market: Evidence on COVID-19 effect. Applied Economics Letters 28 (21): 1898–1901.

Fama, E. 1965. Random walks in stock market prices. Financial Analysts Journal 21 (5): 55–59.

Goldberger, A. L., Amaral, L. A., Hausdorff, J. M., Ivanov, P. C. ., Peng, C. K., & Stanley, H. E. 2002. Fractal dynamics in physiology: alterations with disease and aging. In: Proceedings of the National Academy of Sciences of the United States of America, 99(Suppl 1): 2466–2472

Han, X., N. Sakkas, J. Danbolt, and A. Eshraghi. 2022. Persistence of investor sentiment and market mispricing. Financial Review 57: 617.

Hazra, D.K., B.S. Pujari, S.M. Shekatkar, F. Mozaffer, S. Sinha, V. Guttal, P. Chaudhuri, and G.I. Menon. 2022. Modelling the first wave of COVID-19 in India. PLOS Computational Biology 18 (10): e1010632.

He, P., Y. Sun, Y. Zhang, and T. Li. 2020. COVID–19’s impact on stock prices across different sectors—an event study based on the Chinese stock market. Emerging Markets Finance and Trade 56 (10): 2198–2212.

Homaifar, G.A., J. Adongo, and K.M. Zhao. 2013. The long-run relationship between stock return dispersion and output. Applied Economics 45 (7): 943–952.

Hwang, S., and M. Salmon. 2004. Market stress and herding. Journal of Empirical Finance 11 (4): 585–616.

Ihlen, E.A.F. 2012. Introduction to multifractal detrended fluctuation analysis in Matlab. Frontiers in Physiology 3: 1–18.

Kantelhardt, J.W., S.A. Zschiegner, E. Koscielny-bunde, A. Bunde, S. Havlin, and H.E. Stanley. 2002. Multifractal detrended fluctuation analysis of nonstationary time series. Physica a: Statistical Mechanics and Its Applications 316 (1–4): 87–114.

Lillo, F., and J.D. Farmer. 2004. The long memory of the efficient market. Studies in Nonlinear Dynamics & Econometrics. https://doi.org/10.2202/1558-3708.1226.

Liu, H., A. Manzoor, C. Wang, L. Zhang, and Z. Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17 (8): 1–19.

Malik, K., S. Sharma, and M. Kaur. 2021. Measuring contagion during COVID-19 through volatility spillovers of BRIC countries using diagonal BEKK approach. Journal of Economic Studies 49 (2): 227–242.

Mandelbrot, B.B. 1982. The Fractal Geometry of Nature. Freeman.

Mandelbrot, B. B., Fisher, A., and Calvet, L. 1997. A multifractal model of asset returns. Cowles Foundation Discussion Paper No. 1164.

Mandelbrot, B. B. 1977. Fractals: form, chance, and dimension, Translation of Les objets fractals, ed. W. H. Freeman

Mantegena, R.S., and H.E. Stanley. 1995. Scaling behavior in the dynamics of Economic Index. Nature 376: 46–49.

Mazur, M., M. Dang, and M. Vega. 2021. COVID-19 and the March 2020 stock market crash. Evidence from S&P1500. Finance Research Letters 38: 101690.

Mei, J., and L. Guo. 2004. Political uncertainty, financial crisis and market volatility. European Financial Management 10 (4): 639–657.

Menkveld, A.J. 2013. High frequency trading and the new market makers. Journal of Financial Markets 16 (4): 712–740.

Milos, L.R., C. Hatiegan, M.C. Milos, F.M. Barna, and C. Botoc. 2020. Multifractal detrended fluctuation analysis(MF-DFA) of stock market indexes. Empirical evidence from seven central and eastern european markets. Sustainability 12: 1–15.

Mishra, A.K., B.N. Rath, and A.K. Dash. 2020. Does the Indian financial market nosedive because of the COVID-19 outbreak, in comparison to after demonetisation and the GST? Emerging Markets Finance and Trade 56 (10): 2162–2180.

Mittal, S., and D. Sharma. 2021. The impact of COVID-19 on stock returns of the Indian healthcare and pharmaceutical sector. Australasian Accounting, Business and Finance Journal 15 (1): 5–21.

Mullins, M., and S.B. Wadhwani. 1989. The effect of the stock market on investment: A comparative study. European Economic Review 33 (5): 939–956.

Muzy, J.F., J. Delour, and E. Bacry. 2000. Modelling fluctuations of financial time series: From cascade process to stochastic volatility model. European Physical Journal B: Condensed Matter and Complex Systems 17: 537–548.

Patil, A.C., and S. Rastogi. 2020. multifractal analysis of market efficiency across structural breaks: Implications for the adaptive market hypothesis. Journal of Risk and Financial Management 13: 1–18.

Peters, E. E. 1991. Chaos and Order in the Capital Markets. A New View of Cycle, Prices, and Market Volatility, ed. J.Wiley

Raimundo, M.S., and J. Okamoto Jr. 2018. Application of Hurst exponent (H) and the R/S analysis in the classification of FOREX securities. International Journal of Modeling and Optimization 8 (2): 116–124.

Robert, P. 2013. Economies of contagion: Financial crisis and pandemic. Economy and Society 42 (2): 226–248.

Saleem, A., J. Bárczi, and J. Sági. 2021. Covid-19 and Islamic stock index: Evidence of market behavior and volatility persistence. Journal of Risk and Financial Management 14 (8): 389.

Sánchez Granero, M.A., J.E. Trinidad Segovia, and J. García Pérez. 2008. Some comments on Hurst exponent and the long memory processes on capital markets. Physica a: Statistical Mechanics and Its Applications 387 (22): 5543–5551.

Sarkar, A., A.K. Chakrabarti, and S. Dutta. 2021. Covid-19 infection in india: A comparative analysis of the second wave with the first wave. Pathogens 10 (9): 1222.

Segal, G., I. Shaliastovich, and A. Yaron. 2015. Good and bad uncertainty: Macroeconomic and financial market implications. Journal of Financial Economics 117 (2): 369–397.

Shalini, V., and K. Prasanna. 2016. Impact of the financial crisis on Indian commodity markets: Structural breaks and volatility dynamics. Energy Economics 53: 40–57.

Shiller, R.J. 2000. Irrational Exuberance. Princeton: Princeton University Press.

Shleifer, A. 2003. Inefficient Markets: An Introduction to Behavioral Finance. Oxford: Oxford Academic.

Sinha, S., and R.K. Pan. 2006. The Power (Law) of Indian Markets: Analysing NSE and BSE Trading Statistics. In Econophysics of Stock and other Markets, ed. A. Chatterjee and B.K. Chakrabarti, 24–34. Springer Milan.

Skjeltorp, J.A. 2000. Scaling in the Norwegian stock market. Physica a: Statistical Mechanics and Its Applications 283 (3): 486–528.

Sornette, D., and W.X. Zhou. 2006. Importance of positive feedbacks and overconfidence in a self-fulfilling Ising model of financial markets. Physica a: Statistical Mechanics and Its Applications 370 (2): 704–726.

Takahashi, H., and K. Yamada. 2021. When the Japanese stock market meets COVID-19: Impact of ownership, China and US exposure, and ESG channels. International Review of Financial Analysis 74: 101670.

Thomas, T.C., G. Sankararaman, and S. Suresh. 2020. Impact of COVID-19 announcements on NIFTY stocks. Journal of Critical Reviews 7 (13): 471–475.

Varma, Y., R. Venkataramani, and P. Kayal. 2021. Short-term impact of COVID-19 on Indian stock market. Journal Risk Financial Management 14: 1–15.

Vera-Valdes J.E. (2022). Valdes_Fin_Res_Lett_2022.pdf. Finance Research Letters, 44: 102056

Voss, J. 2013. Rescaled range analysis: A method for detecting randomness, persistence or mean reversion in financial markets. Enterprising Investor 21: 1–35.

Wang, S., and C. Zhang. 2005. Microscopic model of financial markets based on belief propagation. Physica a: Statistical Mechanics and Its Applications 354: 496–504.

Zhang, S., and W. Fang. 2021. Multifractal behaviors of stock indices and their ability to improve forecasting in a volatility clustering period. Entropy 23: 1–19.

Zhang, W., and S. Hamori. 2021. Crude oil market and stock markets during the COVID-19 pandemic: Evidence from the US, Japan, and Germany. International Review of Financial Analysis 74: 101702.

Zhang, D., M. Hu, and Q. Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest among the authors of this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bhattacharjee, A., Nandy, M. & Lodh, S. COVID-19 and persistence in the stock market: a study on a leading emerging market. Int J Discl Gov (2024). https://doi.org/10.1057/s41310-024-00250-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41310-024-00250-7