Abstract

Participation of women on corporate boards has long been a topic of debate in academia and practice. Yet, the threshold of women's participation in a corporate board to obtain a synergetic impact on corporate sustainability performance remains to be examined. Data from 19 European countries, having 2640 firm-year of observation, this study revealed that women on boards positively affect corporate sustainability performance in the European context, with an approximately 30% participation of women on boards (WoB) ensuring synergetic impact. This study further revealed that after the threshold of WoB participation, the market value of companies tends to be negative in the European setting. An indication of investors' reactions. The issue was first examined through the lens of the resource-based view, social role, agency and critical mass theories and then empirically tested. To reach a conclusion, this study employs both static and dynamic econometric models; thus, the finding is consistent and empirically robust. The research findings contribute to the current discussion on corporate governance and corporate sustainability performances issues, especially in the European context, and have implications for researchers, business practitioners, and policymakers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

By 2030 and 2050, human consumption patterns will demand natural resources equivalent to two and three planets, respectively (Goyal et al. 2018). Linear business models and a lack of prudence in corporate governance have brought humanity to the edge of a precipice. However, in order to reduce the negative impact of business activities, an enormous trend in corporate sustainability has begun to emerge as a result of a shift in business attitudes (Xie et al. 2019). This has resulted in a positive shift from voluntary business participation in sustainability activities to mandatory encumbrance due to social expectations and institutional requirements (Rahi et al. 2022a, 2022b, 2023; Wang et al. 2016; Xie et al. 2019). In addition, the UN sustainability development goals (SDGs) call on companies to participate and contribute to the development of actions at all levels to mitigate climate risks and protect the natural environmental ecosystem, ensuring social security by applying prudent governance models (Birindelli et al. 2019; Martínez-Ferrero and García-Meca 2020). The corporate focus on sustainability strategies, such as environmental, social, and governance (ESG) strategies, is increasing, resulting in significant shifts in business practices as well as corporate governance mechanisms (Xie et al. 2019; Rahi et al. 2022a; Sanseverino et al. 2023). Environmental sustainability ensures long-run sustainability and resilience of ecosystems that support human life by minimizing pollution, biodiversity loss, greenhouse gas emissions, and waste, as well as achieving goals such as renewable energy and energy efficiency. Social sustainability takes responsibility for ensuring the quality of life, well-being, biodiversity, equality, employee relations, and human capital management. Finally, internal control, routines, board diversity, independence, information transparency, and risk management are all addressed in the governance sustainability dimension.

Top management levels now pay thorough attention to sustainability (Setó-Pamies 2015). According to Deloitte (2018), issues connected to corporate sustainability performance are increasingly positioned at the top of board agendas and given greater importance by directors. Good corporate governance affects all stakeholders’ well-being in the corporate, social, and political environments (Aras and Crowther 2008; Ehikioya 2009). Due to inadequate resources, it may be difficult to meet the minimum expectations of stakeholders. But sound corporate governance can soothe the metaphoric pain by contributing to the well-being of the business, society, and the environment together (Aras and Crowther 2008). Many studies have been conducted to investigate the relationship between effective corporate governance with environmental or corporate social responsibility (CSR)Footnote 1 performance, with some studies indicating that woman board members have a positive effect on outreach (Birindelli et al. 2019; Gangi et al. 2019; García Martín and Herrero 2020; García-Sánchez et al. 2018; Khan 2010; Lu and Herremans 2019; Walls and Hoffman 2013). The majority of these studies looked at the link between WoB and CSR or environmental performance. Research on the impact of women participation on boards and corporate sustainability performance (CSP) is lagging behind, especially in the European context. In addition, there is a dearth of research (according to the Scopus database search) on the question of the minimum composition of women on boards (WoB) required to have a synergetic impact on sustainability performance remains to be examined.Footnote 2

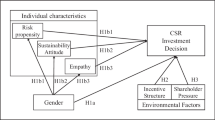

Ethical and social considerations encourage increasing number of WoB, as well as, of course, emphasizing the issue of gender equality (Brieger et al. 2019). In addition, SDG 5 encourages businesses to achieve gender equality in order to be socially responsible and contribute to a “peaceful, prosperous and sustainable world” (Birindelli et al. 2019). Furthermore, by promoting women to positions on corporate boards,Footnote 3 European companies can motivate their entire female workforce, thereby strengthening the process of sustainable development.Footnote 4 Walls and Hoffman (2013), Birindelli et al. (2019), and García Martín and Herrero (2020) have found that firms with more independent boards and higher gender diversity demonstrate higher environmental performance. In addition, according to the resource-based view, social role theory, and agency and critical mass theories, women’s presence on boards can bring change to the style of management operation. For instance, women tend to be more prudent than men in their management style, and they have been shown to prioritize the welfare policies of the stakeholders more than that of the shareholders (Adams 2016; Jain and Zaman 2020; Nielsen and Huse 2010). Boards that lack women participation tend to be less involved in considering sustainability and risk management (Bord and O’Connor 1997). Gabaldon et al. (2016) conducted a systematic review on women on boards and discovered that different male and female perspectives on the natural environment positively influence board decision making. Women are considered more committed to forming and maintaining connections to stakeholders than their male counterparts (Boutchkova et al. 2021; Pucheta-Martínez et al. 2019), and a gender-diverse board tends to improve a firm's management processes, resulting in a better management team and thus improved long-term sustainable performance. As discussed, to improve CSP, it is inevitable that women should participate on boards. Women's representation on boards is legally required (in the form of a quota) in many European countries (Mensi-Klarbach et al. 2021). Norway, for example, was the first in Europe to implement a gender-balance law with a quota requirement for corporate boards in 2003, and countries such as Sweden, Germany, Italy, France, and Spain quickly followed the trend to increase the representation of WoB (Adams 2016; Clark et al. 2021). Yet, the minimum number of WoB to get a synergetic effect on sustainability performance is unknown. Thus, this study will contribute to the growing corporate governance and corporate sustainability literature and help practitioners and policymakers, particularly within the board gender diversity and sustainability performance discussion. To reach a conclusion, this study applies the following models: Pooled OLS, Random Effect (with and without robust standard error), Fixed Fffects, two-step system Generalized Method of Moments (GMM) and Threshold regression. The use of both static and dynamic econometric models ensures the robustness of the findings, as previous research has highlighted that relationships found only by OLS or Fixed Effects are spurious (Schultz et al. 2010). The analyses of the study revealed that having women on boards positively affects CSP in the European context, with approximately 30% participation by women on boards ensuring a synergetic impact. This study contributes to the discussion on gender diversity and corporate sustainability performance issues by providing evidence of previously unexplored WoB participation threshold to ensure the synergetic impact on CSP in the European context. This study further revealed that when exceeding the threshold of WoB participation (i.e., 30%) the firm value tends to be negative in the European setting, an indication of investors’ reactions, following shareholder’s theory.

The remaining sections are organized as follows: section “Literature review, theoretical background and hypothesis development” deals with the literature review, theoretical conceptualization and hypothesis development, leading to two hypotheses. section “Data and methodology” covers data and methodological issues. Section “Results and discussion” elaborates on the findings and facilitates discussion, and finally section "Conclusion" concludes the discussion by highlighting possible policy implications and recommendations.

Literature review, theoretical background and hypothesis development

Women’s participation on the management board and corporate sustainability performance

There are many empirical studies available that incorporate an agenda of increasing WoB with CSR, environmental or climate performance, social engagement, earning management, and sustainability reporting (Alazzani et al. 2017; Ardito et al. 2021; Buertey 2021; Burkhardt et al. 2020; Charumathi and Rahman 2019; Fahad and Rahman 2020; Fan et al. 2019; Govindan et al. 2021; Helfaya and Moussa 2017; Jizi et al. 2022; Pucheta-Martínez and Gallego-Álvarez 2019; Tapver et al. 2020; Tingbani et al. 2020; Xie et al. 2020; Dobbin and Jung 2011; Groening 2019). Among the studies, the majority of them reported positive associations yet few divulged contradictory or indifferent results. In general, a positive outcome of WOB participation is common in the literature. Systematic literature reviews conducted by Khatib et al. (2021) and Nguyen et al. (2020) have identified a similar trend in gender – and sustainability-related research and support the above argument. On the contrary, a few of the previous literature provided factors that could be categorized as contributing to a negative relationship; such as too much of good thing’s effect (Groening 2019), triggering in-group conflict (Talavera et al. 2018), country-specific effect (Ardito et al. 2021; Oldford et al. 2021; Adams and Ferreira 2009) or industry-specific effect (Talavera et al. 2018; Fan et al. 2019). While being thoroughly examined the country-specific effect, papers written by Ardito et al. (2021) Oldford et al. (2021) and Adams and Ferreira (2009) identified negative relationships between women's participation on boards and corporate (sustainability) performance. All the three mentioned articles took samples from the United States (USA); perhaps samples from a specific region led to a negative relationship, as US firms are more shareholder-focused and tend to have a male-dominated corporate board culture (Arfken et al. 2004; Davies-Netzley 1998; Skaggs et al. 2012). A recent hybrid literature review written by Rahi et al. (2023b) supports this proposition, and they further argue that this phenomenon is common among capitalist countries such as the USA, Ireland and the UK.

In contrast, the scenario is the opposite in Europe,Footnote 5 where many countries must ensure mandatory female participation (quota) on corporate boards by law. The European Union (EU) was advised in July 2020 to take action on board gender diversity, such as by spurring a new EU directive on board composition (EY, 2020). Moreover, SDG 5 urges companies to implement gender equality and empowerment of women. Therefore, research samples taken from EU countries would lead to a positive association between WoB and corporate sustainability performance. A recent study by Nuber and Velte (2021) provides empirical evidence in the European context and shows that women offered specific functional expertise on boards to increase board heterogeneity. To align with the previous literature review along with empirical studies, there are numerous reasons to support the notion that women's participation on corporate boards improves the quality of board governance and thus corporate sustainability performance in the European context.

Greater gender diversity on a board brings a broader range of perspectives, which aids in the development of corporate long-term sustainability strategies. WoB has long been a topic of debate, but the resource-based view, social role theory, and agency and critical mass theories provide positive and solid theoretical underpinnings. According to the resource-based view, organizations gain a competitive advantage in sustainability by acquiring and creating bundles of extraordinary, valuable, unique, and non-substitutable resources (Barney 1991). Board members, particularly women, are frequently presented with these characteristics, and their experience, expertise, and reputation can be used to boost the firm's competitive advantage in the pursuit of sustainability. Previous empirical evidence supports this proposition (e.g., Post et al. 2011; Bord and O’Connor 1997). According to social role theory, women and men directors have fundamentally different core values (Eagly 2013); the former is more generous and more concerned about stakeholders, while the latter are more power-oriented (Adams and Funk 2012). Gender balance in a management board, as with family composition, brings symmetry to decision making and thus avoids agency problems, as women are considered to be adroit at problem solving, having strong skills to deal with ambiguity, conflict, and uncertainty (He and Jiang 2019; Rosener 1997). These attributes of women can improve the quality and effectiveness of board discussions, allowing firms to make strategic changes in the case of sustainability performances. Therefore, this paper asserts the following hypothesis.

H1

Women’s participation on the corporate board ensures sustainability performance in the European context.

Critical mass theory and corporate sustainability performance

The term critical mass, adopted from nuclear physics and the analogy of the term has been used in social science to refer to any environment in which things change when a certain number of individuals congregate or enter a place or setting (Konrad et al. 2008). According to this notion, a group's influence becomes more evident only after a critical mass is attained. The application of critical mass theory is intimately involved when research deals with women participation on corporate boards. Previous empirical evidence has shown a positive impact of the presence of such a critical mass on boards (Ben-Amar et al. 2017; Cordeiro et al. 2020; He and Jiang 2019; Hollindale et al. 2019; Liu 2018; Post et al. 2011). In addition, previous research has shown that when there is a critical mass of women on corporate boards, corporations spend more on sustainability concerns (Post et al. 2011). This phenomenon can be further explained with feminist stakeholder theory; the theory argues for better interests and well-being of all stakeholders (Burton and Dunn 1996; Wicks et al. 2023). This is due to the fact that critical mass in the corporate boards enables the implementation of sustainable stakeholder-oriented business strategies. The balance in power dynamics in the corporate boards actively shapes corporate governance mechanisms, making it more inclusive and responsive toward stakeholders as well as to the corporation itself. Focusing on the effect of WoB on the board’s agenda, most of aforementioned articles advocated critical mass theory and thereby ended up showing empirical analysis that one, two, three or more women participating on a board (in absolute numbers) can create a positive impact on board governance toward sustainability. For example, Kramer et al. (2006) and Konrad et al. (2008) both claimed that three women is a magical number on a corporate board.

However, arguing for an absolute number of WoB compositions does not address the matter of the minimal threshold as a relative number. An absolute number such as two or three doesn’t answer, the minimum percentage of women participation required. According to critical mass theory, having only one or two women on board may not be enough to create substantial influence on strategic decision making because either (a) societal or group pressure forces minorities to conform to the wishes of the majority, or (b) minorities change their positions against their will to follow the majority's preferences, due to social or group pressure (Konrad et al. 2008; Kramer et al. 2006; Nemeth 1986). Therefore, these earlier findings may create a paradox in board composition and, thereby adaptation in practice. Burkhardt et al. (2020) tried to rationalize the relative number by using a dummy variable of WoB participation of 10% or more, which is still far behind the concept of the minimum threshold of women on board composition required to have a synergetic impact on CSP. Joecks et al. (2013) attempted to find a relative number by computing a ratio from the sample's mean of WoB participation. This justification is only rational without deploying any econometric model (multivariate analysis). Finally, Slomka-Golebiowska et al. (2022) investigated the influence of two distinct endpoints, such as 20% and 33% WoB involvement, in accordance with Italian legal requirements, and they found that changes are visible at the higher end. Earlier literature has signaled the existence of a WoB threshold with regard to sustainability. Yet, the minimum threshold (as a relative number) of WoB to obtain a synergetic impact, by deploying proper econometric models, on corporate sustainability performance remains to be examined. Therefore, the second hypothesis is proposed.

H2

A minimum threshold (relative number) of WoB ensures synergetic impact on sustainability performance.

Data and methodology

Sample selection and data extraction

During the initial data extraction phase, this study collected data from 30 European countries. Later decided to exclude 11 countries since their representative firms did not give enough data: too much data was missing for comparison. Furthermore, Russia and the UK are excluded due to distinct regulatory frameworks and country-specific characteristics. In the end, this study used data from the years 2015–2020 from 19 European countries, in 9 different industries, a total of 440 companies (see Table 1). While choosing the industries, the financial industry has also been dropped due to its specificities form others. In term of countries, in this study Norway and Switzerland have been chosen outside the European Union due to the fact that they operate in accordance with EU regulations and directives, allowing for import, export, and investment within the region (Dupont and Sciarini 2001; Emerson and Woolcock 2002). Norway, for example, is included in the European Economic Area (EEA) as a partner state of the European Union (Emerson and Woolcock 2002). The free trade agreement of 1972 and the bilateral agreements of 1999 allow Switzerland a privileged status within the EU (Dupont and Sciarini 2001). The sample consists of companies listed on the European stock exchange, because previous research has demonstrated that firm size is important in ensuring sustainability performance as well as the presence of women on boards (Cosma et al. 2021; Lückerath-Rovers 2013).

The data obtained from the Eikon database yielded a total of 2640 firm-year of observations. Previous studies also acknowledge that the database is comprehensive enough to include all the major listed companies in the European region (Nuber and Velte 2021; Rahi et al. 2022a; Velte 2017). In addition, the database can be depended on for objective, relevant, auditable, and systematic data (Nadeem et al. 2020b). Missing data for the sample were replaced with series means to get balanced panel data (Hair et al. 1998). The reasons for selecting the countries listed in Table 1 are threefold. First, European countries, especially those in the EU alliance, are the pioneers in terms of incorporating women participating on boards by amending laws; second, these countries are well known for their sustainability initiatives; and third, data for the selected variables are available for the years 2015–2020. Figure 1 shows the advancement of WOB in European countries during the studied years.

Variables of the study

This study uses ESG score—a proxy of corporate sustainability performance (CSP)—as a dependent variable. ESG encompasses several aspects of sustainability, including the environmental, social, and governance dimensions. Information on energy consumption, recycled water, carbon emissions, waste management, spills, and pollution issues would normally be included in data regarding the (E)nvironmental dimension. Employee turnover, injury rates, accidents, training hours, donations, and health and safety issues are typically included in the (S)ocial dimension. And finally, internal control, routines, board diversity, independence, information transparency, and risk management are included in the (G)overnance dimension. The aggregate ESG score accords equal weight to all relevant data of E, S and G- by z-scoring them and comparing them to the data points of all other organizations to generate a relative measure of performance stated as a percentage ranging from 0 to 100% in the Eikon database. These measurements ensure relative comparability over time and among organizations. A number of studies previously used this variable to indicate non-financial and sustainability related performances (Eccles et al. 2020; Fatemi et al. 2018; Galbreath 2013; Nuber & Velte 2021). This shows the study has empirical support to use ESG as a proxy of CSP. Furthermore, professional analysts use ESG data gathered from a variety of certified data providers to assess nonfinancial performance in order to make sustainability investment decisions (Kirby 2021). Therefore, ESG is a valid estimator to measure corporate sustainability performance. Within the ESG score, the (G)overnance score included the board gender diversity issue, which is suspected to be endogenous with the independent variable of women on boards. Therefore, to rule out possible threats, this study has taken the average environment and social score (ES) as the dependent variable for the alternative analysis (i.e., all analyses under panel B).

The main variable of interest, WoB (the percentage of woman members on a management board) is the independent variable. In line with the existing literature, this study expects that women participation on boards enhances corporate sustainability performance (Birindelli et al. 2019; Cordeiro et al. 2020; Nuber and Velte 2021). If the first hypothesis is proven, the next step will be to find a threshold point for WoB composition, according to the second hypothesis. Other firm-specific variables are used as control variables to control the relationship. For instance, the existence of a sustainability committee helps to achieve higher sustainability performance. Previous literature has confirmed such an association (García-Sánchez et al. 2019; Nuber and Velte 2021). In addition, firm leverage has also been taken as a control variable, as highly leveraged businesses tend to be poorer in terms of sustainability performance. It is also believed that being financially buoyant gives more space to focus on social responsibility (Arora and Dharwadkar 2011) thus enhancing sustainability performance. Following the financial buoyancy logic, it is further argued that large firms are capable and socially bound to perform sustainability performance compared to their smaller counterparts, which is supported by the stakeholder theory. In addition, sustainability activities reduce transaction costs for large firms and improve access to resources, thereby ensuring profit (Ghoul et al. 2016). As previous arguments are built upon financial buoyancy, therefore two more financial performance indicators were taken: economic value added (EVA) and Tobin’s Q. Here, EVA is a finance-based performance indicator and Tobin’s Q is a market-based performance indicator. Previous studies dealing with board gender diversity have taken both finance and market-based measures to observe changes in the relationship (Dobbin and Jung 2011; Liao et al. 2015; Nuber and Velte 2021; Solal and Snellman 2019;). Among those authors, Solal and Snellman (2019) argued that Tobin’s Q is the best estimator to capture market reaction. The association between financial and sustainability performance has been mixed in the previous literature (Rahi et al. 2022a). Table 2 exhibits the detailed variable list.

Estimation methods

Given the aim and hypotheses, the following seven econometric models are provided for the analysis.

Here, αi is the constant term; γϑi,t−1 refers to the lag value of dependent variables; Zit represents the independent variables, and εit is the error term.

For \(i = 1, \ldots .,n;\quad t = 1, \ldots T\)

For \(i = 1, \ldots .,n;\quad t = 1, \ldots T\).

Here, yit = dependent variable; \(\beta x_{it}^{\prime }\) = lagged dependent variables; \(x_{it}^{\prime }\) = Explanatory and control variables (where applicable); qit = the threshold variable; γ = threshold parameter; K = Kink; μi = to estimate unknown parameter β′, δ′, γ′ for dynamic model (see Seo et al. 2019); εit is the error term.

To estimate the relationship, this study used seven different models following panels A and B. The distinction of panels is as follows. Panel A includes ESG, and panel B includes ES as dependent variables, respectively. In addition, models 1–4 are static and 5–7 are dynamic models. The purpose of using static and dynamic models is to assure the robustness of the findings and to overcome endogeneity issues that may arise with static regression models. In addition, models 1–5 helped to prove the first hypothesis, while 6 and 7 helped to prove the second hypothesis. In the models, several influential control variables have been used to ensure homogeneity among variables. To ensure findings are unaffected by any extreme outliers, each of the continuous variables was winsorized. Before analyzing the models, the normality of the dependent variables was checked and confirmed. Variance Inflation Factors (VIF) were separately checked for collinearity diagnosis and found to be within the normal range (i.e., maximum value, irrespective of models, is counted below 1.30, whereas the maximum accepted value is 10) (Fox and Monette 1992). Table 3 presents details of the collinearity test.

Results and discussion

Descriptive statistics

Descriptive statistics of the data set are reported in Table 4 for all dependent, independent, and control variables for a six-year period (2015–2020). For the ESG value, there is a wide disparity between the minimum and maximum. This is supported further by the mean and standard deviation. The ESG score, for example, implies that few organizations performed poorly in the ESG aspects. The ESG score ranges from 0 to 100; in the European context, the mean value is 64.09, indicating that organizations' sustainability performance can be improved. The same trend has been observed for the ES score. Nonetheless, the values are reasonable and within the range of previous studies on the similar topic (Rahi et al. 2022a; Velte 2017). Focusing on the WOB variable, the disparity between the minimum and the maximum value is also high. I intentionally kept all the companies that reported zero for WoB participation to evaluate the degree of disparity. Figure 2 below shows the declining trend of having zero women on boards over six studied years. The maximum value of WoB is 75%, whereas the mean is 28.83%, which is quite high compared to the sample taken from US firms (i.e., Nadeem et al. 2020a) as many European companies socially and legally ensure more women participation in corporate boards. The 75th percentile of the women on boards score implies that at least 25% of companies have 38.46% or more women on their boards. In addition, data from the Eikon database yielded all the European listed companies where WoB participation is socially constructed.

Correlation result

Table 5 presents the correlation matrix of all the variables selected for this study. The results indicate that multicollinearity is not an issue because the correlation values are considerably below the conventionally acceptable level (i.e., 0.80). However, the findings of both univariate and correlation analyses provide some preliminary signals that gender-diverse boards are associated with sustainability performance in the European context, where firm size plays an important role. These findings initially support the first hypothesis. Nonetheless, multivariate analyses have also been performed with other control variables to strengthen the result as well as to prove the second hypothesis.

Baseline outcomes

Given the balanced panel data following regression with a time-invariant variable (i.e., ECSR), Eq. 1 (see Sect. “Estimation methods”) was estimated for the Pooled OLS (POLS) and Random Effects (RE) model, and the Breusch-Pagan Lagrangian Multiplier (BPLM) test was performed to select the statistically preferred model. The BPLM test confirmed that RE is preferred. Table 6 (Panel A) shows that WoB positively and significantly affects corporate sustainability performance at the 1% significance level where coefficients are 0.218, 0.251 and 0.251 for POLS, RE and RE with robust standard error, respectively (see Table 6, Panel A). In addition, the R2 of models are 41%, 39% and 39%, respectively, which indicates the instruments' adequate explanatory power (Larcker and Rusticus 2010). In other words, it implies that better sustainability performance can be achieved when there is gender diversity in the boardroom. One additional woman on the board results in a 22 to 25% increase in corporate sustainability performance on average. For the robustness checking in a different setting (see Sects. “Sample selection and data extraction”, “Variables of the study”, and “Estimation methods” for a detailed explanation), Panel B was employed with similar results. As a result, the first hypothesis of this study is confirmed. This outcome of the analyses could perhaps be attributed to the women board members’ specific skill set to effectively lead management teams toward responsibility for stakeholders and be more engaged toward the environment and society in general. This result confirms that women participation on boards is significantly associated with CSP in the European context. This outcome is consistent with prior research on the topic in similar settings (Haque and Jones 2020; Nuber and Velte 2021) but contradicts the evidence by Ardito et al. (2021) and Solal and Snellman (2019) within the US setting.

Additionally, to understand industries’ effects, more analyses have been conducted (see Appendix). The result in Appendix highlights that the Real estate, Technology and Utilities industries, when compared to the Basic Materials (reference category), contribute to negative toward sustainability. As previously discussed in the descriptive statistics, these industries might be contributing toward low mean ESG scores in the European context.

Robustness test and further explanation

To overcome endogeneity issues arising from WoB with other variables, this study further employed two-step system GMM. For example, the WoB variable might be endogenous with firm-specific performance variables. To handle the endogeneity issue, GMM is frequently used in economic and business research as it is considered to be a valid estimator for dynamic panel data in capturing cause-and-effect relationships between underlying phenomena that change over time, allowing it to deal with time series and random walks (Blundell and Bond 1998). First-difference GMM and two steps system GMM have both been used in previous empirical studies, but two steps system GMM is considered to be a relatively better statistical tool because when the time series follows a random walk process, the level estimation instruments are effective predictors for the endogenous variables in the two-steps system GMM (Blundell and Bond 1998). In addition, two steps system GMM uses a firm's lag data to account for endogeneity and establish a dynamic relationship by including lags of the dependent variable as repressors (instruments) (Blundell and Bond 1998).

For GMM, Eq. 2 (see Sect. “Estimation methods”) was executed. Additionally, a Fixed Effects (FE) model was also employed after taking care of the time-invariant variables such as ECSR. The findings for WoB remain statistically positively significant across models (Table 7, panel A) and validate that the positive impact of gender diversity brings higher corporate sustainability performance. Here both FE and GMM show association at the 1% and 5% significance level, where coefficients are 0.285 and 1.227, respectively. In addition, the insignificant result of the Hansen test in model 5 (GMM) shows that the instruments used for the GMM test are valid. This is further confirmed by the insignificant result of the AR2 test, consistent with the system GMM requirements (Blundell and Bond 1998; Nuber and Velte 2021; Rahi et al. 2022a; Rahman et al. 2019; Ullah et al. 2018). Panel B results were similar and confirm the findings in panel A. Apart from that, the effects of firm size, firm profitability and the existence of a CSR committee were mixed.

Another possible explanation for this result, from the agency and social role theory, is that since women board members reduce the agency problem as well as conflict among board members, they are more focused and involved in increasing sustainability performance.

Identifying the minimum threshold level of WoB composition

Sect. “Robustness test and further explanation” confirmed that, in the European context, WoB appears to have a positive impact on the corporate sustainability performance (both in panel A and B settings). Therefore, the next goal is to identify the threshold level of WoB composition that would contribute to a synergetic impact on CSP. To do so, Eqs. 3 and 4 (see Table 8 and 9) were used to identify the threshold level suggested by Seo et al. (2019). The Bootstrap p-values for linearity of the corresponding threshold values of WoB in both panels across models are significant. Models A6 (with kink slope) and A7 (panel A) confirmed the threshold levels (R) are 29% (R = 28.571) and 30% (R = 30.00), respectively. With panel B, models B6 and B7 had a similar threshold level. Therefore, approximately 30% participation by women has a synergetic impact on corporate sustainability performance in the European context. In addition, according to model A7, after the threshold slope, a firm’s market value (Tobin’s Q) tends to be negative (coefficient − 4.745 at 10% significance level) in the European context. The change is visible for large firms, where firm size is also significant at 5% significance level with the coefficient of 7.416. The result is in line with a study conducted in the US context (Solal and Snellman 2019). Solal and Snellman (2019) argued that companies that strive to be more gender diverse appear to be penalized rather than rewarded by investors. However, this trend disappeared in the panel B setting.

Conclusion

The participation of women on corporate and management boards has become a widespread phenomenon around the world, and growing interest focuses on how WoB could drive organizations toward more sustainability. Theoretically, there is a consensus that WoB not only reduces agency conflict but also ensures improvements for stakeholders through corporate sustainability performance, following stakeholder, agency, and social role theories. European firms have been pioneers in facilitating women participation on management boards following the sustainable development goals, EU recommendations, and country-specific laws. The situation is completely adverse in the USA, where firms are more shareholder-focused and tend to have a male-dominated corporate board culture (Arfken et al. 2004; Davies-Netzley 1998; Skaggs et al. 2012). This may explain why women's participation on boards is more likely to be positively correlated with sustainability and financial performance in gender-equal cultures with more progressive attitudes toward women, such as Europe and some southeast Asian countries (Low et al. 2015). Byron and Post (2016) found a similar outcome: in countries with greater gender equality and stronger shareholder protection, women on boards have a significant impact on a company's social performance. Increasing the number of women on boards is encouraged by ethical and social points of view, as well as for the sake of gender equality. However, in previous research, only linear relationships between WoB and environmental performance have been discovered, and the impact of a critical mass of WoB composition, specifically a minimum percentage (as a relative number) of women participating on boards to ensure a synergistic effect on CSP, remains to be examined. This study contributes to answering two unexplored questions. First, do women on boards affect sustainability performance in the European context? Second, what does the threshold point of women participation on boards to get a synergetic impact on corporate sustainability performance?

Using data from 19 European countries with 2640 firm-year observations, this study confirms a positive association between WoB and CSP in the European context. In addition, a distinct panel, panel B, was constructed to remove endogeneity from the relationship of dependent and independent variables. To reach a conclusion, both static and dynamic econometric models were employed. The results showed that a board composition of approximately 30% women leads to a synergetic impact on corporate sustainability performance, which may be due to women’s style of managing, operating, and setting strategies. Women board members are more stakeholder-oriented and more likely to establish policies that further higher sustainability performance. In this way, this study has proved both hypotheses.

In addition, this study successfully filled the research gap by analyzing the connections between WoB participation and CSP as well as the critical mass of women composition in corporate boards. Policy makers continue to suggest new policies on gender balance, and it is important that they understand the real effects on CSP. Previously in 2012, the European Council (EC) proposed a directive to implement 40% fixed gender quotas for nonexecutive directors for the EU listed companies. Later, the EC rejected the proposal in 2015 (Leszczyńska 2018; Nuber and Velte 2021). In the draft, it was clearly mentioned that if companies were not able to reach the quota requirement, then an explanation for noncompliance had to be given, and otherwise, sanctions would apply (Leszczyńska 2018). Before implementing any strict regulations, the policymakers need to consider scientific research. In particular, the EC may consider a new EU directive, ensuring a gender balance for formulating guidelines for board composition—because in many European countries, the progression of increasing numbers of women on boards has been rather slow (Casaca 2017; Nuber and Velte 2021). For a few countries, the composition results in too much of good thing, generating negative investor reactions (Dobbin and Jung 2011; Groening 2019; Solal and Snellman 2019). Recently in 2022, EU parliament approved 40% gender (under-represented sex) quota for certain (large) firms aimed to balance gender participation on boards (European Commission 2022). The quota requirement will be executed in 2026. This study’s outcome sheds light that 40% quota requirement might create too-much-of-a-good-thing effect (TMGT), and there is more in-depth study required to understand the TMGT as well as synergetic effects. This study can be considered as the first attempt at the journey.

The findings from this study can help policymakers to understand the balance of women participation on corporate boards. Below the threshold level, in accordance with the critical mass theory, women participation would not create value toward sustainability. Rather, such participation would only serve the purposes of board selfieFootnote 6 or board ornamentation, for convenience in order to meet legitimacy requirements, or even as greenwashing or tokenism. Above the threshold of WoB participation, this study showed reactions by the investors, thus reducing the firm’s market value (Tobin’s Q). This supports the economics law of diminishing marginal returns or the too-much-of-a-good-thing effect (Pierce and Aguinis 2013). Therefore, a balance is required and needs to be considered by policymakers. However, this investor reaction was not evident in the panel B setting. The present outcome provides a signal that shareholders penalize rather than reward companies that strive to be more gender diverse (i.e., WoB) in the European context. A similar outcome was identified in the US context (Solal and Snellman 2019), even though the social construction of the two regions is different. The findings of this study indicate that the market's response, as measured with Tobin’s Q, is relatively subdued as the details investigation of investor reaction is beyond the scope of this study. This would open new endeavors for future research direction in the European context. Another limitation of this study is that cultural and religious barriers to women’s participation on management boards were not considered. This consideration is necessary prior to addressing the issue at the policy level. Future research could emphasize these issues and contribute to enhancing knowledge of corporate governance, management, behavioral finance, and cognitive economics. Finally, this study takes ESG as a proxy for CSP, but many researchers consider this as a "Janus phenomenon" with two opposing sides and hence not beyond debate (Dorfleitner et al. 2022; Rahi et al. 2023a). Future research could explore or create measures other than ESG to examine corporate sustainability performances. To conclude, the findings of this study are consistent and empirically robust; hence, it delivers key messages to policymakers and practitioners about the importance of promoting gender diversity in the boardroom to ensure better corporate sustainability performance.

Notes

This study considers CSR only a part (a single dimension) of holistic sustainability actions.

To achieve holistic sustainability, companies need to strive for ecological, social, governance, and economic dimensions of sustainability consistently through their business-as-usual.

This paper uses the terms corporate boards and management boards interchangeably.

In this paper, female and woman are applied interchangeably whereas the author is completely aware of the difference of the terms.

In this context, 'Europe' refers to non-Anglo-Saxon countries.

Here, the author meant selfies as a form of eye-washing, as well as actions that are misleading or deceptive, used to meet legitimacy requirements or for serving the purpose of greenwashing or tokenism.

References

Adams, R.B. 2016. Women on boards: The superheroes of tomorrow? The Leadership Quarterly 27 (3): 371–386. https://doi.org/10.1016/j.leaqua.2015.11.001.

Adams, R.B., and D. Ferreira. 2009. Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 94 (2): 291–309.

Adams, R.B., and P. Funk. 2012. Beyond the glass ceiling: Does gender matter? Management Science 58 (2): 219–235. https://doi.org/10.1287/mnsc.1110.1452.

Alazzani, A., A. Hassanein, and Y. Aljanadi. 2017. Impact of gender diversity on social and environmental performance: Evidence from Malaysia. Corporate Governance: The International Journal of Business in Society 17 (2): 266–283. https://doi.org/10.1108/CG-12-2015-0161.

Aras, G., and D. Crowther. 2008. Governance and sustainability. Management Decision 46 (3): 433–448. https://doi.org/10.1108/00251740810863870.

Ardito, L., R.M. Dangelico, and A. Messeni Petruzzelli. 2021. The link between female representation in the boards of directors and corporate social responsibility: Evidence from B corps. Corporate Social Responsibility and Environmental Management 28 (2): 704–720. https://doi.org/10.1002/csr.2082.

Arfken, D.E., S.L. Bellar, and M.M. Helms. 2004. The ultimate glass ceiling revisited: The presence of women on corporate boards. Journal of Business Ethics 50 (2): 177–186. https://doi.org/10.1023/B:BUSI.0000022125.95758.98.

Arora, P., and R. Dharwadkar. 2011. Corporate governance and corporate social responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corporate Governance: An International Review 19 (2): 136–152.

Barney, J. 1991. Firm resources and sustained competitive advantage. Journal of Management 17 (1): 99–120. https://doi.org/10.1177/014920639101700108.

Ben-Amar, W., M. Chang, and P. McIlkenny. 2017. Board gender diversity and corporate response to sustainability initiatives: Evidence from the Carbon Disclosure Project. Journal of Business Ethics 142 (2): 369–383. https://doi.org/10.1007/s10551-015-2759-1.

Birindelli, G., A.P. Iannuzzi, and M. Savioli. 2019. The impact of women leaders on environmental performance: Evidence on gender diversity in banks. Corporate Social Responsibility and Environmental Management. https://doi.org/10.1002/csr.1762.

Blundell, R., and S. Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 66.

Bord, R.J., and R.E. O’Connor. 1997. The gender gap in environmental attitudes: The case of perceived vulnerability to risk, Vol. 78, No. 4. https://www.jstor.org/stable/42863734.

Boutchkova, M., A. Gonzalez, B.G.M. Main, and V. Sila. 2021. Gender diversity and the spillover effects of women on boards. Corporate Governance: An International Review 29 (1): 2–21. https://doi.org/10.1111/corg.12339.

Brieger, S.A., C. Francoeur, C. Welzel, and W. Ben-Amar. 2019. Empowering women: The role of emancipative forces in board gender diversity. Journal of Business Ethics 155 (2): 495–511. https://doi.org/10.1007/s10551-017-3489-3.

Buertey, S. 2021. Board gender diversity and corporate social responsibility assurance: The moderating effect of ownership concentration. Corporate Social Responsibility and Environmental Management 28 (6): 1579–1590. https://doi.org/10.1002/csr.2121.

Burkhardt, K., P. Nguyen, and E. Poincelot. 2020. Agents of change: Women in top management and corporate environmental performance. Corporate Social Responsibility and Environmental Management 27 (4): 1591–1604. https://doi.org/10.1002/csr.1907.

Burton, B.K., and C.P. Dunn. 1996. Feminist ethics as moral grounding for stakeholder theory. Business ethics quarterly 66: 133–147.

Byron, K., and C. Post. 2016. Women on boards of directors and corporate social performance: A meta-analysis. Corporate Governance: An International Review 24 (4): 428–442. https://doi.org/10.1111/corg.12165.

Casaca, S. F. 2017. Portugal: The slow progress of the regulatory framework. In Gender diversity in the boardroom (pp. 45–74). Springer. https://doi.org/10.1007/978-3-319-57273-4_3

Charumathi, B., and H. Rahman. 2019. Do women on boards influence climate change disclosures to CDP? Evidence from large Indian companies. Australasian Accounting, Business and Finance Journal 13 (2): 5–31. https://doi.org/10.14453/aabfj.v13i2.2.

Clark, C.E., P. Arora, and P. Gabaldon. 2021. Female representation on corporate boards in Europe: The interplay of organizational social consciousness and institutions. Journal of Business Ethics 66: 1–22.

Cordeiro, J.J., G. Profumo, and I. Tutore. 2020. Board gender diversity and corporate environmental performance: The moderating role of family and dual-class majority ownership structures. Business Strategy and the Environment 29 (3): 1127–1144. https://doi.org/10.1002/bse.2421.

Cosma, S., P. Schwizer, L. Nobile, and R. Leopizzi. 2021. Environmental attitude in the board. Who are the “green directors”? Evidences from Italy. Business Strategy and the Environment 30 (7): 3360–3375. https://doi.org/10.1002/bse.2807.

Davies-Netzley, S.A. 1998. Women above the glass ceiling. Gender & Society 12 (3): 339–355. https://doi.org/10.1177/0891243298012003006.

Deloitte. 2018. Sustainability and the board: What do directors need to know in 2018? Global Center for Corporate Governance. https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Risk/gx-sustainability-and-the-board.pdf. Accessed March 21 2022.

Dobbin, F., and J. Jung. 2011. Corporate board gender diversity and stock performance: The competence gap or institutional investor bias. North Carolina Law Rev. 89 (3): 809–838.

Dorfleitner, G., C. Kreuzer, and C. Sparrer. 2022. To sin in secret is no sin at all: On the linkage of policy, society, culture, and firm characteristics with corporate scandals. Journal of Economic Behavior and Organizations 202: 762–784. https://doi.org/10.1016/j.jebo.2022.08.027.

Dupont, C., and P. Sciarini. 2001. Switzerland and the European integration process: Engagement without marriage. West European Politics 24 (2): 211–232. https://doi.org/10.1080/01402380108425440.

Eagly, A.H. 2013. Sex Differences in Social Behavior. Psychology Press. https://doi.org/10.4324/9780203781906.

Eccles, R.G., L.-E. Lee, and J.C. Stroehle. 2020. The social origins of ESG: An analysis of innovest and KLD. Organization & Environment 33 (4): 575–596. https://doi.org/10.1177/1086026619888994.

Ehikioya, B.I. 2009. Corporate governance structure and firm performance in developing economies: Evidence from Nigeria. Corporate Governance: The International Journal of Business in Society 9 (3): 231–243. https://doi.org/10.1108/14720700910964307.

Emerson, M., and S. Woolcock. 2002. Navigating by the stars: Norway, the European Economic Area and the European Union. Centre for European Policy Studies.

European Commission. 2022. Press release: Women on Boards: Commission report shows progress, but more efforts needed to reach gender balance. Retrieved from https://ec.europa.eu/commission/presscorner/detail/en/ip_22_3478.

EY and Directorate-General for Justice and Consumers. 2020. Study on directors' duties and sustainable corporate governance. Final Report. 2020. https://op.europa.eu/en/publication-detail/-/publication/97cac494-d20c-11ea-adf7-01aa75ed71a1/language-en.

Fahad, P., and P.M. Rahman. 2020. Impact of corporate governance on CSR disclosure. International Journal of Disclosure and Governance 17 (2–3): 155–167. https://doi.org/10.1057/s41310-020-00082-1.

Fan, Y., Y. Jiang, X. Zhang, and Y. Zhou. 2019. Women on boards and bank earnings management: From zero to hero. Journal of Banking & Finance 107: 105607. https://doi.org/10.1016/j.jbankfin.2019.105607.

Fatemi, A., M. Glaum, and S. Kaiser. 2018. ESG performance and firm value: The moderating role of disclosure. Global Finance Journal 38: 45–64. https://doi.org/10.1016/j.gfj.2017.03.001.

Fox, J., and G. Monette. 1992. Generalized Collinearity Diagnostics. Journal of the American Statistical Association 87 (417): 178–183. https://doi.org/10.1080/01621459.1992.10475190.

Gabaldon, P., C. de Anca, R. Mateos de Cabo, and R. Gimeno. 2016. Searching for women on boards: An analysis from the supply and demand perspective. Corporate Governance: An International Review 24 (3): 371–385. https://doi.org/10.1111/corg.12141.

Galbreath, J. 2013. ESG in focus: The Australian evidence. Journal of Business Ethics 118 (3): 529–541. https://doi.org/10.1007/s10551-012-1607-9.

Gangi, F., A. Meles, E. D’Angelo, and L.M. Daniele. 2019. Sustainable development and corporate governance in the financial system: Are environmentally friendly banks less risky? Corporate Social Responsibility and Environmental Management 26 (3): 529–547. https://doi.org/10.1002/csr.1699.

García Martín, C.J., and B. Herrero. 2020. Do board characteristics affect environmental performance? A study of EU firms. Corporate Social Responsibility and Environmental Management 27 (1): 74–94. https://doi.org/10.1002/csr.1775.

García-Sánchez, I.M., M.E. Gómez-Miranda, F. David, and L. Rodríguez-Ariza. 2019. Board independence and GRI-IFC performance standards: The mediating effect of the CSR committee. Journal of Cleaner Production 225: 554–562. https://doi.org/10.1016/j.jclepro.2019.03.337.

García-Sánchez, I.-M., J. Martínez-Ferrero, and E. García-Meca. 2018. Board of directors and CSR in banking: The moderating role of bank regulation and investor protection strength. Australian Accounting Review 28 (3): 428–445. https://doi.org/10.1111/auar.12199.

Ghoul, S. O. el Guedhami, Y. Kim, and Y. Kim. 2016. Institutional voids, firm value, and CSR: Country-level institutions, firm value, and the role of corporate social responsibility initiatives. https://doi.org/10.1057/jibs.2016.4.

Govindan, K., M. Kilic, A. Uyar, and A.S. Karaman. 2021. Drivers and value-relevance of CSR performance in the logistics sector: A cross-country firm-level investigation. International Journal of Production Economics 231: 107835. https://doi.org/10.1016/j.ijpe.2020.107835.

Goyal, S., M. Esposito, and A. Kapoor. 2018. Circular economy business models in developing economies: Lessons from India on reduce, recycle, and reuse paradigms. Thunderbird International Business Review 60 (5): 729–740. https://doi.org/10.1002/tie.21883.

Groening, C. 2019. When do investors value board gender diversity? Corporate Governance: The International Journal of Business in Society 19 (1): 60–79. https://doi.org/10.1108/CG-01-2018-0012.

Hair, J.F., W.C. Black, B.J. Babin, R.E. Anderson, and R.L. Tatham. 1998. Multivariate data analysis. Upper Saddle River, NJ: Prentice Hall.

Haque, F., and M.J. Jones. 2020. European firms’ corporate biodiversity disclosures and board gender diversity from 2002 to 2016. The British Accounting Review 52 (2): 100893. https://doi.org/10.1016/j.bar.2020.100893.

He, X., and S. Jiang. 2019. Does gender diversity matter for green innovation? Business Strategy and the Environment 28 (7): 1341–1356. https://doi.org/10.1002/bse.2319.

Helfaya, A., and T. Moussa. 2017. Do board’s corporate social responsibility strategy and orientation influence environmental sustainability disclosure? UK evidence. Business Strategy and the Environment 26 (8): 1061–1077. https://doi.org/10.1002/bse.1960.

Hollindale, J., P. Kent, J. Routledge, and L. Chapple. 2019. Women on boards and greenhouse gas emission disclosures. Accounting & Finance 59 (1): 277–308. https://doi.org/10.1111/acfi.12258.

Jain, T., and R. Zaman. 2020. When boards matter: The case of corporate social irresponsibility. British Journal of Management 31 (2): 365–386. https://doi.org/10.1111/1467-8551.12376.

Jizi, M., R. Nehme, and C. Melhem. 2022. Board gender diversity and firms’ social engagement in the Gulf Cooperation Council (GCC) countries. Equality, Diversity and Inclusion: An International Journal 41 (2): 186–206. https://doi.org/10.1108/EDI-02-2021-0041.

Joecks, J., K. Pull, and K. Vetter. 2013. Gender diversity in the boardroom and firm performance: What exactly constitutes a “Critical Mass?” Journal of Business Ethics 118 (1): 61–72. https://doi.org/10.1007/s10551-012-1553-6.

Khan, H. 2010. The effect of corporate governance elements on corporate social responsibility (CSR) reporting. International Journal of Law and Management 52 (2): 82–109. https://doi.org/10.1108/17542431011029406.

Khatib, S.F.A., D.F. Abdullah, A.A. Elamer, and R. Abueid. 2021. Nudging toward diversity in the boardroom: A systematic literature review of board diversity of financial institutions. Business Strategy and the Environment 30 (2): 985–1002. https://doi.org/10.1002/bse.2665.

Kirby, A. 2021. Why data remains the biggest ESG investing challenge for asset managers. https://www.ey.com/en_gl/financial-services-emeia/why-data-remains-the-biggest-esg-investing-challenge-for-asset-managers.

Konrad, A.M., V. Kramer, and S. Erkut. 2008. The impact of three or more women on corporate boards. Organizational Dynamics 37 (2): 145–164. https://doi.org/10.1016/j.orgdyn.2008.02.005.

Kramer, V.W., A.M. Konrad, and S. Erkut. 2006. Critical mass on corporate boards: Why three or more women enhance governance, Wellesley Centers for Women. Report WCW 11.

Larcker, D.F., and T.O. Rusticus. 2010. On the use of instrumental variables in accounting research. Journal of Accounting and Economics 49 (3): 186–205. https://doi.org/10.1016/j.jacceco.2009.11.004.

Leszczyńska, M. 2018. Mandatory quotas for women on boards of directors in the European Union: Harmful to or good for company performance? European Business Organization Law Review 19 (1): 35–61. https://doi.org/10.1007/s40804-017-0095-x.

Liao, L., L. Luo, and Q. Tang. 2015. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review 47 (4): 409–424. https://doi.org/10.1016/j.bar.2014.01.002.

Liu, C. 2018. Are women greener? Corporate gender diversity and environmental violations. Journal of Corporate Finance 52: 118–142. https://doi.org/10.1016/j.jcorpfin.2018.08.004.

Low, D.C.M., H. Roberts, and R.H. Whiting. 2015. Board gender diversity and firm performance: Empirical evidence from Hong Kong, South Korea, Malaysia and Singapore. Pacific-Basin Finance Journal 35: 381–401. https://doi.org/10.1016/j.pacfin.2015.02.008.

Lu, J., and I.M. Herremans. 2019. Board gender diversity and environmental performance: An industries perspective. Business Strategy and the Environment 28 (7): 1449–1464. https://doi.org/10.1002/bse.2326.

Lückerath-Rovers, M. 2013. Women on boards and firm performance. Journal of Management & Governance 17 (2): 491–509. https://doi.org/10.1007/s10997-011-9186-1.

Martínez-Ferrero, J., and E. García-Meca. 2020. Internal corporate governance strength as a mechanism for achieving sustainable development goals. Sustainable Development 28 (5): 1189–1198. https://doi.org/10.1002/sd.2068.

Mensi-Klarbach, H., S. Leixnering, and M. Schiffinger. 2021. The carrot or the stick: Self-regulation for gender-diverse boards via codes of good governance. Journal of Business Ethics 170 (3): 577–593. https://doi.org/10.1007/s10551-019-04336-z.

Nadeem, M., S. Bahadar, A.A. Gull, and U. Iqbal. 2020a. Are women eco-friendly? Board gender diversity and environmental innovation. Business Strategy and the Environment 29 (8): 3146–3161. https://doi.org/10.1002/bse.2563.

Nadeem, M., E. Gyapong, and A. Ahmed. 2020b. Board gender diversity and environmental, social, and economic value creation: Does family ownership matter? Business Strategy and the Environment 29 (3): 1268–1284. https://doi.org/10.1002/bse.2432.

Nemeth, C.J. 1986. Differential contributions of majority and minority influence. Psychological Review 93 (1): 23–32. https://doi.org/10.1037/0033-295X.93.1.23.

Nguyen, T.H.H., C.G. Ntim, and J.K. Malagila. 2020. Women on corporate boards and corporate financial and non-financial performance: A systematic literature review and future research agenda. International Review of Financial Analysis 71: 101554. https://doi.org/10.1016/j.irfa.2020.101554.

Nielsen, S., and M. Huse. 2010. The contribution of women on boards of directors: Going beyond the surface. Corporate Governance: An International Review 18 (2): 136–148. https://doi.org/10.1111/j.1467-8683.2010.00784.x.

Nuber, C., and P. Velte. 2021. Board gender diversity and carbon emissions: European evidence on curvilinear relationships and critical mass. Business Strategy and the Environment 30 (4): 1958–1992. https://doi.org/10.1002/bse.2727.

Oldford, E., S. Ullah, and A.T. Hossain. 2021. A social capital view of women on boards and their impact on firm performance. Managerial Finance 47 (4): 570–592.

Pierce, J.R., and H. Aguinis. 2013. The too-much-of-a-good-thing effect in management. Journal of Management 39 (2): 313–338. https://doi.org/10.1177/0149206311410060.

Post, C., N. Rahman, and E. Rubow. 2011. Green governance: Boards of directors’ composition and environmental corporate social responsibility. Business & Society 50 (1): 189–223. https://doi.org/10.1177/0007650310394642.

Pucheta-Martínez, M.C., I. Bel-Oms, and G. Olcina-Sempere. 2019. Commitment of independent and institutional women directors to corporate social responsibility reporting. Business Ethics: A European Review 28 (3): 290–304. https://doi.org/10.1111/beer.12218.

Pucheta-Martínez, M.C., and I. Gallego-Álvarez. 2019. An international approach of the relationship between board attributes and the disclosure of corporate social responsibility issues. Corporate Social Responsibility and Environmental Management 26 (3): 612–627. https://doi.org/10.1002/csr.1707.

Rahi, A.F., R. Akter, and J. Johansson. 2022a. Do sustainability practices influence financial performance? Evidence from the Nordic financial industry. Accounting Research Journal 35 (2): 292–314. https://doi.org/10.1108/ARJ-12-2020-0373.

Rahi, A.F., M.A.F. Chowdhury, J. Johansson, and M. Blomkvist. 2023a. Nexus between institutional quality and corporate sustainable performance: European evidence. Journal of Cleaner Production 382: 135188.

Rahi, A.F., J. Johansson, M. Blomkvist, and F. Hartwig. 2023. Corporate sustainability and financial performance: A hybrid literature review. Corporate Social Responsibility and Environmental Management 66: 1–15. https://doi.org/10.1002/csr.2600.

Rahi, A.F., J. Johansson, A. Fagerström, and M. Blomkvist. 2022b. Sustainability reporting and management control system: A structured literature review. Journal of Risk and Financial Management 15 (12): 562.

Rahman, M.M., R.H. Rana, and S. Barua. 2019. The drivers of economic growth in South Asia: Evidence from a dynamic system GMM approach. Journal of Economic Studies 46 (3): 564–577. https://doi.org/10.1108/JES-01-2018-0013.

Rosener, J.B. 1997. America’s competitive secret: Women managers. New York: Oxford University Press.

Sanseverino, A., J. González-Ramírez, and K. Cwik. 2023. Do ESG progress disclosures influence investment decisions? International Journal of Disclosure and Governance 66: 1–20.

Schultz, E.L., D.T. Tan, and K.D. Walsh. 2010. Endogeneity and the corporate governance—Performance relation. Australian Journal of Management 35 (2): 145–163. https://doi.org/10.1177/0312896210370079.

Seo, M.H., S. Kim, and Y.-J. Kim. 2019. Estimation of dynamic panel threshold model using Stata. The Stata Journal: Promoting Communications on Statistics and Stata 19 (3): 685–697. https://doi.org/10.1177/1536867X19874243.

Setó-Pamies, D. 2015. The relationship between women directors and corporate social responsibility. Corporate Social Responsibility and Environmental Management 22 (6): 334–345. https://doi.org/10.1002/csr.1349.

Skaggs, S., K. Stainback, and P. Duncan. 2012. Shaking things up or business as usual? The influence of female corporate executives and board of directors on women’s managerial representation. Social Science Research 41 (4): 936–948. https://doi.org/10.1016/j.ssresearch.2012.01.006.

Slomka-Golebiowska, A., S. de Masi, and A. Paci. 2022. Board dynamics and board tasks empowered by women on boards: Evidence from Italy. Management Research Review. https://doi.org/10.1108/MRR-09-2021-0678.

Solal, I., and K. Snellman. 2019. Women don’t mean business? Gender penalty in board composition. Organization Science 30 (6): 1270–1288. https://doi.org/10.1287/orsc.2019.1301.

Talavera, O., S. Yin, and M. Zhang. 2018. Age diversity, directors’ personal values, and bank performance. International Review of Financial Analysis 55: 60–79.

Tapver, T., L. Laidroo, and N.A. Gurvitš-Suits. 2020. Banks’ CSR reporting—Do women have a say? Corporate Governance: The International Journal of Business in Society 20 (4): 639–651. https://doi.org/10.1108/CG-11-2019-0338.

Tingbani, I., L. Chithambo, V. Tauringana, and N. Papanikolaou. 2020. Board gender diversity, environmental committee and greenhouse gas voluntary disclosures. Business Strategy and the Environment 29 (6): 2194–2210. https://doi.org/10.1002/bse.2495.

Ullah, S., P. Akhtar, and G. Zaefarian. 2018. Dealing with endogeneity bias: The generalized method of moments (GMM) for panel data. Industrial Marketing Management 71: 69–78. https://doi.org/10.1016/j.indmarman.2017.11.010.

Velte, P. 2017. Does ESG performance have an impact on financial performance? Evidence from Germany. Journal of Global Responsibility 8 (2): 169–178. https://doi.org/10.1108/JGR-11-2016-0029.

Walls, J.L., and A.J. Hoffman. 2013. Exceptional boards: Environmental experience and positive deviance from institutional norms. Journal of Organizational Behavior 34 (2): 253–271. https://doi.org/10.1002/job.1813.

Wang, H., L. Tong, R. Takeuchi, and G. George. 2016. Corporate social responsibility: An overview and new research directions. Academy of Management Journal 59 (2): 534–544. https://doi.org/10.5465/amj.2016.5001.

Wicks, A.C., D.R. Gilbert, Jr. and R.E. Freeman. 2023. A feminist reinterpretation of the stakeholder concept. In R. Edward Freeman’s selected works on stakeholder theory and business ethics (pp. 133–155). Cham: Springer.

Xie, J., W. Nozawa, and S. Managi. 2020. The role of women on boards in corporate environmental strategy and financial performance: A global outlook. Corporate Social Responsibility and Environmental Management 27 (5): 2044–2059. https://doi.org/10.1002/csr.1945.

Xie, J., W. Nozawa, M. Yagi, H. Fujii, and S. Managi. 2019. Do environmental, social, and governance activities improve corporate financial performance? Business Strategy and the Environment 28 (2): 286–300.

Acknowledgements

The author would like to express gratitude to Professor Silvia (Editor-in-Chief) and the anonymous reviewers for their assistance and suggestions. Additionally, the author wishes to extend thanks to Professor Jeaneth Johansson and Marita Blomkvist for their encouragement in developing this paper. This paper was also presented at the NORSI conference at BI-Norwegian Business School in 2022. The author is grateful to receive comments from Professor Bjørn Erik Mørk, Jerker Moodysson and Barbara Rebecca Mutonyi to develop this paper further.

Funding

Open access funding provided by Halmstad University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No potential conflict of interest was identified.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Dependent variable | ESG | ES | ||

|---|---|---|---|---|

Coeff | SE | Coeff | SE | |

WOB | 0.251*** | (0.018) | 0.202*** | (0.020) |

ECSR | 8.225*** | (0.529) | 8.899*** | (0.572) |

Leverage | 0.0128 | (0.010) | 0.007 | (0.011) |

Firm size | 5.701*** | (0.363) | 6.359*** | (0.413) |

EVA | 0.002 | (0.003) | 0.004 | (0.003) |

Lag_Tobin’s Q | − 0.226 | (0.141) | − 0.126 | (0.152) |

Industry dummy | 1. Basic Materials | |||

2. Consumer cycle | − 2.813 | (2.128) | − 1.406 | (2.503) |

3. Consumer non cycle | − 4.002 | (2.512) | − 3.534 | (2.956) |

4. Energy | − 2.173 | (2.694) | − 2.092 | (3.170) |

6. Health care | − 3.972 | (2.502) | − 4.557 | (2.942) |

7. Industrial | − 2.390 | (2.061) | − 0.385 | (2.426) |

8. Real estate | − 7.791** | (3.130) | − 7.593** | (3.682) |

9. Technology | − 4.138* | (2.211) | − 5.332** | (2.601) |

10. Utilities | − 8.711*** | (2.845) | − 8.499** | (3.345) |

R-squared: | 0.401 | 0.361 | ||

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Rahi, A. Unpacking women’s power on corporate boards: gender reward in board composition. Int J Discl Gov (2024). https://doi.org/10.1057/s41310-024-00228-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41310-024-00228-5