Abstract

We study changes in corporate governance around mergers and acquisitions by comparing the ex-post corporate governance of the combined firm with the ex-ante weighted average governance of the bidder and target. We find that when the quality of the bidder governance is better than the target before the acquisition, the ex-post corporate governance quality of the combined firm is better than the ex-ante weighted average of each firm. We document post-acquisition improvement in the combined firm’s board independence, audit committee independence, stock compensation, and minority shareholders protection, proposing that these firm-level attributes serve as potential channels to explain better corporate governance quality of the combined firm. The operating performance of the combined firm also improves when the bidder’s pre-deal governance quality is better than the target. Our results support the portability theory of corporate governance, suggesting that poorly governed targets are better off if acquired by better-governed bidders.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The empirical evidence reveals that the target’s country-level governanceFootnote 1 quality is usually lower than the bidder’s before the acquisitionFootnote 2 (see Bris et al. 2008; Rossi and Volpin 2004). The cross-country dissimilarities in governance standards offer an opportunity for the portability of better governance through mergers and acquisitions (Ellis et al. 2017; Martynova and Renneboog 2008a, b; Wang and Xie 2009). Therefore, the post-integration process led by acquirers with better corporate governance can result in higher governance quality of the combined firm by better protecting shareholder rights and more rigorous accounting disclosure requirements. Wang and Xie (2009) argue that the combined firm will adopt the bidder’s more substantial shareholder rights after the acquisition. While the transfer of higher corporate governance standards from bidders to targets happens through the portability channel, the empirical evidence on the change in combined firm’s governance quality is still scarce. To fill this gap, we examine ex-post change in the governance of the combined firm relative to the ex-ante weighted average governance of the bidder and target and show the portability-induced changes in the quality of the combined firm governance.

We expect a positive spillover of the bidder’s governance post-acquisition in deals where the bidder’s corporate governance quality exceeds that of the target’s before an acquisition. In majority or full takeovers, bidders with better corporate governance tend to impose their best practices on the combined firm and overcome the target’s weaker corporate governance. After a deal is completed, a well-conducted integration process is essential for the success of an acquisition (Heimeriks et al. 2012). This phase encompasses changes in the target’s governance standards that can alter the managerial structure and provide better protection to shareholders of the merged firm. Eventually, mergers and acquisitions (henceforth, M&As) with a positive pre-deal bidder–target governance gap (i.e., the bidder has better governance than the target) results in governance convergenceFootnote 3 toward the higher standards in terms of balanced board structure, the effectiveness of board activities, better compensation policies, and minority shareholder protection. This study adopts an agency perspective of the firm to argue that the transfer of the bidder’s better corporate governance to the target is reflected in the combined firm’s higher governance quality.

The countries and firms are heterogeneous in the quality of corporate governance (Doidge et al. 2007; Starks and Wei 2013). Many studies show a considerable discrepancy in firm corporate governance between the merging firms (Klapper and Love 2004; Martynova and Renneboog 2008a, b; Starks and Wei 2013). Therefore, the ongoing portability effect is not merely confined to country-level governance but can also result from a more pervasive shift in firm-level governance from the bidder to the target. Apart from the mandatory governance standards, firms can also adopt voluntary governance practices, which Chhaochharia and Laeven (2009) have shown to be rewarded with higher firm market value.

M&As offer an appropriate setting for studying transfers of acceptable corporate governance practices from bidders to targets. In the spirit of the portability theory of Ellis et al. (2017), we examine whether, ceteris paribus, the ex-post firm-level corporate governance of the combined firm is higher than the ex-ante weighted average governance of the bidder and target, in particular when the bidder–target governance gap is positive (i.e., the bidder has better firm-level governance than the target) before the acquisition. Poorly governed targets pre-acquisition can benefit from the portability of corporate governance following an acquisition as they come under better governance practices provided by the bidder.

Using a global sample of 837 full takeovers announced between 2003 and 2015, in which both bidders and targets are publicly traded, we examine whether combined firm’s corporate governance standards change post-acquisition when bidders with better firm governance acquire targets with weaker governance. We measure firm governance using ASSET4 ESGFootnote 4 corporate governance attributes under categories of board structure, board function, compensation policy, shareholder rights, and construct governance indices of bidders and targets based on each category.Footnote 5 We find that the ex-post combined firm’s corporate governance quality is significantly higher relative to the ex-ante weighted average governance of the bidder and target when the ex-ante bidder–target governance gap is positive. For example, the disparity in the ex-post board structure index of the combined firm versus the ex-ante weighted average of bidder and target firms index is 4.4 percentage points (pp) higher for deals where, before the acquisition, the bidder has a higher governance index than the target. The results are in accordance with the portability theory and suggest a positive spillover effect of the bidder’s corporate governance, as the combined firm reaches a higher governance standard than the average of the stand-alone firms.

The possible endogenous relationship between the bidder–target corporate governance gap and the combined firm’s governance improvement may be an important concern for our results. One can raise a query that deals with a higher bidder–target governance gap may not be randomly distributed. For example, M&As with a higher bidder–target governance gap may be dominated by bidders of specific characteristics, including those with specifically higher governance quality, and therefore offer a greater room for governance improvements of the combined firm. We address this issue using Propensity Score Matching (PSM) and document that our results are robust.

We proceed to examine potential channels that can explain the positive impact of the ex-ante bidder–target firm governance gap on the combined firm’s ex-post governance. To do so, we analyze four individual firm governance attributes that are well established in the literature: board independence (Cotter et al. 1997; Datta, 2020), audit committee independence (see Boone et al. 2007), stock compensation (Datta et al. 2001), and equal treatment of minority shareholders (Doidge et al. 2007). The results show that these governance attributes are possible channels through which the combined firm’s governance indices improve. We find a positive change in board independence of 7.72 pp following acquisitions where the pre-deal bidder–target board structure gap is positive. This result suggests that bidders with better governance practices related to their board structure can transfer those practices to the combined firm and overcome the target’s preexisting lower standards. Similarly, we find that audit committee independence, stock compensation, and minority shareholders protection are higher by 3.85, 6.50, and 1.01 pp subsequent to acquisitions with the positive bidder–target gap in board function, compensation policy, and shareholder rights indices, respectively.

Finally, we investigate the impact of the bidder–target firm governance gap on ex-post change in the combined firm’s operating performance relative to the ex-ante weighted average operating performance of bidder and target. We find that the firm governance gap between the bidder and target has a significantly positive effect on the change in combined firm’s operating performance. This evidence is in line with the prior work (see, for example, Chemmanur et al. 2010; Core et al. 2006) and supports the portability theory, suggesting that higher corporate governance brought about by relatively better-governed bidders improves operating performance after the acquisition.

This work is the first attempt to analyze how the ex-ante bidder–target governance gap affects changes in the average firm-level governance quality of the firms involved in M&As. We contribute to the M&A literature in two ways. First, we extend the work on corporate governance portability (Ellis et al. 2017; Martynova and Renneboog 2008a, b; Wang and Xie 2009) and knowledge transfer (Hitt et al. 1990; Ranft and Lord 2002) in M&As. We explore how bidders with higher pre-deal governance standards than the target can transfer their better practices to the combined firm post-acquisition. Second, our study adds further support to the work on post-merger integration (Bresman et al. 1999; Heimeriks et al. 2012), governance convergence, and the importance of functional convergence (Goergen and Renneboog 2008). This study suggests that firms engage in M&As intending to increase the average quality of the combined firm’s corporate governance, which is an important source of synergies.

The remaining work is arranged as follows: In section “Theoretical framework,” we explain theoretical framework, review the existing literature and develop the hypotheses; in section “Data and summary statistics,” we describe the data and present the summary statistics; in Sect. “Methodology,” we describe the methodology; in section “Main results,” we discuss the main results; in Sect. “Channels of higher combined firm governance,” we analyze possible channels for better governance of the combined firm; in section “Post-acquisition operating performance,” we report changes in operating performance; in section “Robustness tests,” we show robustness tests; and in section “Conclusion,” we conclude.

Theoretical framework

Existing theories on corporate governance have focused on agency theory (Jensen and Meckling 1976), law and finance theory (La porta et al. 1998), and portability theory (Ellis et al. 2017). The work relating corporate governance and firm value documents that higher governance quality increases firm value because of lower agency issues in highly governed corporations (Bebchuk et al. 2009). Firms with better governance standards generate higher takeover value and make better investment decisions as their managers do not show empire-building or myopic behavior (Black et al. 2006). The standard of a firm’s management is perhaps related to better corporate governance.

Law and finance theory (La porta et al. 1998) dispenses the background to understand cross-country disparities in governance practices and their effect on firm value. Nations with poor shareholder rights and institutional quality are financially underdeveloped (Ellis et al. 2017), suggesting that their local firms, compared to firms from higher country governance standards, cannot get benefit from investment opportunities. The portability theory states that governance dissimilarities among countries are the source of higher bidder returns. It further elaborates that the benefits of higher governance are portable from bidders to targets in such a way that target firms will adopt the better governance practices of the bidder firm and the newly combined firm will enjoy higher governance standards.

Literature review and hypotheses development

Post-merger integration is a key driver of M&As success (Heimeriks et al. 2012) that occurs on all facets of the newly combined firm. The integration depends on several factors (for a review see Renneboog and Vansteenkiste 2019), one of them being the pre-deal difference in corporate governance quality between combining firms. Pre-deal differences in firm-specific attributes, such as corporate governance and culture, can create knowledge transfer potential after the acquisition (Björkman et al. 2007; Morosini et al. 1998; Riikka and Vaara 2010). While M&As are often motivated by the transfer of higher corporate governance standards from bidders to targets (see Ellis et al. 2017; Martynova and Renneboog 2008a, b; Wang and Xie 2009), the evidence on change in the combined firm’s governance relative to average governance of merging firms is still limited.

Among other M&A motives, it has been examined that knowledge transfer is a crucial motive for M&As. For instance, Hitt et al. (1990) and Ranft and Lord (2002) find that knowledge-gaining through M&As has a positive effect on ex-post firm performance. More recently, Ellis et al. (2017) have developed portability theory and posited that good country-level corporate governance standards are portable from bidders to targets through cross-border acquisitions. In full takeovers, Martynova and Renneboog (2008a, b) and Bris and Cabolis (2008) find that the bidder’s higher governance has a positive spillover effect. Wang and Xie (2009) show that the bidder’s more substantial shareholder rights than the target generate higher combined announcement returns, suggesting that the target will adopt the bidder’s shareholder rights after the acquisition. Thus, after an acquisition, the combined firm will benefit from the acquirer’s higher governance quality.

The portability of better governance standards may not be restricted to country governance as there is considerable heterogeneity in firm governance between merging firms (Klapper and Love 2004; Martynova and Renneboog 2008a, b; Starks and Wei 2013). Several provisions in investor protection laws allow for some flexibility in adopting voluntary governance mechanisms—i.e., firm-level corporate governance practices (Alexandridis et al. 2017; Black and Gilson 1998) aimed at improving governance and conveying more confidence to the markets. Improvements in corporate governance result in a better interest alignment between managers and shareholders, which leads to better investment decisions made by companies, including the decisions regarding M&As.

The integrationFootnote 6 processes are housed within the combined or bidder firm and take place on each aspect of firm characteristics. The bidder should effectively combine the capabilities of two entities for takeover value (Haapanen et al. 2019; Hussain and Shams 2022; Martynova and Renneboog 2008a, b) and the combined firm will reincorporate its operations and policies, including firm-level governance practices. A higher pre-deal strong corporate governance of the bidder in terms of balanced board structure, board activities effectiveness, better compensation policies, and better minority shareholder protection is transferred to the combined firm post-deal. The portability effect translates into governance convergence of the combined firm that is dominated by the higher governance standards of the bidder. Ralston et al. (2008) define convergence as “the procedure by which value systems of different countries become similar.” We propose that governance convergence is a type of M&A integration where the corporate governance differences are reduced between merging firms. Thus, the combined firm’s corporate governance quality is anticipated to be better than the stand-alone average of merging companies. Based on the discussion, we develop our first hypothesis as:

H1

Ex-post combined firm’s corporate governance is expected to be higher than the ex-ante weighted average governance of the bidder and the target when bidder–target firm governance gap is positive, ceteris paribus.

The prior work on operating performanceFootnote 7 mainly deals with M&As as a channel of improving the combined firm’s operating performance (Ghosh 2001; Healy et al. 1992; Tunyi and Ntim 2016). The increase in operating performance is due to cash financing (Fishman 1989; Myers and Majluf 1984), the difference in size between bidder and target (Ghosh 2001), and already outperforming combining firms (Ghosh 2001; Morck et al. 1990). Nevertheless, some studies do not find an increase in the combined firm’s operating performance (see, for instance, Ravenscraft and Scherer 1987). Once the impact of M&As on operating performance has been identified, scholars paid much attention to anti-takeover provisions (ATPs). The empirical evidence suggests that firms having fewer ATPs or higher shareholder rights can positively affect operating performance (Chemmanur et al. 2010; Core et al. 2006). Using Gompers et al. (2003) index as a proxy for shareholder rights, Wang and Xie (2009) show that the operating performance of the combined firm increases with a higher difference between bidder and target indices.

An essential aspect of the pre-deal corporate governance difference between merging firms is that it can create complementarities (for instance, one firm’s weakness is another firm’s strength). Harrison et al. (1991) provide evidence supporting complementarities and suggest that differences in resources (measured by capital, administrative, debt, and R&D expenditures) between merging firms positively affect the combined firm’s operating performance. Capron (1999) argues that the utilization of resources from the bidder in the target firm post-acquisition contributes to the higher acquisition performance. Further, Capron and Pistre (2002) show that the bidder to target transfer of resources creates higher returns to bidder shareholders. In short, bidders tend to carry complementary capabilities to targets. Developing on this discussion, we hypothesize that:

H2

Changes between the combined firm’s operating performance and weighted average performance of the bidder and target are positively associated with the ex-ante bidder–target corporate governance gap.

Data and summary statistics

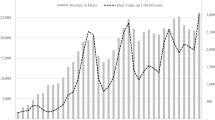

We use Thomson Financial’s Securities Data Corporation (SDC) to get a sample of completed M&As from 2003 to 2015. The bidder and target are public firms where the bidder acquires 100 percent stakes of the target. We apply various filters suggested in existing studies (Martynova and Renneboog 2008a, b; Wang and Xie 2009; Tunyi 2021; Tunyi et al. 2022) and eliminate deals if the bidder is either from financial (SIC codes 6000–6999) or utility industry (SIC codes 4900–4949). Since fewer deals in a country can add noise in the analysis, countries with less than five deals throughout the sample period are dropped. We get a final sample of 837 M&As from 17 countries.

Firm-level corporate governance data of the bidder and target are from the ASSET4 ESG database. The latest empirical work uses this database to measure the firm’s governance quality (Doung et al. 2015; Guney et al. 2019; Tarmuji et al. 2016; Areneke and Tunyi 2022; Areneke et al. 2023). To identify corporate governance changes after the acquisition, we collect governance data one year before and after the deal. Financial statement data and country-level governance data come from the Thomson Reuter’s WorldScope database the World Bank database, respectively, as described in Appendix A.

We show the sample distribution by the bidder’s country in Table 1, including the number of bidders, number of targets, and deal value. The leading countries in the international market of M&As are the USA,Footnote 8 Canada, and Japan, which account for 41% of the sample. The USA is the leading country in the takeover market with 221 bidders that acquired 383 targets during the sample period. We observe considerable dispersion in terms of the number of bidders and targets per country.

Table 2 provides descriptive statistics of governance variables, deal characteristics, and firm characteristics used in this study. We observe that the ex-post combined firm’s corporate governance quality is higher than the ex-ante weighted average of bidder and target, as shown in Panel A of Table 2. The change in a firm’s corporate governance is our dependent variable in regression analysis and calculated using four governance indices: board structure index, board function index, compensation policy index, and shareholder rights index. The average change in the score of the board structure index is 5.72, showing that the governance score of the combined firm is higher relative to the average governance score of combining firms. The ex-post governance quality of the combined firm in other governance is also higher than the pre-acquisition average of combining firms in these dimensions. The mean change in the combined firm’s operating performance is -2%. Panel B reports the bidder–target corporate governance gap before the deal announcement, which is our key independent variable of interest. The mean bidder–target governance scores gap in board structure index, board function index, compensation policy index, and shareholder rights index is 42.30, 43.98, 42.61, and 44.19, respectively. This shows that, on average, bidders have better governance than targets before an M&A deal. Following Kaufmann et al. (2009), we use World Governance Indicators (WGI) and construct the WGI index based on six attributes for bidder and target countries. Panel C shows that the average difference in the WGI index is 0.90, which corroborates the finding of Rossi and Volpin (2004) that acquirers relative to targets domicile in countries with stronger shareholder rights.

In Panel D of Table 2, we show that the majority of sample deals are domestic (68.7%); bidders are less likely to engage in the same industry (39.8%) and pay in stock (46%). To control for the combined firm characteristics in our regressions, we also include change in cash-to-asset ratio (ex-post combined firm cash-to-asset ratio minus the ex-ante weighted average cash-to-asset ratio of combining firms), cash divided by total assets; change in leverage (ex-post combined firm leverage minus ex-ante weighted average leverage of combining firms), long-term debt scaled by assets; change in size (ex-post combined firm size minus ex-ante weighted average combining firms’ size), the log of assets; change in Tobin’s Q (ex-post combined firm Tobin’s Q minus ex-ante weighted average Tobin’s Q of combining firms), assets minus equity’s book value plus equity’s market value scaled by assets. Panel E shows that the combined firm has average cash-to-asset ratio of -0.012, leverage of 0.029, size of 0.557, and Tobin’s Q of 0.033 in the year after deal completion.

We show Pearson correlation coefficients across our variables in Table 3. We observe that the pre-deal bidder–target firm governance gap in our governance indices is positively correlated with the combined firm’s ex-post change in these governance indices. We further find that the differences in the four corporate governance indices are highly correlated.

Methodology

Measure of firm corporate governance

We use governance scores from the ASSET4 ESG database to measure the governance quality of the bidder and target firms. This database rates firms on 250 key performance indicators grouped into four major categories of performance: social, corporate governance, environmental, and economic. To compile the governance scores, ASSET4 ESG uses data from the firm’s annual reports and regulatory filings and assigns a percentage score to each governance attribute that comes under one of the following four governance categories:

-

(1)

Board structure reflects the firm’s commitment toward balance board structure policies through an independent, diverse, and experienced board.Footnote 9

-

(2)

Board function shows the firm’s dedication and effectiveness toward formulating important board committees with assigned responsibilities and tasks.Footnote 10

-

(3)

Compensation policy presents the firm’s commitment toward making manager’s compensation policies in financial and non-financial terms.Footnote 11

-

(4)

Shareholder rights documents the firm’s commitment toward defining equal rights for the majority and minority shareholders?Footnote 12

We use 55 individual firm governance attributesFootnote 13 with scores between 0 (minimum) to 100 (maximum). A nonzero score shows the firm’s commitment and dedication toward a particular firm governance attribute. To capture each governance mechanism’s relative quality, we use collective measures as is common in the literature (Ammann et al. 2011; Bebchuk et al. 2009). We calculate the average score of all governance attributes under each category to develop four governance indicesFootnote 14—board structure index, board function index, compensation policy index, and shareholder rights index, for both bidders and targets. Our key independent variable (bidder–target firm governance gap) is the disparity in governance indices of the bidder and the target one year before the deal. A positive gap means that the bidder’s governance is better than the target. Measuring the bidder–target gap in four firm governance mechanisms permits us to know the scope of firm governance portability through M&As. Our dependent variable is the change in combined firm governance, defined as the ex-post combined firm’s governance index minus the ex-ante weighted average (weights depend on the equity’s market value) index of the bidder and target.

Before we proceed, it is essential to explain how we measure the combined firm’s governance, operating performance, and other firm characteristics. Ideally, we want to compute the change in combined firm governance by comparing the weighted average governance of bidder and target before and after the acquisition. However, the unavailability of the target’s data after the acquisition makes this analysis impossible. After the successful deal, the targets frequently delist from the stock exchanges. We are considering full takeovers, and after the acquisition, the combined firm comes under the bidder’s influence. Therefore, the combined firm’s information comes from the post-deal bidder’s data. Following Wang and Xie (2009), we use the weighted average for the pre-deal combined firm and compute required variables.

Model specification and variable definitions

To test H1, we estimate the following model:

where ∆ Combined \({CG}_{i,j,t-1 to t+1}\) is the ex-post (\(t+1)\) change in combined firm governance index score compared to the weighted average governance index score of bidder and target for the deal i in industry j; \(\alpha\) is the intercept; \({BT GAP}_{i,j,t-1}\) is a dummy variable with the value of one if the pre-deal (\(t-1)\) bidder–target firm governance gap is positive and zero otherwise for the deal i and industry j. \({{\text{Country}} CG GAP}_{i,j,t-1}\) is the bidder–target country governance gap for deal i and industry j one year before the deal; \(Deal { controls}_{i,t}\) is a vector of deal-specific controls for the deal i and year t. The deal-specific controls include: same industry deal, a dummy variable that is equal to one if the merging firms belong to the same Fama–French industry category and zero otherwise; payment method, an indicator variable equals one for cash-financed deals and zero otherwise; cross-border deal, a binary variable having a value of one if the deal is conducted cross the border and zero otherwise. \({\Delta {\text{Firm}} {\text{controls}}}_{k,t-1 to t+1}\) is a vector of change in firm-specific controls for the combined firm k relative to the weighted average of merging firms and includes: change in cash-to-asset ratio, change in the leverage ratio, change in Tobin’s Q, and change in size. To control omitted factors that can influence the combined firm governance, we add dummies for the year, \({\uplambda }_{t}\), industry, \(\upeta { }_{j}\), and country, \({\upgamma }_{c}\). We use Fama–French 48 industry categories for the industry dummies. The firm-specific variables are winsorized by 1% from the bottom and the top for mitigating the effect of outliers.

Main results

Univariate tests

We first perform univariate tests to examine how the bidder–target governance gap affects the combined firm’s ex-post governance change. We split the sample into two groups: the positive governance gap group (the bidder’s governance is higher than the target’s governance) and the negative governance gap group (the target’s governance is higher than the bidder’s governance), as shown in Table 4. We examine the ex-post changes in the scores of four indices: board structure index, board function index, compensation policy index, and shareholder rights index. Considering our first hypothesis (H1), we expect that if the pre-deal bidder–target firm governance gap is positive, then the ex-post combined firm’s governance should be higher than the ex-ante average governance of the merging firms because of the portability of the bidder’s higher governance quality to the target.

We use a two-tailed t-test in Panel A of Table 4 that examines the difference in means between the group of positive governance gap and the group of negative governance gap. There are 749 (89%) deals out of 837, with a positive bidder–target board structure gap. One can raise the issue that our sample is uneven, but it is well established that bidders have higher pre-deal governance quality than targets (Bris et al. 2008; Martynova and Renneboog 2008a, b; Rossi and Volpin 2004). We observe that the average ex-post change in the combined firm board structure score is 6.19 and 1.70 for the groups of the positive and the negative bidder–target board structure gap, respectively, and the reported difference is significant at the 1% level. We see a similar pattern in the ex-post changes in the combined firm’s governance for positive groups of bidder–target board function, compensation policy, and shareholder rights.

Panel B of Table 4 shows the median change in governance scores of each index using the Wilcoxon rank-sum test that examines the differences in medians between the group of positive pre-deal governance gap and the group of negative pre-deal governance gap. Our results reveal a positive change in governance quality post-acquisition when the bidder–target governance gap is positive before acquisition, which is in line with the idea of portability of the bidder’s higher governance standards to the target. After observing a positive pattern in ex-post quality of the combined firm’s governance in both univariate tests, we further examine the reported relationship in a multivariate framework in the following section that takes several deal and firm characteristics into consideration.

Changes in the combined firm’s governance

This section tests whether the pre-deal governance gap between bidder and target affects the post-deal governance quality of the combined firm using four governance indices–board structure index, board function index, compensation policy index, and shareholder rights index. Previous studies (Ellis et al. 2017; Martynova and Renneboog 2008a, b; Wang and Xie 2009) have found evidence that corporate governance is transferable from bidders to targets when the latter has weaker governance and suggest that the target will adopt better governance of the bidder after the acquisition. To test our first hypothesis (H1), we perform regression analysis separately for each governance index because they are highly correlated. We estimate cross-sectional regressions of changes in governance quality around the deal on the ex-ante bidder–target gap in governance indices along with a set of controls. In all models of Table 5, we use a dummy variable for governance gap between the bidder and target that equals one when the governance gap is positive (bidder index—target index > 0) and zero otherwise.Footnote 15

Table 5 examines the effect of the bidder–target board structure gap on the change between the ex-post combined firm’s governance quality and the ex-ante weighted average governance quality of bidder and target. The dependent variable is the ex-post change in the combined firm’s governance index relative to the ex-ante weighted average of the bidder’s governance index and target. In Panel (A) of Table 5, the key variable of interest is the bidder–target gap dummy one year before the announcement day. The parameter estimates of the variable of interest in Models (1)–(4) show that the change in ex-post combined firm’s governance indices relative to ex-ante weighted average governance indices of bidder and target firms is 4.4 to 6.26 pp higher for the positive bidder–target gap (bidder governance index is higher than target governance index) than the negative bidder–target gap (target index is higher than bidder index). Further, instead of using dummies for the governance gap between the bidder and target,Footnote 16 we used gap in governance scores provided by ASSET4 ESG database. The results in Panel (B) of Table 5 are qualitatively similar what we found before. For instance, considering Model (1) of Panel (B), a one standard deviation increase in governance gap (proxied by board structure gap) increases the combined firm’s governance by 89.42 pp.Footnote 17

The results corroborate H1 that the ex-post combined firm’s governance is significantly higher relative to the ex-ante weighted average governance of the bidder and target when the bidder–target governance gap is positive prior to the acquisition. Our results support the portability theory of Ellis et al. (2017) and suggest a positive spillover effect of the bidder’s corporate governance, as the combined firm reaches a higher governance standard than the average governance of the merging firms. The findings show that a positive bidder–target governance gap create the bidder’s governance transfer potential to the target. After a successful acquisition, the bidder applies its higher governance standards on the combined firm for achieving optimal governance performance. The findings are consistent across different subsamples and alternative governance measures.

In line with existing work on governance transfer from the bidder to target (see Ellis et al. 2017; Martynova and Renneboog 2008a, b; Wang and Xie 2009), we provide evidence that bidders with higher firm governance standards than targets before an acquisition bring, on average, positive change in the quality of the combined firm governance. Our results support the studies on knowledge transfers through M&As when pre-deal differences in firm-specific attributes exist (Björkman et al. 2007; Morosini et al. 1998; Riikka and Vaara 2010). The results also support the view that post-merger integration is an essential feature of M&As success (Heimeriks et al. 2012). It depends on several factors (see Renneboog and Vansteenkiste 2019) and occurs on all new firm facets. Overall, the results extend the portability theory application from combined firm’s returns to governance changes.

All regression models in Table 5 include control variables. To measure the bidder–target gap in the country-level governance, we use World Bank’s Governance Indicators (see Kaufmann et al. 2009). The indicators vary with time and measure how well a nation overcomes corruption, government effectiveness, regulatory quality, the rule of law, political stability, and the citizens’ freedom for electing a government. We calculate the mean index (WGI index) based on these six attributes for each country. The WGI gap is the disparity between the acquirer WGI index and the target WGI index. The coefficients on the WGI gap are positive except Model (2), albeit insignificant. We also add some deal-specific characteristics–same industry deal, payment method, cross-border deal; and the combined firm characteristics–change in cash-to-asset ratio, change in leverage ratio, change in size, change in Tobin’s Q. We observe that the statistical significance and the magnitude of estimated coefficients on these variables are similar in magnitude across all models in Table 5. In particular, we find that the combined firm’s governance change is significantly higher when the change in combined firm size and leverage are larger.

Channels of higher combined firm governance

So far, the results suggest that the combined firm’s governance is higher when the pre-deal bidder’s governance quality exceeds that of the target. We now examine the probable channels through which the bidder–target governance gap affects the combined firm’s governance. We follow existing studies to establish the possible channels, for instance, board independence (Byrd and Hickman 1992; Cotter et al. 1997), audit committee independence (see Boone et al. 2007), stock compensation (Datta et al. 2001), and protection of minority shareholders (Doidge et al. 2007), are important firm governance attributes that are more likely to show better governance of the combined firm. Based on these studies, the change in these four individual governance attributes should be more significant for the combined firms that positively change governance quality.

We test whether the governance attributes changes are linked with the governance indices changes. We create a binary variable equals one if the change in combined firm’s governance index is positive and zero otherwise. We use the actual percentage of board independence from WorldScope to measure board independence, and for the other three attributes, we use governance scores from ASSET4ESG. We present the summary statistics, the univariate analysis, and the multivariate analysis on the changes in governance attributes for a detailed analysis.

In Panel A of Table 6, we show the summary statistics of four individual firm governance attributes. The results show a positive change in each governance attribute: board independence, audit committee independence, stock compensation, and policy for equal treatment of minority shareholder rights, increase by 5.86%, 1.24%, 1.85%, and 0.47%, respectively. It shows that the quality of individual governance attributes is higher after the acquisition.

We further conduct univariate tests using two-tailed t-tests to examine if there is a difference in governance attributes changes for two groups of combined firms that show higher governance quality following an acquisition and those who do not. The individual firm governance attributes—board independence, audit committee independence, stock compensation, and policy for equal treatment of minority shareholder rights—are related to our board structure index, board function index, compensation policy index, and shareholder rights index. Therefore, the group of a positive change in each governance index is linked to the change in their respective individual governance attribute. Panel B of Table 6 shows positive changes in all governance attributes that are significant at 1% level. For instance, there are 566 (72%) deals out of 788 deals with the positive change in board structure index, and we find that the average change in board independence after the acquisition is 8.15 for the group of positive change in combined firm board structure index while it is 0.015 for negative subsample. The observed pattern is similar to other firm governance attributes.

To test the effect of change in the combined firm governance index on change in its respective individual firm governance attribute, we estimate the following model:

where \({\Delta CIG}_{i,j,t-1 to t+1}\) is the combined firm’s change in individual governance attribute one year after (\(t+1\)) the acquisition relative to weighted average individual governance attributes of the acquirer and target one year prior to the acquisition (\(t-1\)) for the deal i in industry j; \(\alpha\) is the intercept; \(High{ CG}_{i,j,t-1 to t+1}\) is a binary variable that equals one for the combined firms showing a positive change in governance indices and zero otherwise. \({\Delta {\text{Firm}} {\text{controls}}}_{k,t-1 to t+1}\) is a vector of change in firm-specific controls for the combined firm k relative to weighted average of bidder and target from -1 (one year before the deal) to + 1 (one year after the deal) and includes: sales growth (post-acquisition sales minus pre-acquisition sales scaled by pre-acquisition sales); change in leverage (ex-post leverage minus ex-ante leverage), debt divided by assets; change in size (ex-post size minus ex-ante size), log assets; change in Tobin’s Q (ex-post Tobin’s Q minus ex-ante Tobin’s Q), assets minus equity’s book value plus equity’s market value divided by assets; change in research and development expense (ex-post R&D minus ex-ante R&D); change in board size (ex-post board size minus ex-ante board size), number of directors on the board. Like before, we use industry, year, and country dummies and winsorize firm-specific variables by 1% from the top and bottom.

The key variable of interest here is the \({\text{High}}{ CG}_{i,j,t-1 to t+1}\) that has a significantly positive coefficient in all models. Model (1) in Panel (C) of Table 6 shows that, on average, post-acquisition board independence is higher by 7.72 pp for combined firms with a higher board structure index relative to those that do not. It shows that board independence is an important channel to ensure a balanced board structure in the combined firm. We endorse the monitoring role of board independence (Coles et al. 2008; Linck et al. 2008). These authors accentuate the idea that companies with dissimilar nature of businesses and terrestrially scattered functions should benefit more from independent boards. The result of Model (2) of Panel (C) reports that, on average, post-acquisition audit committee independence is higher by 3.85 pp for combined firms that have a higher board function index, suggesting that audit committee independence is an essential channel for effective board functions. The result supports the movement toward particular board guidelines (see Denis and Mcconnell 2003). For example, the Sarbanes–Oxley Act of 2002 requires that boards should have only independent audit committees. Model (3) of Panel (C) shows that, on average, stock compensation is higher by 6.5 pp subsequent to acquisition for combined firms that improved their compensation policy index than those that do not, suggesting that stock compensation programs are an important channel for enhancing compensation policies, echoing earlier findings on equity-based compensations (Baker et al. 1988; Datta et al. 2001; Harford and Li 2007). Lastly, Model (4) of Panel (C) shows that, on average, ex-post minority shareholder protection is higher by 1 pp for combined firms that increased their shareholder rights index compared to those that do not, indicating that equal treatment of minority shareholders is an important channel for enhancing shareholder rights.

We find that the combined firm’s better corporate governance after the acquisitions derives from higher independence of audit committee, independent boards, stock option compensation, and equal treatment of minority shareholders. Therefore, these are important channels through which combined firms increase their governance quality during the post-deal stage.

Post-acquisition operating performance

We next test our second hypothesis (H2) to examine whether the operating performance between the combined firm and the weighted average of bidder and target improves post-acquisition when better- governed bidders acquire firms with lower governance scores. Toward that end, we check the effect of the bidder–target governance gap on the operating performance changes before and after an M&A deal. Following Healy et al. (1992), Wang and Xie (2009), and Alexandridis et al. (2013), we employ the ratio of operating income to book value of assets as a measurement of operating performance (ROA). To capture the potential effects of industry and countrywide factors, we compute the combined firm’s industry-adjusted operating performance as its ROA minus other companies median operating performance in the same Fama–French industry and country. The pre-deal industry-adjusted ROA of the acquirer and target is calculated in the same way and then compute the weighted average operating performance of the acquirer and target. The weights are assigned on the basis of equity’s market value. Finally, we compute change in operating performance as ROA of the combined firm minus weighted average ROA of the bidder and target.

To test the impact of bidder–target governance gap on operating performance change between the combined firm and weighted average of acquirer and target, we estimate the following model:

where ∆ Combined \({OP}_{i,j,t-1 to t+1}\) is the combined firm’s change in industry-adjusted ROA compared to weighted average ROA of the acquirer and target from \(t-1\) (one year before the deal) to \(t+1\) (one year after the deal) for deal i in industry j. \({BT GAP}_{i,j,t-1}\) is a binary variable with value of one if the pre-deal bidder–target firm governance gap is positive and zero otherwise for deal i and industry j. \({{\text{Country}} CG GAP}_{i,j,t-1}\) is the bidder–target country governance gap for deal i and industry j one year before the deal; \({\text{Deal}}{ {\text{controls}}}_{i,t}\) is a vector of deal-specific controls for deal i and year t. The deal-specific controls include same industry deal, payment method, and cross-border deal. \({\Delta Firm controls}_{k,t-1 to t+1}\) is a vector of change in firm-specific controls for the combined firm k relative to weighted average of the acquirer and target from the year prior to the year after the deal and includes: change in cash-to-asset ratio, change in leverage ratio, change in size, and change in Tobin’s Q.

Our key variable of interest is the \({BT GAP}_{i,j,t-1}\) that shows significantly positive effect on the post-acquisition change in operating performance in all models of Table 7. It suggests that the post-acquisitions operating performance is higher when bidders have better governance than targets prior to an acquisition. For example, the estimated coefficient on the bidder–target gap in Model (1) of Panel (A) shows that the average change in operating performance is 1.9 pp higher for the positive bidder–target board structure gap than the negative bidder–target board structure gap. We find similar results for other governance indices. Also, in Panel (B), we used original governance gap between bidders and targets instead of using dummies of governance gap. Taking Model (1) of Panel (B), we find that a one standard deviation increase in board structure gap will increase operating performance by 43.79 pp. The results support studies documenting higher operating performance post-acquisition (see Ghosh 2001; Healy et al. 1992), and that higher shareholder rights positively affect operating performance (Chemmanur et al. 2010; Core et al. 2006). The results in this section extend the findings of Wang and Xie (2009) and show that apart from the shareholder rights difference, other governance mechanisms positively affect the combined firm’s operating performance. These results provide further support to the portability of bidder’s higher governance standards, suggesting that the bidder–target governance gap is a source of higher ex-post operating performance.

Robustness tests

This section discusses several robustness tests to better understand the positive impact of the bidder–target governance gap on the ex-post change in combined firm governance and operating performance.

In the first set of tests, we replace our bidder–target governance gap measure with alternative measures: an average governance index (Models (1) and (6)), the sum of four governance indices divided by four; governance indices based on the principal component analysis (PCA). We keep the first component having the eigenvalue of greater than one and compute the bidder–target gap as PCA index score of the bidder minus PCA index score of the target using four governance mechanisms discussed above. Each of the ten regressions uses bidder–target governance gap measure with the control variables and results are shown in Panel A of Table 8. In each regression, the coefficient on the bidder–target gap measure is positive, showing that the positive spillover of the bidder’s governance translates into the higher governance quality and operating performance of the combined firm.

In majority stake acquisitions, bidders can transfer their higher governance standards to the targets (Ellis et al. 2017; Wang and Xie 2009). Therefore, in the second set of robustness tests, we apply our work on majority control acquisitions (before the acquisition, the bidder owns less than 50% shares of the target and ends up with more than 50% after the acquisition). To test the change in the combined firm’s governance in majority control acquisitions, we estimate Eq. (1) for deals where the bidder acquires more than 50% shares of the target. The results in Panel B of Table 8 are similar to those for the full takeover sample in Table 5. The coefficients on our key variable of interest (i.e., bidder–target gap) are positive and significant. We show that the combined firm governance and operating performance are higher when the bidder–target governance gap is positive. We argue that the portability of the acquirer’s higher governance standards to the target is not restricted to full takeovers, but it can also affect in the same way when bidders acquire the majority sake of targets. As a further robustness test, we report regression results for the change in combined firm governance and operating performance around the financial crisis of 2008. We estimated our regressions over two sample periods, from 2003 to 2009 and from 2010 to 2015. After the financial crisis of 2008, firms improved both mandatory and voluntary corporate governance mechanisms to increase their market value and convey confidence to the general public (Alexandridis et al. 2017). If the governance improvement during the post-financial crisis period holds, we should observe a higher change in combined firm governance after the financial crisis than before when bidders have better pre-deal governance than targets. In Panel C of Table 8, we show the results of testing the financial crisis story. We find that the combined firm’s governance and operating performance are higher and statistically significant in the subsample of acquisitions after 2009 than before.

The bidders from the USA dominate our sample (41.6%), as shown in Table 1. To confirm that our findings are not due to the USA, we re-estimate models in Table 5 after dropping all deals by the US bidders. The results documented in panel D of Table 8 (Models (1)–(8)) report that our findings are not restricted to the USA. Taking together, our results show that the combined firm’s governance and operating performance are significantly higher where the pre-deal bidder–target governance gap is positive.

The results show a positive relation between the ex-ante bidder–target governance gap and ex-post combined firm’s governance quality. However, the results may arise from a non-random distribution of M&A deals with higher bidder–target governance gap. We address this potential endogeneity issue using Propensity Score Matching (PSM). We employ PSM to find a matched sample of M&A deals. The main reason for using PSM is that it allows us to ascribe any observed impacts to the M&A deals with higher bidder governance themselves, rather than firm attributes associated with deals of positive bidder–target governance gap. We divide our sample into two groups (see, for instance, Bose et al. 2021) of high and low ex-ante bidder–target governance gap based on the median ex-ante bidder–target governance gap for the full sample. The M&A deals above the median show our treatment group while the remainder show the donor pool from which we select our control group. We estimate logit model to get our control group where we use same controls as in our baseline model. We used one-to-one matching (without replacement with caliper distance of 0.01). Our results still hold as shown in Panel E of Table 8.

Conclusion

We study the change in the ex-post governance quality of the combined firm relative to the ex-ante weighted average governance of the bidder and target when the quality of the bidder’s firm-level governance is higher than the target. To measure the quality of firm governance, we use four essential mechanisms: board structure, board function, compensation policies, and shareholder rights. We find that when the bidder–target governance gap is positive before the acquisition, the ex-post combined firm’s governance is better than the ex-ante weighted average governance of combining firms. We further find that the combined firm’s better governance appears to stem from increased board independence, audit committee independence, stock compensation, and minority shareholder protection after the acquisition. Additionally, the impact of the bidder–target governance gap on the combined firm’s operating performance relative to the weighted average operating performance of merging firms is higher.

Overall, the findings support the portability theory of Ellis et al. (2017) and suggest a positive spillover effect of the bidder’s firm governance, as the combined firm reaches a higher governance standard than the average of merging firms. We show that the pre-deal governance gap between bidders and targets brings governance transfer opportunity through M&As. Our results are not because of the firm-level governance acting as a proxy for the country-level governance. We control for the bidder–target country governance gap in all our regression analyses, and results on the higher ex-post governance standards of the combined firm still hold.

The work offers some insights for policymakers and regulators on how an efficient takeover market can increase the combined firm’s governance quality and operating performance through the portability channel. We show that the takeover market can serve as a vehicle for exporting better governance practices between merging firms. As the firms differ in the quality of firm corporate governance, regulators must decide whether shareholders can believe in the portability of governance standards as a motive behind M&As.

Since the pre-deal governance gap between merging firms increases the governance quality of the merged firm so acquiring firm managers should consider the adoption of better governance practices as a value-enhancing tool to benefit from takeover activities. Bidder managers must do a proper evaluation of the target’s governance practices to realize synergies after the acquisition. Governments of target country firms must weigh these potential benefits in while deciding whether to encourage or discourage these acquisition offers. Our findings can help investors to evaluate the benefits associated with higher governance practices in the international takeover market.

This work has some limitations that open avenues for further research on the topic. It would be interesting to investigate how the bidder–target gap in the other two dimensions of ESG, environmental and social, affects the combined firm performance in these dimensions. We have examined full takeovers (100%), and the same work can be applied to partial takeovers and joint ventures. Although, we have addressed potential endogeneity concern through PSM and used year, industry, and country fixed effects, there may still be some other unobserved factors including cultural proximity, takeover competition, and deal size that can influence our results. Finally, there is a lack of reliable sources for firm-level governance data in the case of private bidders and targets, and the study on private combining firms can enhance the generalizability of the portability theory.

Notes

Corporate governance can be either country level or firm level. Country-level governance corresponds to the rule of law, minority shareholder protection, control of corruption, political stability, government effectiveness, voice, and accountability while firm-level governance identifies a firm’s commitments to better disclosures and board-related activities.

It is so because target firms import bidders’ governance by law.

Recently, the ASSET4 ESG has updated the data. Using new governance categories and employing principal component analysis to construct the overall governance index, we show that our findings remain unchanged in Appendix C.

We calculate four governance indices named board structure index, board function index, compensation policy index, and shareholder rights index. Each index is defined as: sum of scores of all individual governance attributes in a category divided by the number of variables in a category. These indices are time-varying and have scores from 0 (lowest) to 100 (highest).

Larsson and Finkelstein (1999) define integration as “the degree of interaction and coordination of the two firms involved in a merger or acquisition.”

Although the USA is dominating our sample, our results on the improvement in the combined firm’s governance are still valid when we exclude deals made by the US bidders.

Based on information from the firm’s annual reports and regulatory filings, ASSET4ESG assigns the scores to board structure attributes depending on answers to questions such as: Does the company describe every board member’s professional experience or skills? Does the CEO is also chairman of the board?

The score of board function attributes is based on questions: Does the firm show board meetings information? Does the firm require non-executives for audit committees?

Governance attributes incorporated into the compensation policy are assigned scores based on questions like Does the firm shares executives’ compensation information? Does the firm describe compensation policy implementation?

Governance attributes considered in the shareholder rights category are assigned scores based on answers to questions: Are the firm’s statutes available to the public? Does the firm describe the implementation of its shareholder rights policy?

In robustness tests, we use the most relevant governance attributes and develop different governance indices.

These indices are time-varying and capture the gap in the governance quality between bidders and targets. Each governance index is calculated by adding up scores of each governance attribute in a category provided by ASSET4 ESG and dividing by the number of variables in a category.

In our robustness tests, we use actual gap in governance indices between the merging firms and results remain qualitatively unchanged.

We are thankful to the anonymous reviewer to highlight this issue.

In Model (1) of Panel (B), the coefficient on Bidder–target gap for board structure is 3.5122 (t-statistic of 4.156) with 25.462 standard deviation. Therefore, one standard deviation increase in Bidder–target gap (proxied by board structure gap) increases combined firm’s governance by 89.42 percentage points (Standard deviation \(\beta\) coefficient = 25.462 × 3.5122 = 89.42).

References

Alexandridis, George, K.P. Fuller, L. Terhaar, and N.G. Travlos. 2013. Deal size, acquisition premia and shareholder gains. Journal of Corporate Finance 20: 1–13.

Alexandridis, G., N. Antypas, and N. Travlos. 2017. Value creation from M&As: New evidence. Journal of Corporate Finance 45: 632–650.

Ammann, M., D. Oesch, and M. Schmid. 2011. Corporate governance and firm value: International evidence. Journal of Empirical Finance 18 (1): 36–55.

Areneke, G., and A.A. Tunyi. 2022. Chairperson and CEO foreignness and CG quality of emerging markets MNCs: Moderating role of international board interlocks. International Journal of Finance & Economics 27 (3): 3071–3092.

Areneke, G., E. Adegbite, A. Tunyi, and T. Hussain. 2023. Female directorship and ethical corporate governance disclosure practices in highly patriarchal contexts. Journal of Business Research 164: 114028.

Baker, G.P., M.C. Jensen, and K.J. Murphy. 1988. Compensation and Incentives: Practice vs. Theory. The Journal of Finance 43 (3): 593–616.

Bebchuk, L., A. Cohen, and A. Ferrell. 2009. What matters in corporate governance. Review of Financial Studies 22 (2): 783–827.

Björkman, I., G.K. Stahl, and E. Vaara. 2007. Cultural differences and capability transfer in cross-border acquisitions : The mediating roles of capability complementarity, absorptive capacity, and social integration. Journal of International Business Studies 38 (4): 658–672.

Black, B.S., and R.J. Gilson. 1998. Venture capital and the structure of capital markets: Banks versus stock markets. Journal of Financial Economics 47: 243–277.

Black, B.S., H. Jang, and W. Kim. 2006. Does corporate governance predict firms’ market values? Evidence from Korea. Journal of Law Economics and Organization 22 (2): 366–413.

Boone, A.L., L.F. Casares, J.M. Karpoff, and C.G. Raheja. 2007. The determinants of corporate board size and composition: An empirical analysis. Journal of Financial Economics 85: 66–101.

Bose, S., K. Minnick, and S. Shams. 2021. Does carbon risk matter for corporate acquisition decisions? Journal of Corporate Finance 70: 102058.

Bresman, H., J. Birkinshaw, and R. Nobel. 1999. Knowledge transfer in international acquisitions. Journal of International Business Studies 30 (3): 439–462.

Bris, A., and C. Cabolis. 2008. The value of investor protection: Firm evidence from cross-border mergers. The Review of Financial Studies 21 (2): 605–648.

Bris, A., N. Brisley, and C. Cabolis. 2008. Adopting better corporate governance: Evidence from cross-border mergers. Journal of Corporate Finance 14 (3): 224–240.

Byrd, J.W., and K.A. Hickman. 1992. Do outside directors monitor managers? Evidence from tender offer bids. Journal of Financial Economics 32: 195–221.

Capron, L. 1999. The long-term performance of horizontal acquisitions. Strategic Management Journal 20 (11): 987–1018.

Capron, L., and N. Pistre. 2002. When do acquirers earn abnormal returns? Strategic Managment Journal 23 (9): 781–794.

Chemmanur, T.J., B.D. Jordan, M.H. Liu, and Q. Wu. 2010. Antitakeover provisions in corporate spin-offs. Journal of Banking and Finance 34 (4): 813–824.

Chhaochharia, V., and L. Laeven. 2009. Corporate governance norms and practices. Journal of Financial Intermediation 18 (3): 405–431.

Coles, J.L., N.D. Daniel, and L. Naveen. 2008. Boards: Does one size fit all? Journal of Financial Economics 87: 329–356.

Core, J.E., W.R. Guay, and T.O. Rusticus. 2006. Does weak governance cause weak stock returns ? An examination of firm operating performance and investors’ expectations. Journal of Finance 61 (2): 655–687.

Cotter, J.F., A. Shivdasani, and M. Zenner. 1997. Do independent directors enhance target shareholder wealth during tender offers? Journal of Financial Economics 43: 195–218.

Datta, S., M. Iskandar-Datta, and K. Raman. 2001. Executive Compensation and Corporate Acquisition Decisions. Journal of Finance 56 (6): 2299–2336.

Datta, D.K., D.A. Basuil, and A. Agarwal. 2020. Effects of board characteristics on post-acquisition performance: A study of cross-border acquisitions by firms in the manufacturing sector. International Business Review 29 (3): 101674.

Denis, D.K., and J.J. Mcconnell. 2003. International corporate governance. The Journal of Financial and Quantitative Analysis 38 (1): 1–36.

Doidge, C., G.A. Karolyi, and R.M. Stulz. 2007. Why do countries matter so much for corporate governance ? Journal of Financial Economics 86: 1–39.

Doung, H.K., H. Kang, and S.B. Salter. 2015. National culture and corporate governance. Journal of International Accounting Research 15 (3): 67–96.

Ellis, J.A., S.B. Moeller, F.P. Schlingemann, and R.M. Stulz. 2017. Portable country governance and cross-border acquisitions. Journal of International Business Studies 48 (2): 148–173.

Fishman, M.J. 1989. Preemptive bidding and the role of the medium of exchange in acquisitions. The Journal of Finance 44 (1): 41–57.

Ghosh, A. 2001. Does operating performance really improve following corporate acquisitions? Journal of Corporate Finance 7 (2): 151–178.

Gilson, R.J. 2001. Globalizing corporate governance: Convergence of form or function. American Journal of Comparative Law 49 (2): 329–358.

Goergen, M., and L. Renneboog. 2008. Contractual corporate governance. Journal of Corporate Finance 14 (3): 166–182.

Gompers, P., J. Ishii, and A. Metrick. 2003. Corporate governance and equity prices. Quarterly Journal of Economics 118 (1): 107–155.

Guney, Y., Hernandez-perdomo, E., & Rocco, C. M. (2019). Does relative strength in corporate governance improve corporate performance? Empirical evidence using MCDA approach. Journal of the Operational Research Society, 1–26.

Haapanen, L., P. Hurmelinna-Laukkanen, S. Nikkilä, and P. Paakkolanvaara. 2019. The function-specific microfoundations of dynamic capabilities in cross-border mergers and acquisitions. International Business Review 28 (4): 766–784.

Harford, J., and K. Li. 2007. Decoupling CEO wealth and firm performance: The case of acquiring CEOs. Journal of Finance 62 (2): 917–949.

Harrison, J.S., M.A. Hitt, R.E. Hoskisson, and D.R. Ireland. 1991. Synergies and post-acquisition performance: Differences versus similarities in resource allocations. Journal of Management 17 (1): 173–190.

Healy, P.M., K.G. Palepu, and R.S. Ruback. 1992. Does corporate performance improve after mergers? Journal of Financial Economics 31 (135): 135–175.

Heimeriks, K.H., M. Schijven, and S. Gates. 2012. Manifestations of higher-order routines: The underlying mechanisms of deliberate learning in the context of post acquisition integration. The Academy of Management Journal 55 (3): 703–726.

Hitt, M.A., R.E. Hoskisson, and D.R. Ireland. 1990. Mergers and acquisitions and managerial commitment to innovation in M-Form firms. Strategic Managment Journal 11: 29–47.

Hussain, T., and S. Shams. 2022. Pre-deal differences in corporate social responsibility and acquisition performance. International Review of Financial Analysis 81: 102083.

Jensen, M.C., and W.H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3 (4): 305–360.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2009). Governance Matters VIII: Aggregate and Individual Governance Indicators 1996–2008, World Bank Policy Research Working Paper 4978.

Klapper, L.F., and I. Love. 2004. Corporate governance, investor protection, and performance in emerging markets. Journal of Corporate Finance 10 (5): 703–728.

La Porta, R., F. Lopez-de-Silanes, A. Shleifer, and R.W. Vishny. 1998. Law and finance. Journal of Political Econ. 106 (6): 1113–1155.

Larsson, R., and S. Finkelstein. 1999. Integrating strategic, organizational, and human resource perspectives on mergers and acquisitions: A case survey of synergy realization. Organization Science 10 (1): 1–26.

Linck, J.S., J.M. Netter, and T. Yang. 2008. The determinants of board structure. Journal of Financial Economics 87: 308–328.

Malhotra, S., H.M. Morgan, and P. Zhu. 2020. Corporate governance and firms’ acquisition behavior: The role of antitakeover provisions. Journal of Business Research 118: 26–37.

Malikov, K., M. Demirbag, A. Kuvandikov, and S. Manson. 2021. Workforce reductions and post-merger operating performance: The role of corporate governance. Journal of Business Research 122: 109–120.

Martynova, M., and L. Renneboog. 2008b. A century of corporate takeovers: What we have learned and where do we stand? Journal of Banking & Finance 32 (10): 2148–2177.

Martynova, M., and L. Renneboog. 2008a. Spillover of corporate governance standards in cross-border mergers and acquisitions. Journal of Corporate Finance 14 (3): 200–223.

Morck, R., A. Shleifer, and R.W. Vishny. 1990. Do managerial objectives drive bad acquisitions ? The Journal of Finance 45 (1): 31–48.

Morosini, P., S. Shane, and H. Singh. 1998. National cultural distance and cross-border acquisition performance. Journal of International Business Studies 29 (1): 137–158.

Myers, S.C., and N.S. Majluf. 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13 (2): 187–221.

Popli, M., R.M. Ladkani, and A.S. Gaur. 2017. Business group affiliation and post-acquisition performance: An extended resource-based view. Journal of Business Research 81: 21–30.

Ralston, D.A., D.H. Holt, R.H. Terpstra, and Y. Kai-cheng. 2008. The impact of national culture and economic ideology on managerial work values: A study of the United States, Russia, Japan, and China. Journal of International Business Studies 39 (1): 8–26.

Ranft, A.L., and M.D. Lord. 2002. Acquiring new technologies and capabilities : A grounded model of acquisition implementation. Organization Science 13 (4): 420–441.

Ravenscraft, D.J., and F.M. Scherer. 1987. Life after takeover. The Journal of Industrial Economics 36 (2): 147–156.

Renneboog, L., and C. Vansteenkiste. 2019. Failure and success in mergers and acquisitions. Journal of Corporate Finance 58: 650–699.

Riikka, S.M., and E. Vaara. 2010. Cultural differences, convergence, and crossvergence as explanations of knowledge transfer in international acquisitions. Journal of International Business Studies 41 (8): 1365–1390.

Rossi, S., and P.F. Volpin. 2004. Cross-country determinants of mergers and acquisitions. Journal of Financial Economics 74 (2): 277–304.

Starks, L.T., and K.D. Wei. 2013. Cross-border mergers and differences in corporate governance. International Review of Finance 13 (3): 265–297.

Tarmuji, I., R. Maelah, and N.H. Tarmuji. 2016. The impact of environmental, social and governance practices ( ESG ) on economic performance: evidence from ESG score. International Journal of Trade, Economics and Finance 7 (3): 67–74.

Tunyi, A.A. 2021. Revisiting acquirer returns: Evidence from unanticipated deals. Journal of Corporate Finance 66: 101789.

Tunyi, A.A., and C.G. Ntim. 2016. Location advantages, governance quality, stock market development and firm characteristics as antecedents of African M&As. Journal of International Management 22 (2): 147–167.

Tunyi, A. A., Yang, J., Agyei-Boapeah, H., & Machokoto, M. (2022). Takeover vulnerability and pre-emptive earnings management. European Accounting Review, 1–35.

Wang, C., and F. Xie. 2009. Corporate governance transfer and synergistic gains from mergers and acquisitions. Review of Financial Studies 22 (2): 829–858.

White, H. 1980. A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Journal of Econometric Society 48 (2): 817–838.

Acknowledgements

The work is done without any financial support.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

Nothing to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Variable definitions

Variable | Definition |

|---|---|

Panel A: ex-post change in combined firm’s governance indices and operating performance | |

∆ Board Structure (BS) | Ex-post combined firm’s BS index minus ex-ante weighted average BS index of combining firms. Source: ASSET4ESG |

∆ Board Function (BF) | Ex-post combined firm’s BF index minus ex-ante weighted average BF index of combining firms. Source: ASSET4ESG |

∆ Compensation Policy (CP) | Ex-post combined firm’s CP index minus ex-ante weighted average CP index of combining firms. Source: ASSET4ESG |

∆ Shareholder Rights (SR) | Ex-post combined firm’s SR index minus ex-ante weighted average SR index of combining firms. Source: ASSET4ESG |

∆ Operating performance | Ex-post combined firm’s industry-adjusted ROA minus ex-ante weighted average ROA of combining firms. Source: WorldScope |

Panel B: Firm-level governance indices | |

Board Structure index | Taken from ASSET4ESG, based on lagged average of 16 variables (definitions in appendix B) |

Board function index | Taken from ASSET4ESG, based on lagged average of 15 variables (definitions in appendix B) |

Compensation policy index | Taken from ASSET4ESG, based on lagged average of 13 variables (definitions in appendix B) |

Shareholder rights index | Taken from ASSET4ESG, based on lagged average of 11 variables (definitions in appendix B) |

Bidder–target gap dummy | Dummy variable: 1 for deals where the bidder’s governance score is higher than target, 0 otherwise. Source: ASSET4ESG |

Bidder–target gap | The bidder’s governance minus target’s governance. Source: ASSET4ESG |

Panel C: Bidder’s country governance | |

WGI index | It is the average index based on six country governance dimensions proposed by Kaufmann et al. (2009). These dimensions include control of corruption, political stability, government effectiveness, rule of law, voice, and accountability, and regulatory quality. Source: World Governance Indicators |

Panel D: deal characteristics | |

Payment method | Dummy variable: 1 for purely cash-financed deal, 0 otherwise. Source: Securities Data Corporation |

Cross-border deal | Dummy variable: 1 if cross-border deal, 0 otherwise. Source: Securities Data Corporation |

Same industry deal | Dummy variable: 1 for same industry deal, 0 otherwise. Source: Securities Data Corporation |

Panel E: combined firm characteristics | |

∆ Cash-to-asset ratio | Ex-post combined firm cash-to-asset ratio minus ex-ante weighted average cash-to-asset ratio of combining firms. Source: WorldScope |

∆ Leverage | Ex-post combined firm leverage ratio (long-term debt/total assets) minus ex-ante weighted average leverage of combining firms. Source: WorldScope |

∆ Size | Ex-post combined firm size (log of book value of total assets, WC02999) minus ex-ante weighted average size of combining firms. Source: WorldScope/DataStream |

∆ Tobin’s Q | (Assets – book value of equity + market value of equity assets)/assets. Ex-post combined firm Tobin’s q minus ex-ante weighted average Tobin’s Q of combining firms Source: WorldScope/DataStream |

Appendix B: Definitions of firm-level governance variables

A. Board Structure index | |

(1) Background and skills | “Does the company describe the professional experience or skills of every board member? OR Does the company provide information about the age of individual board members?”. |

(2) Board Diversity | “Percentage of female on the board.” |

(3) Board Member Affiliations | “Average number of other corporate affiliations for the board member.” |

(4) CEO–Chairman Separation | “Does the CEO simultaneously chair the board? AND has the chairman of the board been the CEO of the company?”. |

(5) Experienced Board | “Average number of years each board member has been on the board.” |

(6) Implementation | “Does the company describe the implementation of its balanced board structure policy?”. |

(7) Improvements | “Does the company have the necessary internal improvement and information tools to develop balanced board structure?”. |

(8) Independent board members | “Percentage of independent board members as reported by the company.” |

(9) Individual Reelection | “Are all board members individually subject to re-election (no classified or staggered board structure)?”. |

(10) Mandates Limitation | “Does the company provide information about the other mandates of individual board members? AND Does the company stipulate a limit of the number of years of board membership?”. |

(11) Monitoring | “Does the company monitor the board functions through the establishment of a nomination committee?”. |

(12) Non-executive board members | “Percentage of non-executive board members.” |

(13) Policy | “Does the company have a policy for maintaining a well-balanced membership of the board?”. |

(14) Size of Board | “Total number of board members which are in excess of ten or below eight.” |

(15) Specific Skills | “Percentage of board members who have either an industry specific background or a strong financial background.” |

(16) Strictly Independent Board Members | “Percentage of strictly independent board members (not employed by the company; not representing or employed by a majority).” |

B. Board function index | |

(1) Audit Committee Expertise | “Does the company have an audit committee with at least three members and at least one ‘financial expert’ within the meaning of Sarbanes-Oxley?”. |

(2) Audit Committee Independence | “Percentage of independent board members on the audit committee as stipulated by the company.” |

(3) Audit Committee Management Independence | “Does the company report that all audit committee members are non-executives?”. |

(4) Board Attendance | “Does the company publish information about the attendance of the individual board members at board meetings?”. |

(5) Board Meetings | “Number of board meetings per year.” |

(6) Compensation Committee Independence | “Percentage of independent board members on the compensation committee as stipulated by the company.” |

(7) Compensation Committee Management Independence | “Does the company report that all compensation committee members are non-executives?”. |

(8) Implementation | “Does the company describe the implementation of its board functions policy?”. |

(9) improvements | “Does the company have the necessary internal improvement and information tools to develop appropriate and effective board functions?”. |

(10) Monitoring | “Does the company monitor the board functions through the establishment of a corporate governance committee?”. |

(11) Nomination committee independence | “Percentage of non-executive board members on the nomination committee.” |

(12) Nomination committee involvement | “Percentage of nomination committee members who are significant shareholders (more than 5%).” |

(13) Nomination Committee Management Independence | “Are the majority of the nomination committee members non-executives?”. |