Abstract

This paper feeds the literature about investors’ reaction to the release of going concern modified audit reports, which is abundant and controversial among scholars. Moving a step beyond the solely detection of abnormal stock returns at and around the event date, as done in the only two previous studies on the Italian setting, we perform an OLS multiple regression to test the informativeness of CARs and the influence of variables as selected firms’ accounts, auditor characteristics, the market capitalization and specific measures of financial distress to gather evidence whether investors react adversely to elements different from going concern modifications (GCMs). Based on our findings, investors react negatively to GCMs attached to qualified opinions and, surprisingly, positively to GCMs attached to clean opinions, reversing the prevailing evidence found out in the literature, especially in the USA. We attribute these results to the rough knowledge of Italian naïve investors of the going concern (GC) issue. The study detects how disclosure features conceived for large equity markets can lead to different investors’ behaviours in small ones on the one hand; on the other hand, it cannot lead to unequivocable generalization, even within similar countries, in light of sub-specific country features. The piece of evidence achieved suggests, for further research, to make an investors categorization to analyse market reactions, which takes more into account three main features stressed by the prevailing literature of small equity markets: high ownership concentration, the higher presence of institutional investors and the poorer reputation of BIG4 auditors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The audit report is the result of the audit process and represents the most important link between auditors and stakeholders. Until the last decade, some audit report features (as the Key Audit Matters or the release of a going concern modification—GCM) were the only direct communication with shareholders about the audit process and its outcome (Blay et al. 2011; DeFond and Zhang 2014). Several studies focus on the consequences of going concern (GC) uncertainty (Carson et al. 2013) observing the market reaction around the issuance of an audit report containing a going concern modification (GCM) (e.g. Dodd et al. 1984; Elliott 1982; Khan et al. 2017; Menon and Williams 2010; Myers et al. 2018). However, scholars report mixed results. Among studies, concerns arise from the possibility that the auditor can “misreport” (DeFond and Zhang 2014; Deng et al. 2012), decreasing the level of informativeness of audit reports to investors. Moreover, Kausar et al. (2013) evinced a certain degree of market inefficiency for audit report disclosures imputable to investors. This inefficiency could be attributable to the existence of confounding information released in the period investigated (Kothari 2001) often through the same document (Khan et al.2017; Myers et al. 2018). To avoid this possibility, and in response to previous accounting scandals in the early 2000s, regulation around the world is increasing requirements on financial reporting disclosure, especially in the presence of doubts over the GC assumption. In this perspective, the mandatory full adoption of International Accounting Standards (ISAs) and the new versions of ISA 570 (“Going Concern”), ISA 700 (“Forming an Opinion on the Financial Statements”) and ISA 706 (“Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report”) moved in this direction. Moreover, in the USA and in other western countries (such as Germany and Italy), various securities laws aimed to increase the number of disclosures to the market on GCMs. These new regulatory environments provide an opportunity to examine again the issue, going beyond the simple application of the solely event study methodology. Ianniello and Galloppo (2015) and Brunelli et al. (2020) are among the few studies that examined the Italian context. Those authors have conducted archival researches to analyse the Italian stock market reaction to GCMs release in the period 2007–2010 and 2009–2015, respectively. In both studies, authors showed that, on average, qualifications expressed in audit reports containing a GCM have negative effects on the stock prices of companies. However, while Ianniello and Galloppo (2015) found that only qualified opinions containing a GCM negatively affect stock prices, Brunelli et al. (2020) found an average negative reaction for all going concern modified audit reports.

In the light of these findings, we believe that the effects on stock market returns of audit reports containing GCMs deserve further empirical investigation. This study aims to better identify, isolate and verify whether the effects on stock prices are due to the solely ability of GCMs to drive investors’ reactions or if other elements connected with the overall financial health of the firms, stock market capitalization, auditors characteristics and specific measures of financial distress (or a mix of these features) play some roles.

We developed a two-stage research pathway to pursue the aim. First, we tested the statistical significance of cumulative abnormal returns (CARs) at and around the GCMs release date. Then, we regressed the CARs found in the first stage on selected explanatory variables that are deemed to influence cumulative abnormal returns.

We analyse a sample of Italian listed firms, which received a GCM, excluding banks and insurance firms, over the 2008–2015 period, which was characterized by severe financial conditions in all economic sectors in Italy and worldwide. We stopped our analysis to 2015 for several reasons. First, in 2016 the new ISA 570 should have entered in force, changing the structure of the audit report and the GCM format. However, The Italian Ministry of Finance shifted forward the mandatoriness to 2017. As a result audit reports in 2016 were mixed, therefore the contents among reports are not aligned among them and we cannot analyse consistently the reports and the related investors’ reaction. Second, as for as 2017 and 2018 the main concern is completely different: the number of observations is not sufficient to yield reliable empirical results. Finally, the dissemination of 2019 audit reports and GCMs were mostly released at the time of COVID outbreak that autonomously produced huge stock abnormal returns, impeding us to isolate the issue under investigation.

Besides the scarcity of studies that focus on the Italian setting, the choice of the Italian market is tied with the need to explore financial reporting matters taking into account the main existing international differences in financial reporting (Ball et al. 2000; Bushman and Piotroski 2006; Hagerman and Zmijewski 1979; Hatfield 1966; Jaafar and McLeay 2007; Kvaal and Nobes 2010, 2012). To this respect, Italy is characterized by the absolute predominance of civil law, weak equity market, the prevalence of small and medium size entities (SME’s) and majority of insider shareholders (Nobes 1998; Nobes and Parker 2016). Furthermore, in 2008 an improvement in the Italian regulation has occurred, asking for a specific press release for all types of GCMs, considering the relevance it has for investors. The joint effects of these features pose the Italian environment and this type of research among those that consider press releases as more efficient, less technical and more interpretable for investors (Khan et al. 2017; Kothari et al. 2009).

This study aims to expand the existing literature with interesting and contrasting results. On the one hand, the event study methodology confirms the statistical significance of negative CARs at and around the event date in selected event windows, covering 15 days before and after the GCM release. On the other hand, the regression model (and the related robustness checks) provides contrasting evidence since the CARs, before and after the event date, seem largely determined by the qualification degree of audit opinion than by the attached GCM. At the meantime, around the GCM release CARs are the results of distressed accounts as reflected by the earnings surprise and Zmijevski z score used in our model.

In light of the empirical evidence achieved, this study would bring other multiple contributions to the existing literature and to the audit profession. First, it suggests a resizing about the impact of GCMs on stock prices, at least for Italy, reinforcing evidence achieved by Ianniello and Galloppo (2015) in Italy and by other scholars in several European countries (Pucheta-Martínez et al. 2004; Taffler et al. 2004; Guiral et al. 2014). At the same time, the study reverses evidence found in countries with strong equity markets (especially in the USA as argued by Khan et al. 2017; Menon and Williams 2010); second, it provides fresh insights about effects of GCM on stock markets in a country like Italy, which was underexplored, as demonstrated by the only two studies conducted so far (Ianniello and Galloppo 2015; Brunelli et al. 2020). Third, it may assist regulators, auditors and standard setters for further developments of standards with respect to GC; fourth, it reveals how the sentiment of investors are naturally over-captured by quantitative information (i.e. earnings announcement, as demonstrated by Myers et al. 2018, financial highlights, accounting ratios and the perceived degree of financial distress or related proxies) than qualitative ones (the audit opinion). Finally, despite the regulatory improvements aimed to enhance the relevance of GCMs, the desirable effects seem far from the empirical evidence. The “growing noise” that is increasingly characterizing the financial and non-financial reporting landscape by adding information required or extending the existing ones (i.e. the mandatoriness of including into the annual reports many non-financial information) could jeopardize the ability of potential good information to turn into actual ones.

The remainder of the paper is organized as follows. Section 2 reviews the literature related to audit reports issuance and stock market reactions and outlines the study hypotheses. Section 3 presents the data sample and the methodology used for the empirical analysis. Section 4 discusses the main findings. Section 5 concludes with some final remarks and opens up avenues for future research.

Consequences of GCMs for investors: literature background and hypotheses development

As noted by Carson et al. (2013), the consequences of a GCM could be different and multilateral. In particular, the GCM release has a potential impact on the same auditor who released it, lenders, investors and other stakeholders in their capacity as capital providers and not only. Overall, when dealing with the market reaction, the majority of studies agrees in recognizing a negative reaction even if there are many differences in terms of reaction’s magnitude or when referring with first or subsequent GCMs (Gissel et al. 2010).

A large strand of US literature found that investors react negatively to GCMs (Chow and Rice 1982; Elliott 1982; Fleak and Wilson 1994; Geiger and Kumas 2018; Herbohn et al. 2007; Jones 1996; Myers et al. 2018; Sainty et al. 2002; Schaub 2006). There is a shared theoretical agreement around the potential stronger reaction in case of first-time GCM, but this effect has been dealt only in several studies (Jones 1996; Herbohn et al. 2007; Geiger and Kumas 2018). In most cases, a GCM corresponds to a certain degree of financial troubles for the company, that is why in many studies the proxies adopted to measure the degree of investors’ expectations are usually the level of financial distress of the company. In line with Fleak and Wilson (1994) and Jones (1996), Blay and Geiger (2001) adopted similar proxies to divide their sample between “subsequently bankrupt” and “subsequently viable” companies, finding that abnormal returns are more negative for the first group, characterized by more financial distress frames. However, when they considered the sample as a whole, no association between first-time GCMs and abnormal returns was found. In another study, Ogneva and Subramanyam (2007) did not find a market anomaly in the USA, because their results on market mispricing differ from the choice of different expected results. However, Kausar et al. (2009), considering the same sample, found that a GCMs market underreaction anomaly exists in the 12-months subsequent to the GCM. The author justified these different results with problems in the data source and in the method adopted in the study of Ogneva and Subramanyam (2007).

In other researches, additional and valuable findings have been retrieved. Khan et al. (2017) found that small investors have a negative reaction after a long time from GCM release and, more precisely, only when a GCM re-release occurs through press and media releases. Another factor that could affect the impact of GCMs is the bankruptcy legal regime instituted in a country. In line with this, Kausar et al. (2017) showed that investors in a debtor-friendly bankruptcy regime—such as the USA—react less adversely to first-time GCMs than investors in a creditor-friendly bankruptcy regime (the UK). Blay et al. (2011) documented the occurrence of a GCM brings investors in reading more carefully official financial statements and Amin et al. (2014) showed that this announcement increases the interest return asked by investors, generating an automatic increase in the cost of the equity capital of the company.

The negative stock market reaction to GCMs is confirmed by Menon and Williams (2010), since they showed that this reaction is higher if the audit report contains information related to a company’s problem with obtaining financing. For this reason, they asserted that investors are able to capture the information content of audit reports.

Unlike the USA, studies on the market reaction of the GCM announcement in Europe do not always show a negative effect on investors. Indeed, Pucheta-Martínez et al. (2004) reveal that in Spain GCMs are not relevant for investors. Interestingly, in Italy Ianniello and Galloppo (2015) found that an unqualified opinion with a GCM has a positive effect on stock market prices in the short-term. However, when analysing the subsample of GCM disclaimer of opinions, the negative effect is confirmed. Recently, Brunelli et al. (2020), studying a longer period (2009–2015) have found confirmation of an average negative and persistent reaction of Italian Investors to whatever kind of GC modified audit report. Gassen and Skaife (2009), focusing on Germany, found that market reactions to first-time GCMs is a consequence of regulatory improvement. In fact, they observed that after the audit reforms mandated by the German government in the Act on Control and Transparency of Enterprises in 1998, investors reacted negatively to first-time GCMs, whereas this evidence was not found in the period before the regulatory improvement.

In the UK, Citron et al. (2008), Kausar et al. (2017), and Kausar and Lennox (2017) confirmed the general trend of a negative stock price reaction. The latter authors assessed that for companies entering bankruptcy, the issuance of a GCM has predictive value with respect to the wedge between the book values of assets and the future liquidation values of those same assets.

Despite these results, in a previous research Citron and Taffler (2001) found that in the UK a company’s failure probability is not affected by the issuance of a GCM, while it depends on the level of financial distress.

Opposite findings were deducted in Portugal (Bhimani et al. 2009) and in Belgium (Vanstraelen 2003), where an increase in the likelihood of bankruptcy or opening insolvency proceedings is confirmed. In the light of both mixed evidence and the presence of only two studies in Italy, we would deepen the GCM effects on stock market in Italy starting from the following basic hypothesis as follows:

H1 Investors react negatively to a GCM release, as demonstrated by significant negative CARs at and around the release.

By testing the hypothesis we pursue a twofold aim: first, we search for confirming evidence achieved by Ianniello and Galloppo (2015) and Brunelli et al. (2020); second, if the hypothesis is supported it gives us the possibility to further explore if different elements than GCM have the ability to explain the negative abnormal returns found. In line with other prominent studies in this research mainstream, we regressed the CARs on pivotal market-based and accounting-based variables, auditors characteristics and specific measures of financial distress (Bédard et al. 2019; Menon and Williams 2010; Myers et al. 2018; Rosegreen and Dawkins 2000), testing the following second hypothesis:

H2 Investors’ negative reaction along the release of GC modified audit reports is driven by specific determinants connected with the overall financial (un)health of the firms and/or market ratios and/or auditors characteristics.

We begin by controlling for several additional variables that could explain the investor reaction at and around the event date. Thus, we fixed as explanatory three accounting-based variables, namely the natural logarithm of total assets, the return on assets and the Zmijevski Z score, one market-based variable, the natural logarithm of market capitalization at year end, and a mixed-based variable, the earnings surprise. With the aim to boost the reliability of the model, we added two variables regarding the audit opinion and auditors characteristic: a dummy variable which assumes value 1 if the GCM is attached to a qualified opinion, 0 if attached to a clean opinion and a second dummy variable which detects by the role played by a BIG4 auditor (1) or not (0), which represents a feature historically focused by scholars in this kind of studies.

Sample and research methodology

Sample definition

The initial sample consists of all firms listed in the Italian Stock Exchanges (Borsa Italiana) in the period 2008–2015 (fiscal years) considering any new listed or delisted firm each year. This mechanism allowed the inclusion of all companies, including those listed only 1 year during the full time span. We started from a potential sample of 2349 observations but we focused only on the industrial sector, obtaining 1769 observations. We manually downloaded all the audit reports of consolidated financial statements and the separate annual reports only when the consolidated document was not available. The other financial information and data were collected from different sources: the closing daily stock prices and the main Italian stock market index (FTSE MIB) were gathered from Datastream (Thomson Reuters), the financial data and ratios from Datastream (Thomson Reuters) and from AIDA, while the audit report date, the audit opinion and the auditors' information, manually from the audit reports. Considering the focus of this research, we considered only the companies that received an audit report (both qualified and unqualified) containing a GCM, obtaining 286 observations (16.2% of the total). The percentage of GCM rate is in line with the rate reported by Xu et al. (2013) in Australia (15.3%) and Carson et al. (2013) in the USA (15.9%), although the composition, the size and the environment are completely different in these countries. However, we had to remove 23 observations due to missing data (e.g. availability of market price, or unreliable stock return data). The final sample comprises 263 observations from 72 unique firms. Among them, only 75 observations contain severe qualifications (“except for”, adverse opinion and disclaimer of opinion), representing less than 29% of GCMs, whereas the remaining 188 observations represent unqualified opinions with GCM (71%). The breakdown of the sample, by year and type of audit opinion, is provided in Table 1.

Research methodology

This subsection describes our short-term market reaction tests and the multivariate analysis that allow us to provide a more robust check over the ability of GCMs to generate negative abnormal returns and to control for other factors that might potentially affect investors’ reaction.

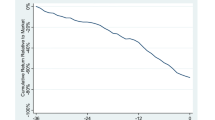

We begin by performing univariate tests and an ES to investigate the market response to GCMs in the Italian market in the period 2008–2015 (Brown and Warner 1985; Shevlin 1981). We use the date of the public press release of a GCM as the event date to estimate the abnormal returns (Ars) associated with the announcement. This type of event is mainly clustered in the period of the year starting from the beginning of March until the end of June and when received is viewed as being bad news. Appendix I reports the full list of companies and the GC modified audit reports date release, alongside the information about which companies went to bankruptcy or voluntary liquidation during the period. Figure 1 presents the distribution of all audit reports dates during the fiscal year. It is worthwhile noting that out of 263 GCMs, 242 (92%) were released between March and June.

Under the Italian Regulation, for each relevant information disclosed in the period of the approval of the financial statement, is required a specific press releaseFootnote 1 with the purpose of informing the market. The power of the test is affected by the exact determination of the announcement date and any concurrent disclosures. Specifically, we calculate AR as follows:

where Rit is the daily return of firm I on day t, RMt is the return of the stock market index (the FTSE MIB in Italy) on day t, \(\hat{\alpha }_{i} {^{\prime}}s{ }and{ }\hat{\beta }_{i} {^{\prime}}s\) are the estimated parameters of the model for each firm i, applying the linear market model of Sharpe (1964). The estimation window used to the "normal behaviour" of parameters in the market model consists in 172 trading days starting 200 days before the event date and ending 15 days before. Then, we compute CARs by cumulating the daily abnormal returns over a time window from ta to tb, which includes the announcement day in the following way:

To choose the appropriate length of event windows, we compute CARs for several windows and sub-windows before, after and around the event date. The aim of this process is to capture also the eventual pre- and post-announcement effect as detected in prior researches (Dodd et al. 1984; Blay et al. 2011; Al-thuneibat et al. 2008). Then, let \(t = 0\) represent the event date, AR is estimated in the test period which is equal to 30 trading days around each event, \({\text{TP}} = \left[ { - 15,{ }0} \right) \cup (0,{ } + 15],\) and then divided into several subintervals. In particular, we focus on the following windows: \(\left[ { - 15; - 10} \right); \left( { - 2, + 2} \right);\left( { + 2; + 15} \right]\). and \(\left[ { - 1,1} \right]\). The first three windows are further split into \(\left[ { - 15; - 2} \right);\left( { - 10; - 5} \right);\left( { - 5, - 1} \right);\left( { + 1, + 5} \right);\left( { + 5, + 10} \right);\left( { + 10, + 15} \right]\), while the latter into \( \left( { - 1,0} \right);\left( 0 \right);\left( {0, + 1} \right)\), for a fine-tuning analysis in proximity of the event date. The chosen main event winds and sub-windows are the same used by Brunelli et al. 2020 with the aim to make results comparable.

T test the first hypothesis and to increase the level of reliability of our investigation, parametric statistics tests are used to know the significance level of CARs during the event windows considered null hypothesis is rejected, it will show that the CARs are significantly different from zero, and the GCM released an effect on stock prices (Liljeblom and Vaihekoski 2004). We apply a t test in the first moment. However, Cummins and Weiss (2004) have detected an increase in the variance of ARs in the days around the event date respect to the estimation period. This aspect could result in an over rejection of the null hypothesis. To avoid this limitation, we follow the methodology suggested by Mikkelson and Partch (1988)Footnote 2 and adopted in other subsequent researches (Boehmer et al. 1991; Harrington and Shrider 2007; Mentz and Schriereck 2008).

Multivariate analysis

We use OLS multiple regression to test the significance of GCMs and the influence of other additional variables related to financial information disclosed in the audit and annual reports or in the days around the event date. We estimated the following model:

The dependent variable is the CAR in the windows and sub-windows analysed in the study. Hence, the regression is repeated for each window and sub-window adopted in the ES analysis. The independent variables Zscore, LnTA, Surprise, ROA and lnMV capture aspects of financial performance or information that may be related to the market reaction detected in the days around the press release of the audit report containing a GCM. However, the two control (dummy) variables (GCM and BIG4) have been used to isolate effects due to the opinions’ qualification and the presence of well-reputed auditors, following studies observed in the main related literature (Amin et al. 2014; Bédard et al. 2019; Geiger and Kumas 2018; Kausar et al. 2017; Menon and Williams 2010; Zmijewski 1984).

To capture the financial distress of the companies analysed, we included the Zscore, which is the probability of bankruptcy computed using the Zmijewski (1984) coefficient. It includes three components: return on assets, debt to assets and current ratio, all related to health conditions of the company. Following Menon and Williams (2010), we expect a negative coefficient. lnTA is the natural logarithm of total assets at the end of the year associated with the audit report and it is a measure of the company size, with expectations of a positive coefficient. Surprise is the annual earnings surprise calculated following Geiger and Kumas (2018) as the difference between current year annual earnings before extraordinary items and last year's annual earnings before extraordinary items scaled by the market value of equity from last year. We expect to see a positive association between earnings surprise and CARs considered. ROA is the return on assets to capture the firm's financial performance, it is calculated by dividing a company’s net income prior to financing costs by total asset and we expect a positive coefficient (Bèdard et al. 2019). Finally, lnMV is the natural logarithm of the market value of the firm at the end of the fiscal year associated with the audit report and is a proxy of the firm's size perceived by the market. It is also useful to capture the firm's information environment and we would expect that larger firms are likely to have richer information environment (Menon and Williams 2010). Thus, we expect a positive coefficient for lnMV.

GCM is a variable that equals to 0 if the company received an unqualified opinion with GCM in the year selected, and 1 if the company received a qualified opinion with a GCM.

BIG4 is a dummy variable equal to 1 if the external auditor is a top-four auditor (Deloitte, EY, KPMG, PWC) and 0 otherwise. Although prior research associated audits from Big N firms to higher quality verifications (Francis and Krishnan 1999; Gaeremynck and Willekens 2003; Ruiz-Barbadillo et al. 2009), studies in the Italian context show that BIG4 firms are not necessarily viewed as superior compared to their smaller peers (e.g. Cameran et al. 2010). Therefore, we are not able to draw an expectation on its coefficient. All variables and related brief descriptions are presented in the Appendix II.

Empirical analyses and discussion

Descriptive statistics

Table 2 presents descriptive statistics for the variables used in the multivariate tests that are useful to understand the financial distress situation for the firms in the sample. Most of the firms received an unqualified opinion with GCM (GCM = 0) in the period under investigation and they are mainly audited by a BIG4 audit firm. On average, sample firms receiving a GCM are small (total assets mean = 264.08 thousand of euros; market value mean = 56.039 thousand of euros) and show poor financial performance (strong negative average net income, negative average ROA and high mean leverage). Moreover, they have a high probability to go bankrupt (Zscore > 0).

Panels B and C of Table 2 compare the two types of GCMs: qualified opinions with a GCM versus unqualified opinion with a GCM, respectively. Firms with qualified opinions appear smaller (total assets mean = 172.82 million of Euros; market value mean = 28.507 million of Euros €) and with a higher probability to move to bankrupt (Zscore = 4.68 vs. 2.82) than the subsample of companies that received unqualified opinions. However, the latter group of firms performs worst in terms of net income (mean NI = − 32.754 vs. − 25.562 million of Euros) and leverage (mean LEV = 551.44 vs 134.36). Both subsamples show a negative operating performance (ROA < 0). Finally, BIG4 auditors show a higher propensity to issue unqualified opinions (BIG4 = 0.755 for unqualified opinion with GCM subsample).

In Table 3, we report the descriptive statistics about the CARs for each window and sub-windows identified. Considering the full sample under investigation, the average CARs are negative for the most part of windows and sub-windows defined. Moreover, the percentage of CARs is higher than 53% with the only exception of the sub-windows (− 15, − 10), (+ 5, + 10) and (+ 10, + 15) which are the most distant from the event date. The percentage of negative CARs exceeds 61% in the days immediately after the GCM release (+ 1, + 5). The preliminary results shown in Table 3 highlight a negative market reaction in the period around the issuance of a GCM, confirming H1. This conclusion was obtained observing the coefficient of both parametric tests conducted on CARs.Footnote 3 The coefficients are negative and significant especially in the days around the event date (− 2, + 2), (− 1, + 1), (− 1, 0), (0, + 1) and in the day of the event (0). Moreover, a pre-announcement effect is detected in the sub-window (− 10, − 5) for both tests and in (− 15, − 10) according to the t test. The anticipation of the negative reaction from investors is not unusual as witnessed by Menon and Williams (2010), due to the possibility to have preliminary information on the probable GCM release, related to bad financial conditions shown in the interim financial report or through other sources of information. Thus, H1 is supported. However, as prior literature asserted (Menon and Williams 2010; Myers et al. 2018), the negative reaction detected around a GCM issuance could not be related only to the specific event considered. Although in Italy the possibility to separate the effect of each release is higher due to the requirement to do a specific press release for each financial information, problems always exist due to other contaminating information. For these reasons, we attempt to investigate which are others information that may explain this negative reaction detected in the period around the issuance of a GCM.

To foster an immediate visualization of upward and downward trends of each single observation, Fig. 1 provides the CARs distribution at the event date and for all the windows and sub-windows investigated.

Correlation analysis

Table 4 displays Pearson and Spearman correlation coefficients between the independent variables used in the regression and each dependent variable (CARs). Bold numbers mean a statistic significance at 0.05 (at least). Without focusing on the correlation among CARs, for the purpose of this study is interesting observe a significant negative correlation between GCM and CARs in multiple windows. Moreover, the correlation exists also between CARs and the Zscore, Surprise and lnMV (Pearson coefficient) and between CAR and Surprise and BIG4 (Spearman coefficient). However, lnTA and ROA are not correlated with CARs. In addition, we do not find high correlations between the independent variables, except, as expected, for lnMV and lnTA. To fix the potential negative effects of that correlation on the reliability of the regression model, we perform, as robustness test, the regression by excluding from Eq. (3) the lnTA and we found similar results. After all, these analysis assure that multicollinearity is less likely to be a concern for the reliability of the model.Footnote 4

Regression results

The results of estimating Eq. (3) are presented in Table 5. Although previous tests conducted to verify H1 revealed the significance of only some of the windows and sub-windows, we preferred to conduct the multivariate analysis on all of them. It is because some sub-windows appear relevant only for one test (t−test or Mikkelson and Parch) and by the intention to verify the effect of the variables considered in the period before and after the GCMs' release (Fig. 2).

As shown in Table 3, the sub-windows that are not significant for both tests cover days not so close to the event date, but previous literature (Al-thuneibat et al. 2008; Blay et al. 2011; Dodd et al. 1984) found significance of certain variables during pre- and post-announcement periods. After controlling for the aforementioned variables, we found contrasting evidence about the ability of GCMs in determining CARs. Each variable has significant coefficients in one or more windows or sub-windows. The most important result is revealed by the dummy variable GCM. When significant, it reveals that a negative association with CARs exists only for GCM attached to qualified opinion (GCM = 1). Confirming the results of Ianniello and Galloppo (2015), but for a different period of analysis, this means that, when a GCM is associated with a clean opinion, the effects on CARs are positive signalling that negative effects found in the first stage on stock prices are mostly due by the opinion qualification degree. Curiously, the referred effect is detected before \(\left[ { - 15; - 2} \right)\), (−15; −10), (−10; −5) and after \(\left[ { + 2; + 15} \right)\), (+ 10; + 15) the event date but not around it, revealing that close to the event others are the variables which may determine abnormal returns. Thus, the audit report contents are not detrimental for stock prices at the event date, the qualification plays a role before and after and the GCM does not appear to be relevant at all. The dummy variable identifying the presence of a BIG4 auditor provides poor results. Only in the window (0; + 1) it reveals a positive association with CARs, meaning that a low positive effect on stock prices is played by BIG4 auditors only around the event date and not persistently before or after the audit report release. Thus, the effect of the higher reputation of BIG4 auditors is very weak in the Italian stock market. This evidence confirms previous results of Cameran et al. (2010) on Italy, where the BIG4 audit firms are not perceived as superior in comparison with their smaller counterparts. Moving to the Z score, we found contrasting evidence. Its coefficient is significant before \(\left[ { - 15; - 2} \right)\), (− 5; − 1) and around the event date (0), (− 1; + 1) assuming opposite direction. Unexpectedly, before the event date the association is positive, suggesting that a bad z score seems to play a positive effect on stock prices. On the contrary, around the event date, confirming the expectations, a deterioration in the financial position of the company is associated with a negative effect on stock prices. The two variables regarding the firm size, the lnTA and the lnMV, provide poor results as well, revealing a negative association between the solely lnMV and CARs only around the event date (0; + 1). This reversal of our expectations could be explained, arguing that the greater is the dimension assumed in the stock market of a distressed firm, the higher is the negative effect on stock prices. However, this effect is not persistent before and after the event date. Also the results about the Earnings Surprise present a certain degree of novelty. In fact, when the regression coefficient is significant, a positive association with CARs is detected only around the event date (0; + 1), while after the event date the relation becomes negative. This evidence is the only in favour of a GCM’s role in negatively affecting the stock market, suggesting that investors are frightened by a GC problem and this pessimism is not reversed, at least in the very short term, by receiving positive information about firm’s earnings. Furthermore, the joint reading of GCM and Earnings Surprise effects confirms the prevailing literature predictions about the importance of other confounding events (Myers et al. 2018) and the growing role played by earnings announcement in the Italian setting, especially after the IFRS adoption (Kim et al. 2019). At last, the ROA does not present significant relation with CARs. Taking together all evidence we may support our H2 highlighting that, to a great extent, abnormal returns are the result of the opinion qualification bolstered by mixed effects of other variables. Yet importantly, the regression model reveals that a GCM has not a per se ability to determine negative CARs. This result feeds the persisting difference, detecting overtime by scholars, between the higher impact of GCMs in the USA than in European countries where the GC issue seems less felt by investors. Under the regulatory standpoint, the evidence achieved suggests that the inclusion of GCM release among the relevant information for investors, obliging firms to provide timely disclosure, has not produced the desired effects.

To assuage the concern that potential omitted variables drive our results, we rerun our regressions using a firm fixed-effects model (panel A, Table 6), year fixed-effects model (panel B, Table 6) and a change regression model (panel C, Table 6). Collectively, results reported in Table 6 show that our results of Table 5 remain qualitatively unchanged, indicating that omitted variables bias is less likely to be a concern in this study.

Additional Analysis and Insights

For an overall understanding of the evidence achieved, additional analysis were performed. A very first doubt might arise concerning the homogeneity of the period investigated that, as argued in the introduction, was characterized by a persistent financial crisis in Italy. It is worldwide acknowledged that the crisis hurt European countries and related security markets between 2008 and 2010. Thus, the possibility that our sample, which is extended to 2015, is not homogenous exists. To address this plausible issue, it is worthwhile noting that the dynamics of the 2008 onwards global financial crisis in Italy were a bit different from other countries. Italy has been importantly hurt multiple times and the worst one, probably, was not in 2008. After an important collapse of the Italian Stock Market during 2008–2009, another, in relative terms equal or more violent, has been observed between 2011 and 2012. In those years, in fact, Italy was the target of a severe speculation because of its huge sovereign debt. These facts are reflected also in our sample. As reported in Table 2, the number of GC modified audit reports reached its peak in 2012 (40). Interestingly, 2008 and 2009 were the years with the lowest amounts (28 and 27, respectively). To control for the effects before and after 2010, we isolated the subsample covering the years 2008–2010 from the one 2011–2015, we performed a two-sample t test with equal variance (because the number of obs. differs importantly) and we calculated the t test coefficient for the difference in meaning between the two subsamples for all the event windows. The t test is significant and negative for 7 out of 13 event windows or sub-windows. This led to the conclusion that the GC modified audit reports released in the sub period 2011–2015, produced more robust negative abnormal returns than the ones released in the period 2008–2010. These results are trivial, since they witness the higher duration of the financial crisis in the Italian setting and confirm the fairness of the time span considered in the study. The results of the two-sample t test are reported in Table 7.

Another important aspect not considered in the study is the audit firm tenure, which is usually measured as the length of the auditor–client relationship and represents a proxy of high (poor) audit quality and indipendence. It is acknowledged that a close relationship between the auditor and its clients can lead to decreased independence and effort (Garcia-Blandon et al. 2020). Table 8 reports for all the 263 observations included in the sample the auditors in charge at the time of the GCM release.

As a simple measure of audit tenure, we accounted for how many times GCMs were released by the same auditor of prior year and how many were not. The results are straightforward: the 90% of GCMs were released by the same auditor that released a GCM the year before. Thus, we can reliably conclude that in the Italian case the audit tenure does not affect the possibility to release a GCM. On the contrary, it might be seen as an additional feature in favour of GCMs release. However, it is important to recall how, according to the Italian Law, a long audit tenure is an intrinsic feature of the audit environment. As for Table 8, it is interesting to observe that many times the auditor did not change for the full time span. This evidence would make the audit tenure feature as a non-explanatory variable for detecting the issuance and related stock market reaction of GC modified audit reports.

However, other aspects may affect the issuance of GCMs and the related investors’ reaction. Namely: the audit lag, the subsequent bankruptcy/viability of the firms receiving a GCM, the first/subsequent GCM and the net profitability of the firms. To control for this aspects, we reported some interesting statistics in Table 9.

The audit report lag often signals problems with the company. Indeed, the auditor may delay the issuance of audit reports while trying to resolve issues and avoid issuing a GCM (Geiger et al. 2005; Simamora and Hendarjatno 2019). However, as earlier documented, the audit lag can be neglected in the Italian case given that the 92% of audit reports containing GCMs were released in the time lapse March–June, in line with the prescriptions of the Italian law.

As for the historical debate around the subsequent bankruptcy/viability of firms receiving a GCM, the evidence from the sample is against the usage of the GCM as a fair predictor: Over 72 firms included in our sample only 12 went to bankruptcy (9) or voluntary liquidation (3). Thus, the viability rate is quite high (and the fatal one quite small).

Concerning the issue first vs. subsequent GCM our sample reveals that a GCM, once issued, becomes a habit. Indeed, out of 263 total GCMs investigated, 193 happened for the second (or multiple) consecutive time. This can be interpreted as a signal of poor audit quality, impairing the early warning role that a GCM would have for investors and the firms themselves.

Finally, it is not a surprise to find that only the 10% of the total sample is about GCMs released to firms with a positive net income.

Conclusions and avenues for future research

Disentangling the relationships among market values, book values, financial reporting events and investors behaviours is a historical challenge for scholars. In this study, we tried to feed the debate about effects on stock market of a GCM in the audit report investigating the Italian setting in the period 2008–2015, which was characterized by severe financial conditions and regulatory amendments. Observing stock market trends and investors behaviour around the GCMs releases, we detect a possible negative effect. However, when regressing the CARs on additional variables, we found that the main effect is primarily given by the opinion qualification and we noticed that a GCM attached on a clean opinion is positively associated with CARs. This evidence markedly resizes the theoretical negative impact of GCMs on stock market reinforcing evidence achieved by Ianniello and Galloppo (2015) in Italy and from several scholars in other European countries (Pucheta-Martínez et al. 2004; Taffler et al. 2004; Guiral et al. 2014). Thus, we firstly provide validation, as for Italy, that the negative reaction is largely and mostly detected in the USA than in Europe. The empirical evidence could be explained considering that European stock markets are smaller and less able in explaining investors’ behaviours in the light of the higher ownership concentration. In addition, Martin (2000) stressed the lower attitude of non-US auditors to issue GCMs. Thus, ceteris paribus, investors’ reaction to whatever financial reporting events is lower and could be neglected by using statistical tools. Notwithstanding this feature, it is focal to address how investors react because the ongoing auditing and accounting harmonizations would pursue the objective of comparability of financial disclosure worldwide and represents a room for improvements for those searching for the mutual influence between finance and accounting matters. On the other hand, this under reaction creates worries considering that, on average, firms encompassed in our sample that received a clean opinion with a GCM have poor financial position similar to those received qualified opinions. However, we may not conclude investors are unable to capture financial distress. On the contrary, we may imagine investors have the ability to anticipate audit report contents using interim financial reports and other sources of information about the financial health of firms. At the same time, according to Menon and Williams (2010), if the financial distress is already discounted by stock markets at the time of audit opinion release, it is curious and biased to observe additional negative reactions at the event date. Alternatively, it is possible that some investors discount information sooner or later in the time according to their different abilities in capturing and understanding public available information. Even, this could represent an issue of different degrees of financial education among investors. If so, when running studies like this we should decide a priori who are the investors we would like to focus on. Indeed, among reasons provided for mispricing of audit opinions, naïve investors’ inability to understand information contained in GCMs is often cited as a primary explanation (Chen et al. 2020; Kausar et al. 2009; 2013; Taffler et al. 2004). To conclude, evidence achieved in this study opens new research questions and suggests to feed underexplored ones. First, do financial reporting events re-release (or already known by investors and discounted by the market) affect again the stock market (Khan et al. 2017)? The re-release of GC modified audit reports might have a stronger and negative effects since minority shareholders do not have privileged access to company information. This issue is historically debated and confirmed in the landscape of bad governance practices (Di Miceli da Silvera and Dias Jr 2010). Second, which are the most appropriate approaches in amending auditing standards? The triangle accounting–auditing–governance is the ground, but what about the role of the standard setters and the effects on auditor behaviour (Burns and Fogarty 2010) in cases full of “blurred lines” like the going concern modification? Third, do we need to cluster investors when investigating their reaction to financial reporting events? If so, how we may distinguish reactions among different investors’ clusters (institutional investors, private investors, the nature of controlling shareholders) beyond successful attempts observed as in the cases of short sellers (i.e. Jain et al. 2019) or distinguishing among industries (Woodley et al. 2020)? Fourth, in line with recent studies about the explanatory language (EL) of audit reports (Bedàrd et al. 2019; Czerney et al. 2019), does the technical language used in the audit report have the ability to determine or not significant investor reaction? If so, how can we measure and isolate this effect? Fifth, as accounting and auditing scholars, do we continue in thinking the GCM as a quasi-qualified audit report, searching confirmation for this thought or do we change our mindset detecting GCM with additional and different new approaches? Sixth, do additional modifications over the GC play a role on investors’ behaviour (Pei and Hamill 2013)? How we may distinguish effects of multiple modifications attached to the same (qualified or unqualified) audit reports? And, finally, for how long, the growing of additional financial and non-financial disclosure required, especially to listed firms and multinational corporations, will allow us to perform studies aimed at isolating effects about investors reaction to specific events using the traditional statistic tools? Will this “growing noise” lead scholars to search alternative ways to find confirmation to their hypotheses? If so, which would be the new methodology paradigms in the future?

Notes

Following the approval of the draft Financial Statement, the Board of Directors must forward it to external auditors (art. 154-ter of Consolidate Law of Finance) at least 15 days before its public disclosure through specific press release (art. 66 of Issuers' Regulation), publication on the company's website and communication to the CONSOB. This press release is the yearly earnings announcement and has to fall at least 21 days before the ordinary shareholders' meeting date, called for the approval of the final annual report. Instead, the auditor must issue the audit report and send it to the company’s registered office at least 15 days before the ordinary shareholders’ meeting date (art. 2429 Civil Code and art. 154-ter TUF). Since 2008, when the audit report contains a GCM, they must disclose immediately to the market (by a specific press release) the audit report (CONSOB Communication No. DME/9081707). Each press release (earnings announcement and GC audit report) does not contain any reference to the others. However, the audit report, especially when related to a GCM, could contain references to the financial distress status of the company. Finally, taking into account the Italian Regulation it is possible to consider and investigate the GCM public release separately from the Earnings Announcement.

Mentz and Shiereck (2008) based on Boehmer et al. (1991) calculated security i’s standardized residual on the event day (SRi) as: \({\text{SRi}} = {\raise0.7ex\hbox{${{\text{CAR}}_{{i,t_{a} t_{b} }} }$} \!\mathord{\left/ {\vphantom {{{\text{CAR}}_{{i,t_{a} t_{b} }} } {\sqrt {\sigma_{{{\text{CAR}}_{{i,t_{a} t_{b} }} }}^{2} } }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${\sqrt {\sigma_{{{\text{CAR}}_{{i,t_{a} t_{b} }} }}^{2} } }$}}\). (6).

and then, used (9) to calculate a Z statistic (called here ZM):

\(Z_{M} = {\raise0.7ex\hbox{${\frac{1}{N}\mathop \sum \nolimits_{i = 1}^{N} {\text{SR}}i}$} \!\mathord{\left/ {\vphantom {{\frac{1}{N}\mathop \sum \nolimits_{i = 1}^{N} {\text{SR}}i} {\sqrt {\frac{1}{{N\left( {N - 1} \right)}}\mathop \sum \nolimits_{i = 1}^{N} \left( {{\text{SR}}i - \mathop \sum \nolimits_{i = 1}^{N} \frac{{{\text{SR}}i}}{N}} \right)^{2} } }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${\sqrt {\frac{1}{{N\left( {N - 1} \right)}}\mathop \sum \nolimits_{i = 1}^{N} \left( {{\text{SR}}i - \mathop \sum \nolimits_{i = 1}^{N} \frac{{{\text{SR}}i}}{N}} \right)^{2} } }$}}\)

We did not identify a control sample of non-GCM firms to conduct the same investigation on them because as we argued in a previous paragraph, the mandatory issuance of a specific press release is not required for all audit reports, but only for them containing a GCM, including the unqualified ones.. Moreover, as asserted by Myers et al. (2018) there is not the possibility to define a sample of financially distressed companies that should have received a GCM but did not. Indeed, financially distressed GCM firms have specific characteristic, which are not identifiable in other healthy companies. Hence, the use of a control sample is not a feasible strategy for this research enquiries.

For all regressions, we verify that multicollinearity is not a concern in that we calculate variance inflation factors (VIF) and find they are lower than 2.

References

Al-Thuneibat, A.A., B.A. Khamees, and N.A. Al-Fayoumi. 2008. The effect of qualified auditors’ opinions on share prices: Evidence from Jordan. Managerial Auditing Journal 23: 84–101.

Amin, K., J. Krishnan, and J.S. Yang. 2014. Going concern opinion and cost of equity. Auditing 33: 1–39.

Ball, R., S.P. Kothari, and A. Robin. 2000. The effect of international institutional factors on properties of accounting earnings. Journal of Accounting & Economics 29: 1–51.

Bédard, J., C. Brousseau, and A. Vanstralen. 2019. Investor reaction to auditors’ going concern emphasis of matter: Evidence from a natural experiment. Auditing 38: 27–55.

Bhimani, A., M.A. Gulamhussen, and S. Lopes. 2009. The effectiveness of the auditor’s going concern evaluation as an external governance mechanism: Evidence from loan defaults. International Journal of Accounting 44: 239–255.

Blay, A.D., and M.A. Geiger. 2001. Market expectations for first-time going-concern recipients. Journal of Accounting Auditing and Finance 16: 209–226.

Blay, A.D., M.A. Geiger, and D.S. North. 2011. The auditor’s going-concern opinion as a communication of risk. Auditing 30: 77–102.

Boehmer, E., J. Musumeci, and A. Poulsen. 1991. Event-study methodology under conditions of event-induced variance. Journal of Financial Economics 30: 253–272.

Brown, S., and J. Warner. 1985. Using daily stock returns: The case of event studies. Journal of Financial Economics 14: 3–31.

Brunelli, S., C. Carlino, R. Castellano, and A. Giosi. 2020. Going concern modifications and related disclosures in the Italian stock market: Do regulatory improvements help investors in capturing financial distress? Journal of Management and Governance 25: 433–473.

Burns, J., and J. Fogarty. 2010. Approaches to auditing standards and their possible impact on auditor behavior. International Journal of Disclosure and Governance 7: 310–319.

Bushman, R.M., and J.D. Piotroski. 2006. Financial reporting incentives for conservative accounting: The influence of legal and political institutions. Journal of Accounting & Economics 42: 107–148.

Cameran, M., C. Gabbioneta, P. Moizer, and A. Pettinicchio. 2010. What do client-firms think of their auditors? Evidence from the Italian Market. Corporate Reputation Review 12: 316–326.

Carson, E., N.L. Fargher, M.A. Geiger, C.S. Lennox, K. Raghunandan, and M. Willekens. 2013. Audit reporting for going-concern uncertainty: A research synthesis. Auditing 32: 353–384.

Chen, S., B. Hu, D. Wu, and Z. Zhao. 2020. When auditors say ‘no’, does the market listen? European Accounting Review 29: 263–305.

Chow, C.W., and S.J. Rice. 1982. Qualified audit opinions and share prices-an investigation. Auditing 1: 35–53.

Citron, D.B., and R.J. Taffler. 2001. Ethical behaviour in the u.k. audit profession: The case of the self-fulfilling prophecy under going-concern uncertainties. Journal of Business Ethics 29: 353–363.

Citron, D.B., R.J. Taffler, and J.Y. Uang. 2008. Delays in reporting price-sensitive information: The case of going concern. Journal of Accounting and Public Policy 27: 19–37.

Cummins, J.D., and M.A. Weiss. 2004. Consolidation in the European insurance industry: Do mergers and acquisitions create value for shareholders? Brookings-Wharton Papers on Financial Services 7: 217–258.

Czerney, K., J.J. Shmidt, and A.N. Thompson. 2019. Do investors respond to explanatory language included in unqualified audit reports? Contemporary Accounting Research 36: 198–229.

DeFond, M.L., and J. Zhang. 2014. A review of archival auditing research. Journal of Accounting & Economics 58: 275–326.

Deng, M., N.D. Melumad, and T. Shibano. 2012. Auditors’ liability, investments, and capital markets: A potential unintended consequence of the Sarbanes-Oxley Act. Journal of Accounting Research 50: 1179–1215.

Dodd, P., N. Dopuch, R. Holthausen, and R. Leftwich. 1984. Qualified audit opinions and stock prices. Journal of Accounting & Economics 6: 3–38.

Elliott, J.A. 1982. Subject to audit opinions and abnormal security returns: Outcomes and ambiguities. Journal of Accounting Research 20: 617–638.

Fleak, S.K., and E.R. Wilson. 1994. The incremental information content of the going-concern audit opinion. Journal of Accounting Auditing and Finance 9: 149–166.

Francis, J.R., and J. Krishnan. 1999. Accounting accruals and auditor reporting conservatism. Contemporary Accounting Research 1: 135–165.

Gaeremynck, A., and M. Willekens. 2003. The endogenous relationship between audit-report type and business termination: Evidence on private firms in a non-litigious environment. Accounting & Business Research 33: 65–79.

Garcia-Blandon, J., J.M. Argiles-Bosch, and D. Ravenda. 2020. Audit firm tenure and audit quality: A cross-European study. Journal of International Financial Management and Accounting 31: 35–64.

Gassen, J., and H.A. Skaife. 2009. Can audit reforms affect the information role of audits? Evidence from the german market. Contemporary Accounting Research 26: 867–898.

Geiger, M.A., Raghunandan, K., & Rama, D.V. 2005. Recent changes in the association between bankruptcies and prior audit opinions. Auditing: A Journal of Practice & Theory 24: 21–35

Geiger, M.A., and A. Kumas. 2018. Anticipation and reaction to going concern modified audit opinion by sophisticated investors. International Journal of Auditing 22: 522–535.

Gissel, J., J.C. Robertson, and C.M. Stefaniak. 2010. Formation and consequences of going concern opinions: A review of the literature. Journal of Accounting Literature 29: 59–141.

Guiral, A., E. Ruiz, and H.J. Choi. 2014. Taxation Audit report information content and the provision of non-audit services: Evidence from Spanish lending decisions. Journal of International Accounting Auditing & Taxation 23: 44–57.

Hagerman, R.L., and M.E. Zmijewski. 1979. Some economic determinants of accounting policy choice. Journal of Accounting & Economics 1: 141–161.

Harrington, S.E., and D.G. Shrider. 2007. All events induce variance: Analyzing abnormal returns when effects vary across firm. Journal of Financial and Quantitative Analysis 42: 229–256.

Hatfield, H.R. 1966. Some variations in accounting practice in england, france, germany and the united states. Reprinted in Journal of Accounting Research 4: 169–182.

Herbohn, K., V. Ragunathan, and R. Garsden. 2007. The horse has bolted: Revisiting the market reaction to going concern modifications of audit reports. Accounting & Finance 47: 473–493.

Ianniello, G., and G. Galloppo. 2015. Stock market reaction to auditor opinions—Italian evidence. Managerial Auditing Journal 30: 610–632.

Jaafar, A., and S. McLeay. 2007. Country effects and sector effects on the harmonization of accounting policy choice. Abacus 43: 156–189.

Jain, A., C. Jain, and C.X. Jiang. 2019. Early movers advantage? Evidence from short selling during after-hours on earnings announcement days. Financial Review 54: 235–264.

Jones, F.L. 1996. he information content of the auditor’s going-concern evaluation. Journal of Accounting and Public Policy 15: 1–27.

Kausar, A., and C. Lennox. 2017. Balance sheet conservatism and audit reporting conservatism. Journal of Business Finance & Accounting 44: 897–924.

Kausar, A., R.J. Taffler, and C.E.L. Tan. 2009. The going-concern market anomaly. Journal of Accounting Research 47: 213–239.

Kausar, A., R.J. Taffler, and C.E.L. Tan. 2017. Legal regimes and investor response to the auditor’s going-concern opinion. Journal of Accounting Auditing and Finance 32: 40–72.

Kausar, A., Kumar, A., & Taffler, R.J. 2013. Why the going-concern anomaly: gambling in the market? (Working paper). WBS Finance Group Research Paper 200. https://doi.org/10.2139/ssrn.2249029 Accessed 15 November 2022.

Khan, S.A., G. Lobo, and E.T. Nwaeze. 2017. Public re-release of going-concern opinions and market reaction. Accounting & Business Research 47: 237–267.

Kim, P., P.L. Marchini, and G. Siciliano. 2019. Information content of earnings announcements around ifrs adoption and a simultaneous change in press release disclosure in Italy. International Journal of Accounting 54: 1–36.

Kothari, S.P. 2001. Capital markets research in accounting. Journal of Accounting & Economics 31: 105–231.

Kothari, S.P., X. Li, and J.E. Short. 2009. The effect of disclosures by management, analysts, and business press on cost of capital, return volatility, and analyst forecasts: A study using content analysis. Accounting Review 84: 1639–1670.

Kvaal, E., and C.W. Nobes. 2010. International differences in ifrs policy choice: A research note. Accounting & Business Research 40: 173–187.

Kvaal, E., and C.W. Nobes. 2012. IFRS policy changes and the continuation of national patterns of ifrs practice. Accounting Review 21: 343–371.

Liljeblom, E., and M. Vaihekoski. 2004. Investment evaluation methods and required rate of return in finnish publicly listed companies. Finnish Journal of Business Economics 53: 1–24.

Martin, R.D. 2000. Going-concern uncertainty disclosures and conditions: A comparison of french, german, and U.S. practices. Journal of International Accounting Auditing & Taxation 9: 137–158.

Menon, K., and D.D. Williams. 2010. Investor reaction to going concern audit reports. Accounting Review 85: 2075–2105.

Mentz, M., and D. Schiereck. 2008. Cross-border mergers and the cross-border effect: The case of the automotive supply industry. Review of Managerial Science 2: 199–218.

Miceli, Di., A. da Silveira, and A.L. Dias Jr. 2010. What is the impact of bad governance practices in a concentrated ownership environment? International Journal of Disclosure and Governance 7: 70–91.

Mikkelson, W.H., and M.M. Partch. 1988. Withdrawn security offerings. Journal of Financial Quantitative Analysis 23: 119–133.

Myers, L., J. Shipman, Q. Swanquist, and R. Whited. 2018. Measuring the market response to going concern modifications: The importance of disclosure timing. Review of Accounting Studies 23: 1512–1542.

Nobes, C.W. 1998. Towards a general model of the reasons for international differences in financial reporting. Abacus 34: 162–187.

Nobes, C.W., & Parker, R. 2016. Comparative international accounting (13th ed.). Pearson.

Ogneva, M., and K.R. Subramanyam. 2007. Does the stock market underreact to going concern opinions? Evidence from the U.S. and Australia. Journal of Accounting & Economics 43: 439–452.

Pei, D., and P.A. Hamill. 2013. Do modified audit opinions for Shanghai listed firms convey heterogeneous information? Journal of International Accounting Auditing & Taxation 22: 1–11.

Pucheta-Martínez, M.C., A.V. Martinez, and M.A.G. Benau. 2004. Reactions of the Spanish capital market to qualified audit reports. European Accounting Review 13: 689–711.

Rosegreen, E.N.A., and M.C. Dawkins. 2000. The Association between bankruptcy outcome and price reactions to bankruptcy filings. Journal of Accounting Auditing and Finance 15: 425–438.

Ruiz-Barbadillo, E., N. Gómez-Aguilar, and N. Carrera. 2009. Does mandatory audit firm rotation enhance auditor independence? Evidence from Spain. Auditing 28: 113–135.

Sainty, B.J., G.K. Taylor, and D.D. Williams. 2002. Investor dissatisfaction toward auditors. Journal of Accounting Auditing and Finance 17: 111–136.

Schaub, M. 2006. Investor overreaction to going concern audit opinion announcements. Applied Financial Economics 16: 1163–1170.

Sharpe, W.F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 19: 425–442.

Shevlin, T. 1981. Measuring abnormal performance on the Australian securities market. Australian Journal of Management 6: 67–107.

Simamora, R.A., and H. Hendarjatno. 2019. The effects of audit client tenure, audit lag, opinion shopping, liquidity ratio, and leverage to the going concern audit opinion. Asian Journal of Accounting Research 4: 145–156.

Taffler, R., J. Lu, and A. Kausar. 2004. In denial? Stock market underreaction to going-concern audit report disclosures. Journal of Accounting & Economics 38: 263–296.

Vanstraelen, A. 2003. Going-concern opinions, auditor switching, and the self-fulfilling prophecy effect examined in the regulatory context of Belgium. Journal of Accounting Auditing and Finance 18: 231–253.

Woodley, M., P. DaDalt, and J.R. Wingender. 2020. The price and volume response to earnings announcements in the corporate bond market. Financial Review 55: 669–696.

Xu, Y., E. Carson, N. Fargher, and L. Jiang. 2013. Responses by Australian auditors to the global financial crisis. Accounting and Finance 53: 301–338.

Zmijewski, M. 1984. Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research 22: 59–82.

Funding

Open access funding provided by Università degli Studi di Roma Tor Vergata within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix I: GCMs date release and companies went to bankruptcy or voluntary liquidation in the period 2008–2015

GCM Firms | GCM 2008 | GCM 2009 | GCM 2010 | GCM 2011 | GCM 2012 | GCM 2013 | GCM 2014 | GCM 2015 |

|---|---|---|---|---|---|---|---|---|

Acotel Group | 01/04/2016 | |||||||

Aedes | 14/04/2009 | 29/04/2013 | 05/06/2014 | 28/04/2015 | ||||

Agronomia | 07/07/2016 | |||||||

Aicon | 12/12/2009 | 29/12/2010 | Bankruptcy | |||||

Aion Renewables | 28/04/2010 | 23/06/2011 | 07/06/2012 | Bankruptcy | ||||

Alba Private Equity | 29/04/2011 | 27/04/2012 | ||||||

Antichi Pellettieri | 10/06/2011 | 12/06/2012 | 12/06/2013 | 10/04/2014 | Liquidation | |||

Arena | 15/04/2009 | 14/04/2010 | 15/05/2011 | 12/07/2012 | ||||

Art’è | 02/04/2009 | |||||||

Autostrade Meridionali | 24/03/2015 | 22/03/2016 | ||||||

Bastogi | 05/06/2013 | 08/04/2014 | 30/04/2015 | |||||

Bee Team | 10/04/2009 | 14/04/2010 | 06/04/2011 | 04/04/2012 | ||||

Beghelli | 30/04/2013 | |||||||

Best Union Company | 08/04/2015 | |||||||

Bialetti Industrie | 10/04/2009 | 12/04/2010 | 08/06/2011 | 29/04/2012 | 06/06/2013 | 05/06/2014 | 09/04/2015 | |

Biancamano | 12/04/2013 | 31/03/2014 | 07/05/2015 | 04/08/2016 | ||||

Bioera | 15/04/2009 | 28/04/2010 | ||||||

Borgosesia | 29/04/2011 | 28/04/2012 | 29/04/2013 | 30/03/2014 | 24/04/2015 | 29/04/2016 | ||

Brioschi Sviluppo | 05/06/2013 | 07/04/2014 | 08/04/2015 | 07/04/2016 | ||||

Chl | 29/03/2012 | 30/04/2013 | 28/04/2014 | 29/04/2015 | 27/04/2016 | |||

Ciccolella | 10/04/2009 | 14/04/2010 | 29/04/2011 | 07/06/2012 | 09/04/2013 | 30/04/2014 | ||

Cobra Automotive Technologies | 14/04/2010 | 15/04/2011 | 08/04/2013 | |||||

Cogeme Set | 07/04/2011 | 02/07/2012 | Bankruptcy | |||||

Crespi | 14/04/2009 | 14/06/2010 | 21/04/2011 | 16/06/2012 | 31/07/2013 | Liquidation | ||

Digital Magics | 12/04/2016 | |||||||

Dmail Group | 13/04/2010 | 12/04/2011 | 12/04/2012 | 04/10/2012 | 12/10/2015 | |||

Eems Italia | 10/04/2009 | 13/04/2010 | 29/03/2012 | 22/05/2013 | 30/04/2014 | 27/04/2015 | 22/06/2016 | |

Enertronica | 06/04/2016 | |||||||

Eukedos | 10/04/2009 | 12/04/2010 | 04/04/2011 | 23/04/2012 | 30/04/2013 | |||

Eutelia | 15/04/2009 | Bankruptcy | ||||||

Finarte | 10/04/2009 | Bankruptcy | ||||||

Fintel Energia Group | 29/06/2013 | 30/06/2014 | 30/03/2015 | 13/06/2016 | ||||

Gabetti Holding | 14/04/2009 | 13/04/2010 | 07/04/2011 | 28/04/2012 | 15/05/2013 | 07/04/2014 | 07/04/2015 | 07/04/2016 |

Gruppo Waste | 24/06/2016 | |||||||

Industria E Innovazione | 28/03/2013 | 07/04/2014 | 30/04/2015 | 28/04/2016 | ||||

Investimenti E Sviluppo | 10/04/2009 | 01/03/2010 | 13/05/2011 | 12/04/2012 | 29/04/2013 | 03/11/2014 | 22/05/2015 | |

IPI | 10/04/2009 | |||||||

Ki Group | 06/04/2016 | |||||||

Kr Energy | 28/03/2009 | 09/04/2010 | 28/04/2011 | 27/04/2012 | 30/04/2013 | 29/04/2016 | ||

Lventure Group | 26/03/2009 | 04/04/2011 | 04/04/2014 | |||||

Maire Tecnimont | 09/04/2013 | 09/04/2014 | ||||||

Mediacontech | 10/04/2009 | 07/04/2011 | 27/04/2012 | 07/06/2013 | 30/04/2014 | |||

Meridiana | 10/04/2009 | 13/04/2010 | 06/04/2011 | 27/04/2012 | 28/02/2013 | |||

Meridie | 08/04/2014 | |||||||

Molmed | 29/03/2009 | 09/04/2010 | 04/04/2011 | 02/04/2012 | 28/03/2013 | 18/03/2014 | 30/04/2015 | 25/03/2016 |

Montefibre | 13/05/2009 | 12/06/2010 | 11/05/2011 | 07/07/2012 | 26/11/2013 | Liquidation | ||

Monti Ascensori | 08/06/2011 | Bankruptcy | ||||||

Moviemax Media Group | 15/04/2009 | 14/05/2010 | 15/07/2011 | 06/06/2012 | 26/04/2013 | 01/08/2014 | Bankruptcy | |

Nova Re | 29/04/2013 | 05/06/2014 | 19/02/2016 | |||||

Olidata | 09/04/2009 | 09/04/2010 | 23/03/2011 | 20/04/2012 | 05/04/2013 | 04/04/2014 | 08/04/2015 | 30/05/2016 |

Pierrel | 28/04/2012 | 23/04/2013 | 29/05/2014 | 30/04/2015 | 29/04/2016 | |||

Pininfarina | 07/04/2009 | 14/04/2010 | 07/04/2011 | 11/04/2012 | 12/04/2013 | 03/04/2015 | ||

Pramac | 13/04/2010 | 29/04/2011 | 02/05/2012 | |||||

Prelios | 28/03/2013 | 30/04/2014 | 09/04/2015 | 04/04/2016 | ||||

Premuda | 30/04/2014 | 29/04/2015 | 29/04/2016 | |||||

Primi Sui Motori | 10/04/2015 | 21/03/2016 | ||||||

Retelit | 30/04/2015 | |||||||

Ricchetti | 18/04/2013 | 18/04/2014 | 17/04/2015 | 29/04/2016 | ||||

Risanamento | 15/04/2009 | 29/04/2014 | 03/04/2015 | 22/02/2016 | ||||

Rizzoli Corriere | 29/04/2013 | 16/04/2014 | 06/04/2016 | |||||

Safe Bag | 15/06/2016 | |||||||

Screen Service | 07/01/2013 | 11/08/2014 | Bankruptcy | |||||

Seat Pagine Gialle | 29/03/2011 | 30/04/2012 | ||||||

Sintesi | 06/10/2011 | 19/04/2012 | 29/04/2013 | 14/11/2014 | 24/06/2015 | |||

Snai | 07/04/2011 | 05/04/2012 | 04/04/2013 | 07/04/2014 | 03/04/2015 | 29/04/2016 | ||

Sopaf | 14/04/2010 | 29/04/2011 | Bankruptcy | |||||

Stefanel | 08/04/2009 | 13/04/2010 | 07/04/2011 | 05/04/2012 | 05/04/2013 | 07/04/2014 | 31/03/2015 | 29/04/2016 |

Tas | 13/04/2010 | 05/04/2011 | 28/04/2012 | 29/04/2016 | ||||

Tiscali | 14/04/2009 | 12/04/2010 | 05/04/2011 | 20/04/2012 | 05/04/2013 | 26/06/2014 | 20/03/2015 | 06/04/2016 |

Visibilia Editore | 12/03/2013 | 09/06/2014 | 25/06/2015 | 14/04/2016 | ||||

Wm Capital | 09/06/2016 | |||||||

Zucchi | 10/04/2009 | 07/06/2010 | 29/04/2011 | 06/06/2012 | 29/04/2013 | 30/04/2014 | 21/03/2015 | 28/04/2016 |

Source: Authors’ elaboration

Appendix II: Variables definition

Variable | Definition |

|---|---|

CAR | Cumulative abnormal returns over trading days ta to tb around the day t, where t is the event date. CARs were calculate for each firm in the sample as: \(CAR_{{\left( {t_{a} ,t_{b} } \right),i}} = \mathop \sum \limits_{{t = t_{s} }}^{{t_{b} }} AR_{it}\), where ARit is the firm's abnormal stock return measured each day in the test period |

GCM | A dummy variable equal to 1 if the company received a qualified opinion with GCM and 0 if the company received an unqualified opinion with GCM |

BIG4 | A dummy variable where BIG4 = 1 if the firms is audited by a top-four auditor (EY, KPMG, Deloitte and PWC) and BIG4 = 0 otherwise |

Zscore | A composite measure of financial distress based upon Zmijerski (1984) distress score. The distress model includes three components: return on assets, debt to assets and current ratio. When Zscore > 0 there is probability to bankrupt |

lnTA | The natural log of the total assets at the end of the year associated with the audit report |

lnMV | The natural log of the market value of the firm at the end of the fiscal year associated with the audit report |

Surprise | The annual earnings surprise measured as the difference between current year annual earnings before extraordinary items and last year annual earnings before extraordinary items scaled by the market value of equity from last year |

ROA | Earnings before extraordinary items on total assets |

TA | Total assets of the firma t year end (thousands of €) |

MV | Market value measured by market capitalization at year end in thousands of € |

NI | Value of the net income at year end (thousands of €) |

LEV | The ratio of total liabilities to total assets |

Current ratio | The ratio of currents assets to current liabilities |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Brunelli, S., Venuti, F., Niederkofler, T. et al. Financial distress, auditors’ going concern modification (GCM) and investors’ reaction in a concentrated ownership environment: new evidence from the Italian stock market. Int J Discl Gov 21, 313–339 (2024). https://doi.org/10.1057/s41310-023-00197-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41310-023-00197-1

Keywords

- Audit reports

- Going concern modification (GCM)

- Event study

- OLS multiple regression

- Financial distress

- Investors’ reaction