Abstract

This paper uses cross-country firm-level data to explore the impact of U.S. monetary policy shocks on firms’ sales, investment, and employment. We estimate a significant impact of U.S. monetary policy on the average foreign firm, while controlling for other macroeconomic and financial variables like the VIX and exchange rate fluctuations that accompany U.S. monetary policy changes. We then estimate the role of international trade exposure and financial constraints in transmitting monetary policy shocks to firms, allowing for a better identification of the importance of external demand effects and the financial channel. We first exploit cross-country-sector-level data on intermediate and final goods to show that greater global production linkages amplify the impact of U.S. monetary policy at the firm level. We then show that the impact varies along the firm-level distribution of proxies for firms’ financial constraints (e.g., size and net worth), with the impact being significantly attenuated for less constrained firms.

Similar content being viewed by others

Notes

There are several differences between the setup our paper and that of the related literature, which has to date looked only at heterogeneity in the responses of U.S. firms’ outcomes to U.S. monetary policy shocks. These differences include the outcome variables, monetary policy shock series, proxies for financial constraints, and regression specifications. Ottonello and Winberry (2020) report results showing that firms with low default risk and low leverage are more responsive to monetary policy. As Ottonello and Winberry (2020) discuss in detail in an Appendix, they interpret differences between their results and the more standard findings of Jeenas (2019), for example, as a difference between within-firm effects and across-firms effects, and do not consider them to be in conflict.

See also Georgiadis (2016), who finds that the magnitude of U.S. monetary policy spillovers depends on a host of receiving country characteristics, including trade and financial integration, exchange rate regime, and participation in global value chains; Dedola et al. (2017), who find that a surprise U.S. monetary policy tightening leads to a dollar appreciation, decline in foreign industrial production, real GDP, and inflation, and a rise in unemployment in a panel of advanced and emerging economies; and Kearns et al. (2019), who measure monetary policy shocks for seven advanced economy central banks and spillovers to 47 advanced and emerging market economies, and find no evidence that spillovers are related to real linkages such as trade flows, but some importance for exchange rate regimes, with the key country characteristic being financial openness.

While finalizing our first draft, we became aware of contemporaneous work in progress by Arbatli-Saxegaard et al. (2022). These authors also examine the cross-border effects of U.S. monetary policy shocks in a large panel of firm-level data. Although we do much more analysis of trade network channels and use different measures of Fed monetary policy shocks and investment, the two papers have a similar focus.

We experimented with additional lags, but this did not yield any additional insights.

We also experimented with including firm age, Tobin’s Q, and other measures of firms’ financial health, such as the changes in its leverage ratio. Including these regressors did not impact our results, but cut the sample size substantially in several cases (for example, Italian firms do not report the age variable in our dataset). Therefore, in order to maximize sample size, we constrain the inclusion of firm-level controls in the final analysis to those mentioned in the main text.

See di Giovanni et al. (2023) for evidence that sales growth of firms more exposed to trade are more sensitive to changes in world GDP.

See Carvalho (2014) for a more detailed discussion of the weighted outdegree and other possible production network sufficient statistics.

Note that including time-varying fixed effects eliminates the possibility of estimating the average impact of monetary policy, \(\beta _1\). Therefore, we first run regressions without time fixed effects in order to estimate the importance of firm heterogeneity relative to the average effect of monetary policy on all firms in an economy.

As noted in the firm dynamics literature (Cloyne et al. 2020, and others), age also plays a role independently of size or net worth. We have also run regressions with age, and results were qualitatively similar to using size or net worth. However, this cut the sample size quite substantially, so we omit these results.

Another common measure of financial constraints is a firm’s leverage (e.g., Jeenas 2019; Durante and Elena 2022). However, given that the variable is highly correlated with firm size in our dataset, as found for European firms by Gopinath et al. (2017) and U.S. ones by Dinlersoz et al. (2018), we omit the analysis of this variable for brevity.

Our intuition for the root cause of these insignificant results is a lack of power arising from insufficient variation in the trade variables, since they are measured at the country-sector level rather than at the firm level. Therefore, it is hard to isolate sufficient variation in the triple interactions that is not already soaked up by the firm-level interaction variables.

To provide further meaning, Bu et al. (2021) regress contemporaneous changes in interest rates of different maturities on the shock. The response coefficient reaches its maximum at the 2-year interest rate (normalized to be 1.0). The response of the 5-year interest rate is of comparable (large) magnitude and significance. Response coefficients for all other maturities (3-mo., 6-mo., 1-yr, 10-yr, and 30-yr) are significant but smaller. Thus, both the short and long ends of the yield curve respond to the BRW shock to a lesser degree than 2- and 5-yr rates. This is similar to the experiment in Gürkayanak et al. (2005), who show that the long rate responds relatively more to their estimated “path factor," while the short rate responds relatively more to the “target factor."

Note that the scales of the policy news shock and the forward guidance shock are also arbitrary. Nakamura and Steinsson (2018) rescale their series such that its effect on the 1-year nominal Treasury yield is equal to one. Swanson (2021) offers one natural way to interpret his forward guidance shock: a 25bp change in the expected federal funds rate one year ahead, which would be very large by historical standards (about 4.4 standard deviations). Applying that to his estimates suggests that a forward guidance surprise of this magnitude would raise the 2-yr Treasury bill rate by around 20bp. Concerning values in 2001, Cochrane and Piasezzi (2002) argue that it is problematic to interpret movements in interest rates around September 11, 2001 as a shock versus an expected movement. Their measure, like ours, does not exhibit this feature.

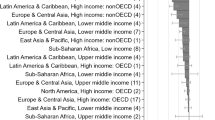

The country sample includes Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, South Korea, Malaysia, Poland, Russia, Sweden, Taiwan, Thailand, Turkey, UK, and Vietnam.

We also ran baseline regressions, which do not require information on trade exposure, with the full set of Worldscope countries, and our results are robust. Note that the sample size only increases by roughly twenty percent in these regressions, since our cleaning procedure results in a set of firms in the largest industrial and emerging market countries, which also have the most comprehensive data coverage in Worldscope.

One exception is the sales ratio, which we winsorize at the 5% level.

The inclusion of country or country-sector fixed effects would also help assuage this concern. However, given that we run interaction regressions with firm characteristics and the monetary policy shock, it is best to first demean the firm variables.

We use the rest-of-the-world (ROW) variables for three countries that are missing data: Malaysia, Thailand, and Vietnam. Given the sparse data for Asia, the ROW data cover many of the smaller Asian economies, so we view this approximation to be reasonable. If anything, this assumption will bias against our regressions finding any trade effects as we are killing some cross-sectional heterogeneity by imputing the same numbers for several country-sectors.

In particular, we fill in the 2012–2019 country-sector trade and output data with values from 2011.

Note that when we write “goods”, these might be services depending on the export sector.

See di Giovanni and Hale (2022) for a structural econometric analysis of this problem.

While the estimated coefficients on the monetary policy shock imply a large impact in our back-of-the-envelope calculations, the overall model fits are not strong, as indicated by the rather small \(R^2\)s for the within-identification of our regressions. These low \(R^2\)s are not surprising, however, as the endogenous variables are changes in microlevel variables, which are volatile given idiosyncratic shocks to firms. Indeed, finding low \(R^2\)s is common in microstudies like ours. For example, note the low \(R^2\)s in Table 1 of di Giovanni et al. (2023), where the dependent variable is sales growth.

The authors further control for size, leverage, Tobin’s Q, and sales growth. We have also explored including these variables. While doing so cuts sample size substantially, our baseline result does not change. Gulen and Ion (2016), who examine political uncertainty and investment, control for Tobin’s Q, cash flow, and sales growth in regressions for U.S. firm-level investment and find all of these controls to be positive and significant, consistent with our regressions.

Note that the largest shock, in absolute value, occurs for a loosening, so we have run regressions dropping this year and results are robust.

There are several reasons why our finding greater significance of easing shocks contrasts with Ravn and Sola (2004) or Barnichon et al. (2017), who find stronger results for contractionary shocks. These include (1) use of different measures of monetary policy innovations (the other authors use the change in M1 or the Fed Funds rate, respectively); (2) the other authors examining U.S. outcome variables; and (3) different time periods for analysis.

The Bu et al. (2021) shock series for the ECB were computed using the same method described above for the Fed.

We also investigate whether the “information effect” of monetary policy spills over across countries in Table 17, where we use the information shock series estimated by Bu et al. (2021). The information variable is never significant and does not impact our baseline results for the monetary policy shock variable.

We also experimented with including sector\(\times\)year fixed effects and obtained similar results as our baseline OLS regressions. Regressions including both country\(\times\)year and sector\(\times\)year fixed effects yield similar coefficients as our main regressions, though the majority of the coefficients are no longer significant. This finding is not surprising given that the inclusion of both country and sector time-varying fixed effects greatly reduces degrees the of freedom.

This is akin to looking at a standard deviation of the distribution, but given that the normalized variables are still somewhat skewed, we opt for the IQR.

Results are qualitatively similar if we instead use age or measure size by employment using a smaller subset of firms for which these data exist.

The firm size results also match findings on how small (U.S.) firms cut investment by more than large firms following a monetary contraction, the key result in early work by Gertler and Gilchrist (1994).

We follow di Giovanni et al. (2021) and define a country episode dummy variable as a depreciation (appreciation) when the annual exchange rate change falls within the country’s top (bottom) quartile of exchange rate changes vis-à-vis the U.S. dollar over the sample period.

We also allow for heterogeneity in the non-interacted coefficients to avoid omitted variable bias.

References

Anderson, James E., and Eric van Wincoop. 2004. Trade costs. Journal of Economic Literature 42 (3): 691–751.

Antràs, Pol. 2021. De-globalisation? Global value chains in the post-COVID-19 age. In 2021 ECB Forum: ‘Central banks in a shifting world’ conference proceedings.

Arbatli-Saxegaard, Elif, Melih Firat, Davide Furceri, and Jeanne Verrier. 2022. U.S. monetary policy shock spillovers: Evidence from firm-level data. IMF working paper 22/191.

Autor, David, David Dorn, Lawrence F. Katz, Christina Patterson, and John van Reenen. 2020. The fall of the labor share and the rise of superstar firms. Quarterly Journal of Economics 135 (2): 645–709.

Barnichon, Regis, Christian Matthes, and Tim Sablik. 2017. Are the effects of monetary policy asymmetric? Federal Reserve Bank of Richmond Brief EB17–03: 1–4.

Bauer, Michael D. and Eric T. Swanson. 2020. An alternative explanation for the ‘fed information effect’. NBER working paper 27013.

Bernanke, Ben S., and Mark Gertler. 1989. Agency costs, net worth, and business fluctuations. American Economic Review 79 (1): 14–31.

Bernanke, Ben S., Mark Gertler, and Simon Gilchrist. 1999. The financial accelerator in a quantitative business cycle framework. Handbook of Macroeconomics 1: 1341–1393.

Bräuning, Falk and Viacheslav Sheremirov. 2021. The transmission mechanisms of international business cycles: Output spillovers through trade and financial linkages. Federal Reserve Bank of Boston research department working papers no. 21-13.

Bräuning, Falk, Viacheslav Sheremirov, and Victoria Ivashina. 2020. U.S. monetary policy and emerging market credit cycles. Journal of Monetary Economics 112: 57–76.

Bu, Chunya, John H. Rogers, and Wu. Wenbin. 2021. A unified measure of Fed monetary policy shocks. Journal of Monetary Economics 118: 331–349.

Caglio, Cecilia R, R. Matthew Darst, and Şebnem Kalemli-Özcan. 2021. Risk-taking and monetary policy transmission: Evidence from loans to SMEs and large firms. NBER working paper 28685.

Carvalho, Vasco M. 2014. From micro to macro via production networks. Journal of Economic Perspectives 28 (4): 23–48.

Claessens, Stijn, Hui Tong, and Shang-Jin. Wei. 2012. From the financial crisis to the real economy: Using firm-level data to identify transmission channels. Journal of International Economics 88: 375–387.

Cloyne, James, Clodomiro Ferreira, Maren Froemel, and Paolo Surico. 2020. Monetary policy, corporate finance and investment. Journal of the European Economic Association. https://doi.org/10.1093/jeea/jvad009.

Cochrane, John, and Monika Piasezzi. 2002. The Fed and interest rates: A high-frequency identification. American Economic Review P &P 92 (2): 90–95.

Dao, Mai Chi, Camelia Minoiu, and Jonathan D. Ostry. 2021. Corporate investment and the real exchange rate. Journal of International Economics 131: 103437.

Dedola, Luca, Giulia Rivolta, and Livio Stracca. 2017. If the Fed sneezes, who catches a cold? Journal of International Economics 108: S23–S41.

Degasperi, Riccardo, Seokki Simon Hong, and Giovanni Ricco. 2021. The global transmission of US monetary policy. Mimeo: University of Warwick.

di Giovanni, Julian, and Andrei A. Levchenko. 2012. Country size, international trade and aggregate fluctuations in granular economies. Journal of Political Economy 120 (6): 1083–1132.

di Giovanni, Julian, and Galina Hale. 2022. Stock market spillovers via the global production network: Transmission of U.S. monetary policy. Journal of Finance 77 (6): 3373–3421.

di Giovanni, Julian, Andrei A. Levchenko, Andrei A. Levchenko, and Isabelle Mejean. 2014. Firms, destinations, and aggregate fluctuations. Econometrica 82 (4): 1303–1340.

di Giovanni, Julian, Andrei A. Levchenko, and Isabelle Mejean. 2018. The micro origins of international business cycle comovement. American Economic Review 108 (1): 82–108.

di Giovanni, Julian, Andrei A. Levchenko, and Isabelle Mejean. 2023. Foreign shocks as granular fluctuations. Forthcoming, Journal of Political Economy.

di Giovanni, Julian, Andrei A. Levchenko, Isabelle Mejean, Sebnem Kalemli-Özcan, Mehmet F. Ulu, and Yusef S. Baskaya. 2021. International spillovers and local credit cycles. Review of Economic Studies 89 (2): 733–773.

Dinlersoz, Emin, Şebnem Kalemli-Özcan, Henry Hyatt, and Veronika Penciakova. 2018. Leverage over the life cycle and implications for firm growth and shock responsiveness. NBER working paper 25226.

Durante, Annalisa Ferrando, and Philip Vermeulen Elena. 2022. Monetary policy, investment and firm heterogeneity. European Economic Review 148: 104251.

Eichenbaum, Martin, and Charles Evans. 1995. Some empirical evidence on the effects of shocks to monetary policy on exchange rates. Quarterly Journal of Economics 110 (4): 975–1009.

Fama, Eugene F., and James D. MacBeth. 1973. Risk, return, and equilibrium: Empirical tests. Journal of Political Economy 81 (3): 607–636.

Faust, Jon, and John H. Rogers. 2003. Monetary policy’s role in exchange rate behavior. Journal of Monetary Economics 50 (7): 1403–1424.

Faust, Jon, John H. Rogers, Eric T. Swanson, and Jonathan H. Wright. 2003. Identifying the effects of monetary policy shocks on exchange rates using high frequency data. Journal of the European Economic Association 1 (5): 1031–1057.

Fernández, Andrés, Michael W. Klein, Alessandro Rebucci, Martin Schindler, and Martin Uribe. 2016. Capital control measures: A new dataset. IMF Economic Review 64 (3): 548–574.

Freund, Caroline, and Martha Denisse Pierola. 2015. Export superstars. Review of Economics and Statistics 97 (5): 1023–1032.

Gabaix, Xavier. 2011. The granular origins of aggregate fluctuations. Econometrica 79 (3): 733–772.

Georgiadis, Georgios. 2016. Determinants of global spillovers from US monetary policy. Journal of International Money and Finance 67: 41–61.

Gertler, Mark, and Simon Gilchrist. 1994. Monetary policy, business cycles, and the behavior of small manufacturing firms. Quarterly Journal of Economics 109 (2): 309–340.

Gopinath, Gita, Sebnem Kalemli-Özcan, Loukas Karabarbounis, and Carolina Villegas-Sanchez. 2017. Capital allocation and productivity in south Europe. Quarterly Journal of Economics 132: 1915–1967.

Gulen, Huseyin, and Mihai Ion. 2016. Policy uncertainty and corporate investment. Review of Financial Studies 29 (3): 523–564.

Gürkayanak, Refet S., Brian Sack, and Eric T. Swanson. 2005. Do actions speak louder than words? The response of asset prices to monetary policy actions and statements. International Journal of Central Banking 1 (1): 55–93.

Han, Xuehui, and Shang-Jin. Wei. 2018. International transmissions of monetary shocks: Between a trilemma and a dilemma. Journal of International Economics 110: 205–219.

Jeenas, Priit. 2019. Firm balance sheet liquidity, monetary policy shocks, and investment dynamics. Mimeo, Universitat Pompeu Fabra.

Jordà, Òscar. 2005. Estimation and inference of impulse responses by local projections. American Economic Review 95 (1): 161–182.

Kalemli-Özcan, Sebnem. 2019. U.S. monetary policy and international risk spillovers. Federal Reserve Bank of Kansas City Jackson hole economic policy symposium.

Kearns, Jonathan, Andreas Schrimpf, and Fan Dora Xia. 2019. Explaining monetary spillovers: The matrix reloaded. Mimeo, Reserve Bank of Australia.

Kim, Soyoung, and Nouriel Roubini. 2000. Exchange rate anomalies in the industrial countries: A solution with a structural VAR approach. Journal of Monetary Economics 45 (3): 561–586.

Kiyotaki, Nobu, and John Moore. 1997. Credit cycles. Journal of Political Economy 105 (2): 211–248.

Melitz, Marc J. 2003. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71 (6): 1695–1725.

Miranda-Agrippino, Silvia. 2016. Unsurprising shocks: Information, premia, and the monetary transmission. Bank of England working paper.

Miranda-Agrippino, Silvia, and Hélène. Rey. 2020. US monetary policy and the global financial cycle. Review of Economic Studies 87 (6): 2754–2776.

Morais, Bernardo, José-Luis. Peydró, Jessica Roldán-Peña, and Claudia Ruiz-Ortega. 2019. The international bank lending channel of monetary policy rates and QE: Credit supply, reach-for-yield, and real effects. Journal of Finance 74 (1): 55–90.

Nakamura, Emi, and Jòn. Steinsson. 2018. High-frequency identification of monetary non-neutrality: The information effect. Quarterly Journal of Economics 133 (3): 1283–1330.

Obstfeld, Maurice. 2022. Uncoordinated monetary policies risk a historic global slowdown. Peterson institute for international economics, September 12, 2022.

Obstfeld, Maurice, and Kenneth Rogoff. 2000. The six major puzzles in international macroeconomics: Is there a common cause? NBER Macroeconomics Annual 15: 339–390.

Ottonello, Pablo, and Thomas Winberry. 2020. Financial heterogeneity and the investment channel of monetary policy. Econometrica 88 (6): 2473–2502.

Ramey, Valerie A. 2016. Macroeconomic shocks and their propagation. In Handbook of Macroeconomics, eds. John Taylor and Harald Uhlig, vol. 2, 71–162. Elsevier.

Ravn, Morten, and Martin Sola. 2004. Asymmetric effects of monetary policy in the United States. Federal Reserve Bank of St. Louis Review 86: 41–60.

Rey, Hélène. 2013. Dilemma not trilemma: The global financial cycle and monetary policy independence. Federal Reserve Bank of Kansas City Jackson hole economic policy symposium.

Rey, Hélène. 2016. International channels of transmission of monetary policy and the Mundellian trilemma. IMF Economic Review 64 (1): 6–35.

Rogers, John H. 1999. Monetary shocks and real exchange rates. Journal of International Economics 48: 269–88.

Rogers, John H., Chiara Scotti, and Jonathan H. Wright. 2014. Evaluating asset-market effects of unconventional monetary policy: A multi-country review. Economic Policy 29: 749–799.

Shambaugh, Jay C. 2004. The effect of fixed exchange rates on monetary policy. Quarterly Journal of Economics 119 (1): 301–352.

Swanson, Eric T. 2021. Measuring the effects of federal reserve forward guidance and asset purchases on financial markets. Journal of Monetary Economics 118: 32–53.

Timmer, Marcel P., Erik Dietzenbacher, Bart Los, Robert Stehrer, and Gaaitzen J. de Vries. 2015. An illustrated user guide to the world input-output database: The case of global automotive production. Review of International Economics 23 (3): 575–605.

Wei, Shang-Jin. 2022. The risk of competitive interest rate hikes. Project Syndicate, September 8, 2022.

Wei, Shang-Jin., and Yinxi Xie. 2020. Monetary policy in an era of global supply chains. Journal of International Economics 124 (2): 283–296.

Acknowledgements

We would like to thank the editor (Prachi Mishra), our discussant (Shang-Jin Wei), two anonymous referees, and participants at the IMF 23rd Jacques Polak Annual Research Conference Honoring Maurice Obstfeld for their insightful comments. All remaining errors are our own. We are grateful to Wenchuan Dong, Neel Lahiri, and Yijing Ren for excellent research assistance. The views expressed herein are those of the authors and not necessarily those of the Federal Reserve Banks of New York or any other person affiliated with the Federal Reserve System.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Prepared for the IMF 23rd Jacques Polak Annual Research Conference Honoring Maurice Obstfeld.

Appendices

Appendix 1: Additional Figures

See Figures 2, 3, 4, 5, 6, 7 and 8.

Alternative U.S. monetary policy shocks: Nakamura and Steinsson. Notes: This figure plots the annual aggregate of the policy news shock constructed by Nakamura and Steinsson (2018) (updated)

Alternative U.S. monetary policy shocks: Swanson’s forward guidance. Notes: This figure plots the annual aggregate of the forward guidance factor estimated by Swanson (2021)

European monetary policy shocks. Notes: This figure plots the annual aggregate of the pure European monetary policy shock constructed by Bu et al. (2021)

Estimated coefficient on U.S. monetary policy shock leaving out one year. Notes: This figure plots the estimated \(\beta\) obtained from estimating Equation (1) multiple times leaving out one year’s worth of observations at a time. The left-out year is indicated on the horizontal axis

Cumulative impulse responses for investment, sales, and employment of a one percentage point contraction in U.S. monetary policy. Notes: This figure plots the cumulative impulse response function of a one percentage point contraction in U.S. monetary policy (Bu et al. 2021) for a investment ratio, b sales ratio, and c log employment (in millions). Estimation is based on local projection method (Jordà 2005) of the baseline regression (1) with \(h = 0, \ldots , 3\), controlling for firm-level fixed effects. 90% confidence intervals are plotted in dashed lines, and regressions are clustered at the firm and year levels

Heterogeneous impact of trade exposure on the transmission of U.S. monetary policy shocks across countries. Notes: This figure plots coefficients for the trade exposure interaction with the monetary policy shock from regression (2) (\(\beta _2\)) where we allow the coefficient to vary across countries. Panel (a) plots the coefficients for the ‘TotExp/Out’ variable interaction, panel (b) for the ‘FinExp/Out’ variable interaction, panel (c) for the ‘IntExp/Out’ variable interaction, and panel (d) for the ‘WtOutdeg’ variable interaction. All regressions were run with firm controls and country\(\times\)year fixed effects, and with clustering at the firm and year levels. The blue standard error bounds are for the 95% level

Heterogeneous impact of financial constraints on the transmission of U.S. monetary policy shocks across countries. Notes: This figure plots coefficients for the financial constraint interaction with the monetary policy shock from regression (3) (\(\beta _2\)) where we allow the coefficient to vary across countries. Panel (a) plots the coefficients for the ‘Size’ variable interaction, while panel (b) plots the coefficients for the ‘Net Worth’ variable interaction. All regressions were run with firm controls and \(\hbox {country}\times \hbox {sector}\times \hbox {year}\) fixed effects, and with clustering at the firm and year levels. The blue standard error bounds are for the 95% level

Appendix 2: Additional Tables

See Tables 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26 and 27.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.