Abstract

This paper sheds light on the impact of global macroeconomic uncertainty on the euro area economy. We build on the methodology proposed by Jurado et al. (Am Econ Rev 105(3):1177–1216, 2015) and estimate a global measure of economic uncertainty using data for fifteen large euro area trade partners and the euro area. Our measure displays a clear counter-cyclical pattern and lines up well to a wide range of historical events generally associated with heightened uncertainty. In addition, following Piffer and Podstawski (Econ J 128(616):3266–3284, 2018), we estimate a proxy SVAR where we instrument uncertainty shocks with changes in the price of gold around specific past events. We find that global uncertainty shocks have historically been important drivers of fluctuations in euro area economic activity, with one standard deviation increase in the identified uncertainty shock subtracting around 0.12 percentage points from euro area industrial production in the first months following the shock.

Similar content being viewed by others

Notes

The exposition below draws substantially on JLN and Redl (2017) who also extends their procedure to a global context. We depart from Redl (2017) in what the methodology employed to estimate the global factor is concerned, through an innovation which allows us to obtain a more precise estimate of the factor which in our case is orthogonal to country-specific uncertainty measures.

Relaxing this assumption does not substantially alter the estimation of the uncertainty measures.

Following JLN, the stochastic volatility parameters are estimated using Markov chain Monte Carlo (MCMC) methods with the STOCHVOL package in R using the ancillarity-sufficiency interweaving approach discussed in Kastner and Frühwirth-Schnatter (2014).

In “Appendix B.1” we show how alternative methods used to construct the global uncertainty measure compare with our preferred method.

Similarly, the measure by Ahir et al. (2022), based on the frequency of the word “uncertainty” in the quarterly Economist Intelligence Unit country reports, shows more spikes than our baseline measure.

The original proxy ended in 2015M6, while the new one lists events up until end 2019.

One alternative proxy excludes events originated in the euro area and in the UK and is shown in Fig. 3. Incidentally, considering the events included in our list, this corresponds to removing all events originated in the pre-Brexit European Union. Notwithstanding, in the reminder of the paper, we will refer to this proxy as “excluding euro area and UK events".

More formally, in order to identify a structural shock \(\epsilon ^{k}_{t}\), the valid instrument \(Z_{t}\) simultaneously needs to satisfy the two conditions:

$$\begin{aligned} E(Z_t \epsilon ^{k}_{t} ) \ne 0, \end{aligned}$$(7)$$\begin{aligned} E(Z_t \epsilon ^{\setminus k}_{t} ) = 0, \end{aligned}$$(8)Results for the exogeneity test of the proxy constructed excluding euro area-specific events can be found in “Appendix D”.

The identification of the model’s shocks using a Cholesky decomposition of the covariance matrix of the VAR reduced-form residuals is considered standard in the literature, see for example Bloom (2009) and JLN.

Specifically, the optimisation has been implemented using the toolbox command options.max_minn_hyper.

Please note that a larger value for the parameters implies a tighter prior. The default value of the parameters are set in the toolbox following Chris Sims’ codes. See footnote 4, p. 9 in the toolbox manual.

References

Adina, P., and F.R. Smets. 2010. Uncertainty, risk-taking, and the business cycle in Germany. Economic Studies 56: 596–626.

Ahir, H., N. Bloom, and D. Furceri. 2022. The world uncertainty index (29763). https://ideas.repec.org/p/nbr/nberwo/29763.html.

Baker, S.R., and N. Bloom. 2013. Does uncertainty reduce growth? Using disasters as natural experiments. In NBER working papers 19475, National Bureau of Economic Research, Inc. https://ideas.repec.org/p/nbr/nberwo/19475.html.

Baker, S.R., N. Bloom, and S.J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131(4): 1593–1636.

Baumeister, H. 2019. Structural interpretation of vector autoregressions with incomplete identification: Revisiting the role of oil supply and demand shocks. American Economic Review 12(2): 1–43.

Baumeister, C., and P. Guérin. 2020. A comparison of monthly global indicators for forecasting growth. In CAMA working papers 2020-93, centre for applied macroeconomic analysis. Crawford School of Public Policy, The Australian National University. https://ideas.repec.org/p/een/camaaa/2020-93.html.

Belke, A., and T. Osowski. 2019. International effects of euro area versus U.S. policy uncertainty: a FAVAR approach. Economic Inquiry 57(1): 453–481.

Berger, T., S. Grabert, and B. Kempa. 2017. Global macroeconomic uncertainty. Journal of Macroeconomics 53(C): 42–56.

Bloom, N. 2009. The impact of uncertainty shocks. Econometrica 77(3): 623–685.

Bonciani, D., and M. Ricci. 2020. The international effects of global financial uncertainty shocks. Journal of International Money and Finance 109: 205–216.

Breitung, J., and S. Eickmeier. 2014. Analyzing business and financial cycles using multi-level factor models. In Discussion papers 11/2014. Deutsche Bundesbank. https://ideas.repec.org/p/zbw/bubdps/112014.html.

Caldara, D., C. Fuentes-Albero, S. Gilchrist, and E. Zakrajšek. 2016. The macroeconomic impact of financial and uncertainty shocks. European Economic Review 88(C): 185–207.

Canova, F. 2007. Bayesian time series and DSGE models, from methods for applied macroeconomic research. In Methods for applied macroeconomic research. Introductory chapters. Princeton University Press. https://ideas.repec.org/h/pup/chapts/8434-11.html.

Canova, F., and F. Ferroni. 2020. A hitchhiker guide to empirical macro models. CEPR discussion papers 15446, C.E.P.R. Discussion papers. https://ideas.repec.org/p/cpr/ceprdp/15446.html.

Carrière-Swallow, Y., and L.F. Céspedes. 2013. The impact of uncertainty shocks in emerging economies. Journal of International Economics 90(2): 316–325.

Carriero, A., T.E. Clark, and M. Marcellino. 2020. Assessing international commonality in macroeconomic uncertainty and its effects. Journal of Applied Econometrics 35(3): 273–293.

Carriero, A., T.E. Clark, and M. Marcellino. 2021. Using time-varying volatility for identification in vector autoregressions: An application to endogenous uncertainty. Journal of Econometrics 225(1): 47–73 (themed Issue: Vector Autoregressions).

Cuaresma, J.C., F. Huber, and L. Onorante. 2019. The macroeconomic effects of international uncertainty. In Working paper series 2302. European Central Bank. https://ideas.repec.org/p/ecb/ecbwps/20192302.html.

Decker, Haltiwanger, R.S. Jarmin, and J. Miranda. 2020. Changing business dynamism and productivity: Shocks versus responsiveness. American Economic Review 110(2): 3952–3990.

Forni, M., L. Gambetti, and L. Sala. 2020. Macroeconomic uncertainty and vector autoregressions. Center for Economic Research (RECent) 148, University of Modena and Reggio E., Dept. of Economics "Marco Biagi". https://ideas.repec.org/p/mod/recent/148.html.

Gertler, M., and P. Karadi. 2015. Monetary policy surprises, credit costs, and economic activity. American Economic Journal: Macroeconomics 7(1): 44–76.

Giannone, D., M. Lenza, and G.E. Primiceri. 2015. Prior selection for vector autoregressions. The Review of Economics and Statistics 97(2): 436–451.

Gieseck, A., and Y. Largent. 2016. The impact of macroeconomic uncertainty on activity in the euro area. Review of Economics 67(1): 25–52.

Gilchrist, S., and E. Zakrajsek. 2012. Credit spreads and business cycle fluctuations. American Economic Review 102(2): 1692–1720.

Imbs, J. 2003. Trade, finance, specialization and synchronization. CEPR Discussion Papers 3779, C.E.P.R. Discussion Papers. https://ideas.repec.org/p/cpr/ceprdp/3779.html.

Jarociński, Karadi. 2020. Deconstructing monetary policy surprises—The role of information shocks. American Economic Journal: Macroeconomics 12(2): 1–43.

Jurado, K., S.C. Ludvigson, and S. Ng. 2015. Measuring uncertainty. American Economic Review 105(3): 1177–1216.

Kastner, G., and S. Frühwirth-Schnatter. 2014. Ancillarity-sufficiency interweaving strategy (ASIS) for boosting MCMC estimation of stochastic volatility models. Computational Statistics & Data Analysis 76(C): 408–423.

Kose, M.A., C. Otrok, and C.H. Whiteman. 2003. International business cycles: World, region, and country-specific factors. American Economic Review 93(4): 1216–1239.

Ludvigson, S.C., S. Ma, and S. Ng. 2021. Uncertainty and business cycles: Exogenous impulse or endogenous response? American Economic Journal: Macroeconomics 13(4): 369–410.

Mertens, K., and M.O. Ravn. 2013. The dynamic effects of personal and corporate income tax changes in the United States. American Economic Review 103(4): 1212–1247.

Miescu, M. 2019. Uncertainty shocks in emerging economies. Technical reports.

Miranda-Agrippino, S., and H. Rey. 2020. U.S. monetary policy and the global financial cycle. The Review of Economic Studies 87(6): 2754–2776. https://doi.org/10.1093/restud/rdaa019.

Mumtaz, H., and A. Musso. 2019. The evolving impact of global, region-specific, and country-specific uncertainty. Journal of Business & Economic Statistics. https://doi.org/10.1080/07350015.2019.1668798.

Mumtaz, H., and K. Theodoridis. 2017. Common and country specific economic uncertainty. Journal of International Economics 105(C): 205–216.

Ozturk, E.O., and X.S. Sheng. 2018. Measuring global and country-specific uncertainty. Journal of International Money and Finance 88(C): 276–295.

Pfarrhofer, M. 2019. Measuring international uncertainty using global vector autoregressions with drifting parameters. Papers 1908.06325. https://ideas.repec.org/p/arx/papers/1908.06325.html.

Piffer, M., and M. Podstawski. 2018. Identifying uncertainty shocks using the price of gold. Economic Journal 128(616): 3266–3284.

Ramey, Vine. 2011. Oil, automobiles, and the US economy: How much have things really changed? NBER Macroeconomics Annual 25(2): 1–43.

Raïsa, B., and L. Geert. 2014. Recent changes in saving behaviour by Belgian households: The impact of uncertainty. Technical report.

Redl, C. 2017. The impact of uncertainty shocks in the United Kingdom. Bank of England working papers 695, Bank of England. https://ideas.repec.org/p/boe/boeewp/0695.html.

Stephanie, D., and P. Kannan. 2013. The impact of uncertainty shocks on the UK economy. In Working paper 13/66, IMF. https://www.imf.org/en/Publications/WP/Issues/2016/12/31/The-Impact-of-Uncertainty-Shocks-on-the-UK-Economy-40380.

Stock, J.H., and M.W. Watson. 2012. Disentangling the channels of the 2007–09 recession. Brookings Papers on Economic Activity 43(1): 81–156.

Wu, J.C., and F.D. Xia. 2016. Measuring the macroeconomic impact of monetary policy at the zero lower bound. Journal of Money, Credit and Banking 48(2–3): 253–291.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The views expressed in this paper belong to the authors and are not necessarily shared by the European Central Bank and the OECD. The authors would like to thank seminar participants at the ECB and anonymous referees for their useful comments and suggestions.

Appendices

A. Appendix

1.1 A.1. Data Sources

This section lists both the global and the country specific series used to construct our global measure of uncertainty. In addition, for each series we provide the code used to stationarise the series. The coding scheme used is detailed in Sect. A.2.

Brazil Capacity Utilization (SA %), Real Turnover in Manufacturing (SA,2006=100), Retail Sales (SA, 2014=100), Exports of goods (SA, Mil.US$),Imports of goods(SA, Mil.US$), Hours worked in Production (SA, 2006=100), Business Confidence Index (SA, Dec-01=100), Monetary Base (EOP, SA, Mil.Reais), Selic Target Interest Rate (EOP %) Foreign Exchange Rate Commercial Bid(Avg, Reais/US$), Total Private Sector credit growth (EOP, NSA, Mil.R$),Total Public Sector credit growth (EOP, NSA,Mil.R$), Stock Price Index Bovespa (29Dec1983=100).

Transformation: [1,5,5,5,5,5,1,2,6,2,5,6,6,5].

Canada Terms of Trade (SA, 2010=100), All Industries GDP(SAAR, Mil.Chn.2012.C$), Employment Rate(SA, %) Actual Hours Worked(SA, Thous.Hrs), Dwelling Starts(SAAR, Thous.Units) , Real Shipments in Manufacturing(SA, Mil.2012.$), New Motor Vehicle Sales(NSA, Units), Wholesale Sales(SA, Thous.C$), Residential and Nonresidential Building Permits(SA, Thous.C$), Total Merchandise Exports(NSA, Thous.C$), Total Merchandise Imports(NSA, Thous.C$), Chain Fisher BoC Commodity Price Index(NSA, Jan-72=100), Car and Truck Production (NSA, Units), Target Rate (average, percent), Bank of Canada Rate (AVG, %) 3-Month Treasury Bill Tender(AVG, %), 10-Year and Over Bond Yield(Monthly Avg, %), US Dollar Exchange Rate (Avg, C/US), S &P/TSX Composite, Close, Consumer Credit at Month-End(EOP, SA, Mil.C$),Business Credit(SA, Mil.C$),M1+ (SA, Mil.C$), M1++ (SA, Mil.C$), M1B (SA, Avg, Mil.C$), M2 (SA, Avg, Mil.C$) M1 Component Currency Outside Banks (Avg/Weds, SA, Mil.C$).

Transformation: [5,5,1,5,5,5,5,5,5,5,5,5,5,6,6,6,6,6,2,2,2,2,2,1,5,5,6].

Switzerland Exports [Chained] (SA, 1997=100), Imports [Chained] (SA, 1997=100), Overnight Stays (NSA, Nights), Central Government Finance Expenses (NSA, Mil.Francs), Unemployment Rate (SA,%), SNB Business Cycle Index (%), Business Surveys Business Climate (SA,%), Business Surveys Business Plans (SA,%), Business Survey Order Books Assessment (SA,%), Business Surveys Expected Orders Inflow Next 3 Months (SA, %), Business Survey Export Order Books Assessment (SA, %), KOF Economic Barometer (LT AVG, 2009-2018=100), Sentix Overall Economic Index (NSA, %Bal), Consumer Price Index (NSA, Dec-15=100),Producer Price Index All Items (NSA, Dec-15=100),Export Price Index (NSA, Dec-15=100),Import Price Index (NSA, Dec-15=100), Money Supply, M1 (NSA,EOP, Mil.Francs),Money Supply M3 (NSA,EOP, Mil.Francs), Domestic Bank Loans Credit Lines (EOP, NSA, Mil.CHF), Domestic Bank Loans to Households Credit Lines (EOP, NSA, Mil.CHF), Total Bank Loans to Nonfinancial Corporations Credit Lines (EOP, NSA, Mil.CHF), Swiss Market Index (AVG, Jun-30-88=1500), 10-Year Government Bond Yield (AVG, %), Nominal Effective Exchange Rate (NSA, Dec-00=100), PMI Manufacturing (SA, 50+=Expansion), PMI Manufacturing Output (SA, 50+=Expansion).

Transformation: [5,5,5,5,2,1,1,1,1,1,1,5,5,5,5,5,5,6,6,6,6,6,5,2,5,1,1].

China Merchandise Exports, fob (NSA, Mil.US$), Merchandise Imports, cif (NSA, Mil.US$), Retail Sales (NSA, Y/Y %change),Investment in Fixed Assets (YTD, NSA, Y/Y %Chg), Real Industrial Value Added (NSA, Y/Y %Chg), Consumer Confidence (NSA, 100+=Optimistic, Money Supply M2 (EOP, SA, Bil.Yuan),Monetary Authority: Reserve Money (EOP, SA, 100 Mil.Yuan),90-day Interbank Rate (Weighted Avg, % per annum),Total Loans (EOP, NSA, 100 Mil.Yuan).

Transformation: [5,5,1,1,1,5,6,6,1,5].

Denmark Retail Trade excl Motor Veh & Motorcycles (SA, 2015=100), New Passenger Car Registrations (SA, Units),Export Volume Index (NSA, 2015=100),Import Volume Index (NSA, 2015=100), Industrial Confidence Indicator (SA, % Bal),Consumer Confidence Indicator (NSA, %Bal), Harmonized Consumer Price Index (NSA, 2015=100), OMX Copenhagen Stock Exchange Share Prices (Dec-31-95=100), Government Bonds [Redemption Yield] (% per annum), Manufacturing PMI (SA, 50+=Expansion), PMI Manufacturing Output (SA, 50+=Expansion), PMI Manufacturing New Orders (SA, 50+=Expansion).

Transformation: [5,5,5,5,1,1,5,5,2,1,1,1].

Euro area HICP Consumer Prices(SA, 2015=100), Industrial Production Industry Including Construction (SWDA, 2015=100), Industrial Production Manufacturing (SWDA, 2015=100), Unemployment Rate (SA, %), Industrial Turnover in Manufacturing (SWDA, 2015=100), Retail Trade Excluding Autos & Motorcycles (SWDA,2015=100), Consumer Confidence Indicator (SA, %), Industrial Confidence Indicator (SA, %), Money Supply M1 (EOP, SWDA, Bil.EUR),Money Supply M2 (EOP, SWDA, Bil.EUR), Money Supply M3 (EOP, SWDA, Bil.EUR), Sales & Securitization Adjusted Lons(EOP, SWDA, Bil.EUR), 3-Months EURIBOR (%), 10-Year Government Benchmark Bond Yield (AVG, %), EURO STOXX Price Index (Dec-31-91=100), PMI Manufacturing (SA, 50+=Expansion).

Transformation: [5,5,5,2,5,5,1,1,5,5,5,5,2,2,5,1].

India Industrial Production (SA, Apr.11-Mar.12=100),Merchandise Imports, c.i.f. (SA, Mil.US$),Money Supply M1 (EOP, SA, Bil.Rupees), JPMorgan Real Broad Effective Exchange Rate Index (2010=100),Rupee/US$ Exchange Rate (AVG), Stock Price Index NSE 500 (AVG, 1994=1000), 91-Day Treasury Bill Implicit Cut-Off Yield (% per annum), 364-Day Treasury Bill Implicit Cut-Off Yield (% per annum), 10-Year Government Bond Yield (EOP, % per annum), Money Supply M3 (EOP, SA, Bil.Rupees), Reserve Money (EOP, SA, 10 Mil.Rupees), Commercial Banks Loan to Deposit Ratio (EOP, %).

Transformation: [5,5,5,6,6,5,5,5,2,2,2,5,6,6,2].

Japan Consumer Confidence Index, Small Business Sales Forecast (Diffusion Index),Real Synthetic Consumption Index (SA, 2011=100), New Motor Vehicle Registrations (Thous Units),Machinery Orders Received (SA, Mil.Yen), Mining and Manufacturing Production (SA, 2015=100),Operating Rate in Manufacturing (SA, 2015=100) Real Imports (SA, 2015=100),Capital Goods Producers shipments (SA, 2015=100), Durable Consumer Goods Producers shipments (SA, 2015=100), New Housing Construction Started (SA, Mil.Sq.Meters), Total Employed (SA, 10,000 Persons), Unemployment Rate (SA, %), Ratio of Active Job Openings to Applications (SA, Ratio), Real Effective Foreign Exchange Rate (2010=100),General Consumer Price Index (NSA, 2015=100), CPI Ku-area of Tokyo(NSA, 2015=100),Building Starts Nonresidential (NSA, Bil.Yen), Housing Starts New Construction (SA, Thous Units), Machinery Orders Received (SA, Mil.Yen), Spot Exchange Rate Yen/US$ (AVG, Yen/US$),Average Contract Rate on Total Loans of Domestic License Banks (%), Average Contracted Rate on Long-Term Loans of Domestic Licensed Banks (%), Average Interest Rate on New Loans & Discounts of Domestic licensed Banks (NSA, %), Average Interest Rate on New short-term Loans & Discounts (%), 10-Year Benchmark Government Bond Yield (AVG, % p.a.),Nikkei Stock Average (EOP, Yen).

Transformation: [1,1,5,5,5,5,2,5,5,5,5,5,5,2,2,5,5,5,5,5,2,2,2,2,2,2,5].

South Korea Coincident Composite Index (SA, 2015=100), Merchandise Exports (SA, Bil.Won), Merchandise Imports (SA, Bil.Won), All industries Shipments (SA, 2015=100), All Industries inventories (SA, 2015=100), Retail Sales Volume Index (SA, 2015=100), Registered Motor Vehicles: Passenger Cars (EOP, NSA, Units),Unemployment (SA, Thous), All Industry Production including Construction (SA, 2015=100) Manufacturing Industrial Production (NSA, 2015=100),Bank of Korea Base Rate (% per annum), Interest Rates on to Corporations (% per annum),Interest Rates on New Loans to Households (% per annum), Basic US$ Rate (Avg, Won/$),Reserve Money (Avg, SA, Bil.Won), Stock Price Index Korea Composite [KOSPI] (Jan-04-80=100), MSCI Share Price Index (US$,AVG, Dec-87=100).

Transformation: [5,5,5,5,5,5,5,5,5,5,2,2,2,1,6,5,5].

Mexico Economic Activity Indicator (SWDA, 2013=100), Industrial Production (SA, 2013=100), Industrial Production of Primary Metal Manufacturing (SA, 2013=100),Industrial Production of Utilities (SA, 2013=100), Industrial Production of Electric Power Generation, Transmiss & Distribution, Retail Sales Volume, Exports, fob (SA, Mil.USD), Imports, fob (SA, Mil.USD), Nonpetroleum Exports (SA, Mil.USD), Worker’s Remittances (NSA, Mil.USD), JPMorgan Real Broad Effective Exchange Rate Index, PPI Based (2010=100), Exchange Rate (NewPeso/US), Stock Price Index IPC, 91-Day Treasury Certificates [CETES] (%), 364-Day Treasury Certificates [CETES] (%), Coincident Index IMSS Insured Workers (NSA, LT Avg=100), Consumer Price Index (NSA, Jul 16-31 2018=100), Consumer Price Index (NSA, Jul 16-31, 2018=100), CPI of Food, Beverages & Tobacco (NSA, Jul 16-31 2018=100), Final Goods Domestic Demand (NSA, Jul-19=100), Monetary Aggregates M1 (EOP, SA, Mil.Pesos).

Transformation: [5,5,5,5,5,5,5,5,5,2,2,5,5,5,5,5,5,5,2,5,6].

Poland: Manufacturing Index of Overall Economic Climate (SA, % Bal), Retail Sales in Constant Prices (SA, 2015=100), Industrial Production excluding Construction (NSA, 2015=100), Industrial Production in Manufacturing (NSA, 2015=100), Construction & Assembly Production (SA, 2015=100), Housing Dwellings Completed (SA, Units), JPMorgan Real Broad Effective Exchange Rate Index PPI Based (2010=100), Money Supply Narrow Money M1 (EOP, SA, Mil.Zloty), Money Supply Broad Money M2 (EOP, SA, Mil.Zloty), Money Supply M3 (EOP, SA, Mil.Zloti), Average Paid Employment Enterprise Sector (SA, 2010=100), Total Exports fob (SA, Mil.Zloty), Total Imports, cif (SA, Mil.Zloty).

Transformation: [2, 5, 5, 5, 5, 5, 5, 6, 6, 6, 5, 5, 5].

Sweden Retail Trade Volume Excl Fuel (SA, 2015=100), New Car Registrations (NSA, Units), Merchandise Exports (TC, Mil.Kronor), Merchandise Imports (TC, Mil.Kronor), PMI in Manufacturing (SA, 50+=Expansion), Manufacturing Production (SA, 50+=Expansion), PMI Manufacturing New Orders (SA, 50+=Expansion), PMI Manufacturing Export Orders (SA, 50+=Expansion), Economic Tendency Indicator (NSA, Mean Value=100), Confidence Indicator of Total Industry (SA, 100=Mean), Consumer Confidence Indicator (SA, 100=Mean), Harmonized Consumer Price Index (NSA, 2015=100), Producer Price Index (NSA, 2015=100), Total Agriculture and Industry Less Construction exports(NSA, 2015=100), Total Agriculture and Industry Less Construction imports (NSA, 2015=100), Money Supply M1, Money Supply M3 (EOP, Mil.Kronor), MFI Loans to Households (EOP, % per annum), Outstanding MFI Loans to Nonfinancial Corporations (% per annum), Outstanding Bank Deposit Rates for Households (% per annum), Outstanding Bank Deposit Rates for Nonfinancial Corporations (% pa), Stock Price Index Stockholm Affarsvarlden (AVG, Dec-29-95=100), Government Bond Yield: 10-year (% p.a.),JP Morgan Nominal Broad Effective Exchange rate (2010=100).

Transformation: [5, 5, 5, 5, 1, 1, 1, 1, 5, 5, 5, 5, 5, 5, 5, 6, 6, 2, 2, 2, 2, 5, 2, 5].

UK Industrial Production (SA, 2018=100), Industrial Production in Manufacturing (SA, 2018=100), Index of Services Total Service Industries (SA, 2018=100) Exports Goods (SA, Mil.Pounds), Imports Goods (SA, Mil.Pounds), Retail Sales Volume Retailing including Auto Fuel(SA,2018=100), Unemployment Claimant Count Rate (SA, %), Employment (SA, Thous), Unemployment Rate Aged 16 and Over (SA, %), CBI Industrial Trends Current Total Order Book(% Balance), Mortgage Loans Approved for House Purchase (SA, Number), Consumer Credit Net Change (SA, Mil.GBP), London Interbank Offered Rate [LIBOR], Sterling 3 Month (AVG, %), Government Securities Real Forward Yields, 10-Year (AVG, %), Exchange Rate (US$/GBP), FTSE All Share Price Index (Avg, Apr-10-62=100), Money Supply M1 Amount Outstanding (EOP, SA, Mil.GBP), Money Supply M2 Amount Outstanding (EOP, SA, Mil.GBP), Money Supply M3 (EOP, SA, Mil.GBP), Money Supply M4 Amount Outstanding (EOP, SA, Mil.GBP), MFI Net Lending to nonfinancial corporation (EOP, NSA, Mil.GBP), Government Bonds, 10-Year Zero Coupon Nominal Yields (Average, %), London Interbank Offered Rate [LIBOR] Sterling (AVG, %), PMI Manufacturing Output (SA, 50+=Expansion), PMI Services Business Activity (SA, 50+=Expansion, PMI Construction (SA, 50+=Expansion).

Transformation: [5,5,5,5,5,5,2,5,2,1,1,5,1,2,2,5,5,6,6,6,6,5,5,2,1,1,1].

USA Industrial Production Index (SA, 2012=100),Manufacturing New Order of Nondefense Capital Goods ex Aircraft (SA, Mil.$), PMI Composite Index (SA, 50+ = Econ Expand), Services PMI Composite Index (SA, 50+=Increasing), Retail Sales & Food Services (SA, Mil.$), Light Weight Vehicle Sales (SAAR, Mil.Units), University of Michigan Consumer Sentiment (NSA, Q1-66=100), S &P CoreLogic Case-Shiller Home Price Index (NSA, Jan-00=100), Housing Starts (SAAR, Thous.Units), Civilian Unemployment Rate (SA, %), All Employees Total Nonfarm (SA, Thous), Exports FAS Value (SA, Mil.Chn.2012$), Imports Customs Value (SA, Mil.Chn.2012$), CPI All Items (NSA, 1982-84=100), CPI All Items Less Food and Energy (NSA, 1982-84=100) PCE Chain Price Index (SA, 2012=100), NAR Total Existing Home Sales, USA (SAAR, Thous), FHFA House Price Index (SA, Jan-91=100), New Orders of All Manufacturing Industries (SA, Mil.$), Conference Board Consumer Confidence (SA, 1985=100), Real Personal Income (SAAR, Bil.Chn.2012$), Real Personal Consumption Expenditures (SAAR, Bil.Chn.2012$), Federal Funds effective Rate (% p.a.), 3-Month Nonfinancial Commercial Paper (% per annum), Bank Prime Loan Rate (% p.a.), 10-Year Treasury Note Yield at Constant Maturity (% p.a.), Money Stock M1 (SA, Bil.$), Contract Rates on Commitments: Conventional 30-Yr Mortgages (%), Dow Jones 30 Industrial Stocks Average Price Close (AVG, May-26-1896=40.94),Standard & Poor’s 500 Composite (1941-43=10), ACM Fitted Yield 10 Year (AVG, %), Commercial Paper Outstanding (EOP, SA, Bil.$), Break-Adjusted Consumer Credit Outstanding (EOP, SA, Bil.$), All Commercial Banks Loan to Deposit Ratio (%), Home Builders Housing Market Index (SA, All Good = 100), NFIB Small Business Optimism Index (SA, 1986=100).

Transformation: [5,1,1,1,5,5,5,5,5,2,5,5,5,5,5,5,5,5,5,5,5,5,5,2,2,2,2,5,6,2,5,5,2,6,6,2,5,5].

Russia Exports of Goods fob (SA, Mil.US$),Imports of Goods, fob (SA, Mil.US$), Retail Trade Volume Index (SA, 2000=100),Unemployment Rate, ILO Concept (SA, %),MOEX Russia Index Closing Value (AVG, Sep-22-97=100), Money Supply M2 (EOP, SA, Bil.RUB),Central Bank of Russia Policy Rate (EOP,%),Government Bond Zero Coupon Yield Curve 10-Year (AVG, % p.a.),Private Sector Credit (EOP, NSA, Mil.RUB), PMI Manufacturing (SA, 50+=Expansion),EMBI Plus Sovereign Spread (bp).

Transformation: [5,5,5,2,5,5,6,2,5,5,1,5].

Turkey Imports volumes (SA, 2010=100), CPI Based Real Effective Exchange Rate (2003=100), Industrial Production (SWDA, 2015=100), Total Vehicle Production (NSA, Units), Exports volumes (SA, 2010=100), Financial Account Excluding Reserve Assets (NSA, Mil.US$), Money Supply M3, (EOP, SA, Mil.TL), Reserve Money (EOP, SA, Thous.TL), BIST 100 Composite Stock Price Index (AVG, Jan-01-86=.01), EMBI Plus Sovereign Spread (bp).

Transformation: [5,5,5,5,5,2,6,6,5,5].

Global Global PMI Composite Output (SA, 50+=Expansion),Global PMI Composite New Orders (SA, 50+=Expansion),Euro Area PMI Manufacturing New Orders (SA, 50+=Expansion),Federal Funds Effective Rate (% p.a.), World Industrial Production ex Construction (SWDA,2010=100),Dow Jones Global Index World (Avg, Dec-31-91=100), European Brent Spot Price FOB ($/Barrel),Emerging Markets Share Price Index (EOP, Dec-31=100),OECD Total Consumer Price Index (NSA, 2015=100),OECD Total Retail Sales Volume (SA, 2015=100),Average Spot Price: Crude Oil Brent (US$/Barrel),Average Price Natural Gas Europe (US$/Mil.BTU),World Bank Comm Price Index for Emerging Countries of Agriculture (2010=100),World Bank Comm Price Index for Emerging Countries of Energy (2010=100),EU27 Industrial Production in Manufacturing (SWDA, 2015=100), CBOE Market Volatility Index (Index), ISM Composite Index (SA,>50=Increasing), Industrial Production Index (SA, 2012=100),Retail Sales & Food Services (SA, Mil.$),All Employees Total Nonfarm (SA, Thous), Housing Starts (SAAR, Thous.Units), ISM Manufacturing PMI Composite Index (SA, 50+=Increasing).

Transformation: [1,1,1,1,5,5,5,5,5,5,5,5,5,5,5,1,1,5,5,5,5,5,1,1,1,1,1,1,1].

1.2 A.2. Transformation Methods

In order to enter the factor model, variables need to be stationary. Thus, all series used to construct the uncertainty measure have been suitably transformed using the following scheme:

-

Code (1) level \(X_{i,t}^{T} = X_{i,t}\)

-

Code (2) \(\Delta\) level \(X_{i,t}^{T} = X_{i,t} - X_{i,t-1}\)

-

Code (3) \(\Delta ^{2}\) level \(X_{i,t}^{T} = \Delta ^{2}X_{i,t}\)

-

Code (4) \(\ln\): \(X_{i,t}^{T} = \ln X_{i,t}\)

-

Code (5) \(\Delta \ln\): \(X_{i,t}^{T} = \ln X_{i,t} - \ln X_{i,t-1}\)

-

Code (6) \(\Delta ^{2} \ln\): \(X_{i,t}^{T} = \Delta ^{2}\ln X_{i,t}\)

where \(X_{i,t}^{T}\) is the transformed variable and \(X_{i,t}\) is the variable i observed at time t.

B. Appendix

1.1 B.1. Alternative Methods to Construct the Global Uncertainty Index

In this section, we show two alternative methods to construct the global uncertainty index and how they compare to our preferred measure. Specifically, we consider (i) a simple average of the identified uncertainty series to obtain country-specific uncertainty measures i and a simple average of those individual country measures to obtain a global measure, (ii) a simple average of the identified uncertainty series to obtain country-specific uncertainty measures for each country i and a weighted average of individual country measures employing GDP at purchasing power parity weights to obtain the global measure. The two methods are described in details below:

Method (i) Having obtained an uncertainty measure for each single series \(u_{j,i,t}\), we compile country measures i by taking a simple average across all country-specific series:

Global measures are then aggregated using simple averages across country-specific measures:

where K is equal to the number of countries in our data set, namely 16.

Method (ii) Country-specific uncertainty measures are constructed as in Method (i), but the global measure is aggregated using GDP at purchasing power parity weights:

where K, is equal to the number of countries in our data set, namely 16, and \(\omega _{i,t}\) are time-varying GDP weights.

In Fig. 8, our three measures of global economic uncertainty are plotted and juxtaposed against a variety of events commonly associated with elevated uncertainty, including the 9/11 attacks, the Iraq war, the failure of Lehman Brothers, the euro area sovereign debt crisis as well as the 2016 US presidential election. All measures are lining up reassuringly well with these events, with the escalating trade tensions between the USA and China marking the latest increase at the end of our sample period.

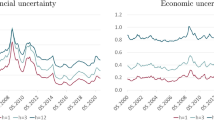

1.2 B.2. Country-Specific Measures

The focus of the paper is to construct a global measure of uncertainty. However, following the methods sketched in Sect. B.1 is it possible to obtain country-specific measures which however strongly co-move with our global measure of uncertainty. Specifically, Fig. 9 shows individual country measures of uncertainty obtained following JLN and Redl (2017) as defined in Eq. B.1, against the country-specific uncertainty measures obtained from Eq. 3 and the baseline global uncertainty measure obtained following the same method. Those measures generally react to events that are likely to be associated with increases in global or local uncertainty. For example, in the USA and in its trading partners, including Canada, China, Japan and Mexico, uncertainty rose in response to the assertive trade policies of the Trump administration. Likewise, challenges to implement the Brexit referendum results lifted uncertainty in the UK in 2018. In the group of emerging markets, Turkey experienced a steep rise in uncertainty in mid-2018 on the back of political tensions that also triggered financial market stress and large capital outflows. In the case of Brazil, uncertainty increased in the run-up to the presidential elections of October 2018.

Country-specific Macroeconomic Uncertainty Measures. Notes: Measures are standardised. Data are monthly and span the period 2000:7 to 2019:12. The red and blue lines show, respectively, our baseline global uncertainty measure and the country-specific uncertainty measures obtained using our baseline factor model. The black line shows country-specific uncertainty measures obtained using equal weights across all \(u_{i,j,t}\) - Method (i) and (ii)

Our analysis also suggests that during periods of global stress and in their immediate aftermath, movements in uncertainty tend to be synchronised across countries. This is in line with recent evidence in the literature that deepening global financial integration over the last 30 years has increased the exposure of individual countries to common financial shocks (Miranda-Agrippino and Rey 2020). The results generally point to a co-movement of country-specific uncertainty indicators with the global common factor, particularly around large-scale systemic events like the global financial crisis, when most countries in our sample experienced a surge in uncertainty. However, they also highlight the importance of idiosyncratic factors in shaping uncertainty in individual countries. It is interesting to note that country-specific uncertainty measures change along with the estimation method. For example, following equation 3, country-specific factors are by construction orthogonal to the global factor. Thus, we observe that countries with a high load on the global factor, such as the USA, are only mildly correlated with measures constructed on the basis of Methods (i) and (ii). This reflects the fact that in countries with a strong global influence, uncertainty gets picked up by the global factor.

1.3 B.3. Data and BVAR Model

Table 3 lists the variables used in our baseline proxy SVAR, their description and source.

The model is estimated with Bayesian techniques using the Empirical Macro Toolbox developed by Canova and Ferroni (2020). The prior considered is a Minnesota prior implemented through dummy observations with the prior for the “own-lag” parameter centred at 0 to reflect the stationary data processes featuring in our setup. Hyperparameters have been chosen to maximise the marginal data density, as described in Canova (2007) and Giannone et al. (2015).Footnote 14 The optimisation is performed with the default optimiser cminwel.m developed by Chris Sims. This yields a value of 3.8 for the overall tightness (default value of 3), 1.5 for the prior tightness on the lags greater than one (default value of 0.5), and 2 for the scalar controlling the prior on the covariance matrix (default value 2).Footnote 15 We do not use the “co-persistence” or “sum-of-coefficients” priors. The BVAR has been estimated using 12 lags. The lag length does not affect substantially our results; impulse responses from alternative robustness exercises with different lags specifications are available upon request.

Additional Robustness Tests

This section contains additional robustness checks and material that do not form part of the main sections of the paper (Figs. 10, 11, 12, 13, 14, 15, 16, 17, 18, 19).

Instrument Variable and Cholesky Decomposition, Alternative Ordering. Notes: Impulse responses to a one standard deviation increase in the identified shock to global uncertainty. The shaded areas show 68% credibility intervals. Variables order for the Cholesky identification is IP, CPI, interest rate, Unemployment, Uncertainty, Equity prices

Baseline model: Variables in levels. Notes: Impulse responses to a one standard deviation increase in the identified shock to global uncertainty. The shaded areas show 68% credibility intervals. The Minnesota prior for the “own-lag” parameter is centred at 1. Hyperparameters have been chosen to maximise the marginal data density as described in “AppendixB” Sect. B.3. For variables in levels we use the “co-persistence” and “sum-of-coefficients” priors. The values of the hyperparameters are the following: 2.8 for the scalar controlling the overall tightness, 1.5 for the scalar controlling the prior tightness on the lags, 3.3 for the scalar controlling the Sum-of-Coefficient prior, 3.7 for the scalar controlling the co-persistence prior and 3 for the scalar controlling the prior on the covariance matrix

Uncertainty Aggregation with PPP GDP Weights. Notes: Impulse responses to a one standard deviation increase in the identified shock to global uncertainty. The shaded areas show 68% credibility intervals. Equity prices, IP, CPI and Unemployment are in \(\Delta \ln\). The policy rate and the uncertainty measure enter in levels

Uncertainty Aggregation with Equal Weights. Notes: Impulse responses to a one standard deviation increase in the identified shock to global uncertainty. The shaded areas show 68% credibility intervals. Equity prices, IP, CPI and Unemployment are in \(\Delta \ln\). The policy rate and the uncertainty measure enter in levels

Different proxy: Excluding euro area events from baseline proxy. Notes: Impulse responses to a one standard deviation increase in the identified shock to global uncertainty. The shaded areas show 68% credibility intervals. Equity prices, IP, CPI and Unemployment are in \(\Delta \ln\). The policy rate and the uncertainty measure enter in levels

Different proxy: Constructed as a dummy equal to 1 for each event for which the price of gold reacted positively. Notes: Impulse responses to a one standard deviation increase in the identified shock to global uncertainty. The shaded areas show 68% credibility intervals. Equity prices, IP, CPI and Unemployment are in \(\Delta \ln\). The policy rate and the uncertainty measure enter in levels

Different proxy: Constructed as a dummy equal to 1 for every identified event. Notes: Impulse responses to a one standard deviation increase in the identified shock to global uncertainty. The shaded areas show 68% credibility intervals. Equity prices, IP, CPI and Unemployment are in \(\Delta \ln\). The policy rate and the uncertainty measure enter in levels

Different proxy: All events collected by Piffer and Podstawski (2018). Notes: Impulse responses to a one standard deviation increase in the identified shock to global uncertainty. The shaded areas show 68% credibility intervals. Equity prices, IP, CPI and Unemployment are in \(\Delta \ln\). The policy rate and the uncertainty measure enter in levels

Different proxy: All events collected by Piffer and Podstawski (2018) excluding those originated in the euro area. Notes: Impulse responses to a one standard deviation increase in the identified shock to global uncertainty. The shaded areas show 68% credibility intervals. Equity prices, IP, CPI and Unemployment are in \(\Delta \ln\). The policy rate and the uncertainty measure enter in levels

C. Appendix: Robustness of the Proxy

For robustness, we performed exogeneity and relevance tests also considering the proxy that excludes euro area- and UK-specific events. As indicated in Table 4 the correlation of the proxy with other structural shocks confirms the exogeneity of the instrument also in the case we drop European events. In addition, looking at the relevance test, this modified proxy seems even more correlated with our uncertainty measure and the VIX than the proxy that includes all events as shown in Table 5. However, given the low number of events left if we exclude euro area and UK events and our belief that euro area-specific events do have an impact on global uncertainty and thus need to be considered in our analysis, we decided to keep the original proxy as our baseline.

D. Appendix: List of Events Employed to Construct the Proxy

Table 6 shows the events used for the construction of the baseline proxy in chronological order. Events used for the baseline proxy are indicated with a 1 in the third column, while events which are originated either in the euro area or in the UK are marked in blue. Those events are removed from the baseline proxy in the construction of an alternative proxy. We also construct a proxy which includes all the events identified by Piffer and Podstawski (2018), namely considering also the events with a zero in the third column and also for this proxy we provide a robustness check by removing euro area- and UK-specific events.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.