Abstract

The power of an inverted yield curve to predict recessions is widely discussed in the financial press, yet most undergraduate textbooks provide little discussion of this stylized fact. This paper fills this gap by extending a 3-equation textbook model to include an accessible treatment of a term structure of interest rates formed by the one-period policy rate and a two-period rate that obeys the Fisher Equation. The Phillips curve features partially anchored adaptive expectations, while financial markets and the central bank have perfect foresight. Using this framework, we show that raising the policy rate in response to an inflation shock inverts the yield curve. Whether this inversion foreshadows a recession, however, depends on the bank’s monetary policy rule, which we illustrate using numerical examples. In particular, we show that, with anchoring and an output-gap averse central bank, inflation can stabilize and the yield curve can invert without an ensuing recession.

Similar content being viewed by others

Notes

See Wheelock and Wohar (2009) for a detailed survey of the empirical literature. Note that the 2019 yield curve inversion in Fig 1 correctly predicted the Covid recession by sheer chance, and thus offers very little informational content for the issues we are addressing, since no one would think financial markets predicted the pandemic.

A temporary inflation shock is equivalent to a temporary supply shock. Should instructors choose, the model can also easily accommodate a temporary demand shock. A positive demand shock would create an increase in inflation and a policy response using the original IS curve to determine the appropriate interest rates, treating a temporary demand shock as a one-period shift in the IS curve.

The quadratic loss function shows that the central bank experiences symmetric utility losses due to both positive or negative deviations from both its inflation and employment targets. To derive the monetary rule, one can set up the central bank’s loss minimization exercise, which involves minimizing losses (described by the loss function) subject to its constraints (namely, the Phillips curves, which describe the combinations of output and inflation available for any given level of expected inflation). The monetary rule comes out of the first order condition for this minimization exercise. For further details see, for example, pages 111-113 of Carlin & Soskice [2014].

To clarify, if we measured gap aversion absolutely using βπ and βy so that β=βπ/βy, this case would arise when the weight applied to the output gap is zero.

Because we assume \(\chi =0.5\), the Phillips curve will have shifted halfway back to its original position in \(t=1\).

If you expand the no-arbitrage condition and rearrange a little you get \(2i+\left(1+{i}^{2}\right)={i}^{P}+{i}_{+1}^{P}+(1+{i}^{P}{i}_{+1}^{P})\). The items placed in parenthesis very nearly cancel out.

Unconventional monetary policies like Quantitative Easing are aimed at these term premia. Conventional monetary policy works by exploiting the expectational component of the yield curve elaborated in this paper.

This interest rate (\({r}_{n}\)) goes by other names, including the natural rate, the neutral rate, or sometimes just \({r}^{*}\).

The implicit value of the slope term in the Phillips curve is \(\alpha =0.2\) and the implicit IS curve is \({y}_{+1}=100-5r\) (measuring rates using percentages rather than decimals).

References

Adrian, Tobias, Arturo Estrella, and Hyun Song Shin. 2010. Monetary cycles, financial cycles, and the business cycle. Federal Reserve Bank of New York Staff Report no. 421.

Ball, Laurence M. and Sandeep Mazumder. 2011. Inflation dynamics and the Great Recession. National Bureau of Economics Research Working Paper No. w17044.

Bauer, Michael D. Bauer and Thomas M. Mertens. 2018. Economic forecasts with the yield curve. Federal Reserve Bank of San Francisco Economic Letter 2018-07.

Bernard, Henri, and Stefan Gerlach. 1998. Does the term structure predict recessions? The international evidence. International Journal of Finance & Economics 3(3): 195–215.

Blanchard, Olivier. 2017. Macroeconomics, 7th ed, London: Pearson.

Blanchard, Olivier. 2021. Macroeconomics, 8th ed, London: Pearson.

Blinder, Alan. 2023. Landings, soft and hard: The Federal Reserve, 1965–2022. Journal of Economic Perspectives 37(1): 101–120.

Bosner-Neal, Catherine, and Timothy R. Morley. 1997. Does the yield spread predict real economic activity? A multicountry analysis. Federal Reserve Bank of Kansas City 82(Q III): 37–53.

Carlin, Wendy, and David Soskice. 2005. The 3-equation new Keynesian model—A graphical exposition. Contributions to Macroeconomics 5(1): 13.

Carlin, Wendy, and David Soskice. 2006. Macroeconomics: Imperfections, institutions and policies. New York: Oxford University Press.

Carlin, Wendy, and David Soskice. 2014. Macroeconomics: Institutions, instability, and the financial system. New York: Oxford University Press.

Coy, Peter 2022. A strong signal that recession is looming. The New York Times, December 21.

Davis, Leila, and Leopoldo Gómez-Ramírez. 2022. Teaching post-intermediate macroeconomics with a dynamic 3-equation model. The Journal of Economic Education 53(4): 348–367.

Estrella, Arturo. 2005. Why does the yield curve predict output and inflation? The Economic Journal 115(505): 722–744.

Estrella, Arturo, and Gikas A. Hardouvelis. 1991. The term structure as a predictor of real economic activity. The Journal of Finance 46(2): 555–576.

Estrella, Arturo, and Frederic Mishkin. 1996. The yield curve as a predictor of US recessions. Current Issues in Economics and Finance. https://doi.org/10.2139/ssrn.1001228.

Fontana, Giuseppe, and Mark Setterfield. 2009. Macroeconomic theory and macroeconomic pedagogy. New York: Springer.

Harvey, Campbell. 1989. Forecasts of economic growth from the bond and stock markets. Financial Analysts Journal 45(5): 38–45.

Lavoie, Marc. 2015. Book review: Carlin, Wendy and David Soskice (2015): Macroeconomcis: Institutions, instability and the financial system, Oxford UK (638 pages, softcover, Oxford University Press, ISBN 978-0-19-965579-3). European Journal of Economics and Economic Policies: Intervention 12 (1): 135-142.

Michl, Thomas R., and Kayla M. Oliver. 2019. Combating hysteresis with output targeting. Review of Keynesian Economics 7(1): 6–27.

Rudebusch, Glenn, and John C. Williams. 2009. Forecasting recessions: the puzzle of the enduring power of the yield curve. Journal of Business & Economic Statistics. 27 (4): 492–503.

Wheelock, David C., and Mark Wohar. 2009. Can the term spread predict output growth and recessions? A survey of the literature. Federal Reserve Bank of St. Louis Review 91(5): 419–440.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Solving for the Policy Rate

Appendix: Solving for the Policy Rate

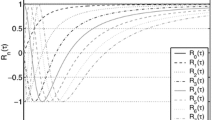

Now as promised, we can outline the mathematical procedure the central bank will use to set the sequence of policy rates in the soft-landing case. Using the yield curve and iterating forward from \(t=0\), we can solve for the initial policy rate:

Moreover, we know that \(i={\uppi }^{F}\) since \(r=0\), and that \({\uppi }^{F}=3/{2}^{t}\) by virtue of our assumption that \(\chi =1/2\) and the fact that \({\uppi }_{0}^{F}=3\). Substituting and simplifying gives:

Taking the limit of the right-hand side as \(T\to \infty\), recalling that the terminal \({i}^{P}\) is assumed to be zero, and recognizing that the alternating converging series sums to 2/3 gives us the solution \({i}_{0}^{P}=4\). We can then calculate the sequence \({\left\{{i}^{P}\right\}}_{1}^{T}\) by using the yield curve.

Instructors hoping to generate more general numerical examples can automate recursive methods like this using a spreadsheet. The key is recognizing that the terminal value of the policy rate is a parameter.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Davis, L., Michl, T.R. The Inverted Yield Curve in a 3-Equation Model. Eastern Econ J 50, 195–212 (2024). https://doi.org/10.1057/s41302-024-00264-7

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41302-024-00264-7