Abstract

The Euro and the RMB are both relatively new currencies traded on the global foreign exchange market. While the Euro was introduced in 2001, China started cross-border settlement in RMB in 2009. We analyse the evolution of Euro trading based on data from the BIS triennial survey and compare the patterns to the experience of RMB internationalization. We find that—similar to the RMB—Euro trading displayed some convergence to the geographical pattern of all currencies in the first years of its existence. Thereafter, the convergence process appears to have come to halt. We document that the determinants of Euro trading include links to offshore trading centres, economic and institutional characteristics, but these turn out to be rather unstable over time. The RMB, in comparison, displays a clear convergence pattern and is more strongly influenced by policies and recent trade disputes. Furthermore, we compare the geographical dispersion of Euro trading to the previous D-Mark period and to other commonly used international currencies. These results help to interpret the evidence on initial convergence as a rebound effect from a decline in the international use of the D-Mark during the 1990s.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The Euro and the Renminbi (RMB) are two currencies that are relatively new on the worldwide foreign exchange market. For the RMB, this is due to a major policy change that occurred in 2009; for the Euro, this is due to the establishment as a new currency formed by initially eleven Euro Area countries that in the meantime have grown to include 19 members. Do these two currencies have a common geographical dispersion pattern across offshore trading centres? Are there common determinants, and do policies matter for their relative position vis-à-vis other currencies? In this paper, we address these questions by analysing the BIS triennial survey on currency trading that covers a cross section of up to 39 non-Euro-Area countries.

In the literature, the currency trading of the RMB has already received quite a bit of attention. In particular, Cheung et al. (2017, 2019, 2021) have used the same dataset to report the evolution of RMB dispersion across trading centres for the 2013–2016 and 2016–2019 periods, respectivelyFootnote 1. The empirical approach used in these papers will also be pursued in the present article. In the papers by Cheung et al., it is postulated that in the longer term the share of RMB trading will converge to a steady state value. This steady state is reached when the share of RMB traded in a given market is proportional to the relative size of that market in the global foreign exchange market. In all periods, though with different external control variables, there is overwhelming evidence that this convergency hypothesis is supported by the data.

Also, for the Euro, the internationalization debate has been accompanying the currency since its establishment. In an early contribution, Portes and Rey (1998) have argued that the Euro is “expected to challenge the Dollar supremacy”, based on its GDP size and role in international tradeFootnote 2. After 20 years of existence, these expectations have not materialized and the debate is more focused on the question of why the Euro has not achieved a more prominent stance. Ilzetzki, Reinhart and Rogoff (2020) put it aptly when they argue that the Euro is still “punching below its weight”Footnote 3. These studies are considering for instance the bid-ask spreads, reserve holdings, or discuss the political dimensions of monetary policy and the slow steps forward towards a banking unionFootnote 4. The strong position of the Dollar vis-à-vis the Euro, based on data by the BIS triennial survey, has been highlighted by Kenen (2011) and a comprehensive overview of the Euro’s evolution is given in ECB (2021). Hudecz et al. (2021) discuss possible policies that would further strengthen the role of the Euro on international capital markets and refer to the RMB experience in their analysis.

Earlier econometric research on Euro trading has been focusing on higher frequencies. Using data from a major electronic brokerage platform Brzeszczynski and Melvin (2006) have analysed the rise and fall of Euro trading from 1999 to 2003. The authors use daily, weekly and intra-daily data to illustrate that momentum and carry-trade motives have been driving factors during this period. However, a longer-term analysis of turnover data, analogous to the RMB trading analysis of Cheung et al. (2019), has so far not been conducted yet.

The core of the empirical analysis is the link between the change in currency trading of the Euro/RMB and a gap-variable, which covers the difference between the levels of Euro/RMB and all currencies traded in that market. Suppose for instance an offshore trading centre has a 5% share of all currencies traded on the global foreign exchange market, but the share of Euros traded is only 2%. The prediction would be that the Euro-trading share over the following 3-year period would go up, such that the gap between all currencies traded and the Euro trading would be closed over time on that offshore trading centre. A second key explanatory variable is the change in all currencies traded. If the change in Euro/RMB trading has reached a more mature stage, i.e. it is closer to its long-term equilibrium, the convergence process is expected to come to halt, and the change in all currencies is expected to be the most relevant determining factor for the change in either Euro, RMB or indeed any other currency.

While a significant gap-variable is a well-established result in the literature for the RMB, we do not find a robust comparable counterpart in the Euro data, except for the initial period of 2001–2004, right after the introduction of the Euro. Instead, the second variable, the change in the share of all currencies, dominates the regression. This is true for the size of the coefficient, its statistical significance, and its contribution to the R-square of the regression. Economically, we attribute this central result to the fact that the Euro, while new on the global foreign exchange market, is the successor of more established currencies, such as the D-Mark, Lira, or Peseta. In particular, the D-Mark has been widely used as an international currency, but due to the uncertainty about the modalities of the changeover, it lost popularity in many countries during the 1990s. Thus, the initial strong evidence on convergence for the Euro is likely to be a rebound effect from the D-Mark losing ground in currency trading during the previous decade.

Several further exercises shed light on the Euro-trading pattern and its geographical dispersion across trading centres. For instance, we analyse several sets of control variables that include the links to the Euro Area and economic and institutional characteristics of offshore trading centres. In the most recent 2016–2019 period, a dummy variable for the existence of a bilateral swap-line and a dummy variable for Eastern Europe (where some countries expect to introduce the Euro in the future), are significantly positive determinants. There is also some limited evidence that institutional characteristics, such as the distinction between a banks-based vs. market-based financial system, the colonial history, and legal origin play a role. Our overall conclusion regarding the control variables, however, is that they are neither stable over time, nor have a sizeable impact on the overall fit of the regression. This contrasts with earlier results for the RMB in Cheung et al. (2021), who document that the bilateral trade with offshore centres, as well as trade dispute episodes and their interaction with the bilateral trading volume, play an important role for the RMB.

A second striking difference between the two currencies is the initial conditions at the beginning of the sample period. While the RMB was overrepresented, i.e. the “gap” to the share of all currencies was positive, not negative, in only 3 out of 51 offshore trading centres (Hong Kong, Korea, and Singapore), this was the case in 14 of out 37 offshore financial centres in the Euro benchmark regression. We therefore analyse whether these initial conditions matter, and indeed find that there is substantially more evidence of convergence for the Euro as well, when over- and underrepresented markets are distinguished. Again, the evidence is not stable over time, but generally, there is more convergence from below the equilibrium share than from above. This distinction also matters for the pre-Euro D-Mark period, where we find that in the 1990s, the D-Mark was losing ground in both types of centres. In those markets where the D-Mark was overrepresented, it was losing ground, and in the market where it was initially underrepresented, it was falling behind even further in some of the sub-periods.

Finally, we also analyse other currencies that from an institutional and economic perspective might be more similar to the Euro than the Renminbi, i.e. the US Dollar, the British Pound, the Canadian Dollar, the Swiss Franc, the Japanese Yen, and the Australian Dollar. These currencies—except for the Canadian Dollar—do not show any sign of convergence at all. The Australian Dollar was even diverging from the equilibrium most recently, possibly due to the popularity of the currency during the most recent global financial crisis in 2007/2008. In earlier sub-periods, there are—similar to the Euro—occasional periods with significant convergence terms. But unlike the RMB and the early period of the Euro, the marginal R-square of the gap-variable is almost always practically zero. Also, the change in the share of all currencies, the second main variable in the regression, explains close to 100% of the variance in most of these other countries. This is a remarkable difference to the RMB, where the marginal R-square of the gap-variable alone is about 20%.Footnote 5

Summing up, in the comparison of the Euro and the RMB, there are both similarities and differences. The similarity is the convergence phenomenon at the beginning of the period. Here the dynamics of the Euro trading are reminiscent of those experienced by the RMB. Another common observation is the time-varying nature of determining factors. In this perspective, the results blend into earlier findings reported in Cheung and Yiu (2017), Cheung et al. (2019) and Cheung et al. (2021). The differences can be found in the patterns after the initial convergence period, as well as with regard to policy variables. While Euro-trading appears to be largely driven by market forces, the RMB-trading has been shown to react to policies and episodes of trade disputes. Overall, in our regressions, the Euro displays a more similar behaviour to established currencies on international markets, like the Swiss Franc, the Canadian Dollar or the Australian Dollar.

The remainder of the paper is organized as follows: In “The Evolution of Euro and Renminbi Currency Trading” section, we start by eyeballing the data and discussing the historical evolution of Euro and RMB trading. Empirical Analyses starts with a benchmark regression for the period 2016–2019, then adds control variables and traces the evolution of the convergence term over time. It also compares the Euro findings to those earlier reported on the RMB. Finally, in the extended analysis in “Extended Analysis” section, we distinguish between the pattern from above/below the equilibrium, present the results for the earlier D-Mark period and draw the analogies to other countries.

The Evolution of Euro and Renminbi Currency Trading

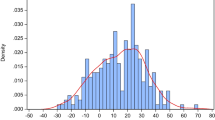

The starting point of the empirical analysis is a graphical illustration of currency trading in Euro and RMB over the past 30 years. Regarding the RMB, two observations are clear which have shaped the empirical literature up this point: First, it is a relatively new currency on the foreign exchange market, as reflected by the first significant deviation from zero around the year 2010. As elaborated on in detail in Cheung et al. (2021) this period coincides with the first pilot cross-border trade settlement scheme and China’s implementation of several policy initiatives to facilitate the international use of the RMB, including the establishment of clearing banks, bilateral swap lines, and investment quotas (RQFII)Footnote 6. In the following years, the RMB has proceeded to establish itself rapidly, gaining a share of 4–5% of global currency trading in recent years. This observation has motivated researchers to think about the geographical dispersion process as a convergence phenomenon that starts in an underrepresented status quo and approaches an equilibrium value at a point where the share of RMB resembles the share of all currencies traded in any particular market.

The Euro and its predecessors, on the other hand, experienced substantial ups and downs for at least two decades earlier. When we look at the pre-Euro period first, it is clear to see that the D-Mark has been by far the internationally most traded currency among the initial Euro−11 group. This observation matches early studies of the Bundesbank that regularly surprised in that the amount of currency put in circulation far exceeds the changes that could be rationalized by GDP changes or movements in interest rates. Seitz et al. (1995) and Sinn and Westermann (2001) have attributed this phenomenon to the popularity of the D-Mark as a second currency in other countries. Throughout the 1980s and into the early 1990s, this helps to explain the considerable increase in pre-Euro currency trading, and also its marked declined beginning in the early and mid−1990s. The uncertainties that were associated with the exact modalities and the exchange rates have contributed to both a strong decline of D-Mark cash (M0) in and outside Germany, as documented in Sinn and Westermann (2001), and were visible in BIS Data on currency trading. Key dates in this evolution were the Maastricht Treaty in 1992, which for the first time included a clear roadmap to a common currency, and the summit in Dublin in 1995, where the irreversible conversion rates from old currencies into Euro were agreed uponFootnote 7. When the Euro was finally introduced in 1999 (initially as a virtual currency, later in 2001 as a physical currency), the market share of the underlying currencies had been reduced from 50% to about 40%, and that of the D-Mark share had been reduced from 40 to 30%.

The evolution of the Euro has been comparably stable thereafter. In the first decade of its existence, it was floating around 35–40% of all currency trading and declined to just above 30% of global currency trading after the global financial crisis in 2010. Of course, when interpreting these numbers, one needs to keep in mind that there are always two currencies involved in each trade, and therefore the sum of all shares goes up to 200%, not 100%. Accordingly, each of these numbers is not as large as it looks at first sight.

Empirical Analyses

A Benchmark Regression

We start by analysing the most recent BIS triennial survey (Bank for International Settlements 2019) that covers the period from 2016 to 2019Footnote 8. The basic regression equation is taken from Cheung et al. (2019) and includes the following key variables:

The dependent variable is \(\Delta\)Yi,19 ≡ Yi,2019 − Yi,2016 which denotes the change in the share of Euro trading in the i-th financial centre from 2016 to 2019. Yi,2019 is the financial centre’s i’s share of offshore Euro trading as measured by the ratio of its average daily Euro turnover to the average global offshore daily Euro turnover.

The key explanatory variables are all constructed from the same BIS survey. First, \(\Delta\) Xi,19 ≡ Xi,2019 − Xi,2016, where Xi,2019 is the financial centre i’s share of 2019 global currency trading given by the ratio of its average daily FX turnover to the global FX turnover. It is intended to capture the change in the relative position of the respective financial centre on the worldwide FX market.

Secondly, the convergence towards the global FX trading pattern is captured by Zi,16 ≡ Yi,2016 − Xi,2016. It represents the gap between financial centre i’s share of offshore Euro trading and its share of global FX trading. This is our main variable of interest. If Yi,2016 < Xi,2016

and correspondingly, Zi,16 < 0, it means that in this financial centre, the Euro is underrepresented. If Zi,16 > 0, then the Euro’s share traded in that centre is larger than the share of all currencies traded in that centre, and the Euro would be considered overrepresented. In the later part of the regression analysis, we will control for these two cases. In both cases, we expect a negative sign of the coefficient, if the share of Euro trading convergences to the share of all currencies traded in this market. If the sign of the β-coefficient is negative, the gap—from either side—will be closed in the sample periodFootnote 9.

Finally, the variable Wi,16 gives jurisdiction i’s Euro turnover as a share of its total FX turnover. We include it to account for the relative importance of the Euro in the i’s market in the beginning of the period.

The empirical results are reported in Table 1. We start by including each of the variables individually and then jointly. Focusing on the individual variables first, we already observe a first striking difference to the results reported on RMB trading in the literature, as the variable \(\Delta\) Xi,19 is not just the only significant variable, but also by itself accounts for 84% of the variation in the dependent variable, \(\Delta\)Yi,19. It seems that the size of the respective market, relative to the word FX market is by far the most important determinant of Euro currency trading. Both other variables are statistically insignificant at conventional levels, also when included jointly. The variable Zi,16 that is intended to capture the convergence effect, in Column (4) has the expected negative sign. But unlike the reported corresponding parameters for the RMB in Cheung et al. (2019) and (2021), it is not statistically significant in this first parsimonious setup. Of course, the latter observation may be due to other control variables being missing. In the next section, we follow up on this possibility in an extended multiple regression setupFootnote 10.

Further Control Variables

In this section, we extend to basic regression equation to include further control variables, which we classify in three categories, (i) links to the Euro Area (Ti,19), (ii) economic characteristics of financial centres (Ui,19) and (iii) institutional characteristics (Vi,19)Footnote 11. The extended regression equation is:

The sets of variables (i–iii) are first added to the regression individually, then jointly as a group, and finally as a full set, which is reduced to the set of significant variables in a stepwise regression approach.

Links to the Euro Area

Table 2 reports the set of variables that is intended to capture the links between the Euro Area and the offshore financial centres. Typical variables used in the literature are the bilateral trade (BTi,19), the logged distance to the Euro Area, the existence of a bilateral swap-line between the ECB and the respective trading centre’s central bank, and whether the financial centre has signed a free trade agreement with the EU. From Table 2, we see that most of these control variables are statistically insignificant and add little to the explanatory power of the regression. In column 6, where we add all variables at the same time, we see that only bilateral trade and swap-line variables are statistically significant. Both enter with a positive sign, i.e. they have a positive impact on the amount of Euro currency trading in the financial centre. Looking at the individual contributions to the R-square of the regression, as reported in columns (1–6), it is clear, however, that only the swap-line variable also leads to a sizeable increase in the R-square, from 0.86 (see Table 2, Column (4)), to 0.90. All other variables together only add a further one per cent of the total variance that can be explained. As the variable \(\Delta\) Xi,19 by itself already has an R-square of 0.84, the additional contributions of control variables can be viewed as extremely small. Interestingly in the last column of Table 2, the convergence term Zi,16 has become larger in size and has become statistically significant. In the following tables, we will be monitoring if this result stabilizes when further controls are added, or not.

Economic Characteristics of Financial Centres

In Table 3, we add the next set of control variables that are intended to capture the economic characteristics of the offshore financial centres. These control variables include GDP growth, equity market capitalization and international bond market capitalization (both relative to GDP), and the degree of financial development. When adding these variables to the regression equation jointly, none of them is statistically significant. Also, when looking at the individual contributions, in Columns (1−5), none of them adds substantially to the R-square of the regression. Individually, only the international bond market capitalization is statistically significant, but with a puzzling negative signFootnote 12. It would imply a larger international bond market, correlated with less Euro trading. The same negative sign—although only significant at 10%—is also observable on the equity market capitalization variable. A possible explanation could be that the Euro Area is widely considered to be a “bank-based” economy, while other countries are classified as “market-based” economies. This would explain why a currency from a bank-based economy is less traded in a market-based financial centre. This hypothesis will be followed up in the next table that focuses on the institutional characteristics of the offshore financial centres.

Institutional Characteristics of Financial Centres

In Table 4, we consider the following set of financial centre characteristics: First, we add a dummy variable for Eastern European. This dummy is intended to capture the historically close link between these countries and the Euro Area. Historically, the D-Mark has been used in several Eastern European countries as a second currency. Also, in some countries, the degree of Euroization is quite high, as they anticipate being future members of the EMU. This dummy variable has indeed a positive sign but is statistically insignificant. Secondly, we add variables to capture the colonial history of the financial centre as well as the legal origin. If the legal origin is either German or French, or if the financial centre has a colonial past with any of the Eurozone member countries, the dummy variable is one, and zero otherwise. Finally, to follow up on the results in the previous table, we add a dummy variable that is equal to one if the financial centre can be classified to be a bank-based systemFootnote 13. If it is market-based, the dummy variable is equal to zero. Similarly, to the previous tables, we find that all variables are statistically insignificant at conventional levels. The only variable that is significant at 10%, the legal origin, has the expected sign. However, when looking at the R-square, we see that only very little is added to explain the overall variation in the dataFootnote 14.

The Evolution of Currency Trading Over Time

In the previous section, we have found very little effects of either convergence or other external determining factors. The most important variable in the regression has been the size of the respective financial centre, captured by the variable \(\Delta\) Xi,t. So far, we have been focusing on the 2019 and 2016 surveys. In this section, we illustrate how the relationship has evolved over time. The results are reported in Table 5. In this table, we analyse all BIS triennial surveys dating back to 2001, albeit at different sample sizes, ranging from 34 trading centres in the period from 2001 to 2004 to a maximum of 39 trading centres in 2010–2013. Thereafter—due to some countries joining the Euro Area—the sample size decreases again to 37Footnote 15.

We start by considering the convergence parameter associated with the variable Zi,t−1. We see in Table 5 that this parameter is always negative, in all sample periods except 2013–2016. This means that a gap, either positive or negative, has been closed in nearly each of the sub-samples. The significance and size of the coefficient are quite different, however, from period to period. The largest and most highly significant parameter is in the first sample, directly after the establishment of the Euro as a new currency. Thereafter, the coefficient fluctuates in size, and is mostly insignificant, except for the 2007–2010 period, where it is significant at 5% and 2016–2019 period, where it is significant at 10%. The dominance of the \(\Delta\) Xi,t variable remains a feature of the data throughout the different time periods. Finally, in the period 2016–2019, the variable Wi,16 displays a negative sign and is statistically significant. It is included to account for the initial relative importance of Euro trading in the respective jurisdiction. Note, however, that the Wi,16 is statistically insignificant at conventional levels in all other regressions.

Regarding the other control variables, we aim to enhance the efficiency of the regression by performing a stepwise regression approach, where we eliminated the statistically most insignificant variable, and keep dropping them from the regression until only those variables remain in the specification that are significant at the conventional 5% level. We find that the effects described in the previous section are highly unstable over time and vary both with regard to their significance and with respect to the size and sign of the coefficient. For the further analysis, we will keep the significant control variables in the regression but will focus on other aspects of interest regarding the convergence pattern.

Similarities and Differences to Renminbi Trading

To highlight the similarities and differences between Euro and Renminbi trading, we reproduce Table 1 from “A Benchmark Regression” section for the RMB for the periods 2013–2016 and 2016–2019 in Table 6 and some of the results from Cheung et al. (2021) in Table 7. From these tables, some similarities, but also striking differences are noteworthy. First, in the 2016–2019 sample, the bilateral-trade variable and a trade dispute dummy variable have been important factors—this is the main theme of the Cheung et al. (2021) article, which discusses these findings in the light of the increasing trade dispute between China and several other countries, most prominently the United States. Without these control variables—as Columns (1) and (4) of Table 6 show—the convergence term Z is insignificant. While the bilateral trade variable (BTi,19) has a positive impact, though insignificant, the Dispute dummy variable has a significant negative impact, as illustrated in Columns (3) and (5) of Table 7—the latter is estimated without Hong Kong, by far the largest trading centre, and a potential outlier in the regression. Also, the interaction of the two variables is statistically significant and enters with a positive sign. This means that the negative impact of the trade dispute dummy variables is mitigated by a high volume of bilateral trade.

A first remarkable difference between the Euro and RMB dataset is that these external variables indeed play an important role in explaining the variation in the data. Individually, the basic variables \({Z}_{i,16}\), \(\Delta {X}_{i,19}\), and \({W}_{i,16}\) explain only 15% of the variance, and the external factors, \({D}_{i}\), BTi,19 and BTi,19*\({D}_{i}\) explain 45% of the variation, but jointly, the variables have an R-square of 70% (and 89% without Hong Kong). This suggests that beyond the market forces, geopolitical factors and their interaction with market forces are important to understanding the RMB trading pattern.

The second difference is regarding the convergence variable, Zi,16. In the full specifications (3) and (5), it is highly significant and has a coefficient larger than those previously reported for the Euro. Furthermore, when we drop the convergence variable from the specification, in columns (4) and (6), the R-square of the regression drops substantially to 0.51 (from 0.70) and 0.68 (from 0.89). Thus, the marginal R-square of the variable Zi,16 is quite sizeable, as it explains around 20% of the variance in the full specification with control variables. From the initial Table 1 we know that the marginal R-square of the same variable for the Euro is only 2%. In the appendix, Table 15, we show that marginal R-squares of Zi,t−1, for all sub-periods and find that the only sub-sample in which the Euro-convergence term even comes close to having a comparably sizeable impact is the very first sample window from 2001 to 2004, where the marginal R-square is 17%. In all other sub-samples, it fluctuates around 1%, up to at most 5% (in 2007–2010). Thus, as also anticipated from the graphical inspection above, the convergence dynamics play a much bigger role for the Renminbi than for the Euro.

A third difference is regarding the role of \(\Delta\) X. In the case of the Euro, it is always statistically significant and is one of the most important variables in the regression. In China, this is the case only for the 2013–2016 period, as reported in Column (5) of Table 6. In the more recent period, after the inclusion of the control variables, \(\Delta\) X becomes statistically insignificant.

Extended Analysis

Converging from Above or Below?

So far, we have been analysing the pattern of dispersion on Euro-currency trading following the same benchmark specification as in Cheung et al. (2019). However, one clear difference that emerged from the initial graphical inspection, is that the Euro has been an internationally much more established currency from the beginning in 2001. Thus, it might matter whether, at the beginning of each of the sub-samples, the Euro is already above the equilibrium amount of currency trading, i.e. Yi > Xi and correspondingly, Zi > 0. For the RMB, as a new emerging currency on the global FX market, this is hardly ever the case. The only markets where the RMB is overrepresented are Hong Kong, Singapore, and Korea. In all other markets Zi < 0, and the convergence pattern would be a convergence from below the long-term equilibrium value.

For the Euro, the situation is quite different. As the Euro has been introduced as a follow-up currency of initially 11 established currencies in Euro-Area countries, it is not surprising that in some markets, the share of Euro trading was above the share of all currencies being traded in that market. Accordingly, in these markets, a significant convergence term would imply a convergence from above, i.e. the Euro would be losing ground in a financial centre where it was initially overrepresented. In the 2016–2019 sample, for instance, that was the case in 14 out of the 37 financial centres. In Table 8, we control for this potential effect and investigate whether initially the above- and below status matters for the speed and significance of the convergence to the equilibrium value. Table 8 reports the results of the extended regression equation (3) and shows that this is indeed the case.

While the dummy variable Dummy_Zi,16, which is equal to one if Zi is larger than 0, and 0 otherwise, is mostly insignificant, except in the 2010–2013 sample, and there only at 10%, the interaction between the dummy and the Zi,t−1 variable matters in the 2010–2013 and the 2016–2019 sample. In both periods, the interaction term has a positive sign and is statistically significant at the 5 and 10% levels, respectively. The positive sign means that the convergence is mitigated in all financial centres where the Euro was already overrepresented—thus findings of a positively significant sign in two sub-periods are quite plausible. Also, it is interesting that in the presence of the dummy and interaction variables, the Z variable itself becomes larger and is statistically significant at the 1% level in 2001–2004 and at the 5% level in 2016–2019. In means that in the periods there has indeed been significant and sizeable convergence in those markets, where the Euro was still underrepresented.

To evaluate the positive sign on the interaction term and to compute the total effect in the overrepresented markets, we need to compute the sum of the coefficients on Zi,t−1 and Dummy Zi,t−1 * Zi,t−1 and evaluate the significance via a Wald-Test which is reported in the bottom of Table 8. Here the results differ in different sub-samples. In the initial period 2001–2004, convergence occurred both from above and from below. From above, however, the convergence occurred at a considerably reduced speed, as the sum of the coefficients is only about half as large, although still significant at the 1% level. In the 2007–2010 period, we only see a convergence from above, as the Wald-Test is statistically significant at the 5% level, and the sum of the coefficients is negative. The Z variable by itself, however, is not significant. In 2010–2013, the interaction term is so strongly positive that the sum of the two coefficients is positive as well and even statistically significant at the 5% level. This means that during that period, the Euro was even gaining ground in those financial centres, where it was already overrepresented in the beginning of that sample period. This implies that there was even a divergence pattern for a short period. Finally, in the latest sample, the sum of the coefficients is close to zero and statistically insignificant. But it is nevertheless interesting as the Z variable by itself becomes significant at the 5% level. In Tables 1, 2, 3 and 4 above, the coefficient was mostly insignificant, or significant only at the 10% level.

Convergence Pattern of the Previous D-Mark Period

The most compelling evidence on convergence for the Euro—with respect to the size of the coefficient, the marginal R-square of the convergence term, and the above/below distinction—is in the initial 2001–2004 period, the period immediately after the Euro introduction. In this section, we explore this observation further and return to the patterns prior to the Euro introduction that were illustrated in Fig. 1. The D-Mark, one of the 11 currencies that formed the initial group of Euro-Area participants, in particular has displayed very distinct behaviour by first increasing rapidly in international popularity during the 1980s and early 1990s, and then losing its attractiveness due to the uncertain modalities of the Euro changeover that occurred in 2001Footnote 16. In Table 9, we therefore estimate the same benchmark-regressions, as well as the one including the above/below dummy- and interaction variables, also for the previous D-Mark period.

When focusing on the patterns of the three variables in the benchmark regressions that are reported in the first two columns of Table 9 for the periods 1992−1995 and 1995−1998, we see that there is a significant convergence term only in the latter subsample. In the first subsample, it is statistically insignificant. The latter two columns that include the interaction terms shed further light on this issue. They show that in the earlier period, the absence of convergences masks a diverse pattern in above and below equilibrium financial trading centres. In those trading centres where the D-Mark was underrepresented, it was losing further ground, and in those markets where it was overrepresented after the boom in the 1980s and early 1990s, it was converging from above, i.e. it was also losing market share. In the following subsample, from 1995 to 1998, this was the case both from above and from below. Thus, to some extent, the evidence remains a bit puzzling. A conclusion one can draw, however, is that significant convergence from above has taken place in D-Mark trading throughout the 1990s, and the significant convergence effect in the beginning of the Euro-sample, from 2001 to 2004, may well be a rebound phenomenon from this D-Mark decline.

Other Currencies

Our main benchmark country against which we compare the Euro Area in this paper is China. This is because the literature on the geographical dispersion of currency trading has started with the RMB analysis and both currencies are relatively new in the global foreign exchange markets. But it is certainly also of interest to draw the analogy to other more mature currencies, such as the US Dollar, the British Pound, the Japanese Yen, the Canadian Dollar, the Swiss Franc, and the Australian Dollar. A more comprehensive analysis goes beyond the scope of this paper, but a first impression can be gained by considering the results of the benchmark regression from Equation (1), which is reported in Table 10 for the 2016–2019 sample period. In Table 11, we estimate the same regression but omit the convergence term Z to illustrate the marginal R-square of this variable.

Starting with the two most established currencies on world markets, the US Dollar and the British Pound, we see from Table 11, that the total variance is already fully explained by the \(\Delta\) Xi,19 variable. That is, the larger the financial centre, the more US Dollar and the more British Pound it will trade. From Table 10, we see that the Z variable is statistically insignificant and does not add anything to the explanatory power. The same is nearly true also for the Japanese Yen, for which 96% of the variance can be explained. For the other three currencies, as without the convergence terms, the R-square for the CAD, CHF and AUD is only 0.89, 0.59 and 0.63, respectively. For the Canadian Dollar—the only currency with a negative significant Z-variable—and the Swiss Franc, the marginal explanatory power of the convergence term is also very limited. The two currencies most closely resemble what has previously been reported for the Euro. The only country with quite different convergence dynamics is Australia. Here, the convergence term has an unconventional positive sign. Also, it adds 29% to the explanatory power of the regression. This would imply a divergence from the equilibrium that could be explained—like the Euro in one of the sub-samples—by the AUD being a popular currency that might have gained ground even in markets where it was initially overrepresented. A more detailed analysis of other countries or sub-samples goes beyond the scope of the present paper. A preliminary exploration of the Australian data, however, showed that the divergence phenomenon is a characteristic for the 2016–2019 period only, and thus seems to reflect a more recent trend in AUD trading. In most of the other sub-samples, the results for the AUD are indeed quite similar to this reported for the Euro.

Conclusions and Policy Implications

We conclude the analysis by returning to the policy debate and the implications for central banks and governments. The evidence presented in this paper suggests that China, to a considerably larger extent than the Euro Area, has the ability to affect the international use of its currency through policies, such as trade policy or the promotion via clearing banks, RQFII quotas, and the swap-line agreements. This is not because the two regions are so fundamentally different, but rather the fact that the RMB with only a 4–5% market share is still far away from its equilibrium value and from reaching its potential on global currency markets. In this situation, the convergence dynamics are strong, and the guidance of policies can both promote or hinder the evolution of the path towards a geographic pattern of all other currencies.

The Euro experienced a similar—but considerably less pronounced—situation in the beginning of its existence. As a successor of established currencies, it has benefited from a rebound effect, rather than a genuine transition, starting from near zero. After a few years already, market forces, rather than policies, appear to be the driving factors. In our regressions, the Euro is more similar to the Canadian Dollar, the Swiss Franc, or the Australian Dollar, which rank in a second tier behind the dominating currency, the US Dollar, together with the British Pound and Japanese Yen. It is interesting to observe that the Euro has not caught up to the US Dollar, as some observers expected, despite the early enthusiasm that accompanied its introduction. It will be interesting to continue monitoring the future path of either currency, and future research still has plenty of open questions that go beyond the scope of the present paper.

Notes

For earlier, more anecdotal evidence on the RMB see, for example, Cheung (2015), Ehlers and Packer (2013), Ehlers et al. (2016). Eichengreen et al. (2016), He et al. (2016), He and Yu (2016), Mehl (2017) and Wójcik et al. (2017), more generally discuss the offshore trading of international currencies.

A further discussion is given by the Report of the European Commission (2018).

On a more positive note, Pisani-Ferry (2021) asses that despite recent challenges: “the euros international status is no trivial achievement”, pointing out China’s legal safety and transparency issues an obstacle for providing a stable global currency.

There is no obvious relation between the earlier discussion on over- and underrepresented markets and the discussion of these main trading centres. While the Euro is indeed overrepresented in the US, the UK and Switzerland, it was underrepresented in Japan, Australia, and Canada.

Prior to the introduction of the Euro, the D-Mark was circulating in Eastern Europe as a second currency where uncertainties resulted from a lack of information translated to other languages.

Offshore centres included in this data-set are: Argentina, Australia, Austria, Bahrain, Belgium, Brazil, Bulgaria, Canada, Chile, China, Colombia, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, HKG (SAR), Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, Malaysia, Mexico, Netherlands, New Zealand, Norway, Peru, Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Singapore, Slovakia, Slovenia, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, UK and US.

Descriptive statistics on the basic variables are reported in Table 12. The countries with the highest degree of Euro trading are Bulgaria (98%), Romania (89%) and Hungary (67%).

Very similar estimates are visible in a pooled regression where we make use of the full panel dataset from 2001 to 2019. Both point estimates and adjusted R squares are similar. The results are reported in Table 13 of the appendix. We do not use this specification as a benchmark regression, as the parameter estimates vary across subperiod, most notably in the beginning of the sample, as illustrated in the later sections. Here, a Chow test rejects the null of no structural break with a test statistic of 2.79 and a p value of = 0.033. Furthermore, we have explored longer intervals, i.e. periods from 2013–2019, 2010–2019 etc. In the longer samples, there is no stronger evidence of convergence than at the higher frequency.

These categories have been used in Cheung et al. (2021), who provide further motivation and theoretical underpinning for each variable.

Note that the international bond market as well as equity market capitalization are scaled by GDP. Therefore, the bond market growing more slowly than GDP could explain the negative sign. We also estimated the effect for the first difference for bond and equity market capitalization, but the effects where statistically insignificant.

We stipulate those countries with similar institutional characteristics generally trade more of each other’s currencies. These institutional characteristics also reflect ties between the countries more generally, and therefore historic links. The financial architecture, as proxied by the bank-based vs. market-based classification, is an important part of the institutional setting.

A possible reason that the control variables appear to add little to the regression is that some variables do not change very much over time. We have explored the possibility that instead of explaining the change in Y, they might be more useful to explain the level of Y. In similar regression, which did not include the basic variables on the Change in X, W and Z, however, we do not find support for this hypothesis.

In the appendix, Table 14, we report a robustness test, where the number of financial centers is held constant. In almost all periods the results are the same, except for the period 2010–2013, which displays a (negatively) significant Z variable, i.e. it indicates convergence during this period.

For discussion on the changeover see also Moss (2011**). The D-Mark evolution is discussed in Franke (1999).

References

Bank for International Settlements, 2019. Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity in 2019, Bank for International Settlements, Basel.

Beck, Thorsten, Asli Demirgüç-Kunt, and Ross Levine. 2010. Financial Institutions and Markets across Countries and over Time: The Updated Financial Development and Structure Database. The World Bank Economic Review 24: 77–92.

Beck, Thorsten, Levine, Ross and Demirgüç-Kunt, Asli, 2002. Law and finance: Why does legal origin matter? NBER Working Paper No. w9379.

Brzeszczynski, Janusz, and Michael Melvin. 2006. Explaining trading volume in the euro. International Journal of Finance & Economics 11(1): 25–34.

Chinn, Menzie, and Jeffrey Frankel. 2008. Why the euro will rival the dollar. International Finance 11(1): 49–73

Cheung, Yin-Wong, 2015. The role of offshore financial centres in the process of renminbi internationalization, in Eichengreen, B. and Kawai, M. 2015. Renminbi internationalization: achievements, prospects, and challenges. Tokyo and Washington: Asian Development Bank Institute and Brookings Institution, 207–235.

Cheung, Yin-Wong., Robert McCauley, and Chang Shu. 2019. Geographic spread of currency trading: The renminbi and other EM currencies. China & World Economy 27(5): 25–36.

Cheung, Yin-Wong., and Matthew Yiu. 2017. Offshore renminbi trading: Findings from the 2013 Triennial Central Bank Survey. International Economics 152: 9–20.

Cheung, Yin-Wong, Louisa Grimm, and Frank Westermann. 2021. The Evolution of Offshore Renminbi Trading: 2016 to 2019, Journal of International Money and Finance, Vol. 113, 102369, May 2021.

Detken, Carsten, and Philipp Hartmann. 2000. Features of the euro's role in international financial markets. Economic Policy 17(35): 553–569.

Detken, Carsten, and Philipp Hartmann. 2002. The euro and international capital markets. International Finance 3(1): 53–96.

Ehlers, Torsten, and Packer, Frank. 2013. FX and derivatives markets in emerging economies and the internationalization of their currencies. BIS Quarterly Review (December), 55-67.

Ehlers, Torsten, Packer, Frank and Zhu, Feng. 2016. The changing landscape of renminbi offshore and onshore markets. BIS Quarterly Review (December), 72-73.

Eichengreen, Barry. 2013. Renminbi Internationalization: Tempest in a Teapot? Asian Development Review 30: 148–164.

Eichengreen, Barry and Kawai, Masahiro, eds., 2015. Renminbi Internationalization: Achievements, Prospects, and Challenges, Brookings Institution Press for ADBI.

Eichengreen, Barry, Lafarguette, Romain and Mehl, Arnaud. 2016. Cables, sharks and servers: Technology and the geography of the foreign exchange market. NBER Working Paper, No. 21884, January. National Bureau of Economic Research, Cambridge, MA.

Eichengreen, Barry, and Domenico Lombardi. 2017. RMBI or RMBR? Is the renminbi destined to become a global or regional currency? Asian Economic Papers 16(1): 35–59.

European Commission, 2018. Towards a stronger international role of the euro: Commission contribution to the European Council and the Euro Summit. https://ec.europa.eu/commission/publications/towards-stronger-international-role-euro-commission-contribution-european-council−13−14-december-2018_en.

European Central Bank, 2021, The international role of the euro. https://www.ecb.europa.eu/pub/pdf/ire/ecb.ire202106~a058f84c61.en.pdf

Franke, Günter, 1999. The Bundesbank and the Markets, in Deutsche Bundesbank (eds.), Fifty Years of the Deutsche Mark: Central Bank and the Currency in Germany since 1948. Oxford: Oxford University Press, Chapter V, 219–267.

Frankel, Jeffrey. 2012. Internationalization of the RMB and Historical Precedents. Journal of Economic Integration 27: 329–365.

Hudecz, Gergely, Edmund Moshammer, Alexander Raabe, and Gong Cheng, 2021, The Euro in the World, ESM Discussion Paper #16. https://www.esm.europa.eu/system/files/document/dp16.pdf

Hartmann, Philipp, and Otmar Issing. 2002. The international role of the euro. Journal of Policy Modeling 24(4): 315–345.

Hau, Harald, William Killeen, and Michael Moore. 2002. The euro as an international currency: Explaining puzzling first evidence from the foreign exchange markets. Journal of International Money and Finance 21(3): 351–383.

He, Dong, and Xiangrong Yu. 2016. Network effects in currency internationalisation: Insights from BIS triennial surveys and implications for the renminbi. Journal of International Money and Finance 68: 203–229.

He, Qing, Iikka Korhonen, Junjie Guo, and Fangge Liu. 2016. The geographic distribution of international currencies and RMB internationalization. International Review of Economics and Finance 42: 442–458.

Ilzetzki, Ethan, Carmen M. Reinhart, and Kenneth S. Rogoff. 2020. Why Is the Euro Punching Below Its Weight? NBER Working Papers No. w26760.

La Porta, Rafael, Lopez-de-Silanes, Florencio, Shleifer, Andrei, and Vishny, Robert W. 1998. Law and Finance. Journal of Political Economy 106: 1113–1155.

Kenen, Peter. 2011. Beyond the dollar. Journal of Policy Modeling 33(5): 750–758.

Mehl, Arnaud. 2017. The euro and the geography of the foreign exchange market, in European Central Bank, International Role of the Euro, July, 28-38.

Packer, Frank, Schrimpf, Andreas, and Sushko, Vladyslav. 2019. Renminbi turnover tilts onshore, BIS Quarterly Review, December, 35-36.

Pisani-Ferry, Jean. 2021. The Euro at 20. Project Syndicate. December 28, 2021.

Portes, Richard, and Helene Rey. 1998. The emergence of the euro as an international currency. Economic Policy 13(26): 306–343.

Prasad, Eswar S. 2016. Gaining Currency: The Rise of the Renminbi. New York: Oxford University Press.

Schrimpf, Andreas and Sushko, Vladyslav. 2019. Sizing up global foreign exchange markets, BIS Quarterly Review, December, 21-38.

Seitz, Franz, Der Dm-Umlauf Im Ausland. 1995. Bundesbank Series 1 Discussion Paper No. 1995,01.

Sinn, Hans-Werner and Frank Westermann. 2001. Why has the Euro been falling? An investigation into the determinants of the exchange rate, NBER Working Papers 8352.

Wójcik, Dariusz, Duncan MacDonald-Korth, and Simon X. Zhao. 2017. The political–economic geography of foreign exchange trading. Journal of Economic Geography 17(2): 267–286.

Acknowledgments

Frank Westermann gratefully acknowledges financial support from Hong Kong Institute for Monetary and Financial Research. This paper represents the views of the author, which are not necessarily the views of the Hong Kong Monetary Authority, Hong Kong Institute for Monetary and Financial Research, or its Board of Directors or Council of Advisers. The above-mentioned entities except the author take no responsibility for any inaccuracies or omissions contained in the paper. The author also would like to thank three anonymous referees for helpful comments and Louisa Grimm for excellent research assistance.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Westermann, F. On the Geographical Dispersion of Euro Currency Trading: An Analysis of the First 20 Years and a Comparison to the RMB. Comp Econ Stud 65, 263–287 (2023). https://doi.org/10.1057/s41294-022-00196-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41294-022-00196-1