Abstract

The COVID-19-driven stock market crash in early 2020, as well as the recession following the financial crisis, generated sizeable operating losses for property–liability insurance companies. However, property–liability insurers were able to hold their capitalisation levels relatively stable during both recessions, issuing new capital and reducing dividends. We use these two recent recessions to empirically examine the determinants and consequences of capital issuances by property–liability insurance companies. We find that property–liability insurers raise capital to restore depleted levels due to operating losses and to fund business growth, and these determinants do not change during recessions. We further examine whether capitalisation levels constrain insurers' ability to meet demand during recessions and find no evidence this occurs. We rather find that new capital is associated with premium growth in subsequent time periods. There seem to be fewer frictions affecting property–liability insurers to recapitalise and accommodate demand compared to other financial services firms.

Similar content being viewed by others

Introduction

The COVID-19 pandemic shook global stock markets. The S&P 500 index dropped 20% between December 31, 2019 and March 31, 2020, with drops large enough to trigger a market-wide circuit breaker, halting all trading on stock exchanges.Footnote 1 This crash generated sizeable operating losses for U.S. property–liability insurance companies. The (asset-weighted) average return on assets (ROA) of property–liability insurers in the first quarter of 2020 dropped over four percentage points from the fourth quarter of 2019, marking the lowest quarterly ROA since the financial crisis.

In this paper, we examine how U.S. property–liability companies issue capital differently during the boom and busts of the business cycle. Differences in issuance between boom-and-bust periods are indicative of frictions that limit insurers’ ability to supply the market. Understanding the interaction between capital issuances and the business cycle is particularly important in the post-COVID era as the pandemic waves and lingering policies to address the initial economic downturn threaten to cause future market woes. We finally explore whether capitalisation levels during recessionary periods constrain insurance companies’ ability to meet demand and to what degree new capital alleviates potential supply constraints.

We use comprehensive financial data from nearly every property–liability insurer in the U.S. from the first quarter of 2002 to the second quarter of 2022. We find that property–liability insurers issue capital for two main reasons: to fund additional business growth and to restore capital depleted by operating losses. Since our data span both the financial crisis and the COVID-19 recession, we are able to examine whether these driving forces change during recessionary periods. We fail to find evidence that this is occurring, indicating a low likelihood that frictions in financial markets limit insurers’ ability to recapitalise.

We also analyse the partial correlations between an insurer’s characteristics and its decision to pay stockholder dividends, which directly reduce an insurer’s capitalisation level. We find that insurers are less likely to pay stockholder dividends when their capitalisation level and earnings are low, and that insurers are less likely to pay dividends when they have growth opportunities. These results support the view that property–liability insurers use both capital issuances and dividend cuts to restore their capitalisation levels and to support business growth.

We next find that insurance companies that issue capital experience growth in premiums and assets and are less likely to pay stockholder dividends. This last result indicates that insurers seem to simultaneously use both new capital and dividend cuts as alternative ways to restore their capitalisation levels. We do not find evidence that companies’ capitalisation levels constrain their premium growth during recessions. On the contrary, we find evidence that insurance companies that issue new capital tend to experience larger premium growth. Again, we find no evidence of frictions that might limit insurers’ ability to meet market demand.

We explicitly examine whether insurance companies’ capitalisation levels constrain their ability to meet demand during recessions. Controlling for contracting demand with a tight set of fixed effects (Degryse et al. 2019), we do not find any evidence that companies’ capitalisation levels constrain their premium growth during recessions and limit insurers’ ability to meet market demand.

We make two primary contributions. First, we contribute to the literature on recessions' economic and financial consequences. A growing body of research focuses explicitly on the COVID-19 pandemic and studies its cost for consumers (Coibion et al. 2020), stock market reaction (Baker et al. 2020), asset prices (Sinagl 2020) and small businesses (Bartik et al. 2020), and the effect of other financial constraints on firm outcomes during the pandemic (Fahlenbrach et al. 2020; Pagano and Zechner 2022). Our research is related to Li et al. (2020), who examine banks' lending growth when demand for liquidity increased during March 2020. They document that banks' pre-pandemic holding of liquid assets and capitalisation levels did not constrain banks' credit supply in the first quarter of 2020, which is in stark contrast to banks' credit supply during the financial crisis, as shown by Cornett et al. (2011) and Acharya and Mora (2015). We add to this literature by showing that property–liability insurance companies respond differently to recessions, specifically, they (1) raise new capital to restore depleted levels, (2) cut dividends and (3) do not appear to restrict insurance supply during recessions. Our results also complement and extend the study of Berry-Stölzle et al. (2014), who examine capital issuances of life insurance companies during the financial crisis.

Second, we contribute to the literature on contagion and systemic risk. There is a large literature analysing contagion effects during the global financial crisis, focusing on sovereign debt (Wegener et al. 2019), stock markets (Wang et al. 2017), cross-market linkages of emerging markets (Aloui et al. 2011) and dependencies between financial sector stocks and real economy stocks (Baur 2012). There is a specific branch of the literature focusing on contagion and systemic risk in the financial services sector (e.g. Billio et al. 2012; Pais and Stork 2013; Bierth et al. 2015; Daly et al. 2019; Chen et al. 2020).Footnote 2 These studies document that financial services firms, including property–liability insurance companies, are interconnected but fail to disentangle whether insurance companies are a source or a victim of systemic risk. To establish property–liability insurers as the source of systemic risk, it is necessary to show how the failure of one insurer leads to a chain reaction of failures of other firms. Kanno (2016) analyses the systemic importance of the global reinsurance network to the global non-life insurance market and finds that systemic risk via the reinsurance network is relatively restricted. Park and Xie (2014) and Chen et al. (2020) examine reinsurance relationships between property–liability insurers as a possible source of contagion and come to a similar conclusion. Our research adds to this literature by examining the ability of property–liability insurance companies to raise new capital—or the lack thereof—as a possible source of contagion. Our result that property–liability insurers did not have difficulties raising new capital through issuances and dividend cuts during recessionary periods is inconsistent with a contagion effect that creates systemic risk among property–liability insurers and their business partners. Moreover, our results provide evidence that the business model of the property–liability insurance industry is surprisingly resilient, allowing insurance companies to supply the market during economic downturns.

Our paper also adds to the growing literature examining dividend payments by insurance companies during crisis periods (Reddemann et al. 2010; Jakubik and Teleu 2022). This literature has focused mostly on European markets and examined dividend payments largely in isolation. We add to this literature by examining U.S. insurers and by expanding the analysis to include more detailed capital issuance decisions as well. Finally, our analysis of the time periods following capital issuances also adds to the literature on property–liability insurers’ capital structure (e.g. Cheng and Weiss 2012).

Data overview and aggregate industry dynamics

The goal of this paper is to examine why U.S. property–liability companies issue capital and the consequences of these issuances with a particular focus on the business cycle. To conduct this analysis, we need (1) to determine recessionary periods and (2) a comprehensive financial dataset of U.S. property–liability insurance companies. We determine recessionary periods using the National Bureau of Economic Research (NBER) Business Cycle Dating Committee’s assessment of the business cycle.Footnote 3 We use quarterly financial statement data of the universe of U.S. property–liability insurance companies, which comes from their regulatory filings with state insurance commissioners. Our data span from the first quarter of 2002 through the second quarter of 2022. According to NBER, the sample period spans two recessions: (1) the financial crisis (i.e. December 2007–June 2009) and (2) the COVID-19 recession (i.e. February–April 2020).

The initial sample includes all property–liability insurance companies. We exclude firms that operate primarily as reinsurers and exclude filings from insurers that ceased operations prior to the filing date and filings from state funds and residual markets. We then remove those companies with organisational structures other than a stock or mutual company. Next, we drop insurer-quarter observations with non-positive values for total net admitted assets, policyholder surplus, net premiums written, premiums earned or losses incurred. We then exclude firms whose reinsurance activity casts doubt on their ability to sustain as a solvent and independent insurer. Specifically, we remove observations if either the ratio of reinsurance ceded to the sum of direct premiums written and reinsurance assumed or the ratio of reinsurance assumed to the sum of direct premiums written and reinsurance assumed has a value below zero or above one. Finally, we exclude observations if the previous year’s values are not available, as our analysis uses up to four lags. The resulting sample includes 74,329 observations from 1873 unique insurers.

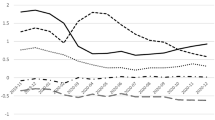

To get a better sense of the overall financial landscape of property–liability insurers, we begin by looking at aggregate industry dynamics. More precisely, we aggregate the profitability, capitalisation and capital issuance activity of all insurers in our sample, and we plot these industry-wide aggregates for the whole sample period (i.e. 2001–2022).Footnote 4 Figure 1 presents these visuals with NBER defined recessionary periods highlighted in gray.Footnote 5

Panel A presents the (asset-weighted) average profitability of property–liability insurance companies, underwriting profitability and investment profitability. We measure profitability with the ROA, which is calculated as the ratio of net income (including unrealised capital gains) to the one-period lagged total net admitted assets. Underwriting profitability is measured as the ratio of net underwriting gains to one-period lagged total net admitted assets. Investment profitability is measured as the ratio of net investment gain plus unrealised capital gains to lagged total net admitted assets. While the profitability of property–liability insurance companies is relatively volatile, the two most recent recessions associated with the COVID-19 pandemic and the financial crisis presented real shocks to property–liability insurers’ profitability with profits falling sharply. Interestingly, Panel A also shows a sharp decrease in property–liability insurers’ profitability in the second quarter of 2022, which aligns with high stock market volatility during that time. Due to current data availability, a more detailed analysis of events in 2022 has to be left for future research.Footnote 6

The (asset-weighted) average capitalisation of property–liability insurance companies is shown in Panel B. We measure capitalisation with the ratio of total capital and surplus as regards policyholders to total net admitted assets. Compared to profitability swings in Panel A, changes in capitalisation during the two most recent recessions were small, which suggests that insurers were able to smooth shocks to income to mitigate their impact on capitalisation.

Panel C depicts the (asset-weighted) average of the amount of new capital issued by property–liability insurance companies, which includes all types of new capital from paid-in capital to surplus notes. It scales the total amount issued during a quarter by the total amount of capital and surplus an insurer has on its balance sheet at the beginning of the quarter. Issuing new capital is one mechanism that allows insurers to smooth shocks to income. Panel C shows that property–liability insurers regularly issue new capital, but average amounts are small with the two largest spikes occurring during and in the aftermath of the financial crisis.

Panel D presents the (asset-weighted) frequency of stockholder dividend payments among property–liability insurers that are organised as a stock company. Dividend payments directly reduce an insurer’s capitalisation level. Reducing the amount and frequency of dividend payments is an alternative mechanism for stock companies to preserve capital. Panel D shows that the frequency of dividend payments is substantially lower during the financial crisis than in other time periods. Furthermore, we see that companies scaled back dividend payments during the COVID-19 pandemic. Our regression analysis explores the drivers of insurers’ decisions to pay dividends in more detail and confirms that dividend payments are indeed more frequent among better capitalised insurers.

Which property–liability insurers issue new capital?

To examine which property–liability insurers issue new capital, we follow the approach of Hovakimian et al. (2001), Leary and Roberts (2005) and Berry-Stölzle et al. (2014) and construct measures of capital issuance for new paid-in capital and surplus notes from insurance companies’ quarterly balance sheets and statements of income. A capital issuance is defined as having occurred if the amount of new paid-in capital or new surplus notes, scaled by the company’s surplus as regards policyholders of the previous quarter, exceeds 2%.Footnote 7

We use regression analysis to examine the determinants of capital issuance focusing explicitly on differences between recessionary periods and other time periods.Footnote 8 To do this, we interact all explanatory variables with an indicator for recessionary and non-recessionary periods, which allows the coefficients on explanatory variables to differ across these groupings. We can then test the significance of the difference with a Wald test. Formally, we estimate the following model:

where Issuancei,t is one of our capital issuance measures, Distressi,t is a vector of variables measuring insurer i’s financial distress costs, Growthi,t is the year-over-year percentage growth in net premiums written for quarter t, Xi,t is a vector of control variables; Recessiont is an indicator equal to one for recessions, Other Quarterst is an indicator equal to one for all non-recessionary quarters, and \({\varepsilon }_{i,t}\) is a random error term.Footnote 9

We use a logistic regression model when estimating Eq. (1) with the capital issuance indicator as the dependent variable. The alternative specification with the amount of capital issued relative to last quarter’s capital and surplus as the dependent variable is estimated as a tobit regression model accounting for censoring at zero. Standard errors for both models are clustered at the insurer level.

We use three variables capturing an insurer’s financial distress costs. Since companies with high capitalisation levels are less likely to experience financial distress, we use the ratio of policyholder surplus to total net admitted assets as an inverse proxy for financial distress costs. We include the natural logarithm of the capital-to-assets ratio in the model to account for the positive skew. If an insurer is profitable and retains earnings, then these retained earnings will increase surplus and reduce the need to raise new capital. To account for this expected negative association, the ratio of an insurer’s net income, including changes in net unrealised capital gains, scaled by lagged total net admitted assets is included in our model. We expect a negative relationship between an insurer’s ROA and capital issuances. To capture any additional, non-linear effects of operating losses, we also include an indicator variable equal to one in quarters in which an insurer’s net income is negative. Our empirical design follows Berry-Stölzle et al. (2014) and is based on the assumptions that business choices: (1) precede capital considerations and (2) shape an insurer’s profitability and capitalisation. We therefore treat an insurer’s business decisions and the resulting financial performance as exogenous.

We include the year-over-year percentage change in net premiums written for quarter t in the model to capture changes in investment opportunities. We expect a positive relationship between an insurer’s premium growth and capital issuances.

The vector of control variables includes: (1) the ratio of reinsurance ceded to the sum of direct premiums written and reinsurance assumed (i.e. a reinsurance utilisation measure), (2) the natural logarithm of total net admitted assets, (3) the standard deviation of an insurer’s loss ratio over the past three quarters, (4) an indicator variable distinguishing between commercial and personal line carriers and (5) a set of dummy variables for whether the insurer has the organisational form of a mutual company, is affiliated with an insurer group or its parent company is listed on the stock exchange.Footnote 10 We include quarter indicators to control for any possible differences across time periods and adjust standard errors for insurer-level clustering.

Summary statistics

Table 1 reports descriptive statistics of the variables used in the regression analysis. Note that the Ln(Capital/Assets), the Net income/Lagged Assets and the Std. Dev.(Loss ratio) variables are winsorised at 1 and 99% and that the Growth in net premium written variable is winsorized at 5 and 95% to reduce the influence of outliers on our results. On average, about 4% of property–liability insurers issue new capital in a quarter, which corresponds to an annualised average of 16%. The amount of new capital raised by the average company in a given quarter is about 1% of its existing capital and surplus. Most of the raised capital is in the form of common or preferred stock, as only about 13% of all issuances are surplus note issuances.

Regression results

Table 2 presents the estimates from Eq. (1). We find that property–liability insurance companies with lower capitalisation levels are more likely to issue new capital. Columns (1) and (2) indicate that if an insurance company’s capitalisation levels drop from one standard deviation above to one standard deviation below the sample mean of Ln(Capital/Assets) then the probability that the insurer issues capital increases by 3.1% and 9.5% for non-recessionary and recessionary periods, respectively. Similarly for Net income/Assets, Columns (1) and (2) show that moving from one standard deviation above to below the sample mean increases the probability of capital issuance by 1.5% and 1.4% for non-recessionary and recessionary periods, respectively. If net income is negative, the probability of issuance increases by an additional 1.0% (1.1%) in non-recessionary (recessionary) periods. These results support the view that property–liability insurance companies issue new capital to restore capitalisation levels depleted by operating losses to avoid the negative consequences/costs associated with financial distress. However, Column (3) shows that for all three financial distress cost proxy variables, we fail to find a statistically significant difference between non-recessionary and recessionary periods based on a Wald test. The last row in Table 2 presents the p-value of a Wald test for a joint null hypothesis, which we again fail to reject. There is no evidence in Table 2 that the relationship between depleted capital and capital issuances is different during recessions.Footnote 11

The results for the Amount Issued/Capital as the dependent variable presented in columns (4) through (6) allow similar conclusions. The coefficient of the Ln(Capital/Assets) variable is negative and significant. Based on the estimate in column (4) for non-recessionary quarters, moving from one standard deviation above to below the sample mean increases the amount of capital issued as a percent of last quarter’s capital and surplus by 1.5%, which is a large effect compared to the unconditional mean of 1.2%. The comparable number for recessions is even larger at 6.5%. Similarly, property–liability insurance companies with lower net income issue significantly more capital. Moving from one standard deviation above to below the mean of the Net income/Assets variable increases the amount of capital issued as a percent of surplus by 0.7% in both time periods. If net income is negative, the amount of capital issued increases by an additional 0.4% in both periods. Again, we cannot reject the joint null hypothesis that the coefficients of the two proxies for financial distress costs are equal across recessionary and non-recessionary periods.Footnote 12

Next, we examine growth opportunities as proxied by the year-over-year percentage change in net premiums. Table 2 shows that in both models and time periods, the coefficients for growth opportunities are positive and statistically significant, which aligns with theoretical predictions. The difference between time periods for either model is not statistically significant. These results imply that property–liability companies were able to raise new capital and finance growth even during bust cycles. Overall, we fail to find evidence that the relationship between capital issuance and depleted capital or growth opportunities varied during the COVID-19 pandemic or the financial crisis.Footnote 13

Interestingly, the coefficients of the Mutual control variable in Table 2 indicate that a firm’s organisational firm may have different implications for capital issuance decisions in recessions compared to other time periods. The explanatory power of the two major drivers of capital issuances, funding additional business growth and restoring capital depleted by operating losses, remains unchanged, making it unlikely that frictions in financial markets limit insurers’ ability to recapitalise during recessions.

Which property–liability insurers pay dividends?

Cutting dividends is an alternative way for stock insurance companies to preserve capitalisation levels. We expand our analysis to dividend payments and examine the conditional correlations between an insurer’s characteristics and its dividend policy. The model specification is as follows:

where Dividendi,t is one of two dividend policy measures, and all other variables are as defined in Eq. (1). Our first dividend policy measure is an indicator variable equal to one if an insurer pays stockholder dividends in quarter t, and zero otherwise. The second is an indicator variable equal to one if an insurer pays dividends in quarter t that are larger or equal to the total amount of dividends paid during the past five quarters. The second indicator captures whether the dividend payment continues at the previous level or higher while allowing for the dividend to be paid in a different quarter than in the previous year; the alternative category is basically a dividend cut or zero dividend. We exclude mutual insurance companies from this analysis as they do not pay stockholder dividends.

Table 3 presents the pooled logistic regression estimates. We find a positive and significant relationship between property–liability insurers’ capitalisation and the likelihood that they pay dividends and for dividend payments that are larger or equal to the total amount of dividends paid during the past five quarters. Columns (1) and (2) show that moving from one standard deviation below to above the mean of Ln(Capital/Assets) increases the probability of dividend payment by 2.9% for non-recessionary periods and 1.9% for recessionary periods. Columns (4) and (5) are interpreted as a one standard deviation movement from below to above the mean increases the probability of a large dividend payment by 1.2% in boom quarters and 0.8% in bust quarters. For both dividends and large dividends, the difference is not statistically significant across time periods.

Similarly, we find a positive and significant relationship between insurers’ profitability and the likelihood of both any and large dividend payments. Column (4) shows that a two-standard deviation increase in Net income/Assets increases the probability of a large dividend payment by 0.9%, with no statistical difference between time periods. For any dividend, we find that a two-standard deviation increase in Net income/Assets increases the probability of a dividend payment by 4.0% and 0.6% for non-recessionary and recessionary periods, respectively. Column (3) indicates that the difference across time periods is statistically significant at the 1% level. Columns (1) and (4) show that if net income is negative, the probability of any (a large) dividend payment increases by an additional 3.1% (1.2%), with no statistical difference between the time periods. Together these results indicate that property–liability companies’ decisions to pay sizeable dividends are comparable in both recessionary and non-recessionary periods, but the extreme decisions to start paying dividends or to cut dividends to zero are less sensitive to net income during recessions. The significant difference in coefficients on Net income/Assets across the two groupings also holds for the joint test for the equality of coefficients of all three proxies for financial distress costs.

We can conclude that dividend policy allows property–liability insurers to manage their capitalisation. Importantly, the estimated relationships for large dividend payments are stable across recessionary and non-recessionary periods. Our results indicate that when paying (or not paying) dividends, property–liability insurers adjust their decision-making process to some degree during recessions.

The negative and statistically significant coefficients on Growth in net premiums written in Table 3 provide evidence that property–liability insurers adjust their dividend policies when growth opportunities exist. Property–liability companies seem to make cuts to dividends to fund new business growth during both normal and recessionary times, and the estimates are not statistically different between time periods.

Overall, our results indicate that some firm characteristics may have different implications for dividend policy in recessions compared to other time periods. For the decision to make dividend payments that are at least as large as last year’s dividends, funding additional business growth and restoring capital depleted by operating losses are important considerations for property–liability insurance companies both in normal time periods as well as during recessions.Footnote 14

Consequences of capital issuances

To explore the consequences of capital issuances, we analyse how property–liability insurer outcomes change in the time periods following a capital issuance. Our analysis focuses on six outcomes: (1) premium revenue measured with the natural logarithm of insurer i’s net premiums written in quarter t + 1, (2) firm size measured with the natural logarithm of total net admitted assets, (3) an insurer’s capitalisation level measured with the natural logarithm of the capital to asset ratio, (4) reinsurance utilisation measured with the ratio of reinsurance ceded to the sum of direct premiums written and reinsurance assumed, (5) whether an insurer pays dividends to stockholders captured by an indicator variable and (6) whether insurer i pays dividends to stockholders in quarter t + 1 that are larger than or equal to the total amount of dividends paid during the previous five quarters. For each of the six outcome variables, we separately estimated the following fixed-effects regression model:

where Issuance in Recessioni,t is an indicator variable equal to one if an insurer issues capital during a recession and zero otherwise, Issuance in Other Periodi,t is an indicator variable equal to one if an insurer issues capital during a quarter that is not classified as a recession and zero otherwise, Xi,t is a vector of control variables, \({\alpha }_{t}\) and \({\gamma }_{i}\) are quarter and insurer fixed effects, respectively, and \({\varepsilon }_{i,t}\) is a random error term. The first four outcome models are estimated with the standard fixed-effects estimator and standard errors are clustered at the insurer level. For the first three of these four models, the estimated coefficients can be interpreted as growth elasticities. The outcome variables five and six are binary variables and we estimate Eq. (3) with a conditional fixed-effects logistic regression. This estimation can only include insurers that pay dividends at least once during the sample period; other insurers are removed from the sample.

Table 4 presents the results. Column (1) indicates that property–liability insurers issuing capital experience premium growth in subsequent quarters. The significant results in Column (1) for non-recessionary periods suggest that insurers issuing capital increased their net premiums written in subsequent quarters by 2.97% on average. Capital issuances during recessions result in higher premium growth of 6.91% on average. The difference between recessionary and non-recessionary periods is statistically significant (p = 0.039).Footnote 15 Column (2) similarly shows that insurers issuing capital experience growth of total assets in subsequent quarters. Column (2) shows an average growth rate of 0.61% for non-recessionary periods and 1.62% for recessionary periods, with the difference between the two groups being statistically significant (p = 0.005). This implies that either new capital is associated with a larger growth rate during recessions or that insurers raise more capital per issuance during economic downturns resulting in the larger coefficient estimates for the issuance indicators.

Column (3) indicates that insurers issuing capital do not seem to increase their capitalisation. The average of the coefficients on non-recessionary and recessionary quarters implies a slight reduction of the capital-to-assets ratio of − 0.21% and − 0.25%, respectively. These results suggest that insurers that issue capital tend to use the additional capital to fund new growth rather than to fully restore their depleted capitalisation levels, which stands in contrast to Berry-Stölzle et al.'s (2014) findings for life insurers. However, target capital structure theories predict that insurers return to their target capital structure incrementally over time after capital shocks forced them off target, and there is empirical evidence that it will take the average property–liability insurer 2.6 years to get back to its target capital level (Cheng and Weiss 2012; Altuntas et al. 2015). To further examine the relationship between issuances and subsequent capitalisation levels, we create a subsample of the firm-year observations that are in the lowest decile of the sample distribution of insurers’ capitalisation levels and re-estimate the model in Column (3). We expect that these very low capitalised firms give higher priority to restoring their capitalisation level than to funding business growth. For this subsample, we find a slight increase in the capital-to-assets ratio following quarters with capital issuances for both recessionary and non-recessionary quarters, which provides some evidence in support of established capital structure theories.Footnote 16

We find that new capital issuances do not result in changes in reinsurance utilisation. However, capital issuance significantly reduces the probability that a property–liability insurer pays dividends in subsequent quarters, as shown in columns (5) and (6). Four (four) of the eight coefficients are negative and significant in the model with the Dividend (Large Dividend) indicator as the dependent variable, and we cannot reject the joint null hypothesis that the coefficients are the same in recessionary and non-recessionary periods. These results indicate that insurers seem to simultaneously use new capital and dividend cuts as alternative ways to restore their capitalisation levels.

Does insurers’ capitalisation constrain supply during recessions?

There is empirical evidence that the availability of quality financial services, including insurance, facilitates economic growth (e.g. Levine 1997; Arena 2008). That is why supply shortages of financial services are a major concern. There is growing empirical evidence that shocks to bank capital reduce loan supply and create spillover effects into the real economy (e.g. Cornett et al. 2011; Acharya and Mora 2015; Acharya et al. 2018; Dwenger et al. 2020). We examine whether insurance companies’ capitalisation constrains their ability to meet demand during recessions. Demand obviously contracts, but the question is whether insurance supply meets the demand or falls short, leading to rationing with possible negative consequences for the real economy.

To answer this question, we exploit the variation in insurance demand across state markets. We add state-level premium data from Schedule T of insurers’ quarterly financial statements to our baseline dataset and estimate an expanded version of Eq. (3) with insurer-state-quarter observations. The dependent variable is the natural logarithm of insurers’ state-level direct premiums written. The independent variables include the lagged indicators for capital issuance during recessions and all other periods, firm fixed effects and all firm-level characteristics from Eq. (3). We additionally include interaction terms between a recession indicator and all firm-level characteristics and a tight set of fixed effects to control for changes in state-level demand over time. Singleton observations (i.e. insurance companies that only operate in one state market) are dropped from the analysis. The interaction terms with the recession indicator allow us to capture the differential effects of firm-level characteristics on premium growth during recessions while controlling for the baseline pattern during normal periods. The main variable of interest is the interaction term between the recession indicator and insurers’ lagged capitalisation levels. The coefficient of this variable captures the differential effect of insurers’ capitalisation during recessions relative to normal times. If property–liability insurance companies’ capitalisation levels constrain their ability to meet insurance demand, the coefficient of this interaction term will be positive and significant. This research design implicitly assumes that the COVID-19 health pandemic, as well as the financial crisis, came as a surprise to property–liability insurance companies and can be treated as exogenous events.

Our controls for insurance demand are based on the approach proposed by Degryse et al. (2019) and adopted to the specifics of the property–liability insurance industry. The identifying assumption is that the demand for coverage from all insurance companies belonging to the same category of companies and writing business in the same state and quarter is the same. The categories we use to distinguish between insurance companies are based on their size, financial strength measured with the regulatory risk-based capital (RBC) ratio, and the fraction of their business in personal vs. commercial lines. Insurance demand is risk sensitive, and there is substantial empirical evidence that a major drop in insurance companies’ financial strength is associated with a decline in premium revenue (Epermanis and Harrington 2006; Eling and Schmit 2012). Epermanis and Harrington (2006) document that these revenue effects are less pronounced in personal lines where policyholders are protected by state guarantee funds than in commercial lines. Larger insurance companies might have more brand recognition and the ability to absorb the fixed costs associated with marketing and advertising and brand recognition might influence demand. Our tightest specification uses sample quintiles of the RBC ratio and firm size, and four categories of the fraction of business in personal lines and includes state*quarter*RBC*personal*size fixed effects into the model.Footnote 17,Footnote 18

Our focus on premiums, which are determined by price times quantity of coverage, reflects data availability issues. Unfortunately, property–liability insurance companies do not report prices and quantities separately.Footnote 19 Under the assumption that insurance markets are competitive and that prices reflect the risk sensitivity of insurance demand, our tight set of demand fixed effects should absorb variations in prices across markets and time.

Table 5 presents the results of the fixed-effects estimation. The only difference between the three models is the exact specification of the fixed-effects structure controlling for insurance demand. Model (1) only includes state × quarter fixed effects, model (2) uses a more granular specification and includes state × quarter × RBC × personal × size fixed effects coded based on above and below median values of the RBC ratio, fraction of premiums in personal lines and firm size, and model (3) is the tightest fixed effects specification based on sample quintiles of the RBC ratio and firm size, and four categories of the fraction of business in personal lines to code the state × quarter × RBC × personal × size fixed effects.

We do not find any evidence that property–liability insurance companies’ capitalisation levels constrain their premium growth during the financial crisis and the COVID-19 recession. The interaction term between insurers’ capitalisation levels and the recession indicator is insignificant in all model specifications. Furthermore, none of the other interaction terms between the recession indicator and insurance company characteristics is significant. These results indicate that the relationships between insurance company characteristics and premium growth are stable over time.

We find additional evidence that insurance companies that issue capital tend to experience larger premium growth than their peers. In model (3), six of the eight issuance indicator variables are positive and significant and the Wald test results reported at the bottom of the table cannot reject the null hypothesis that the estimated coefficients of the issuance indicators are the same during recessions and normal periods. Our results suggest that property–liability insurance companies’ ability to raise capital and meet market demand is not negatively impacted by recessions and might help insurers to overcome any potential limitations financial conditions might impose on premium growth. Again, we find no evidence that property–liability insurance companies’ capitalisation constrains their premium growth during recessions. We conclude that liability insurance companies were able to meet insurance demand during the two most recent recessions.Footnote 20

Conclusion

This paper examines the causes and consequences of capital issuances by U.S. property–liability insurance companies. In our analysis, we focus particularly on the recession following the financial crisis and the most recent COVID-19 recession. For the industry as a whole, both recessions resulted in sizeable operating losses. However, property–liability insurers were able to hold their capitalisation levels relatively stable during both a financial market and a pandemic-driven recession, issuing new capital and reducing dividends. Our analysis of the causes of capital issuances suggests that property–liability insurers issue capital for two main reasons: to fund additional business growth and to restore capital depleted by operating losses. Most importantly, we do not find any evidence that these driving forces change during recessionary periods, making it unlikely that frictions in financial markets limit insurers’ ability to recapitalise.

We further examine whether capitalisation levels constrain property–liability insurers' ability to meet demand during recessions. Contrary to the empirical evidence in the banking industry, we do not find any evidence that property–liability insurance companies’ capitalisation levels constrained their premium growth during the financial crisis and COVID-19 recession. We rather find that new capital is associated with premium growth in all subsequent time periods, including recessions. Since our model controls for varying demand over time and across markets with a tight set of fixed effects, we can conclude that property–liability insurance companies were indeed able to meet demand during the two most recent recessions. Our results highlight that the business model of the property–liability insurance industry is surprisingly resilient and allows property–liability insurance companies to provide their services even during the most challenging times.

Notes

NBER determined that there was a recession from March to November of 2001. Due to data restrictions, our analysis starts with the first quarter of 2002 and therefore does not include the 2001 recession.

For a more detailed discussion of aggregate industry dynamics, please refer to the Online Appendix.

In an unreported robustness check, we drop all observations after the end of the COVID-19 recession and repeat the analysis. The results based on the shortened sample period that runs from the first quarter of 2002 to the second quarter of 2020 allows the same conclusions as the results presented in the paper.

For a detailed discussion of variable creation please refer to the Online Appendix.

Due to the role of capital in property–liability insurance companies, we hypothesise a positive relationship between (1) an insurer’s growth opportunities and capital issuances and (2) an insurer’s financial distress costs and capital issuances. The discussion of the role of capital in property–liability insurance companies, which led to these hypotheses, can be found in the Online Appendix.

We code the following quarters in the 2002–2020 sample period as recessionary quarters: Q1 2008, Q2 2008, Q3 2008, Q4 2008, Q1 2009, Q2 2009, Q1 2020 and Q2 2020.

The loss ratio is calculated as the ratio of losses and loss adjustment expenses incurred to premiums earned. We calculate the standard deviation of the loss ratio at time t on a rolling window basis using the loss ratio’s values at points in time t, t − 1, t − 2 and t − 3.

We also include a recession indicator variable in the model and re-estimate it with (and without) time fixed effects. The recession indicator is insignificant in both specifications; we fail to find evidence that insurers are more or less likely to issue capital during recessions.

Again, we include a recession indicator variable into the model and re-estimate it with (and without) time fixed effects. The recession indicator is insignificant (significant, coefficient = − 0.674, p = 0.068) in the model with (without) time fixed effects. This result can be interpreted as providing some evidence that, on average, the amount of capital issued during recessions tends to be lower than the amount raised during all other periods.

The analysis in this section focuses on individual property–liability insurance companies, but some of these companies are members of an insurance group and may be able to obtain capital more easily. To show our results in Table 2 are from external financing rather than internal, we re-estimate Eq. (1) using a subsample of single unaffiliated insurers. The results of this estimation and a detailed discussion can be found in the Online Appendix. The estimated relationships for single unaffiliated insurers show the same patterns as the results for the full sample of all property–liability insurance companies indicating that our results from Table 2 are the result of external financing.

The Online Appendix includes an additional analysis on which insurers issue surplus notes rather than common or preferred capital.

The negative and significant coefficient on the Ln(Capital/Assets) ratio in a regression with a premium measure as the dependent variable is surprising. However, we would like to point out that the coefficient of the Ln(Capital/Assets) ratio becomes insignificant in Model (3) in Table 5, which includes a more granular fixed-effects structure that also controls for different categories of capitalisation levels and the associated different premium dynamics.

The results of this estimation and a more detailed discussion can be found in Online Appendix.

The four categories for the fraction of direct premiums written in personal lines are defined as follows: Less than 1%, 1–40%, 40–99%, 99% or more.

See also Epermanis and Harrington (2006) for a more detailed discussion on why using premium revenue is preferred over constructing an ex-post price measure to proxy for ex-ante prices.

An alternative model specification with premium growth rates and the amount of capital allows similar conclusions. See Online Appendix for details.

References

Acharya, V.V., T. Eisert, C. Eufinger, and C. Hirsch. 2018. Real effects of the sovereign debt crisis in Europe: Evidence from syndicated loans. Review of Financial Studies 31 (8): 2855–2896.

Acharya, V.V., and N. Mora. 2015. A crisis of banks as liquidity providers. Journal of Finance 70 (1): 1–43.

Aloui, R., M.S.B. Aïssa, and D.K. Nguyen. 2011. Global financial crisis, extreme interdependences, and contagion effects: The role of economic structure? Journal of Banking and Finance 35 (1): 130–141.

Altuntas, M., T.R. Berry-Stölzle, and S. Wende. 2015. Does one size fit all? Determinants of insurer capital structure around the globe. Journal of Banking and Finance 61: 251–271.

Arena, M. 2008. Does insurance market activity promote economic growth? A cross-country study for industrialized and developing countries. Journal of Risk and Insurance 75 (4): 921–946.

Baker, S.R., N. Bloom, S.J. Davis, K.J. Kost, M.C. Sammon, and T. Viratyosin. 2020. The Unprecedented Stock Market Impact of COVID-19. National Bureau of Economic Research Working Paper 26945.

Bartik, A.W., M. Bertrand, Z.B. Cullen, E.L. Glaeser, M. Luca, and C.T. Stanton. 2020. How are small businesses adjusting to COVID-19? Early evidence from a Survey. National Bureau of Economic Research Working Paper 26989.

Baur, D.G. 2012. Financial contagion and the real economy. Journal of Banking and Finance 36 (10): 2680–2692.

Berry-Stölzle, T.R., G.P. Nini, and S. Wende. 2014. External financing in the life insurance industry: Evidence from the financial crisis. Journal of Risk and Insurance 81 (3): 529–562.

Bierth, C., F. Irresberger, and G.N.F. Weiß. 2015. Systemic risk of insurers around the globe. Journal of Banking and Finance 55: 232–245.

Billio, M., M. Getmansky, A.W. Lo, and L. Pelizzon. 2012. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics 104: 535–559.

Cabral, R. 2022. The banking union and evidence on bail-ins and bailouts. European Financial Management 28: 1079–1103.

Chen, H., J.D. Cummins, T. Sun, and M.A. Weiss. 2020. The reinsurance network among U.S. property-casualty insurers: Microstructure, insolvency risk, and contagion. Journal of Risk and Insurance 87 (2): 253–284.

Cheng, J., and M.A. Weiss. 2012. Capital structure in the property-liability insurance industry: Tests of the tradeoff and pecking order theories. Journal of Insurance Issues 35 (1): 1–43.

Coibion, O., Y. Gorodnichenko, and M. Weber. 2020. The Cost of the COVID-19 Crisis: Lockdowns, Macroeconomic Expectations, and Consumer Spending, Chicago Booth Working Paper No. 20–08.

Cornett, M.M., J.J. McNutt, P.E. Strahan, and H. Tehranian. 2011. Liquidity risk management and credit supply in the financial crisis. Journal of Financial Economics 101: 297–312.

Daly, K., J.A. Batten, A.V. Mishra, and T. Choudhury. 2019. Contagion risk in global banking sector. Journal of International Financial Markets, Institutions and Money 63: 101136.

Degryse, H., O. De Jonghe, S. Jakovljević, K. Mulier, and G. Schepens. 2019. Identifying credit supply shocks with bank-firm data: methods and applications. Journal of Financial Intermediation 40: 100813.

Dermine, J. 2013. Bank regulations after the global financial crisis: Good intentions and unintended evil. European Financial Management 19 (4): 658–674.

Dwenger, N., F.M. Fossen, and M. Simmler. 2020. Firms’ financial and real responses to credit supply shocks: Evidence from firm-bank relationships in Germany. Journal of Financial Intermediation 41: 100773.

Eling, M., and J.T. Schmit. 2012. Is there market discipline in the European insurance industry? An analysis of the German Insurance Market. The Geneva Risk and Insurance Review 37: 180–207.

Epermanis, K., and S.E. Harrington. 2006. Market discipline in property/casualty insurance: Evidence from premium growth surrounding changes in financial strength ratings. Journal of Money, Credit, and Banking 38 (6): 1515–1544.

Fahlenbrach, R., K. Rageth, and R.M. Stulz. 2020. How valuable is financial flexibility when revenue stops? Evidence from the COVID-19 Crisis. National Bureau of Economic Research Working Paper 27106.

Hovakimian, A., T. Opler, and S. Titman. 2001. The debt-equity choice. Journal of Financial and Quantitative Analysis 36 (1): 1–24.

Jakubik, P., and S. Teleu. 2022. Suspension of insurers’ dividends as a response to the COVID-19 crisis: Evidence from the European insurance equity market. The Geneva Papers on Risk and Insurance—Issues and Practice 47 (4): 785–816.

Kanno, M. 2016. The network structure and systemic risk in the global non-life insurance market. Insurance Mathematics and Economics 67: 38–53.

Leary, M.T., and M.R. Roberts. 2005. Do firms rebalance their capital structures? Journal of Finance 60 (6): 2575–2619.

Levine, R. 1997. Financial development and economic growth: views and agenda. Journal of Economic Literature 35: 688–726.

Li, L., P.E. Strahan, and S. Zhang. 2020. Banks as lenders of first resort: Evidence from the COVID-19 crisis. National Bureau of Economic Research Working Paper 27256.

Meier, S., M.R. Gonzalez, and F. Kunze. 2021. The global financial crisis, the EMU sovereign debt crisis and international financial regulation: Lessons from a systematic literature review. International Review of Law and Economics 65: 105945.

Pagano, M., and J. Zechner. 2022. COVID-19 and corporate finance. The Review of Corporate Finance Studies. https://doi.org/10.1093/rcfs/cfac025.

Pais, A., and P.A. Stork. 2013. Bank size and systemic risk. European Financial Management 19 (3): 429–451.

Park, S.C., and X. Xie. 2014. Reinsurance and systemic risk: The impact of reinsurer downgrading on property-casualty insurers. Journal of Risk and Insurance 81: 587–622.

Reddemann, S., T. Basse, and J.M.G. Von Der Schulenburg. 2010. On the impact of the financial crisis on the dividend policy of the European insurance industry. The Geneva Papers on Risk and Insurance—Issues and Practice 35 (1): 53–62.

Sinagl, P. 2020. When does cash-flow risk matter to investors? Evidence from the COVID-19 pandemic. University of Iowa Working Paper.

Wang, G.J., C. Xie, M. Lin, and H.E. Stanley. 2017. Stock market contagion during the global financial crisis: A multiscale approach. Finance Research Letters 22: 163–168.

Wegener, C., R. Kruse, and T. Basse. 2019. The walking debt crisis. Journal of Economic Behavior and Organization 157: 382–402.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Berry-Stölzle, T.R., Esson, M.I. Capital issuances and premium growth in the property–liability insurance industry: evidence from the financial crisis and COVID-19 recession. Geneva Pap Risk Insur Issues Pract 49, 1–25 (2024). https://doi.org/10.1057/s41288-022-00283-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-022-00283-5