Abstract

Annuities provide a lifelong income stream and can therefore help individuals to mitigate the risk of outliving their savings, a highly topical issue in the context of increasing life expectancies. Given that real-world annuitization rates remain relatively low, we investigate the influence of behavioral biases on people’s choice between a lifelong annuity and a lump sum payout. In so doing, we focus on the impact of default effects due to a preselected annuity option (default option) and the impact of the decision’s timing (decisions on annuitization taken by younger individuals refer to a distant future, those taken by older individuals to a near future) on annuity uptake and health consciousness. We used a scientific survey panel to conduct an online experiment with a diversified sample of 339 participants (55.2% female, average age = 42.5 years). Our results show that the timing of the decision moderates the default effect on annuity uptake, in that the effect of a preselected (default) annuity option is stronger for distant-future decisions (i.e., choice of annuity instead of lump sum at retirement made by younger participants purchasing a deferred annuity) than for near-future decisions made by older individuals who are closer to retirement. We further find that the default effect moderates health consciousness after choosing an annuity. Health consciousness is stronger in the no-default condition than in the annuity default condition.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Increasing life expectancies and old-age poverty due to low state pensions are issues many countries are currently facing, with a concomitant continuous increase in the importance of protecting individuals from outliving their savings. Many countries therefore use multi-pillar pension systems, consisting of state pensions, compulsory private savings plans, and voluntary private savings plans; the latter are gaining particularly in significance in the context of aging societies and correspondingly shrinking public funds for pensions. Private pension plans enable people to make private savings on a voluntary basis and are the core focus of this paper. In Germany, for example, such contracts usually offer the option of a lump sum or annuity payout to the policyholder when entering retirement. Annuities in particular address the longevity risk, that is, the risk that a person will outlive their income, by providing secure lifelong payment streams. Early research using rational choice theory (see particularly Yaari 1965) expected that individuals would optimally annuitize their entire wealth at the beginning of retirement; observed real-world annuitization rates, by contrast, are lower (Alexandrova and Gatzert 2019; Benartzi et al. 2011). This “annuitization puzzle” became the subject of a broad stream of literature, resulting in models that enable an improved explanation of observed annuitization rates (see Alexandrova and Gatzert 2019 for a review).

MacDonald et al. (2013), like Alexandrova and Gatzert (2019), distinguish between three categories in explaining low annuitization rates: (1) factors arising from personal preferences and circumstances (such as loss of liquidity, bequest, risk aversion, personal time preference, life expectancy, and confidence in personal financial acumen), (2) rational factors arising from environmental limitations (including high prices, poor financial market environment), and (3) behavioral biases. Several scholars have particularly emphasized the importance of behavioral biases in understanding the annuitization puzzle (Benartzi et al. 2011; Beshears et al. 2014; Brown et al. 2017; Brown 2007; Hu and Scott 2007); this is the focus of this paper. Behavioral biases regarding decisions to annuitize savings can occur due to framing effects such as default effects (a preselected annuity option as the default option) and the timing of the decision (whether the individual is close to retirement or much younger) (Schreiber and Weber 2016). Framing effects impact consumer decision-making due to simple variations of equivalent information toward a choice problem (Kahneman and Tversky 1979). For example, Brown et al. (2008, 2013) observe a higher rate of choice of annuities over lump sums after presenting annuities in a consumption frame than with the use of an investment frame. Default effects, as a type of framing effect, describe the observation that consumer decision-making is often influenced toward a preselected product option (Brown and Krishna 2004; Johnson et al. 2002; Madrian and Shea 2001). However, studies investigating default effects in the context of annuitization decisions have produced contradictory results (Agnew et al. 2008; Bateman et al. 2017; Bütler and Teppa 2007).

Further, annuitization decisions are intertemporal decisions in markets such as Germany, where consumers can purchase private deferred annuities at younger working age, with a savings phase running until retirement. Shortly before retirement, they can usually decide whether they would like to use their built-up reserves as a (lifelong) annuity or receive a one-time lump sum payout (see also Bär and Gatzert (2022) for an overview of such decumulation strategies and products during retirement). Some studies show that time-inconsistent preferences influence consumer preferences and behavior in intertemporal decisions. For example, Schreiber and Weber (2016), likewise working in a German survey setting, detect increased rates of annuity uptake when consumers need to make a decision about their distant future (younger consumers are one example). By contrast, rates of choosing an annuity decrease when consumers need to make a near-future decision (an example here might be older consumers who are closer to retirement).

Another factor influencing annuitization decisions is the individual’s health status (see Alexandrova and Gatzert 2019 for a review of influencing factors). Annuities could become less attractive for individuals in poor health due to their low life expectancy. Indeed, the attractiveness of annuities increases when individuals live a long life and thus benefit from long-term income streams. As a result, healthy individuals with a relatively high life expectancy are more likely to choose an annuity (Schanbacher et al. 2018). For example, Finkelstein and Poterba (2002) confirm a positive relationship between receiving an annuity and longevity. Consequently, Schanbacher et al. (2018) investigated the effect of choosing an annuity over a lump sum on longevity by measuring health behavior intentions as means of increasing life expectancy. Their results show stronger health behavior intentions after priming toward annuities (as opposed to a lump sum); they argue that individuals behave in a healthier manner in order to receive longer monthly payout streams. The question remains as to whether this observation still occurs when the choice of annuitization is made by default.

Against this backdrop, the aim of the present paper is to add to the existing literature on the effect of behavioral biases on annuitization decisions by investigating the impact of default effects and anomalies in intertemporal decision-making and the effect of annuitization decisions on health consciousness. We additionally contribute a further facet to the findings of previous studies in this area by explicitly focusing on the interaction between preselected (default) annuity option settings and the timing of an annuitization decision, i.e., whether this timing (younger individuals considering a distant-future scenario versus older individuals in a near-future scenario) moderates the default effect on annuity uptake. We specifically add to the analysis in Schanbacher et al. (2018) by studying whether the presence of a default setting has an impact on the effect of annuitization decisions on health consciousness as a predictor of health behavior intentions. This novel consideration has various theoretical and practical implications, which we discuss in the final section of this paper.

The research presented here is based on an online experiment with a diversified sample of 339 participants, using the SoSci Panel, a survey panel for the German-speaking regions. While we cannot confirm that default effects and decision timing (distant versus near future) have an impact on annuitization decisions, we do find indications that the default effect of a preselected deferred annuity option is stronger for the distant-future decision time setting than for the near-future decision situation, supporting the hypothesis that the timing of the decision moderates the default effect on the choice of an annuity option. Thus, younger individuals who need to make a distant-future decision exhibit a higher probability of choosing an annuity when the annuity is preselected as a default option than do individuals who need to make a near-future decision, i.e., who are close to retirement. The results also show that the default effect moderates health consciousness after annuity uptake, as health consciousness is stronger for the setting without a default option than for the setting with the preselected (default) annuity option. When consumers rely on the preselected option (default option) while making annuitization decisions, no deliberate decision in favor of the annuity is necessary. This means that consumers’ willingness to behave in a health-promoting manner in order to increase their life expectancy and thus benefit from the long-term annuity income is weaker. A further contribution of our findings to the literature is the provision of additional results regarding covariables that impact consumers’ annuitization decisions, such as their perceptions of the default option, the annuity, and the insurance company (marketplace metacognition); factors arising from personal preferences and circumstances (e.g., financial acumen, income from state pensions, other guaranteed income); and estimated life expectancy.

The paper is structured as follows: the next section sets out the theoretical background to the study and derives the hypotheses, while the subsequent section presents the experimental study and the results. The final section summarizes the paper, discusses theoretical and managerial implications of the findings, and points to limitations of the study and associated avenues for future research.

Theoretical background and derivation of hypotheses

Default effects: a type of framing effect

We first discuss the impact of default settings on decisions around annuitization. Default effects can be classed as a type of framing effect, a term describing the presentation of objectively equivalent information in semantically different ways. Defaults are preselected product options that increase the likelihood of the consumer choosing this product option; many previous studies have confirmed that defaults influence consumer choice toward the preselected product option (Brown and Krishna 2004; Johnson et al. 2002; Madrian and Shea 2001).

Prior work has identified several reasons that may explain default effects. First, consumers may accept the default product option because they want to reduce the physical and cognitive effort required for decision-making (Brown and Krishna 2004; Dinner et al. 2011). In some instances, consumers may even fail to notice that a choice is required and stick to the default option for this reason (Brown and Krishna 2004). The second potential explanation refers to implied endorsement. Consumers perceive the preselected option as an implicit recommendation from a provider (Dinner et al. 2011). Other explanations include the status quo bias and the omission bias. The status quo bias refers to the individual’s tendency to preserve a given state (Johnson et al. 1993; Samuelson and Zeckhauser 1988). The omission bias describes the individual’s tendency to consider a negative outcome of a harmful action to be worse than an equally negative outcome of harmful inaction. In the present context, the harmful action represents the deselection of the default, while the harmful inaction is sticking to the default (Ritov and Baron 1990). Both biases are rooted in the concept of loss aversion, which states that individuals are more affected by losses than by gains (Kahneman and Tversky 1979). The default serves as a reference point and defines the gain and loss domains of a choice. For example, if an expensive, high-quality option is preselected, consumers stick to this option because they want to gain utility from it. By contrast, if an inexpensive, low-quality option is preselected, consumers tend to stick to this option because they want to avoid a loss of money (Grösch and Steul-Fischer 2017; Park et al. 2000).

Previous research further distinguishes between hard and soft defaults (Polak et al. 2008). In the case of a purchase, a hard default is given if complete deselection of a default product or product component is not possible. Consumers can only switch between the product options (Brown and Krishna 2004; Polak et al. 2008). Contrastingly, a soft default represents a recommendation by the provider and aims to steer consumers’ attention to certain product characteristics (Polak et al. 2008). Soft defaults may also include the preselection of one or more services in addition to a basic product. If the basic product is purchased, the additional service does not need to be purchased as well. Previous research has referred to this form of soft default as option framing or opt-in versus opt-out framing (Johnson et al. 2002).

Various experiments have confirmed hard and soft default effects in action. Brown and Krishna (2004) observe that defaults increase consumers’ choice of the preselected option of computers. Further, they have studied marketplace metacognition, which describes consumers’ social intelligence about the marketplace in the sense of a critical perspective, such as their concern that the marketer is acting in its own self-interest (instead of consumers’ interest) by setting a default option. This in turn moderates the default effect by changing consumers’ interpretation of the default; when marketplace metacognition takes place, consumers become more alert to and possibly skeptical about the marketer’s default recommendation, which leads to a more careful evaluation of the default option. Evans et al. (2011) have demonstrated that a default effect for an investment decision (keep or invest USD 20) is moderated by an individual’s state of mental fatigue (also referred to as ego depletion). Participants made smaller changes to the preselected investment option when they were depleted than did non-depleted subjects. Johnson et al. (2002) further investigated a default effect regarding consumers’ acceptance of privacy policies on websites. The authors report that significantly more people agree to privacy policies when the question is framed in an opt-out format (96.3%) than in an opt-in format (48.2%). Grösch and Steul-Fischer (2017, 2018) confirm the default effect in various use cases in non-life insurance decision-making. They show that consumers tend more toward choosing a premium insurance product over a basic insurance product when a default is set to the premium option (Grösch and Steul-Fischer 2017). Further, they find that defaults have a greater influence on consumer behavior when fewer, rather than more, insurance product options are presented (Grösch and Steul-Fischer 2018).

Agnew et al. (2008) investigate the effects of a default option on the choice between a fixed immediate life annuity and self-investing. The default option is implemented by slightly changing the wording of the instructions and by attaching a record sheet for the default option (investment, annuity vs. none). If participants wanted to switch from the default option, they had to request another record sheet. The authors report that in most cases, the presence of a default option did not significantly influence annuitization choice. When controlling for demographic variables, financial literacy, and risk aversion, however, they found that men have a significantly lower annuity uptake rate when they are presented with the investment default. Agnew et al. (2008) explain the weak experimental default effect by the fact that participants were required to make an immediate, near-future decision and were not able to procrastinate. This reasoning accounts for the inconsistency of this finding with prior literature regarding default effects.

Conversely, an empirical study by Bütler and Teppa (2007) does find a positive correlation between a default option and consumers’ decision to annuitize. Their large dataset includes consumer data from ten Swiss companies, of which nine provided an annuity as the default option and a partial or full lump sum payout as an alternative. The results reveal that more than two-thirds of consumers preferred the default option, leading to an annuitization rate that was high overall. The high proportion of annuity default options offered by the ten companies represents a limitation of these findings.

Bateman et al. (2017) also analyze default options for various life annuity products. Participants were asked to allocate their wealth between a life annuity and a phased withdrawal product by using a PC configurator slider ranging from 0 to 100%. The defaults were set at various positions (e.g., 75%) on the configurator slider. The authors found that participants often stuck to the default option. They further reveal that lower levels of education and a lack of involvement (i.e., lack of active interest in matters of personal finance) made it more likely that the individual would choose the default option. They conclude that very poor and very rich people in particular are more likely to stick with the default option, as either the amount of money involved is too small for the choice of option to make a perceived difference (very poor people) or it represents only a small fraction of the individual’s overall wealth (very rich people).

The contradictory nature of these results calls for more research on the influence of default effects on annuitization decisions. In line with general findings regarding defaults (Brown and Krishna 2004; Dinner et al. 2011; Grösch and Steul-Fischer 2017, 2018), we assume that the presence of a default option increases the probability that a consumer will choose a deferred annuity. Our hypothesis is therefore as follows:

H1

Annuity uptake is higher in the annuity default condition than in the no-default condition (default effect).

Decision timing

A second factor influencing annuitization decisions is the timing of that decision. Consumers usually decide whether to take an annuity or a one-time lump sum shortly before entering retirement. Schreiber and Weber (2016) show lower rates of choice of an annuity when consumers need to make this decision soon before they retire (near-future situation). Contrastingly, the probability of choosing an annuity increases for younger consumers who may need to make this decision at the outset of their insurance contract (distant-future situation). This gives rise to an intertemporal decision-making situation, as there is a long period of time between the decision and actually claiming the pension payout. In this context, we note the occurrence of “hyperbolic discounting,” that is, individuals’ tendency to prefer smaller immediate rewards to waiting for a larger future reward, which results in a present bias (Schreiber and Weber 2016; Wang and Sloan 2018). In our context, this means that consumers discount payments in the near future more strongly and payments in the longer term less strongly, a pattern that stands in contrast to exponential discounting (Schreiber and Weber 2016, p. 38; Wang and Sloan 2018). The immediate reward of a lump sum, then, is preferred over monthly payout streams (annuity), even if the present value of both options is the same on the basis of standard discounting. In this respect, Schreiber and Weber (2016) observe a significant negative effect of age on the probability of choosing an annuity over a lump sum, even though the present values of both alternatives are equivalent when standard discounting is applied. Younger individuals showed a strong preference for annuities, whereas older individuals tended to prefer the lump sum. The authors therefore infer that in order to increase the uptake of annuities, insurance agreements should require consumers to choose a payout scheme at the beginning of the contract’s run, when they are younger.

Taking a similar direction, previous studies have analyzed consumer behavior in various decision-making situations in which immediate and future benefits are at stake (Khan and Dhar 2007; Milkman et al. 2008; Wertenbroch 1998). Decisions that offer immediate benefits encourage affective decision-making behavior, that is, behavior that focuses on short-term, impulsive goals. Conversely, decisions that offer future benefits encourage rational decision-making behavior (Milkman et al. 2008). This confirms the overall findings of the field, that consumers choose lump sums when they need to make a near-future decision because they receive an immediate benefit, while consumers who need to make a distant-future decision go for annuities because they give greater priority to rational factors. We derive the following hypothesis from these findings:

H2

Annuity uptake is higher in the distant-future condition than in the near-future condition.

While this hypothesis has been studied before (Schreiber and Weber 2016), research has yet to tackle the question of the extent to which defaults influence the effect of the decision’s timing on annuitization decisions. Overall, the literature investigating the default effect in intertemporal decision-making is sparse.

In a different context, Sutter et al. (2015) analyzed whether the intertemporal decision-making of kindergarten children is susceptible to influence by defaults. Their findings show that about 50% of the children prefer to receive one reward immediately rather than having two rewards the next day. When the researchers set a default on the future condition, the proportion of children choosing two rewards the next day increased to more than 70%. Although these results suggest that defaults work successfully in directing consumer behavior toward the acceptance of later, larger rewards (e.g., deferred annuities) when an immediate decision needs to be made (e.g., soon-to-be retirees making choices on their pension payout scheme), evidence on choices in near-future versus distant-future scenarios is lacking in this study, as is generalizability to an adult sample.

Younger consumers often find it difficult to imagine a retirement situation because their mental representations of this future event are abstract and decontextualized. This is why consumers strive for simplifying and superordinate goals in terms of distant-future decisions. Older individuals who are about to retire, by contrast, have the ability to mentally represent their retirement in a more concrete and contextualized manner. They strive for subordinate goals in terms of near-future decisions (Trope and Liberman 2003). This phenomenon can be explained by construal level theory (Trope and Liberman 2010), which describes the relationship between psychological distance (temporal, social, spatial, and hypothetical distance) and mental abstraction. Individuals can experience psychological distance from a point of reference, which is “the self in the here and now.” A great psychological distance of an object or event from this point of reference leads to high mental abstraction. The smaller the psychological distance, the more concrete a given event seems. In this context, temporal distance in particular changes a consumer’s response to financial decisions in the future by altering the manner of their mental representation of the future event (such as retirement). The greater the temporal distance from a future event, the more likely it is to be represented in an abstract, simple and decontextualized manner (high-level construal). The reverse occurs for temporally close events (low-level construal) (Trope and Liberman 2003, 2010). We therefore assume that consumers who need to make a distant-future decision about their pension payout scheme (e.g., younger consumers) rely more strongly on the default option in order to simplify the decision they face regarding an abstract event of which they struggle to form a mental representation. Consumers who need to make a near-future decision (e.g., older consumers) seem to be more aware of their retirement because of the concrete mental representation they can form, and are therefore less affected by the default option. On the basis of this reasoning, we propose the following hypothesis:

H3

The timing of the decision moderates the default effect on annuity uptake. The default effect is stronger for distant-future than for near-future decision situations.

Health consciousness

As well as in annuitization decisions, individuals also show time-inconsistent, present-biased behavior toward health issues. Although living a healthy lifestyle offers substantial long-term benefits (reducing, for example, obesity and the risk of cardiovascular complications and diabetes), the cost of following a healthy lifestyle—such as healthy diet and physical activity—occurs immediately (Wang and Sloan 2018). In order to address this issue, various scholars have studied framing effects with regard to more proximal presentation of health messaging (e.g., every day versus every year) with the aim of increasing health risk perception and therefore immediate health behavior intention (Chandran and Menon 2004; Heideker 2019; Murdock and Rajagopal 2017). Some studies have validated the positive impact of defaults on health behavior. Chapman et al. (2010) found that automatic scheduling of flu shot appointments increases the likelihood of vaccination uptake.

However, literature on the relationship between annuitization decisions and health consciousness as an antecedent of health behavior and health behavior intentions is sparse. Prior research has focused on health status antecedents (Cappelletti et al. 2013; Payne et al. 2013; Turra and Mitchell 2009) rather than on the consequences of choosing a lump sum as opposed to an annuity. Only Schanbacher et al. (2018) analyze whether the choice made in relation to a pension payout can influence health behavior. Their findings show that individuals who indicate a higher (versus lower) probability of choosing an annuity will be more likely to engage in more (as opposed to less) healthy behaviors in order to increase their life expectancy and benefit from long-term payout streams. The question remains as to whether this observation still holds true when consumers make their decision regarding an annuity or lump sum in the presence of a preselected (default) option. We assume that health consciousness, being an antecedent of health behavior intentions (Gould 1988), is weaker when the decision is made by default, because no deliberate decision in favor of the annuity is necessary in this case. Our fourth hypothesis therefore reads:

H4

The default effect moderates health consciousness after annuity uptake. Health consciousness is stronger in the no-default condition than in the annuity default condition.

In summary, the conceptual framework of our study proposes that the presence of a default option and the timing of the decision influence the probability of choosing an annuity in case of a deferred annuity. We further hypothesize an interaction effect between the default option and the decision’s timing, affecting the probability of annuity uptake, and a further interaction effect between the default option and the probability of annuity uptake, affecting health consciousness. In this context, health consciousness serves as an antecedent for health behavior intentions (see Fig. 1).

Experimental study

Method

To test the hypotheses, we conducted an online experiment involving 491 participants, who were randomly assigned to one of four conditions of a 2 (default option: preselected annuity option vs. no-default option) × 2 (decision timing: distant future vs. near future) between-subjects design. Experiments are an established research method that is especially suitable for testing cause-and-effect relationships. The use of a between-subjects design is advantageous, and preferable to a within-subject design, due to its capacity to eliminate the occurrence of carryover effects (Koschate-Fischer & Schandelmeier 2014). We conducted the online experiment with the help of a scientific survey panel to ensure we obtained a diversified sample structure. The SoSci Panel enables researchers to carry out non-commercial scientific surveys in German-speaking regions (Germany, Austria, Switzerland). Prior to the field phase, two independent reviewers checked our survey to ensure its high scientific quality.

Our scenario is presented in the Appendix, in Table 3 and Figures 3 and 4, and was structured as follows: after a short introductory text, participants were shown a screen outlining a private pension offered by a fictitious insurance company. Immediately after seeing this, participants were requested to indicate the probability of their annuity uptake and answer further questions. The introductory text (see Table 3) asked participants in the distant-future treatment groups (participants aged 40 years and younger) to imagine that they intended to make financial provisions for their retirement and were therefore seeking information about private pension insurance products. During their search, they became aware of the product offered by a fictitious insurance company called XY–insurance. Participants were asked to imagine that the XY insurance product had seemed worth buying to them and that they had accordingly decided to take out the private pension in the form of a deferred annuity (with a term of 40 years until the start of the pension and a monthly premium of EUR 150 with dynamic contributions).Footnote 1 They were further told that the insurance company required them to select their preferred form of payout (annuity or lump sum) as part of the purchasing process. Participants in the near-future treatment (those older than 40 years) were asked to imagine that they were approaching retirement. Forty years ago, in order to make financial provisions for their retirement, they had taken out a private pension policy with the XY-Insurance company at a monthly premium of EUR 150, with dynamic contributions.1 Participants were requested to refamiliarize themselves with “their” product and then decide on their preferred form of payout.

We deliberately decided to assign the subjects to the treatments on the basis of their age in order to create a decision-making situation that was as realistic as possible, which also implies that the “decision timing” effect also reflects an age effect. We regarded the age of 40 years as a suitable threshold to distinguish distant-future from near-future scenarios because individuals in Germany are usually of younger working age when they decide to take out a private pension with a period of saving until retirement. In contrast, participants older than 40 years are closer to retirement. As a result, we consider that the subjects should empathize more closely with the scenario they were assigned to on this basis, due to the more concrete and less abstract nature of that scenario at their particular life stage (Trope and Liberman 2010).

After the introductory text, we used a screenshot of the website of a large German insurance company containing information regarding the contract details and expected payouts, and adjusted it to represent the fictitious insurance company. In so doing, we were able to provide a realistic presentation of the scenario, containing all necessary information. In the upper part of the screenshot, the advantages of the private pension plan are listed in bullet points that mention financial security and the advantage of being able to choose the form of the payout (annuity or lump sum). The lower part of the screenshot compares the expected monthly annuity and the one-time lump sum payout upon retirement in different scenarios. The following information and figures are given regarding the annuity payout: The total expected monthly annuity is EUR 805, the monthly guaranteed minimum annuity payout is EUR 204 and the monthly premium is set at EUR 150 with dynamic contributions1 and a term of 40 years. Regarding the lump sum payout, the information comprises the following: The total expected payout, including dynamic contributions of 3%, is EUR 2,13,566, the return after taking costs into account is 2.64%, the guaranteed payout is EUR 72,000 and the initial monthly premium is set at EUR 150 with dynamic contributions1 and a term of 40 years.Footnote 2 The information and figures regarding the annuity and lump sum payout are displayed in two boxes. A Select button appears at the bottom of each box.

Besides manipulating for the timing of the decision as defined above, we also manipulated the default option by framing, highlighting the annuity information box with a blue frame (Figure 3). In addition, we changed the text on the bottom button to Selected form of payout. In the no-default condition (Figure 4), no payout option was highlighted, and both boxes were kept in simple gray frames. Afterward, the participants were asked to decide whether they would like to receive the payout upon retirement in the form of a one-time lump sum or a lifelong monthly annuity.

Measures: We first measured the participants’ probability of annuity uptake on a 7-point Likert scale (1 = very unlikely, 7 = very likely). The use of Likert scales to elicit individual attitudes, perceptions and purchase probability is a common procedure in the literature [see, for example, Grösch and Steul-Fischer (2017) and Schreiber and Weber (2016)].

We further measured participants’ satisfaction with their choice on a 7-point rating scale (1 = strongly disagree, 7 = strongly agree), adapting a five-item scale from Sainfort and Booske (2000). Questions regarding the participants’ perception of the default, the annuity, and the insurance company and their personal preferences and circumstances followed (see Appendix, Table 4). A two-item scaleFootnote 3 (1 = strongly disagree, 7 = strongly agree) was used to assess the participants’ perception of the default; items included “The default setting helped me in my decision-making.” Three-item scales (1 = strongly disagree, 7 = strongly agree) were used to measure the participants’ perception of the annuity (e.g., “I think that most people choose the lifetime monthly pension.”) and their marketplace metacognition. The marketplace metacognition scale was adapted from Brown and Krishna (2004) and from Grösch and Steul-Fischer (2017) and is intended to measure participants’ attitudes toward the insurance company; items included “I believe the insurance provider cares about my interests.” In order to control for other factors influencing annuitization decisions, we measured factors arising from personal preferences and circumstances by adapting eight selected items based on the categorization in MacDonald et al. (2013). Among these were “I am able to balance financial risks within the family.”, “I trust my personal abilities to invest the money.”, “I have other sources of guaranteed income.”, “The monthly state pension seems insufficient to me.”, and “The monthly annuity payout seems insufficient to me.”

The survey continued with questions on the participants’ health consciousness and health behavior intentions. We first used a nine-item scale (1 = extremely uncharacteristic, 2 = somewhat uncharacteristic, 3 = uncertain, 4 = somewhat characteristic, 5 = extremely characteristic) from Gould (1988) in order to determine the participants’ general health consciousness (e.g., “I reflect on my health a lot.”, “I’m very conscious of my health.”, “I’m constantly examining my health.”). In addition, the participants’ current and future health behavior intentions were measured using four items that controlled for their eating habits (fruit and vegetables) and levels of physical activity (walking and other exercise) following Pozolotina and Olsen (2019). According to the German Federal Ministry of Health (Bundesministerium für Gesundheit 2019), healthy eating habits and physical activity are among the primary factors in the prevention of common health conditions such as diabetes mellitus and cardiovascular disease. Participants indicated how often they had, for example, eaten vegetables during the past year and how often they planned to do this during the year to come, on the following scale: 1 = never, 2 = infrequently, 3 = several times a month, 4 = once a week, 5 = several times a week, 6 = daily (Pozolotina and Olsen 2019).

Participants’ temporal focus (Shipp et al. 2009) was measured using a 7-point scale (1 = never, 3 = sometimes, 5 = often, 7 = always) in order to investigate how participants incorporate their perceptions of their past experiences, current situations, and future expectations into their annuitization decisions. Four items each were used to measure past (e.g., “I replay memories of the past in my mind.”), present (e.g., “I focus on what is currently happening in my life.”), and future temporal focus (e.g., “I think about what my future has in store.”). Another variable that may influence participants’ annuitization decisions is their perceived life expectancy. We therefore measured perceived life expectancy by adapting a four-item scale from Payne et al. (2013). Within this scale, participants were asked to indicate their estimates of the probability that they will attain the age of 65 +, 75 +, 85 +, and 95 + years. In addition, participants were requested to estimate their life expectancy in an open-text question. Further, a 7-point rating scale (1 = strongly disagree, 7 = strongly agree) was used to control for participants’ general risk aversion as a factor driving annuity demand; we derived the scale’s six items from Mandrik and Bao (2005) (examples are “I do not feel comfortable about taking chances.”, “I prefer situations that have foreseeable outcomes.”).

Finally, the survey closed by asking participants about the financial provisions they currently had in place for their retirement, their knowledge about insurance and particularly about pension insurance (e.g., “my level of knowledge about insurance products in general is very low/very high”), and their socio-demographic variables (gender, age, height, weight, education, work status, net income, and nationality). (See Appendix, Table 4, for an overview of measures used for the experimental study).

Results

Manipulation check

We asked the participants whether the annuity option had been preselected by the insurance company or not. Participants who did not answer this manipulation check correctly, and those participants who exhibited low self-assessed accuracy of responses and understanding of the questions, low perceived realism of the scenario described, and low ability to put themselves in the scenario, were eliminated from the data set. Cases where completion had taken an unusually long time and those containing implausible details of height were also excluded. Finally, we excluded participants older than 64—the average retirement age in Germany—from our analysis to ensure the sample was realistic in terms of the scenarios given. The total number of exclusions was 152.Footnote 4 The final sample comprised 339 participants. Table 1 shows the approximately equal distribution of the final sample across the four treatments. Following the assertion by Sawyer and Ball (1981) that approximately 30 participants are required for each experimental condition, we can consider our sample size sufficient for the experiment, with more than twice as many subjects in each treatment.

Sample characteristics

The sample consisted of 55.2% female and 43.7% male participants. The remaining 1.2% recorded their gender as “diverse,” a German legal category available to those who do not identify with binary gender classifications. The participants had an average age of 42.5 years. The youngest participant was 19 and the oldest 64 years old. The majority of participants held a German Diploma or Master's degree as their highest educational qualification (38.6%). Seventeen point four percent each stated that their highest level of education was a high school diploma—which entitles the holder to enter higher education—and a Bachelor's degree. Other participants reported holding a secondary school diploma (10.6%), a state-examined degree (i.e., in teaching, medicine, pharmacy, or law) (8.3%), or a doctoral degree (5.3%). With regard to their current work status, 59.6% of respondents said they held an employed position. Students (12.1%), self-employed people (10.3%), and public officials (7.7%) are also represented in the sample. The remaining participants were jobseekers, homemakers, or retirees, or held other work statuses (total 9.4%). The participants’ monthly net income was distributed as follows: less than EUR 1500: 25.3%; between EUR 1,500 and EUR 2999 : 34.2%; EUR 3000 or over: 31.8%. Eight point six percent of the respondents did not choose to give any information on their income. The sample is predominantly German in nationality (87.6%), with some Austrian (6.9%), and Swiss participants (5.4%).

Default option and decision timing

An ANCOVA was performed to investigate the main effects of the default option and the timing of the decision and to ascertain their interaction effect on the probability of annuity uptake, while controlling for risk aversion, confidence in personal financial acumen, income from state pensions, other guaranteed income, and estimated life expectancy. The analysis shows no significant influence of the default option (F(1,309) = 1.828; p = 0.177) on the probability of annuity uptake. The participants’ overall annuity uptake, then, is not significantly higher when the annuity is presented as the preselected option (default option) than it is without a default setting. Our findings therefore fail to support the default effect and thus hypothesis H1.

We further observe that the participants’ satisfaction with their choice differs significantly between the annuity default and no-default treatments. Subjects’ satisfaction with their choice regarding annuity uptake is significantly lower when the annuity payout was preselected by the insurance company than in the no-default conditions (Mno_default = 5.57 and Mdefault = 5.31, p = 0.042). The further survey questions regarding the participants’ perception of the default option, the annuity, and the insurance company (marketplace metacognition) yield the following results (on a scale of 1 to 7): First, participants assigned to the annuity default treatments (n = 146) reported not finding the preselection of the annuity option very helpful (M = 2.45, SD = 1.750) and tended not to consider it good (M = 2.51, SD = 1.794) that the annuity payout was preselected by the insurance company. The more strongly participants rated the default setting as helpful (β = 0.308, t = 3.390, p = 0.000) or good (β = 0.455, t = 5.456, p = 0.000), the higher their probability of annuity uptake. Second, participants’ perception of the annuity differed significantly between the annuity default and no-default treatments. Participants in the annuity default treatments agreed significantly more strongly to the statement that the annuity seems to be a popular choice (Mno_default = 4.04 and Mdefault = 4.70, p = 0.000), that most people choose the annuity (Mno_default = 4.10 and Mdefault = 4.77, p = 0.000), and that the insurance company recommends it (Mno_default = 5.06 and Mdefault = 5.57, p = 0.003) than did participants assigned to the no-default treatments. Third, the results regarding the participants’ perception of the insurance company indicate a high level of marketplace metacognition, which means that respondents tend not to perceive the insurance company as trustworthy (M = 2.33, SD = 1.333), interested in their needs (M = 2.94, SD = 1.401), or unselfish (M = 2.39, SD = 1.525). A regression analysis further shows that participants indicate a significantly higher probability of annuity uptake the more strongly they rate the insurance company as trustworthy (β = 0.224, t = 2.755, p = 0.006), interested in their needs (β = 0.365, t = 4.638, p = 0.000), or unselfish (β = 0.244, t = 3.401, p = 0.000).

With respect to H2, the ANCOVA shows no significant influence of decision timing (F(1,309) = 0.402; p = 0.527) on the probability of annuity uptake. This means that participants younger than 40, i.e., those in the distant-future treatment groups, do not exhibit a significantly higher probability of annuity uptake than older participants, i.e., those in the near-future treatment groups. On the basis of this analysis, hypothesis H2 cannot be supported.

Our analysis regarding the participants’ temporal focus further reveals that respondents assigned to the distant-future treatments (younger consumers, who were asked to imagine purchasing a deferred private annuity) are significantly more future-focused (Mdistant = 4.55 and Mnear = 4.11, p = 0.000) and less focused on the present (Mdistant = 4.68 and Mnear = 5.02, p = 0.000) than are respondents assigned to the near-future treatment groups (older consumers, whose task was to imagine that they were about to retire and claim their payout in the form of an annuity or a lump sum). This means that distant-future treatment groups are more concerned about future events, while near-future treatment groups focus more on the here and now. On average, participants indicate probabilities of 90%, 80%, 60%, and 30% that they will reach, respectively, the ages of 65 + , 75 + , 85 + , and 95 + . Their mean perceived life expectancy is 84.6 years, with female respondents giving an average estimated life expectancy of 85.1 years and male respondents stating 84.1 years on average.

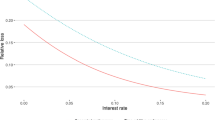

However, as Figure 2 demonstrates, the ANCOVA shows a significant interaction effect between the default option and the timing of the decision (F(1,309) = 3.945; p = 0.048).

Consequently, hypothesis H3 can be supported, as the influence of the default effect on the probability of annuity uptake is moderated by the timing of the decision. This finding is in line with construal level theory and the relationship between temporal distance and mental abstraction. In particular, participants in the distant-future treatments who were shown the annuity as the preselected option (default option) exhibit a higher probability of annuity uptake (Mdefault = 3.99) than do participants in the distant-future treatments who were not shown the annuity as the default option (Mno default = 3.32). The opposite is observable for participants in the near-future treatments. Participants asked to imagine that they were about to retire thus showed a marginally higher probability of annuity uptake when the annuity option was presented without the default option (Mno default = 3.72 vs. Mdefault = 3.54).Footnote 5

Health consciousness:

Our analysis shows a significant difference in health consciousness between the no-default and annuity default treatments (Mno_default = 3.67 and Mdefault = 3.43, p = 0.018) under the condition of a high annuity uptake rate (n = 160).Footnote 6 Participants who indicate a high probability of annuity uptake when the annuity payout option is preselected report significantly lower levels of health consciousness. We can consider hypothesis H4 as supported on this basis. A regression analysis reveals a highly significant direct effect of health consciousness on future health behavior intentions (β = 0.252, t = 4.050, p = 0.000). Furthermore, participants’ past health behavior is significantly worse than their future health behavior intentions (Mpast = 4.45 and Mfuture = 4.83; p = 0.000).Footnote 7

Lastly, results regarding participants’ current financial provisions for retirement show the following distribution: 31.6% of the participants state that they had taken out private pension insurance as a form of retirement provision. In addition, occupational pension funds (45.1%), stocks and shares (42.8%), real estate (38.9%) and “Riester-Rente”Footnote 8 (23.6%) are also popular forms of retirement provision among the respondents. Further, participants indicate a moderate level of knowledge regarding insurance products in general (M = 3.53, SD = 1.466) and pension insurance in particular (M = 3.27, SD = 1.547). However, the participants in the distant-future treatments indicate significantly lower knowledge about insurance products in general (Mdistant = 3.16 and Mnear = 3.87, p = 0.000) and about pension insurance products in particular (Mdistant = 2.83 and Mnear = 3.69, p = 0.000) than do the participants in the near-future treatments. Men report significantly higher knowledge about insurance products in general (Mmen = 3.94 and Mwomen = 3.20, p = 0.000) and pension insurance products in particular than do women (Mmen = 3.66 and Mwomen = 2.96, p = 0.000). Self-reported knowledge about pension plans positively correlates with the past purchase of a private pension plan. Consequently, the findings reveal that the probability of annuity uptake is significantly higher for participants in the distant-future treatments (n = 164) who had previously purchased private pension insurance than for those who had not (Mprivate_pension_insurance = 4.36 and Mno_private_pension_insurance = 3.55, p = 0.013).

Further results

The analysis of factors arising from personal preferences and circumstances provides additional information on the factors driving the choice of a deferred annuity. Table 2 shows the mean values and standard deviations of factors arising from personal preferences and circumstances. On average, participants agree strongly with the statements “I want to be without cashflow worries during retirement,” “The monthly state pension seems insufficient to me,” “I have other sources of guaranteed income,” and “The monthly annuity payout seems insufficient to me”.

Summary and discussion of implications

Theoretical implications

In our study, we examined the impact of default effects and decision timing on the choice of an annuity over a lump sum pension insurance payout. Alongside analyzing whether the presence (as opposed to the absence) of a preselected (default) annuity option increases annuity uptake, we examined whether annuity uptake increases in distant-future as opposed to near-future scenarios (e.g., depending on participants’ age) and the interaction effect between a default effect and the timing of the decision. We further studied the impact of annuity uptake on individuals’ health consciousness depending on the presence of a preselected (default) annuity option.

Our findings reveal no significant main effect of a preselected annuity option (default option) or of decision timing on the probability of annuity uptake, a result largely in line with Agnew et al. (2008). Although a tendency toward a default effect is perceptible, the default effect (hypothesis H1) cannot be statistically supported. The participants’ high marketplace metacognition (i.e., their critical view of the insurer’s intentions) and negative perception of the default option accounts for the weak default effect, which corresponds to the findings regarding marketplace metacognition in Brown and Krishna (2004).

Further, we could not find support for hypothesis H2; our findings thus contradict those in Schreiber and Weber (2016). Their sample consisted of predominantly male (83%) and highly educated readers of a German national daily newspaper, which contrasts with our diversified sample. In addition, their survey design differs from ours, as they randomly assigned the participants to an immediate or future scenario. In contrast, we deliberately assigned the participants of our study to the different scenarios on the basis of their age in order to create a decision-making situation that was as realistic as possible. However, our findings reveal a significant interaction effect between default option and decision timing, confirming H3, which has not been studied to date. In particular, the timing of the decision moderates the default effect on annuity uptake, where the default effect is stronger for distant-future than for near-future decisions. In line with construal level theory (Trope and Liberman 2010) and specifically the relationship between temporal distance and mental abstraction, we find that consumers who need to make a distant-future decision about their pension payout scheme (younger consumers) rely more closely on the default option than do consumers who need to make a near-future decision (older consumers). The default option simplifies choices on an abstract event such as retirement, that participants in distant-future scenarios struggle to mentally represent. In contrast to this, participants in near-future scenarios are barely affected by the presence of a default option because they appear more aware of their retirement due to their situational ability to form a concrete mental representation of it. The probability of annuity uptake for near-future subjects is marginally lower in the annuity default option condition than for the no-default option.

An additional contribution of our study to the literature consists in its examination of the impact of annuity uptake on individuals’ health consciousness. Schanbacher et al. (2018) were the first to show that individuals who indicate a higher probability of choosing an annuity will be more likely to engage in healthier behaviors in order to increase their life expectancy and benefit from long-term payout streams. We therefore sought to ascertain whether the presence of an annuity default option weakens this observed tendency. Because when consumers rely on the default while making annuitization decisions, no deliberate choice in favor of the annuity is necessary. The results reveal that the default effect indeed moderates health consciousness after annuity uptake, supporting H4. Health consciousness is stronger for the no-default condition than for the annuity default condition. Our results further confirm a positive effect of health consciousness on future health behavior intentions.

Managerial implications

Our findings promote better understanding of the impact of a preselected annuity option (default option) in connection with the timing of consumers’ choices between a lifelong annuity and a lump sum payout at retirement and in connection with health consciousness. This information is valuable in that it provides insights into potential routes to increasing annuitization rates and health consciousness among individuals by acknowledging biases in decision-making. In Germany, for instance, deferred annuities with a long savings period, in which consumers decide on the form of pension payout they wish to receive (annuity or lump sum) shortly before entering retirement, are common. But, as Schreiber and Weber (2016) have proposed in their considerations of how to solve the annuity puzzle, encouraging consumers to commit to a binding choice when they are younger could help increase annuity uptake. Taking their observations further, our empirical evidence additionally suggests that presenting the annuity option as a preselected (default) option may be advantageous for increasing annuity uptake among consumers in a distant-future decision situation. Conversely, the implementation of a preselected (default) annuity option appears not to be necessary for increasing annuity uptake among consumers who are close to retirement and thus need to make a near-future decision. Our empirical evidence may further prompt insurance companies to make improvements in product design and communication, such as taking account of consumers’ health consciousness and health behavior intentions. By expanding their role and partnering with the consumer in supporting their health and taking preventive action—which they might do, for example, by providing information on healthy behaviors or health-related apps—insurance companies can have a positive impact on consumers’ health behaviors after they have made annuitization decisions. In addition, insurance companies should take action to retain or build consumer trust in the company, because a higher level of skepticism toward a provider (marketplace metacognition) can cause consumers to avoid the annuity option.

Limitations and directions for future research

This research has some limitations that offer opportunities for future research. First, the results are limited to an academic sample in the German-speaking regions and were gained from an online experiment. Future research should attempt to replicate the findings in samples including different or diverse nationalities. Data from real annuitization decisions would also be advantageous, as fictional decision situations may differ from real ones. Individuals may evaluate their pension gap, risks, and default options differently when making annuitization decisions in the real world. Second, more research on the influence of default effects on annuitization decisions is required. The annuity default option in our scenarios was color-coded and appeared as a recommendation from the fictitious insurance company offering the product. We are of the view that more detailed investigation of the preselection of the annuity option could be warranted. It may be advantageous to combine the preselected (default) annuity option with extensive advice from the insurance company explaining why consumers should choose the annuity option (Grösch and Steul-Fischer 2017). Finally, it would be of interest to investigate forms of marketing or communication interventions and methods (e.g., chatbots, informational videos, labels) in order to increase consumers’ knowledge about insurance products—specifically pension plans—and counter their critical view of insurers’ intentions (marketplace metacognition), both of which can be influencing factors in decisions on annuitization. Future research that takes account of these issues and variables may be able to attain further insights into the behavioral biases that occur during annuitization decisions and consequently help solve the annuitization puzzle.

Notes

The premium increases by 3% every year to compensate for inflation.

Note that all figures were calculated using a calculator to be found on the website of a large German insurance company.

These items were filtered for participants who were assigned to one of the two annuity default treatment groups (n = 146).

Low self-assessed accuracy of responses (n = 9; participants who rated the accuracy of their responses lower than or equal to 3 on the 7-point Likert scale (1 = strongly disagree, 7 = strongly agree)); failed manipulation check (n = 49; participants who indicated incorrectly whether the annuity option was preselected or not); low levels of understanding of the question, low perceived realism of the scenario, and low ability to put oneself in the scenario (n = 37; participants who placed their understanding of the question, the perceived realism of the scenario, and their ability to put themselves in the scenario lower than or equal to 3 on the 7-point Likert scale (1 = strongly disagree, 7 = strongly agree)); response duration (n = 5; outliers with very high response duration > 4000 s); implausible details of height (n = 1); age > 64 (n = 51).

Note that our results remain robust if we enlarge the sample by including participants above the age of 64. When these participants are included in the sample (n = 368), the ANCOVA also shows no significant influence of the default option (F(1,359) = 2.522; p = 0.113) and decision timing (F(1,359) = 1.141; p = 0.286) on the probability of annuity uptake. As in the final sample without participants above the age of 64, there is a significant interaction effect between the default option and the timing of the decision (F(1,359) = 4.088; p = 0.044).

Note that our results remain robust if we enlarge the sample by including participants who showed low self-assessed accuracy of responses, low levels of understanding, low perceived realism of the scenario, and low ability to put themselves in the scenario, alongside cases where responding took a notably long time or where implausible details of height were given. When these participants are included in the sample (n = 385), the ANCOVA also shows no significant influence of the default option (F(1,376) = 0.485; p = 0.487) and decision timing (F(1,376) = 0.021; p = 0.885) on the probability of annuity uptake. As in the final sample without the mentioned participants, there is a significant interaction effect between the default option and the timing of the decision (F(1,376) = 3.937; p = 0.048).

Participants who gave a probability of annuity uptake greater than or equal to 4 on the 7-point Likert scale (1 = very unlikely, 7 = very likely).

Note that these results remain robust if we enlarge the sample by including participants above the age of 64. When these participants are included in the sample (n = 191), the analysis also shows a significant difference in health consciousness, when annuity uptake is high, between the no-default option and the annuity default treatment groups (Mno_default = 3.64 and Mdefault = 3.46, p = 0.039). In addition, a regression analysis reveals a highly significant direct effect of health consciousness on future health behavior intentions (β = 0.212, t = 2.382, p = 0.018). Overall, participants’ past health behavior is significantly worse than their future health behavior intentions (Mpast = 4.41 and Mfuture = 4.76; p = 0.000).

Note that these results are also robust if we enlarge the sample by including participants who showed low self-assessed accuracy of responses, low levels of understanding, low perceived realism of the scenario, and low ability to put themselves in the scenario, and cases where responding took a notably long time or where implausible details of height were given. When these participants are included in the sample (n = 179), the analysis also shows a significant difference in health consciousness, when annuity uptake is high, between the no-default option and annuity default treatment groups (Mno_default = 3.67 and Mdefault = 3.42, p = 0.023). In addition, a regression analysis reveals a highly significant direct effect of health consciousness on future health behavior intentions (β = 0.228, t = 3.959, p = 0.000). Overall, participants’ past health behavior is significantly worse than their future health behavior intentions (Mpast = 4.46 and Mfuture = 4.83; p = 0.000).

A German state-subsidized private retirement provision scheme.

References

Agnew, J.R., L.R. Anderson, J.R. Gerlach, and L.R. Szykman. 2008. Who chooses annuities? An experimental investigation of the role of gender, framing, and defaults. American Economic Review 98 (2): 418–422.

Alexandrova, M., and N. Gatzert. 2019. What do we know about annuitization decisions? Risk Management and Insurance Review 22 (1): 57–100.

Bär, M., and N. Gatzert. 2022. Products and Strategies for the decumulation of wealth during retirement: insights from the literature. North American Actuarial Journal (forthcoming).

Bateman, H., C. Eckert, F. Iskhakov, J. Louviere, S. Satchell, and S. Thorp. 2017. Default and naive diversification heuristics in annuity choice. Australian Journal of Management 42 (1): 32–57.

Benartzi, S., A. Previtero, and R.H. Thaler. 2011. Annuitization puzzles. Journal of Economic Perspectives 25 (4): 143–164.

Beshears, J., J.J. Choi, D. Laibson, B.C. Madrian, and S.P. Zeldes. 2014. What makes annuitization more appealing? Journal of Public Economics 116: 2–16.

Brown, J.R. 2007. Rational and behavioral perspectives on the role of annuities in retirement planning. NBER Working Paper Series.

Brown, J.R., A. Kapteyn, E.F.P. Luttmer, O.S. Mitchell, and A. Samek. 2017. Behavioral impediments to valuing annuities: Evidence on the effects of coplexity and choice bracketing. NBER Working Paper Series 24101.

Brown, J.R., J.R. Kling, S. Mullainathan, and M.V. Wrobel. 2008. Why don’t people insure late-life consumption? A framing explanation of the under-annuitization puzzle. American Economic Review 98 (2): 304–309.

Brown, J.R., J.R. Kling, S. Mullainathan, and M.V. Wrobel. 2013. Framing lifetime income. The Journal of Retirement 1 (1): 27–37.

Brown, C.L., and A. Krishna. 2004. The skeptical shopper: A metacognitive account for the effects of default options on choice. Journal of Consumer Research 31 (3): 529–539.

Bundesministerium für Gesundheit, 2019. Prävention. https://www.bundesgesundheitsministerium.de/service/begriffe-von-a-z/p/praevention.html. Accessed 23 September 2021

Bütler, M., and F. Teppa. 2007. The choice between an annuity and a lump sum: Results from Swiss pension funds. Journal of Public Economics 91 (10): 1944–1966.

Cappelletti, G., G. Guazzarotti, and P. Tommasino. 2013. What determines annuity demand at retirement? The Geneva Papers on Risk and Insurance — Issues and Practice Issues and Practice 38 (4): 777–802.

Chandran, S., and G. Menon. 2004. When a day means more than a year: effects of temporal framing on judgments of health risk. Journal of Consumer Research 31 (2): 375–389.

Chapman, G.B., M. Li, H. Colby, and H. Yoon. 2010. Opting in vs opting out of influenza vaccination. JAMA—Journal of the American Medical Association 304 (1): 43–44.

Dinner, I.M., E.J. Johnson, D.G. Goldstein, and K. Liu. 2011. Partitioning default effects: Why people choose not to choose. SSRN Electronic Journal: 1–33.

Evans, A.M., K.D. Dillon, G. Goldin, and J.I. Krueger. 2011. Trust and self-control: the moderating role of the default. Judgment and Decision Making 6 (7): 697–705.

Finkelstein, A., and J. Poterba. 2002. Selection effects in the United Kingdom individual annuities market. The Economic Journal 112 (476): 28–50.

Gould, S.J. 1988. Consumer attitudes toward health and health care: a differential perspective. Journal of Consumer Affairs 22 (1): 96–118.

Grösch, M., and M. Steul-Fischer. 2017. Defaults and advice in self-customization procedures of insurance. Zeitschrift Für Die Gesamte Versicherungswissenschaft 106 (3–4): 325–341.

Grösch, M., and M. Steul-Fischer. 2018. Less is more: how the number of insurance options influences customers’ default acceptance. Zeitschrift Für Die Gesamte Versicherungswissenschaft 107 (5): 517–529.

Heideker, S. 2019. Consumers’ future orientation and the effect of temporal framing on health risk perception. AP - Asia-Pacific Advances in Consumer Research 12: 279–286.

Hu, W.Y., and J.S. Scott. 2007. Behavioral obstacles in the annuity market. Financial Analysts Journal 63 (6): 71–82.

Johnson, E.J., S. Bellman, and G.L. Lohse. 2002. Defaults, framing and privacy: why opting in-opting out. Marketing Letters 13 (1): 5–15.

Johnson, E.J., J. Hershey, J. Meszaros, and H. Kunreuther. 1993. Framing, probability distortions, and insurance decisions. Journal of Risk and Uncertainty 7 (1): 35–51.

Kahneman, D., and A. Tversky. 1979. Prospect theory: an analysis of decision under risk. Econometrica 47 (2): 263–291.

Khan, U., and R. Dhar. 2007. Where there is a way, is there a will? The effect of future choices on self-control. Journal of Experimental Psychology: General 136 (2): 277–288.

Koschate-Fischer, N., and S. Schandelmeier. 2014. A guideline for designing experimental studies in marketing research and a critical discussion of selected problem areas. Journal of Business Economics 84 (6): 793–826.

MacDonald, B.-J., B. Jones, R.J. Morrison, R.L. Brown, and M. Hardy. 2013. Research and reality—A literature review on drawing down retirement financial savings. Sponsored by Society of Actuaries Pension Section prepared by. North American Actuarial Journal 17 (3): 181–215.

Madrian, B.C., and D.F. Shea. 2001. The power of suggestion: Inertia in 401 (k) participation and savings behavior. The Quarterly Journal of Economics 116 (4): 1149–1187.

Mandrik, C.A., and Y. Bao. 2005. Exploring the concept and measurement of general risk aversion. NA - Advances in Consumer Research 32: 531–539.

Milkman, K.L., T. Rogers, and M.H. Bazerman. 2008. Harnessing our inner angels and demons: what we have learned about want/should conflicts and how that knowledge can help us reduce short-sighted decision making. Perspectives on Psychological Science 3 (4): 324–338.

Murdock, M.R., and P. Rajagopal. 2017. The sting of social: how emphasizing social consequences in warning messages influences perceptions of risk. Journal of Marketing 81 (2): 83–98.

Park, C.W., S.Y. Jun, and D.J. MacInnis. 2000. Choosing what I want versus rejecting what I do not want: an application of decision framing to product option choice decisions. Journal of Marketing Research 37 (2): 187–202.

Payne, J.W., N. Sagara, S.B. Shu, K.C. Appelt, and E.J. Johnson. 2013. Life expectancy as a constructed belief: evidence of a live-to or die-by framing effect. Journal of Risk and Uncertainty 46 (1): 27–50.

Polak, B., A. Herrmann, M. Heitmann, and M. Einhorn. 2008. Die Macht des Defaults — Wirkung von Empfehlungen und Vorgaben auf das individuelle Entscheidungsverhalten. Zeitschrift Für Betriebswirtschaft ZfB 78 (10): 1033–1060.

Pozolotina, T., and S.O. Olsen. 2019. Consideration of immediate and future consequences, perceived change in the future self, and health behaviour. Health Marketing Quarterly 36 (1): 35–53.

Ritov, I., and J. Baron. 1990. Reluctance to vaccinate: omission bias and ambiguity. Journal of Behavioral Decision Making 3 (4): 263–277.

Sainfort, F., and B.C. Booske. 2000. Measuring post-decision satisfaction. Medical Decision Making 20: 51–61.

Samuelson, W., and R. Zeckhauser. 1988. Status quo bias in decision making. Journal of Risk and Uncertainty 1 (1): 7–59.

Sawyer, A.G., and A.D. Ball. 1981. Statistical power and effect size in marketing research. Journal of Marketing Research 18 (3): 275–290.

Schanbacher, A., D. Faro, S. Botti, and S. Benartzi. 2018. The psychological impact of annuities: can pension payout choice influence health behavior? NA - Advances in Consumer Research 46: 775–776.

Schreiber, P., and M. Weber. 2016. Time inconsistent preferences and the annuitization decision. Journal of Economic Behavior and Organization 129: 37–55.

Shipp, A.J., J.R. Edwards, and L.S. Lambert. 2009. Conceptualization and measurement of temporal focus: the subjective experience of the past, present, and future. Organizational Behavior and Human Decision Processes 110 (1): 1–22.

Sutter, M., L. Yilmaz, and M. Oberauer. 2015. Delay of gratification and the role of defaults: an experiment with kindergarten children. Economics Letters 137: 21–24.

Trope, Y., and N. Liberman. 2003. Temporal construal. Psychological Review 110 (3): 403–421.

Trope, Y., and N. Liberman. 2010. Construal-level theory of psychological distance. Psychological Review 117 (2): 440–463.

Turra, C.M., and O.S. Mitchell. 2009. The impact of health status and out-of-pocket medical expenditures on annuity valuation. Recalibrating Retirement Spending and Saving

Wang, Y., and F.A. Sloan. 2018. Present bias and health. Journal of Risk and Uncertainty 57 (2): 177–198.

Wertenbroch, K. 1998. Consumption self-control by rationing purchase quantities of virtue and vice. Marketing Science 17 (4): 317–337.

Yaari, M.E. 1965. Uncertain lifetime, life insurance, and the theory of the consumer. The Review of Economic Studies 32 (2): 137–150.

Funding

Open Access funding enabled and organized by Projekt DEAL. This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there are no conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Unger, F., Steul-Fischer, M. & Gatzert, N. How default effects and decision timing affect annuity uptake and health consciousness. Geneva Pap Risk Insur Issues Pract 49, 180–211 (2024). https://doi.org/10.1057/s41288-022-00280-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-022-00280-8