Abstract

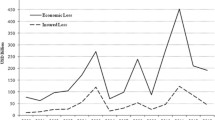

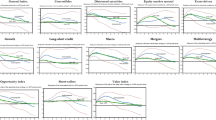

We study the time variation of the market price of catastrophe (CAT) bonds for the period 1999–2016. While we find an overall decreasing trend in the price of expected loss risk, large catastrophes increase this price by 34% on average. Our empirical tests show that the latter effect is temporary and unlikely to be the byproduct of behavioural changes in investors’ perceptions about catastrophic risk, as previously argued. Instead, we find evidence that changes in the price of expected loss risk may be explained by changes in investor effective risk aversion, initiated by catastrophic events triggering CAT bond losses that could bring investors closer to their habit consumption levels and lead to a hard reinsurance market environment. Contagion effects from reinsurance markets are more relevant after main catastrophes given the levels of liquidity in the markets. Furthermore, contagion effects from financial markets are minor and only relevant during the subprime financial crisis, as documented in previous studies.

Similar content being viewed by others

Notes

Artemis Catastrophe Bond & Insurance-Linked Securities Deal Directory, Catastrophe bonds & ILS issued and outstanding by year, retrieved from: https://www.artemis.bm/dashboard/catastrophe-bonds-ils-issued-and-outstanding-by-year/.

We refer the price of expected loss risk to the coefficient (multiple) of the linear regression of CAT bond spreads and bond expected loss. This price does not measure uncertainty on the estimation of expected loss.

It is important to note that we test the theoretical motivations of Gürtler et al. (2016) and Dieckmann (2010) and not their empirical results. Different from our study, the empirical tests in Gürtler et al. (2016) are based on secondary market data and are oriented to test the long-term change of expected loss multiples after catastrophic events.

The price of expected loss risk decreased by 42% between the 1999–2005 period and the 2014–2016 period.

Artemis Catastrophe Bond & Insurance-Linked Securities Deal Directory: https://www.artemis.bm.

See Braun (2016) appendix for details on outlier removal. Our results are robust to the use of the complete sample (including outliers). These results are available upon request.

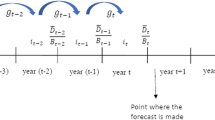

To validate the forecast power of the model, Braun (2016) leaves 114 tranches (from January 2010 to December 2012) out of the estimation period reserved for out-of-sample tests.

Alternative pricing models include non-arbitrage valuation models for CAT derivatives (Cummins and Geman 1994, 1995; Bakshi and Madan 2002; Chang et al. 1996, 2008, 2010; Braun 2011; Gatzertet al. 2019; Beer and Braun 2019; Beer et al. 2019) and also for the valuation of CAT bonds (Lee and Yu 2002; Vaugirard 2003a, b; Jarrow 2010; Ma and Ma 2013). More recently, models analysing the risk-return correlation profile of CAT bond returns have been proposed in the literature, including Carayannopoulos and Perez (2015), Braun et al. (2019), Drobetz et al. (2020) and Trottier et al. (2019).

Lei et al. (2008) model PFL and CEL along with probability of exhaustion (POE) and find that investors care about their probability of losing (PFL) and losing everything (POE) more than how much they would lose (CEL).

A complete descriptive analysis of changes in CAT bond market characteristics from 1999 to 2016 is reported in Online Appendix.

To test for significant differences, we estimate a regression using the full sample of bonds and including subperiod dummy variables and interaction terms of these dummy variables with all coefficients in our model; complete results are available from the authors upon request.

We also estimate the rolling regressions using the last 50 bonds issued until month t and using a 48-month window. The estimated risk prices are highly correlated with the ones reported and our main conclusions are the same. The results are available from the authors upon request.

We also analyse for what periods the rolling EL coefficients are above the 12-month moving average for more than one period, and find the same time series patterns.

Bantwal and Kunreuther (2000) use behavioural economics to explain the reluctance of investment managers to invest in CAT bonds.

‘Catastrophe bond losses: CAT bonds defaulted, triggered or at risk’, retrieved from: https://www.artemis.bm/cat-bond-losses/.

It is possible that the occurrence of Hurricane Sandy (October 2012) may have affected our results for the 2- and 3-years before and after samples. As a robustness test, we included a dummy variable for bonds issued after Hurricane Sandy and its interaction with EL. We find non-significant contamination effects. The results are available from the authors upon request.

In unreported experiments we also test the effect of events with relatively smaller investors’ losses. For example, the default of four CAT bonds for which Lehman Brothers served as a total return swap counterparty, with aggregate loss from all four bonds of only 21% of initial investment and Hurricane Patricia, which triggered one CAT bond and resulted in just a USD 50 million loss to the investors. Our test shows no significant increase in the price of EL risk after these events.

The results of the robustness tests are available from the authors upon request.

These model changes also include all model changes available from news on Artemis since 2008.

For example, Gürtler et al. (2016) show that the price of EL risk in the secondary market of CAT bonds changed after Hurricane Katrina and they attribute the change to changes in investors’ trust in catastrophe models. However, their results may differ to those of our primary market setup, especially because their aim is to test for the long-term effects of large catastrophic events.

We also test for another large non-insured (minimally insured) catastrophe, the heatwave in Russia and the Czech Republic in June 2010 (55,630 victims), and do not find any significant change in EL. The results are available upon request.

We acknowledge the fact that the post-Haiti Earthquake period may include possible effects of the Tohoku Earthquake or Hurricane Sandy. However, these effects may lead to a larger EL coefficient; thus, our reported results of no significant effects of the Haiti Earthquake can be seen as conservative. Similarly, the results for the period prior to Hurricane Sandy may have been affected by the Tohoku Earthquake. Thus, our results in Table 8 for 1 year before and 1 year after should be interpreted as Hurricane Sandy not having an additional effect on the EL coefficient. For the case of 2 and 3 years before and after, this contamination effect will be weighted down; thus, our interpretation of insignificant effects of Hurricane Sandy are robust.

Detailed results are available from the authors upon request.

References

Aon Benfield. 2013. RMS Hurricane Model Change. Aon Benfield Analytics.

Bakshi, G., and D. Madan. 2002. Average rate claims with emphasis on catastrophe loss options. Journal of Financial and Quantitative Analysis 37 (1): 93–115.

Bantwal, V.J., and H.C. Kunreuther. 2000. A cat bond premium puzzle? Journal of Psychology and Financial Markets 1 (1): 76–91.

Beer, S., and A. Braun. 2019. Market-consistent valuation of natural catastrophe risk. Working Paper.

Beer, S., A. Braun, and A. Marugg. 2019. Pricing industry loss warranties in a Lévy-Frailty framework. Insurance: Mathematics and Economics 89: 171–181.

Braun, A. 2011. Pricing catastrophe swaps: A contingent claims approach. Insurance Mathematics and Economics 49 (3): 520–536.

Braun, A. 2016. Pricing in the primary market for Cat bonds: New empirical evidence. Journal of Risk and Insurance 83 (4): 811–847.

Braun, A., S. Ben Ammar, and M. Eling. 2019. Asset pricing and extreme event risk: Common factors in ILS fund returns. Journal of Banking and Finance 102: 59–78.

Braun, A., K. Müller, and H. Schmeiser. 2013. What drives insurers' demand for Cat bond investments? Evidence from a pan-European survey. The Geneva Papers on Risk and Insurance—Issues and Practice 38 (3): 580–611.

Braun, A., and J. Weber. 2017. Evolution or revolution? How Solvency II will change the balance between reinsurance and ILS. Journal of Insurance Regulation 36 (4): 1–26.

Brown, M.J., V. Jaeger, and P. Steinorth. 2015. Impact of economic conditions on individual risk attitude. MRIC Working Paper No. 29.

Campbell, J.Y., and J.H. Cochrane. 1999. By force of habit: A consumption-based explanation of aggregate stock market behaviour. Journal of Political Economy 107 (2): 205–251.

Carayannopoulos, P., and M.F. Perez. 2015. Diversification through catastrophe bonds: Lessons from the subprime financial crisis. The Geneva Papers on Risk and Insurance—Issues and Practice. 40 (1): 1–28.

Chang, C.W., J.S.K. Chang, and W. Lu. 2008. Pricing catastrophe options in discrete operational time. Insurance: Mathematics and Economics 43 (3): 422–430.

Chang, C.W., J.S. Chang, and W. Lu. 2010. Pricing catastrophe options with stochastic claim arrival intensity in claim time. Journal of Banking & Finance 34 (1): 24–32.

Chang, C.W., J.S.K. Chang, and M.-T. Yu. 1996. Pricing catastrophe insurance futures call spreads: A randomized operational time approach. Journal of Risk and Insurance 63 (4): 599–617.

Cohn, A., J. Engelmann, E. Fehr, and M.A. Maréchal. 2015. Evidence for countercyclical risk aversion: An experiment with financial professionals. American Economic Review 105 (2): 860–865.

Cummins, D., D. Lalonde, and R.D. Phillips. 2004. The basis risk of catastrophic-loss index securities. Journal of Financial Economics 71 (1): 77–111.

Cummins, D., and O. Mahul. 2008. Hedging under counterparty credit uncertainty. Journal of Futures Markets 28 (3): 248–263.

Cummins, D., and P. Trainar. 2009. Securitization, insurance, and reinsurance. Journal of Risk and Insurance 76 (3): 463–492.

Cummins, D., and M.A. Weiss. 2009. Convergence of insurance and financial markets: Hybrid and securitized risk transfer solutions. Journal of Risk and Insurance 76 (3): 493–545.

Cummins, J.D., and H. Geman. 1994. An Asian option approach to the valuation of insurance futures contracts. Review of Futures Markets 13 (2): 517–557.

Cummins, J.D., and H. Geman. 1995. Pricing catastrophe insurance futures and call spreads: An arbitrage approach. Journal of Fixed Income 4 (4): 46–57.

Dieckmann, S. 2010. By force of nature: Explaining the yield spread on catastrophe bonds. University of Pennsylvania Philadelphia Working Paper.

Drobetz, W., H. Schroder, and L. Tegtmeier. 2020. The role of catastrophe bonds in an international multi-asset portfolio: Diversifier, hedge, or safe haven? Finance Research Letters 33: 101198.

Froot, K.A. 2001. The market for catastrophe risk: A clinical examination. Journal of Financial Economics 60 (2–3): 529–571.

Froot, K.A., and P.G.J. O’Connell. 2008. On the pricing of intermediated risks: Theory and application to catastrophe reinsurance. Journal of Banking and Finance 32 (1): 69–85.

Galeotti, M., M. Gürtler, and C. Winkelvos. 2013. Accuracy of premium calculation models for CAT bonds: An empirical analysis. Journal of Risk and Insurance 80 (2): 401–421.

Gatzert, N., S. Pokutta, and N. Vogl. 2019. Convergence of capital and insurance markets: Consistent pricing of index-linked catastrophe loss instruments. Journal of Risk and Insurance 86 (1): 39–72.

Guiso, L., P. Sapienza, and L. Zingales. 2018. Time varying risk aversion. Journal of Financial Economics 128 (3): 403–421.

Gürtler, M., M. Hibbeln, and C. Winkelvos. 2016. The impact of the financial crisis and natural catastrophes on CAT bonds. Journal of Risk and Insurance 83 (3): 579–612.

Jarrow, R. 2010. A simple robust model for Cat bond valuation. Finance Research Letters 7: 72–79.

Lane, M.N. 2000. Pricing risk transfer transactions. ASTIN Bulletin 30 (2): 259–293.

Lane, M.N., and O. Mahul. 2008. Catastrophe risk pricing: An empirical analysis. World Bank Working Paper No. 4765. Washington, DC.

Lee, J.P., and M.T. Yu. 2002. Pricing default-risky CAT bonds with moral hazard and basis risk. Journal of Risk and Insurance 69 (1): 25–44.

Lei, D.T., J.H. Wang, and L.Y. Tzeng. 2008. Explaining the spread premiums on catastrophe bonds. National Taiwan University Working Paper.

Ma, Z.G., and C.Q. Ma. 2013. Pricing catastrophe risk bonds: A mixed approximation method. Insurance: Mathematics and Economics 52 (2): 243–254.

Trottier, D.A., V.S. Lai, and F. Godin. 2019. A characterization of CAT bond performance indices. Finance Research Letters 28: 431–437.

Vaugirard, V.E. 2003a. Pricing catastrophe bonds by an arbitrage approach. Quarterly Review of Economics and Finance 43 (1): 119–132.

Vaugirard, V.E. 2003b. Valuing catastrophe bonds by Monte Carlo simulations. Applied Mathematical Finance 10 (1): 75–90.

Funding

Peter Carayannopoulos: Financial Services Research Centre, Lazaridis School Business and Economics, Wilfrid Laurier University, Waterloo, Ontario N2L 3C5, Canada. Perez acknowledges the financial support received by the Arthur Wesley Downe Professorship of Finance and the Social Sciences and Humanities Research Council of Canada.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Carayannopoulos, P., Kanj, O. & Perez, M.F. Pricing dynamics in the market for catastrophe bonds. Geneva Pap Risk Insur Issues Pract 47, 172–202 (2022). https://doi.org/10.1057/s41288-020-00194-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-020-00194-3