Abstract

This paper empirically assesses selection effects and determinants of the demand for supplemental health insurance that covers hospital and dental benefits in Germany. Our representative data set provides doctor-diagnosed indicators of the individual’s health status, risk attitude, demand for medical services and insurance purchases in other lines of insurance, as well as rich demographic and socio-economic information. Controlling for a wide range of individual preferences, we find evidence that individuals aged 65 and younger with hospital coverage are sicker than those without. In addition, insurance propensity and income are the most important drivers of the demand for supplemental hospital and dental coverage.

Similar content being viewed by others

Notes

Association of German Private Health-care Insurers (2012).

Pauly et al. (1995).

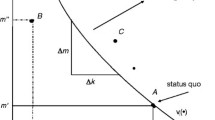

The front-loading accounts for higher future expected costs which result from the expected deterioration of the policyholder’s health over time.

Browne and Hofmann (2013).

In auto insurance, the majority of studies have not found evidence of adverse selection (e.g. Chiappori and Salanié, 2000; Kim et al., 2009; Dionne et al., 2001; Zavadil, 2011). Finkelstein and Poterba (2004) find evidence of adverse selection with respect to the choice of different types of annuity insurance policies but not with respect to annuity size. Cohen and Siegelman (2010) provide a comprehensive survey on empirical findings of adverse selection in insurance.

Marquis and Phelps (1987).

Schmitz (2011).

De Meza and Webb (2001).

Bauer et al. (2015).

Schokkaert et al. (2010).

See, e.g. Hendel and Lizzeri (2003).

Until 2008, SHI funds charged different contribution rates depending on their risk structure and profitability. With the introduction of the health fund (‘Gesundheitsfonds’) in 2009, uniform premiums of 15.5 per cent have been introduced in SHI. See Simon (2013) for an overview of the German health insurance system.

Differences in the percentages of SHI insureds who hold SuppHI, from SOEP data and the Association of German Private Health-care Insurers arise from the fact that individuals under age 17 years are not included in the SOEP.

Travel abroad policies usually cover transportation home in cases of medical emergencies as well as medical bills incurred due to emergencies when travelling and which were not covered by SHI. SHI funds may only cover a fraction or nothing at all in countries without bilateral health insurance agreements.

Cohen and Siegelman (2010).

Bolhaar et al. (2012).

Crossley and Kennedy (2002) find that the reliability of self-assessed health status is strongly related to other observable variables such as age, income and occupation.

We merge the 2009 and 2011 sickness data into the 2008 and 2010 data set because doctor-diagnosed diseases were not surveyed in 2008 and 2010 and information on SuppHI is not available in the 2009 data.

Dardanoni and Li Donni (2012).

Kapfer (2008).

Finkelstein and McGarry (2006).

Browne et al. (2015).

Garfinkel et al. (1987).

Fang et al. (2008).

Borrell et al. (2001).

Saliba and Ventelou (2007).

Vargas and Elhewaihi (2008).

Browne and Doerpinghaus (1994).

Ettner (1997).

Dohmen et al. (2011).

Households answer a household questionnaire. All household members then answer an individual questionnaire. The data set maps individuals to their households. Individuals are allowed to participate from the age of 17 years.

Wagner et al. (2007).

In 2009, no questions on SuppHI were included in the SOEP questionnaire.

We later run a robustness check with a larger data set for each observation period using a dummy variable adjustment approach, where missing values are replaced by means.

The variable Sick in 2009 (2011) also contains individuals who were affected by more than one disease; thus, 32.5 per cent (36.6 per cent) is not the sum of the means of the different chronic diseases.

Regression results are available directly from the authors upon email request. We omit them here to keep the paper to an acceptable length.

These results are available upon email request.

Note that we do not use the 2010 data set here as there is no information on supplemental health insurance 2009. Therefore, we cannot tell if an individual had uninterrupted coverage for the last three years.

The variance inflation factor (VIF) in the full model did not exceed a value of 2 for any variable used in the regression, which indicates no multicollinearity issues.

When only considering the compulsory insured in the next section, significance is only at the 10 per cent level for both waves; see Table 8.

Actual sickness was included in the SOEP in 2009 for the first time. Data on self-reported health and medical service intensity were available previously.

We do not find significant effects of gender or risk attitude when accounting for the different perceptions of risk among male and female individuals by introducing the interaction of male and risk attitude.

We could theoretically go back more years, but this would reduce the sample size to a level which will make meaningful statistical results questionable. Furthermore, the demand for SuppHI has been promoted by the health reform in 2004.

Sample statistics for the subsample of compulsory insured are directly available from the authors upon email request.

References

Association of German Private Healthcare Insurers (2012) Financial Report for Private Healthcare Insurance 2012, Cologne: PKV.

Bauer, J.M., Schiller, J. and Schreckenberger, C. (2015) Heterogeneous Selection in the Market for Private Supplemental Dental Insurance: Evidence from Germany, working paper, University of Hohenheim.

Berghman, J. and Meerbergen, E. (2005) Supplementary Social Provisions in Second and Third Pillar Health Care, Research Project AG/01/084, Centre for Sociological Research, Leuven.

Bolhaar, J., Lindeboom, M. and van der Klaauw, B. (2012) ‘A dynamic analysis of the demand for health insurance and health care’, European Economic Review 56(4): 669–690.

Borrell, C., Fernandez, E., Schiaffino, A., Benach, J., Rajmil, L., Villalbi, J.R. and Segura, A. (2001) ‘Social class inequalities in the use of and access to health services in Catalonia, Spain: What is the influence of supplemental private health insurance’, International Journal for Quality in Health Care 13(2): 117–125.

Briys, E. and Schlesinger, H. (1990) ‘Risk aversion and the propensities for self-insurance and self-protection’, Southern Economic Journal 57(2): 458–467.

Browne, M.J. (1992) ‘Evidence of adverse selection in the individual health insurance market’, The Journal of Risk and Insurance 59(1): 13–33.

Browne, M.J. and Doerpinghaus, H. (1994) ‘Asymmetric information and the demand for Medigap insurance’, Inquiry 31(4): 445–450.

Browne, M. and Hofmann, A. (2013) ‘One-sided commitment in dynamic insurance contracts: Evidence from private health insurance in Germany’, Journal of Risk and Uncertainty, 46(1): 81–112.

Browne, M.J., Knoller, C. and Richter A. (2015) ‘Behavioral bias and the demand for bicycle and flood insurance’, Journal of Risk and Uncertainty 50(2): 141–160.

Chiappori, P.A. and Salanié, B. (2000) ‘Testing for Asymmetric Information in Insurance Markets’, Journal of Political Economy 108(1): 56–78.

Christoph, B. (2003) `Soziale Sicherheit im Krankheitsfall. Objektive Charakteristika und subjektive Einstellungen zur Gesundheit von Personen mit zusätzlicher privater Absicherung gegen Gesundheitsrisiken´, in J.Allmendinger, (ed.) Entstaatlichung und soziale Sicherheit : Verhandlungen des 31. Kongresses der Deutschen Gesellschaft für Soziologie, Leipzig, 7–11 October 2002, Opladen: Leske u. Budrich, pp. 1–9.

Cohen, A. and Siegelman, P. (2010) ‘Testing for adverse selection in insurance markets’, The Journal of Risk and Insurance 77(1): 39–84.

Crossley, T.F. and Kennedy, S. (2002) ‘The reliability of self-assessed health status’, Journal of Health Economics 21(4): 643–658.

Dardanoni, V. and Li Donni, P. (2012) ‘Incentive and selection effects of Medigap insurance on inpatient care’, Journal of Health Economics 31(3): 457–470.

De Meza, D. and Webb, D.C. (2001) ‘Advantageous selection in insurance markets’, RAND Journal of Economics 32: 249–262.

Dionne, G. and Eeckhoudt, L. (1985) ‘Self-insurance, self-protection and increased risk aversion’, Economics Letters 17: 39–42.

Dionne, G., Gourieroux, C. and Vanasse, C. (2001) ‘Testing for evidence of adverse selection in the automobile insurance market: A comment’, Journal of Political Economy 109: 444–453.

Dohmen, T., Falk, A., Huffmann, D., Sunde, U., Schupp, J. and Wagner, G. (2011) ‘Individual risk attitudes. Measurement, determinates and behavioral consequences’, Journal of the European Economic Association 9(3): 522–550.

Ettner, S.L. (1997) ‘Adverse selection and the purchase of Medigap insurance by the elderly’, Journal of Health Economics 16(5): 543–562.

Fang, H., Keane, M.P., and Silverman, D. (2008) ‘Sources of advantageous selection: Evidence from the Medigap insurance market’, Journal of Political Economy 116(2): 303–350.

Finkelstein, A. and Poterba, J. (2004) ‘Adverse selection in insurance markets: Policyholder evidence from the U.K. annuity market 2004’, Journal of Political Economy 112(1): 183–208.

Finkelstein, A. and McGarry, K. (2006) ‘Multiple dimensions of private information: Evidence from the long-term care insurance market’, American Economic Review 96: 938–958.

Garfinkel, S.A., Bonite, A.J. and McLeroy, K.R. (1987) ‘Socioeconomic factors and Medicare supplemental health insurance’, Health Care Financing Review 9(1): 21–30.

Goldman, D.P. and Zissimopoulos, J.M. (2003) ‘High out-of-pocket health care spending by the elderly’, Health Affairs 22(3): 194–202.

Hendel, I. and Lizzeri, A. (2003) ‘The role of commitment in dynamic contracts: Evidence from life insurance’, Quarterly Journal of Economics 11(1): 299–327.

Kapfer, J. (2008) Three Essays in Empirical Economics, Dissertation, Ludwig-Maximilians-Universität München: Volkswirtschaftliche Fakultät.

Kim, H., Kim, D., Im, S. and Hardin, J.W. (2009) ‘Evidence of asymmetric information in the automobile insurance market: dichotomous versus multinomial measurement of insurance coverage’, The Journal of Risk and Insurance 76(2): 343–366.

Marquis, M.S. and Phelps, C.E. (1987) ‘Price elasticity and adverse selection in the demand for supplementary health insurance’, Economic Inquiry 25(2): 299–315.

McCall, N., Rice, T. and Sangl, J. (1986) ‘Consumer knowledge of Medicare and supplemental health insurance benefits’, Health Service Research 20(1): 633–657.

Pauly, M. (1974) ‘Overinsurance and public provision of insurance: The roles of moral hazard and adverse selection’, Quarterly Journal of Economics 88(1): 44–62.

Pauly, M., Kunreuther, H. and Hirth, R. (1995) ‘Guaranteed renewability in insurance’, Journal of Risk and Uncertainty 10(2): 143–156.

Pourat, N., Rice, T.; Kominski, G. and Snyder, R.E. (2000) ‘Socioeconomic Differences in Medicare Supplemental Coverage’, Health Affairs 19(5): 186–196.

Rothschild, M. and Stiglitz, J. (1976) ‘Equilibrium in competitive insurance markets: An essay on the economics of imperfect’, Quarterly Journal of Economics 90(4): 629–649.

Saliba, B. and Ventelou, B. (2007) ‘Complementary health insurance in France who pays? Why? Who will suffer from public disengagement?’, Health Policy 81(2–3): 166–182.

Schmitz, H. (2011) ‘Direct evidence of risk aversion as a source of advantageous selection in health insurance’, Economic Letters 113(2): 180–182.

Schokkaert, E., Van Outric, T., De Graeve, D., Lecluyse, A. and Van De Voorde, C. (2010) ‘Supplemental health insurance and equality of access in Belgium’, Health Economics 19(4): 377–395.

Shmueli, A. (2010) ‘The effect of health on acute care supplemental insurance ownership: An empirical analysis’, Health Economics 19(4): 341–350.

Simon, M. (2013) Das Gesundheitssystem in Deutschland, Eine Einführung in Struktur und Funktionsweise (4th ed.). Bern: Huber.

Socio-Economic Panel (SOEP). Data for years 1984–2010, version 27, SOEP, 2011, doi: 10.5684/soep.v27.

Van de Ven, W.P.M.M. and Schut, F.T. (2008) ‘Universal mandatory health insurance in The Netherlands: A model for The United States?’, Health Affairs 27(3): 771–781.

Vargas, M.H. and Elhewaihi, M. (2008) ‘What is the impact of duplicate coverage on the demand for health care in Germany?’, working paper, Munich Personal RePEc Archive from https://mpra.ub.uni-muenchen.de/6749/, accessed 1 September 2015.

Wagner, G.G., Frick, J.R. and Schupp, J. (2007) ‘The German Socio- Economic Panel Study (SOEP)—Evolution, scope and enhancements’, Schmoller’s Jahrbuch—Journal of Applied Social Science Studies 127(1): 139–169.

Wilson, C. (1977) ‘A model of insurance markets with incomplete information’, Journal of Economic Theory 16(2): 167–207.

Woolfe, J.R. and Goddeeris, J.H. (1991) ‘Adverse selection, moral hazard, and wealth effects in the Medigap insurance market’, Journal of Health Economics 10(4): 433–459.

Zavadil, T. (2011) ‘Do the better insured cause more damage? Testing for asymmetric information in car insurance’, working paper, National Bank of Slovakia, Bratislava.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lange, R., Schiller, J. & Steinorth, P. Demand and Selection Effects in Supplemental Health Insurance in Germany. Geneva Pap Risk Insur Issues Pract 42, 5–30 (2017). https://doi.org/10.1057/s41288-016-0023-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-016-0023-2

Keywords

- supplemental health insurance

- asymmetric information

- one-sided commitment

- insurance demand

- German statutory health insurance

- insurance propensity