Abstract

Despite its importance for development, long-term finance is particularly scarce in countries with lower income levels. This not only results in unrealized growth and employment creation, but may also undermine a broader shift towards better jobs. After all, many long-term investments comprise investments in labor that have the potential to contribute to improvements in job quality. This paper uses more than 17,000 firm-level observations from 73 mostly low- and middle-income countries to provide first empirical evidence of the extent to which LTF affects the quality of jobs. Additionally, it looks into effects on investments and firm performance. The findings, based on inverse probability weighted regression adjustment, indicate that long-term finance increases the likelihood of formal training by 4.4 to 4.8 percentage points, raises average wage by 4.1 percentage points and the share of permanent employees by 1.3 percentage points. Effects are also significant for investments in fixed assets and process innovation as well as for employment and sales growth. The fact that the positive effects on job quality increase with loan maturities underlines the importance of longer-term finance for better jobs. Despite several robustness checks, it cannot be ruled out completely that unobservable variables affect the estimation of effect sizes.

Résumé

Malgré son importance pour le développement, le financement à long terme (en anglais: « Long Term Finance», LTF) est particulièrement rare dans les pays à faible revenu. Cela se traduit non seulement par une croissance et une création d'emplois non réalisées, mais peut également compromettre un changement plus large vers des meilleurs emplois. Après tout, de nombreux investissements à long terme comporte des investissements dans le travail qui ont le potentiel de contribuer à l'amélioration de la qualité des emplois. Ce document utilise plus de 17 000 observations au niveau des entreprises provenant de 73 pays principalement à faible et moyen revenu pour fournir les premières preuves empiriques de l'ampleur des effets du financement long terme sur la qualité des emplois. De plus, il en examine les effets sur les investissements et la performance des entreprises. Les résultats, elaborés par regression pondérée ajustée par la probabilité inverse, indiquent que le financement à long terme augmente la probabilité d'une formation formelle de 4,4 à 4,8 points de pourcentage; le FLT augmente aussi le salaire moyen de 4,1 points de pourcentag,e et la part des employés permanents de 1,3 points de pourcentage. Les effets sont également significatifs pour les investissements en actifs fixes et l'innovation de processus, ainsi que sur la croissance de l'emploi et des ventes. Le fait que les effets positifs sur la qualité de l'emploi augmentent avec les maturités des prêts souligne l'importance d'un financement à plus long terme pour de meilleurs emplois. Malgré plusieurs vérifications de robustesse, il ne peut être totalement exclu que des variables non observables affectent l'estimation des tailles d'effet.

Resumen

A pesar de su importancia para el desarrollo, la financiación a largo plazo (en ingles: “Long Term Finance”, LTF) es particularmente escasa en los países con niveles de ingresos más bajos. Esto no solo resulta en un crecimiento y creación de empleo no realizados, sino que también puede socavar un cambio más amplio hacia mejores empleos. Después de todo, muchas inversiones a largo plazo incluyen inversiones entrabajos que tienen el potencial de contribuir a mejoras en la calidad del empleo. Este estudio utiliza más de 17,000 observaciones a nivel de empresa en 73 países, en mayoría de bajos y medianos ingresos, para proporcionar la primera evidencia empírica de hasta qué punto la LTF afecta la calidad de los empleos. Además, se analizan los efectos en las inversiones y el rendimiento de la empresa. Los hallazgos, basados en el ajuste de regresión ponderado por probabilidad inversa, indican que la financiación a largo plazo aumenta la probabilidad de formación formal en 4.4 a 4.8 puntos porcentuales, aumenta el salario promedio de 4.1 puntos porcentuales, y la proporción de empleados permanentes de 1.3 puntos porcentuales. Los efectos también son significativos para las inversiones en activos fijos y la innovación de procesos, así como para el crecimiento del empleo y las ventas. El hecho de que los efectos positivos en la calidad del empleo aumenten con los vencimientos de los préstamos subraya la importancia de la financiación a largo plazo para la generación de mejores empleos. A pesar de varias comprobaciones de robustez, no se puede descartar completamente que las variables no observables afecten la estimación de los tamaños de efecto.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Long-term finance (LTF) is crucial for development both on the micro level, for firms and households, and on the macro level, for national economies. Loans with longer maturities, equity and other forms of LTF are typically used to realize projects that require capital commitment over a longer period of time and contribute substantially to productivity growth. Consequently, LTF increases economic growth both at the level of the firm (e.g. Caprio and Demirguc-Kunt 1998) and at the national level (e.g. Aghion et al. 2005). In addition, it decreases aggregate volatility, as long-term investments tend to be counter-cyclical (e.g. Aghion et al. 2005; Gutierrez et al. 2018).

Despite its importance for economic development, LTF is particularly scarce in low- and middle-income countries (LMICs), with the proportion of LTF increasing with national income levels (Fan et al. 2012; Demirgüç-Kunt et al. 2020).Footnote 1 The limited availability of LTF has gained attention among researchers and policy-makers in the development field (e.g. G20 2013; World Bank 2015; Chen et al. 2019; Demirgüç-Kunt et al. 2020). It is also felt by firms, since constrained access to long-term loans impedes their operation and growth (Ayyagari et al. 2008; Gutierrez et al. 2018). This not only results in situations of unrealized growth and missed opportunities for employment creation, but may also undermine a broader shift towards better job quality. After all, many long-term investments also comprise investments in labor through training, human capital accumulation and similar activities that positively affect skill development, wages and stability of employment relations. The availability of good jobs, in turn, has been argued to contribute to more cohesive societies (World Bank 2012; Wietzke 2014). Understanding the significance of longer-term finance is particularly important against the background of current growth in digital finance and fintechs, since digital lending tends to be more short-term (e.g. Beaumont et al. 2021) and may thus increase short-termism in credit markets (e.g. United Nations Secretary-General’s Task Force on Digital Financing of the Sustainable Development Goals 2020).

The study analyses to what extent LTF affects job quality, investments and firm performance. LTF is defined here as bank loans with longer maturities. Even though the focus on bank loans ignores equity and other potential sources of LTF, it can be expected to account for the vast majority of long-term (external) finance. In LMICs, in particular, non-bank sources for LTF are the exception (Martinez Peria and Schmukler 2017) such that firms, irrespective of their size, mostly rely on banks to access LTF (Gutierrez et al. 2018). Different thresholds (namely 1, 2, 3, 4 and 5 years) for the initial loan duration are used to distinguish and compare firms with short-term and with long-term loans. A second approach differentiates across firms with LTF based on the loans’ remaining time to maturity. This allows exploring the role of loan maturities in empowering firms to pursue long-term growth strategies such as productivity-enhancing investments in technology, capital and in labor and its subsequent effects on the outcome variables of interest.

Along this line, the more than 17,000 firm-level observations from 73 mostly low- and middle-income countries are divided into a group with LTF and a control group with short-term finance (STF) in the first approach; or into a group with LTF of longer remaining maturity and a control group with shortly maturing LTF in the second approach. In both cases, inverse probability weighted regression adjustment (IPWRA) is employed, since this estimation strategy identifies treatment effects in observational data. Reweighting based on the propensity scores achieves similarity and balance of (observable) covariates across treatment and control group. Despite theoretical arguments and descriptive statistics suggesting that treatment and control groups may not differ too much with regard to observable and unobservable characteristics, it cannot be ruled out completely that unobservables affect the estimation. The findings indicate that LTF is significantly and positively associated with job quality. It increases the likelihood that firms offer formal training by 4.4 to 4.8 percentage points—depending on the chosen specification. The share of trained production workers increases by 15 to 17% and the share of trained non-production workers by 13%. Average wages relative to GDP per capita are found to rise by 4.1 percentage points. The share of permanent employees is 1.3 percentage points higher for firms with LTF. The fact that the positive effects increase with loan durations and loan maturities underlines the importance of longer-term finance for moving towards better jobs. Moreover, LTF is significantly and positively associated with investments. Firms with LTF are, again depending on the specification, 5 to 14 percentage points more likely to invest in fixed assets and 5.3 to 6.2 percentage points more likely to invest in process innovation, while effects on investments in product innovation are modest and only marginally significant. Firm performance tends to rise as well: The positive effects are substantial, which is reflected by a 0.95 to 1.53 percentage points higher employment growth rate and a 1.14 to 1.80 higher sales growth rate, but these effects are only significant for some maturity thresholds.

This paper contributes to at least two strands of literature. First, my work adds to the nascent literature on the role of finance with regard to job quality, since it is the first study to empirically investigate the effect of loan maturities on job quality. There is a more established sub-strand on capital markets that shows via theoretical models (e.g. Amable et al. 2005) and empirical evidence (e.g. Black et al. 2007; Darcillon 2015) that equity finance negatively affects employment conditions such as job tenure, pay and training, since shareholder maximization tends to target at short-term performance of the financed firms. However, this literature on equity finance stems from and mainly applies to high-income countries. Looking beyond equity—i.e. into financing sources that are more relevant in LMIC contexts—most studies are concerned with the quantity of jobs created through access to finance (e.g. Ayyagari et al. 2021). One notable exception is the work by Blanas et al. (2019) which uses firm-level data from 19 countries in Sub-Saharan Africa to show that foreign-owned firms tend to offer better-quality jobs. In particular, they find that foreign direct investment is associated with higher shares of permanent jobs, reduced likelihood of unpaid work, more training and higher wages. My analysis employs almost the same outcome variables, but differentiates finance along the maturity dimension instead of its origin. The significance of my study is to provide the first empirical evidence of how loan maturities affect the quality of jobs.

Second, this paper adds further evidence to the literature on the effect of LTF on investment by providing the first cross-country evidence from LMICs. Exploiting the financial crisis of 2007/2008 as an exogenous shock to credit supply, several scholars found LTF to causally increase firms’ investments and to decrease investment volatility in the US (Duchin et al. 2010; Almeida et al. 2012) and Belgium (Vermoesen et al. 2013). Using the same setting, Duval et al. (2020) confirm these findings in a cross-country analysis based on firm-level data from 15 high-income countries. So far, studies have been limited to high-income contexts, while for LMICs only correlational evidence for individual countries such as Ecuador (Jaramillo and Schiantarelli 2002) or China (Li et al. 2009) exists. This study adds cross-country evidence from LMICs for the effect of LTF on investments.

Lastly, this paper contributes to the closely related literature on LTF and growth through additional cross-country evidence and new insights on the effects on SMEs. Within-country evidence points towards a positive relationship between LTF and firms’ productivity and growth, which is attenuated or even reversed in the case of high shares of subsidized credit (Schiantarelli and Sembenelli 1997; Schiantarelli and Srivastava 1997; Jaramillo and Schiantarelli 2002). No effect emerges for Chinese firms (Li et al. 2009), which may also be related to the adverse impact of subsidized credit. Cross-country studies find a positive relationship between LTF and growth based on country-level data (Tasic and Valev 2008) and firm-level data (Demirgüç-Kunt and Maksimovic 1998). In addition, long-term debt is found to reduce growth volatility (Demirgüç-Kunt et al. 2017). When focusing on SMEs, Léon (2020) finds no evidence that higher levels of LTF at the national level increase firm growth. He argues that LTF increases lending towards larger transparent firms (intensive margin), at the expense of unserved SMEs (extensive margin). The relevance of my paper is to complement his work by analyzing the effects on SMEs with LTF (and in the main analysis, on firms with LTF in general). Léon (2020) used the share of LTF in the national private credit portfolio as a measure for availability of long-term loans in a particular country. My paper, however, identifies SMEs (or firms in general) that actually have a long-term loan and analyses whether they perform differently from SMEs (or firms) that rely on STF (or shortly maturing LTF) alone. This complements the findings of Léon (2020) on potential trade-offs at the extensive margin with insights on the effects at the intensive margin in order to more fully understand the effects of LTF on SME development and growth.

The rest of the paper is structured as follows. First, the conceptual framework introduces how LTF affects the performance of firms and job quality from a theoretical perspective. The following section describes the dataset. The method section outlines the estimation strategy, before the subsequent section presents the results and robustness checks. The last section concludes.

Conceptual Framework

The most important reason for firms to rely on LTF is the realization of long-term investments. Theory suggests that maturity matching of assets and liabilities is optimal (Hart and Moore 1995) and survey evidence from the US, indeed, emphasizes that this is the most relevant factor for firms when deciding between short-term and long-term debt (Graham and Harvey 2001). Firms’ tendency to match maturities is confirmed by cross-country evidence from both high-income countries (Rajan and Zingales 1995) and LMICs (Booth et al. 2001). Thus, STF is primarily used for working capital like payroll, inventory, and seasonal imbalances and LTF for investments with returns in the more distant future, for example, R&D, technology adoption, fixed assets or human capital.

Reliance on short-term debt for longer-term projects exposes firms to rollover risk—having to refinance in bad times when creditors may refuse to roll over credits or refinancing terms are detrimental to the borrower (Diamond 1991, 1993) and may lead to excessive liquidation of projects by the lender (Diamond 1991). Rollover risk discourages profitable long-term investments with potentially adverse effects on firms’ growth potential.Footnote 2 Firms forgo investments in more productive projects and technologies for the sake of investments with more immediate payoffs (Caprio and Demirguc-Kunt 1998; Almeida et al. 2012; Milbradt and Oehmke 2015). This is formalized by the theoretical model of Milbradt and Oehmke (2015), which builds on the assumptions that financing terms and investment decisions are interlinked and that financing frictions increase with maturity. They show that, in equilibrium, investments are inefficiently short-term and that economic growth is lowered and shocks are amplified.

Despite this literature on maturity matching and rollover risk, the effect of LTF on the performance of firms is ambiguous from a theoretical perspective. A certain strand of literature argues that long-term loans also trigger suboptimal actions, whereas STF creates strong pressure for efficiency, profitability and (short-term) performance. STF is described as a tool for lenders to discipline borrowers and minimize agency problems. The threat of liquidation curbs suboptimal investments and activities (Rajan 1992) and credit rollovers inflict frequent renegotiations, pressuring borrowers towards efficiency and towards actions in the interest of the lenders (Jensen 1986; Calomiris and Kahn 1991; Diamond and Rajan 2001; Jeanne 2009). This results in short-term profit maximization and positive (short-term) performance.Footnote 3

The view that LTF benefits the performance of firms stresses the importance of maturity matching and rollover risk in decisions on productivity-enhancing, longer-term investments. LTF is preferred for investments with returns in the more distant future, such as R&D, technology adoption, fixed assets, equipment, human capital and similar investments, which are central to firms’ productivity and growth prospects (e.g. Caprio and Demirguc-Kunt 1998; Almeida et al. 2012). Following this line of argumentation—since it takes into account the previously introduced evidence on maturity matching and rollover risk—LTF can be expected to positively affect my outcome variables for investments (fixed assets, process innovation, product innovation) and firm performance (employment and sales growth). However, LTF also has the potential to improve job quality. While investments in highly profitable long-term projects generally include investments in physical capital such as fixed assets and equipment, it often comprises complementing investments in labor as well (with subsequent positive effects on firm performance). New equipment, technology adoption and R&D, for instance, require staff training and accumulation of human capital (e.g. Caselli and Coleman 2001) (this hypothesis of complementing investments is explicitly tested in the “Results” section). As a positive side effect of investment in labor, the quality of jobs can be expected to rise, reflected, for instance, in skill development through training, higher wages and more stable employment relations. Investments in training and human capital, as necessary complements to capital investments, incentivize firms to reduce staff turnover in order to fully reap the returns on the investment and to reduce skill drain (e.g. Crook et al. 2011). This should increase the share of permanent jobs within a firm and potentially even raises wages as a means of increasing the opportunity costs of switching jobs (which further increases employment stability) (e.g. Bloom and Michel 2002).

Data

The data stem from World Bank’s Enterprise Surveys (ES), with additional control variables from the World Development Indicators (WDI), Worldwide Governance Indicators (WGI) and the Financial Development and Structure Database.

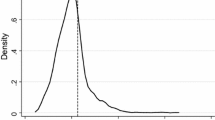

My key explanatory variable is based on the variable from the ES dataset capturing the initial loan duration. In the analysis, different thresholds for the loan duration (1, 2, 3, 4 and 5 years) are used to distinguish between STF and LTF. The 1-year threshold that defines loans with maturities of up to 1 year as STF and those above as LTF is in line with the commonly used categorization in balance sheets, reports and datasets (e.g. Gutierrez et al. 2018; Leon 2018). Even though the other thresholds deviate from the commonly used classification, they allow for a better understanding of the role of loan maturities as they allow to explore whether longer loan durations are associated with larger effects. The distribution of loan durations in my sample is illustrated by the empirical cumulative distribution function in Fig. 1.

Data on loan maturity are only available from 2002 to 2009. Even though the variable was discontinued from 2010 onwards, its quality seems very promising: First, it does not exhibit more missing values than other numerical variables capturing loan characteristics. Second, it is not taken at its face value, but merely used to create a dummy for LTF, and this dummy aligns quite well with other country-level data on loan maturities (see Online Appendix for details).

The outcome variables also stem from the ES dataset and can be organized into the broader categories of job quality, investments and firm performance—with summary statistics provided in Table 1. It is challenging to adequately measure decent work and working conditions, but this paper follows Blanas et al. (2019) and approximates job quality by indicators for training, average wage and the share of permanent employees. A higher share of permanent jobs takes away the insecurity and pressures associated with temporary employment. Training contributes to skill development and reveals the firms’ willingness to foster the development of their employees. It is measured by a dummy indicating whether the firm offered formal training in the last fiscal year as well as by one variable for the share of production workers and one for the share of non-production workers that received such training in the last fiscal year.Footnote 4 Lastly, better pay is associated with better jobs. The average wage is computed from the total labor costs divided by the number of employees. In order to make it comparable across countries, it is set in relation to the national GDP per capita.

Investments include, first, investments in machinery, vehicles, equipment, land or buildings, which are captured by a dummy for whether the firm purchased fixed assets. Second, they include investments in innovation measured by a dummy for whether new and/or significantly improved products were introduced over the last three fiscal years and a dummy for the respective equivalent for production processes.

Less immediate outcomes are the performance of firms as reflected in employment and sales growth. The growth rates are derived as annual averages from employment and sales figures in the last fiscal year and three fiscal years ago following Léon (2020): Sales were deflated with the GDP deflator from the WDI dataset and both growth rates were computed in a manner to avoid the regression-to-the-mean effect.Footnote 5

Firm-level characteristics are also from the ES database and correspond to the controls commonly used in the literature on firms’ access to finance (e.g. Beck et al. 2008; Love and Martínez Pería 2015): size and age of firms as well as dummy variables for the manufacturing sector, exporters, foreign- and government-owned firms and firms with audited financial statements.Footnote 6 Summary statistics are presented in Table 1 (disaggregation by treatment and control group in Table A1 in the Online Appendix).

The choice of country-level controls is informed by the same literature and comprises inflation and GDP per capita. For the first step in the estimation (propensity score model of having a loan with a loan duration above the chosen threshold, see “Method” section), additional variables are included: private credit relative to GDP, measures for competition in the banking sector (bank concentration, bank overhead costs, net interest margin) and for quality of contract enforcement, property rights and the courts (rule of law) as well as GDP growth. Details on the definition and sources for all the variables are provided in Table A2 in the Online Appendix.

Some observations had to be removed prior to the analysis: first, observations with missing values for country-level controls or firm-level variables; second, the most extreme values for employment and sales growth as well as for average wage: The 1% at the lower and upper end were excluded, as routinely done in literature (for average wage a 10%-threshold was chosen since the variable exhibited considerably more suspiciously low/high values). Lastly, countries with too few remaining observations (< 20) and countries with only controls or only treated were removed before the estimation. The final sample comprises 17,057 firms from 73 countries for the period of 2002 to 2009 (number of observations differs depending on outcome variable and specification). The sample is slightly tilted towards lower-middle-income countries (44% of observations) and upper-middle-income countries (33%), with fewer observations for low-income (13%) and high-income countries (10%). (For details on the distribution across country-year couples, see Table A3 in the Online Appendix.)

Method

In order to identify causal effects of LTF and loan maturities on job quality, investments and growth performance of firms, one needs to control for confounding characteristics of the firm and the country-specific economic and institutional context. Accurate estimation would ideally build on random assignment of LTF to firms in order to ensure balanced characteristics between treated firms (\(d_{i}\) = 1, i.e. with LTF) and untreated firms (\(d_{i}\) = 0, i.e. with shortly maturing finance). The chosen inverse probability weighted regression adjustment (IPWRA) model identifies treatment effects in observational data by reweighting based on the propensity scores (Imbens and Wooldridge 2009). More weight is given to observations that were unlikely to receive treatment (or respectively likely to receive treatment), but ended up in the treatment group (or respectively in the control group). As a consequence, balancing between treated and untreated observations and some quasi-random distribution of treatment and control is achieved.

Since IPWRA only balances according to observable variables, two analytical approaches have been chosen that minimize issues introduced through unobservables. After all, unobservable characteristics may affect both the likelihood of receiving treatment and the level of the outcome variables, which would introduce endogeneity problems. This means that for unbiased estimation, unobservable variables need to be correlated with the observables such that the balancing properties extend to the unobservables as well (or unobservables need to be balanced already). By definition, the conditions of unobservable variables cannot be tested. However, there are theoretical and descriptive arguments indicating that treatment and control may not differ too much with regard to unobservables in the two approaches.

First Approach: Comparing Firms with STF and Firms with LTF

The first approach compares firms with STF (control) to firms with LTF (treatment). One commonly discussed unobserved confounder in the context of (long-term) finance and firm performance is the quality of firms’ management (World Bank 2015).

The theoretical literature suggests that the quality of the firm—which includes the unobservable quality of the management—does not necessarily allow for conclusions on the respective loan maturities. Of course, firms need to surpass a certain quality threshold to access external finance and the threshold is probably higher for long-term loans. Yet the pool of applicants for STF and LTF might not be too different according to economic theory. The decision whether to borrow short- or long-term depends on the firms’ needs arising from maturity matching and rollover risk (e.g. Graham and Harvey 2001). The quality of the management could be related to the demand for LTF, since better managers may see and create more long-term investment opportunities and would thus—if they should opt to match maturities—demand more LTF. However, it is further argued that firms with good growth potential—which is probably associated with good-quality management—are best-suited to short-term borrowing. The reason for this is that high-growth firms will benefit less from their investment if they have to share returns with their lenders for a longer time (Myers 1977); firms with good growth potential will also benefit from short-term loans in the context of asymmetric information even for long-term investments, as positive news on their growth will lead to better financing terms when rolling over credits (Diamond 1991).

Taken together, the theoretical arguments support the notion that firms applying for LTF are not necessarily of much better (observed and unobserved) quality than firms applying for STF. Hence, even though financial institutions probably cherry-pick good-quality firms for long-term loans, there are also high-quality firms among the applicants for STF that will subsequently receive loans with short maturities.

This notion is underscored by descriptive statistics in Table A1 in the Online Appendix. Panel B compares firms with STF to firms with LTF (using different thresholds to define LTF). Firms with STF and LTF are not that different (even for quality of the management and the firm). When using a measure that is not influenced by the sample size, the standardized mean difference (Austin 2011), only audited financial statements is found to be significantly different, while the other variables do generally not surpass the value of 0.1 commonly used in literature for significant differences (one exception each for the 1-year and 5-year threshold). Furthermore, it is noteworthy that minor differences in ‘experience of manager’ and ‘certification by an internationally-recognized quality standard’—which may be seen as proxies for quality of the management and firm—are in favor of firms with STF.

In line with the theoretical arguments, however, stark differences emerge when comparing firms with loans to the group of firms without loans, as depicted in Panel A of Table A1: except for foreign-owned, all differences are highly significant. The descriptive statistics suggest that the endogeneity problem is much stronger when estimating the effect of finance (i.e. comparing firms with and without loans as, for example, in Ayyagari et al. (2021)) than for estimation of the effect of LTF (i.e. comparing firms with LTF to those with STF, as done here).

Second Approach: Comparing Firms with Shortly Maturing LTF and Firms with LTF

The second approach compares firms with long-term loans that mature in less than 2 years (i.e. shortly maturing LTF; control) to firms with LTF that has longer remaining maturities (≥ 2 years; treatment).Footnote 7 This approach addresses potential concerns that—despite previous theoretical and descriptive arguments—certain unobserved variables (e.g. strategy or quality of a firm) may affect demand for STF and LTF. In such a scenario, only certain types of firms—for instance, firms with quality management that identifies and creates long-term investment opportunities—would seek LTF such that systematic differences between firms with STF and LTF would remain. This would give rise to two different problems: First, effects may be driven by the demand side (only certain types of firms seeking LTF) instead of the hypothesized supply-side constraints with regard to LTF that affect firm behavior due to maturity matching and rollover risk. Second, if these systematic differences additionally affect the outcome variables (job quality, investments, firm performance), unobservables would cause endogeneity issues and biased estimates. Hence, in this second line of analysis, I follow the approach of Almeida et al. (2012) and compare firms with long-term loans of different remaining maturities.Footnote 8 The underlying idea is that these firms revealed both demand for LTF as well as the ability to acquire LTF and may thus exhibit close similarities also with regard to unobservable characteristics (including firm strategy and quality that affect demand for LTF as well as ability to acquire LTF). This ensures that even in a scenario where certain unobserved variables (e.g. strategy or quality of a firm) affect demand for STF and LTF, the findings of this second approach are not driven by endogeneity issues or demand-side factors.

Estimation Strategy

In both approaches, propensity scores \(\hat{p}_{ict} = \Pr {(}d_{ict} = 1{ |}X_{i} ,{ }Z_{c,t - 1} ,{ }\gamma_{c} ,{ }\gamma_{t} )\) for firm i in country c and year t are estimated based on the following propensity score model with probit specification:

The dummy variable \(d_{ict}\) captures treatment and equals one for firms with a loan of a maturity above the chosen threshold of 1, 2, 3, 4 or 5 years. The vector \(X_{it}\) comprises firm characteristics and the vector \(Z_{c,t - 1}\) country characteristics. Country fixed effects (\(\gamma_{c}\)) and time fixed effects (\(\gamma_{t}\)) control for unobservable differences between countries and years respectively, which includes institutional quality, economic shocks and similar confounders on the country- or year-level.Footnote 9

The propensity scores \(\hat{p}_{ict}\) are used to compute weights according to \(w_{i} = { }d_{i} /p_{i} + { }(1 - d_{i} )/(1 - p_{i} )\). The formula implies that observations are weighted by their inverse probability. The weights are employed in the conditional mean model:

The outcome variable \(y_{ict}\) captures job quality (training, average wage, share of permanent jobs), investments (fixed assets, product innovation, process innovation) or firm performance (employment or sales growth). In case of a binary outcome variable, the probit specification has been used. The vectors of firm characteristics and country-level controls differ slightly from the ones in the propensity score model. An overview of the respective included variables is provided in Table 1 in the “Data” section, details on definitions and data sources in Table A2 in the Online Appendix. Analogous to the propensity score model, country-level controls are lagged and country and time fixed effects (\(\gamma_{c}\), \(\gamma_{t}\)) are inserted. The conditional mean model is estimated separately for the treatment and the control group using the estimated propensity scores \(\hat{w}_{i} = { }d_{i} /\hat{p}_{i} + { }(1 - d_{i} )/(1 - \hat{p}_{i} )\). The average treatment effect (ATE) is then computed as the average difference between the predicted outcomes of the treatment and the control group.

One compelling feature of the IPWRA estimates is that they are doubly robust (Wooldridge 2007). This means that misspecification of either the propensity score model or the conditional mean model still results in consistent estimates. Consistent estimation further depends on the conditional independence (CI) and the overlap assumption. CI assumes treatment to be independent of potential outcomes \(y\left( 1 \right)_{ict}\) and \(y\left( 0 \right)_{ict}\) after controlling for observables: \((y\left( 1 \right)_{ict} ,{ }y\left( 0 \right)_{ict} ) \bot d_{i} { }|{ }X_{i} ,{ }Z_{c,t - 1} ,{ }\gamma_{c} ,{ }\gamma_{t}\). Imbens and Wooldridge (2009) emphasize that this strong assumption is quite controversial, even though it underlies every multiple regression approach. Tables A4 and A6 in the Online Appendix show that the CI is valid for observables, as covariates are balanced between the treatment and control group after weighting. The second assumption is known as overlap assumption: \(0 < {\text{Pr(}}d_{i} = 1{| }X_{i} = x) < 1\), for all x. It constitutes that every observation must have a positive probability of receiving any of the two treatments \(d_{i}\) = 1 and \(d_{i}\) = 0. Online Figs. A3 and A4 show that this assumption holds.

Differentiation of Stock Variables, Flow Variables and Growth Rates

In order to avoid underestimation in the first approach, the analysis must differentiate between flow variables, stock variables and growth rates. For stock variables such as the share of permanent employees or average wage, it should not matter in which period after the loan approval we measure the (potential) impact of LTF—i.e. the remaining time until LTF matures should not matter. The variables should stay at the new level for at least two reasons. First, because of the theoretical arguments discussed in the conceptual framework that LTF allows firms to invest in a stable and skilled workforce and that firms can only fully benefit from the human capital investments when binding their employees long-term. This implies offering permanent positions and increasing the incentives to stay by paying higher wages. Second, from a more practical perspective, it might be argued that these impacts are only meaningful if they endure over time.

The situation is different for flow variables such as the training and investment variables. Instead of measuring, for instance, the number or share of production workers who were ever trained (stock variable), the ES capture which share was trained in the last fiscal year (flow variable). While it can be expected that LTF is used to increase the human capital stock, the firms’ need to match assets and liabilities in the face of rollover risk makes such longer-term investments more likely to take place when there is still more remaining time before the loan matures. Hence, the full effects of LTF on these outcome variables are only observable when finance matures in the more distant future and effects are attenuated continuously the closer we get to the maturity date, i.e. the sooner the loan matures. Hence, the remaining time until maturity is considered as well for flow variables: Only firms with an initial loan duration of more than 1 year (or respectively 2, 3, 4 or 5 years) and a remaining maturity of 1 year (or respectively 2, 3, 4 or 5 years) or more are included in the treatment group.Footnote 10

For employment and sales growth, the analysis should additionally be restricted to the subsample of firms that have taken out their loan in the last fiscal year or the year before (or if we expect a lagged effect, then last fiscal year ago or 1–2 years before; both are included in the analysis). This ensures that the computation of the growth rates is based on changes between periods before and after the uptake of LTF. (Recall that growth rates are based on employment/sales figures of the last fiscal year (t-1) and three fiscal years ago (t-3).)

Results

First Approach: Comparing Firms with STF and Firms with LTF

As outlined in the previous section, IPWRA addresses non-random treatment allocation by balancing the covariates. Using propensity scores for weighting moves standardized differences of the means closer to zero and variance ratios closer to one. Balancing has been achieved as almost none of the reweighted covariates deviates more than 0.1 from these targeted values (see Table A4 in the Online Appendix). In support of the overlap assumption, we have positive values for the propensity scores of both treated and controls over the whole range of realized values (see Fig. A5 in the Online Appendix).

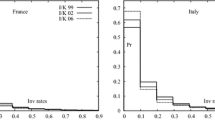

Baseline Results for Job Quality

In the following, the baseline ATEsFootnote 11 for the job quality variables are presented.Footnote 12 LTF positively affects all of the indicators, but not all of the effects are statistically significant. The likelihood that firms offer formal training increases with increasing maturities as shown in Fig. 2 where the ATEs are plotted against the different maturity thresholds for LTF (confidence intervals in grey). This means that firms with LTF, that subsequently enjoy more financial security for a longer planning horizon, are more willing to invest in human capital to build a trained and skilled workforce. The effects are statistically significant for the 3-year (p = 0.005), 4-year (p = 0.003) and 5-year threshold (p = 0.028). Given that about 55% of firms offer formal training in the control group, increasing the likelihood of training provision by 4.8% (for 4- and 5-year threshold) is also substantial and thus economically significant.

Moreover, I find evidence for the mechanism of complementing investments described in the theoretical framework; i.e. that investments in new equipment, machines and technology adoption, for instance, require staff training and human capital accumulation and thus lead to complementing investments in labor, in particular formal training. For the subsample of firms that invested in fixed assets-or respectively in process innovation or product innovation-, effect sizes of the training variable are ((mostly) statistically significant and) much larger than for the subsample of firms that did not undertake such investments as depicted in Fig. A6 in the Online Appendix (for the latter subsample effect sizes are often zero or close to zero).Footnote 13

In accordance with the baseline findings on training, the share of production workers (top row) and the share of non-production workers (bottom row) that receive such formal training rises correspondingly with longer loan maturities as depicted in Fig. 3. Effects are statistically and economically significant: For the 5-year threshold, for instance, an additional 4.2% (2.6%) of production workers (non-production workers) benefit from training offers over the average 28% (20%) that are trained in firms with STF. This corresponds to a relative increase of about 15 or 13% respectively. Effect sizes are similar (even slightly higher) when using listwise deletion instead of multiple imputation (right graph; note: not enough observations for non-production workers).

In line with the theoretical arguments, average wages are found to rise with increasing loan maturities (Fig. 4). The average wage relative to national GDP per capita amounts to 1.08 for firms with STF. Wages in firms with LTF are, on average, up to 4.1 percentage points (4-year threshold) higher, which is marginally significant (p = 0.095). Effect sizes and significance are marginally higher when looking only at recent borrowers (firms that received their loan in the last fiscal year or 1–2 years before; right graph); but most importantly, the similar effect sizes suggest that LTF increases average wages not just shortly after the approval of a long-term loan, but permanently.

LTF is found to reduce the use of temporary jobs and to increase permanent jobs within firms, with significant effects for the 1-year (p = 0.063) and 2-year threshold (p = 0.019) as depicted in the left graph of Fig. 5. In firms with STF, about 88% of employees enjoy a permanent contract. The ATE states that LTF raises the share of permanent employees by 0.9 percentage points for the 1-, 2- and 3-year threshold. Surprisingly, the ATE decreases when further increasing the maturity threshold.

The effects on permanent and temporary employment can be better understood when looking at the subsample of recent borrowers (right graph), for which the share of permanent jobs increases with rising maturity thresholds (e.g. 1.3 percentage points higher for 4-year threshold). Differences between ATEs for the whole sample and the subsample especially materialize for longer loan maturities, i.e. when firms that had received their loans in the more distant past are more prevalent. Taking into account that LTF is associated with higher growth of permanent jobs over all loan maturities (as presented shortly in Fig. 7), this suggests the following: LTF creates more permanent jobs, such that the share of permanent jobs increases; however, some years after the injection of LTF, firms still create additional permanent jobs, but create relatively more temporary jobs such that the positive effect on the share of permanent employees is attenuated for higher maturity thresholds. The subsample of recent borrowers does not suffer from this attenuation and thus shows a clear positive trend over loan maturity thresholds.

Baseline Results for Investments and Firm Performance

Baseline IPWRA estimates for the ATEs on investments and firm performance are positive and mostly significant. However, a key difference to the job quality indicators is the lacking positive trend over maturity thresholds (except for process innovation). The effects on investments in fixed assets and process innovation are (mostly) highly significant as shown in the top row of Fig. 6. They are also economically significant as access to LTF raises the likelihood of investments in fixed assets by up to 5 percentage points (for 3-year threshold) and by 6.2 percentage points for process innovation (for 4-year threshold). To put this into perspective, about 69% of the included firms with STF have invested in fixed assets and roughly 49% in process innovation. Effects on investments in product innovation are only significant for the 1-year and 2-year threshold (p = 0.030 and p = 0.043). Furthermore, effect sizes are quite small given that roughly 50% in the control group undertook such investments: The probability of financing product innovation increases by only up to 2.7 percentage points (for 1-year threshold).

Additional information in the ES dataset helps to better understand the differences in effect sizes and statistical significance for investments in process and product innovation. ‘Process innovation’ in the ES captures improvements related to the production process and/or the service delivery. In most cases, these improvements include adoption of new technologies as indicated in answers to the open-ended follow-up question. Such investments are generally of longer-term nature and thus require LTF. Consequently, effect sizes increase with higher maturity thresholds. ‘Product innovation’, in contrast, mainly describes the addition of a new product or service to the existing portfolio. Depending on the industry of the firm, this may be achieved rather easily (e.g. in industries such as food, textile, garments, wood and furniture, retail and wholesale trade) and thus be feasible in the short term. In other cases, ‘product innovation’ captures minor modifications to the product, e.g. with regard to the packaging or inputs, which can be implemented in the short term and thus with STF. The open-ended follow-up questions indicate that real quality improvements of the product and services, which may require longer time and thus LTF, are the exception for the ES variable ‘product innovation’.

The effects of LTF on firm performance are positive and quite large, but only partially significant. The graphs on the left show the ATEs for employment and sales growth when assuming an immediate response to the uptake of LTF, while the ones on the right assume a lagged response (by 1 year); they are quite similar in terms of effect sizes, but sales growth exhibits a positive trend (i.e. increase over the maturity thresholds) when assuming a lagged response. As depicted in the top row of Fig. 7, the growth rate of permanent jobs increases considerably by up to 0.95 percentage points (for 4-year threshold, right graph) over the average growth rate of 5.2% among firms with STF. Despite the relative increase of about 18%, effects are only significant for the 1-year (left graph: p = 0.025; right: p = 0.034) and 2-year threshold (p = 0.031 and p = 0.027). The substantial effect sizes in the sales growth rate of up to 1.14 percentage points (for 4-year threshold, right graph) constitute a relative increase of 51% (growth rate of 2.2% in control group), but are only significant for the 3-year threshold (left graph: 0.016; right graph: p = 0.010) and 4-year threshold (right graph: p = 0.042).

For almost all investment and firm performance variables, it seems sufficient to provide loans with a maturity of more than 1 year to foster investments and firm growth. One important exception are ATEs of investments in process innovation that increase with higher maturity thresholds—meaning that LTF is needed to facilitate such investments. Given that ‘process innovation’ in most cases captures adoption of new technologies, this type of investment (and thus LTF) is key to realize productivity gains and to boost firms’ long-term growth prospects.

Second Approach: Comparing Firms with Shortly Maturing LTF and Firms with LTF

When comparing firms with shortly maturing long-term loans (< 2 years remaining maturity; control) to firms with LTF with longer maturities (treatment), there is support for the conditional independence and the overlap assumption: covariates are balanced between treatment and control groups after reweighting (see Table A6 in the Online Appendix); and in terms of propensity scores, we have positive values for both treated and controls over the whole range of realized values (see Fig. A7 in the Online Appendix).

Baseline Results for Job Quality

Results are in line with those of the first approach: Effect sizes for the job quality indicators are positive and increase with rising maturity thresholds, i.e. longer-term loans are associated with more pronounced improvements in job quality.Footnote 14 Effect sizes are larger than in the previous approach (for respective thresholds), but statistical significance is lower since the sample size is much smaller and thus estimation less precise. For most indicators, there are not enough observations to (reliably) estimate effects for the 4-year or 5-year threshold.

Firms with long-term loans that mature in the more distant future (in 2 or more years) are more willing to invest in human capital compared to firms with shortly maturing LTF. The likelihood of offering formal training is increased by 4.4% (for 3-year threshold; see top row in Fig. 8). Effects are significant for the 2-year threshold (p = 0.059) and 3-year threshold (p = 0.093). This increases the share of production workers and the share of nonproduction workers receiving such training by 4.4 percentage points and 1.8 percentage points respectively (bottom row in Fig. 8). Yet only the effects for production workers are statistically significant. Given that 26% of production workers in the relevant control group benefitted from training offers, the effect is also economically significant as it corresponds to a relative increase of 17%.

This (second) approach is unable to identify effects of LTF on stock variables, namely the share of permanent employees and average wage: Both the theoretical framework and the previous analysis suggest that firms with LTF will have alleviated levels for the stock variables irrespective of the remaining maturity of their long-term debt. Consequently, this second approach should find no difference between treatment (firms with LTF) and control group (firms with shortly maturing LTF) for stock variables. Indeed, ATEs for the share of permanent employees and average wage are zero or close to zero.

Baseline Results for Investments and Firm Performance

The results largely underline the findings from the first approach: the effects of longer maturities on investments and firm performance are positive and in most cases highly significant. Overall, the effect sizes are larger than in the first approach and tend to increase with larger maturity thresholds.

The likelihood that firms invest in fixed assets increases by 14% (for 3-year threshold; top left in Fig. 9) if firms have LTF finance that does not mature in less than 2 years. The size of the effect is relatively large, given that, on average, 62% of firms in the relevant control group purchased fixed assets. Subsequently, effect sizes are also statistically significant at the 1-percent level for all maturity thresholds.

Firms’ likelihood of investing in process innovation increases by 5.3% (2-year threshold) and 5% for investments in product innovation (3-year threshold) as depicted in Fig. 9. However, effects are marginally significant for product innovation, while they are highly significant for process innovation. Effect sizes are substantial since 45% (47%) in the respective control groups invest in process innovation (product innovation).

Firms with LTF that expires in the more distant future experience faster growth of permanent jobs and sales. As shown in Fig. 10, the growth rates increase for employment growth by 1.53 percentage points (2-year threshold) and for sales growth by 1.79 percentage points (3-year threshold). This corresponds to a relative increase of about 46% and 179% respectively.Footnote 15 Effect sizes are economically and statistically significant.

Robustness Checks

The thrust of this section is twofold. First, it takes a closer look at the role of rollover risk since firms’ preference for maturity matching of their assets and liabilities renders rollover risk a main explanatory factor for why LTF fosters crucial productivity-enhancing, long-term investments. Second, this section shows that results are robust to changes on different dimensions: subsample analyses restricted to LMICs or small and medium-sized enterprises (SMEs); propensity score matching instead of IPWRA; and different thresholds for defining treatment and control groups in the second approach.

The identification strategy relies on different behavior of firms with LTF and those with shortly maturing loans due to rollover risk in economies with frictions in their credit markets. Rollover and liquidation risk introduces the necessity to match maturities of assets and liabilities such that firms tend to use shortly maturing loans for short-run investments and to finance long-term investments with loans of longer maturities. Hence, firms with shortly maturing loans should be unable to undertake similar investments and thus exhibit behaviors different from firms with longer maturities. The robustness check sheds further light on the role of rollover risk by exploiting different degrees of exposure to rollover risk. Separate analyses are run for firms that self-report access to finance as being a constraint (major or very severe obstacle), i.e. that are more severely affected by rollover risk if their current loan matures; and for firms that are less constrained by finance (moderate/minor/no obstacle), i.e. that should feel less pressure from rollover risk even if their loan matures.

Effect sizes of the job quality variables (i.e. differences between treatment and control groups) are attenuated towards zero or even become zero when only looking at financially unconstrained firms (that should feel less pressure from rollover risk) and are considerably larger when only including financially constrained firms in the analysis. This holds both for comparisons between firms with LTF and shortly maturing LTF (second approach) as depicted in Table A8 in the Online Appendix and for comparisons between firms with LTF and STF (first approach) as shown in Fig. A8. It indicates that rollover risk matters for investments related to improvements in job quality.

Rollover risk also affects some of the investment and firm performance variables, but the emerging picture is not as unambiguous as for the job quality indicators. For the second approach (LTF vs shortly maturing LTF), effect sizes of the subsample of financially constrained firms are substantially larger for investments in fixed assets and in product innovation than those of the subsample of financially unconstrained firms. This suggests that credit market frictions and rollover risk matter. However, effects are similar for investments in process innovation and for employment growth, and (unexpectedly) smaller for sales growth (see Table A8 in the Online Appendix). As shown in Fig. A9, findings are similar for the first approach (LTF vs STF)—with more noise for investments in fixed asset. In a nutshell, rollover risk and maturity matching are highly relevant for the job quality indicators, but also matter in the context of several investment and firm performance variables.

In terms of modifications to the sample, the estimation strategy or the chosen definitions, it was first ruled out through subsample analyses that effects were mainly driven by either high-income countries or large firms. High-income countries may affect estimation, since the level of development of financial markets and the availability of LTF may differ from the context of LMICs, which could alter the strength of the effects or the structural impact of LTF. Yet very similar results emerge for LMICs both for the first approach (see Figs. A10 and A11 in the Online Appendix) and for the second approach (Figs. A12 and A13). In a second robustness check, large firms were dropped, since they enjoy better access to LTF from banks (but also, for instance, from capital markets), and long-term loans may thus play a different role for them. Effects are mostly similar for SMEs both for the first (see Figs. A14 and A15 in the Online Appendix) and second approach (Figs. A16, A17).

Furthermore, it was confirmed that results are robust to using propensity score matching instead of IPWRA both for the first (see Figs. A18 and A19 in the Online Appendix) and second approach (Figs. A20, A21). Moreover, the main takeaways are not sensitive to how treatment and control groups are defined in the second approach. The baseline employs a threshold of 2 years such that firms with a loan duration of more than 1 year (2, 3, 4 or 5 years) are included into the control group if it matures in less than 2 years and into the treatment group if the remaining loan maturity amounts to two or more years. Effect sizes are computed for reducing the threshold to 1 year (treatment if remaining maturity is ≥ 1 year; left columns of Figs. A22 and A23 in the Online Appendix) and for raising it to 3 years (treatment if remaining maturity is ≥ 3 years; right columns). The main findings carry over, but effect sizes slightly change in a predictable manner and in line with the findings from the baseline analyses (see Online Appendix for a more detailed discussion).

Conclusions

From a theoretical perspective, the effect of LTF on the performance of firms is ambiguous. Empirical evidence from the micro and macro level favors the notion that LTF fosters investments, productivity and growth. Using firm-level data from 73 mostly low- and middle-income countries, this study provides further empirical support thereof. More importantly, it also analyses the effects on job quality. After all, many of the long-term investments, such as R&D, technology adoption and fixed assets, require complementary investments in labor, such as human capital accumulation, staff training and the like. Consequently, longer-term finance allows firms to pursue more long-term growth strategies, which includes investments in a stable and skilled workforce. This may contribute to better jobs, characterized by training and skill development, higher wages and more stable employment relations. Improved quality of jobs is not only a valuable goal in itself, but more broadly available good jobs also contribute to more cohesive societies (World Bank 2012; Wietzke 2014).

The findings indicate that long-term loans have indeed a positive effect on job quality. Even though presented theoretical and descriptive arguments are favorable, it cannot be ruled out completely that endogeneity problems from unobservable variables affect estimation of the effect sizes. LTF is associated with significant increases in formal training, average wage and the share of permanent jobs. The effects on the job quality indicators increase with longer loan maturities (i.e. when loan maturities are not just above 1 year, but above 2, 3, 4 or 5 years) indicating that long-term loans, indeed, facilitate building up a stable and skilled workforce with positive effects for the employees.

LTF is also associated with significantly increasing the likelihood of investments in fixed assets and investments in process innovation. Effects on product innovation are more modest and only marginally significant. LTF also boost employment growth and sales growth, for which effects are substantial, but only significant for certain maturity thresholds. In contrast to job quality, the importance of offering loans with a maturity above 1 year is less clear: The first approach (LTF vs STF) suggests that loans with a maturity above 1 year are sufficient and that increasing the loan maturities further does not lead to larger effects on investments and firm performance (except for process innovation); whereas the second approach (LTF vs shortly maturing LTF) finds some evidence that effect sizes tend to increase with larger maturities even for investments and firm performance.

The results reveal that LTF helps to enable productivity gains and to promote both employment creation and especially the quality of jobs. Availability of longer-term loans, however, is limited—especially in LMICs—and may further decrease due to current developments such as the growing importance of fintechs and digital lending, which is expected to increase short-termism in credit markets. Nevertheless, additional deliberations and trade-offs need to be considered before adopting a policy agenda committed to promoting LTF. First, it has to be noted that it may require additional reforms and time. Markets generally require good legal infrastructure, a stable economic and political environment and functioning banking and stock markets to provide LTF. Development finance institutions (DFIs) can play an important role in developing markets for LTF, but must not repeat the failures of subsidized lending from the last millennium. Second, not all firms need LTF, and LTF is more likely to go to more transparent, larger firms. This could result in a trade-off, as described by Léon (2020), that more lending with longer maturity goes to larger firms (intensive margin) at the expense of reaching more firms, in particular smaller and younger firms, with STF (extensive margin). More research is needed to better understand the role of LTF in corporate finance. This refers both to exploring its relationship to job quality more thoroughly by using panel data or other means to control for unobservable firm characteristics, and the need to shed more light on the question of how to integrate reforms for LTF into the broader context of financial system development.

Data Availability

Except for the Enterprise Surveys, all datasets are openly accessible on websites of the World Bank Group. Enterprise Surveys data was provided by the Enterprise Analysis Unit of the Development Economics Global Indicators Department of the World Bank Group by permission. Since this data must not be transferred to a third party, data will only be shared on request to the corresponding author with permission of the Enterprise Analysis Unit.

Notes

Respective descriptive statistics for countries in my sample are provided in Fig. A1 in the Online Appendix.

Note that some economists argue that firms with good growth potentials should prefer to borrow short-term despite the rollover risk: first, because otherwise they benefit less from their investment since they have to share returns with their long-term lenders for a longer time (Myers 1977); second, because in the context of asymmetric information the positive news allow for better financing terms when rolling over credits (Diamond 1991). Yet this especially applies to high performers, while average firms are more likely to match maturities in the face of rollover risk—as described in the text.

This may compromise firms’ long-term performance and growth prospects as elaborated in the following paragraphs.

If an observation had non-missing values for the dummy but missings for the shares of trained (non-)production workers, these observations were completed by either simple imputation (training = 0 logically requires both shares to be zero as well) or multiple imputation (for training = 1) using the mice package in R (Van Buuren and Groothuis-Oudshoorn 2011). Details of the multiple imputation procedure can be found in the Online Appendix. The analysis also presents results based on listwise deletion.

The regression-to-the-mean effect is avoided by dividing not by the initial value, but by the average of the initial and last value.

Subsidiary (dummy whether firm is part of a larger firm) or experience of the manager (as proxy for manager quality) are not included as control variables, since they have many missing values (e.g. almost 40% for experience of manager). It has been confirmed that all findings are robust to including these firm-level control variables.

I cannot control for other relevant loan characteristics on the firm level. The ES dataset only captures data on collateral and loan size; while the former is not relevant in my analysis, the latter may be, but the amount of missing values does not allow inclusion of the loan-size variable (outliers raise doubts about the quality of this variable anyways). Issues could arise if the loan size was correlated with loan maturity such that loan size instead of maturity could drive the results. However, as shown in Fig. A4 in the Online Appendix, size and maturity of loans are not correlated in my sample such that this should not be in issue.

The threshold choice is partly informed by results from the first approach: Effect sizes for job quality variables become larger and economically relevant at the 2-year threshold, which suggests that this is a meaningful and relevant threshold. The robustness check includes also other thresholds (1 and 3 years).

One potential concern may be that firms with shortly maturing LTF are at different points in the business/investment cycle; i.e. they invest no longer and show lower investments since the uptake of the loan is longer in the past. However, similar results materialize when controlling for the time since the uptake of the loan.

It has been confirmed that results are robust to using country-year fixed effects instead of country and time (i.e. year) fixed effects.

This implies that firms with an initial loan duration of more than 1 year (or respectively 2, 3, 4 or 5 years) and a remaining maturity of less than 1 year (or respectively 2, 3, 4 or 5 years) are removed from the analysis. (For stock variables, these observations would have been in the treatment group.)

Recall that this paper only looks at firms with a bank loan, i.e. it computes ATEs for the (sub-)population of firms with a loan (and not for the entire population of firms).

Results from the propensity score model are presented exemplarily for the outcome variable share of permanent employees in Table A5 in the Online Appendix.

Despite the small sample size (and resulting imprecise estimation and large confidence intervals), differences between the subsamples are even statistically significant for certain maturity thresholds for investments in fixed assets and process innovation. Differences are statistically insignificant for product innovation (which is not too surprising given that the baseline effects of product innovation are, in contrast to the other two investment variables, relatively small and thus economically insignificant—see Fig. 6). Also in line with the baseline findings of product innovation (significant effects for 1- and 2-year maturity threshold, but not for higher maturity thresholds), differences between the subsamples are substantial for these smaller maturity thresholds and vanish for larger thresholds.

Note that this subsample analysis cannot be repeated for the second approach (LTF vs shortly maturing LTF) due to insufficient observations (smaller sample in the second approach).

Results from the propensity score model are presented exemplarily for the outcome variable formal training in Table A7 in the Online Appendix.

The fact that effect sizes for the growth rates are much larger than in the first approach may be explained by the inability to use the sample of ‘recent borrowers’. The control group comprises firms with LTF that matures in less than 2 years. This implies that the control group has very few firms that have taken out their loan recently, i.e. in the last fiscal year or 1–2 years before (otherwise such long-term loans would mature in the more distant future and thus firms would belong to the treatment group). Yet such recent borrowers are expected to exhibit larger (accurate) effects as growth rates are computed between periods before and after the LTF injection (see “Differentiation of Stock Variables, Flow Variables and Growth Rates” section). In order to account for this tendency towards overestimation, one could remove all recent borrowers to ensure comparability between treatment and control group. This leads to effect sizes that are relatively similar to those in the first approach. Including ‘years since loan approval’ as covariate may also sufficiently control for this issue: Then effect sizes are also similar to the first approach for maturity-thresholds of 2- and 3-years, while the effect for the 1-year threshold is close to zero.

References

Aghion, P., P. Howitt, and D. Mayer-Foulkes. 2005. The effect of financial development on convergence: Theory and evidence. The Quarterly Journal of Economics 120 (1): 173–222. https://doi.org/10.3386/w10358.

Almeida, H., M. Campello, B. Laranjeira, and S. Weisbenner. 2012. Corporate debt maturity and the real effects of the 2007 credit crisis. Critical Finance Review 1 (1): 3–58. https://doi.org/10.1561/104.00000001.

Amable, B., E. Ernst, and S. Palombarini. 2005. How do financial markets affect industrial relations: An institutional complementarity approach. Socio-Economic Review 3 (2): 311–330. https://doi.org/10.1093/SER/mwi013.

Austin, P.C. 2011. An introduction to propensity score methods for reducing the effects of confounding in observational studies. Multivariate Behavioral Research 46 (3): 399–424. https://doi.org/10.1080/00273171.2011.568786.

Ayyagari, M., A. Demirgüç-Kunt, and V. Maksimovic. 2008. How important are financing constraints? The role of finance in the business environment. The World Bank Economic Review 22 (3): 483–516. https://doi.org/10.1093/wber/lhn018.

Ayyagari, M., P. Juarros, M.S. Martinez Peria, and S. Singh. 2021. Access to finance and job growth: Firm-level evidence across developing countries. Review of Finance 25 (5): 1473–1496. https://doi.org/10.1093/rof/rfab003.

Beaumont, P., H. Tang, and E. Vansteenberghe. 2021. The role of FinTech in small business lending, Internal Working paper Report, unpublished.

Beck, T., A. Demirgüç-Kunt, and V. Maksimovic. 2008. Financing patterns around the world: Are small firms different? Journal of Financial Economics 89 (3): 467–487. https://doi.org/10.1016/j.jfineco.2007.10.005.

Black, B., H. Gospel, and A. Pendleton. 2007. Finance, corporate governance, and the employment relationship. Industrial Relations: A Journal of Economy and Society 46 (3): 643–650. https://doi.org/10.1111/j.1468-232X.2007.00484.x.

Blanas, S., A. Seric, and C. Viegelahn. 2019. Job Quality, FDI and institutions in Sub-Saharan Africa: Evidence from firm-level data. The European Journal of Development Research 31 (5): 1287–1317. https://doi.org/10.1057/s41287-019-00211-9.

Bloom, M., and J.G. Michel. 2002. The relationships among organizational context, pay dispersion, and among managerial turnover. Academy of Management Journal 45 (1): 33–42. https://doi.org/10.5465/3069283.

Booth, L., V. Aivazian, A. Demirguc-Kunt, and V. Maksimovic. 2001. Capital structures in developing countries. The Journal of Finance 56 (1): 87–130. https://doi.org/10.1111/0022-1082.00320.

Calomiris, C.W., and C.M. Kahn. 1991. The role of demandable debt in structuring optimal banking arrangements. The American Economic Review. https://doi.org/10.7916/D8TH8X53.

Caprio, G., and A. Demirguc-Kunt. 1998. The role of long-term finance: Theory and evidence. World Bank Research Observer 13 (2): 171–189. https://doi.org/10.1093/WBRO/13.2.171.

Caselli, F., and W.J. Coleman. 2001. Cross-country technology diffusion: The case of computers. American Economic Review 91 (2): 328–335. https://doi.org/10.1257/aer.91.2.328.

Chen, S., M.P. Ganum, L.Q. Liu, M.L. Martinez, and M.M.S.M. Peria. 2019. Debt Maturity and the Use of Short-Term Debt: Evidence form Sovereigns and Firms, (Departmental Paper 19/03). Washington: International Monetary Fund.

Crook, T.R., S.Y. Todd, J.G. Combs, D.J. Woehr, and D.J. Ketchen Jr. 2011. Does human capital matter? A meta-analysis of the relationship between human capital and firm performance. Journal of Applied Psychology 96 (3): 443. https://doi.org/10.1037/a0022147.

Darcillon, T. 2015. How does finance affect labor market institutions? An empirical analysis in 16 OECD countries. Socio-Economic Review 13 (3): 477–504. https://doi.org/10.1093/ser/mwu038.

Demirgüç-Kunt, A., B.L. Horváth, and H. Huizinga. 2017. How does long-term finance affect economic volatility? Journal of Financial Stability 33: 41–59. https://doi.org/10.1016/j.jfs.2017.10.005.

Demirgüç-Kunt, A., and V. Maksimovic. 1998. Law, finance, and firm growth. The Journal of Finance 53 (6): 2107–2137. https://doi.org/10.1111/0022-1082.00084.

Demirgüç-Kunt, A., M.S.M. Peria, and T. Tressel. 2020. The global financial crisis and the capital structure of firms: Was the impact more severe among SMEs and non-listed firms? Journal of Corporate Finance 60: 101514. https://doi.org/10.1016/j.jcorpfin.2019.101514.

Diamond, D.W. 1991. Debt maturity structure and liquidity risk. The Quarterly Journal of Economics 106 (3): 709–737. https://doi.org/10.2307/2937924.

Diamond, D. 1993. Seniority and maturity of debt contracts. Journal of Financial Economics 33 (3): 341–368. https://doi.org/10.1016/0304-405X(93)90011-Y.

Diamond, D.W., and R.G. Rajan. 2001. Liquidity risk, liquidity creation, and financial fragility: A theory of banking. Journal of Political Economy 109 (2): 287–327. https://doi.org/10.1086/319552.

Duchin, R., O. Ozbas, and B.A. Sensoy. 2010. Costly external finance, corporate investment, and the subprime mortgage credit crisis. Journal of Financial Economics 97 (3): 418–435. https://doi.org/10.1016/J.JFINECO.2009.12.008.

Duval, R., G.H. Hong, and Y. Timmer. 2020. Financial frictions and the great productivity slowdown. The Review of Financial Studies 33 (2): 475–503. https://doi.org/10.1093/rfs/hhz063.

Fan, J.P., S. Titman, and G. Twite. 2012. An international comparison of capital structure and debt maturity choices. Journal of Financial and Quantitative Analysis 47 (1): 23–56. https://doi.org/10.1017/S0022109011000597.

G20. 2013. Long-term investment financing for growth and development: Umbrella Paper, Paper presented to the Meeting of the G20 Ministers of Finance and Central Bank Governors, February 2013, Moscow, Russia.

Graham, J.R., and C.R. Harvey. 2001. The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics 60 (2): 187–243. https://doi.org/10.1016/S0304-405X(01)00044-7.

Gutierrez, E., N. Karmali, and D. Sourrouille. 2018. Bank credit allocation in Latin America and the Caribbean, (Policy Research Working Paper 8571). Washington, DC: World Bank.

Hart, O., and J. Moore. 1995. Debt and seniority: An analysis of the role of hard claims in constraining management. American Economic Review 85 (3): 567–585. https://doi.org/10.3386/w488

Imbens, G.W., and J.M. Wooldridge. 2009. Recent developments in the econometrics of program evaluation. Journal of Economic Literature 47 (1): 5–86. https://doi.org/10.3386/w14251.

Jaramillo, F., and F. Schiantarelli. 2002. Access to long term debt and effects on firms’ performance: Lessons from Ecuador, (Research Network Working Paper R-460). Washington: Inter-American Development Bank.

Jeanne, O. 2009. Debt maturity and the international financial architecture. American Economic Review 99 (5): 2135–2148. https://doi.org/10.1257/aer.99.5.2135.

Jensen, M.C. 1986. Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review 76 (2): 323–329. https://doi.org/10.2139/ssrn.99580.

Leon, F. 2018. The credit structure database, (CREA discussion paper series 2018–07). Luxembourg City: University of Luxembourg.

Léon, F. 2020. The provision of long-term credit and firm growth in developing countries. Economic Modelling. https://doi.org/10.1016/j.econmod.2020.04.023.

Li, K., H. Yue, and L. Zhao. 2009. Ownership, institutions, and capital structure: Evidence from China. Journal of Comparative Economics 37 (3): 471–490. https://doi.org/10.1016/j.jce.2009.07.001.

Love, I., and M.S. Martínez Pería. 2015. How bank competition affects firms’ access to finance. The World Bank Economic Review 29 (3): 413–448. https://doi.org/10.1093/wber/lhu003.

Martinez Peria, M.S., and S.L. Schmukler. 2017. Understanding the use of long-term finance in developing economies, (Working Paper 17/96). Washington, DC: International Monetary Fund.

Milbradt, K., and M. Oehmke. 2015. Maturity rationing and collective short-termism. Journal of Financial Economics 118 (3): 553–570. https://doi.org/10.1016/j.jfineco.2014.08.009.

Myers, S.C. 1977. Determinants of corporate borrowing. Journal of Financial Economics 5 (2): 147–175. https://doi.org/10.1016/0304-405X(77)90015-0.

Rajan, R.G. 1992. Insiders and outsiders: The choice between informed and arm’s-length debt. The Journal of Finance 47 (4): 1367–1400. https://doi.org/10.1111/j.1540-6261.1992.tb04662.x.

Rajan, R.G., and L. Zingales. 1995. What do we know about capital structure? Some evidence from International data. The Journal of Finance 50 (5): 1421–1460. https://doi.org/10.1111/j.1540-6261.1995.tb05184.x.

Schiantarelli, F. and A. Sembenelli. 1997. The maturity structure of debt: Determinants and effects on firms' performance, evidence from the United Kongdom and Italy, (Policy Research Working Paper 1699). Washington: World Bank.

Schiantarelli, F., and V. Srivastava. 1997. Debt maturity and firm performance: A panel study of Indian companies, (Policy Research Working Paper 1724). Washington: World Bank.

Tasic, N., and N. Valev. 2008. The maturity structure of bank credit: Determinants and effects on economic growth, (Andrew Young School of Policy Studies Research Paper Series 08–12). Atlanta: Georgia State University.

United Nations Secretary-General's Task Force on Digital Financing of the Sustainable Development Goals. 2020. People’s money: Harnessing digitalization to finance a sustainable future. https://unsdg.un.org/sites/default/files/2020-08/DF-Task-Force-Full-Report-Aug-2020-1.pdf.