Abstract

There are few impact evaluations of social assistance programmes amongst people with disabilities, despite the increasing popularity of disability-targeted programmes. The Disability Allowance in the Maldives is a non-contributory, non-means-tested and unconditional cash transfer of MVR 2000 (US$130) per month. This study explores the impact of the Disability Allowance on financial well-being using a quasi-experimental study design with difference-in-difference analysis conducted between 2017 and 2019. Overall, this study found a modest impact of the Disability Allowance, mainly in food security. Receipt of the Disability Allowance was attributable to a decrease in the use of negative coping mechanisms in response to food insecurity and an increase in the food proportion of household consumption expenditures. There was a non-significant trend towards reduced poverty headcount and gap, and the likelihood of moderate/severe food insecurity. These findings carry implications for the design of social protection in the Maldives and globally, indicating possible improvements in programme design (e.g., increased amount) and for complementary interventions (e.g., improving access to disability-inclusive livelihood development programmes) to maximise impact.

Résumé

Il y a peu d'évaluations d'impact des programmes d'aide sociale parmi les personnes handicapées, malgré la popularité croissante des programmes ciblant les personnes handicapées. L'Allocation pour handicapés aux Maldives est une prestation en espèces non contributive, non soumise à un test de ressources et inconditionnelle de MVR 2000 (US$130) par mois. Cette étude explore l'impact de l'Allocation pour handicapés sur le bien-être financier en utilisant une conception d'étude quasi-expérimentale avec une analyse de différence en différence, menée entre 2017–2019. Globalement, cette étude a trouvé un impact modeste de l'Allocation pour handicapés, principalement en matière de sécurité alimentaire. La réception de l'Allocation pour handicapés était à la racine d’une diminution de l'utilisation de mécanismes d'adaptation négatifs en réponse à l'insécurité alimentaire et à une augmentation de la proportion de nourriture dans les dépenses de consommation des ménages. Cependant, il n'y avait pas d'impact attribuable à l'Allocation pour handicapés pour d'autres objectifs clés du programme, y compris la réduction du nombre et de l'écart de la pauvreté, ou la réduction de la probabilité d'une insécurité alimentaire modérée/sévère. Ces résultats ont des implications pour la conception de la protection sociale aux Maldives et globalement, indiquant des améliorations possibles dans la conception du programme (par exemple, augmentation du montant) et pour des interventions complémentaires (par exemple, amélioration l'accès à des programmes de développement de moyens de subsistance inclusifs pour les personnes handicapées).

Resumen

Hay pocas evaluaciones de impacto de los programas de asistencia social entre las personas con discapacidades, a pesar de la creciente popularidad de los programas dirigidos a las discapacidades. La Asignación por Discapacidad en las Maldivas es una transferencia de efectivo no contributiva, no sometida a prueba de medios y sin condiciones de MVR 2000 (US$130) por mes. Este estudio explora el impacto de la Asignación por Discapacidad en el bienestar financiero utilizando un diseño de estudio cuasi-experimental con análisis de diferencia en diferencia, realizado entre 2017–2019. En general, este estudio encontró un impacto modesto de la Asignación por Discapacidad, principalmente en la seguridad alimentaria. La recepción de la Asignación por Discapacidad fue está a raíz de una disminución en el uso de mecanismos de afrontamiento negativos en respuesta a la inseguridad alimentaria y un aumento en la proporción de alimentos de los gastos de consumo del hogar. Sin embargo, no hubo un impacto atribuible de la Asignación por Discapacidad para otros objetivos clave del programa, incluyendo la reducción de la pobreza y su brecha, o en la reducción de la probabilidad de inseguridad alimentaria moderada/severa. Estos hallazgos tienen implicaciones para el diseño de la protección social en las Maldivas y a nivel mundial, indicando posibles mejoras en el diseño del programa (por ejemplo, aumento de la cantidad) y para intervenciones complementarias (por ejemplo, mejorar el acceso a programas de desarrollo de medios de vida inclusivos para personas con discapacidad).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Social protection is widely used as a strategy for alleviating poverty and improving well-being. The importance of social protection is underscored by its direct and indirect reference in at least five of the 17 Sustainable Development Goals (SDGs), including Goal 1, which seeks to “end poverty in all its forms” (United Nations 2017). Under target 1.3 of Goal 1, States are called to “implement nationally appropriate social protection systems and measures for all, including floors, and by 2030 achieve substantial coverage of the poor and the vulnerable.” Social protection through provision of social assistance, namely cash transfers, is particularly common in low- and middle-income countries (LMICs) (Barrientos 2011).

The more than one billion people with disabilities globally are an important target group for social protection, including social assistance (International Labour Organization 2017). The United Nations Convention on the Rights of Persons with Disabilities (UNCRPD) defines people with disabilities as including “those who have long-term physical, mental, intellectual or sensory impairments which in interaction with various barriers may hinder their full and effective participation in society on an equal basis with others” (United Nations 2006). Access to social protection is important for people with disabilities and their households, as they are more likely to be living in poverty compared to their peers without disabilities (Banks et al. 2017; United Nations 2018). Further, many also face disability-related extra costs, such as for assistive devices, additional healthcare and transport and personal assistance (Mitra et al. 2017). Spending on these costs lower standards of living for households with members with disabilities, while unmet costs can reduce participation and quality of life for people with disabilities (Mont et al. 2022). In addition to a need-based argument, the right to inclusion of people with disabilities in social protection is well established in international treaties such as the Universal Declaration of Human Rights (Article 25) and the UNCRPD (Article 28) (United Nations General Assembly 1948; United Nations 2006). Recognising the need for and right to social protection, 170 countries have implemented disability-targeted social protection schemes (International Labour Organization 2017).

However, there is a lack of evidence on the impact of social assistance amongst people with disabilities despite the increasing popularity of disability-targeted programmes as tool to reduce poverty and improve financial well-being amongst recipients (Banks et al. 2016; Kidd et al. 2019). A systematic review on social protection and disability in LMICs published in 2017 retrieved few rigorous studies on the impact of cash transfers and other programmes amongst people with disabilities, with available evidence limited to cross-sectional or qualitative studies of self-reported impacts with no impact evaluations (Banks et al. 2016). Since then, a disaggregated analysis of a cluster randomised control trial of a child cash grant in Lesotho by disability status was conducted, with results indicating that receipt of the grant resulted in decreased food insecurity (de Groot et al. 2021). Amongst the general population, the impact of social assistance has been relatively well studied: systematic reviews of cash transfers in LMICs have found strong evidence of positive impacts in reducing monetary poverty and food insecurity (Bastagli et al. 2019; Owusu-Addo et al. 2018).

Consequently, this study seeks to add to the limited evidence base on the impact of social protection on poverty amongst people with disabilities in LMICs through a quasi-experimental impact evaluation of the Maldives’ Disability Allowance, a monthly cash transfer. This analysis focuses on the impact on financial well-being, namely poverty and food security.

Study Context: Disability and Social Protection in the Maldives

The Maldives is an upper-middle income island nation in South Asia, with an estimated population of over 540,000 (World Bank 2021). A third of the population lives in the capital Malé, with the remainder dispersed across 186 inhabited islands (World Bank 2020). Prevalence of disability in the Maldives was estimated at 6.8% nationally (Banks et al. 2020). People with disabilities and their households were more likely to be living in poverty and face participation restrictions in areas such as school, work and social life compared to people without disabilities (Banks et al. 2020).

The Maldives has ratified the UNCRPD (United Nations Enable 2016) and the right to social protection for persons with disabilities is codified in Articles 17 and 35 of the Maldivian Constitution (Government of Maldives 2008). The cornerstone of disability-targeted social protection is the Disability Allowance, which was established in 2010 under the Disability Act to “provide financial support to the disabled and enable them to have equal opportunities in the society as others” (Government of Maldives 2010). This scheme is a non-contributory, non-means tested and non-conditional monthly cash transfer of MVR 2,000 (about US$130) per month. Recipients may also be entitled to other benefits, such as priority access to housing and a benefit card that gives discounts on transportation and in certain shops. Eligibility is restricted to Maldivian citizens with disabilities, defined as “all persons with long term physical, psychological, sensory or mental illness facing difficulty in participating community activities to the same level as others shall be considered as persons with disabilities” (Government of Maldives 2010). Disability is assessed through a medical assessment, and if deemed needed, a functional assessment. The programme, including application decisions, is managed by the National Social Protection Agency (NSPA). It is estimated that 25.6% of Maldivian citizens with disabilities are receiving the Disability Allowance, with coverage higher among men, children and young adults, people living outside of the capital Malé and people in the lowest two income quartiles (Hameed et al. 2022b).

In addition to the Disability Allowance, the Maldives has several other social protection programmes that are relevant for people with disabilities. For example, direct healthcare costs are largely covered through Aasandha, the national health financing scheme that covers all Maldivian citizens. Additionally, NSPA runs a complementary programme, Medical Welfare, to which individuals can apply for cover of direct and indirect (e.g., travel) healthcare costs not covered through Aasandha. Importantly, assistive devices are financed through Medical Welfare, and people with disabilities are supposed to be referred for assessment when enrolling in the Disability Allowance though this is not implemented systematically (Hameed et al. 2022b). Finally, people with disabilities may be eligible for other social assistance programmes, such as Old Age Pensions or Single Parent Allowances, that can be received concurrently with the Disability Allowance.

The Maldives provides a compelling setting for understanding the impact of social assistance amongst people with disabilities, as the monthly allotment is one of the largest disability-targeted cash transfers in an LMIC setting (Walsham et al. 2018). The Maldives also offers a range of complementary benefits (i.e., national social health insurance Aasandha, referral and provision of assistive devices through Medical Welfare, priority access to key services), which could address additional drivers of poverty amongst people with disabilities.

Methods

It would not be ethical or legal to randomise people with disabilities to receive the Disability Allowance, as under Maldivian law all eligible people are entitled to receive the programme. Consequently, this study used a quasi-experimental design. Difference-in-difference analysis was used to assess the impact of the Disability Allowance, by comparing changes in indicators of poverty, quality of life and participation between baseline (pre-enrolment) and endline (approximately 22 months post-enrolment) amongst new recipients of the Disability Allowance (intervention group) against people without disabilities and people with disabilities not receiving the Disability Allowance.

Participants

The intervention group was defined as people with disabilities who became newly enrolled in the Disability Allowance after baseline. Two control groups were also used for the evaluation: 1) people without disabilities and 2) people with disabilities who were not enrolled in the Disability Allowance at any point between baseline and endline. The intervention group was recruited through a national population-based survey and through the routine operation of the Disability Allowance, and the control group was identified through the population-based survey only.

The methods for the underlying population-based survey have been described in full elsewhere (Banks et al. 2020; Hameed et al. 2022a). In brief, a two-stage sampling strategy using probability proportionate to size followed by modified compact segment sampling (Turner et al. 1996) was used to screen 5,363 people for disability (aged 2 + , response rate: 82%). Disability was measured using Washington Group Short Set Enhanced (ages 18 +) and the Washington Group-UNICEF Child Functioning modules (ages 2–4, 5–17) (Washington Group and UNICEF 2018, Washington Group on Disability Statistics 2011) along with additional questions designed to align the study definition of disability with Disability Allowance eligibility criteria. The definition of disability used in this study was shared with NSPA for feedback. Specifically, a respondent was determined to have a disability if they met at least one of the following criteria:

-

At least “a lot of difficulty” in one or more of the following domains: seeing, hearing, walking, understanding/being understood, communicating, using hands, remembering, self-care, learning, liftingFootnote 1;

-

Experiencing symptoms of anxiety/depression “daily” with an intensity described as “a lot” (ages 18 +) or daily symptoms (ages 5–17). Symptoms also had to lead to self-reported impacts in either maintaining relationships, socialising with others, finding and maintaining a job, schooling, or household work; or

-

Report of a health condition that may not be captured by the Washington Group questions but would make them eligible for the Disability Allowance, including autistic spectrum disorder or a psychosocial impairment (e.g., bipolar disorder, schizophrenia).

All people with disabilities who were identified in the national survey at baseline were provided with information about the Disability Allowance and encouraged to apply if they were not already enrolled.

Intervention Group Selection

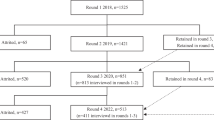

People with disabilities identified in the population-based survey who were not enrolled in the Disability Allowance at baseline but became enrolled before endline were included the intervention group. However, in practice very few people with disabilities from the survey enrolled (n = 10, out of 315). Consequently, the intervention group was also recruited through the routine operation of the Disability Allowance. People (aged 2+) who were accepted into the Disability Allowance between July 2017 and February 2018 were recruited to the study and interviewed before they received the first payment.

Control Group Selection

One participant without disabilities was selected for every person with a disability identified in the survey, matched by age (± 5 years), gender and location (same or nearest cluster), for inclusion as a control (Control group 1). People with disabilities identified in the survey who were not enrolled in the Disability Allowance, and did not become newly enrolled in the Disability Allowance between baseline and follow-up formed Control Group 2. All participants were Maldivian citizens and so eligible for the Disability Allowance and other national programmes (e.g., Aasandha) that could affect the parallel trend assumption.

Sample Size Calculation

Per Capita Expenditure (PCE), a proxy for income, was the primary outcome for the study. We assumed that at baseline the average annual PCE for controls without disabilities was $6670 (Gross National Income estimate from World Bank). We conservatively estimated that people with disabilities were 18% poorer than people without disabilities (Kuper et al. 2008). Consequently, we expected that the PCE among people with disabilities was $5336.

We did not expect that the PCE to change among the controls (i.e. differences between baseline and follow-up per capita expenditure is $0). The addition of the Disability Allowance provided an additional $1,560 per year. Divided by average household size in the Maldives (5.5 members), we anticipated a change in PCE to be $283. The standard deviation for the change in PCE is not known, and so a range of estimates were explored, for a power of 80% and 90% and with 95% confidence (alpha = 0.05). A sample size of 200 people was therefore determined to be sufficient to detect a difference of $280 dollars between baseline and follow-up, with 80% power, even if the standard deviation for the difference is high.

Data Collection

Baseline data collection took place between July 2017 and February 2018, while endline data collection was conducted between April and July 2019. Data were mostly collected in-person at participants’ homes, although phone interviews were also used (e.g., for participants working in fishing or at resorts who were not at their usual home during data collection). Similar questionnaires were administered at baseline and endline and data were entered electronically with Open Data Kit. Questionnaires included questions on household-level indicators (e.g., household expenditures, food security, income and assets), as well as individual-level (e.g., participation in work, school and social life, quality of life, health and access to health services).

Outcome Indicators

This analysis focuses on the impact of the Disability Allowance on financial well-being measured through monetary poverty and food security. These outcomes are in line with the primary aim of the Disability Allowance, to “provide financial support to the disabled…” (Government of Maldives 2010).

Three measures were used to capture household financial security, which included:

-

Total per capita household real consumption expenditures (PCE): Real consumption expenditures was calculated from questions on spending on and consumption of food and non-food household expenses (e.g., electricity, water, clothing, education, transport), which were answered by the most knowledgeable household member. Baseline data was adjusted for inflation so all values are in 2019 Maldivian Rufiyaa (MVR) (World Bank 2022). The Paasche index used within the 2016 Maldives Household and Expenditures Survey to set the most recent poverty line was applied to account for differences in purchasing power across atolls (World Bank 2018).

-

Poverty headcount: A household was deemed to be living in poverty if their total real consumption expenditures (as defined above) was below 52 MVR per capita per day (World Bank 2018).Footnote 2

-

Poverty gap: Amongst those living in poverty, the distance from the poverty line was calculated as the difference in real total per capita household consumption expenditures from the poverty line, over the poverty line.

Three measures of food security were used, which included:

-

Household faces moderate or severe food insecurity: This outcome indicator was based on the Food Insecurity Experience Scale, which is recommended for tracking SDG Goal 2 to “end hunger” (United Nations 2022; Food and Agriculture Organization of the United Nations 2023). It is an 8-item module that asks about household food access in the last 12 months. First, a total score of individuals across the 8 items was generated (never = 0, rarely = 1, sometimes = 2, often = 3), divided by the maximum value. A binary variable was created for determining which households faced moderate/severe food insecurity. A food insecure household was defined as having a food security score of 0.5 or higher (Sharpe and Davison 2022).

-

Food insecurity coping mechanisms: A household was defined as having to use precarious coping mechanisms to counter food insecurity if they reported taking on a loan, buying food on credit or selling land/assets in response to food insecurity.

-

Spending on food: The share of household consumption expenditures for food items was calculated by dividing food consumption expenditures over total consumption expenditures.

Analysis

The impact of the Disability Allowance was estimated through difference-in-difference analysis, comparing the intervention group (people with disabilities who began receiving the Disability Allowance after baseline) first with control group 1 (people without disabilities) and then control group 2 (people with disabilities who did not receive the Disability Allowance between baseline and endline).

Multivariate regression analysis was conducted using the equation below:

where Y is the outcome of interest (e.g. poverty headcount); P is a binary variable set to 1 if the individual is part of the intervention group and 0 if part of the control group (separate regressions run for each control group); T is a dummy variable for time, set to 1 if the observation is from endline and 0 if from baseline; and X represents other individual characteristics (age group, sex of the index person and household location, size and the proportion of dependents, i.e. children < 15 years and older adults 65 + years) which may influence the measure of impact. The coefficient β3 represents the impact of the Disability Allowance amongst the intervention group.

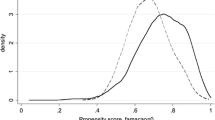

Additionally, as a form of sensitivity analysis, difference-in-difference with matching was used. Characteristics at baseline associated with having a disability (for comparisons to control group 1) and receiving the Disability Allowance amongst people with disabilities (for comparisons to control group 2) were estimated through t-tests and then used to calculate propensity scores. Difference-in-difference was then re-run with kernel matched controls, with analysis restricted to the area of common support.

Ethical Considerations

Ethical approval for this study was granted by the London School of Hygiene & Tropical Medicine, the Maldives National Bureau of Statistics, and the health research committee at the Maldives Ministry of Health prior to the research start date. Informed consent (written or recorded oral) was obtained from all participants. A caregiver provided consent and answered on behalf of children under 18 (age of consent) and adults with severe difficulties understanding/communicating. Participants reporting unmet health needs were referred to available local services, and for the Disability Allowance if not currently enrolled.

Results

Description of the Study Sample

Overall, 616 out of 800 (77.4%) people identified during baseline were successfully followed up at endline (intervention n = 141; control group 1 n = 269; control group 2: n = 206). Frequency of loss to follow up was similar between the intervention and control groups, although reasons for loss to follow differed amongst groups (Table 1). People lost to follow-up had an older mean age and were more likely to be from the capital Malé compared to people included in the endline (Supplemental Table 1). There were no significant differences in any of the outcome indicators at baseline between participants lost to follow up and included in the baseline.

At baseline, people with disabilities in the intervention arm fared worse on most baseline indicators compared to control group 1 (people without disabilities). Compared to control group 2, there was no difference in most outcome indicators except the intervention arm was more likely to use negative coping mechanisms due to food insecurity.

Impact on Financial and Food Security

Three measures were used to assess the impact of the Disability Allowance on financial security (Table 2). Turning first to PCE, there was little change in PCE amongst any group over time and no attributable impact of the Disability Allowance on PCE. Similarly, the Disability Allowance did not have an attributable impact on poverty headcount, although there was a non-significant trend towards reduced poverty particularly compared to control group 1. The poverty gap, which indicates the intensity of poverty amongst the poor was also mostly stable over time, although non-recipients with disabilities (control group 2) had a higher poverty gap at endline compared to baseline. Still, the Disability Allowance did not have an observable impact on reducing poverty gap.

Three variables were used to explore the impact of the Disability Allowance on food security (Table 3). The Disability Allowance did not have an attributable impact on the proportion of households living in moderate/severe food insecurity. No group experienced a difference in the likelihood of experiencing food insecurity over time. Concerning negative coping strategies, Disability Allowance recipients were less likely to use these methods at endline compared to baseline (46.6 to 34.6, p < 0.05) while there were no changes for the two control groups. In the difference-in-difference analysis, the Disability Allowance was attributed to a decreased likelihood of using harmful coping mechanisms in response to food insecurity (decrease of 11.4 percentage points compared to control group 1 and 17.9 percentage points compared to control group 2). The Disability Allowance was also attributed to an increase in proportional consumption on food relative to control group 2 by 5 percentage points.

Sensitivity Analysis

Results of the difference-in-difference with matching were similar to the unmatched analysis (Supplemental Table 2).

Conclusions and Policy Implications

Overall, this study found the Disability Allowance had a modest impact at improving financial well-being for people with disabilities, namely in the domain of food security. There was no attributable impact of the Disability Allowance on poverty headcount, gap, total real expenditures per capita or being moderately/severely food insecure although on some of these indicators non-significant trends towards positive impacts were seen. However, the Disability Allowance did reduce negative coping mechanisms in response to food insecurity and increased the proportion spent on food. Still, Disability Allowance recipients remained worse off in absolute terms on most indicators at endline compared to people without disabilities.

This research is one of the few impact evaluations of a cash transfer – or other form of social protection – amongst people with disabilities (Banks et al. 2016). A community randomised control trial of the Lesotho Child Grant Programme, a non-disability targeted, unconditional cash transfer, disaggregated impact data by disability (de Groot et al. 2021). Similar to this study, it found the cash transfer had some impact on food security, decreasing the number of months households with members with disabilities faced extreme food shortages. Another disaggregated cluster randomised control trial of the Malawi Social Cash Transfer reported a decrease in the poverty headcount of 14 percentage points and of poverty gap of 13 percentage points among recipient households with members with disabilities (Banks et al., forthcoming). The Malawi Social Cash Transfer was also found to reduce worry about food, the likelihood of eating at least 2 meals a day and the proportion of household consumption expenditures spent on food for recipients with disabilities.

The observed impacts of the Disability Allowance are also in line with linked qualitative research, in which recipients reported that the Disability Allowance was helpful for meeting some basic needs but was not enough to cover all their required expenses (Hameed et al., forthcoming). Qualitative research in other settings of other disability-targeted cash transfers have reported similar findings, in which these programmes are helpful but not sufficient for meeting all basic needs (Hanass-Hancock et al. 2017; Trafford 2023; Banks et al. 2018).

It is also important to note that Disability Allowance recipients fared worse on almost all indicators at both baseline and endline compared to non-recipients without disabilities. The trial in Lesotho also found inequalities persisted even after improvements attributable to the cash transfer (de Groot et al. 2021). Other cross-sectional studies on living standards amongst cash transfer recipients with disabilities have found that many are still living in both economic and multidimensional poverty (Hanass-Hancock and McKenzie 2017; Mitra 2010; Banks et al. 2021). This finding indicates that additional programmes may be needed to close inequalities between people with and without disabilities. These gaps are likely even higher than those observed in this study. For example, measures of poverty used a standard poverty line that assumed equivalent consumption needs for people with and without disabilities. However, increasing research indicates that people with disabilities require a higher threshold to cover both basic needs (e.g., food, clothing, shelter) as well as disability-related extra costs (e.g., healthcare, personal assistance, assistive products) (Mitra et al. 2017; Mont and Cote 2020; Mont et al. 2022). Incorporating even modest estimates of these costs can drastically increase the proportion of households with members with disabilities living in poverty (Palmer et al. 2019; Asuman et al. 2021; Braithwaite and Mont 2009).

There are several potential limitations that should be taken into account when interpreting the results of this study. First, it was not possible to undertake a randomised controlled trial, since by law all eligible people with disabilities are entitled to enrol in the programme. Second, participants were recruited at baseline when they had been accepted into the programme, but before they received their first instalment of the Disability Allowance. The knowledge of the incoming additional income could have led to anticipatory changes in behaviour – such as changes in spending patterns – which could have underestimated the impact of the Disability Allowance. However, there was no evidence of this in linked qualitative research (Hameed et al., forthcoming). Third, the follow-up period may have been insufficient to observe change in our key outcomes, particularly in poverty which can take time to escape. It is possible that changes in these outcomes require a longer period of enrolment in the Disability Allowance than was possible within the timeframe of this study. However, other studies have detected changes in these outcome measures after only one year of follow-up compared to the two years used in this study (Kuper et al. 2010). Further, most of these indicators remained very static between the baseline and endline for the intervention group. Finally, there was a lack of power for some analyses, such as poverty gap. It was also not possible to disaggregate of impact amongst people with disabilities (e.g. by gender, domain of functional difficulty) due to power.

Still, this study has important strengths. For example, participants were recruited from a nationally representative, population-based survey and from amongst a geographically diverse group of new recipients to the Disability Allowance, improving the generalisability of findings. Additionally, key elements of the study design, including the definition of outcome indicators, were developed in partnership with the implementing agency NSPA. This collaboration promotes the alignment of the evaluation with the programme’s intended aims.

Additional research is needed to explore if there is heterogeneity in impact amongst people with disabilities, as this study was underpowered to detect differences amongst people with disabilities (e.g. by impairment type, age, gender, area of residence). For example, impact could vary if the recipient is a household head or a child. Further, research is required to assess if improvements in household well-being translate to improvements for people with disabilities. For example, improved household food security may not necessarily translate into improved food security for individuals. Previous research has found that children with disabilities are more likely to be malnourished compared to other children in their household without disabilities (Kuper et al. 2015). Finally, future research could explore the impact of complementary programmes and policies alongside cash transfers for people with disabilities. For example, the association between disability and poverty in Vietnam was found to vary at district-level, and was attenuated in districts with better healthcare and infrastructure (Mont and Nguyen 2018).

The modest impact of the Disability Allowance in the Maldives carries implications for policy. Importantly, it demonstrates that while the cash transfer is an important and valued intervention, it is likely insufficient on its own to achieve its desired aims of providing financial security and equal opportunities for people with disabilities. For example, an individual cash transfer is unlikely to change systemic barriers to improving livelihoods, such as poor availability, quality and accessibility of needed health and social services, or change negative attitudes and discrimination of disability. Investment in complementary interventions to address other barriers to inclusion and participation – such as stigma of disability, inaccessible infrastructure and poor availability, quality and affordability of needed goods and services – are still required.

Notes

Different functional domains asked to different age groups.

52 MVR represents 70% of the poverty line derived from the 2016 Household Income & Expenditures Survey (HIES) (74 MVR per person per day). The 2016 HIES poverty line is set as half the median of consumption expenditures on food, non-food non-durables, consumption flow of durables and rent (real and imputed). Consumption flow of durables and rent represent 30% of the consumption aggregate used to generate the poverty line and so 70% of the poverty line is the proportion consumed for food and non-food non-durables, which is in line with the data available from this study.

References

Asuman, D., C.G. Ackah, and F. Agyire-Tettey. 2021. Disability and household welfare in Ghana: Costs and correlates. Journal of Family and Economic Issues 42: 633–649.

Banks, L.M., S. Hameed, S. Kawsar Usman, and H. Kuper. 2020. No One Left Behind? Comparing Poverty and Deprivation between People with and without Disabilities in the Maldives. Sustainability 12: 2066.

Banks, L.M., H. Kuper, and S. Polack. 2017. Poverty and disability in low-and middle-income countries: A systematic review. PLoS ONE 12: e0189996.

Banks, L.M., R. Mearkle, I. Mactaggart, M. Walsham, H. Kuper, and K. Blanchet. 2016. Disability and social protection programmes in low-and middle-income countries: A systematic review. Oxford Development Studies 45 (3): 223–239.

Banks, L.M., M. Pinilla-Roncancio, M. Walsham, H. Van Minh, S. Neupane, V.Q. Mai, S. Neupane, K. Blanchet, and H. Kuper. 2021. Does disability increase the risk of poverty ‘in all its forms’? Comparing monetary and multidimensional poverty in Vietnam and Nepal. Oxford Development Studies. 49 (4): 386–400.

Banks, L.M., M. Walsham, S. Neupane, S. Neupane, Y. Pradhananga, M. Maharjan, K. Blanchet, and H. Kuper. 2018. Disability-Inclusive Social Protection Research in Nepal: A National Overview with a Case Study from Tanahun District. London: London School of Hygiene & Tropical Medicine.

Barrientos, A. 2011. Social protection and poverty. International Journal of Social Welfare 20: 240–249.

Bastagli, F., J. Hagen-Zanker, L. Harman, V. Barca, G. Sturge, and T. Schmidt. 2019. The impact of cash transfers: A review of the evidence from low-and middle-income countries. Journal of Social Policy 48: 569–594.

Braithwaite, J., and D. Mont. 2009. Disability and poverty: A survey of World Bank poverty assessments and implications. Alter 3: 219–232.

de Groot, R., T. Palermo, L.M. Banks, and H. Kuper. 2021. The impact of the Lesotho Child Grant Programme in the lives of children and adults with disabilities: Disaggregated analysis of a community randomized controlled trial. International Social Security Review 74: 55–81.

Food and Agriculture Organization of the United Nations. 2023. Food Insecurity Experience Scale [Online]. Available: https://www.fao.org/in-action/voices-of-the-hungry/fies/en/. Accessed 21 Mar 2023.

Government of Maldives 2008. The Constitution of the Republic of Maldives.

Government of Maldives 2010. Law on Protecting the Rights of Persons with Disabilities and Provision of Financial Assistance.

Hameed, S., L.M. Banks, S.K. Usman, and H. Kuper. 2022a. Access to the Disability Allowance in the Maldives: National coverage and factors affecting uptake. Global Social Policy, 14680181221084854.

Hameed, S., M. Walsham, L.M. Banks, and H. Kuper. 2022. Process evaluation of the Disability Allowance programme in the Maldives. International Social Security Review 75: 79–105.

Hanass-Hancock, J., and T.C. Mckenzie. 2017. People with disabilities and income-related social protection measures in South Africa: Where is the gap? African Journal of Disability 6: 1–11.

Hanass-Hancock, J., S. Nene, N. Deghaye, and S. Pillay. 2017. ‘These are not luxuries, it is essential for access to life’: Disability related out-of-pocket costs as a driver of economic vulnerability in South Africa. African Journal of Disability 6: 1–10.

International Labour Organization. 2017. World Social Protection Report 2017–19: Universal social protection to achieve the Sustainable Development Goals. Geneva: ILO.

Kidd, S., L. Wapling, R. Schjoedt, B. Gelders, D. Bailey-Athias, A. Tran, and H. Salomon. 2019. Leaving No-One Behind: Building Inclusive Social Protection Systems for Persons with Disabilities. Orpington, UK: Development Pathways.

Kuper, H., V. Nyapera, J. Evans, D. Munyendo, M. Zuurmond, S. Frison, V. Mwenda, D. Otieno, and J. Kisia. 2015. Malnutrition and childhood disability in Turkana, Kenya: Results from a case-control study. PLoS ONE 10: e0144926.

Kuper, H., S. Polack, C. Eusebio, W. Mathenge, Z. Wadud, and A. Foster. 2008. A case-control study to assess the relationship between poverty and visual impairment from cataract in Kenya, the Philippines, and Bangladesh. PLoS Medicine 5: e244.

Kuper, H., S. Polack, W. Mathenge, C. Eusebio, Z. Wadud, M. Rashid, and A. Foster. 2010. Does cataract surgery alleviate poverty? Evidence from a multi-centre intervention study conducted in Kenya, the Philippines and Bangladesh. PLoS ONE 5: e15431.

Mitra, S. 2010. Disability cash transfers in the context of poverty and unemployment: The case of South Africa. World Development 38: 1692–1709.

Mitra, S., M. Palmer, H. Kim, D. Mont, and N. Groce. 2017. Extra costs of living with a disability: A review and agenda for research. Disability and Health Journal 10: 475–484.

Mont, D., and A. Cote. 2020. Considering the Disability Related Extra Costs in Social Protection. New York: UNPRPD.

Mont, D., A. Cote, J. Hanass-Hancock, L.M. Banks, V. Grigorus, L. Carraro, Z. Morris, and M. Pinilla-Roncancio. 2022. Estimating the Extra Costs for Disability for Social Protection Programs. New York: UNPRPD.

Mont, D., and C. Nguyen. 2018. Spatial variation in the poverty gap between people with and without disabilities: Evidence from Vietnam. Social Indicators Research 137: 745–763.

Owusu-Addo, E., A.M. Renzaho, and B.J. Smith. 2018. The impact of cash transfers on social determinants of health and health inequalities in sub-Saharan Africa: A systematic review. Health Policy and Planning 33: 675–696.

Palmer, M., J. Williams, and B. Mcpake. 2019. Standard of living and disability in Cambodia. The Journal of Development Studies 55: 2382–2402.

Sharpe, I., and C.M. Davison. 2022. Investigating the role of climate-related disasters in the relationship between food insecurity and mental health for youth aged 15–24 in 142 countries. PLOS Global Public Health 2: e0000560.

Trafford, Z. 2023. ‘People don’t understand what we go through!’: Caregiver views on South Africa’s care dependency grant. African Journal of Disability 12: 1114.

Turner, A.G., R.J. Magnani, and M. Shuaib. 1996. A not quite as quick but much cleaner alternative to the Expanded Programme on Immunization (EPI) Cluster Survey design. International Journal of Epidemiology 25: 198–203.

United Nations. 2006. United Nations Convention on the Rights of Persons with Disabilities. In: UNITED NATIONS (ed.) Article 1.

United Nations. 2017. Sustainable Development Goal 1: End poverty in all its forms everywhere [Online]. https://sustainabledevelopment.un.org/sdg1.

United Nations. 2018. Disability and Development Report: Realizing the Sustainable Development Goals by, for and with persons with disabilities New York: UN.

United Nations. 2022. SDG Indicators: Metadata repository [Online]. United Nations Department of Economic and Social Affairs. Available: https://unstats.un.org/sdgs/metadata/.

United Nations Enable. 2016. CRPD and Optional Protocol Signatures and Ratifications [Online]. https://www.un.org/disabilities/documents/2016/Map/DESA-Enable_4496R6_May16.jpg.

United Nations General Assembly. 1948. Universal declaration of human rights. In Assembly, U. G. (ed.) 217 A (III).

Walsham, M., H. Kuper, L.M. Banks, and K. Blanchet. 2018. Social protection for people with disabilities in Africa and Asia: a review of programmes for low-and middle-income countries. Oxford Development Studies 47 (1): 1–16.

Washington Group and UNICEF. 2018. Child Functioning Question Sets [Online]. http://www.washingtongroup-disability.com/washington-group-question-sets/child-disability/.

Washington Group on Disability Statistics. 2011. Washington Group—Extended Question Set on Functioning (WG ES-F) [Online]. http://www.washingtongroup-disability.com/wp-content/uploads/2016/01/WG_Extended_Question_Set_on_Functioning.pdf.

World Bank. 2018. Poverty measurement methodology in the Maldives. World Bank Group.

World Bank. 2020. The World Bank in the Maldives: Overview [Online]. Available: https://www.worldbank.org/en/country/maldives/overview#:~:text=Maldives%20has%20a%20population%20of,the%20country's%20infrastructure%20and%20connectivity. Accessed 11 Dec 2020.

World Bank. 2021. Population, total—Maldives. https://data.worldbank.org/indicator/SP.POP.TOTL?locations=MV. Accessed 9 July 2021.

World Bank. 2022. Inflation, consumer prices (annual %). https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No authors have declared any conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Banks, L.M., Hameed, S., Usman, S.K. et al. The Impact of the Disability Allowance on Financial Well-Being in the Maldives: Quasi-experimental Study. Eur J Dev Res 36, 411–427 (2024). https://doi.org/10.1057/s41287-023-00607-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41287-023-00607-8